Bloomin Brands Inc

Latest Bloomin Brands Inc News and Updates

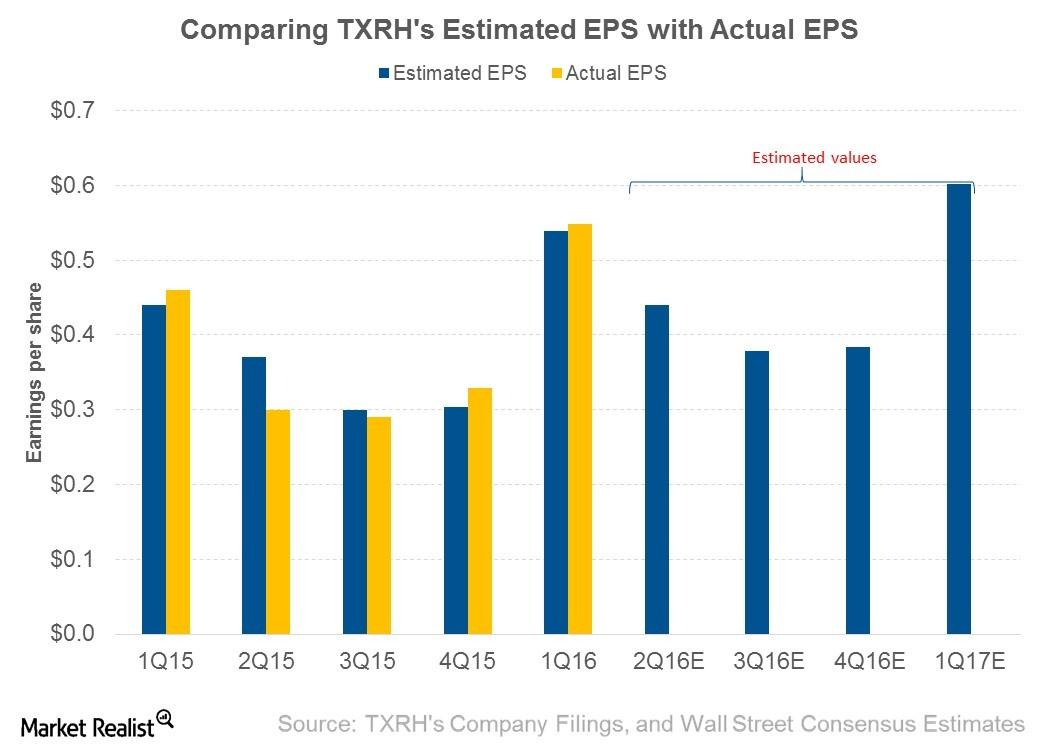

Texas Roadhouse’s 1Q16 EPS Was below Analyst’s Expectations?

In 1Q16, Texas Roadhouse posted EPS of $0.5. This was lower than analysts’ estimate of $0.54. The adjusted EPS was above analysts’ estimate at $0.55.

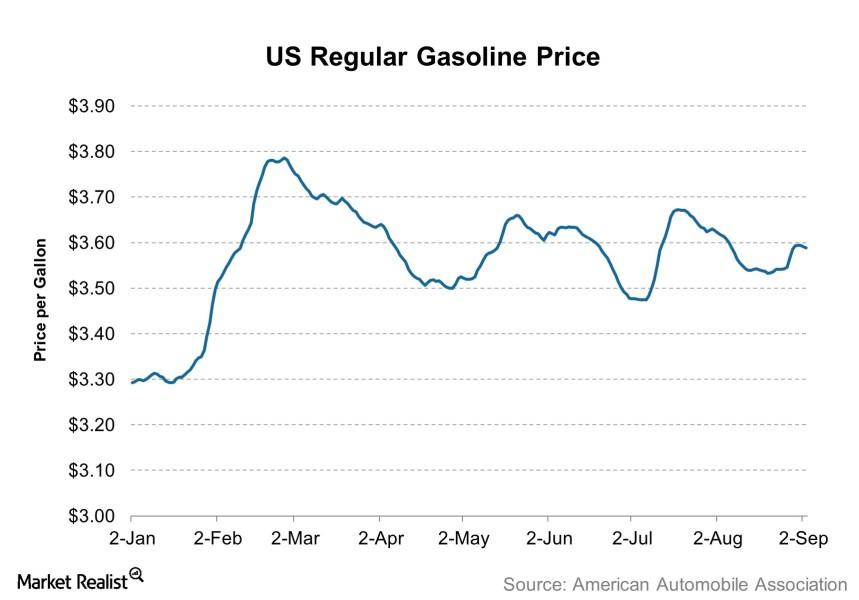

Syria strike would raise gas prices and reduce restaurants’ sales

Why higher gasoline prices can reduce people’s leftover spending at restaurants, which will negatively affect restaurant sales.

