Samantha Nielson

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Samantha Nielson

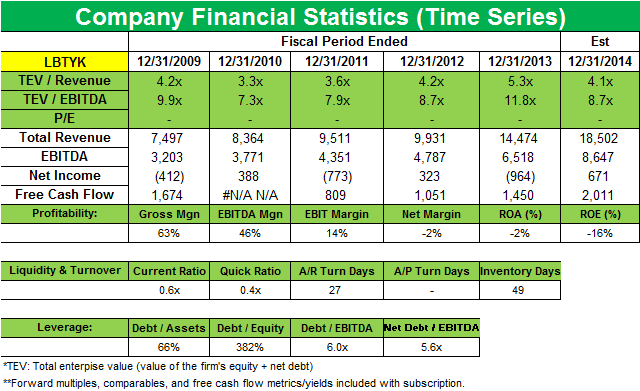

Warren Buffett’s Berkshire Hathaway ups its Liberty Global stake

Berkshire Hathaway added to its position in Liberty Global PLC (LBTYK) last quarter. The position now accounts for 0.57% of Berkshire’s 1Q 2014 portfolio, up from 0.25% last quarter.Technology & Communications Video advertising is the next big thing for social media companies

While Google’s (GOOG) YouTube is already leading the online video advertising space, Facebook (FB) last year announced it’s foraying into video advertising.Technology & Communications Must-know guide to the Walt Disney Company’s competitors

Being a diversified entertainment company, Disney faces a number of competitors in its various segments.

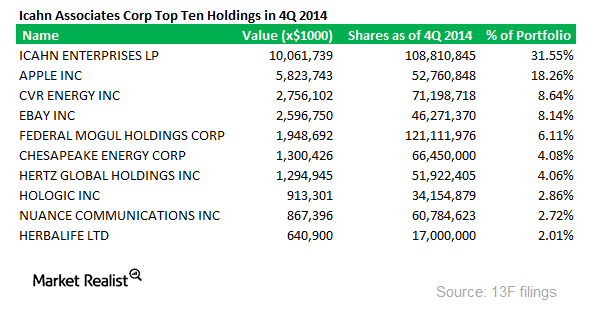

Analyzing Icahn Associates’ 13D and 4Q14 13F Filings

Icahn Associates’ 4Q14 positions were disclosed through a 13F filing in February. The size of the US long portfolio was down to $31.89 billion.

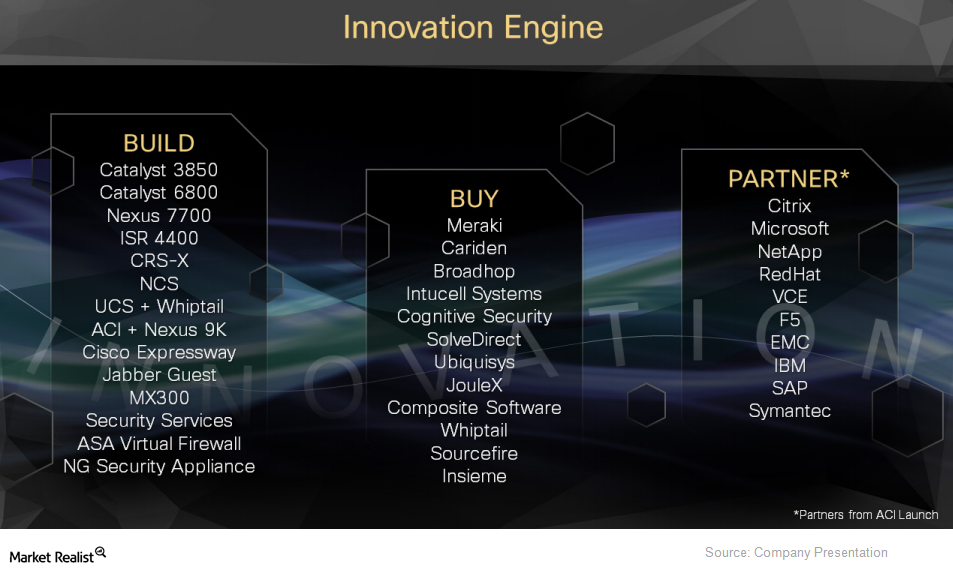

Cisco sticks to its “build, buy, partner, and integrate” strategy

The “build, buy, partner, and integrate” approach is at the heart of Cisco’s innovation culture.

