Darden Restaurants Inc

Latest Darden Restaurants Inc News and Updates

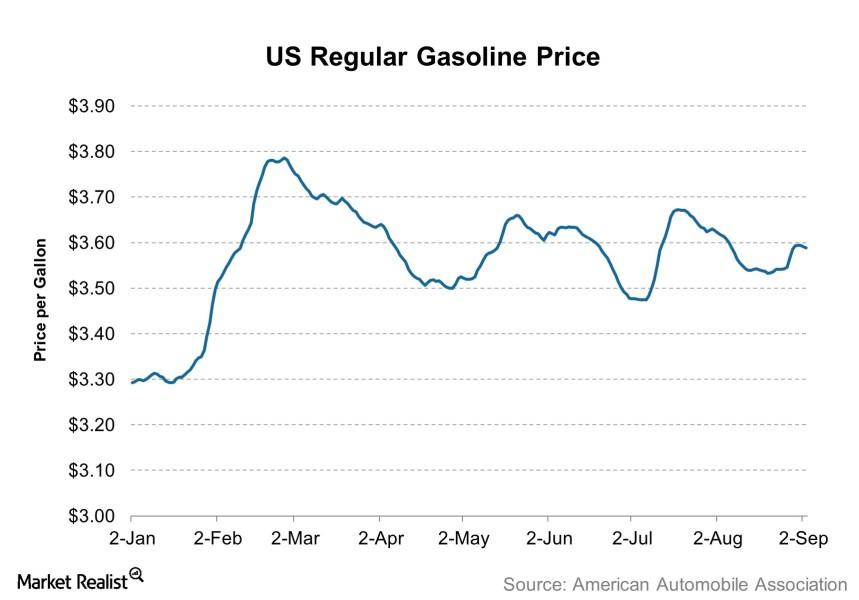

Syria strike would raise gas prices and reduce restaurants’ sales

Why higher gasoline prices can reduce people’s leftover spending at restaurants, which will negatively affect restaurant sales.

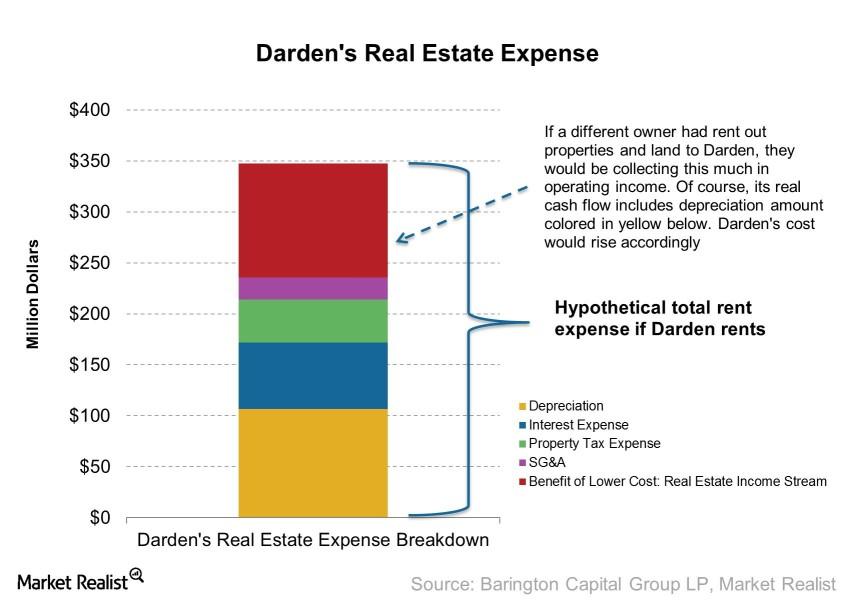

Darden analysis: Key benefits of a restaurant owning properties

Owning properties reduces real estate costs A restaurant business that owns its own building is a bit different from a restaurant business that rents its buildings or lands. From a business standpoint, you can think of a restaurant that owns its buildings as the sum of two businesses: restaurant and real estate. Because the real […]

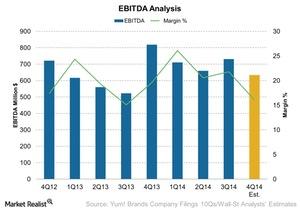

Why Yum! Brands Is Expected To Report Lower EBITDA

Wall Street analysts’ estimated EBITDA for the fourth quarter is $633 million—compared to $918 million in the same quarter last year.

An In-Depth Overview of Panera Bread

Panera Bread is a limited-service fast-casual restaurant company. In July 2017, JAB acquired Panera in a $7.5 billion deal and took it private.

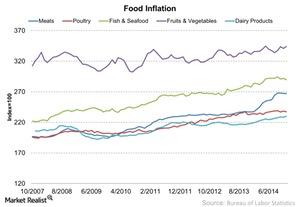

How Food Inflation Impacts The Restaurant Industry

Food inflation can squeeze a restaurant’s operating margins, but a restaurant can adjust the menu pricing and pass the cost on to customers.

An Investor’s Guide to Chipotle and Its Customers

Chipotle Mexican Grill (CMG) operates more than 1,700 fast-casual restaurants. Here’s everything you need to know about the business.

Must-Know: McDonald’s Has Got Tough Competition

McDonald’s (MCD) competition includes large international and national food chains as well as regional and local retailers of food products.Consumer Key restaurant industry formats: The casual dining business

Contrary to fast food restaurants, casual dining restaurants have a relaxed and casual ambiance with a lot of seating. They offer full table service and may also have a wine menu or full bar service.Company & Industry Overviews What are casual-dining restaurants?

Casual-dining restaurants Casual-dining restaurants have a relaxed, casual ambiance with a lot of seating. They offer full table service and may also have a wine menu or full bar service. The menu is higher-priced than fast-food restaurants. Olive Garden, under the umbrella of Darden Restaurants (DRI), for example, has a price range of $10 to $20 for […]Consumer Why McDonald’s same-store sales declined across all segments

During the earnings call, management stated that McDonald’s “hasn’t changed at the same rate as its customers’ eating out expectations” in its priority markets.

Why Darden Restaurants’ Q2 Earnings Weren’t Impressive

Darden Restaurants (DRI) reported better-than-expected earnings for the second quarter of fiscal 2020 on Thursday. However, the stock fell 6.3%.Consumer Why signs of a weak economy affect restaurants

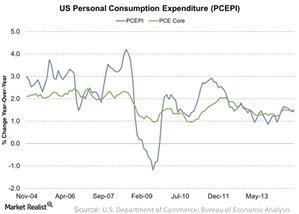

This restaurant industry does well when the economy is expanding and poorly when the economy is contracting. In other words, it’s cyclical.