Must-Know: McDonald’s Has Got Tough Competition

McDonald’s (MCD) competition includes large international and national food chains as well as regional and local retailers of food products.Company & Industry Overviews What are casual-dining restaurants?

Casual-dining restaurants Casual-dining restaurants have a relaxed, casual ambiance with a lot of seating. They offer full table service and may also have a wine menu or full bar service. The menu is higher-priced than fast-food restaurants. Olive Garden, under the umbrella of Darden Restaurants (DRI), for example, has a price range of $10 to $20 for […]Consumer Point72 Asset Management opens new position in Pier 1 Imports

E-commerce represented approximately 1% of total sales in fiscal 2013, 4% in fiscal year 2014, 9% in the first quarter of fiscal 2015, and 9.7% in the second quarter of fiscal 2015.

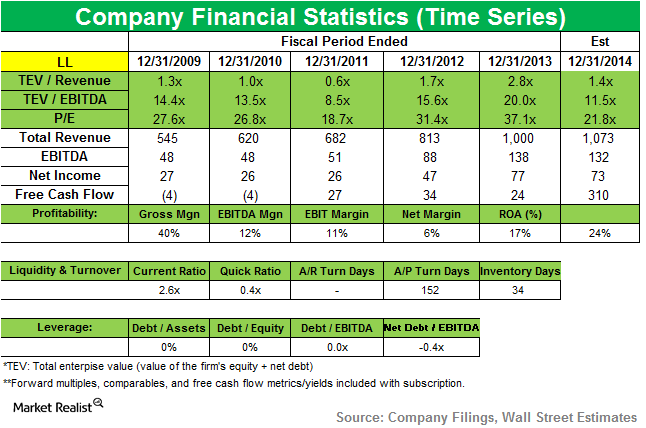

Point72 Asset Management raises stake in Lumber Liquidators

The company “saw improvement in net sales trends over the course of the quarter as inventory levels recovered and the fall flooring season began.” But the shares are down 49% in the year to date.

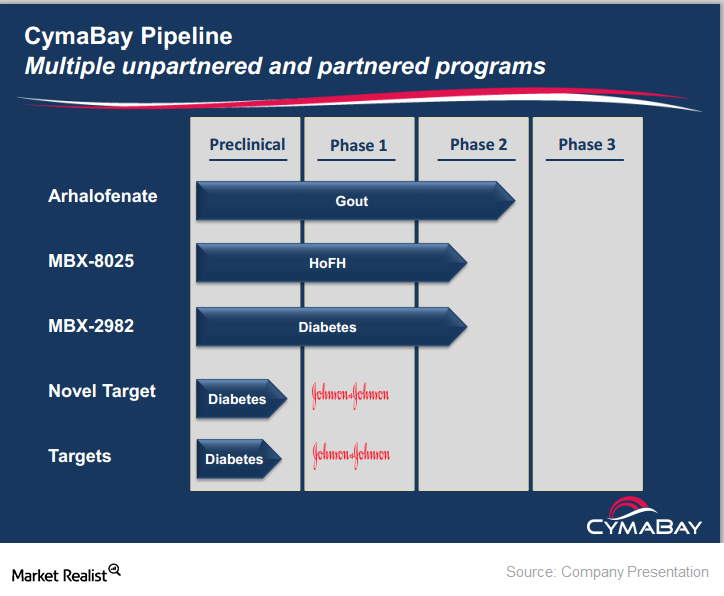

Point72 Asset Management takes position in CymaBay Therapeutics

CymaBay Therapeutics is a clinical-stage biopharmaceutical company formerly known as Metabolex. It develops therapies to treat metabolic and rare diseases with high unmet need.