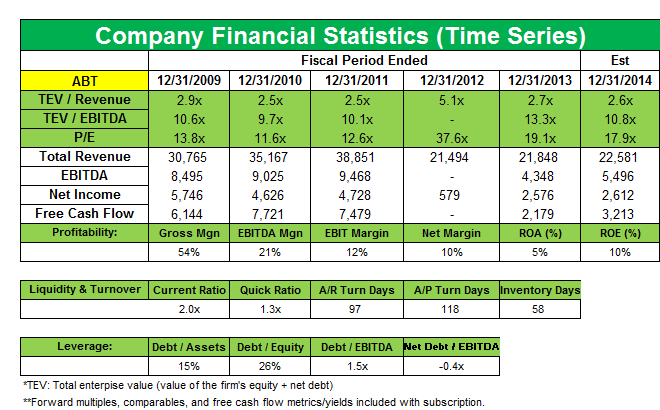

Chilton opens a new position in Abbott Laboratories in 4Q13

Abbott Laboratories (ABT) is a brand new position that accounts for 1.19% of Chilton’s fourth quarter 2013 portfolio.

Apple’s Supply Chain Ranked 1st in the World

IT research firm Gartner ranked Apple’s supply chain last year as the best supply chain in the world for the third time in a row.

Short-term effects of changes to Herbalife’s marketing plan

Pershing Square Capital Management commented on Herbalife’s marketing plan in its latest shareholder letter.

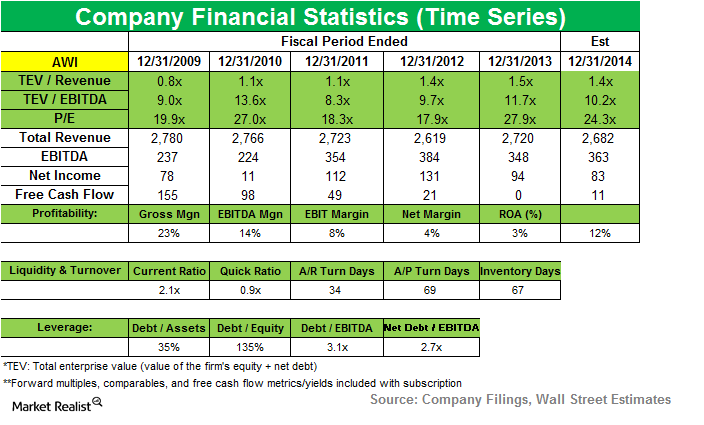

ValueAct gets seat on Armstrong World Industries’ board

While Armstrong’s 3Q14 results beat estimates, its consolidated net sales fell slightly compared to 3Q13, due to lower volumes in Europe and lower sales of resilient and wood flooring in the Americas.

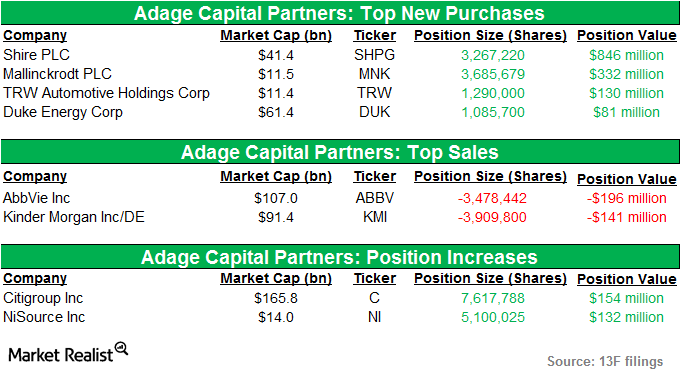

A key overview of Adage Capital’s holdings in 3Q14

Adage Capital’s US long portfolio grew from $38.69 billion in 2Q14 to $40.2 billion in 3Q14. The portfolio comprised around 699 stocks.

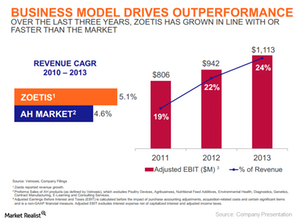

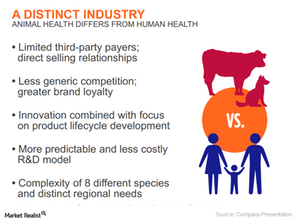

Zoetis: An attractive business model

Zoetis said in a recent statement that “its unique characteristics have established the company as the world leader in animal health, growing revenue faster than the market for the last three years.”

Must-know trends that drive Zoetis’ growth

Demand for Zoetis’ products is driven by a growing population coupled with a rising middle class in emerging markets and increased relocation from rural to urban areas.

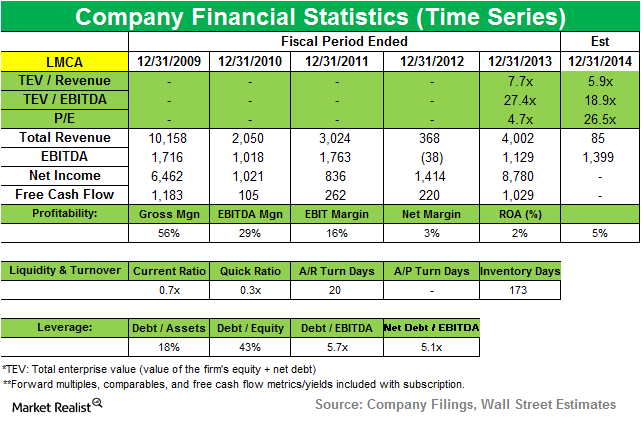

CalPERS adds new position in Liberty Media

Liberty Media Corporation owns interests in a range of communications and entertainment businesses. Recently, the company completed the previously announced spin-off of its cable business, Liberty Broadband.