Darden analysis: Business overview shows limited differentiation

Restaurant industry breakdown The first thing investors should do before making an investment is understand the company’s industry, business, and strategy. We can broadly break the restaurant industry down into the limited-service and full-service sectors. Full-service restaurants are establishments where customers receive their meals at their table, receive table waiting services, and generally pay at […]

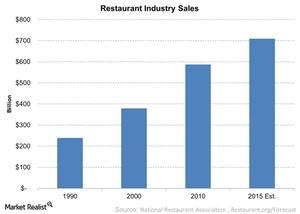

The Restaurant Industry: An Overview

More Americans are eating out, and they’re eating out more often. The restaurant industry’s share of the food dollar is 51%, up from 25% in 1955.

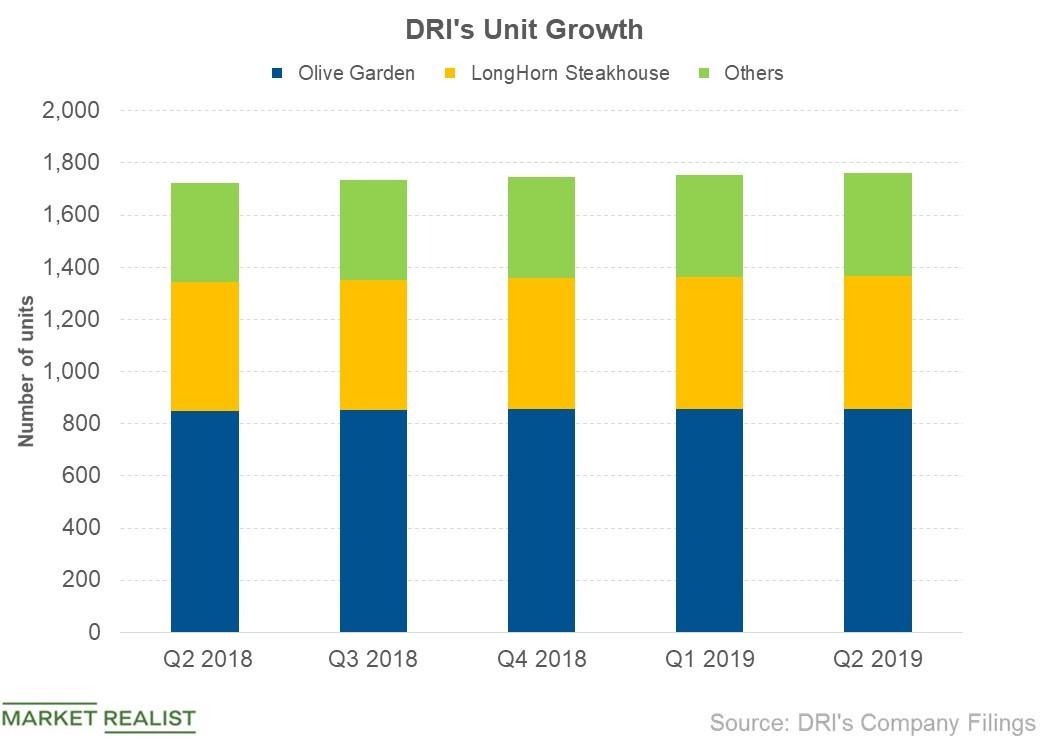

How Is Darden Restaurants Expanding Its Business?

At the end of the second quarter of fiscal 2019, Darden Restaurants (DRI) operated 1,762 restaurants.

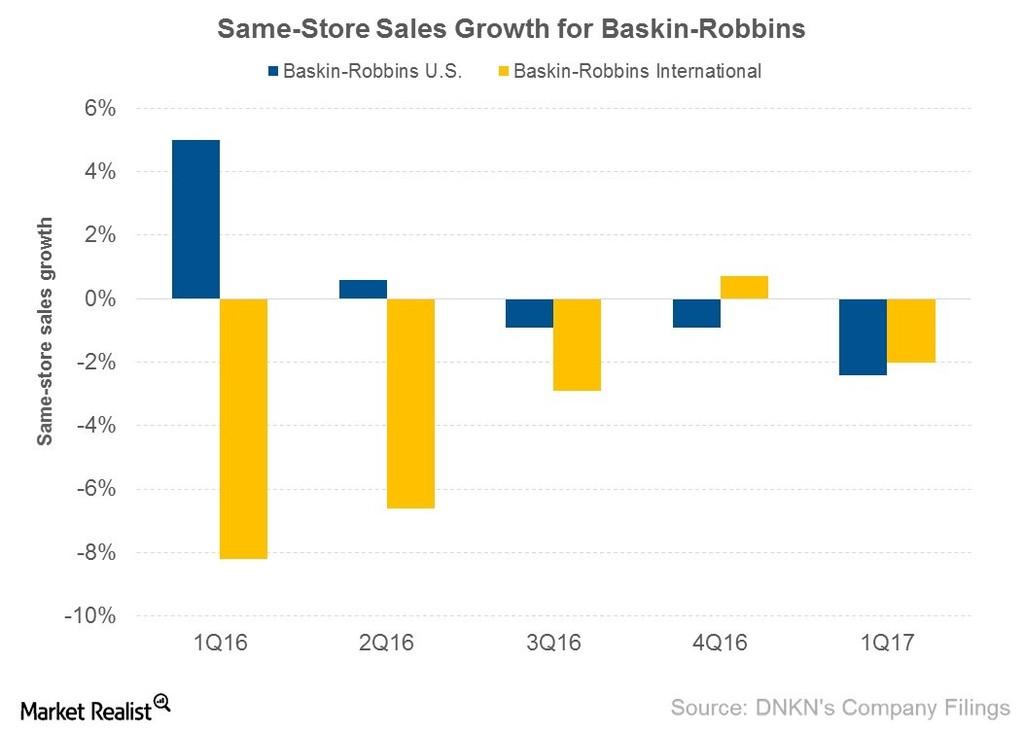

Why Baskin-Robbins Had Negative Same-Store Sales Growth in 1Q17

In 1Q17, Baskin-Robbins, which operates under the umbrella of Dunkin’ Brands (DNKN), had SSSG of -2.4% in the United States and -2.0% in international markets.

