Signet Jewelers Ltd

Latest Signet Jewelers Ltd News and Updates

It Was a Festive Holiday Season for Signet Jewelers

On January 7, 2016, Signet Jewelers (SIG), the world’s largest retailer of diamond jewelry, announced its broad-based success in the holiday season with revenue of $1.9 billion.

State of the Jewelry Industry in 2015: Growth and Challenges

Trends shaping the jewelry industry include Increasing demand for branded jewelry and an increased focus on e-commerce sales.

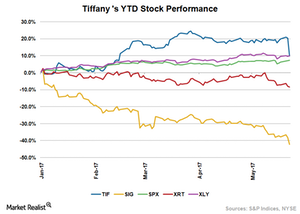

Why Tiffany Stock Plunged

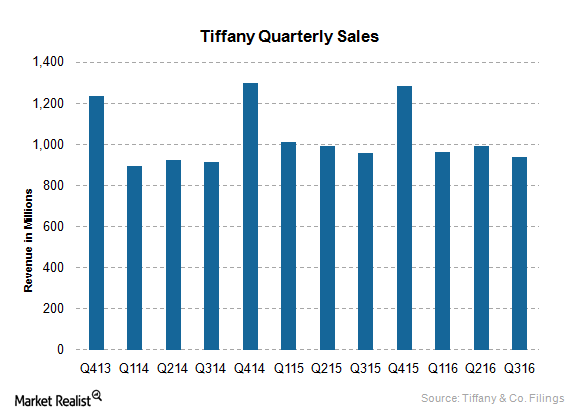

Tiffany (TIF) disappointed investors with its comparable-store sales numbers in 1Q17. After results were announced, the company’s stock plunged ~9%.

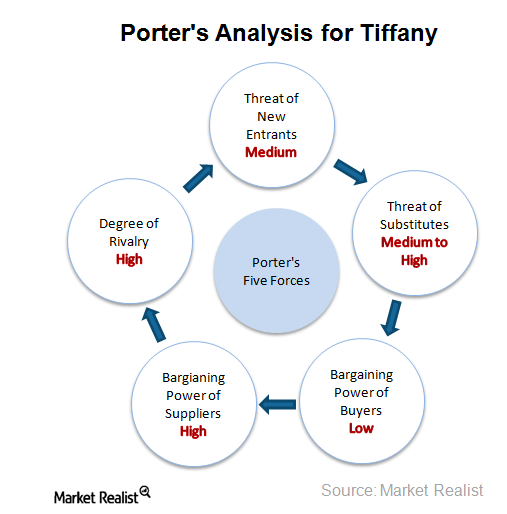

Tiffany’s Competitive Position: Porter’s Five Forces Analysis

Porter’s Five Forces model suggests that there are five forces that determine the attractiveness and long-term profitability of an industry or a sector.

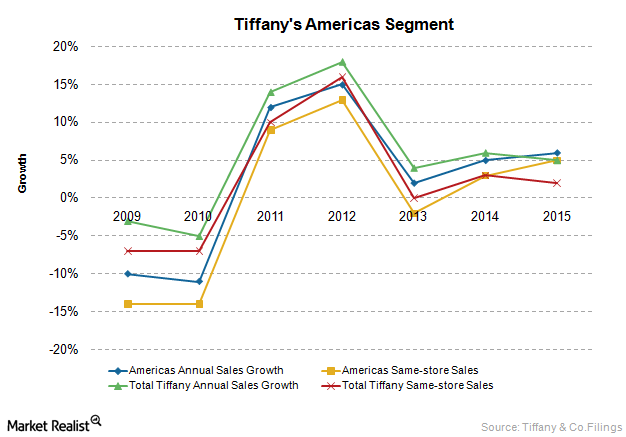

Analyzing Tiffany’s Largest Segment: The Americas

Tiffany & Co.’s Americas segment includes sales from company-operated retail stores in the United States, Canada, Mexico, and Brazil.

Hurdles in Tiffany’s Growth: Weaknesses and Threats

Since it’s a luxury brand, Tiffany & Co.’s products are priced high, with no promotions. Thus, Tiffany products may be out of reach for many customers.

