Samantha Nielson

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Samantha Nielson

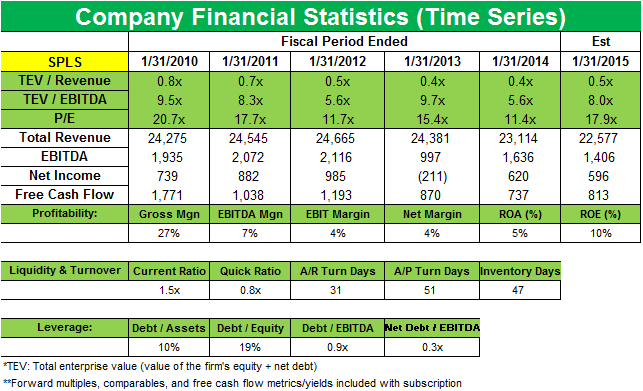

CalPERS raises position in Staples

Staples began discussions to acquire Office Depot in September 2014. Staples will acquire all outstanding Office Depot shares in the $6.3 billion deal.Consumer Renaissance Technologies sells its Amazon shares in 4Q13

Renaissance Technologies eliminated a position in online retailer Amazon.com Inc. (AMZN) that accounted for 0.34% of the fund’s 3Q portfolio.

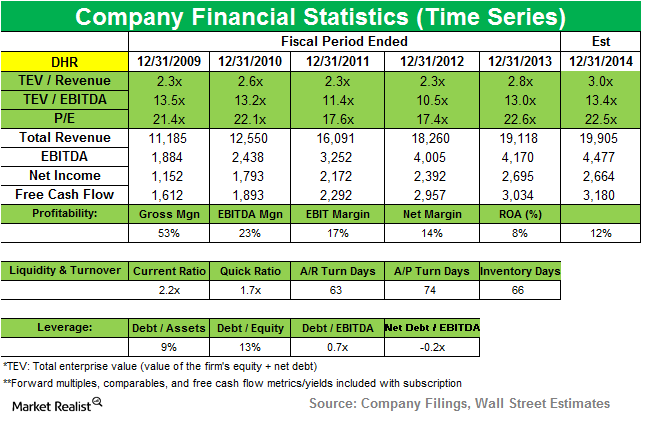

Glenview Capital opens new position in Danaher

Glenview Capital Management added a new position in Danaher Corp. (DHR) in the third quarter. The position accounted for 1.99% of the fund’s total portfolio.

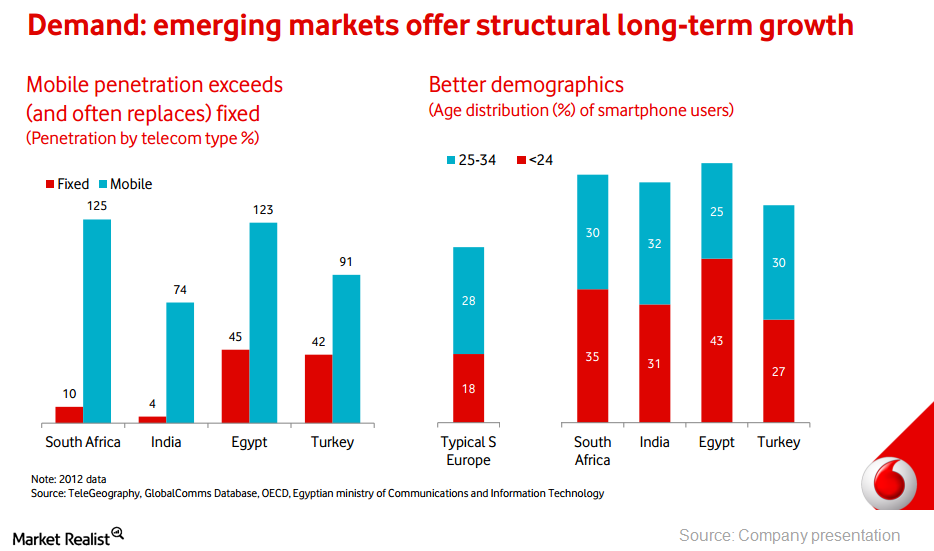

Why AQR Capital Management chose to open a position in Vodafone

AQR Capital started a new position in Vodafone Group plc that accounts for 0.44% of the fund’s 4Q portfolio.

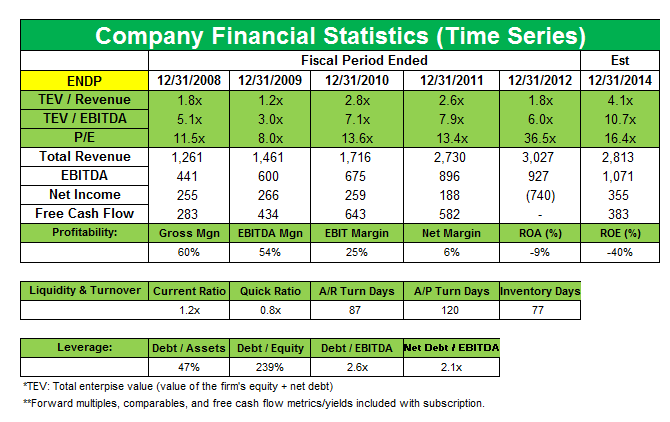

Why Lone Pine bought a new position in Endo Health Solutions

Endo Health Solutions is a 1.26% position initiated by Lone Pine Capital in the 2013 last quarter.