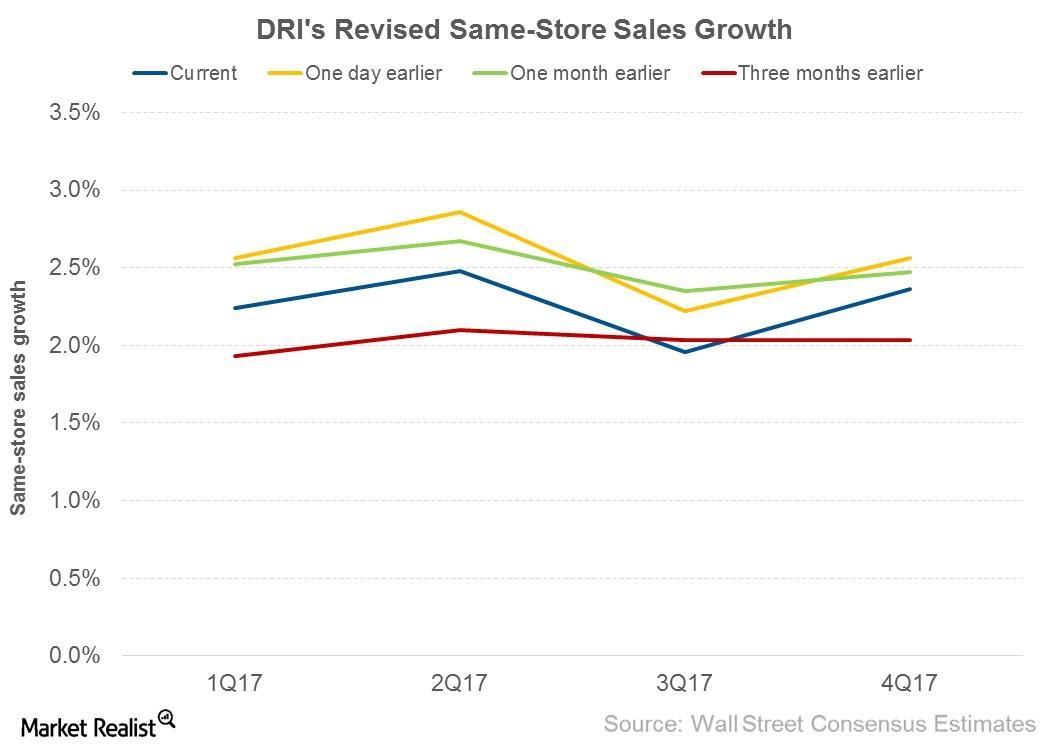

Darden Restaurants Updates Guidance after Fiscal 4Q16 Earnings

After fiscal 4Q16 results, Darden Restaurants’ (DRI) management has revised its same-store sales growth guidance for fiscal 2017 to the range of 1%–2% as compared to earlier estimates of 1%–3%.

What Do Analysts Recommend for Texas Roadhouse?

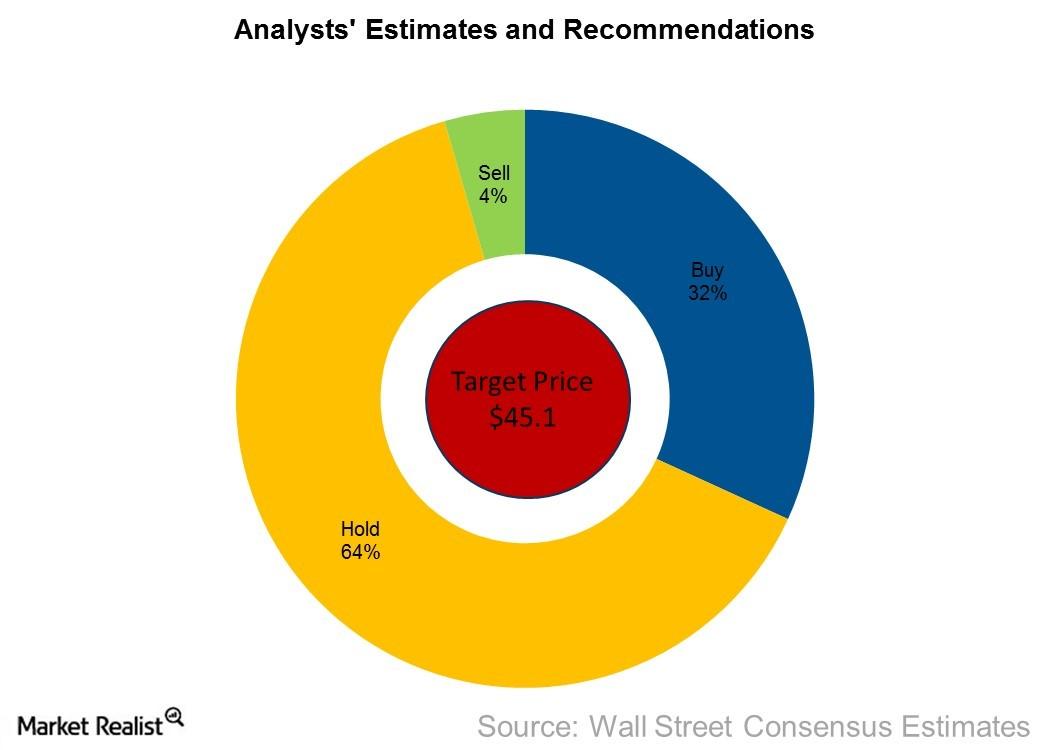

The rise in EPS estimates for the next four quarters has prompted analysts to increase their price target for TXRH for the next 12 months to $45.1 from their earlier estimate of $44.8.