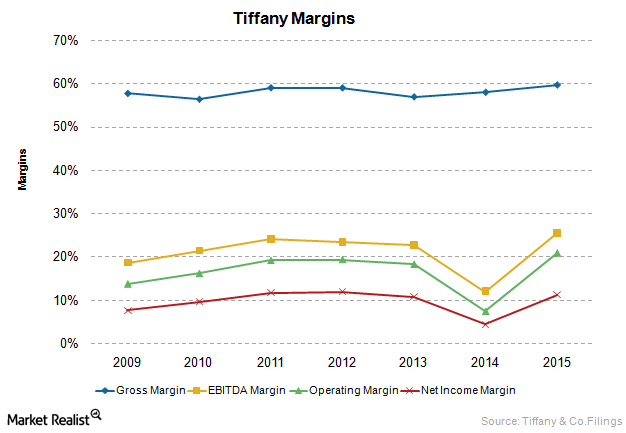

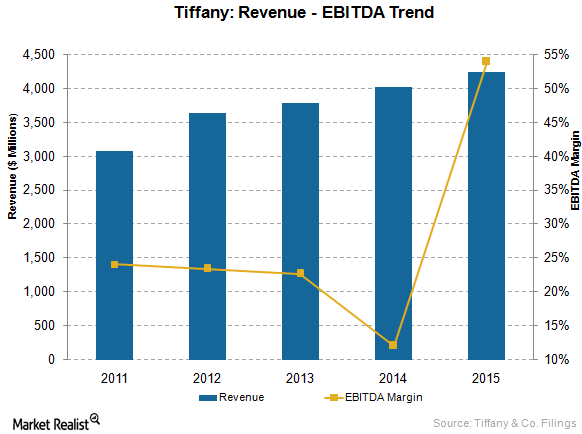

Why Tiffany & Co. Is More Profitable than Its Competitors

Since 2006, Tiffany’s margins have been on the higher side compared to its peers, including Signet Jewelers and Fossil, in the retail jewelry industry.

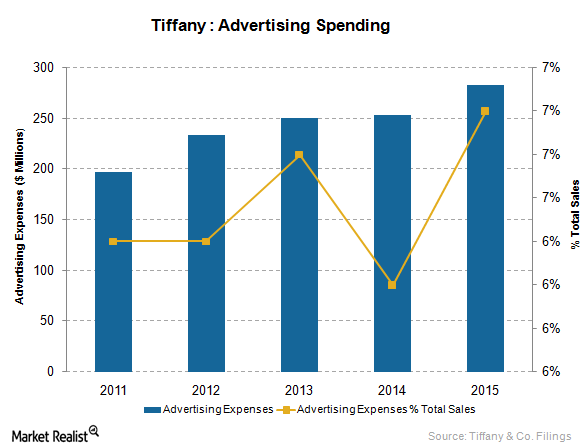

Why Tiffany Is Spending More on Marketing

Tiffany has been increasing its advertising expenses. In fiscal 2015, it spent $284 million on advertising, marketing, and public and media relations.

Signet Jeweler’s Market Positioning in the Retail Jewelry Industry

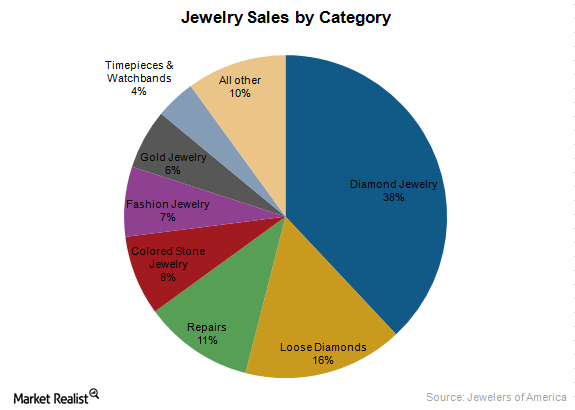

Total retail jewelry sales in the US grew at a CAGR of 4.4%, reaching $74.7 billion in 2014. Fine jewelry sales grew at a CAGR of 5%, reaching ~$69 billion.

Signet Jewelers’ Ever Us Is Setting Trend for Jewelry Industry

Signet launched a new collection called Ever Us in October 2015. It’s meant to meet the need for jewelry that represents the bond between two people.

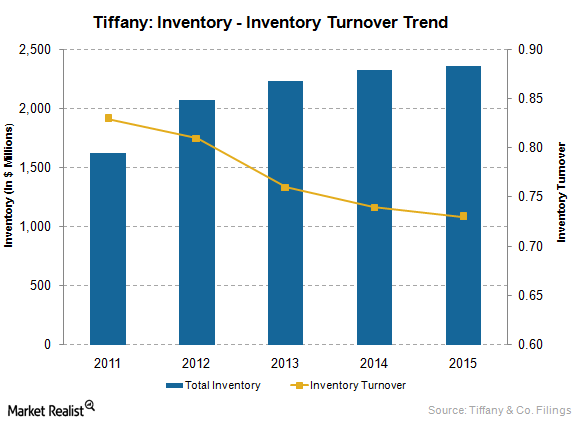

Low Inventory Turnover Is a Concern at Tiffany & Co.

At the end of fiscal 2015, Tiffany had a total inventory of $2.4 billion and inventory turnover of 0.73x, implying potential low sales and excess inventory.

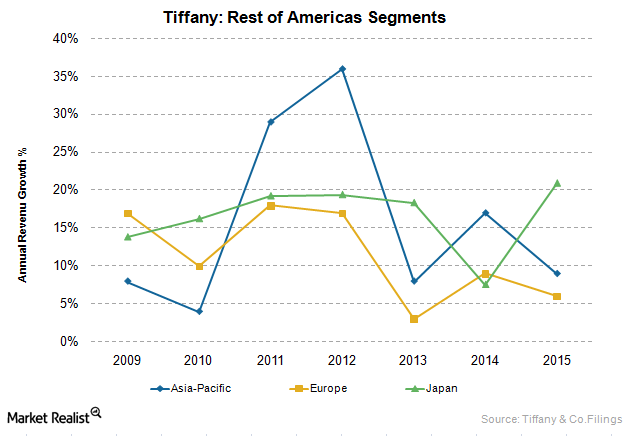

Analyzing Tiffany & Co.’s International Segments

Tiffany & Co. has presences to differing degrees in the Asia-Pacific, Japan, Europe, and Other regions.