Eton Park Capital opens new positions in FDO, STZ, BID, EQIX, Sells NLSN, PCLN – 13F Flash

In this six-part series, we will go through some of the main positions Eton Park Capital traded this past quarter Eton Park Capital Management is a multi-strategy hedge fund founded in November 2004 by former Goldman Sachs partner Eric Mindich. The firm started new positions in Family Dollar Stores (FDO) , Constellation Brands (STZ), […]

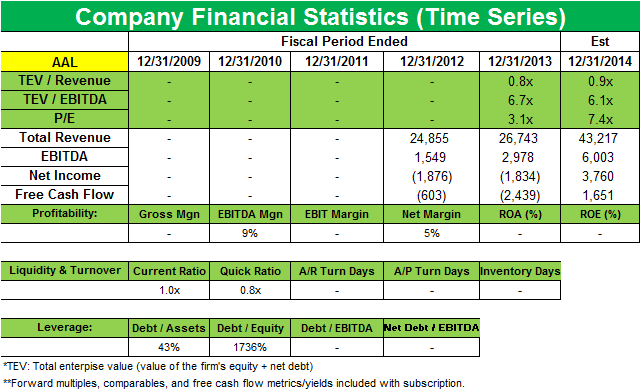

Appaloosa Management raises its stake in American Airlines Group

Appaloosa Management enhanced its position in American Airlines Group Inc. (AAL) last quarter that now accounts for 3.48% of Appaloosa’s total 1Q portfolio.Consumer Must-know: Apple’s valuation versus Google and Microsoft

Apple’s stock is trading at a forward P/E of 12.5x, which is lower than its main peers, Google (GOOG) and Microsoft (MSFT).

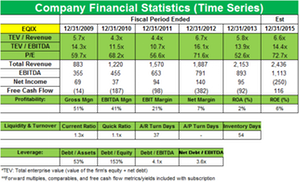

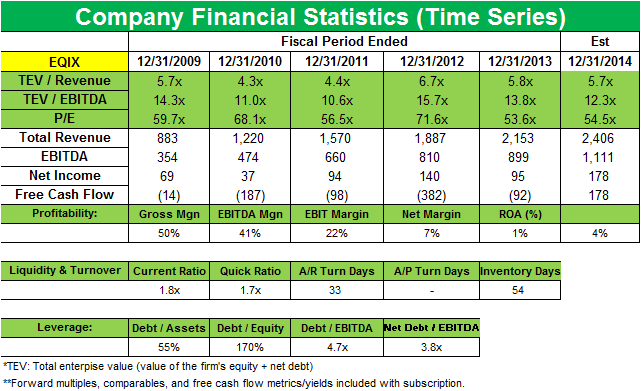

JANA sells stake in Equinix

JANA Partners sold a significant stake in Equinix (EQIX) during the fourth quarter. The position accounted for 3.38% of the fund’s third-quarter portfolio.

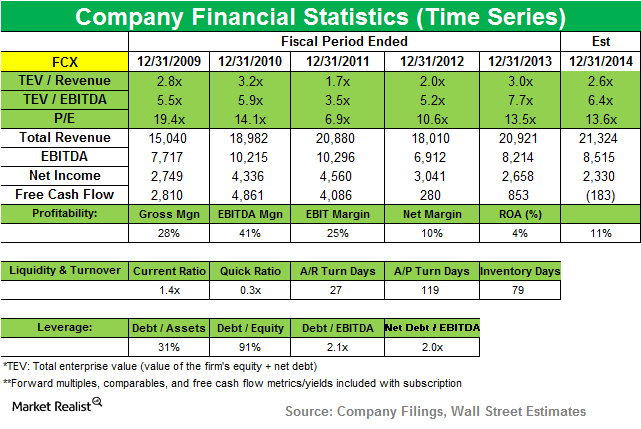

Paulson & Co. eliminates position in Freeport-McMoRan

Freeport-McMoRan is the world’s largest publicly traded copper producer. It posted revenue of $5.7 billion, down 7.6%, saying, results “reflect lower oil volumes and price realizations for copper, gold and oil.”Consumer Chilton Investment Company buys stake in TransDigm in 4Q13

Chilton started a new position in aerospace engineering company TransDigm Group Inc. (TDG) that accounts for 0.76% of the fund’s fourth quarter portfolio.

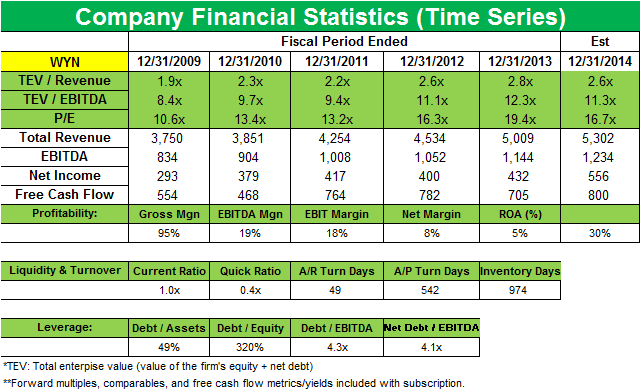

Why Chilton starts new position in Wyndham Worldwide

Approximately 63% of Wyndham’s revenues come from fees for providing services referred to as its “fee-for-service” businesses.