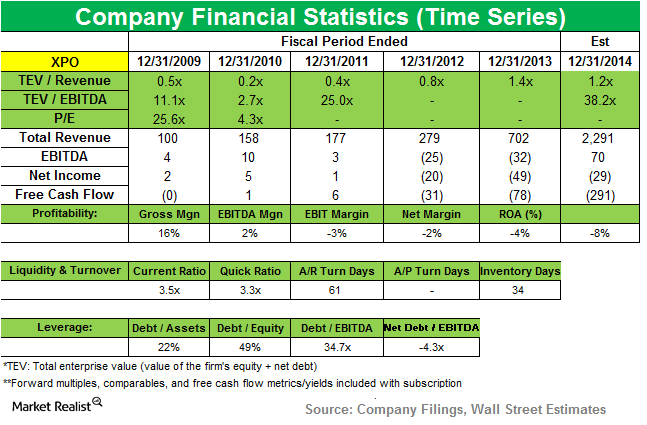

OTPP opens new position in XPO Logistics

OTPP added a new position in XPO Logistics Inc. (XPO) during the third quarter that ended in September. The position accounted for 0.46% of the fund’s total portfolio.

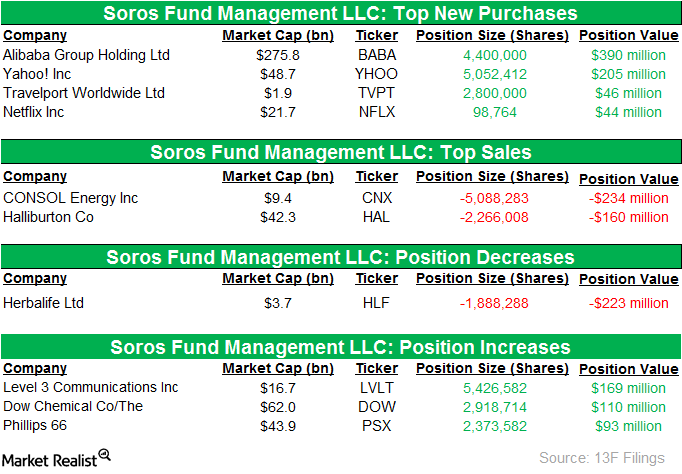

Must-know: positions traded by Soros Fund Management in 3Q14

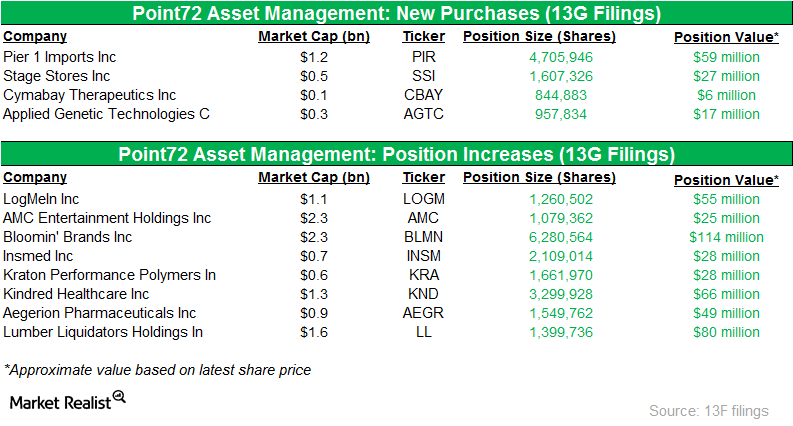

Soros deploys a global macro investment strategy, investing in a wide range of markets and asset classes globally.Consumer Point72 Asset Management opens new position in Pier 1 Imports

E-commerce represented approximately 1% of total sales in fiscal 2013, 4% in fiscal year 2014, 9% in the first quarter of fiscal 2015, and 9.7% in the second quarter of fiscal 2015.

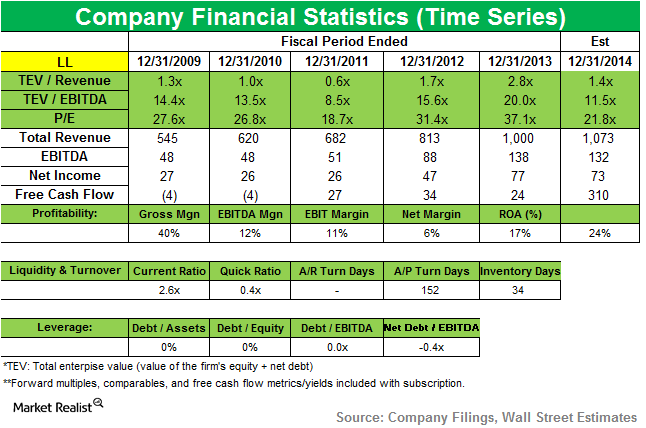

Point72 Asset Management raises stake in Lumber Liquidators

The company “saw improvement in net sales trends over the course of the quarter as inventory levels recovered and the fall flooring season began.” But the shares are down 49% in the year to date.