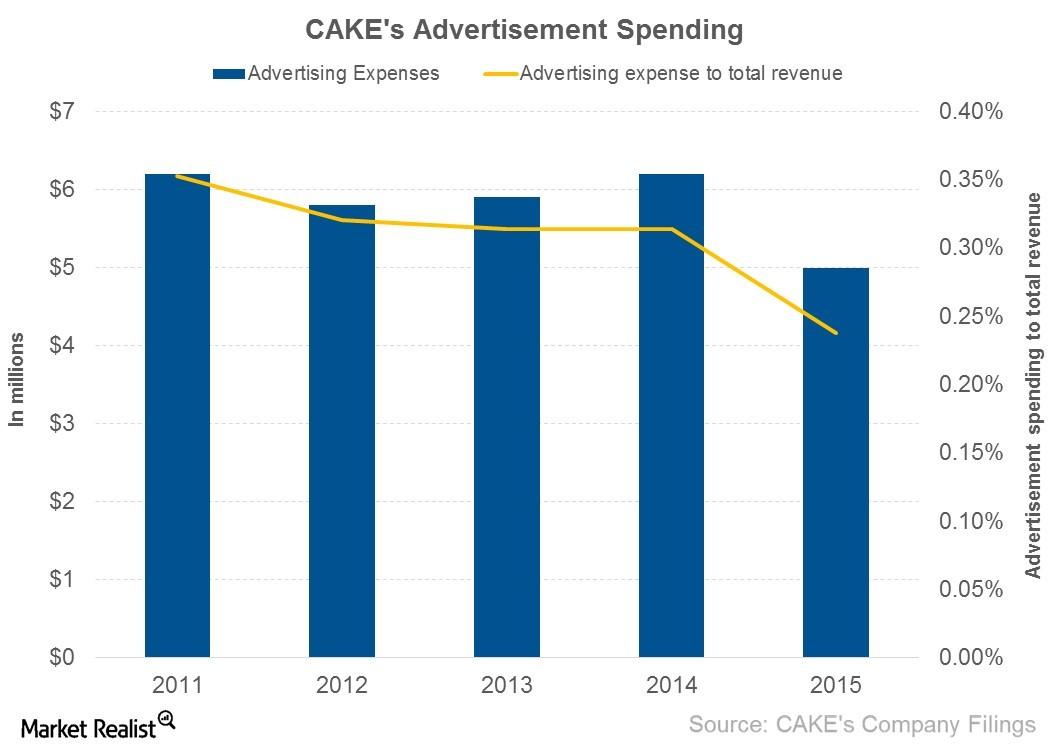

What Is The Cheesecake Factory’s Marketing Strategy?

The Cheesecake Factory (CAKE) is competing in a highly competitive restaurant business, where innovation is absolutely necessary to keep up.

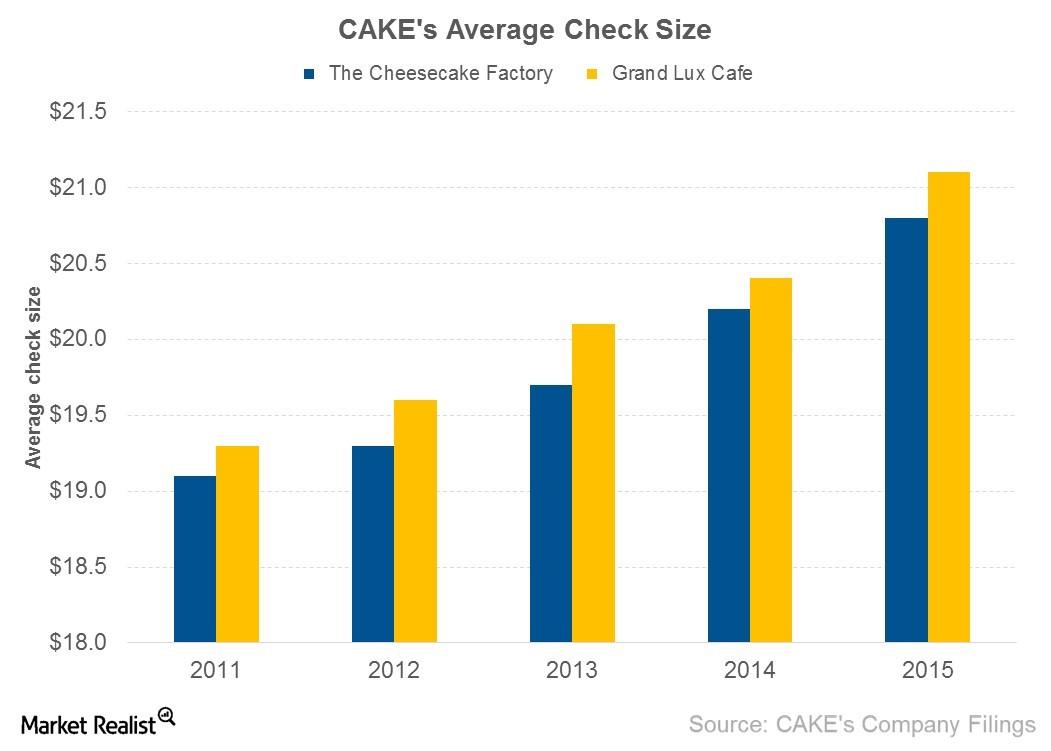

CAKE’s Average Check Has Increased Year-over-Year

In 1992, when CAKE was listed, its average check size was at $13.6. By the end of 2015, the company’s average check size had increased to $20.8.

What’s Been the Main Driver of CAKE’s Same-Store Sales Growth?