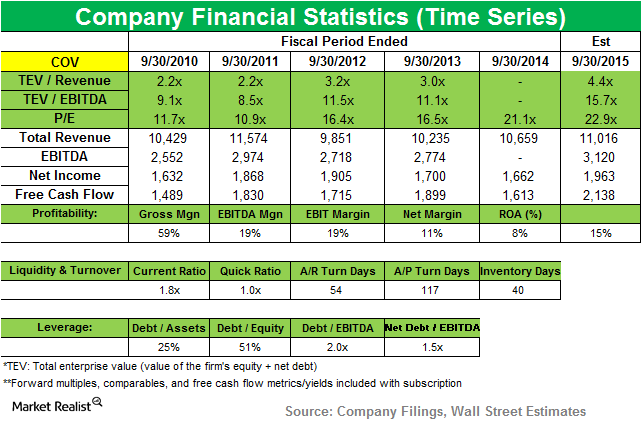

Paulson & Co. ups position in Covidien

The Ireland-based Covidien is engaged in the development, manufacture, and sale of healthcare products for use in clinical and home settings. Its fourth-quarter net sales increased 7% to $2.73 billion.

Gannett plans to split off into two publicly traded companies

In August last year, Gannett Company (GCI) announced that it plans to create two publicly traded companies. It expects to split off its publishing business by the middle of this year.

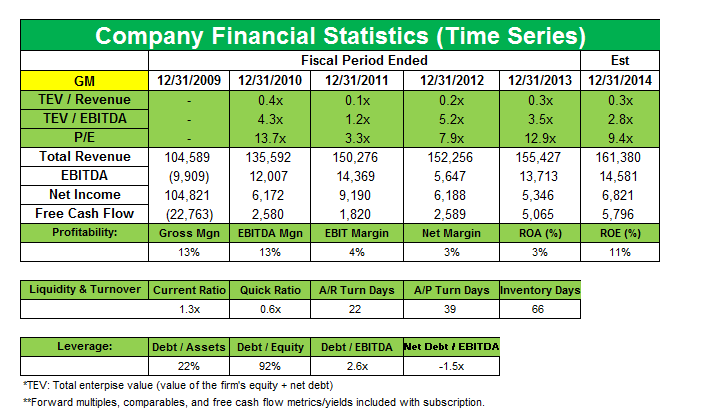

Why did JANA Partners boost its position in General Motors?

JANA Partners enhanced its position in from 0.17% to 4.23% last quarter General Motors.

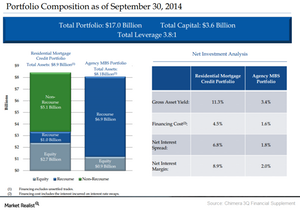

Chimera posts growth in third quarter profit and interest income

Chimera’s core earnings grew to $116 million compared to $93 million in the year-ago period. Growth was mainly due to an increase in net interest income.

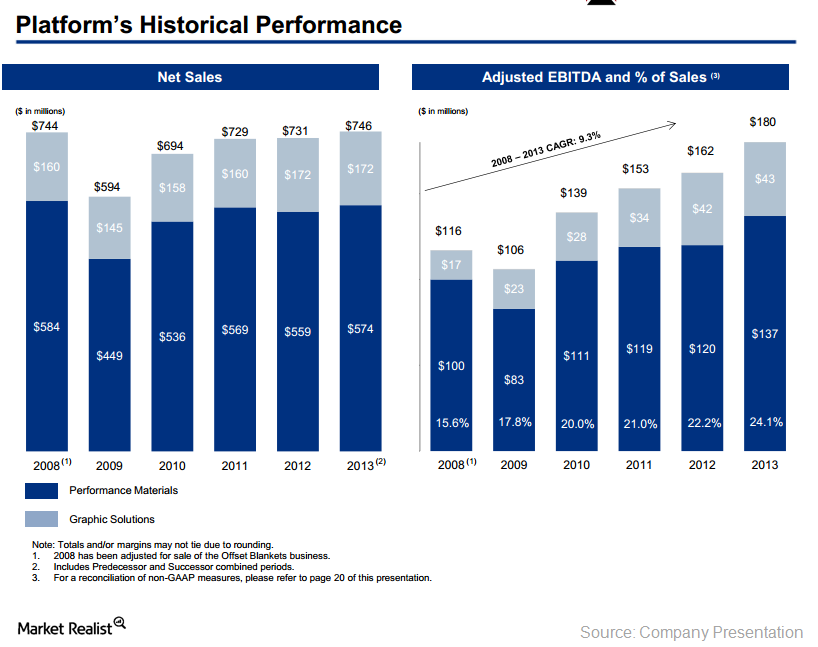

Why Pershing Square initiated a position in Platform Specialty Products

Pershing Square disclosed a new position in Platform Specialty Products (PAH) that accounts for 7.58% of Pershing Square’s 1Q14 portfolio.

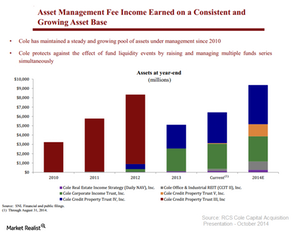

ARCP’s Cole Capital acquisition ended due to accounting issue

In November, RCS Capital terminated a $700 million deal to acquire Cole Capital from ARCP.

Adage Capital adds a new position in Mallinckrodt

Adage Capital added a new position in Mallinckrodt Plc (MNK) in the third quarter of 2014. The position accounted for 0.82% of the fund’s total portfolio.Technology & Communications An assessment: Viacom versus its media peers

Viacom, despite being undervalued by analysts, is expected to see growth from its media networks segment especially with its digital partnership deals.

