Xun Yao Chen

Xun is an analyst based out of Market Realist's New York City office and was formerly an investment analyst for four years. Previously Xun worked at Puji Capital, a hybrid investment bank and private equity firm based in Shanghai. He was also formerly a business consultant for Mic.co in his native Japan. Xun graduated summa cum laude from Boston University, with dual degrees in Economics and Business Administration.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Xun Yao Chen

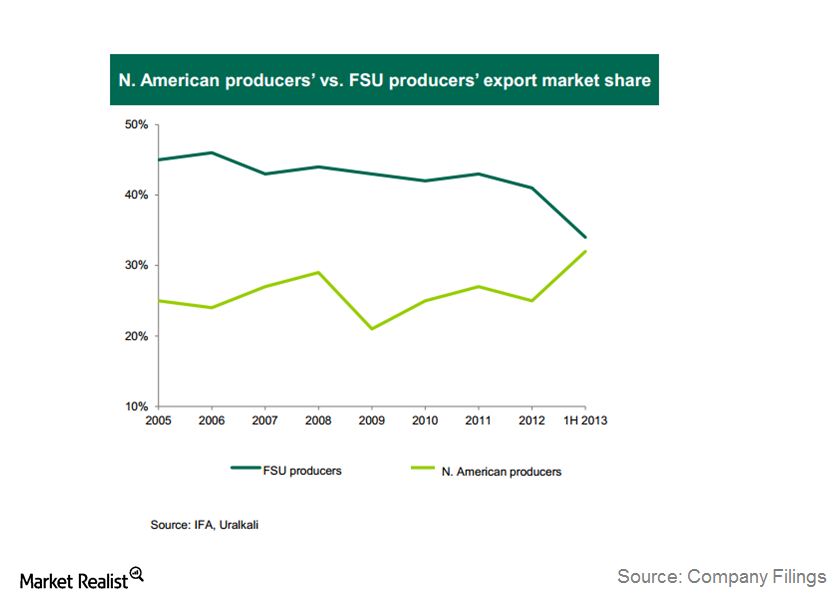

Why the wayward Canpotex upset the Russian giant Uralkali

In its recent earnings call, Uralklali highlighted its new strategy, called the Revenue Maximization Strategy.

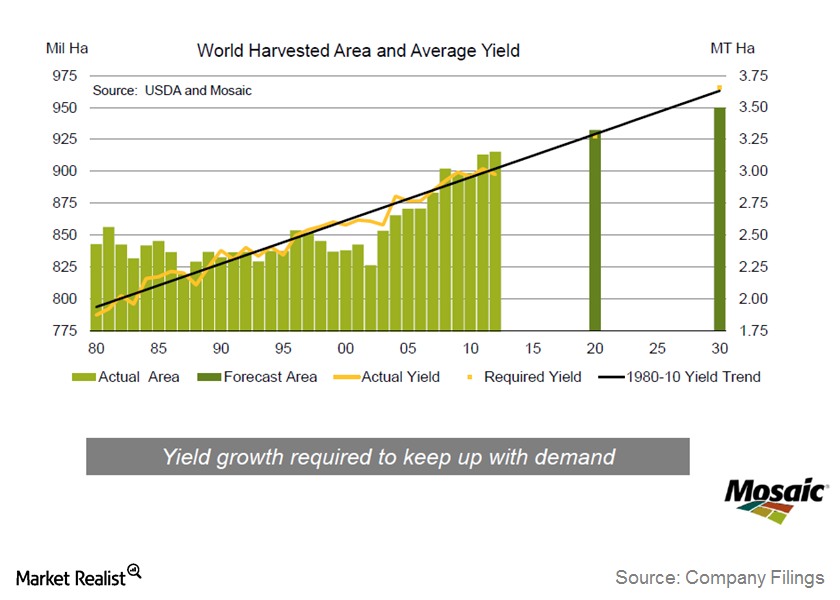

Why Mosaic shows that agriculture is always a cyclical business

In this series, we’ll explore Mosaic Co.’s latest discussions on its third quarter 2013 earnings results and the industry outlook.

