Tiffany & Co

Latest Tiffany & Co News and Updates

It Was a Festive Holiday Season for Signet Jewelers

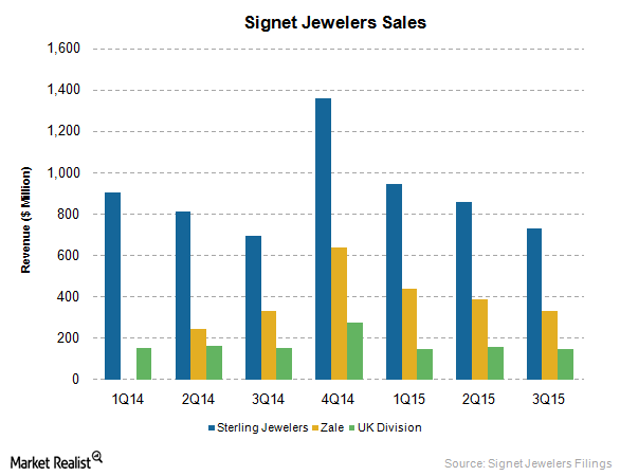

On January 7, 2016, Signet Jewelers (SIG), the world’s largest retailer of diamond jewelry, announced its broad-based success in the holiday season with revenue of $1.9 billion.

State of the Jewelry Industry in 2015: Growth and Challenges

Trends shaping the jewelry industry include Increasing demand for branded jewelry and an increased focus on e-commerce sales.

Why Tiffany Stock Plunged

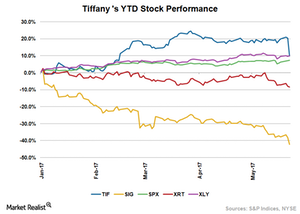

Tiffany (TIF) disappointed investors with its comparable-store sales numbers in 1Q17. After results were announced, the company’s stock plunged ~9%.

Tiffany’s Competitive Position: Porter’s Five Forces Analysis

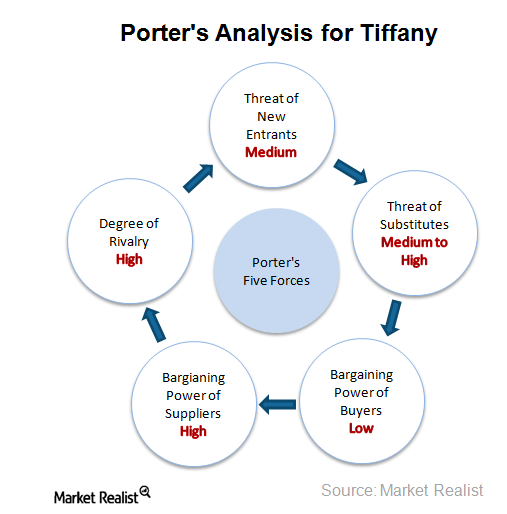

Porter’s Five Forces model suggests that there are five forces that determine the attractiveness and long-term profitability of an industry or a sector.

Why Did Tiffany’s Interim Holiday Sales Improve?

On Thursday, Tiffany posted its interim holiday sales results. The company’s worldwide net sales from November 1 to December 24 increased by about 1%–3%.

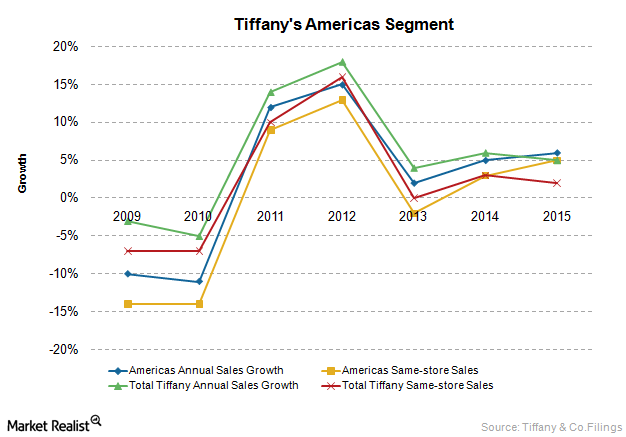

Analyzing Tiffany’s Largest Segment: The Americas

Tiffany & Co.’s Americas segment includes sales from company-operated retail stores in the United States, Canada, Mexico, and Brazil.

Hurdles in Tiffany’s Growth: Weaknesses and Threats

Since it’s a luxury brand, Tiffany & Co.’s products are priced high, with no promotions. Thus, Tiffany products may be out of reach for many customers.