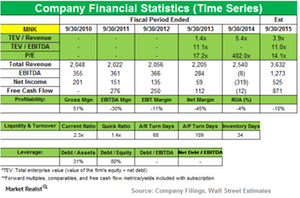

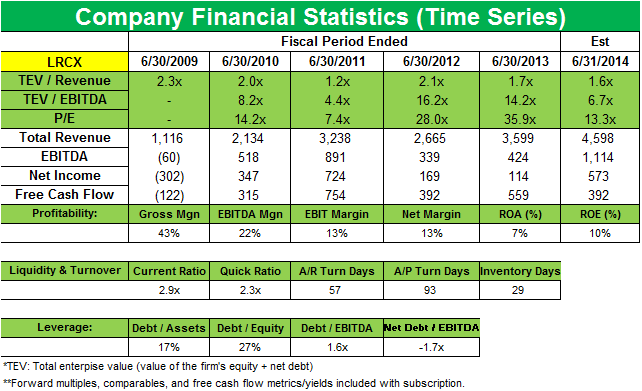

Why Greenlight started a new position in Lam Research Corporation

Greenlight disclosed a new position in Lam Research Corporation, which accounts for 1.01% of the fund’s 1Q 2014 portfolio.

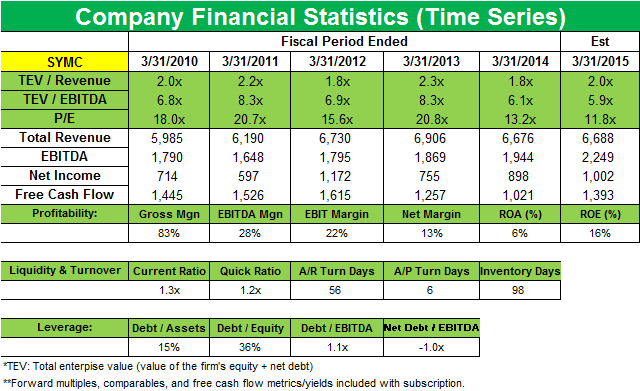

Jeffrey Ubben’s ValueAct Capital buys a new stake in Symantec

ValueAct Capital initiated a new position in Symantec Corp. (SYMC) that accounts for 1.14% of the fund’s first quarter portfolio.

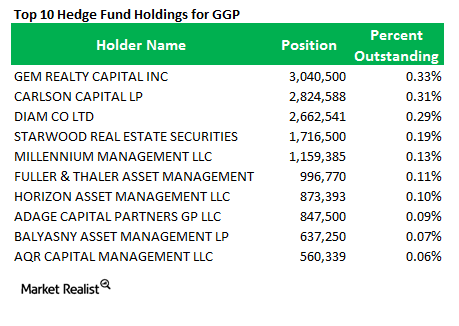

Why did Ackman’s Pershing Square exit General Growth Properties?

Last week, Pershing Square exited its entire stake in General Growth Properties.

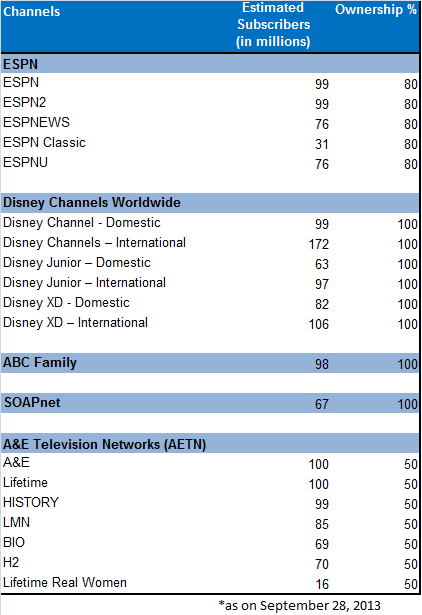

Why ESPN drives Walt Disney’s Media Networks revenue

Disney’s media division has remained its largest source of revenue. For fiscal 2013, revenues from Media Networks increased 5%, to $20.4 billion.

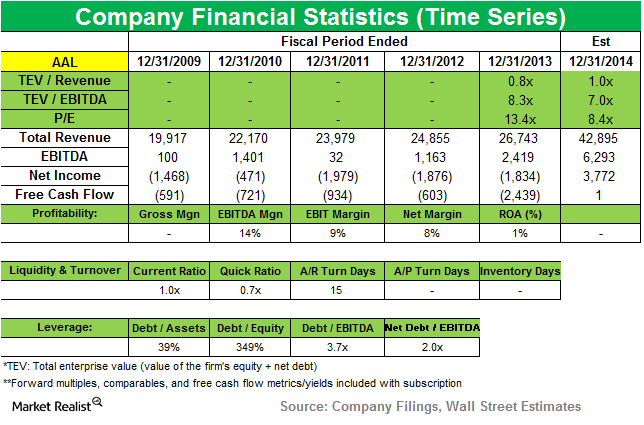

American Airlines gets significantly lower position in Appaloosa

Appaloosa Management significantly lowered its position in American Airlines (AAL) in the third quarter that ended in September 2014. The position accounts for 3.81% of the fund’s total third-quarter portfolio.

