Valeant Pharmaceuticals International Inc

Latest Valeant Pharmaceuticals International Inc News and Updates

JANA sells stake in Equinix

JANA Partners sold a significant stake in Equinix (EQIX) during the fourth quarter. The position accounted for 3.38% of the fund’s third-quarter portfolio.

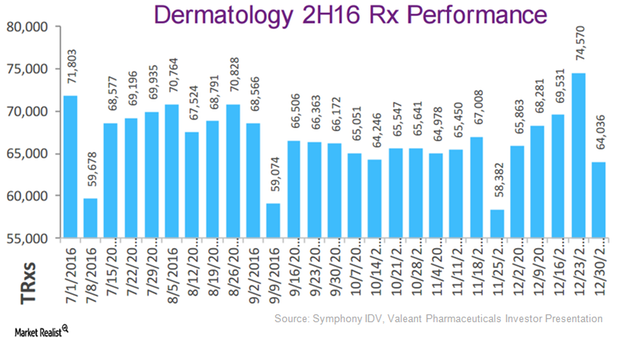

Valeant’s Dermatology Business Felt Pricing Pressure in 2016

Dermatology pricing trends Valeant Pharmaceuticals’ (VRX) dermatology business witnessed intense pricing pressure in 2016, due to a change in the company’s distribution model in 4Q15. While Valeant previously marketed its dermatology drugs through specialty pharmacies, the company now distributes its products through Walgreens. To learn about the company’s current distribution model, please refer to How Valeant Plans […]