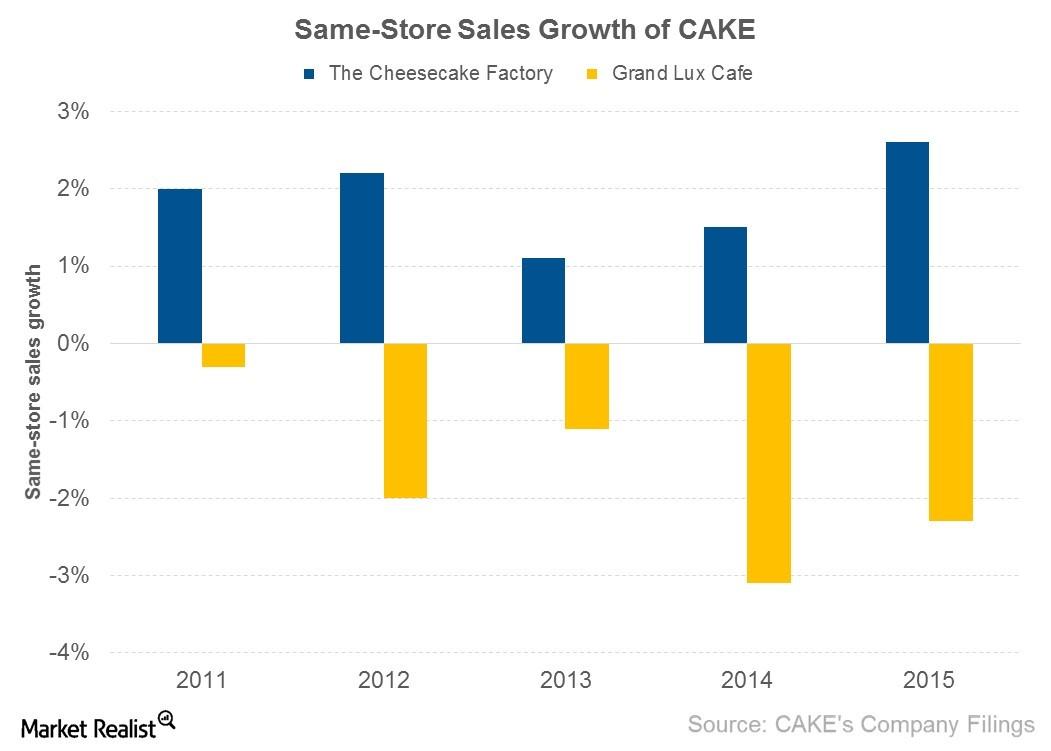

In the last five years, The Cheesecake Factory’s (CAKE) same-store sales growth was in the range of 1%–3%, largely driven by rises in its menu prices.

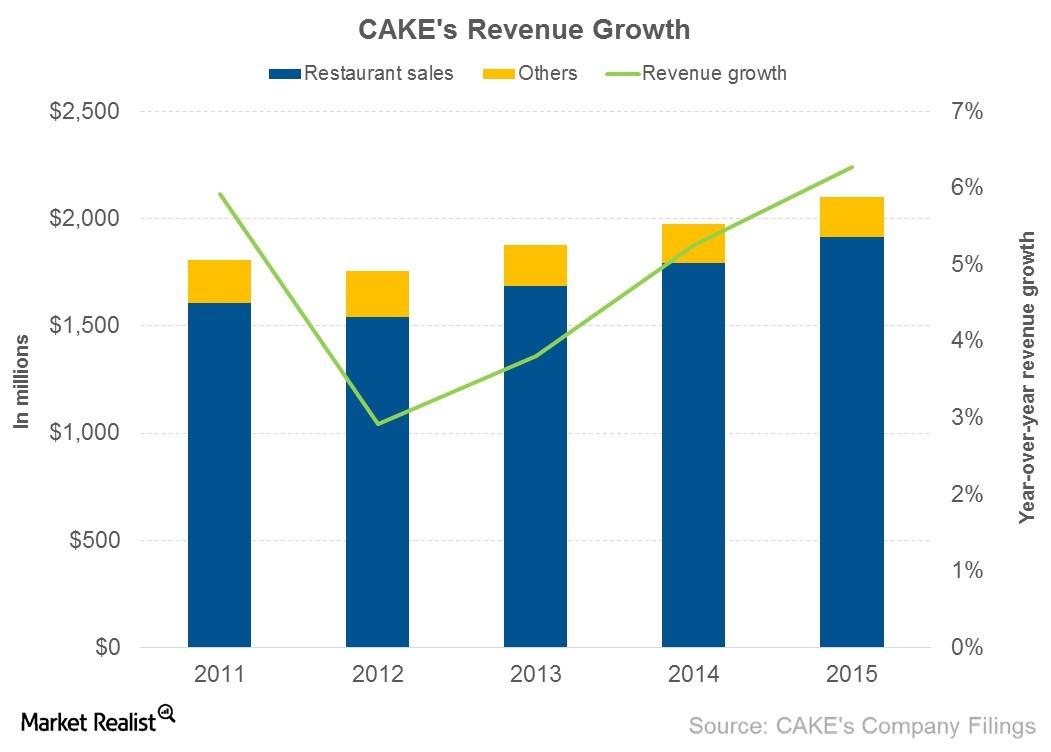

What’s Driving The Cheesecake Factory’s Revenue Growth?

The Cheesecake Factory earns its revenue from its company-owned restaurant sales, franchisee fees and royalties, and its bakery operations.

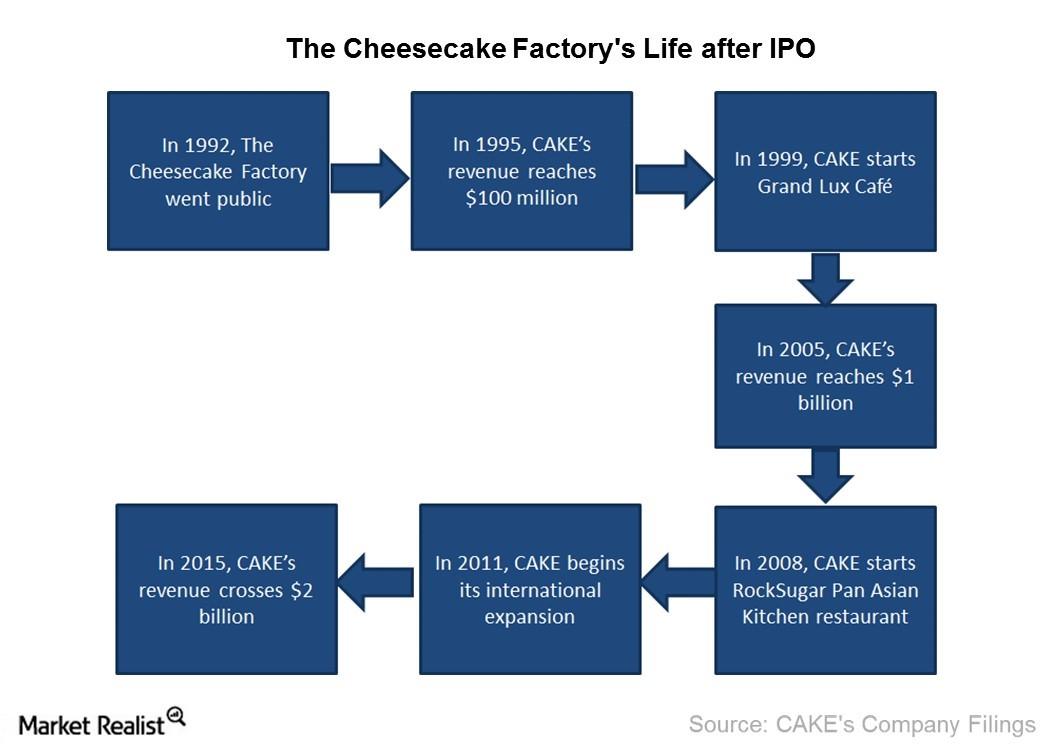

How Did The Cheesecake Factory Expand after Going Public?

