Xun Yao Chen

Xun is an analyst based out of Market Realist's New York City office and was formerly an investment analyst for four years. Previously Xun worked at Puji Capital, a hybrid investment bank and private equity firm based in Shanghai. He was also formerly a business consultant for Mic.co in his native Japan. Xun graduated summa cum laude from Boston University, with dual degrees in Economics and Business Administration.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Xun Yao Chen

Why India’s potash price discount won’t affect share prices

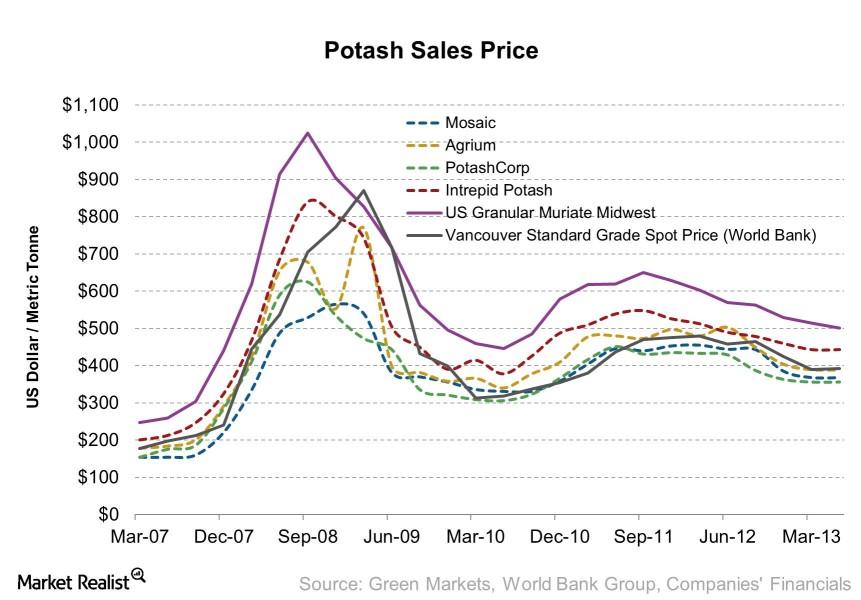

The significance of potash price Wholesale potash price is one of two factors (the other being sales volume) that influence potash producers’ revenues. When prices rise, so does revenue, which will translate to higher profitability (margins), earnings, and share prices. However, when prices fall, they will have a negative impact on fundamentals and share prices. […]

Why current secondhand oil tanker values suggest a mixed outlook

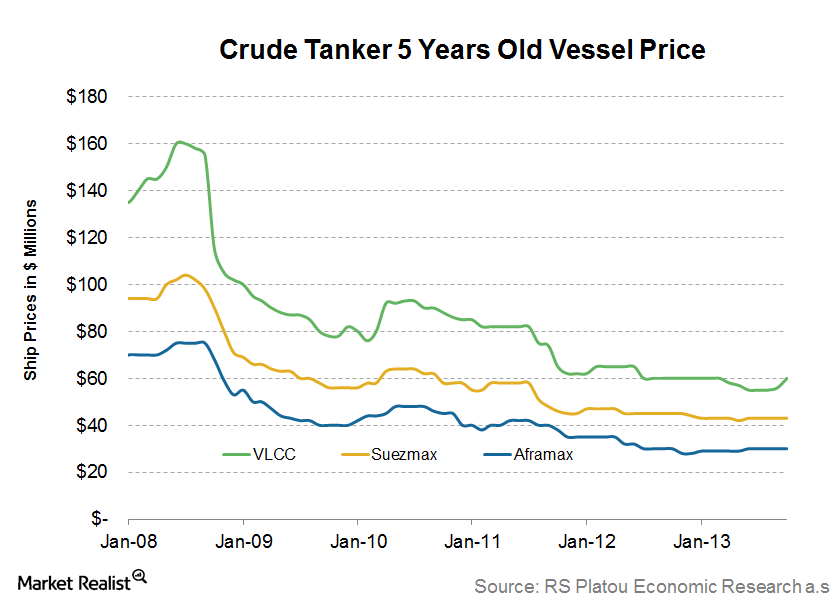

While the VLCC data is positive, the picture for the crude tanker business remains mixed. This could portray a short-to-medium-term negative outlook.

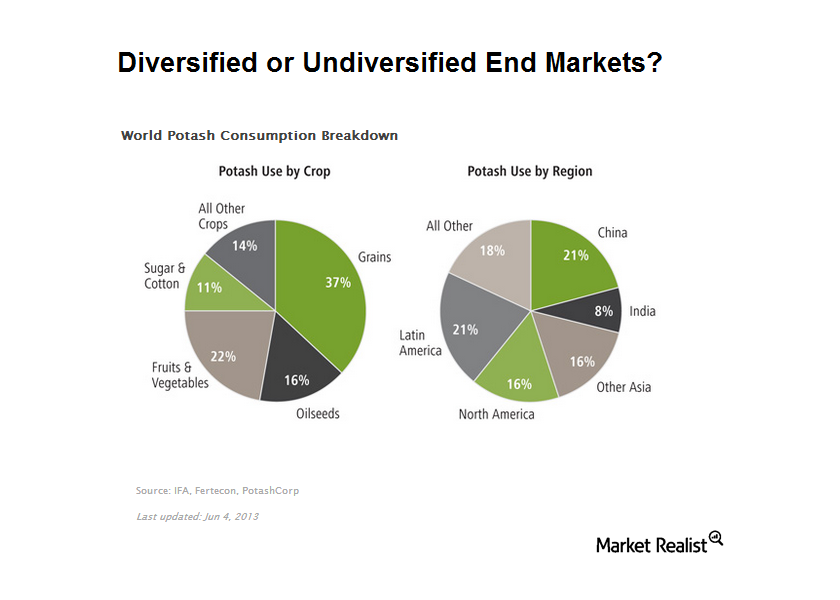

Why is the end use of potash internationally diversified?

As crops widely trade in the international market, they often converge with each other if transportation costs aren’t so high.

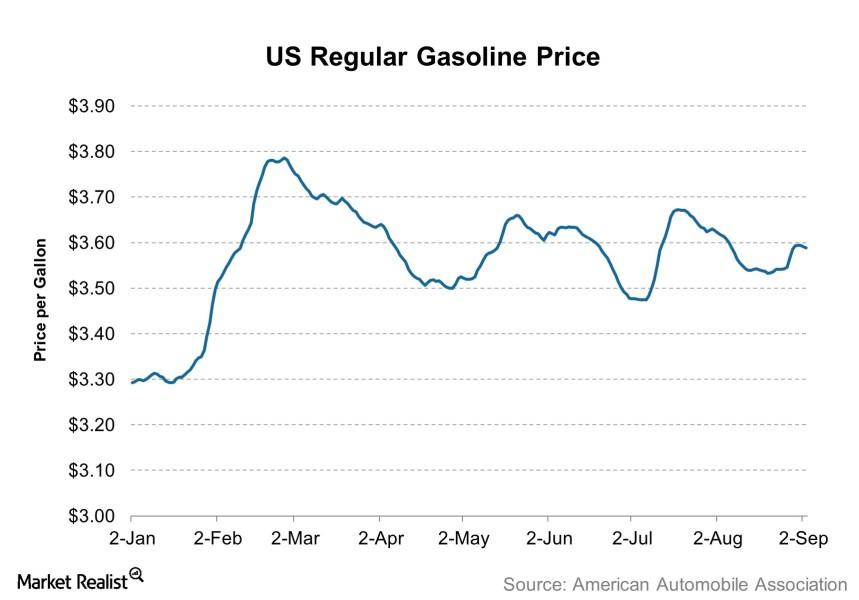

Syria strike would raise gas prices and reduce restaurants’ sales

Why higher gasoline prices can reduce people’s leftover spending at restaurants, which will negatively affect restaurant sales.

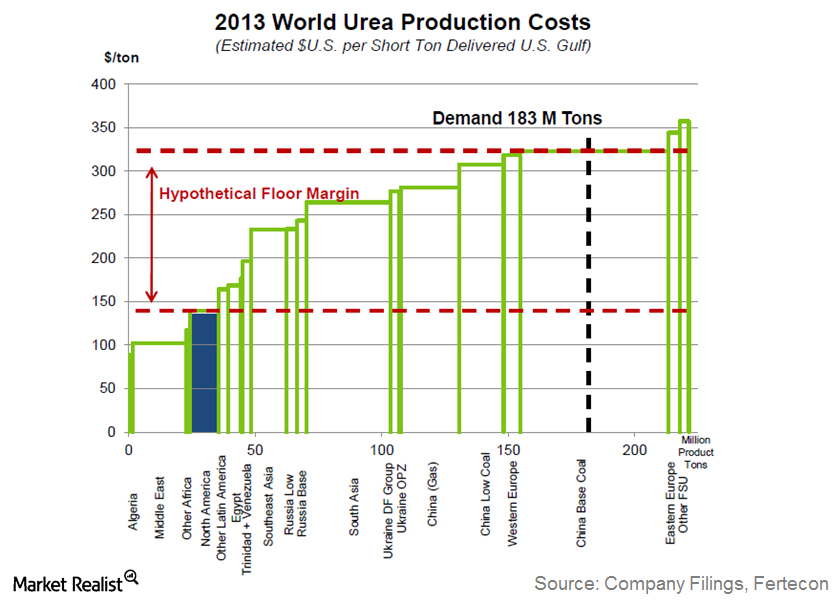

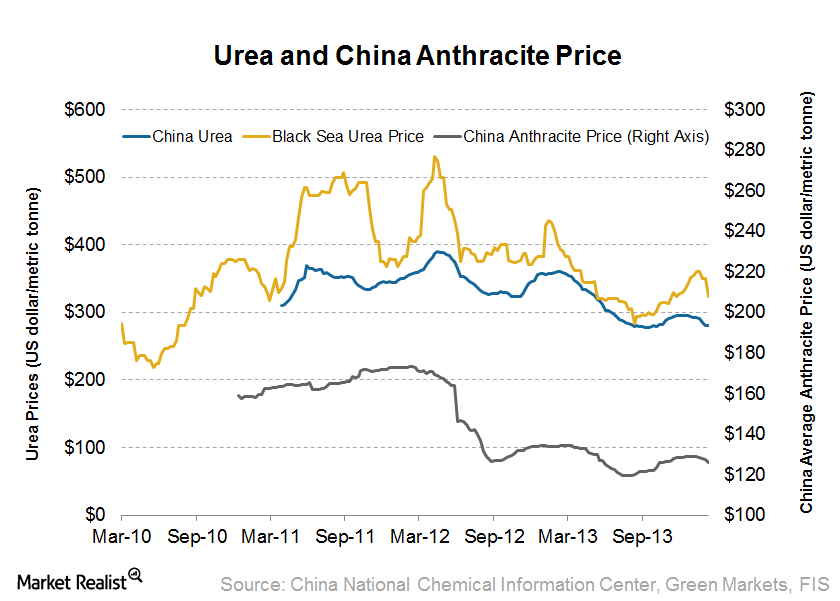

Why industry capacity changes also affect urea prices and profits

Generally, a capacity increase tends to lag demand growth, as producers like to see a stronger market before making significant investments.Industrials Dry bulk shipping weekly analysis (Part 3: Construction rises)