This Space Presents a Market Opportunity for Valeant

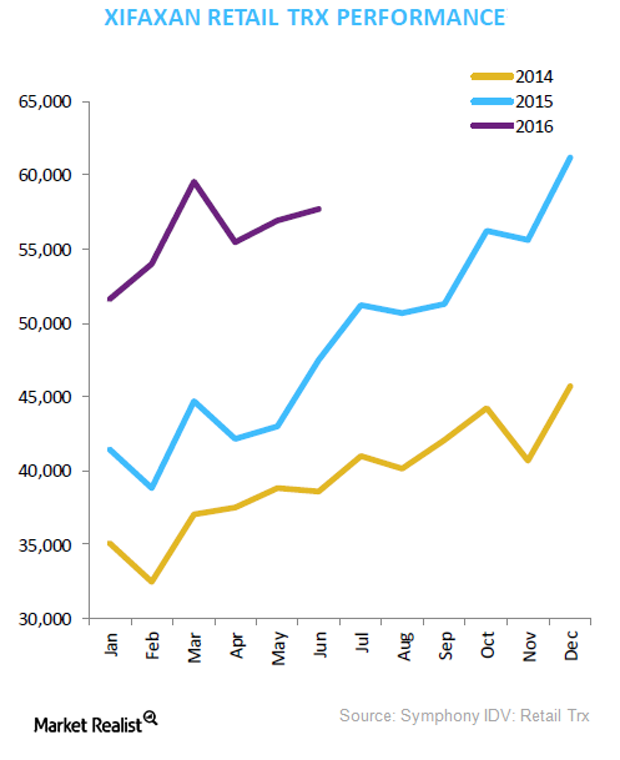

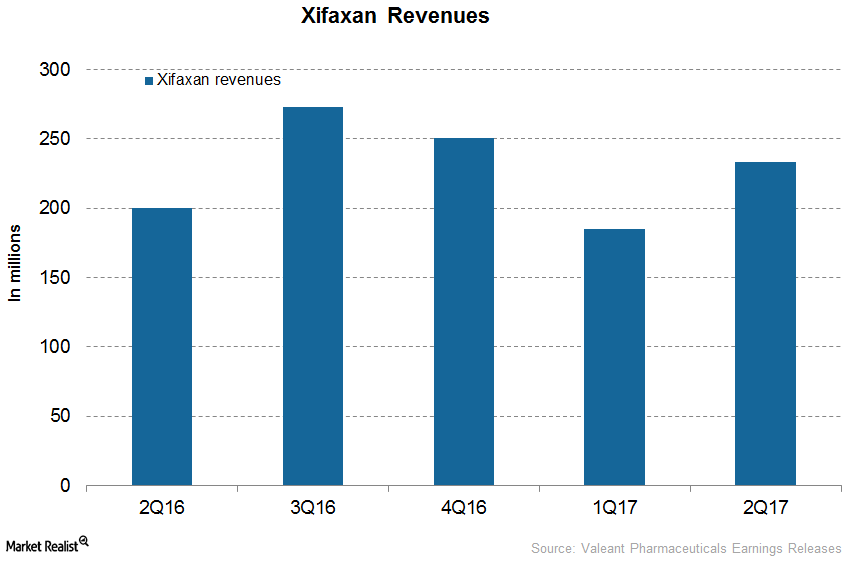

In Valeant’s 2Q16 earnings, Xifaxan reported a year-over-year (or YoY) increase in monthly prescriptions of about 28.0%.

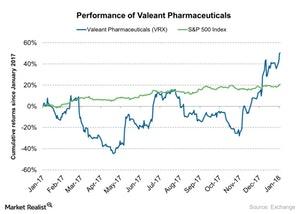

How Valeant Position Affected Pershing Square Capital Management

Valeant Pharmaceuticals is currently trading at $23.05. Its 52-week high is $23.47 and 52-week low is $8.31.

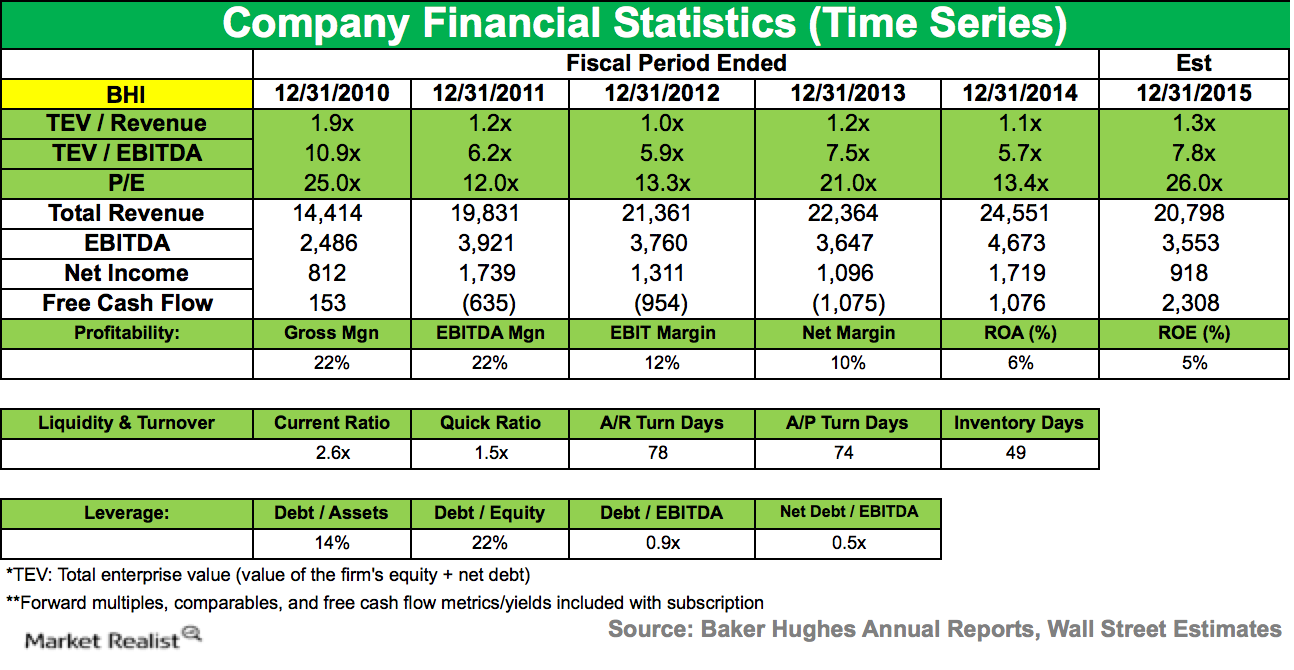

ValueAct Capital discloses activist stake in Baker Hughes

Activist hedge fund ValueAct Capital declared a 5.1% stake in Baker Hughes in its 13D filing on January 15, 2015.