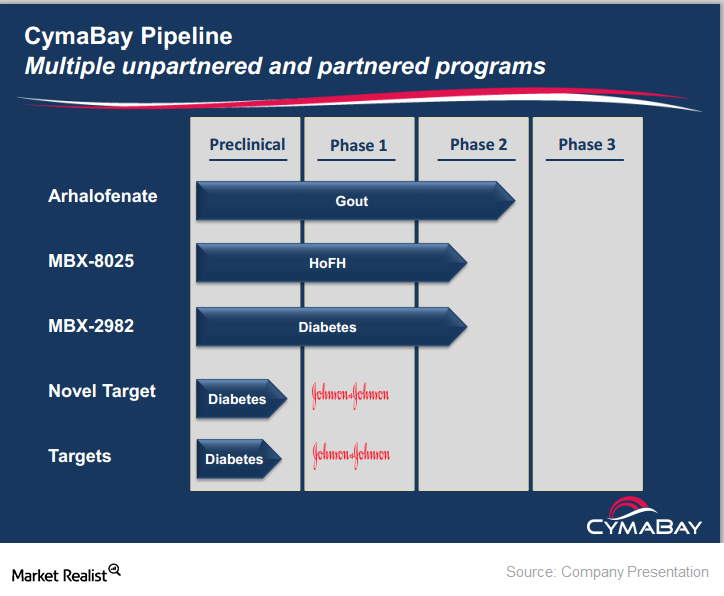

Point72 Asset Management takes position in CymaBay Therapeutics

CymaBay Therapeutics is a clinical-stage biopharmaceutical company formerly known as Metabolex. It develops therapies to treat metabolic and rare diseases with high unmet need.Financials DuPont’s conglomerate structure blamed for underperformance

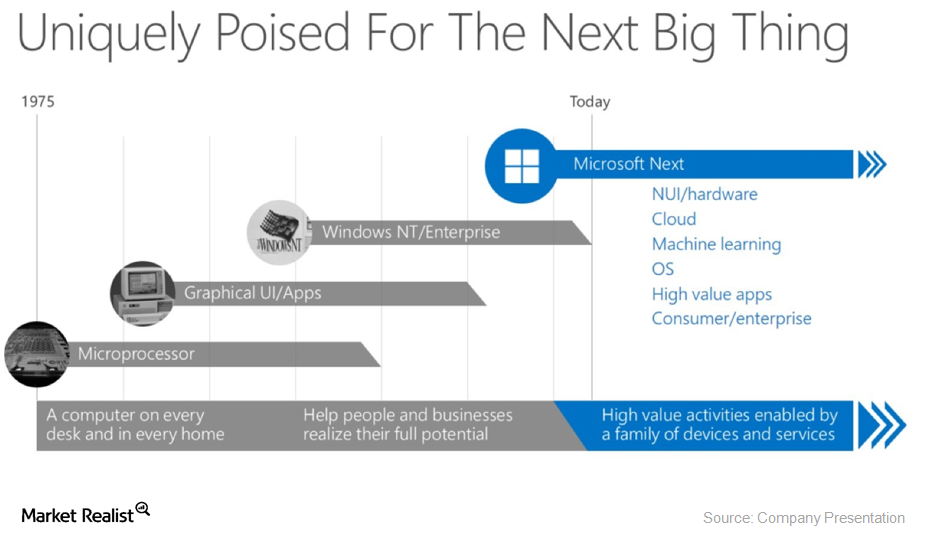

Kullman’s annual letter to DuPont shareholders for 2013 said that the company made acquisitions that added “scientific expertise and access to new markets.”Technology & Communications Must-know: Will Microsoft’s new “one Microsoft” strategy pay off?

The realignment is expected to enable Microsoft to innovate with greater speed, efficiency, and capability in a fast-changing technological landscape.Consumer Berkshire Hathaway buys a new stake in Verizon Communications

Berkshire Hathaway took a new position in Verizon Communications (VZ) last quarter. The position accounts for 2.04% of the fund’s portfolio.