Continued from Part 2 Ship construction activity Part 2 of this series explains how ship orders can illustrate managers’ expectations for future supply and demand differentials. But new ship orders don’t always translate into new constructions right away. Sometimes, shipping firms specify a particular date of delivery for the new orders. If the delivery date is farther […]

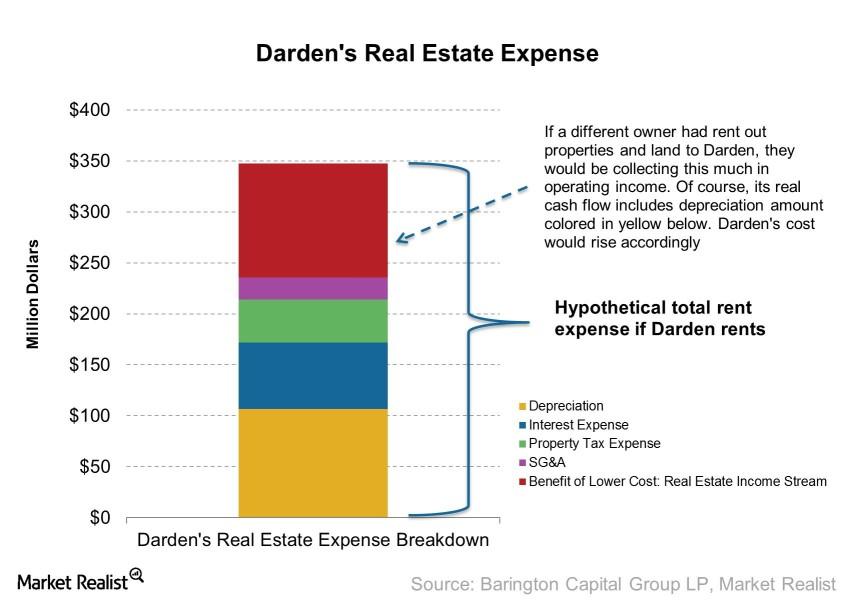

Darden analysis: Key benefits of a restaurant owning properties

Owning properties reduces real estate costs A restaurant business that owns its own building is a bit different from a restaurant business that rents its buildings or lands. From a business standpoint, you can think of a restaurant that owns its buildings as the sum of two businesses: restaurant and real estate. Because the real […]Industrials We just need decent ship orders for dry bulk shippers to recover

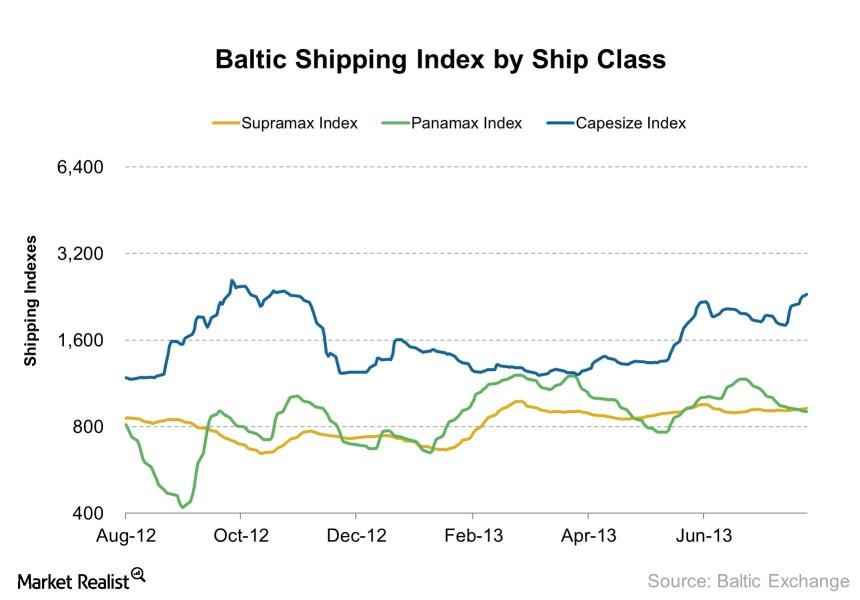

Managers remain optimistic From September 13 to 20, ship orders for Capesize vessels fell by 0.25%, from 10.53% to 10.28%, as a share of the existing number of ships. Orders for Panamax improved from 15.34% of existing ships to 15.87%, while those for Supramax were up slightly, rising 0.04% to 4.64%. Analysts use a percent […]

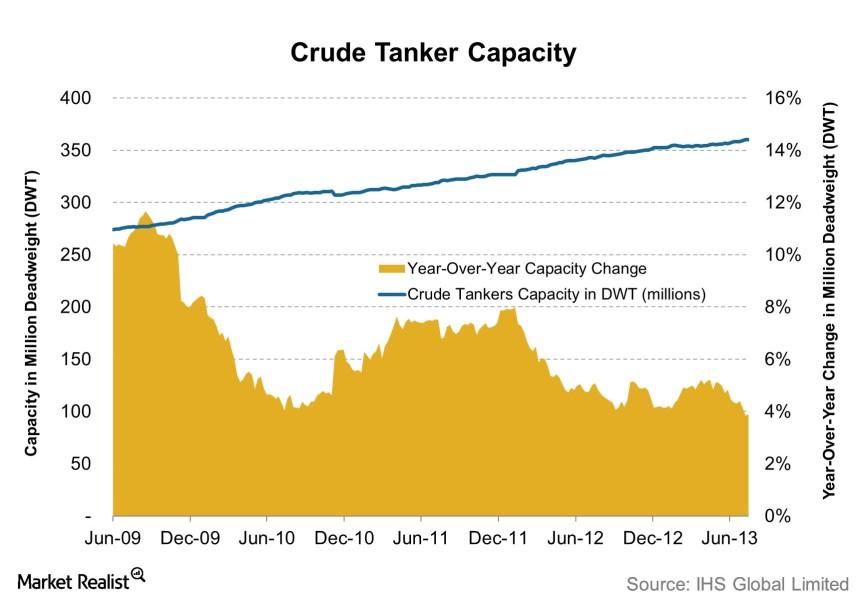

Weekly tanker digest: Have fundamentals changed? (Part 4)

Continued from Part 3 The importance of capacity Capacity, in a commoditized industry like shipping, is an important metric that directly impacts companies’ top line, or revenue performance. When capacity grows faster than demand, competition will rise among individual shipping firms as they try to use idle ships and cover fixed costs. This will lower day […]

Why shipping rates for Capesize vessels continue to outperform

Investors can look forward to higher Capesize rates during the second half of this year compared to the first half, which is positive for dry bulk shippers.

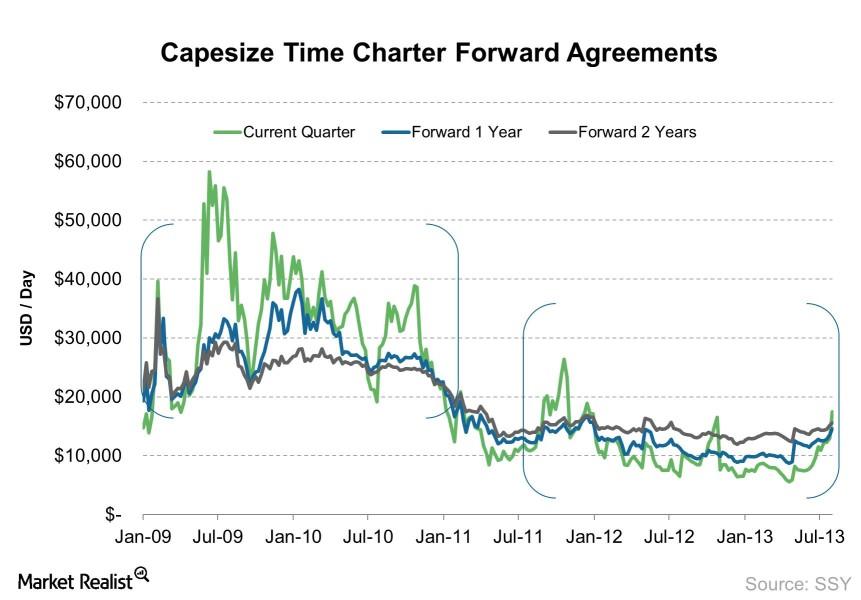

Market Realist dry bulk shipping blast (Part 6: Forward rates)

Continued from Part 5 What are forward contracts? If there are shipping rates for today, then there’s also the expectation of tomorrow’s rates. Companies use forward contracts to lock in the availability of resources in the future at a set price. The dry bulk shipping industry—which transports key dry bulk materials such as iron ore, coal, […]

Shipping stocks rise as Capesize rates approach $20,000

From August 23 to 30, shipping rates for Panamax, Supramax, and Capesize vessels stood relatively unchanged.