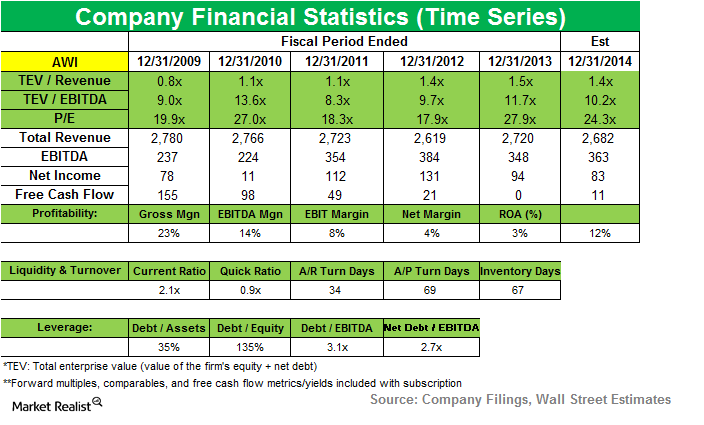

ValueAct gets seat on Armstrong World Industries’ board

While Armstrong’s 3Q14 results beat estimates, its consolidated net sales fell slightly compared to 3Q13, due to lower volumes in Europe and lower sales of resilient and wood flooring in the Americas.

Teva’s Recent Launch of Generic Solodyn: What You Need to Know

On February 20, 2018, Teva Pharmaceutical announced the US launch of the generic version of Solodyn Extended Release tablets in two strengths.

How the Market Reacted to Teva’s Pricing of Its Generic Syprine

On February 9, 2018, Teva Pharmaceuticals (TEVA) announced the US launch of its generic version of 250 mg Syprine capsules.

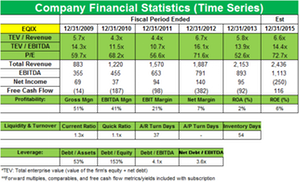

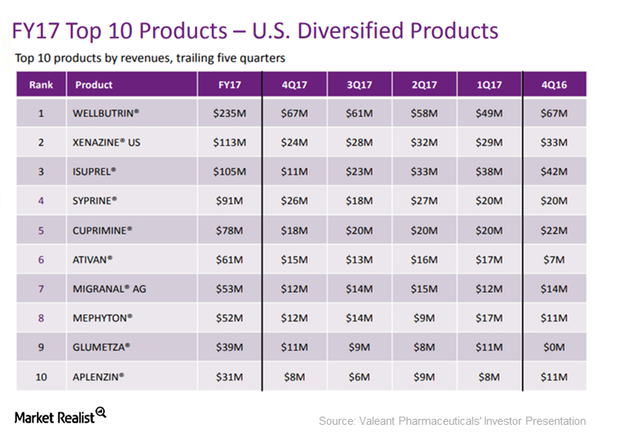

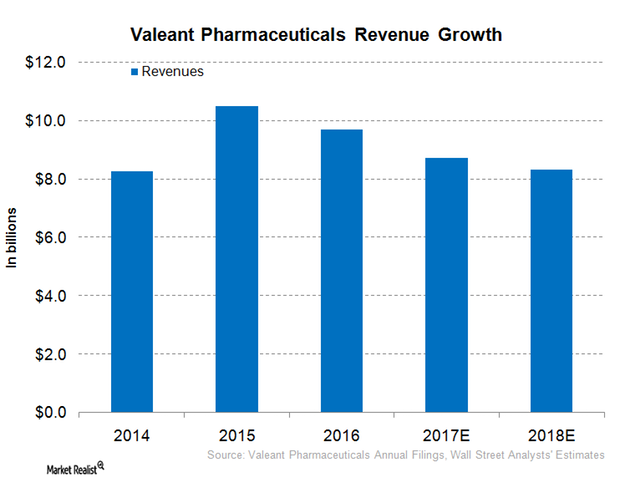

A Deeper Look at Valeant Pharmaceuticals’ Recent Financial Performance

In 3Q16, Valeant Pharmaceuticals (VRX) generated revenues of $2.4 billion, compared with $2.2 billion in 3Q17.

