Darden analysis: Key benefits of a restaurant owning properties

Owning properties reduces real estate costs A restaurant business that owns its own building is a bit different from a restaurant business that rents its buildings or lands. From a business standpoint, you can think of a restaurant that owns its buildings as the sum of two businesses: restaurant and real estate. Because the real […]

Dec. 4 2020, Updated 10:52 a.m. ET

Owning properties reduces real estate costs

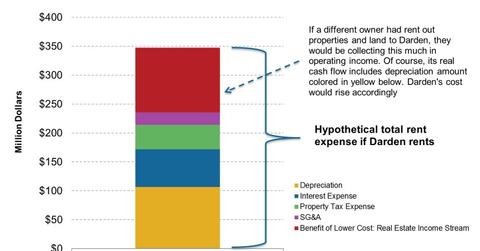

A restaurant business that owns its own building is a bit different from a restaurant business that rents its buildings or lands. From a business standpoint, you can think of a restaurant that owns its buildings as the sum of two businesses: restaurant and real estate. Because the real estate business is internal, it doesn’t show up as revenue on Darden’s income statement. However, it will reduce Darden’s costs, which increases Darden’s profits. Let’s see why.

Renting charges an additional return on assets

Renting is generally more expensive than owning a house. Why? If renting is cheaper than buying a house, then everyone would be renting and no one would be buying. Buying a house is like an investment: once you buy real estate, you can rent it out at a price that you can expect to generate a return from. If real estate owners don’t rent out at prices that cover maintenance and interest expenses, then they won’t be generating returns and they would be better off putting the investment into a different financial asset, like bonds and stocks. If an owner decides to live in the property, it’s still an investment because they wouldn’t have to pay as much if they had rented from someone else.

Renting is more expensive

Likewise, companies that own the buildings and lands that the restaurants sit on are like living in a house that you’ve bought. Although the up-front cost (the initial payment) to buy a house is large, a homeowner generally saves money over time. If you own a house, you won’t need to pay rent and will only have to pay the occasional maintenance to keep your home in shape and interest expenses to pay your mortgage. As a personal property, you will likely pay monthly dues to reduce debt over time. But for a company like Darden that can live on forever, many companies simply roll their debts over.

Lower cost means additional income

Because owning properties is cheaper, Darden’s real estate cost is lower than if it rented. You can think of the differences in monthly expenses between the two as additional income and cash flows. This is embedded within the company’s operating income. As most property owners know, rents that owners receive from their properties can be deducted with depreciation. This lowers the amount of taxable income. Since Darden also uses its properties for business purposes, it can deduct depreciation as well.

But there’s a catch. Continue on to see the downside.