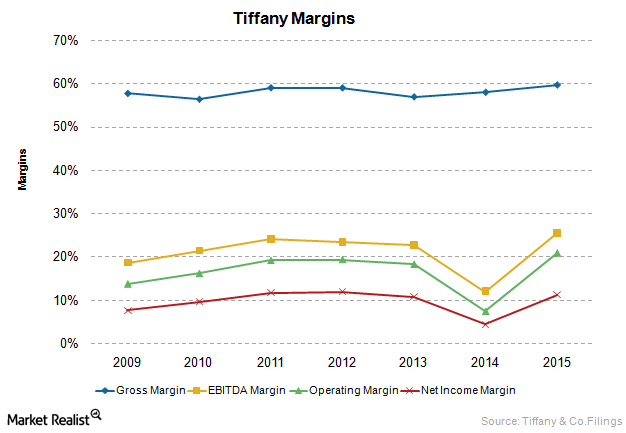

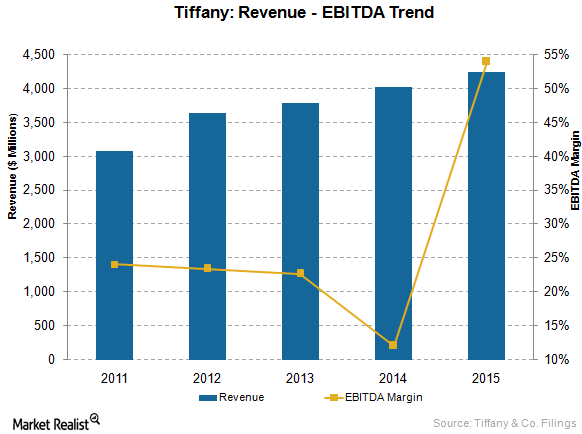

Why Tiffany & Co. Is More Profitable than Its Competitors

Since 2006, Tiffany’s margins have been on the higher side compared to its peers, including Signet Jewelers and Fossil, in the retail jewelry industry.

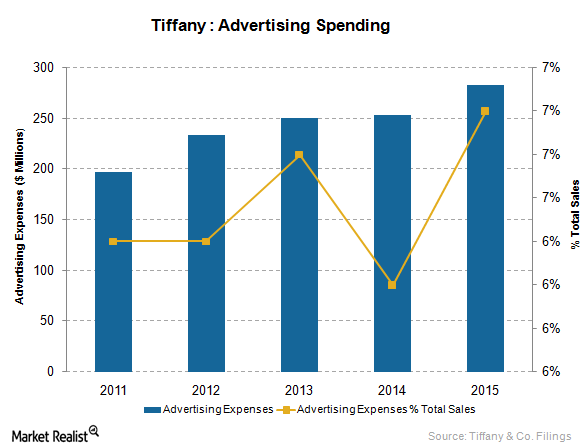

Why Tiffany Is Spending More on Marketing

Tiffany has been increasing its advertising expenses. In fiscal 2015, it spent $284 million on advertising, marketing, and public and media relations.

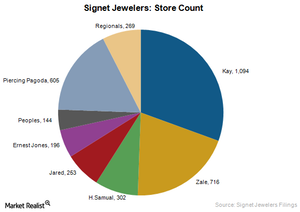

Signet Jeweler’s Market Positioning in the Retail Jewelry Industry

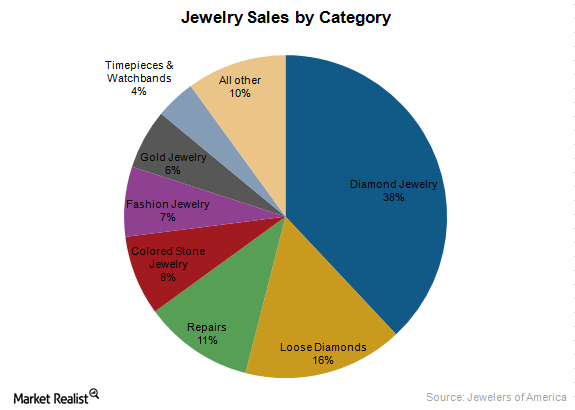

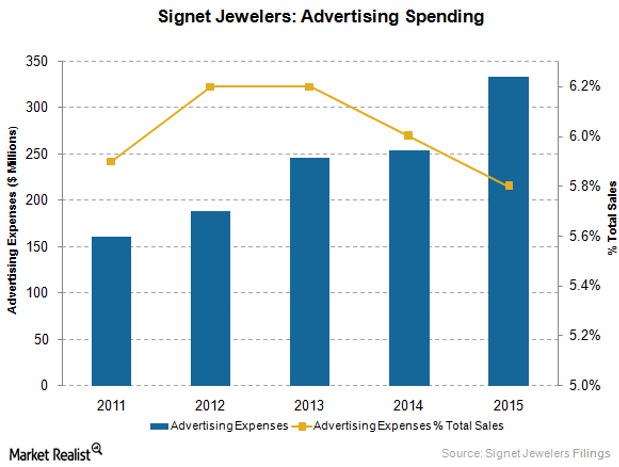

Total retail jewelry sales in the US grew at a CAGR of 4.4%, reaching $74.7 billion in 2014. Fine jewelry sales grew at a CAGR of 5%, reaching ~$69 billion.