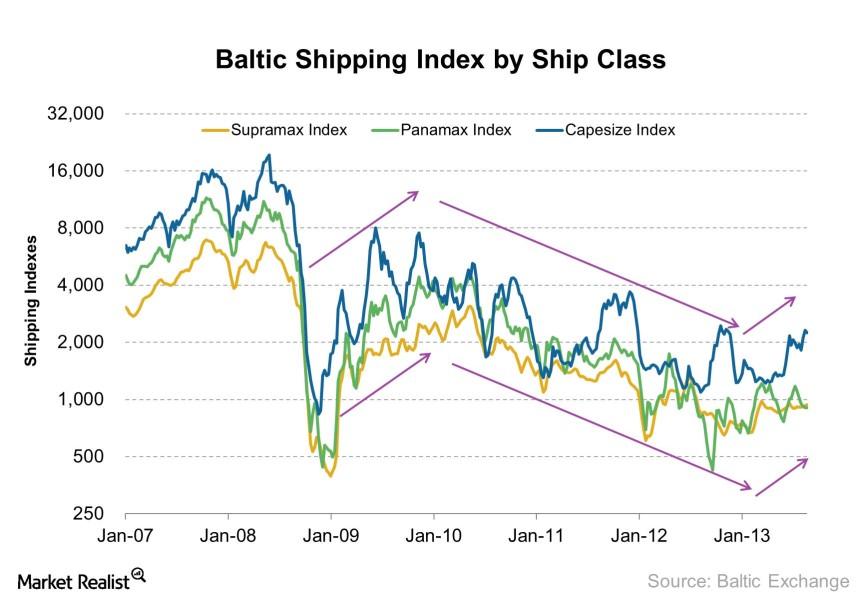

Market Realist dry bulk shipping blast (Part 5: Shipping rates)

Continued from Part 4 Supply and demand drives dry bulk shipping companies Although we must analyze demand in order to project future dry bulk shipping rates, imports data aren’t widely available on a weekly basis. But shipping rates, which reflect the difference in demand and supply, are collected on a daily basis at the London-based Baltic […]

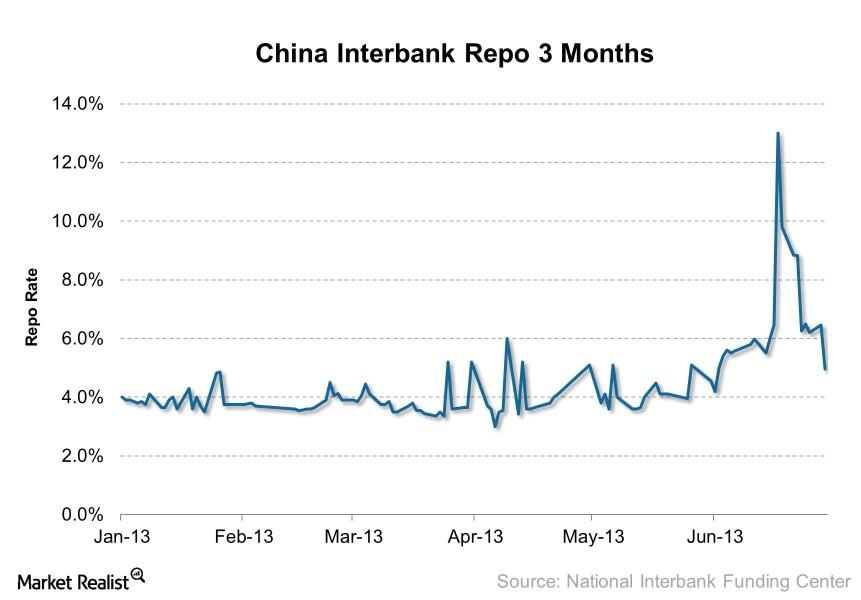

China’s interbank lending rate falls below 6.0%, positive for dry bulk shipping?

Update to Must-know: Shipping companies hit by China’s financial woes The impact of China’s financial industry The financial industry is an essential part of any economy. Without a stable financial system—one that supplies liquidity to businesses and individuals and bridges the gap between savers and borrowers—an economy can’t function as efficiently and productively as it […]

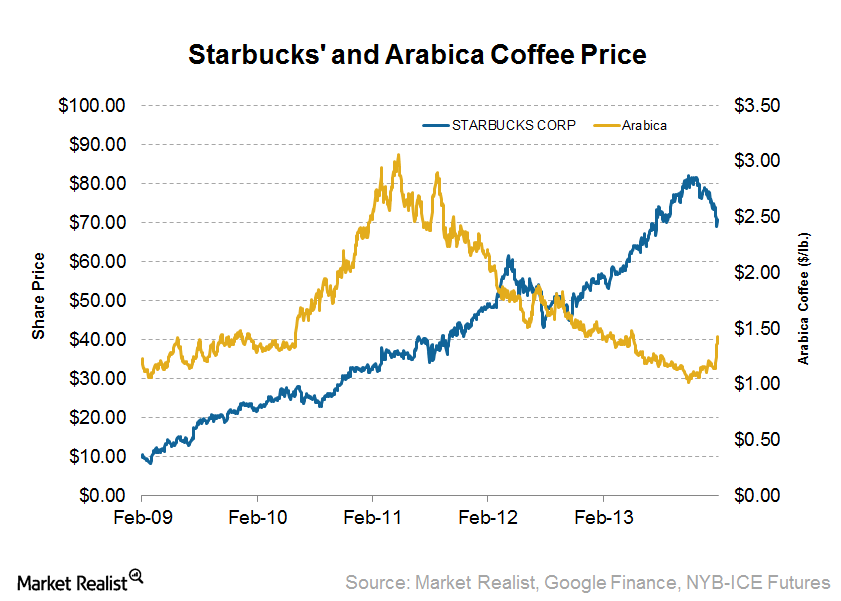

Why high valuation and coffee prices drove Starbucks down ~13%

As store count grew over the past few years, Starbucks’ forward P/E valuation metric also expanded. What used to be just 17x gradually grew to roughly 27x, a 58% based solely on expansion in the valuations.

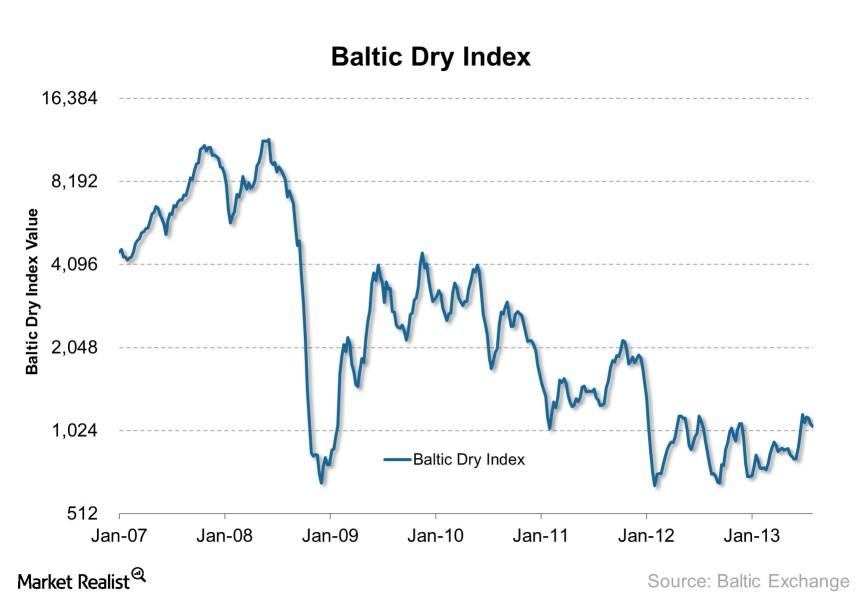

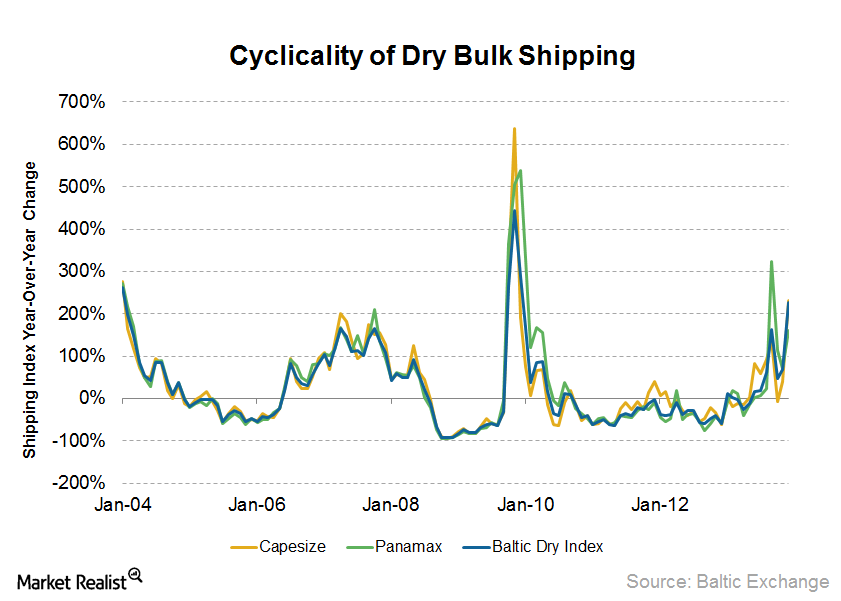

Recommendation: Capitalize on dry bulk shipping’s cyclical waves

The dry bulk shipping industry is cyclical mainly due to economic or business cycles as well as a long lead time between the placement of orders and the delivery of new vessels.