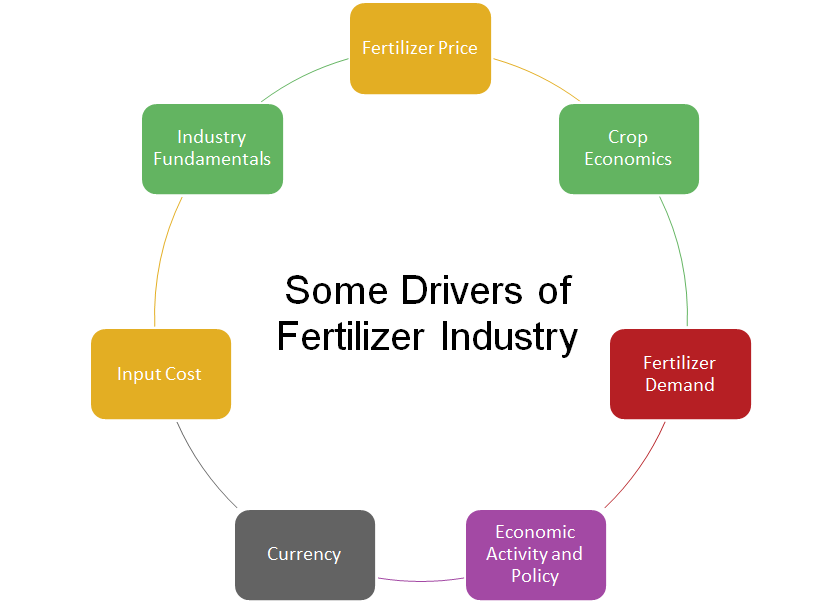

Analyzing the key factors that affect the fertilizer industry

The Essential Fertilizers Weekly series comprises key factors that have a potential impact on the bottom line—depending on revenue and expenses.

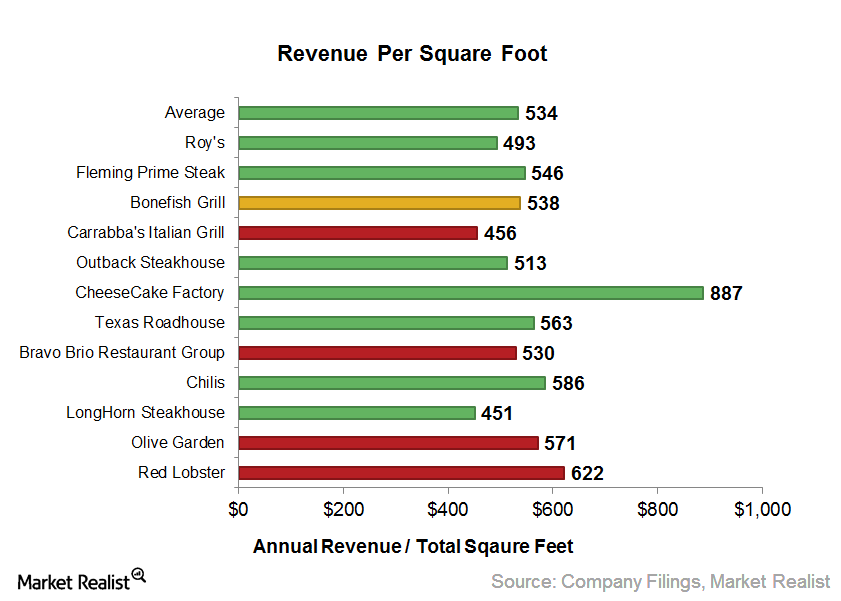

Darden analysis: Why revenue per square foot is essential

Average revenue per square foot To get a better picture of Darden’s business, we further looked into casual dining restaurants’ average revenue per square foot—the square feet of restaurants across primarily the United States and their guest traffic. This will help us decide whether Darden’s Olive Garden and Red Lobster brands should pick up a […]

Must-know: The key drivers of fertilizer company performance

The importance of the bottom line The performance of any investment over the medium to long term depends on current or future changes in the bottom line, like earnings per share, free cash flow per share, EBITDA (earnings before interest, tax, depreciation, and amortization) per share, and dividend per share. When the bottom line is […]