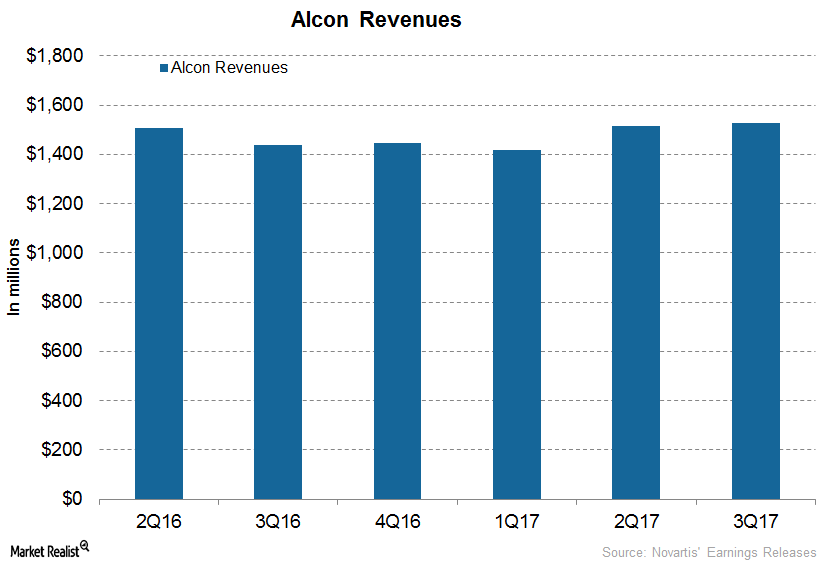

What to Expect for Novartis’s Subsidiary Alcon in 2018

In 1Q17, 2Q17, and 3Q17, Novartis’s (NVS) subsidiary Alcon generated revenues of $1.4 billion, $1.5 billion, and $1.5 billion, respectively.

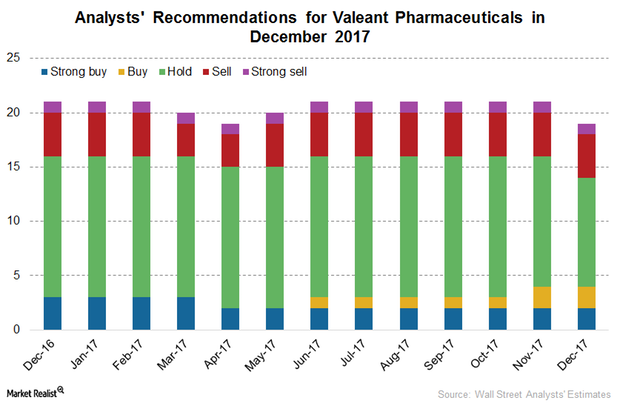

Valeant on the Street: Analyst Recommendations in December 2017

Of the 19 analysts tracking Valeant Pharmaceuticals in December 2017, two recommended a “strong buy,” while another two of recommended a “buy.”

Why Bill Ackman’s Pershing Square Had a Rough 2017

Bill Ackman’s Pershing Square Capital Management saw negative returns in 2017 for the third consecutive year.

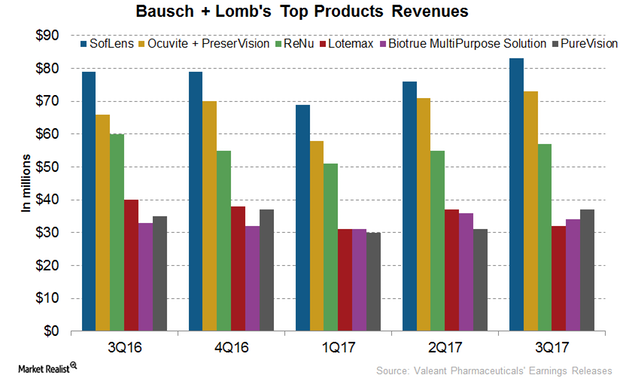

How Did Bausch + Lomb’s Top Products Perform in 3Q17?