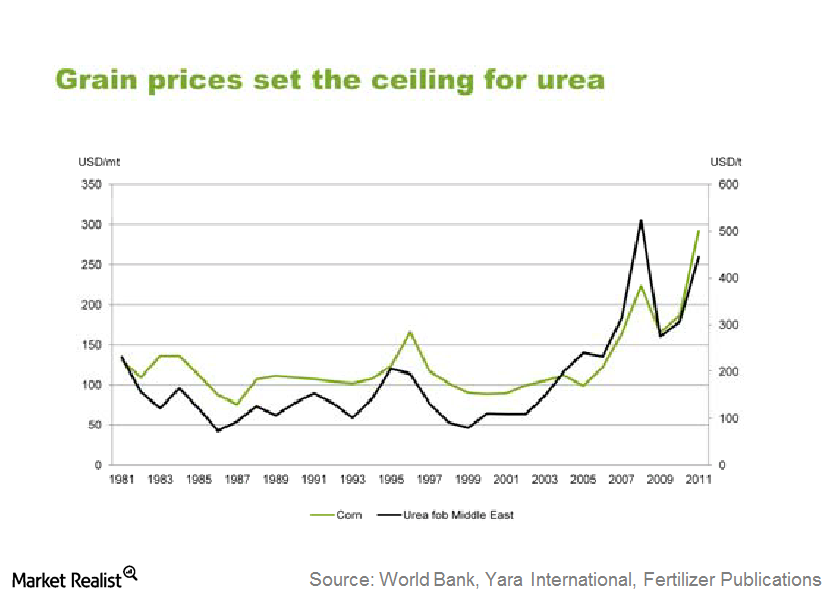

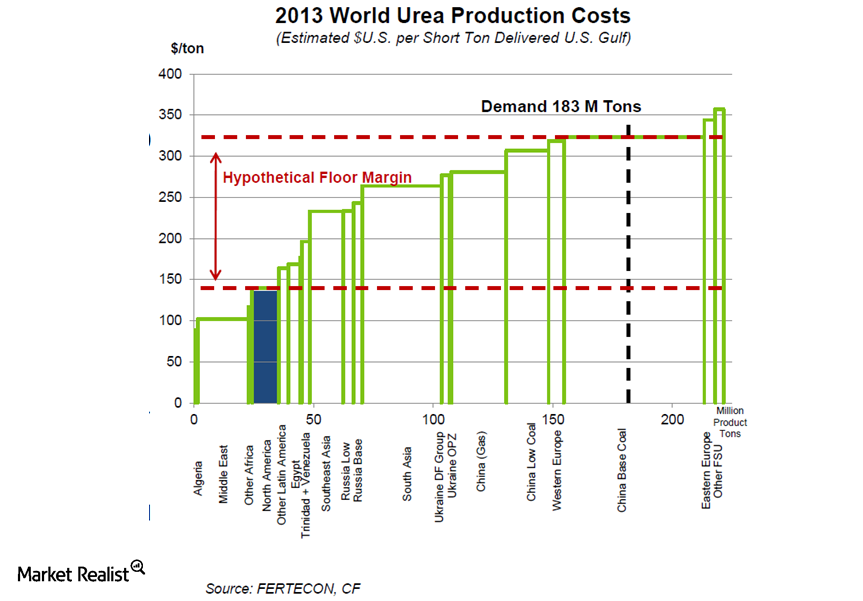

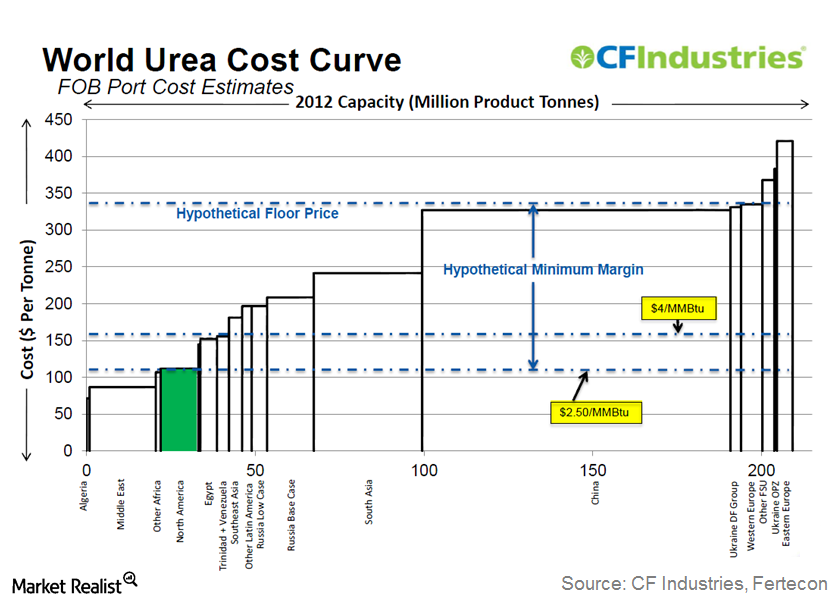

2 key things that set the floor and ceiling for urea prices

Without an understanding of factors that affect crop prices, it would be difficult to formulate a view on future crop prices and demand for nitrogenous fertilizers.

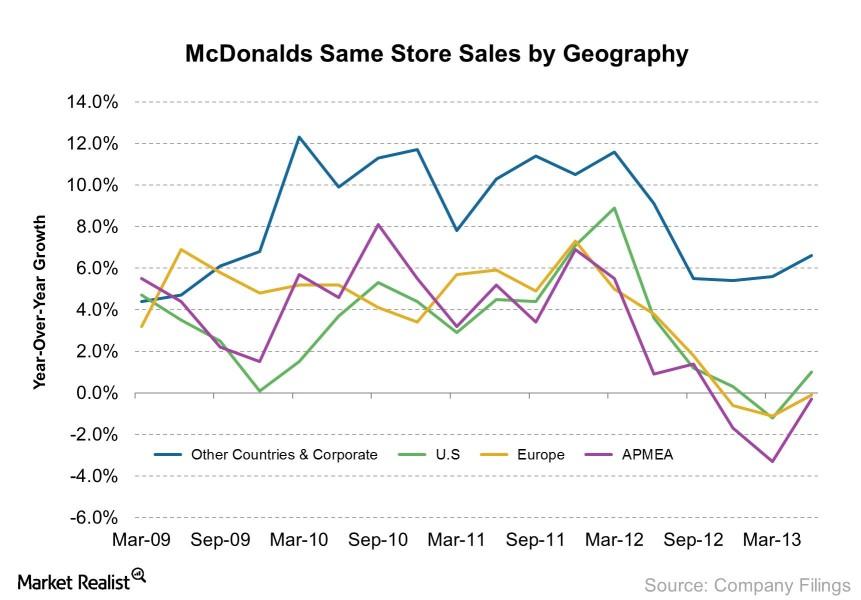

Are McDonald’s higher sales in Europe part of a larger trend?

In this series, we uncover the key indicators investors should know to help them stay calm and position themselves correctly in the restaurant market. Investing is an art and a science. There is no secret formula.

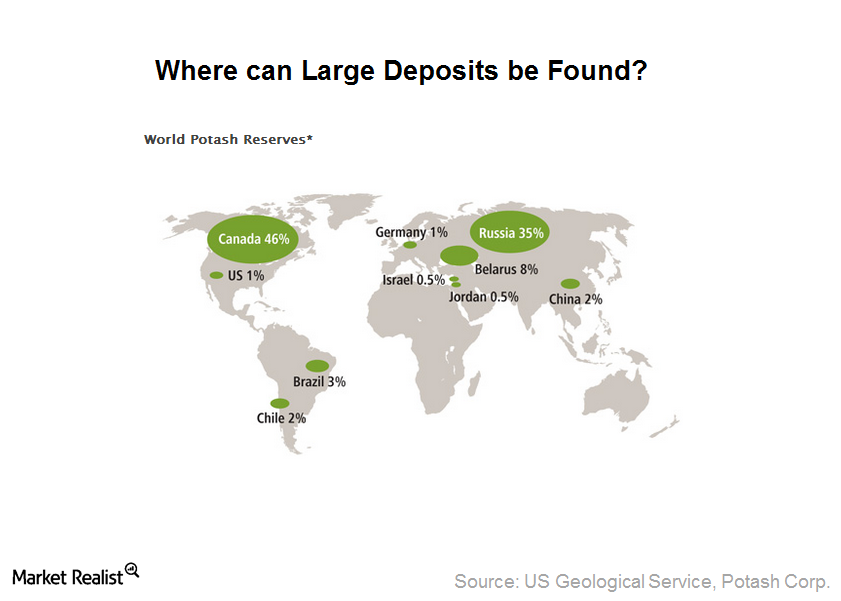

Why are economical potash deposits concentrated in 3 locations?

Canada, Russia, and Belarus together account for more than 89% of the world’s estimated reserves and a little over 66% of global capacity.

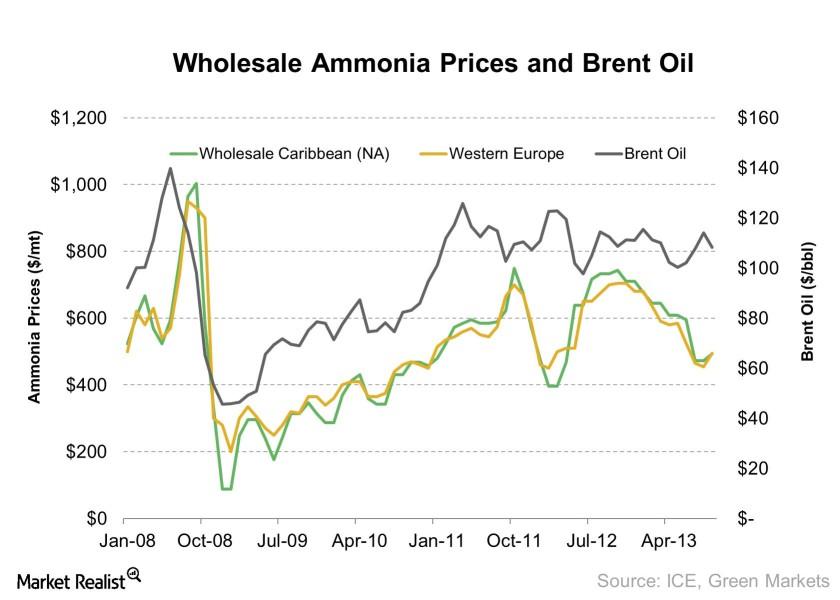

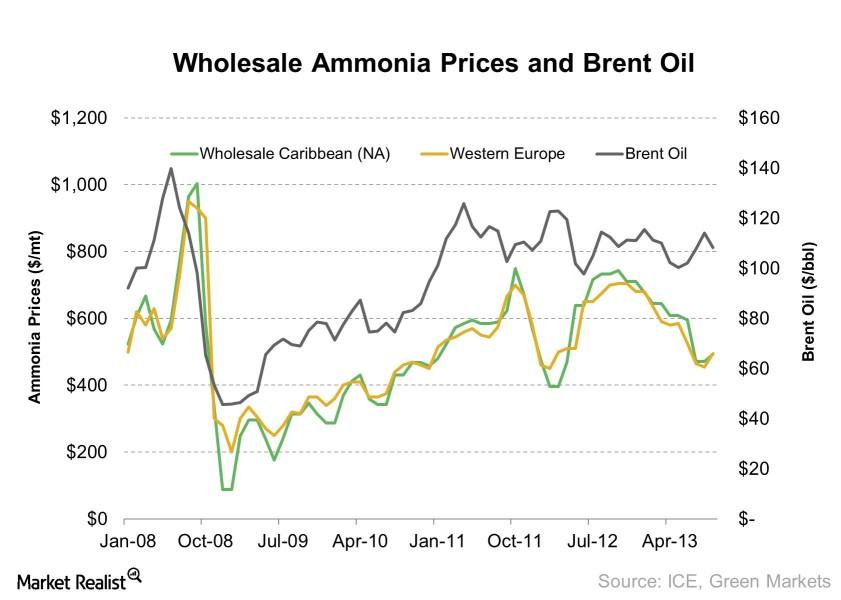

Essential fertilizer trends: The importance of Brent oil prices

Why oil affects fertilizer price In a competitive industry like nitrogenous fertilizer, the marginal producer’s cost sets the floor for the industry. These producers are the most expensive manufacturers to supply the product at that point in time. When the marginal producer’s cost rises, so does the industry’s. On the the other hand, falling costs […]