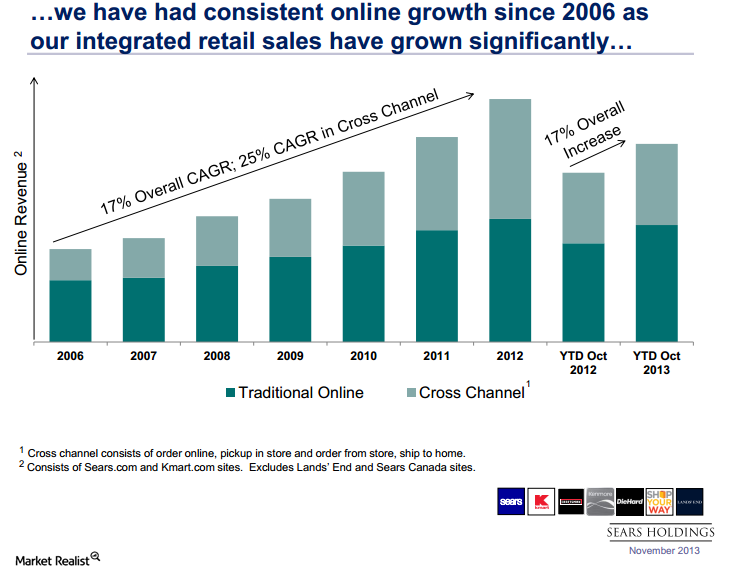

Must-know update: DE Shaw increases its position in Sears Holdings

DE Shaw increased its position in specialty retailer Sears Holdings (SHLD) from 0.01% to 0.07% in 4Q 2013.

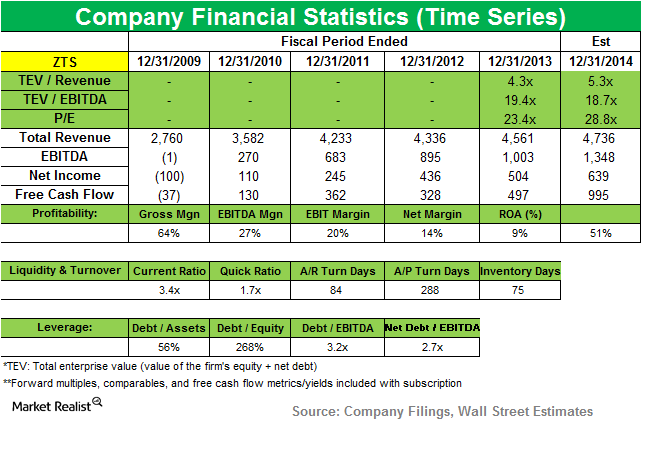

Pershing Square takes 8.5% stake in Zoetis

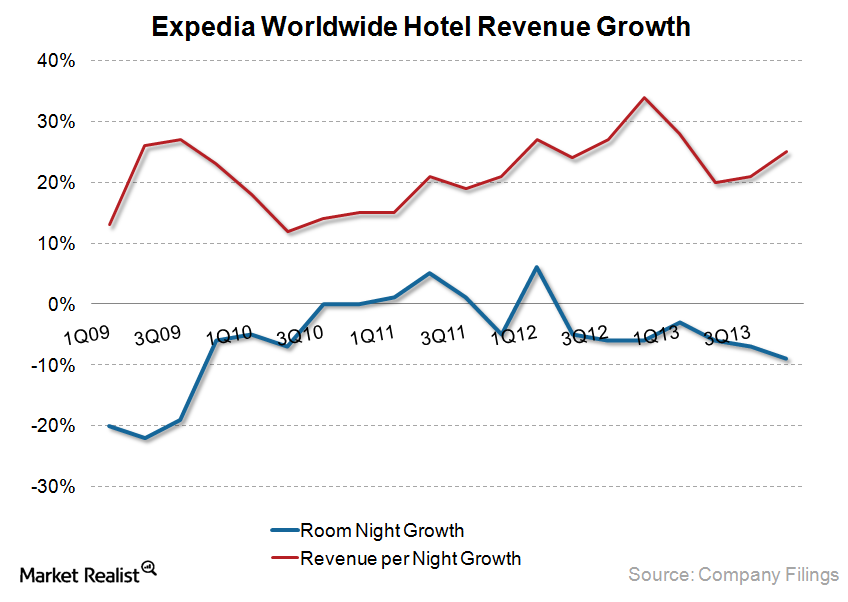

Pershing Square Capital Holdings added a new position in Zoetis Inc. (ZTS), which accounts for 1.52% of Pershing Square’s portfolio for the third quarter that ended in September 2014.Consumer Why Priceline and Expedia clash over “opaque” hotel offerings

Priceline earns the majority of its revenues from the agency model, under which third parties such as hotel suppliers set the rates while Priceline earns a commission on the transaction.

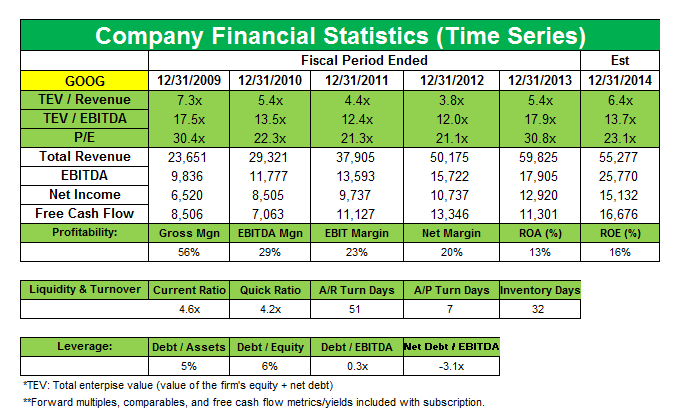

Steven A. Cohen increases SAC Capital’s position in Google

SAC Capital built up its stake in Google Inc. (GOOG) last quarter by 97,523 shares, to 193,550 shares. Google accounts for a 1.26% position in SAC’s portfolio.