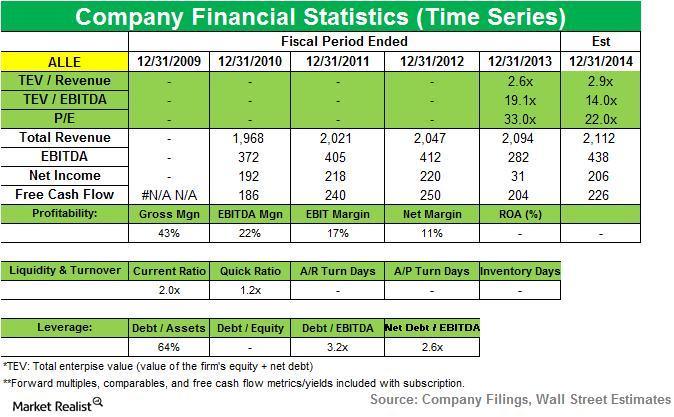

Trian Fund lowers its position in Allegion

Allegion provides security solutions for homes and businesses, employing more than 8,000 people and selling products in more than 120 countries across the world. Allegion reported third-quarter 2014 net revenues of $546.7 million, up 3.3% compared to the previous year.

Was 2019 a “Nightmare” for Warren Buffett and Berkshire?

Warren Buffett underperformed the stock markets last year. Berkshire Hathaway’s returns versus the S&P 500 were the worst since 2009.

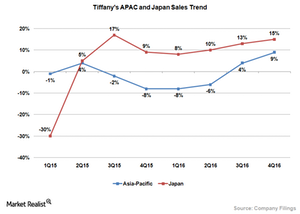

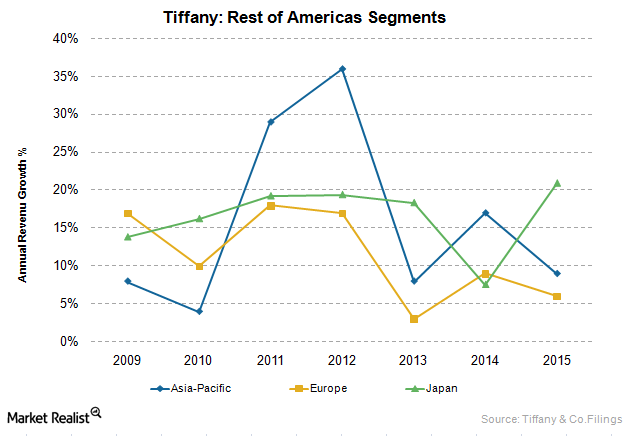

Why Tiffany’s Growth Story May Take Place in Asia

Tiffany’s international operations are vital to top-line growth. In fiscal 2016, US sales accounted for 42.3% of overall sales, while other countries made up 42.6%.

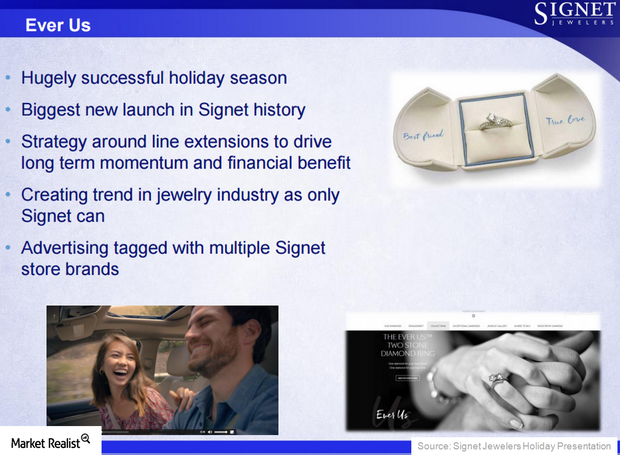

Signet Jewelers’ Ever Us Is Setting Trend for Jewelry Industry

Signet launched a new collection called Ever Us in October 2015. It’s meant to meet the need for jewelry that represents the bond between two people.