Darden analysis: Business overview shows limited differentiation

Restaurant industry breakdown The first thing investors should do before making an investment is understand the company’s industry, business, and strategy. We can broadly break the restaurant industry down into the limited-service and full-service sectors. Full-service restaurants are establishments where customers receive their meals at their table, receive table waiting services, and generally pay at […]

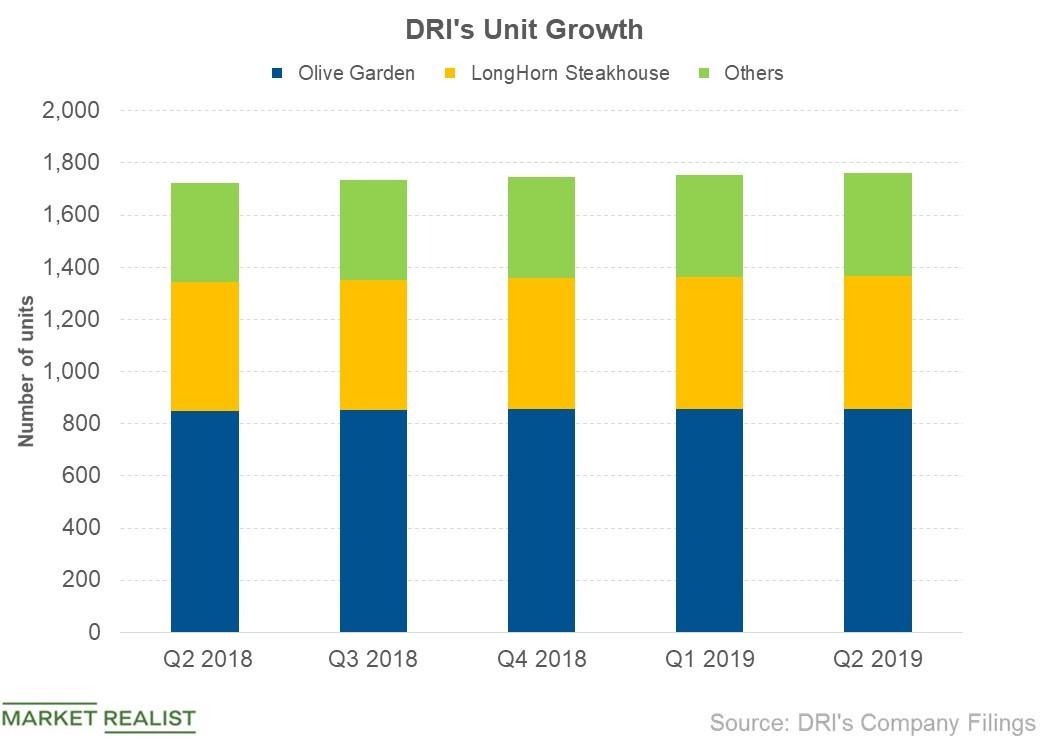

How Is Darden Restaurants Expanding Its Business?

At the end of the second quarter of fiscal 2019, Darden Restaurants (DRI) operated 1,762 restaurants.