In February 1992, The Cheesecake Factory (CAKE) went public by offering 2.3 million shares at $20 per share. It closed its opening day at $27.3 per share.

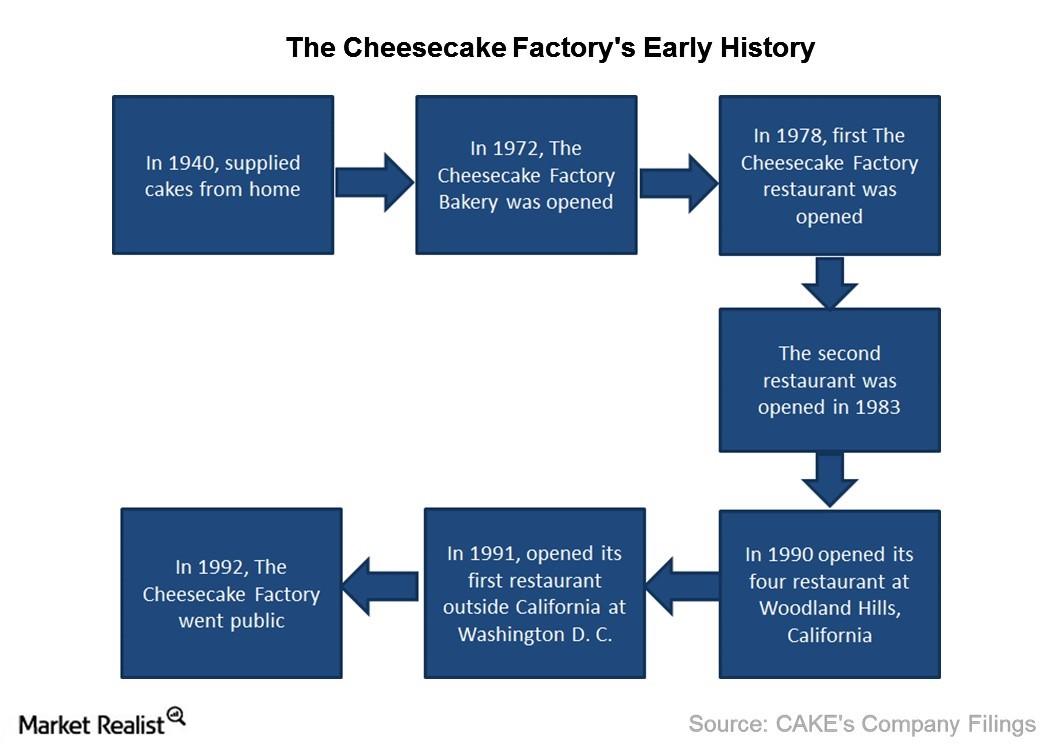

A Must-Know Guide to The Cheesecake Factory

The Cheesecake Factory (CAKE) is a casual restaurant chain that was founded in 1978. The California-based company owns and operates 201 restaurants.

How Did The Cheesecake Factory Come to Exist?

The origin of The Cheesecake Factory dates back to the 1940s, when Evelyn Overton found a recipe in a local newspaper that inspired her original cheesecake.

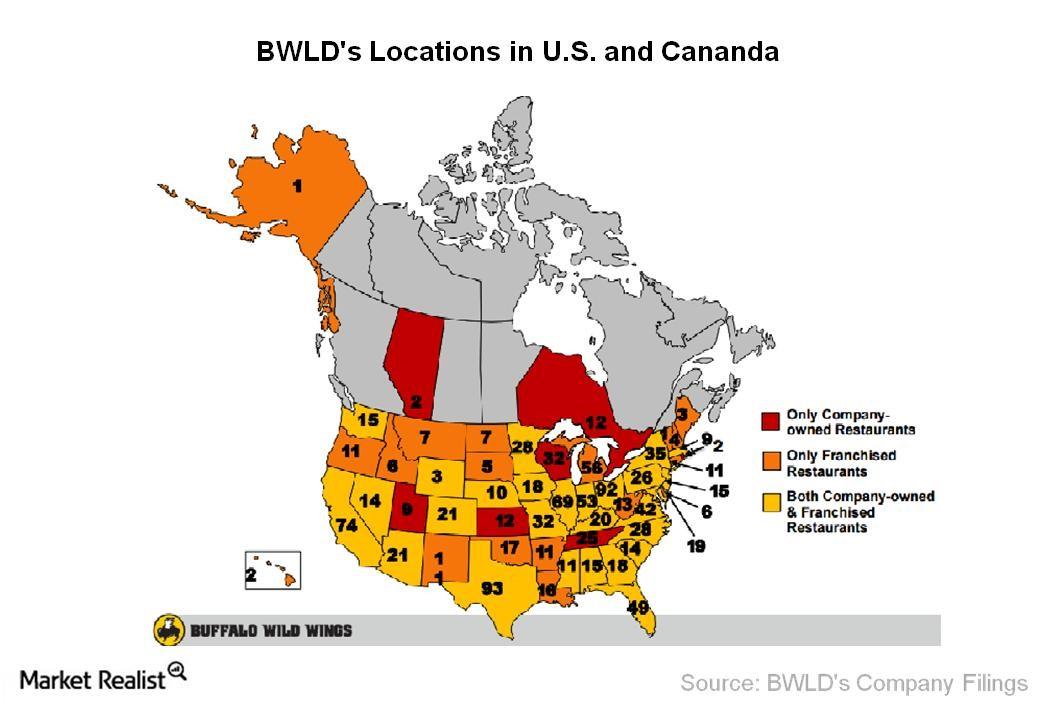

What You Should Know about Buffalo Wild Wings

Buffalo Wild Wings is a casual dining restaurant and sports bar headquartered in Minneapolis. Founded in 1982, the company is also known as BW3.