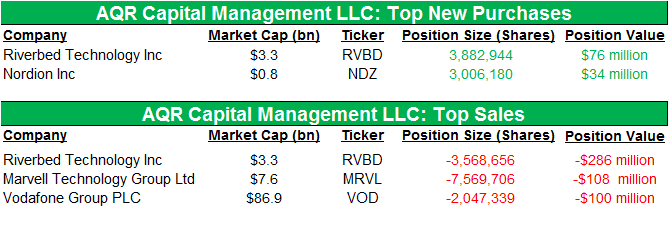

Overview: AQR Capital Management positions in 1Q14

AQR Capital opened new positions in the quarter—the notable ones being Riverbed Technology Inc. (RVBD) and Nordion Inc. (NDZ).Consumer Must-know: An overview of PetSmart’s businesses

Based on 2013 net sales of $6.9 billion, PetSmart is North America’s leading specialty provider of products, services, and solutions for the lifetime needs of pets.Consumer Must-know: An overview of Interpublic Group’s businesses

Interpublic Group’s (IPG) companies specialize in consumer advertising, digital marketing, communications planning and media buying, public relations, and specialized communications disciplines.

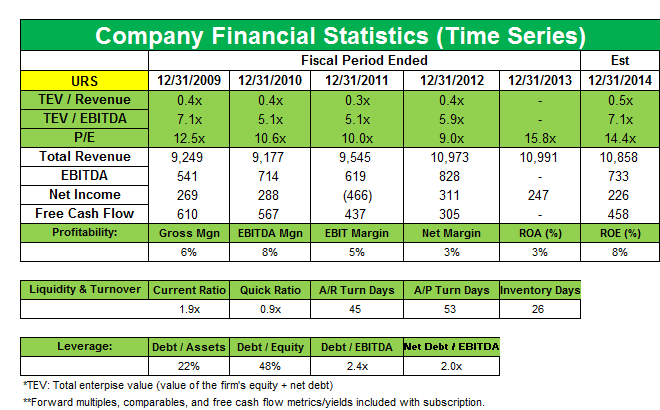

Rosenstein’s JANA Partners buys an activist stake in URS Corp.

Barry Rosenstein’s hedge fund JANA Partners disclosed a new position in URS Corp. (URS) at the end of February 2014. URS is an international provider of engineering, construction, and technical services.Consumer Must-know: The Baupost Group’s 2Q14 positions

The size of the fund’s U.S. long portfolio increased 48% to $6.14 billion in the second quarter from $4.14 billion in the first quarter. The fund’s top positions include Micron Technology, Idenix Pharmaceuticals, and Viasat.

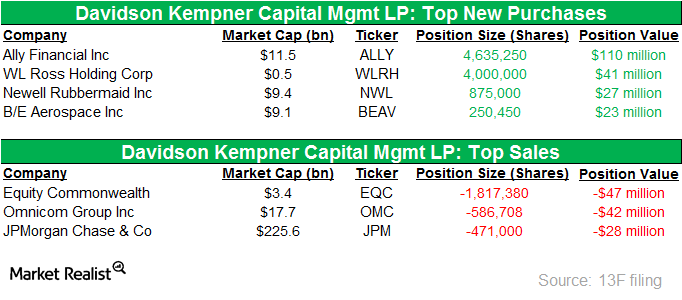

Overview: Davidson Kempner Capital Management’s 2Q14 positions

Davidson Kempner Capital Management LLC is a hedge fund manager. It manages ~$22 billion in assets. In 2Q14, Davidson Kempner Capital added new positions in Ally Financial Inc. (ALLY), WL Ross Holding (or WLRH), Newell Rubbermaid (NWL), and B/E Aerospace (BEAV).

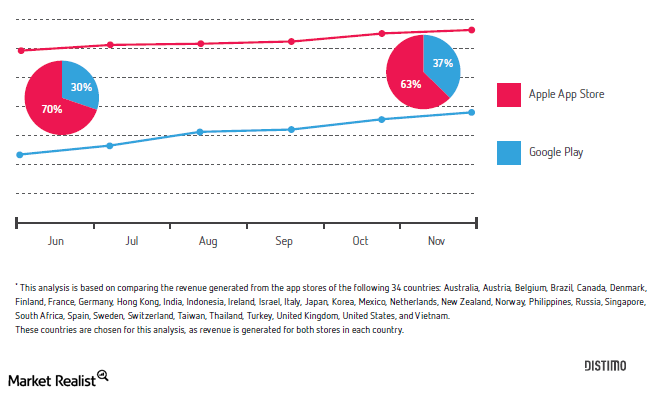

Why Apple’s ecosystem is its biggest competitive advantage

Apple CEO Tim Cook said at a Goldman Sachs conference last year that Apple can be distinguished from other companies due to the company’s expertise in software, hardware, and services.Consumer A guide to Cantillon Capital Management’s investment strategy

The New York–based Cantillon Capital Management is a hedge fund manager founded in 2003 by William von Mueffling.

A guide to Microsoft’s shift from software to devices and services

Microsoft is currently transforming from a software player to a “devices and services company” in an overhaul aimed at improving sales and MSFT’s competitive position.Technology & Communications Must-know factors that could drive future growth at Disney

Disney considers itself a creative content company, and creative excellence is the key to its success. It expects to continue to invest both organically and inorganically.