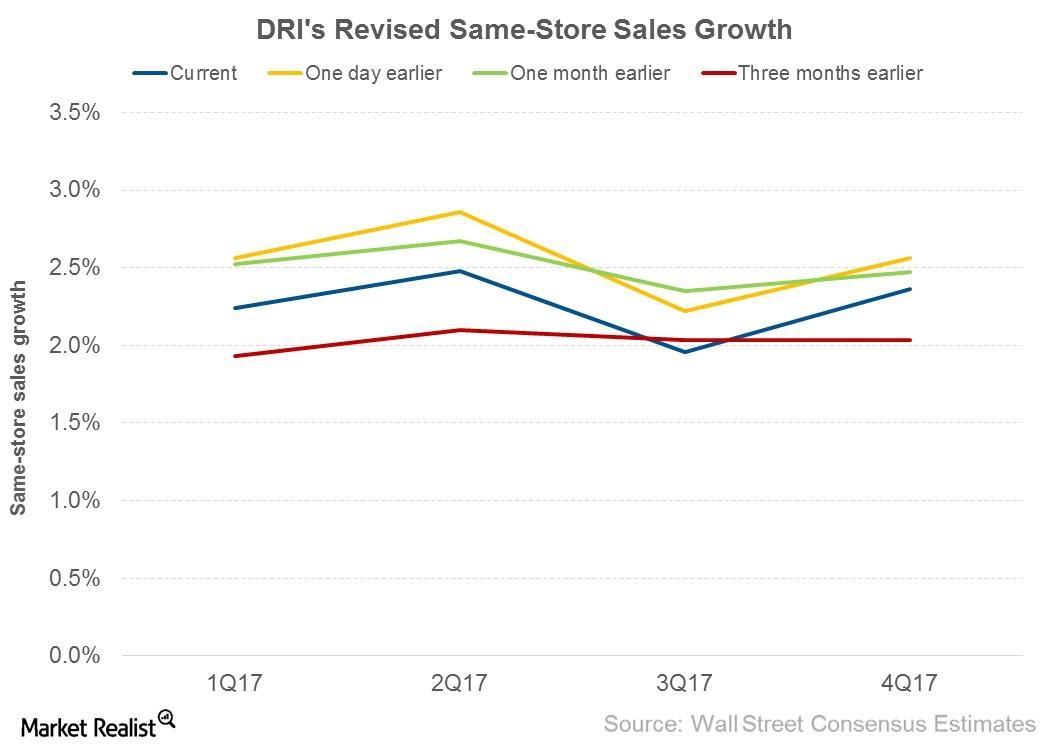

Darden Restaurants Updates Guidance after Fiscal 4Q16 Earnings

After fiscal 4Q16 results, Darden Restaurants’ (DRI) management has revised its same-store sales growth guidance for fiscal 2017 to the range of 1%–2% as compared to earlier estimates of 1%–3%.

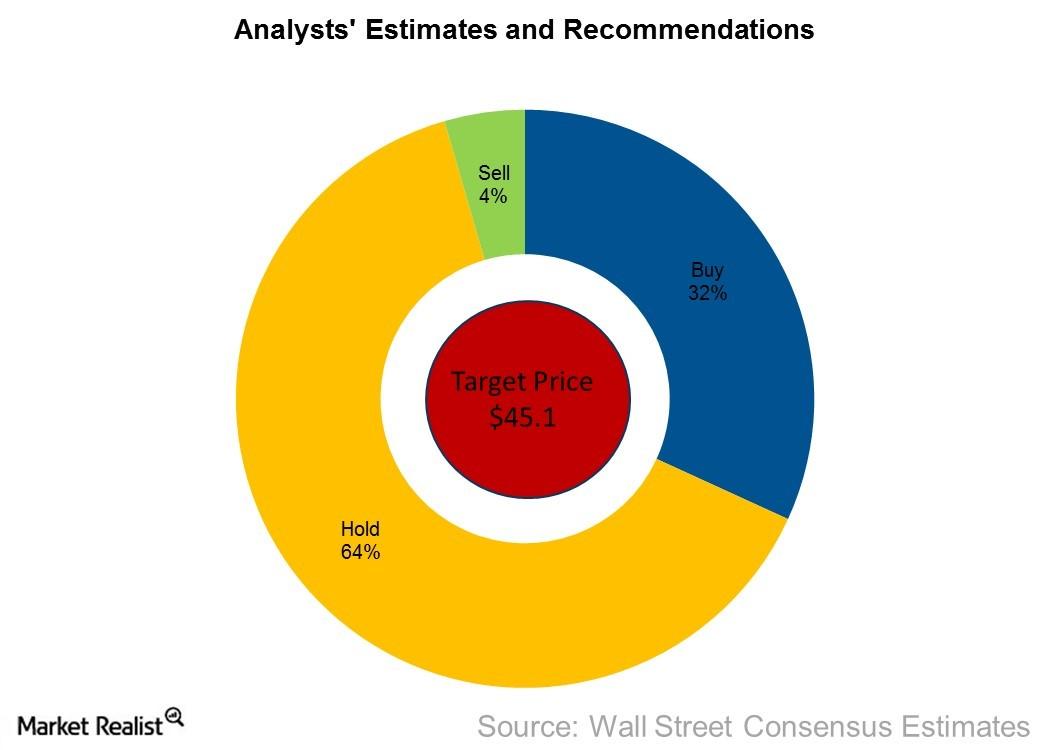

What Do Analysts Recommend for Texas Roadhouse?