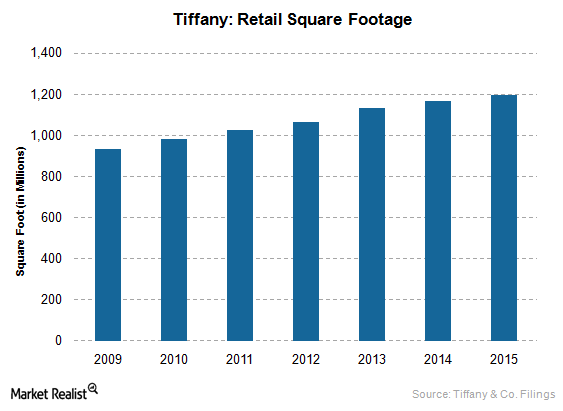

Analyzing Tiffany’s Key Strategic Objectives

Tiffany’s key strategic objectives for growth include expanding marketing communications, opening stores in key markets, and enhancing in-store experience.

A Must-Know Business Overview of Tiffany & Co.

Tiffany & Co. is a holding company that operates through its subsidiary companies. The most notable is Tiffany & Company, a jeweler and specialty retailer.

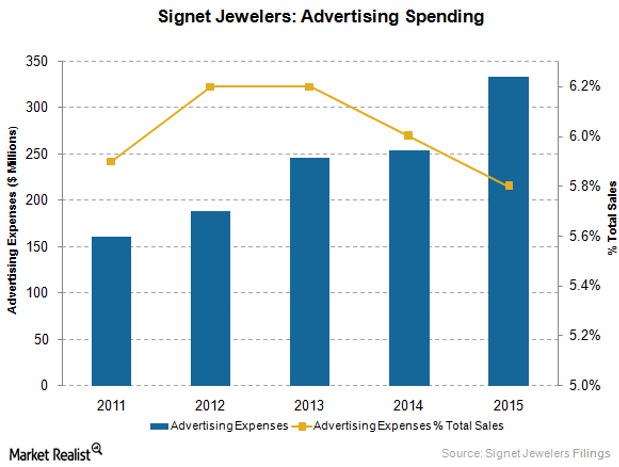

Evaluating Signet Jeweler’s Marketing Strategies and Initiatives

Signet Jewelers’ well-known, exclusive brands aim to influence consumers in their buying decisions. Sterling Jewelers thus provides 32% branded assortments.

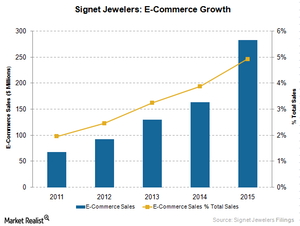

Why Signet Jewelers Prioritizes E-Commerce as a Growth Driver

Signet acknowledges the value of e-commerce growth and its ability to maximize in-store experiences. Signet has thus integrated its website with its stores.

Signet Jewelers’ Aim to Improve Vertical Integration and Supply Chain

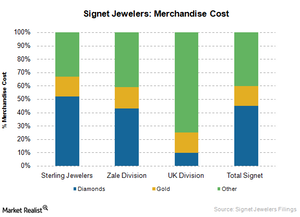

Signet aims to advance its vertical integration, including the sourcing and manufacturing of rough diamonds, which should help improve its supply chain.

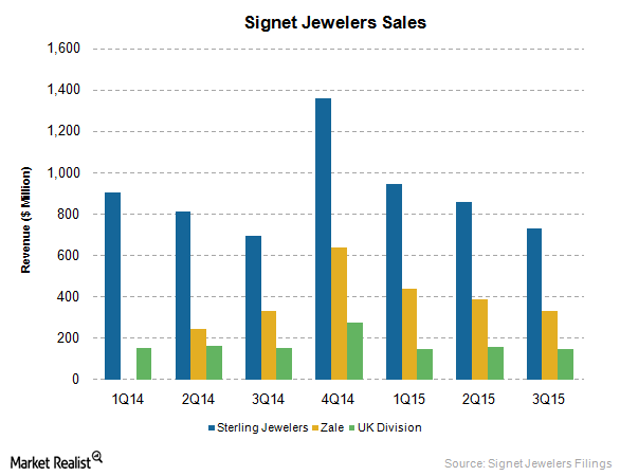

A Snapshot of Signet Jewelers’ Divisions and Product Offerings

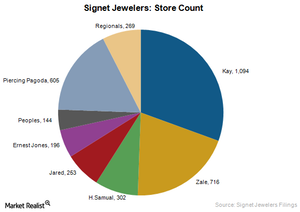

Signet Jewelers operates under three divisions: the Sterling Jewelers division, the Zale division, and the UK Jewelry division.