Analyzing Tiffany’s Key Strategic Objectives

Tiffany’s key strategic objectives for growth include expanding marketing communications, opening stores in key markets, and enhancing in-store experience.

Dec. 11 2015, Updated 10:06 a.m. ET

Tiffany’s key strategic objectives

Tiffany & Co. (TIF) has the following long-term growth strategies:

- adding exciting new designs to complement the company’s core product offerings

- expanding the reach of marketing communications

- opening stores in key markets

- enhancing the in-store experience for its customers through dialogue between salesperson and customer

Tiffany will focus on adding exciting new designs to complement its core product offerings. The company introduces entirely new design collections periodically. The company is aiming to expand, refresh, and reinterpret existing collections in the coming years.

Recent initiatives

Some of Tiffany & Co.’s recent initiatives are as follows:

- Addition of new design in the Return to Tiffany collection to boost sales in silver jewelry priced below $500

- Expansion of the Infinity jewelry collection in both gold and silver. The collection incorporates the design, symbolic of continuous connection, energy, and vitality

- Expansion of the Victoria collection, with new designs in platinum and diamonds

- Expansion of the Bow collection, with designs in gold and diamonds

Expansion of operations

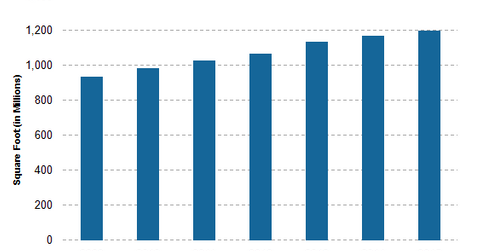

One of the Tiffany’s long-term strategies is to improve its store base through store openings in key markets, renovations, relocations, and closings. The company has set a long-term goal to increase its worldwide square footage close to 2% per year. Tiffany has planned the majority of its expansions in the Asia-Pacific region.

In comparison, Signet Jewelers (SIG) expects to increase its net selling square footage by 2%–3% in fiscal 2016. Fossil (FOSL) has been operating with very limited store growth.

Tiffany, Signet, and Fossil all have exposure in the iShares Russell 1000 Growth ETF (IWF) as well as in the iShares Core S&P 500 ETF (IVV). Together, these three companies make up 0.12% of the portfolio holdings of IWF and 0.19% of the holdings of IVV.

IVV measures the performance of the large-capitalization sector of the US equities market, tracking the top 500 stocks. IWF is a growth-oriented ETF.