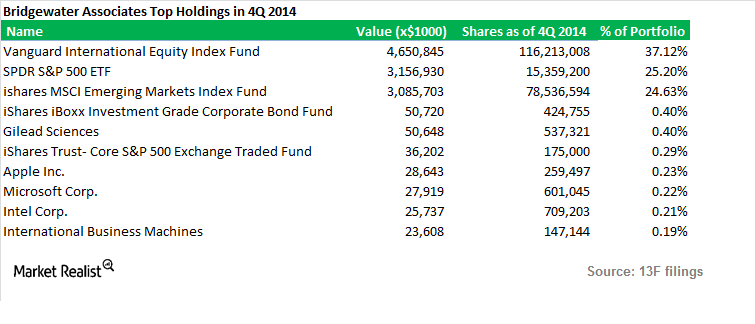

Highlights of Bridgewater Associates’ New Positions in 4Q14

Ray Dalio’s Bridgewater Associates filed its fourth-quarter 13F in February 2015. In 4Q14, the fund had opened four new positions.

Tiger Global starts new position in Mobileye

Mobileye, the Israel-based vehicle safety technology company, earned gross proceeds from its initial public offering of $1.023 billion.

Must-know: Tiger Global Management’s holdings in 3Q14

Tiger Global Management’s holdings included 48 stocks during the third quarter. The size of the fund’s US long portfolio fell slightly from $7.8 billion to $7.5 billion.

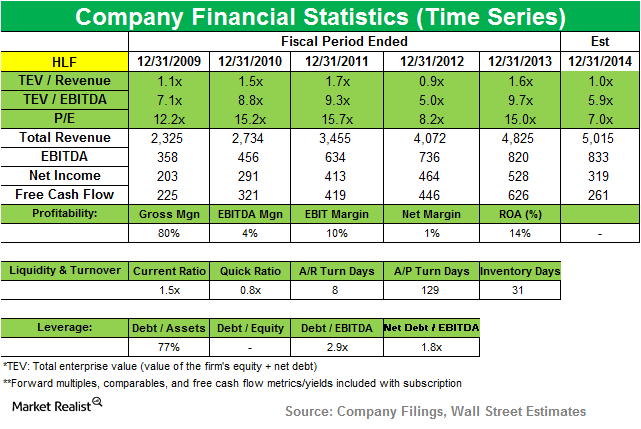

Soros Fund Management significantly lowers position in Herbalife

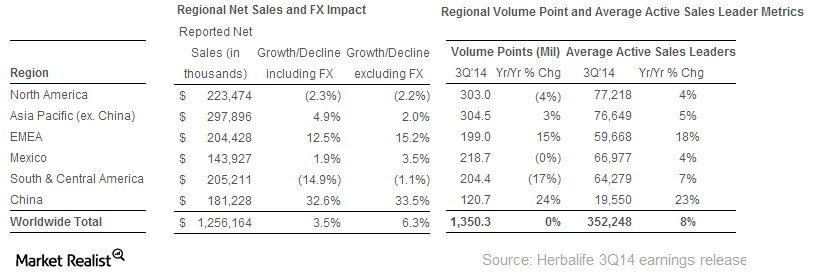

As of 3Q14, Herbalife sold its products in 91 countries to and through a network of 3.9 million independent members, including 0.2 million in China.

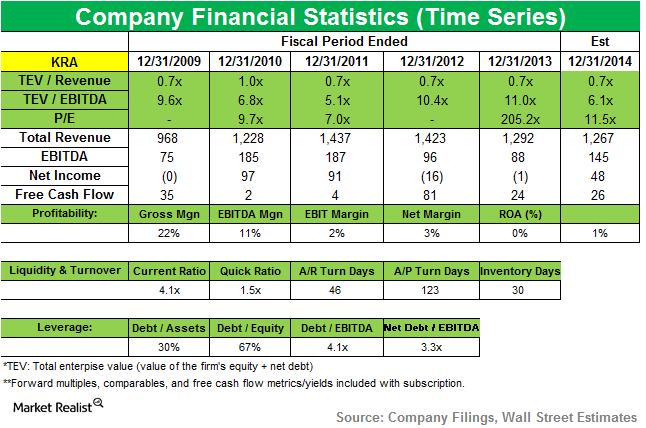

Point72 Asset Management adds to position in Kraton Polymers

Kraton is a leading global producer of engineered polymers and one of the world’s largest producers of styrenic block copolymers. The company reported sales revenue of $323.8 million in the second quarter.

