Insmed Inc

Latest Insmed Inc News and Updates

Consumer Point72 Asset Management opens new position in Pier 1 Imports

E-commerce represented approximately 1% of total sales in fiscal 2013, 4% in fiscal year 2014, 9% in the first quarter of fiscal 2015, and 9.7% in the second quarter of fiscal 2015.

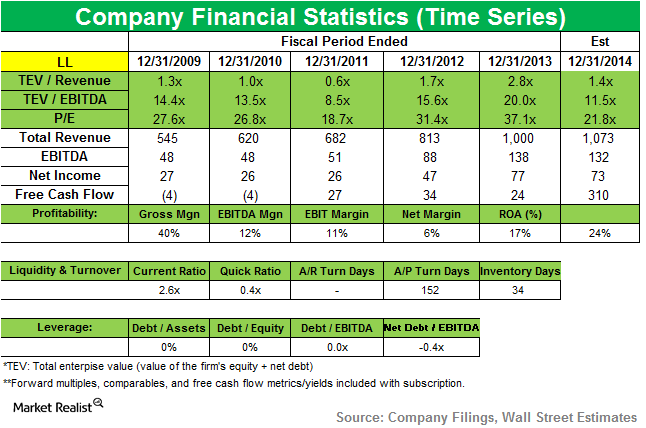

Point72 Asset Management raises stake in Lumber Liquidators

The company “saw improvement in net sales trends over the course of the quarter as inventory levels recovered and the fall flooring season began.” But the shares are down 49% in the year to date.

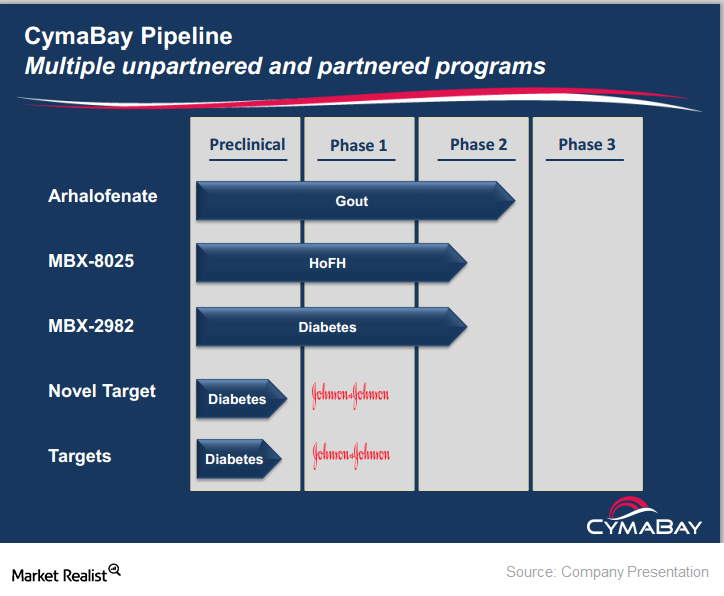

Point72 Asset Management takes position in CymaBay Therapeutics

CymaBay Therapeutics is a clinical-stage biopharmaceutical company formerly known as Metabolex. It develops therapies to treat metabolic and rare diseases with high unmet need.

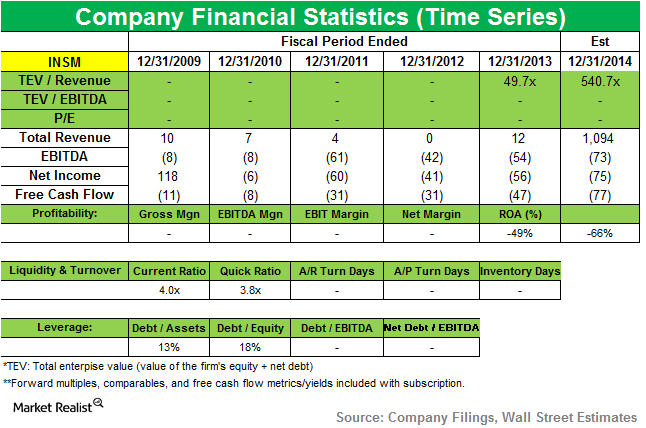

Point72 Asset Management raises position in Insmed

“If approved for NTM patients, we believe Arikayce would be the first and only approved inhaled antibiotic for the treatment of NTM lung infections.” – Insmed