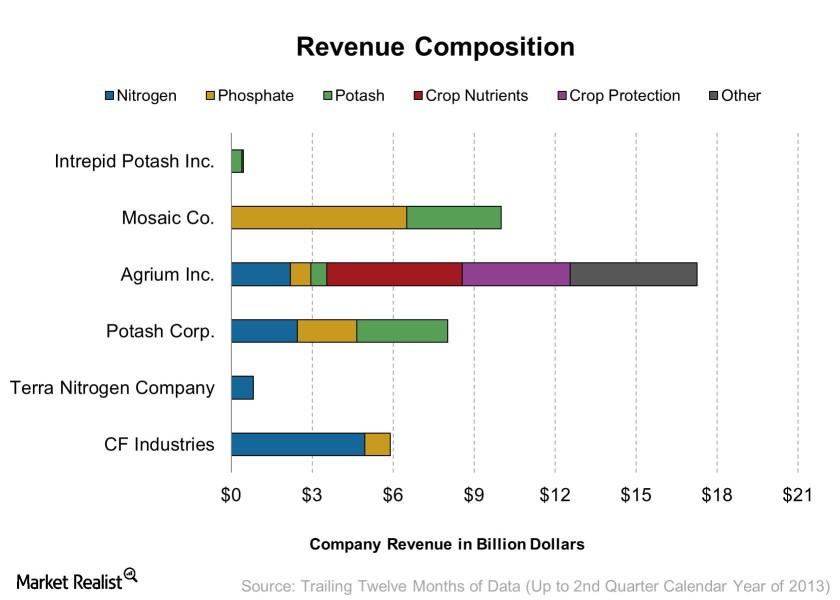

Revenue composition of major publicly traded fertilizer stocks

Main companies traded on the US market There are six main fertilizer producers that are widely traded on the US stock exchange: CF Industries Holdings Inc. (CF), Agrium Inc. (AGU), Mosaic Co. (MOS), Potash Corp. (POT), Terra Nitrogen Company LP (TNH) and Intrepid Potash Inc. (IPI). While they all operate producer fertilizers, each are exposed […]