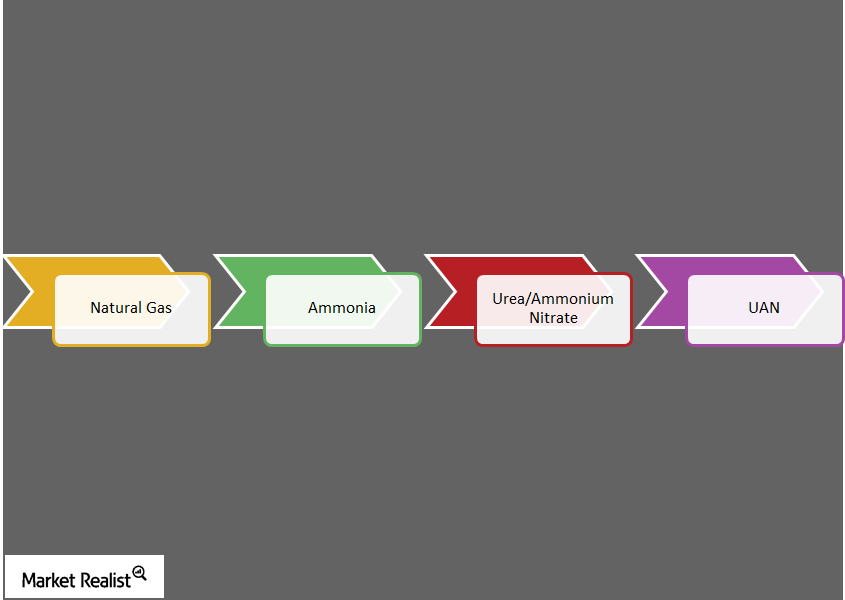

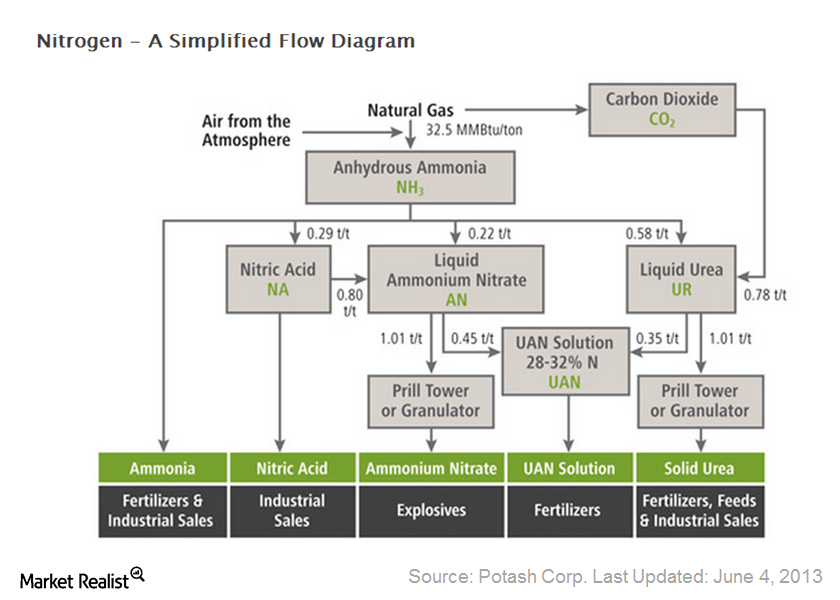

Key inputs and processes of nitrogenous fertilizer production

The importance of costs Understanding how fertilizers are produced is an important part of investing. What companies buy and what they pay for will be their costs. When costs are rising, they can have a negative impact on earnings and cash flow if the industry can’t pass them on to buyers. Conversely, when costs are falling, […]Industrials Lower dry bulk ship supply growth is a catalyst for higher rates

Why is capacity important? Analysts evaluate capacity growth to see whether it will exceed demand growth, instead of solely relying on indicators such as ship orders and ship prices that reflect managers’ perspective of future supply and demand dynamics. When capacity grows faster than demand, competition rises among individual shipping firms as they try to […]

The relationship between ammonia and Brent oil hasn’t returned

In a competitive industry like the nitrogenous fertilizer industry, the marginal producer’s cost sets the industry floor.

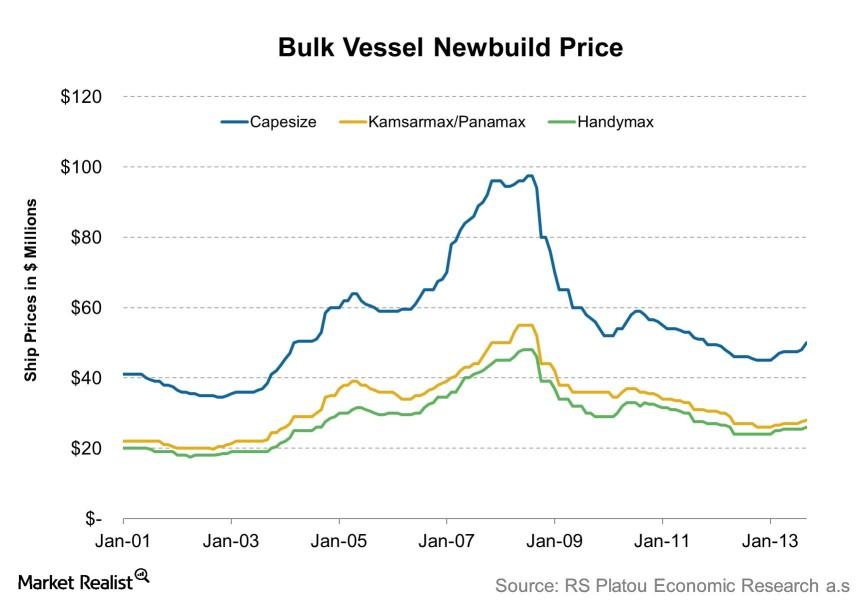

Higher new build prices mean higher dry bulk shipping share prices

What new build prices reflect The prices of new builds are useful indicators that reflect the dry bulk shipping industry’s future fundamental outlook. New prices often rise because of higher orders for ships. Usually, this is the result of managements’ speculation that future shipping rates (which can increase or stay the same from the current […]

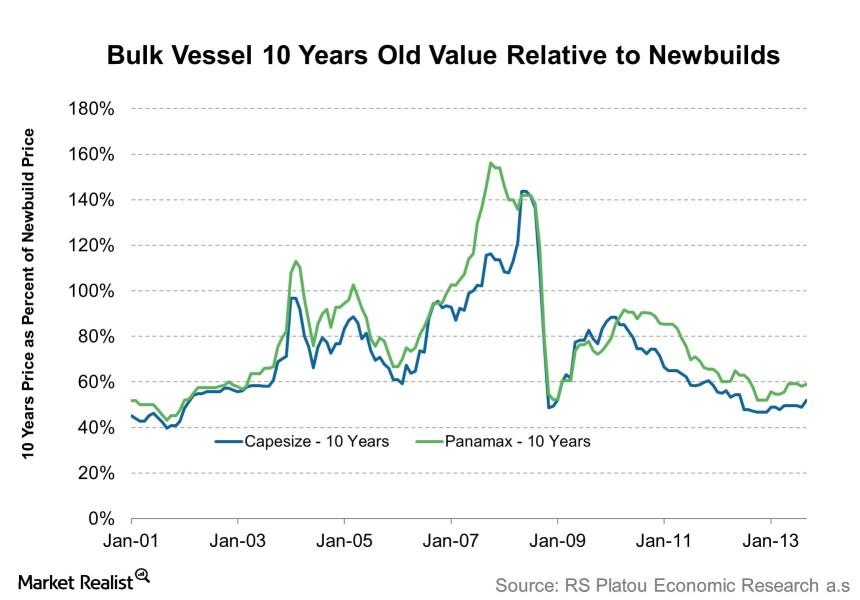

Why second-hand ship values suggest dry bulk shares will climb

The significance of second-hand ship values The prices of older vessels are another indicator that reflects the fundamentals of shipping companies. Because these vessels are sold and bought in the secondary market, it doesn’t take as long for the buyer to receive these vessels. So price movements in older vessels often reflect nearer-term fundamental outlook […]

Why Chinese producers are driving nitrogenous fertilizer prices down (Part 1)

How China affects the global fertilizer market China, the world’s largest producer of nitrogen (a chemical used to make nitrogenous fertilizers for growing plants) occupies roughly 40% of global production capacity. Although much of its output is sold to domestic farmers—as an export tax of as much as 75% during the on-season restricts domestic firms […]