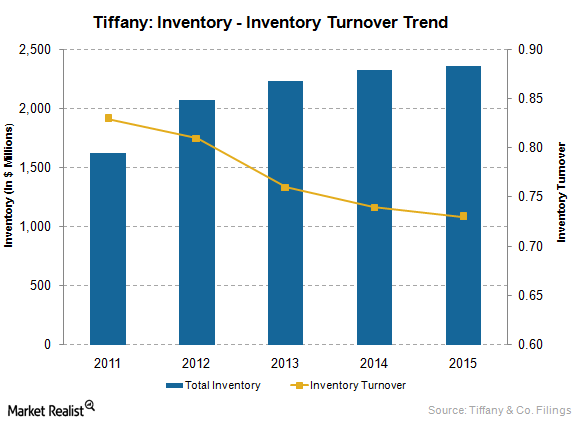

Low Inventory Turnover Is a Concern at Tiffany & Co.

At the end of fiscal 2015, Tiffany had a total inventory of $2.4 billion and inventory turnover of 0.73x, implying potential low sales and excess inventory.

Analyzing Tiffany & Co.’s International Segments

Tiffany & Co. has presences to differing degrees in the Asia-Pacific, Japan, Europe, and Other regions.

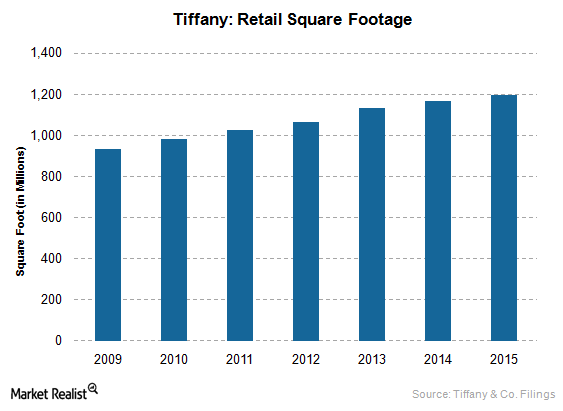

Analyzing Tiffany’s Key Strategic Objectives

Tiffany’s key strategic objectives for growth include expanding marketing communications, opening stores in key markets, and enhancing in-store experience.

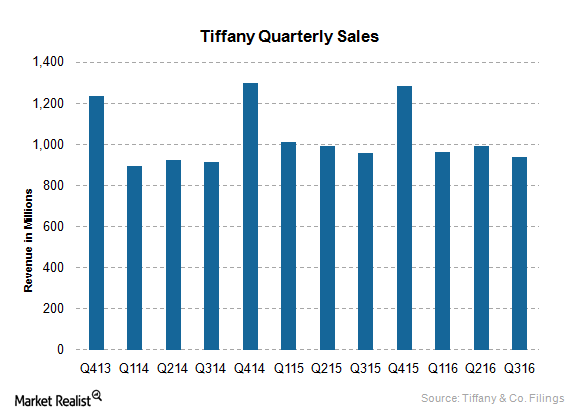

A Must-Know Business Overview of Tiffany & Co.

Tiffany & Co. is a holding company that operates through its subsidiary companies. The most notable is Tiffany & Company, a jeweler and specialty retailer.

Evaluating Signet Jeweler’s Marketing Strategies and Initiatives

Signet Jewelers’ well-known, exclusive brands aim to influence consumers in their buying decisions. Sterling Jewelers thus provides 32% branded assortments.

Signet Jewelers’ Aim to Improve Vertical Integration and Supply Chain

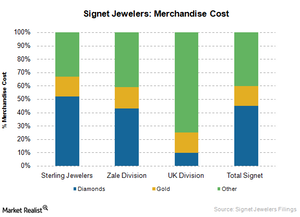

Signet aims to advance its vertical integration, including the sourcing and manufacturing of rough diamonds, which should help improve its supply chain.

A Snapshot of Signet Jewelers’ Divisions and Product Offerings

Signet Jewelers operates under three divisions: the Sterling Jewelers division, the Zale division, and the UK Jewelry division.

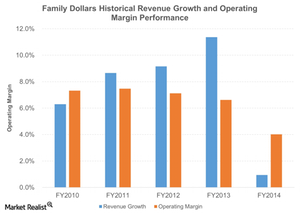

A Glance at Family Dollar’s Historical Performance

Over the last five years, Family Dollar was able to generate a five-year CAGR revenue of 7.2%. That looks decent when you look at it alone. But let’s compare it to its peers.

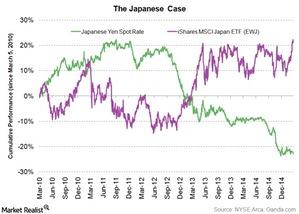

Currency war: Did it boost growth in Japan?

Japan is a classic case of how depreciating currency can boost economic growth. The stimulus package, launched in October 2010, worked over the short term.