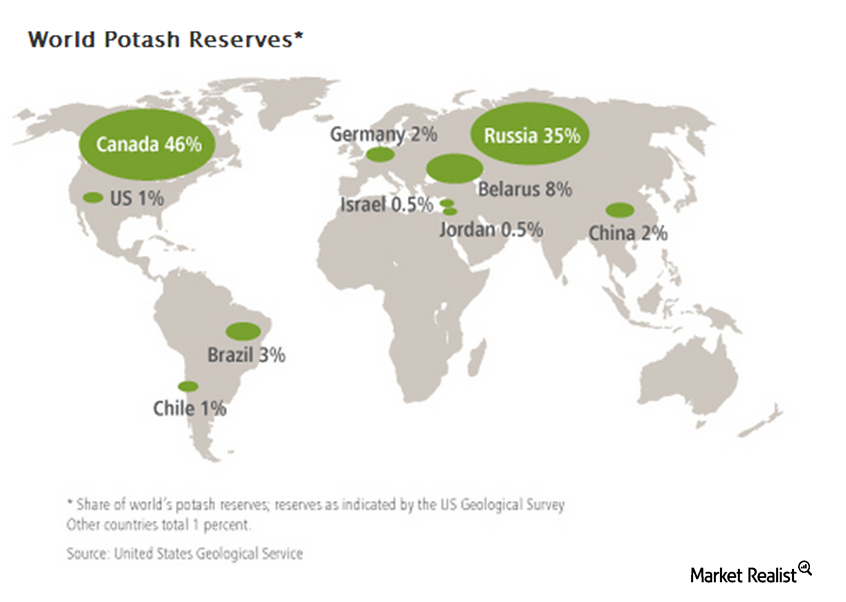

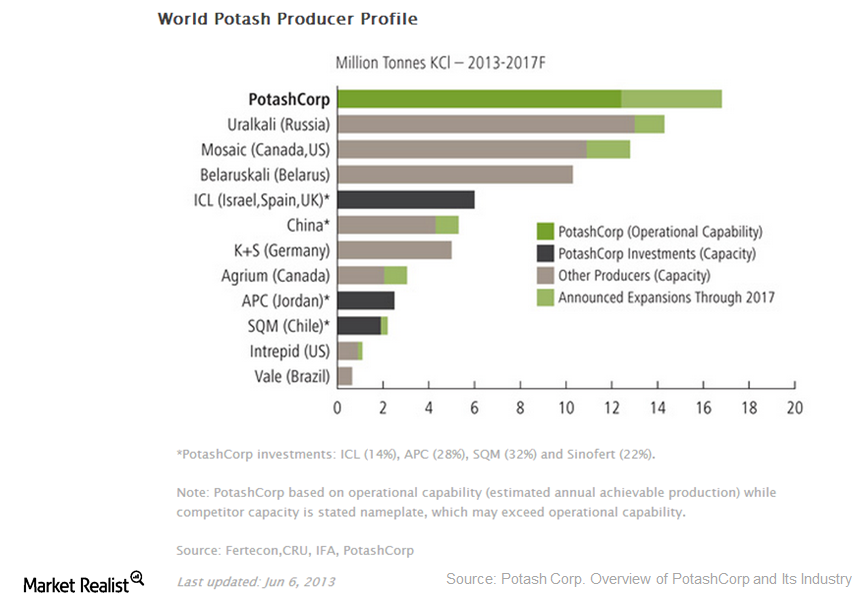

Must-know: Why cost and location affect potash production

Where potash is found Of all the fertilizer sub-industries, potash is the most concentrated. Mineral deposits of potash are more geographically concentrated than phosphate rock. Most of these resources are found in Canada, Russia, and Eastern Europe. Because of this, a large chunk of the world potash supply is controlled by companies like Potash Corp. […]

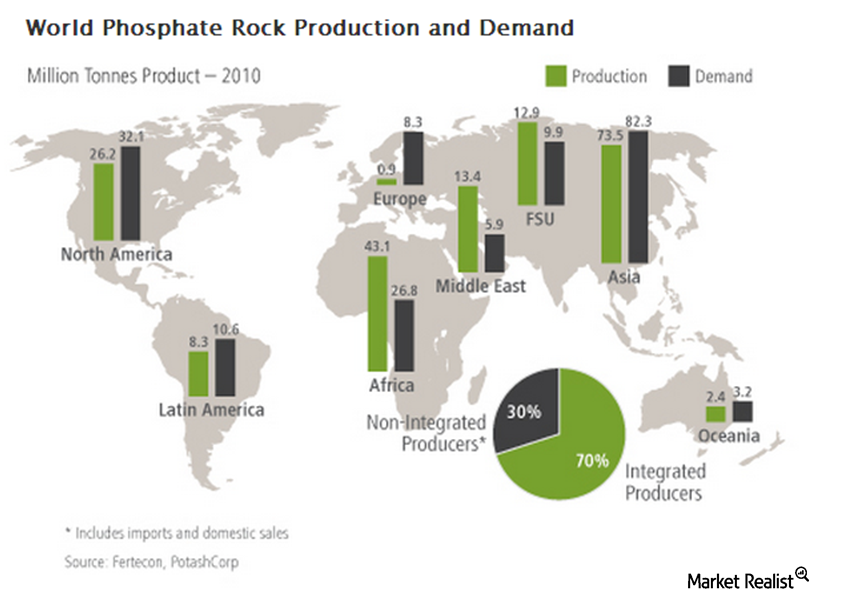

Why phosphate is a less competitive fertilizer sub-industry

The phosphate industry is less competitive than the nitrogen industry Unlike nitrogen-based fertilizers, the production of phosphate and potash fertilizers begins in mines. Mineral deposits for the latter two fertilizers are much scarcer and are usually concentrated in specific regions around the world. Because of this, there are fewer firms that make up the two […]