In 3Q17, Valeant Pharmaceuticals’ Bausch + Lomb’s Soflens generated revenues of $83 million, which was ~5% higher on a YoY basis and ~9% higher QoQ.

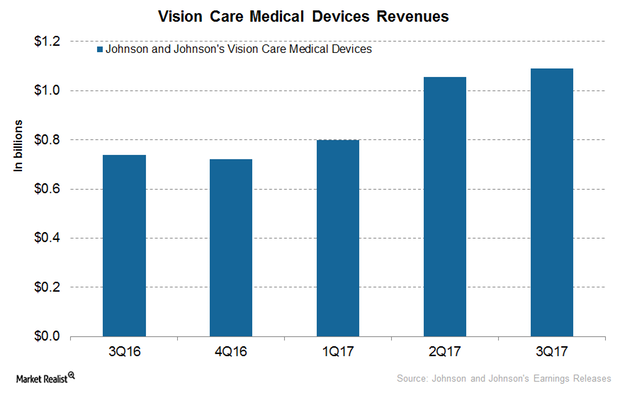

Inside Johnson & Johnson’s Vision Care Performance in 3Q17

In 3Q17, JNJ vision care generated revenues of $1.1 billion, which reflected a ~48% YoY (year-over-year) rise and a 3% QoQ (quarter-over-quarter) rise.

Valeant Pharmaceuticals’ Xifaxan and Apriso

In 1H17, Valeant Pharmaceuticals’ (VRX) Xifaxan reported revenues of $418.0 million compared to $408.0 million in 1H16.

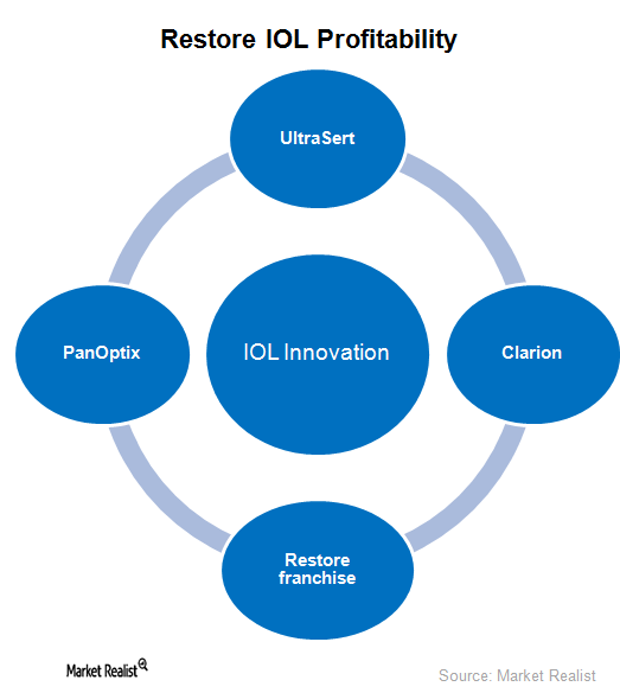

Novartis Expects to Restore Alcon’s Profitability in the Future

Novartis (NVS) has focused its efforts on improving its customer service levels and entering into lucrative partnering deals to boost profitability for its Alcon business.