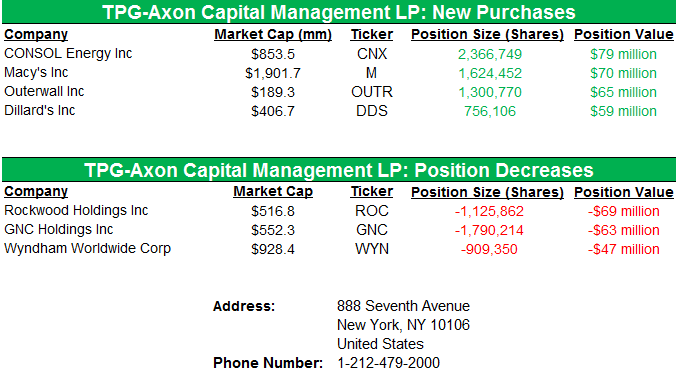

TPG-Axon Capital buys CNX, M, OUTR, and DDS and decreases positions in ROC, GNC, and WYN—13F Flash A

In this six-part series, we’ll go through some of the main positions TPG-Axon Capital traded this past quarter. Why buy CONSOL Energy (CNX)?

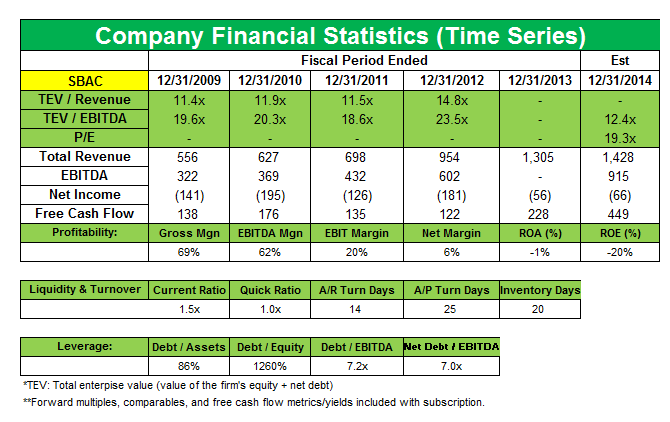

Why did Lone Pine Capital buy a stake in SBA Communications?

SBA Communications Corporation is a 2.11% position initiated by Lone Pine Capital in 4Q 2013.

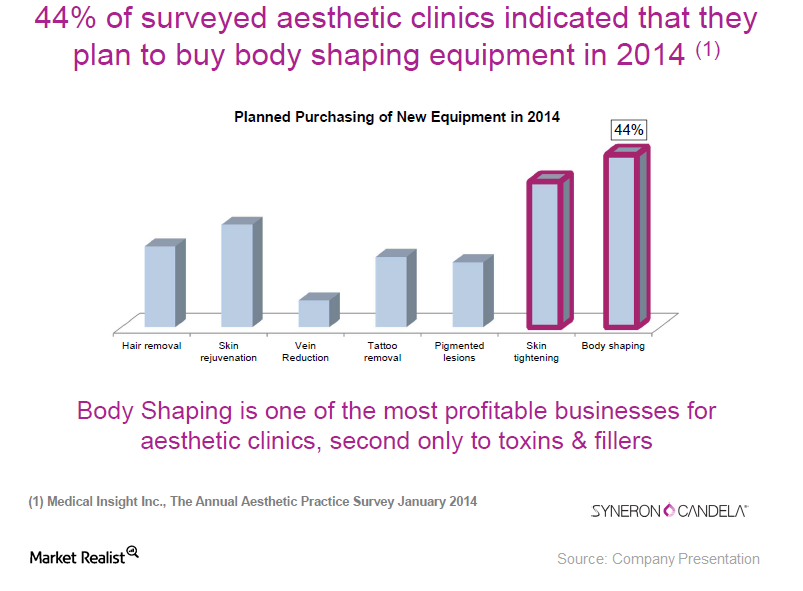

Baupost Group Slightly Reduced Its Stake in Syneron Medical

The Baupost Group lowered its position in Syneron Medical (ELOS) during 4Q14. The position accounted for a minor 0.4% of the total portfolio in 4Q14.Healthcare Why enterprise solid-state drives are a growth driver for Micron

Micron’s solid-state storage business ranges from hard disk drive (or HDD) replacements with solid-state drives (or SSDs) for clients to enterprise-class storage solutions.

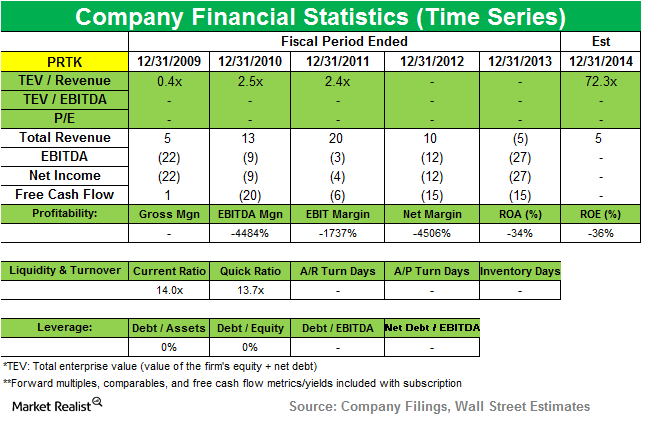

Baupost discloses stake in Paratek Pharmaceuticals

Seth Klarman’s The Baupost Group added a 12.04% stake in Paratek Pharmaceuticals, Inc. (PRTK), according to a 13G filing in December.