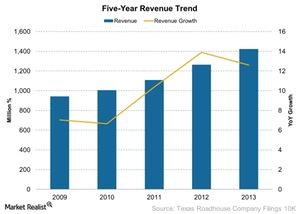

The rise in EPS estimates for the next four quarters has prompted analysts to increase their price target for TXRH for the next 12 months to $45.1 from their earlier estimate of $44.8.

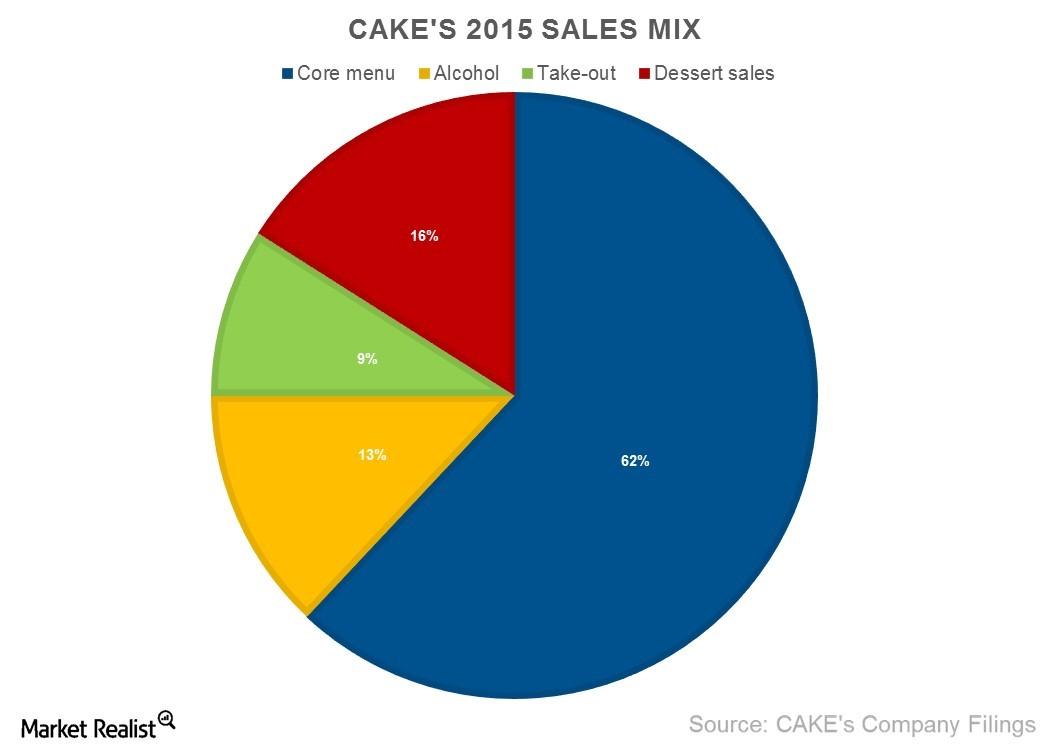

The Cheesecake Factory Is Not Just about Desserts

The Cheesecake Factory has positioned itself as an upscale casual dining concept that focuses on providing a distinctive, high-quality dining experience.