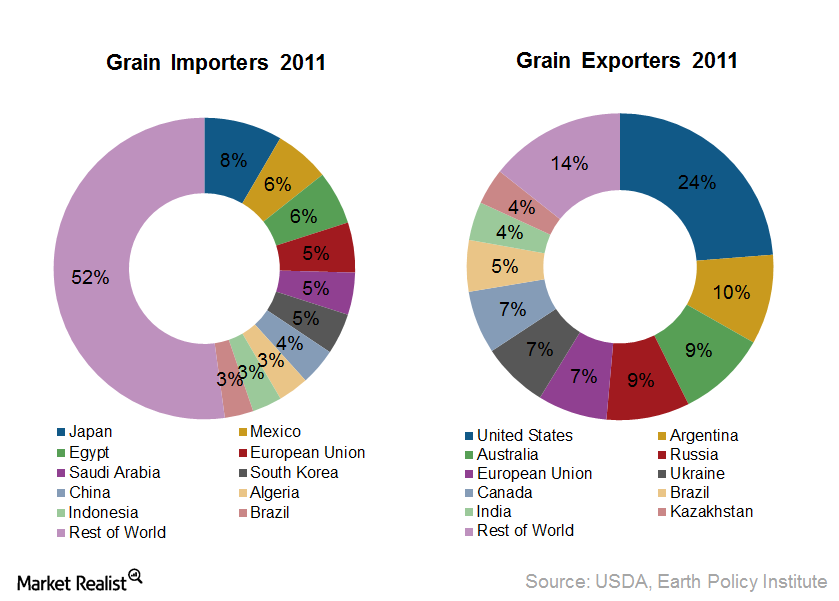

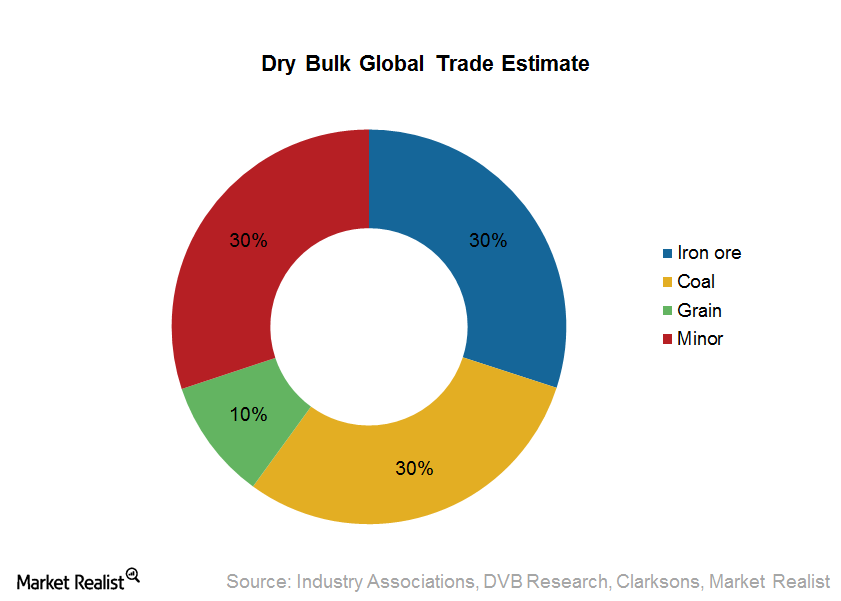

Major importers and exporters of grain and oilseed

Compared to iron ore and coal, the grain and oilseed trade makes up a much smaller part of overall dry bulk shipments—about 10%.

Investing in dry bulk shipping: A must-read overview

This series covers key suppliers of various commodities in the seaborne market as well as indicators pertaining to economic and industry fundamentals.

CEO profile: Navios Holdings’ Angeliki Frangou helps NM and NMM

Angeliki Frangou has been Navios Maritime Holdings Inc.’s chairman and CEO since August 25, 2005.

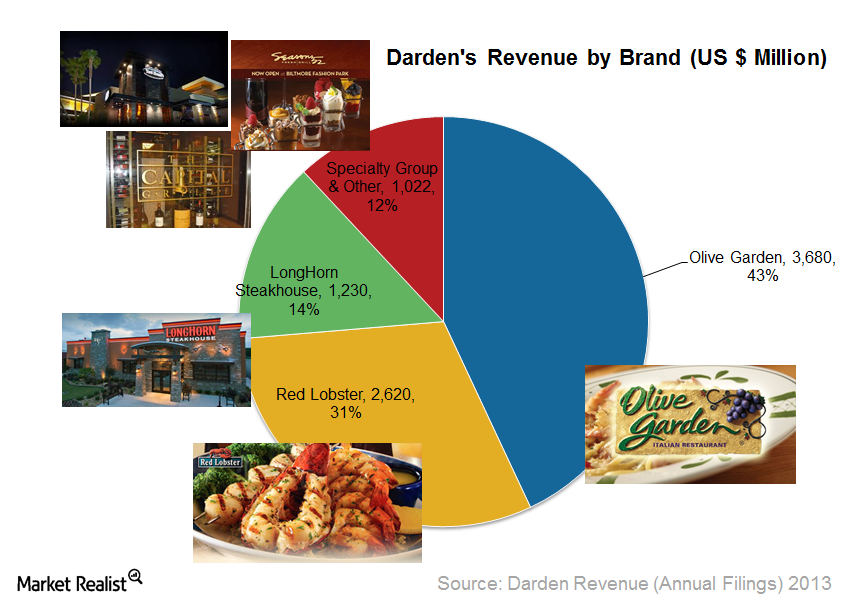

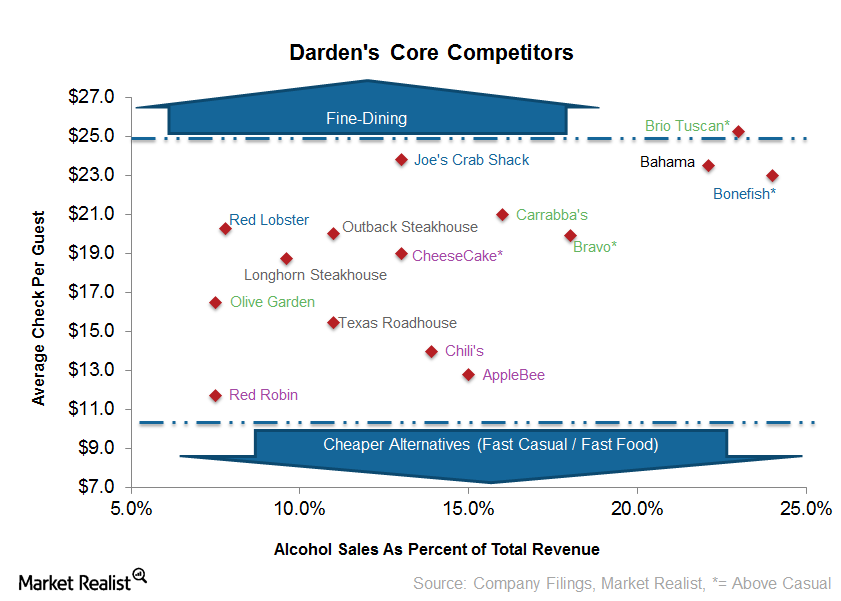

Darden analysis: Business overview shows limited differentiation

Restaurant industry breakdown The first thing investors should do before making an investment is understand the company’s industry, business, and strategy. We can broadly break the restaurant industry down into the limited-service and full-service sectors. Full-service restaurants are establishments where customers receive their meals at their table, receive table waiting services, and generally pay at […]

Darden analysis: Darden brands are losing guests to competitors

Darden’s Olive Garden and Red Lobster brands are losing guests Darden Restaurant Inc.’s (DRI) same store growth and expense breakdowns suggest the company needs to follow a different strategy. With some price cuts, guest count is falling for its Olive Garden and Red Lobster brands. Without a price cut, however, the company would have likely […]

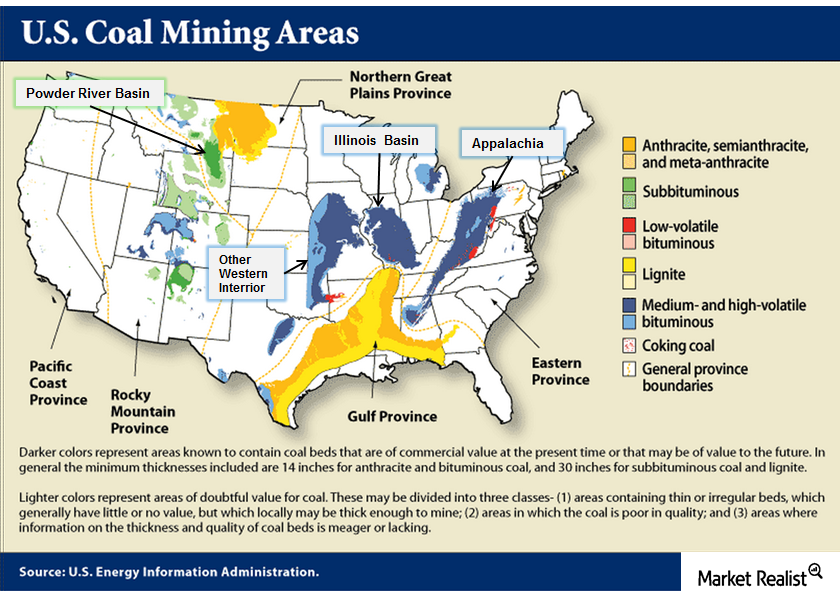

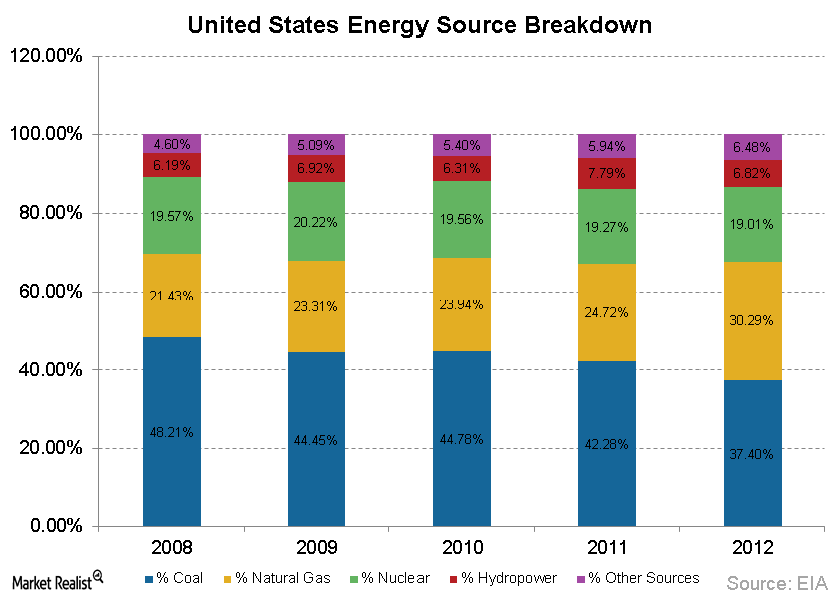

Why coal prices affect global urea fertilizer producers like CF

This series covers key trends that are currently affecting coal and natural gas prices and, consequently, nitrogen fertilizer producers as well.