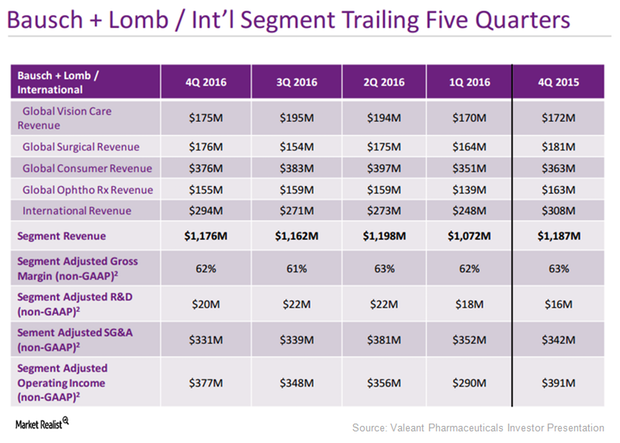

Bausch & Lomb Continues to be Key Growth Driver for Valeant

Bausch & Lomb projections Valeant Pharmaceuticals expects its Bausch & Lomb/International segment to grow at a CAGR (compound average growth rate) of 4%–6% between 2017 and 2020. In 2017, the company expects the segment to grow 5%–7% after adjusting for foreign exchange fluctuations and the impact of impending patent expiries. In 2017, the segment is also expected […]

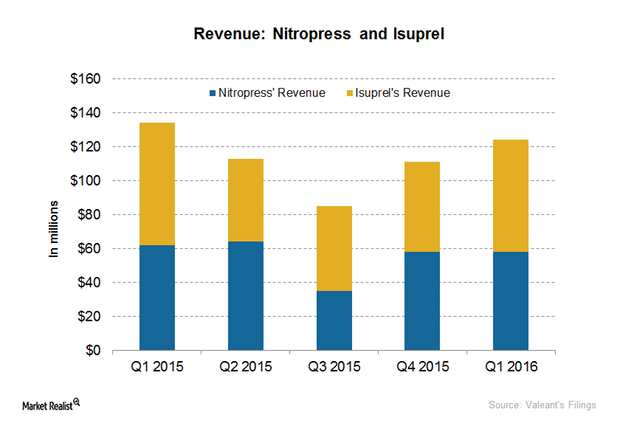

The Facts behind the Valeant Drug Pricing Controversy

Valeant Pharmaceuticals International (VRX) significantly raised the prices of two of its heart drugs—Nitropress and Isuprel—which caused a controversy and an outrage.

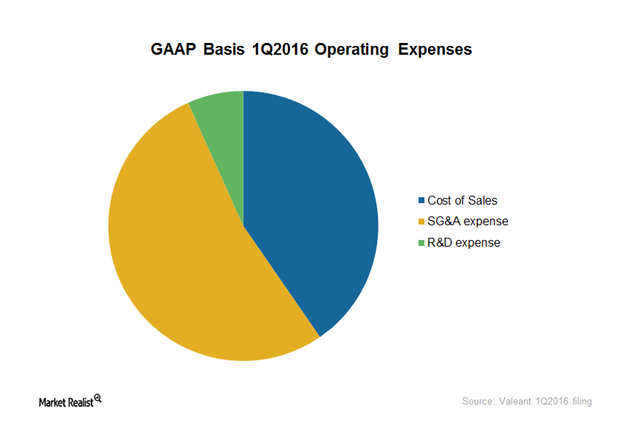

What’s behind Valeant’s Operating Expenses?

Valeant’s major operating expenses include cost of sales, SG&A (selling, general, and administrative) expenses, and R&D (research and development) costs.

What Happened in the Valeant-Philidor Controversy?

Valeant’s (VRX) controversies started with Philidor, a specialty pharmacy company that was accused of altering doctor’s prescriptions so it could sell more of Valeant’s costly drugs.

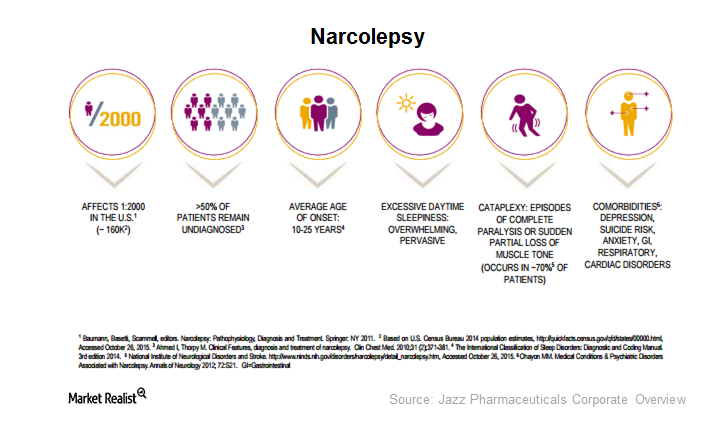

Can Xyrem Maintain Leadership in the Narcolepsy Space?