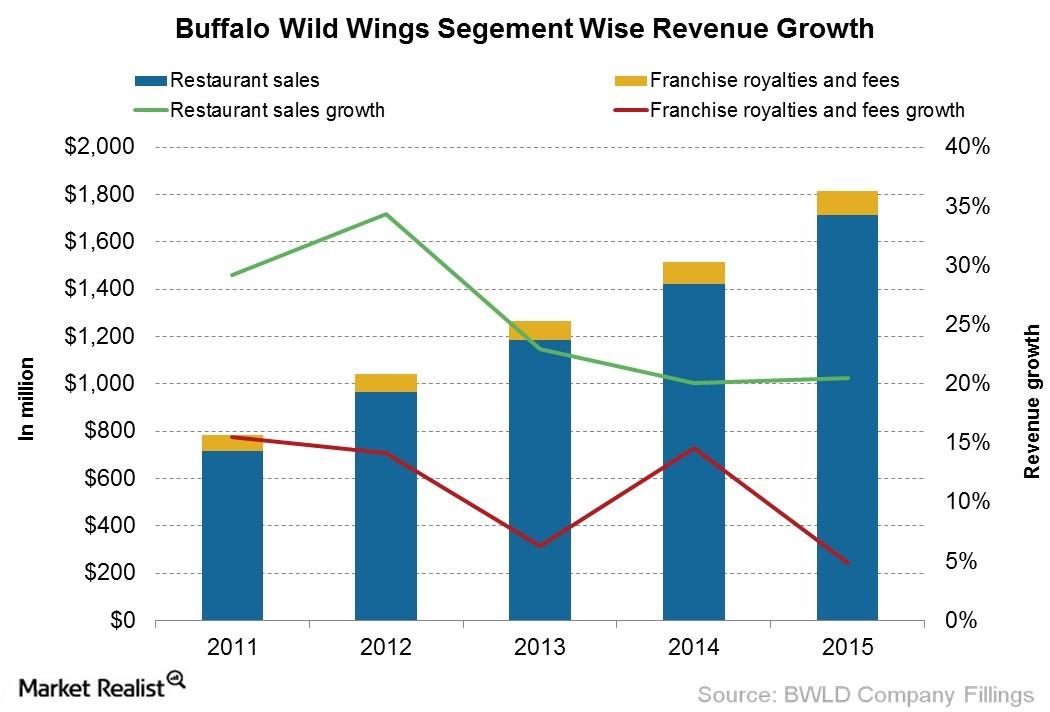

What’s Really Driving Buffalo Wild Wings’ Revenues?

From 2011 to 2015, Buffalo Wild Wings’ (BWLD) revenues increased from $784 million to $1.8 billion—a rise of over 131%.

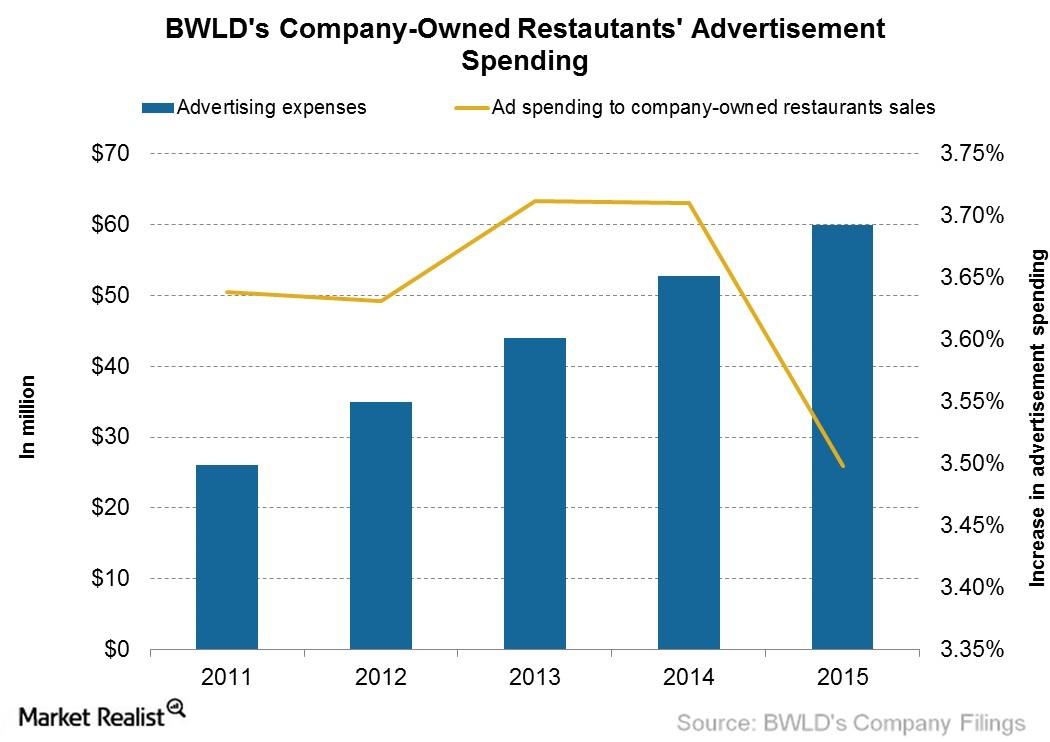

Inside Buffalo Wild Wings’ Marketing Strategies

Buffalo Wild Wings is competing in the highly competitive restaurant business, wherein innovation is a must to keep up with the changing needs of customers.