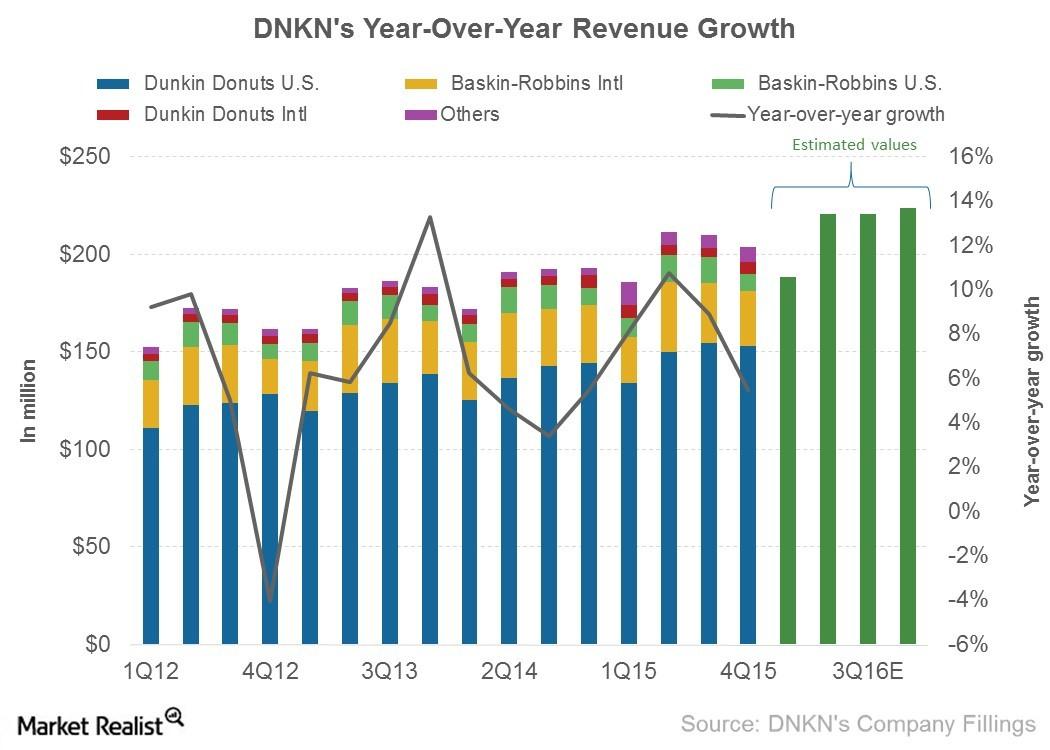

Unit Growth and Dunkin’ K-Cup Sales Drove 4Q15 Revenue Growth

Dunkin’ Brands (DNKN) earns its revenue from five different channels: Dunkin’ Donuts US, Dunkin’ Donuts International, Baskin-Robbins US, Baskin-Robbins International, and others.

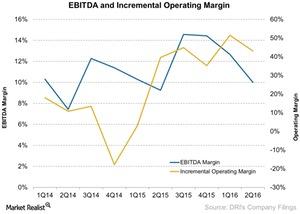

How Darden’s Incremental Margins Have Expanded

A company’s incremental operating margin is calculated as the change in operating income divided by the change in revenue over a period.

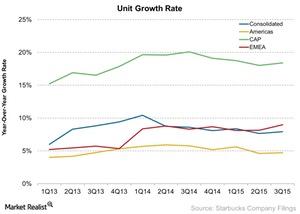

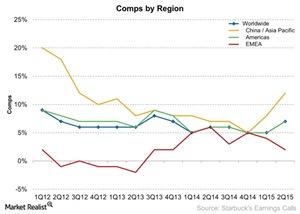

Why the CAP Segment Is the Next Big Market for Starbucks

Starbucks has about 5,239 restaurants in the CAP segment. It’s growing units at an average of 18.4% compared to the rest of the regions.

What to Expect from Starbucks’ Same-Store Sales Growth in 4Q15

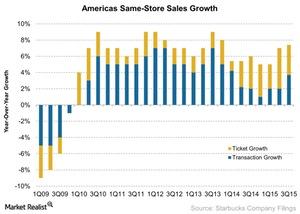

Same-store sales growth is one of the key revenue drivers for a restaurant company like Starbucks (SBUX), McDonald’s (MCD), and Darden Restaurants (DRI).

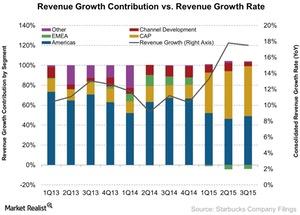

Starbucks’ Key Segments for Its 4Q15 Earnings

Starbucks (SBUX) operates restaurants in 65 countries around the world. However, 83% of its revenue comes from the Americas and the CAP segments.

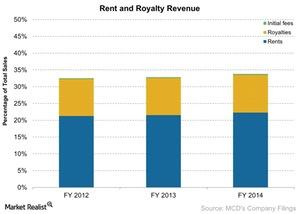

Will McDonald’s Separate Its Real Estate Portfolio?

One of the key reasons why McDonald’s (MCD) stock has remained firm is because of its real estate portfolio.

How Starbucks Is Leveraging Its Star Rewards Program

According to Starbucks (SBUX) management, the company’s My Starbucks Reward program helps increase customer loyalty.

How Commodities Play an Important Role in the Restaurant Industry

Agricultural and livestock commodities such as corn, coffee, beef, pork, chicken, and cheese play an important role in the restaurant business, as demand and supply factors impact prices.

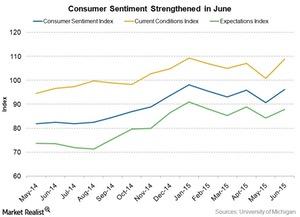

Consumer Sentiment Shines on Wall Street: Upbeat in June

In the US, consumer sentiment rose in June. The Consumer Discretionary Select Sector SPDR ETF (XLY) has gained about 1.22% over the past month.

Key Indicators for Restaurant Industry Growth

Restaurant industry sales have experienced growth in the past 12 months. Sales are poised to grow to $709 billion.

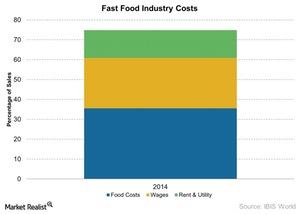

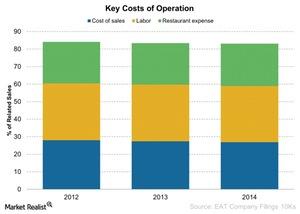

Brinker International’s Key Costs of Operations

Brinker incurs key costs of operations to run its company-owned restaurants, including cost of sales, labor and related costs, and rent and other costs.