Jazz Pharmaceuticals’ (JAZZ) Xyrem is a drug for cataplexy and excessive daytime sleepiness occurring in patients with narcolepsy, a serious orphan disease.

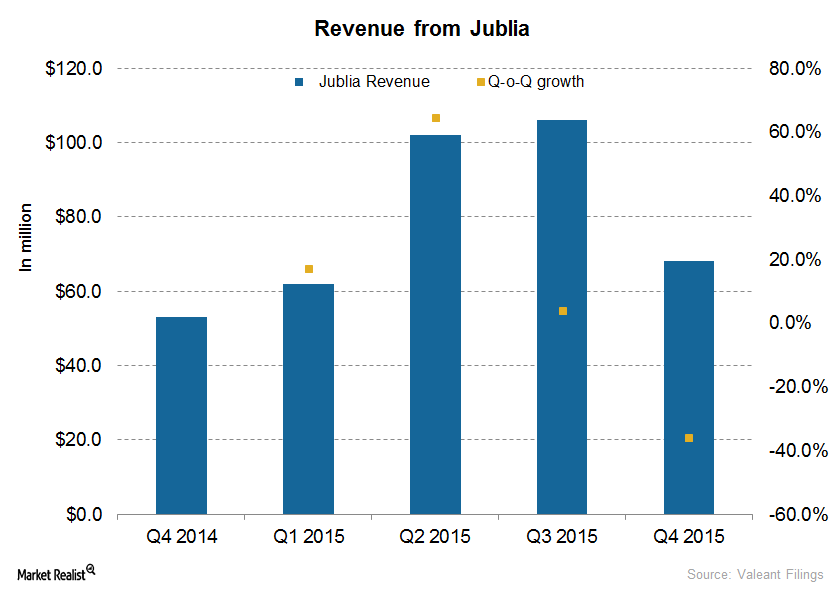

Behind Valeant’s Significant Drop in Jublia Sales

In 4Q15, Jublia added $68 million to the top line of Valeant—the sixth-largest revenue contributor in 4Q15, down from the second-largest in 3Q15.

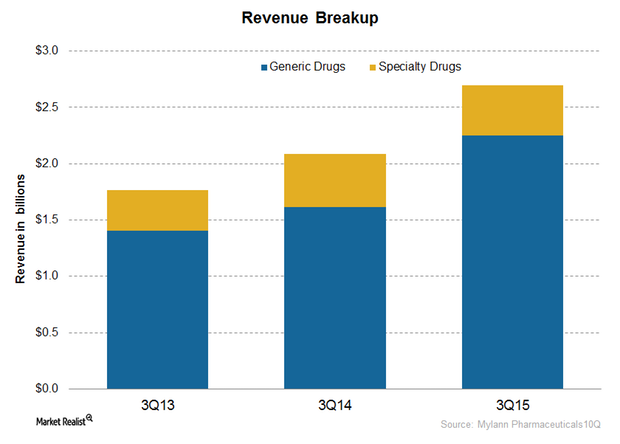

Mylan’s Business Model: A Key Investor Rundown

In 2014, Mylan earned about 85% of its total revenues from the US generic market, which is the largest generic market in the world.

Key challenges facing the Canadian economy

One of the challenges facing the Canadian economy is a lack diversification. More than 70% of the TSX Composite Index is made up of only three sectors.Industrials Paulson & Co. buy a new stake in Verizon Communications in 1Q14

Paulson took a new position in Verizon Communications (VZ) last quarter. The position accounts for 2.04% of Paulson’s $20 billion portfolio.Healthcare The case for Pfizer’s proposed takeover of AstraZeneca

U.S. pharma giant Pfizer’s (PFE) second takeover proposal, of $106 billion (£64 billion), was rejected by Anglo-Swedish drug maker AstraZeneca (AZN) last week.