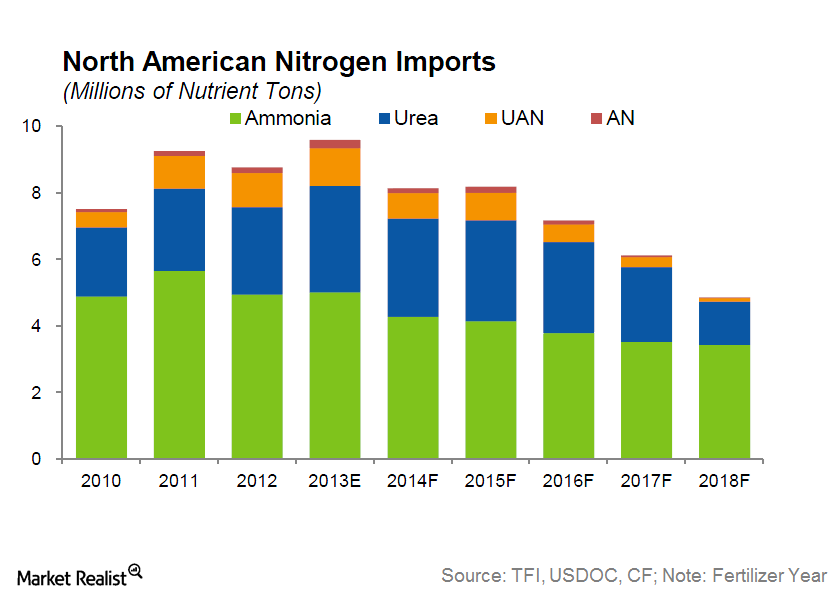

Must-know: Why US fertilizer companies offer a key advantage

The United States is one of the largest producers of agricultural products in the world, but it’s not a key producer of nitrogen fertilizers.

An investor’s guide to nitrogen fertilizers: Key 2014 drivers

Nitrogen is an important nutrient for crop development and growth. It’s also the most important input that allows farmers to feed billions of people in the world.

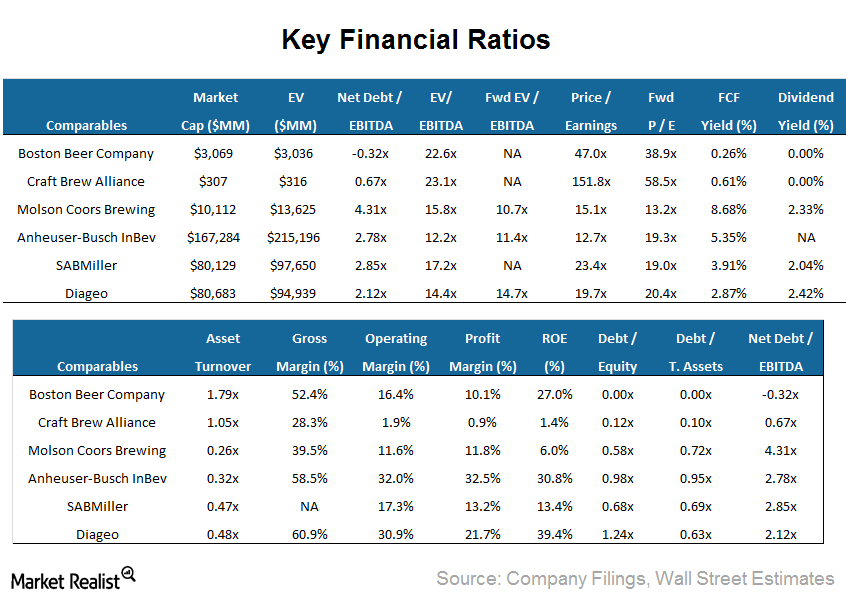

Boston Beer Company: An introduction to better beer business

Boston Beer Company Inc. (SAM) is the largest craft brewer in the United States, having sold ~2.7 million barrels of proprietary core brand products.Energy & Utilities Liquefaction capacity is key to liquefied natural gas carriers

Whether more proposals will get approval and more liquefaction capacity will come online will depend on the economic feasibility of the liquefaction plants.Energy & Utilities A guide to liquefied natural gas carriers and key shipping costs

While there are a few different types of LNG vessels, the two dominant containment systems, Moss (nicknamed “dinosaur egg”) and Membrane systems are employed today.Energy & Utilities Investing in liquefied natural gas carriers: The future of natural gas

Global energy demand will continue to increase, driven by population growth and improved standards of living. At the same time, emphasis on sustainability becomes more critical.

Must-know: The US coal mining areas and coal specifications

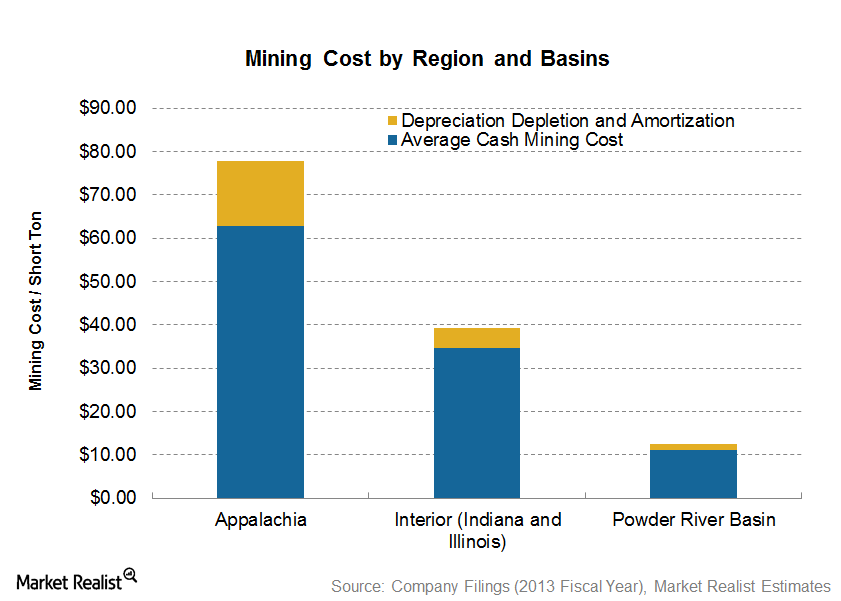

Coal mining in the U.S. can be segregated into three main areas: Appalachia, Interior, and West.

Why underground mines cost higher compared to surface coal mines

Underground mining is more expensive because it’s more capital intensive. Coal companies have to drill more, and use more expensive and complicated machines.

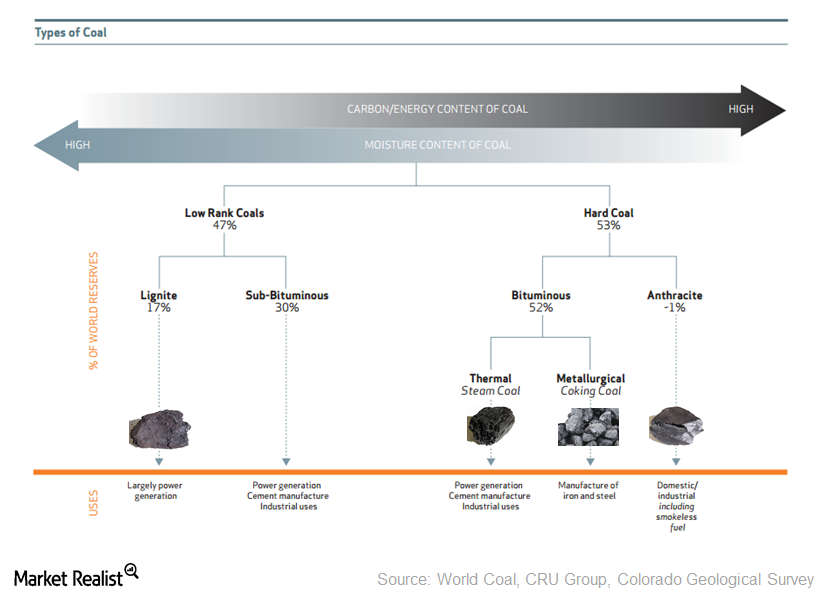

The “buried sunshine”—the coalification process and coal types

Coal is often called the “buried sunshine” because it developed from the remains of plants and greens that existed as long as 400 million years ago.

Why food will become more important to Starbucks’ future growth

As a primary coffee retailer, food has been a relatively minor part of Starbucks Corp.’s (SBUX) focus in the past. But lately, Starbucks has been expanding its product offerings for food.

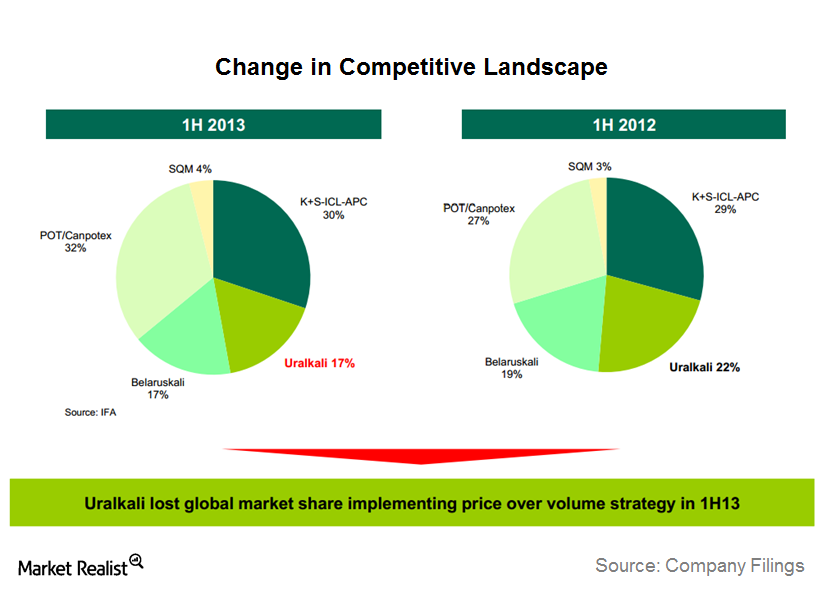

Why is Uralkali taking back—not gaining—fertilizer market share?