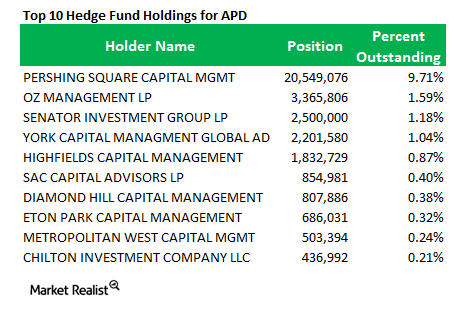

Why Pershing Square increased its stake in Air Products and Chemicals

Pershing Square increased its position in Air Products and Chemicals, Inc. from 21.31% in 3Q 2013 to 27.91% in 4Q 2013.

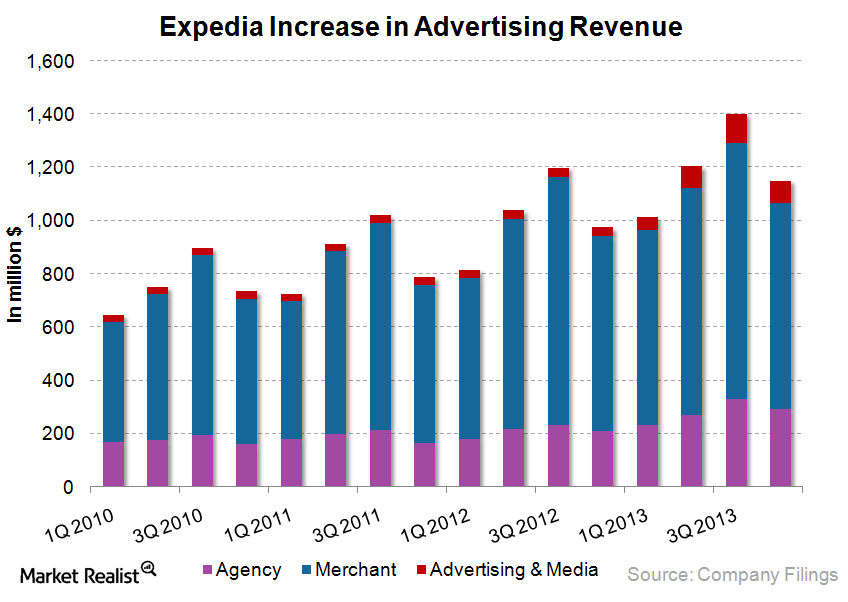

Expedia rolls out ETP program to compete with agency model peers

During 2012, Expedia introduced the Expedia Traveler Preference (ETP) program in the U.S. that offers travelers the choice to either pay Expedia at the time of booking or pay the hotel at the time of stay.

Apple’s Premium Pricing Strategy, Product Differentiation

Here is how Steve Jobs strategy to price and differentiate the products that Apple offers has taken shape over timeTechnology & Communications Why Facebook is a leading social media player

Facebook invests in advertising to attract more marketers to work with the company, to create more value for its marketers, and to enhance marketers’ advertising relevance.

Must-know update: Why is Cisco undervalued? (FCF model included)

Cisco Sytems, Inc.’s stock is up 13% since 2013, and it has underperformed the S&P 500 Index.

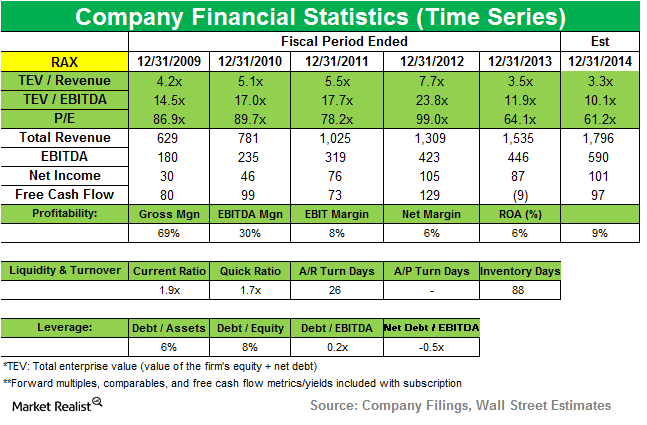

JANA Partners starts a new position in Rackspace Hosting

JANA Partners added a stake in Rackspace Hosting Inc. (RAX). The position accounted for 1.18% of the fund’s total third-quarter portfolio.Technology & Communications Why innovation could be the key to Apple’s growth

Apple’s business strategy leverages its unique ability to design and develop its own operating systems, hardware, application software, and services to provide its customers new products.

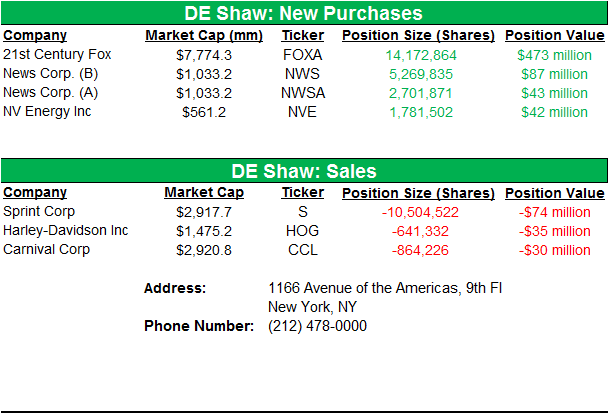

DE Shaw hedge fund opens new positions in FOXA, NWS, NVE, Sells S, HOG, CCL – 13F Flash (A)

In this six-part series, we will go through each one of the larger positions DE Shaw traded this past quarter DE Shaw is a New York–based $30 billion-plus quantitative hedge fund founded in 1988 by David E. Shaw, a former Columbia faculty member. The firm’s primary trading method is systematic and computer-driven. DE Shaw has […]Technology & Communications Must-know: Why is Yahoo undervalued versus its competitors?