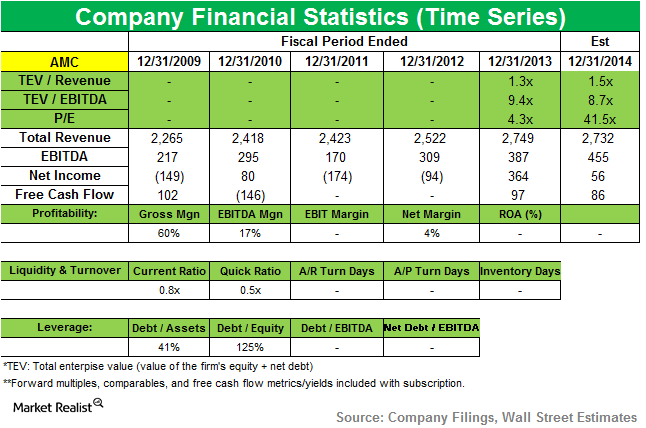

Point72 Asset Management increases position in AMC Entertainment

The additional capital will support AMC’s strategic focus on more guest comfort and convenience, enhanced food and beverage, and premium sight and sound.

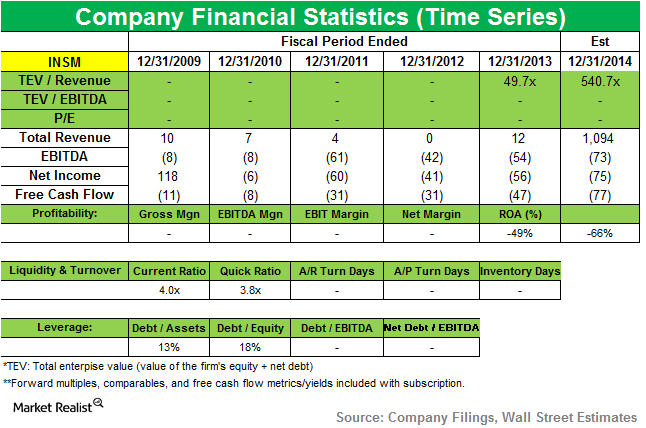

Point72 Asset Management raises position in Insmed

“If approved for NTM patients, we believe Arikayce would be the first and only approved inhaled antibiotic for the treatment of NTM lung infections.” – Insmed

Must-know positions traded by Point72 Asset Management

Point72 focuses primarily on discretionary long and short equity investing and makes significant quantitative and macro investments. According to reports, the fund manages assets valued at between $9 billion and $10 billion.

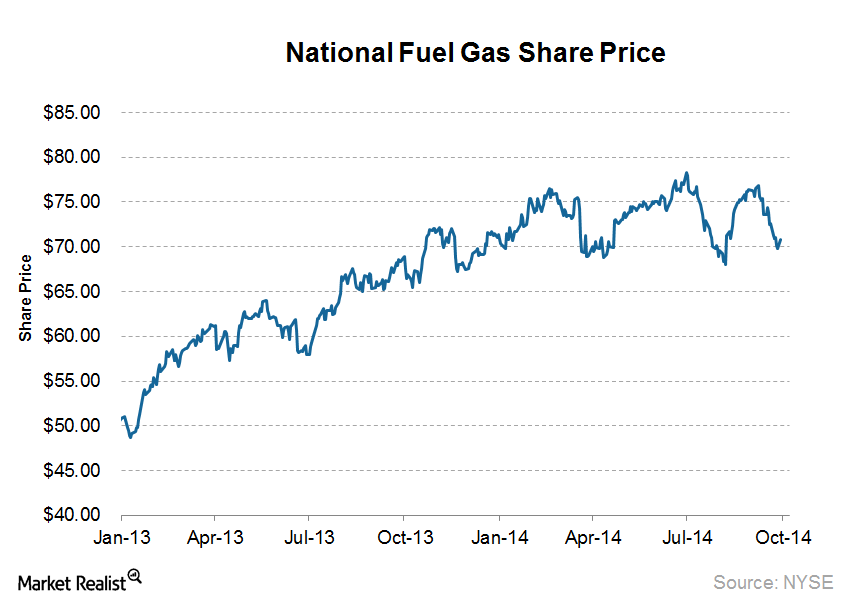

Mario Gabelli’s GAMCO Investors goes activist on National Fuel Gas

Activist investor Mario Gabelli’s GAMCO Investors, which owns a 9.1% in National Fuel Gas (NFG), is pressuring the company to spin off its gas utility segment from its natural gas exploration and midstream assets.

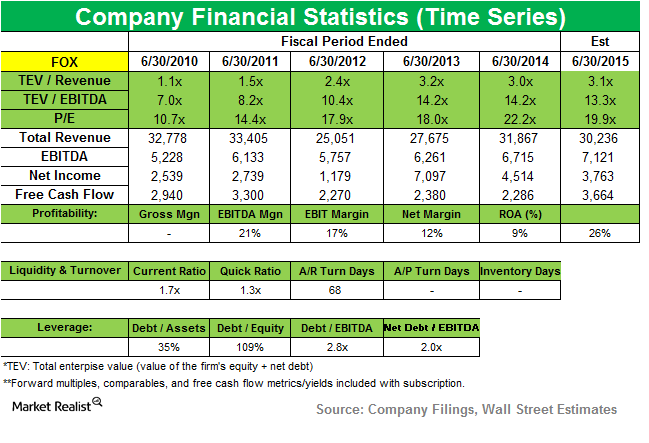

Why ValueAct Capital starts new position in 21st Century Fox

ValueAct Capital initiated a new position in 21st Century Fox (FOX). It’s a diversified global media and entertainment company. FOX accounts for 0.67% of the fund’s first quarter portfolio. 21st Century Fox is home to a global portfolio of cable and broadcasting networks and properties.Consumer Why InterContinental Hotels’ “asset-light” strategy drives growth