Uralkali’s move towards a volume-over-price strategy in order to gain market share (more like taking back market share) was the more important story.

Is craft better? Boston Beer Company’s high-quality ingredients

The four main ingredients that Boston Beer Company uses are malt, hops, yeast, and apples. Malts, hops, and yeast are part of most beer-making processes.

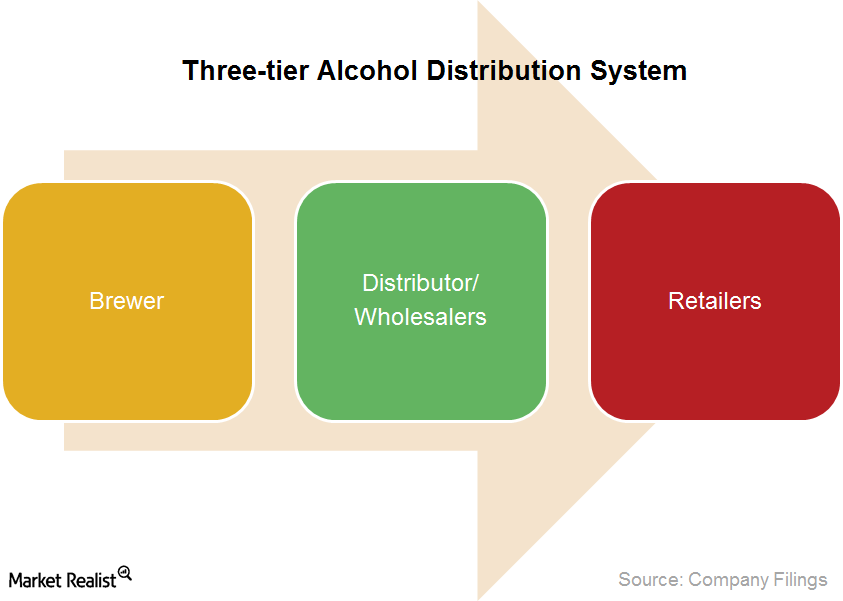

Why Boston Beer Company and peers’ beer distribution is important

Like other brewers in the United States, Boston Beer Company (SAM) sells its products to distributors and wholesalers, which in turn sell to retailers.

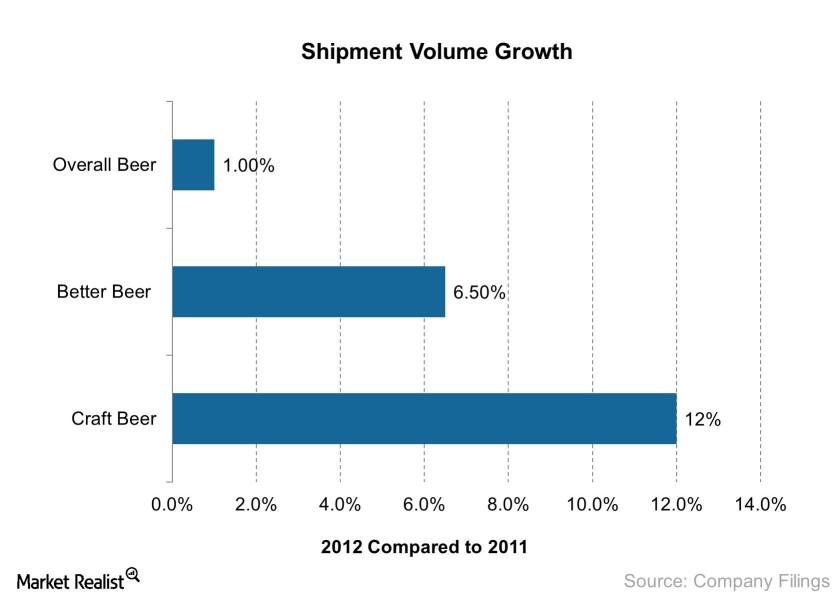

The rise of craft beer: Boston Beer Company and Samuel Adams

Craft beer consumption is on the rise, as drinkers are going for more premium products these days. Boston Beer Company (SAM) stands to benefit.

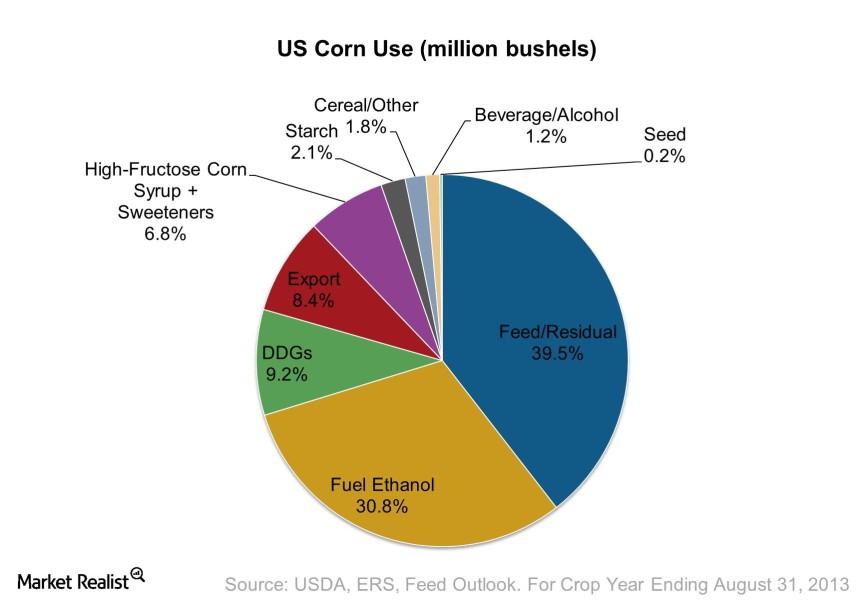

Why the average American uses more than 4 ears of corn per day

The United States is the biggest user of corn, consuming 265 million mt (metric tonnes) of corn in 2012—equivalent to 26% of global consumption.

Overview: The key factors that drive ammonia and urea prices

In this series, we’ll cover how costs in the United States, China, and Europe influence nitrogenous fertilizer prices along with other factors.

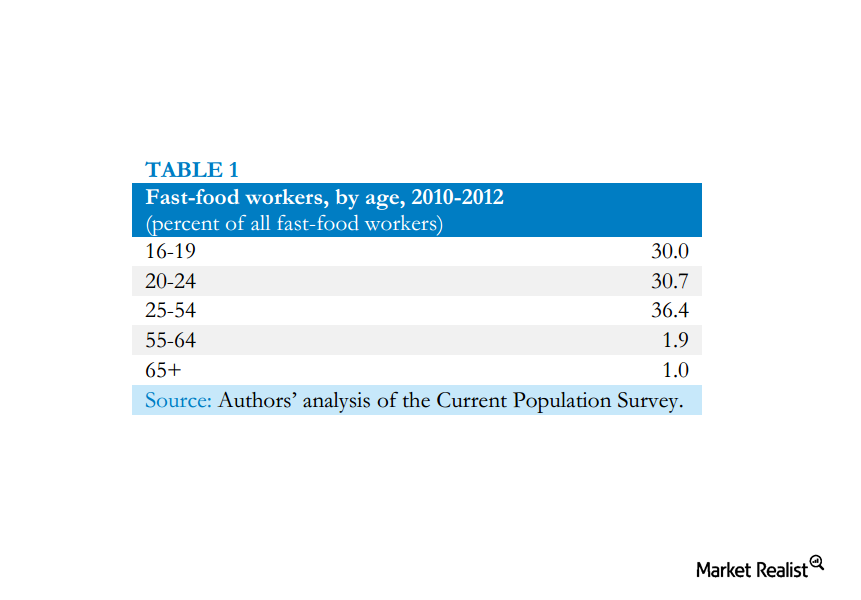

Must-know: Majority of fast food workers “not” above 25 years old

Why the unionization of all fast food workers, which would increase the bargaining power of employees and possibly lead to higher wages, in quite unlikely.

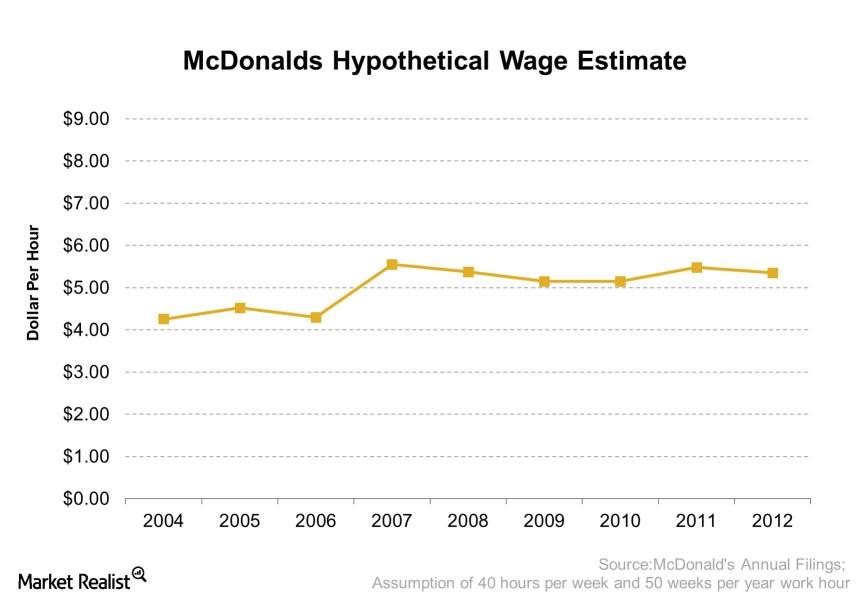

Why do most workers at McDonald’s work part-time?

Part-time work is most likely an industry-wide characteristic within the food retail business.