Yahoo’s trailing P/E is almost in line with its peers but it’s below Google (GOOG), Facebook (FB), and Chinese Internet giant Baidu (BIDU).

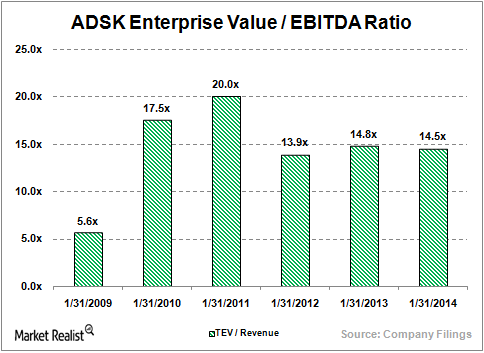

Why did Maverick Capital start new position in Autodesk?

Maverick Capital is a $9 billion long-short equity hedge-fund firm, founded in 1990 by Lee S. Ainslie and Sam Wyly. In 2005, Maverick launched a long-only fund and two market-neutral funds with longer than usual investment lockups. The firm is headquartered in Dallas and has an additional office in New York. The fund bought new […]Consumer How is eBay faring in the e-commerce market

eBay’s profit margins, operating margins, and gross margins are higher than its peers.

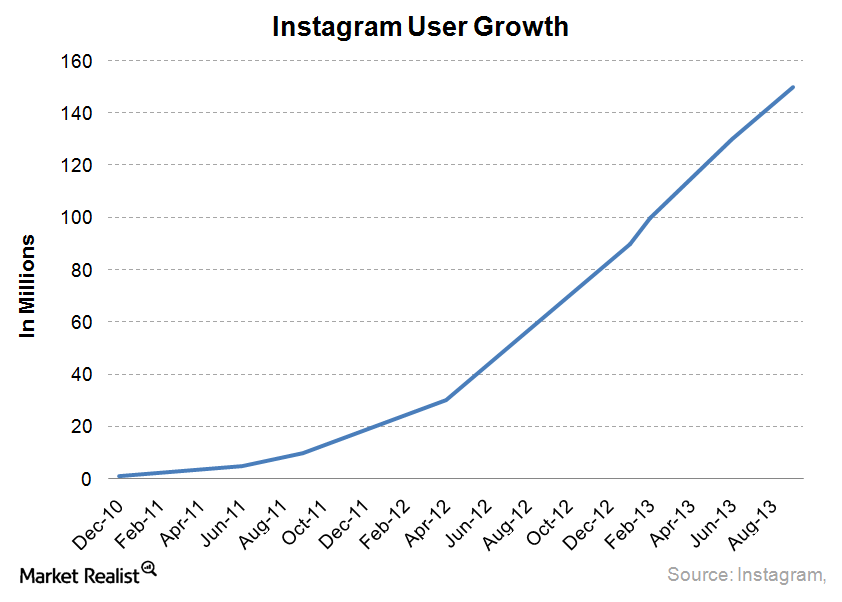

Why Facebook’s Instagram acquisition is a future growth driver

Mobile use has been critical to Facebook’s user growth and engagement over the long term, and accordingly, it’s prioritizing mobile product development.

Stephen Mandel’s Lone Pine Capital buys a new position in Equinix

Lone Pine initiated a new position in Equinix (EQIX) last quarter that accounts for 1.81% of the fund’s total 1Q portfolio. Lone Pine had exited the position in 4Q 2013 and restarted it last quarter.

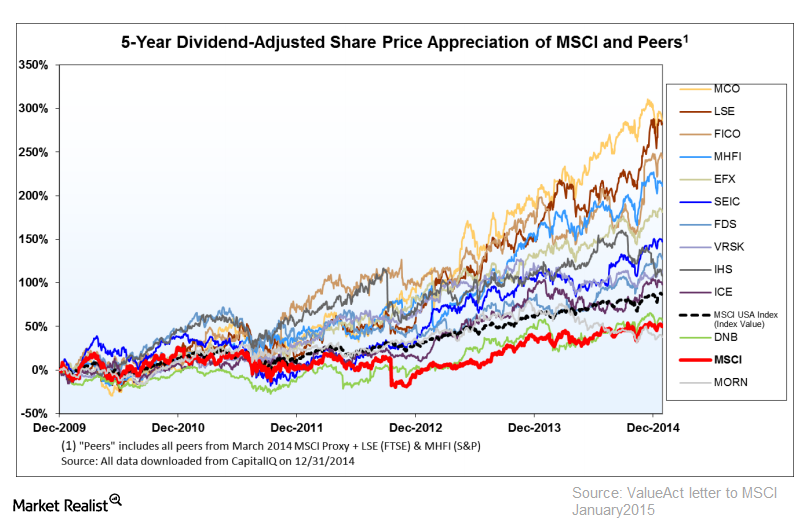

ValueAct challenges “One MSCI” strategy

In September 2014, MSCI approved a quarterly dividend and raised its share repurchase authorization to $850 million from $300 million.Financials Omega Advisors buys stake in IntercontinentalExchange

Omega Advisors opened a new 1.36% position in Intercontinentalexchange (ICE), a leading operator of global markets and clearing houses, in the fourth quarter.

Expedia’s trivago acquisition raises advertising revenue growth

Officially launched in 2005, Expedia’s trivago is a known travel brand in Europe and continues to operate independently, and grow revenue via global expansion.