Must-know positions traded by Point72 Asset Management

Point72 focuses primarily on discretionary long and short equity investing and makes significant quantitative and macro investments. According to reports, the fund manages assets valued at between $9 billion and $10 billion.

Oct. 23 2014, Published 12:25 p.m. ET

Point72 Asset Management

Steven Cohen’s Point72 Asset Management, formerly SAC Capital Advisors, disclosed new positions and amended some existing positions during the third quarter. These positions were disclosed via 13G filings. In this series we’ll go through the positions the fund’s traded since June.

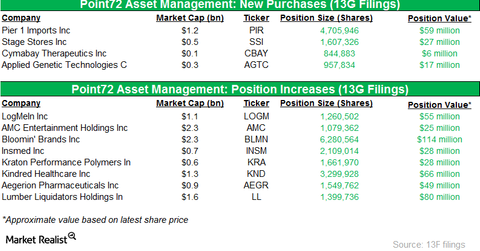

The fund added to its positions in LogMeIn Inc (LOGM), AMC Entertainment Holdings Inc (AMC), Bloomin’ Brands Inc (BLMN), Insmed Incorporated (INSM), Kraton Performance Polymers, Inc. (KRA), Kindred Healthcare, Inc. (KND), Aegerion Pharmaceuticals, Inc. (AEGR), and Lumber Liquidators Holdings Inc (LL).

New positions were initiated in Pier 1 Imports Inc (PIR), Stage Stores Inc (SSI), CymaBay Therapeutics Inc (CBAY), and Applied Genetic Technologies Corp (AGTC).

The number of holdings in Point72’s portfolio in 2Q14 was 657, down from 1,649 in the previous quarter. The size of the U.S. long portfolio was down to $15.6 billion in 2Q14, from $19.2 billion in 1Q14. According to reports, the fund manages assets valued at between $9 billion and $10 billion.

Learn more by reading Assessing Point72 Asset Management’s 2Q 2014 positions.

Investment focus

Point72 focuses primarily on discretionary long and short equity investing and makes significant quantitative and macro investments. News reports earlier this year noted that SAC Capital Advisors’ $1.8 billion settlement of a U.S. government insider-trading investigation received final court approval in April. The business also finalized its transformation into a family office called Point72 Asset Management in the same month.

In the next part of this series, we’ll look at Point72’s increased position in Boston-based remote-connectivity provider LogMeIn.