The company said on its website that its “business model is focused on franchising and managing hotels, rather than owning them, enabling us to grow at an accelerated pace with limited capital investment—we call this ‘asset light.’Consumer Why Ackman targeted Herbalife’s nutrition clubs

Ackman has campaigned against Herbalife since December 2012. He has released numerous presentations and reports alleging the nutritional company’s multilevel marketing model is a fraud and a “pyramid scheme.”Consumer Must-know: An overview of Herbalife’s direct selling model

The founder and CEO of Pershing Square Capital Management, William Ackman, issued a presentation about global nutrition company Herbalife Ltd. (HLF).Consumer Must-know company overview: Carter’s 5 key business segments

The Carter’s brand was established in 1865. It’s known for high-quality apparel for children, ages newborn to seven.

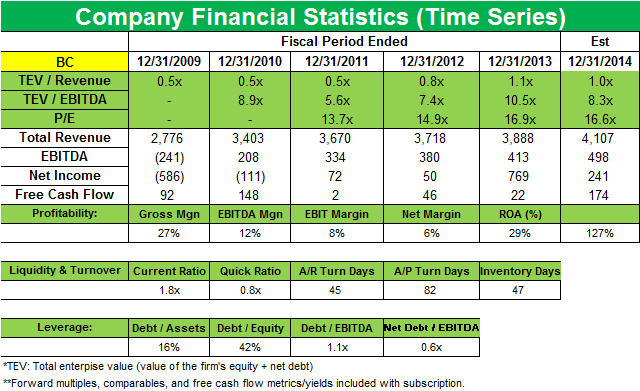

Why Davidson Kempner initiates new position in Brunswick Corp.

Brunswick is a leading global designer, manufacturer, and marketer of recreation products including marine engines, boats, fitness equipment, and bowling and billiards equipment.

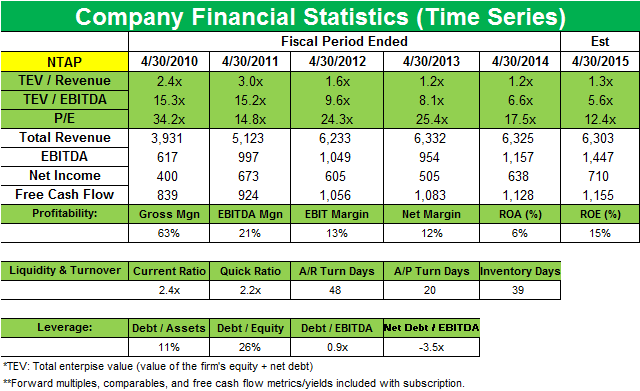

Singer’s Elliott Management sells its large position in NetApp

Elliott Management disposed of a large position in NetApp Inc. (NTAP) last quarter. The position accounted for 10.03% of the fund’s 4Q 2013 portfolio.Industrials Paulson & Co. buy a new stake in Verizon Communications in 1Q14

Paulson took a new position in Verizon Communications (VZ) last quarter. The position accounts for 2.04% of Paulson’s $20 billion portfolio.

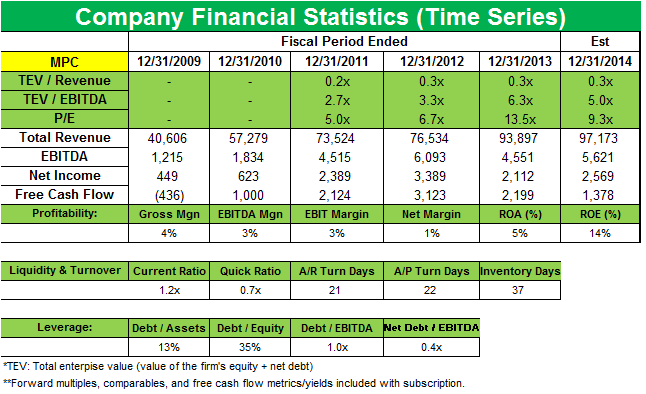

Soros Fund Management opens a new position in Marathon Petroleum

George Soros’ Soros Fund Management added a new position in Marathon Petroleum (MPC) that accounts for 0.45% of the fund’s 1Q 2014 portfolio.Healthcare The case for Pfizer’s proposed takeover of AstraZeneca

U.S. pharma giant Pfizer’s (PFE) second takeover proposal, of $106 billion (£64 billion), was rejected by Anglo-Swedish drug maker AstraZeneca (AZN) last week.