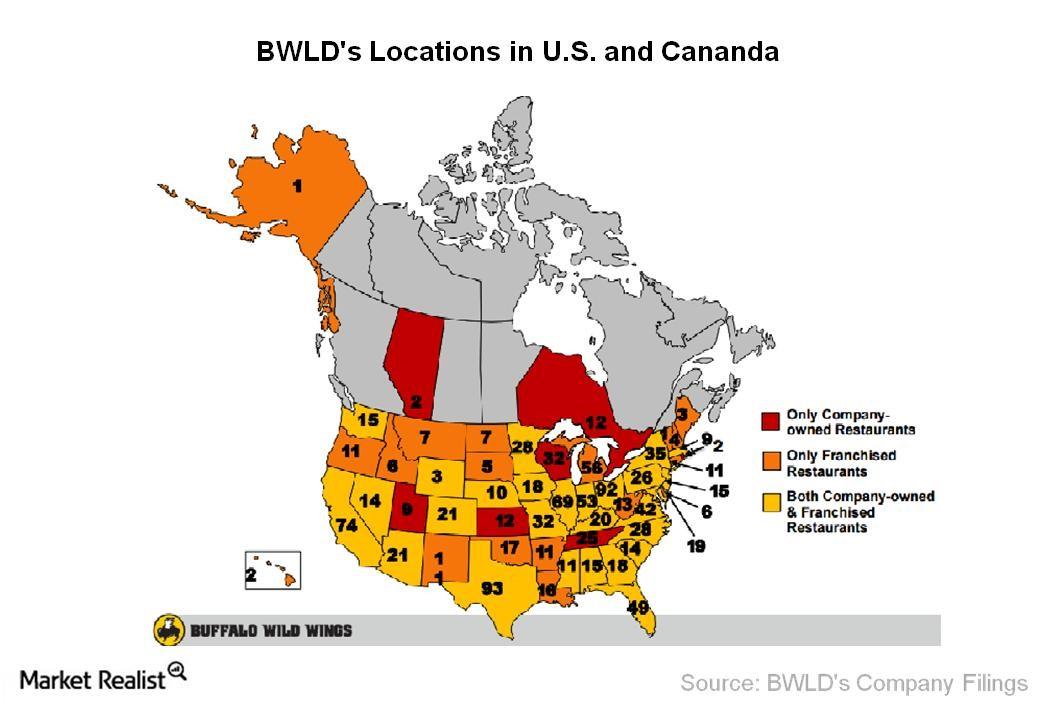

What You Should Know about Buffalo Wild Wings

Buffalo Wild Wings is a casual dining restaurant and sports bar headquartered in Minneapolis. Founded in 1982, the company is also known as BW3.

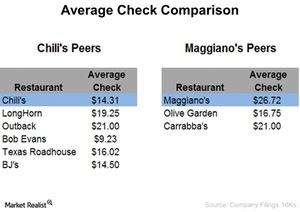

Average Checks at Chili’s and Maggiano’s – Why Do They Matter?

The average check at Chili’s in 2014 was $14.31, lower than its main peers. Maggiano’s average check was $26.72, the highest among its peers.

