Inside Johnson & Johnson’s Vision Care Performance in 3Q17

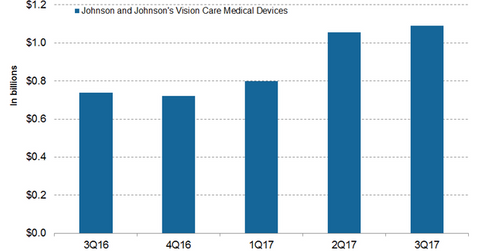

In 3Q17, JNJ vision care generated revenues of $1.1 billion, which reflected a ~48% YoY (year-over-year) rise and a 3% QoQ (quarter-over-quarter) rise.

Dec. 27 2017, Updated 7:33 a.m. ET

Vision Care revenue trends

In 3Q17, Johnson & Johnson’s (JNJ) vision care generated revenues of $1.1 billion, which reflected a ~48% YoY (year-over-year) rise and a 3% QoQ (quarter-over-quarter) rise. In 3Q17, in the US and in international markets, JNJ’s vision care generated revenues of $432 million and $659 million, respectively, compared with $277 million and $462 million in 3Q16.

JNJ’s vision care reported revenues of $2.9 billion for the first nine months of 2017, compared with $2.1 billion for the corresponding period of 2016.

Contact lenses revenue trends

In 3Q17, JNJ’s contact lenses generated revenues of $800 million, which reflected a ~8% YoY rise and a 6% QoQ rise. In 3Q17, in the US and in international markets, JNJ’s contact lenses generated revenues of $302 million and $498 million, respectively, compared with $277 million and $462 million in 3Q16.

Johnson & Johnson’s contact lenses reported revenues of $2.2 billion for the first nine months of 2017, compared with $2.1 billion for the corresponding period of 2016.

Vision care surgical devices

In 3Q17, JNJ’s vision care surgical devices generated revenues of $291 million, compared with $115 million and $302 million in 1Q17 and 3Q17, respectively. In 3Q17, in the US and in international markets, vision care surgical devices generated revenues of $130 million and $161 million, respectively.

JNJ’s vision care surgical devices reported revenues of $708 million in the first nine months of 2017.

Its peers in vision care market include Novartis (NVS), Valeant Pharmaceuticals (VRX), and Cooper Companies (COO). In 3Q17 Novartis and Valeant reported revenues of $12.2 billion and $2.2 billion, respectively.

Notably, the iShares Edge MSCI USA Quality Factor ETF (QUAL) has about ~4.9% of its total portfolio holdings in JNJ.