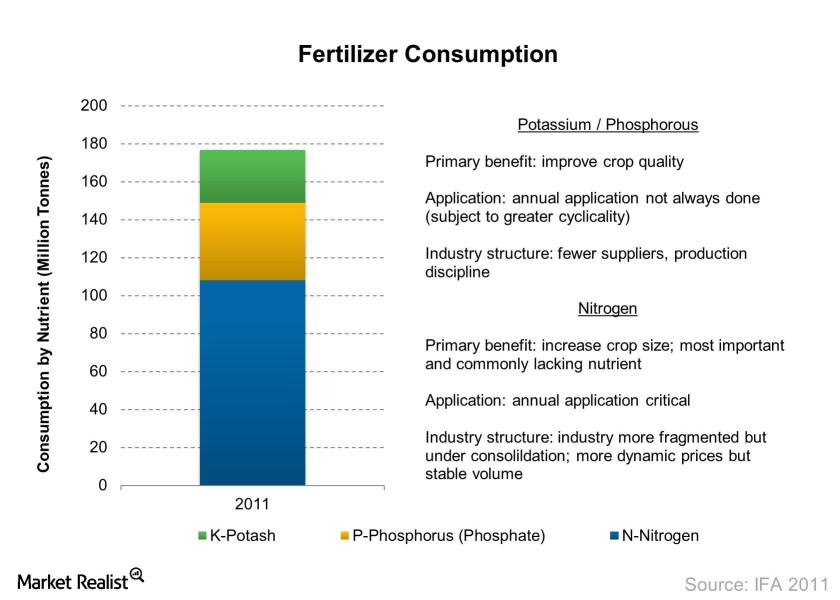

Fertilizer industry overview: Must-know fertilizer types

Fertilizers are used in the agriculture industry to improve the yield farmers receive. The three main types of nutrients or fertilizers are nitrogen, phosphate, and potash.

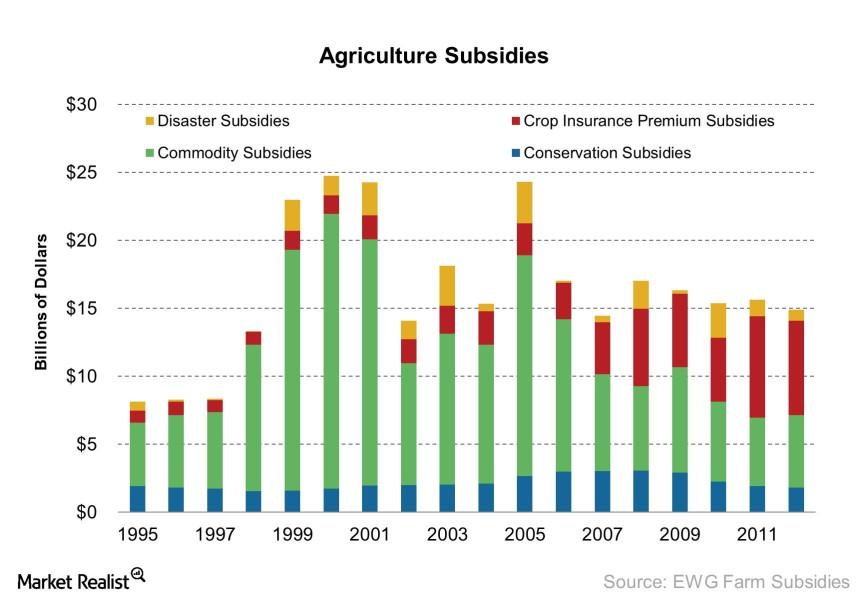

Must-know: Important types of farm subsidies in the United States

As a critical part of economic and social welfare, agriculture is a key industry governments around the world support.

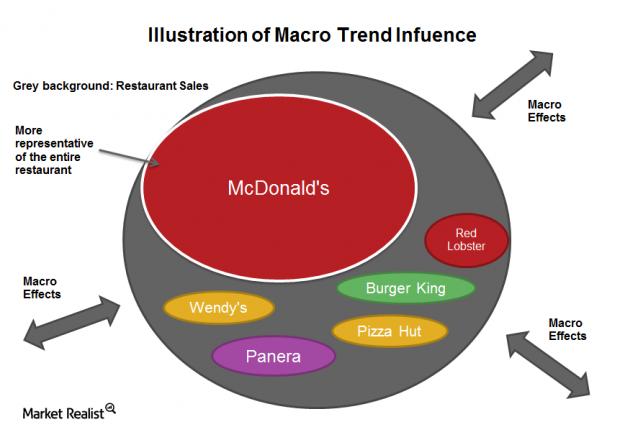

Why mega fast food companies depend on macro trends

Why macro trends are important The two major factors that drive a company’s performance are industry-related and company-specific catalysts. For ETFs that invest in a diversified number of companies, the effect of company-specific catalysts on the overall ETF”s performance is limited. So macro or industry factors tend to be the major factor driving performances. Industry […]

Why are potash producers increasing capacity?

Introduction Most often, investors expect new capacity addition plans as a positive indicator of booming business. This is because companies often increase their capacity following a period of demand boom. But capacity increases can be negative, as we saw with several fiber optics companies back during the tech bubble, when earnings plummet on falling demand […]