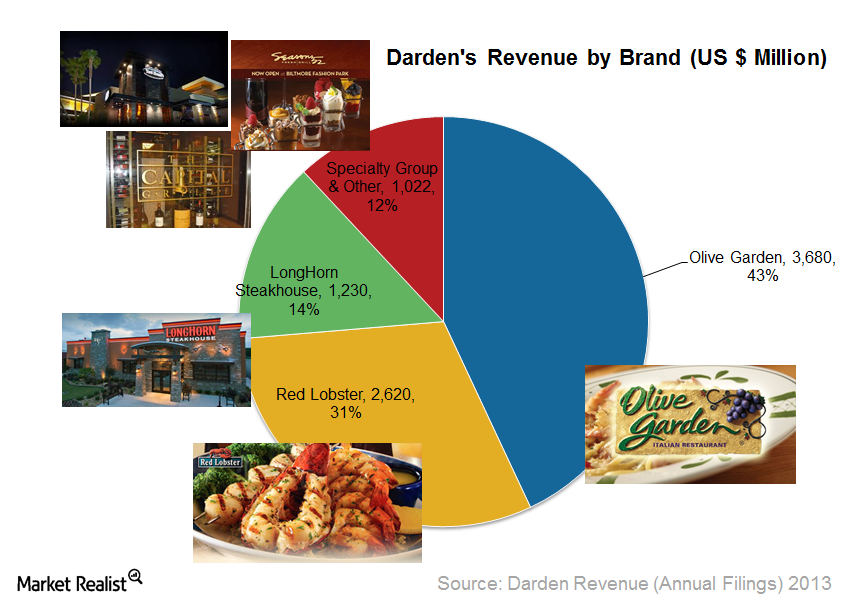

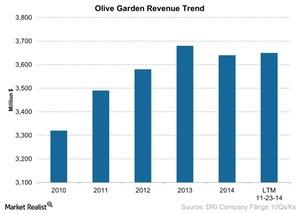

Olive Garden: Darden’s Most Important Brand

In 2014, Olive Garden contributed about 58% to Darden’s revenues as of fiscal 2014. Olive Garden gained importance after Darden sold Red Lobster in 2014.

Pivotal Government Regulations That Affect Texas Roadhouse

In addition to the factors we’ve discussed, regulations can also affect the company’s profits. Let’s look at some of the regulations that apply to TXRH.

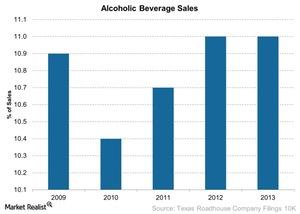

Why Texas Roadhouse Increased Its Menu Prices

The company increased its menu prices by 1.5% in early December of 2013, and in 2012, it increased menu prices by 2.2%.

A Closer Look At Texas Roadhouse’s Steak-Focused Menu

In the last part of this series, we briefly covered Texas Roadhouse’s (TXRH) steak-focused menu. Let’s look at it in more detail in this article.

A Must-Read Business Overview Of Texas Roadhouse

In this overview of Texas Roadhouse, we’ll look at the company’s financial performance, value drivers, competition, unit growth, and other key information.

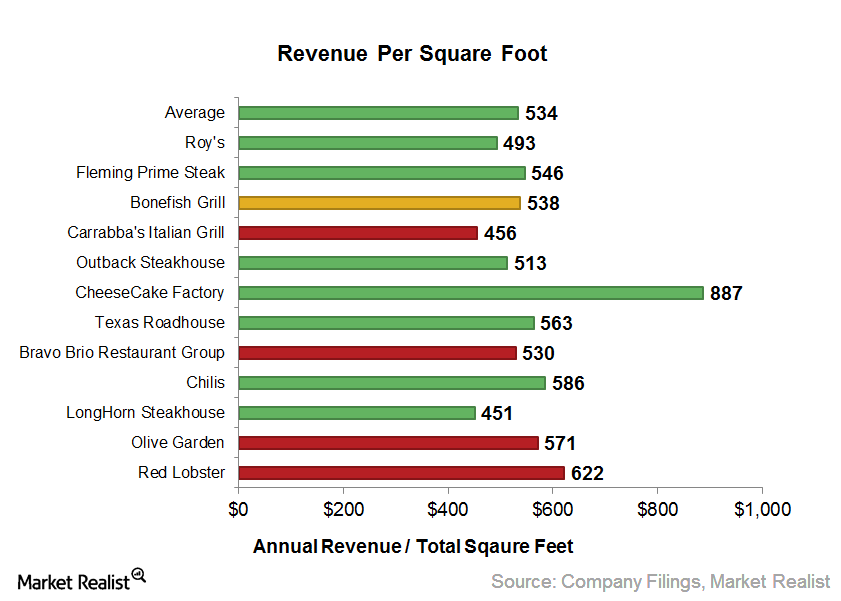

Darden analysis: Why revenue per square foot is essential

Average revenue per square foot To get a better picture of Darden’s business, we further looked into casual dining restaurants’ average revenue per square foot—the square feet of restaurants across primarily the United States and their guest traffic. This will help us decide whether Darden’s Olive Garden and Red Lobster brands should pick up a […]