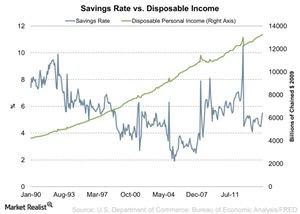

Higher Disposable Income: A Reason for Restaurants to Cheer

Disposable income increased by 40 basis points month-over-month in January. On a YoY (year-over-year) basis, disposable income increased 9.5%.

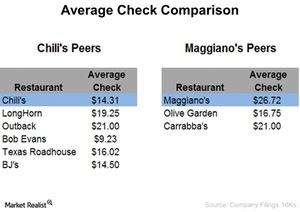

Average Checks at Chili’s and Maggiano’s – Why Do They Matter?

The average check at Chili’s in 2014 was $14.31, lower than its main peers. Maggiano’s average check was $26.72, the highest among its peers.

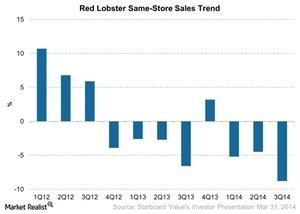

Why Darden Restaurants Sold Red Lobster

Activist investor Starboard Value opposed Red Lobster’s sale, stating that Darden management could do more to turn the undervalued brand around.

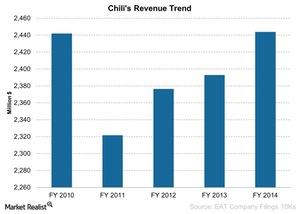

Why Chili’s Matters the Most to Brinker International

Chili’s is the most important restaurant under the Brinker (EAT) umbrella. Chili’s contributed 86%, or $2,443 million, to the company’s sales in 2014.

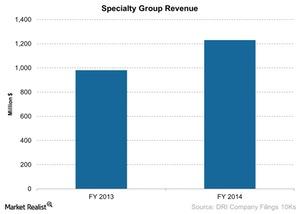

Darden’s Specialty Restaurant Group: The Capital Grille

As of fiscal 2014, revenue from Specialty Restaurant Group was $1,230 million, or 19.5% of the total revenue for Darden Restaurants.

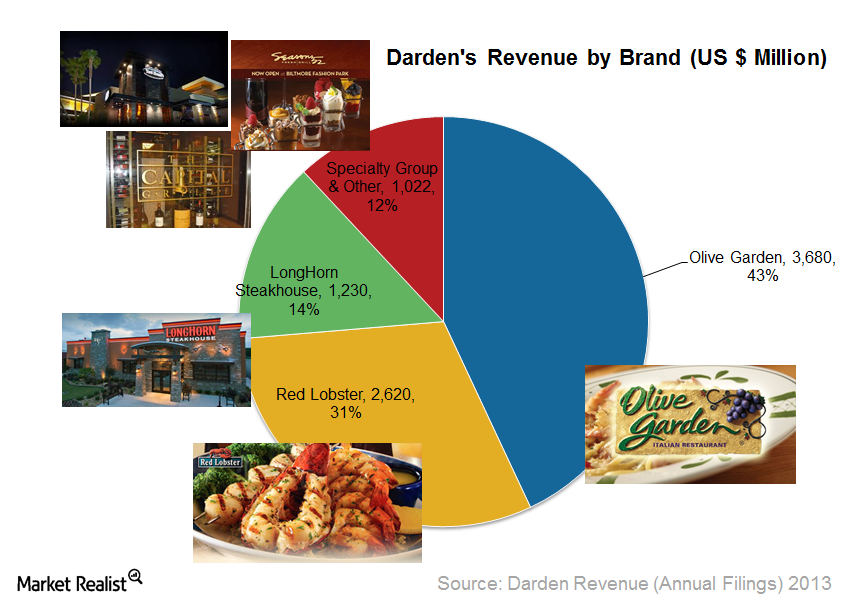

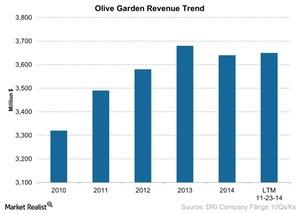

Olive Garden: Darden’s Most Important Brand

In 2014, Olive Garden contributed about 58% to Darden’s revenues as of fiscal 2014. Olive Garden gained importance after Darden sold Red Lobster in 2014.

Business Overview of Darden Restaurants

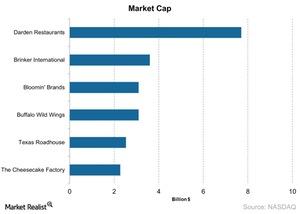

As of 2014, Darden Restaurants owned 1,520 restaurants, excluding more than 700 Red Lobster locations.

How Inflation Impacts The Restaurant Industry

Low inflation means low interest rates. This makes it affordable for restaurants to borrow and expand units.

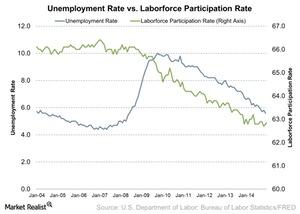

How Unemployment Rate, Labor Participation Affect Restaurants

The unemployment rate for December 2014 was 5.6%, showing a month-over-month decrease from 5.8% in November.

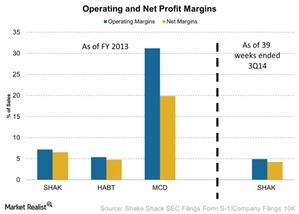

Analyzing Shake Shack’s Profitability

We’ll look at Shake Shack’s profitability in terms of its operating and net profit margins. In 2013, it had an operating profit of $5.9 million.

Pivotal Government Regulations That Affect Texas Roadhouse

In addition to the factors we’ve discussed, regulations can also affect the company’s profits. Let’s look at some of the regulations that apply to TXRH.

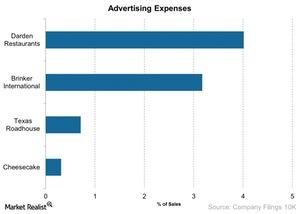

Understanding Texas Roadhouse’s Marketing Approach

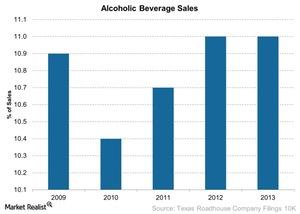

A company can increase its marketing and promotional activities to bring in more customers and obtain operating leverage.

Why Texas Roadhouse Increased Its Menu Prices

The company increased its menu prices by 1.5% in early December of 2013, and in 2012, it increased menu prices by 2.2%.