What Do Analysts Recommend for Texas Roadhouse?

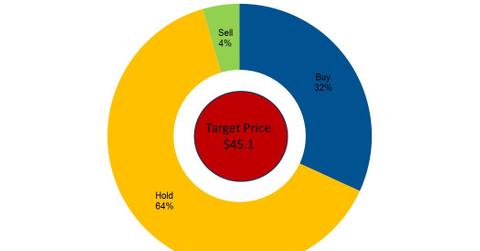

The rise in EPS estimates for the next four quarters has prompted analysts to increase their price target for TXRH for the next 12 months to $45.1 from their earlier estimate of $44.8.

June 16 2016, Updated 11:06 a.m. ET

Analyst target prices

As of June 10, 2016, Texas Roadhouse (TXRH) was trading at $46. The share price might have already priced in the estimates that we discussed earlier in this series. In this part, we’ll look at analysts’ recommendations and estimated price targets over the next 12 months.

The rise in EPS estimates for the next four quarters has prompted analysts to increase their price target for the next 12 months to $45.1 from their earlier estimate of $44.8. The higher EPS estimates have increased investor confidence, which has led to 9.2% growth in TXRH’s share price. Analysts currently are expecting the share price to correct by 1.9% in the next 12 months from its current price of $46.

On the higher side, Alton Stump of Longbow Research is expecting Texas Roadhouse to touch $50 over the next 12 months, which represents a return potential of 8.8%. While on the lower side, John Glass of Morgan Stanley is expecting the share price to touch $34, which represents a return potential of -26%.

The 12-month targets for Texas Roadhouse’s peers are as follows:

Analyst recommendations

According to a Bloomberg consensus that surveyed 22 analysts, 31.8% have a “buy” recommendation for Texas Roadhouse, 63.6% have a “hold” recommendation, and 4.5% have a “sell” recommendation. As the analysts raise their target price for the next 12 months, the share prices of the stock could increase, and vice versa. Texas Roadhouse forms 0.64% of the iShares S&P Small-Cap 600 Growth ETF (IJT).

When the share price is traded at a lower price than the target price, it doesn’t mean an automatic “buy.” Investors should carefully analyze the various matrixes that we discussed in this series before investing.