Will McDonald’s Separate Its Real Estate Portfolio?

One of the key reasons why McDonald’s (MCD) stock has remained firm is because of its real estate portfolio.

Oct. 20 2015, Published 1:43 p.m. ET

McDonald’s real estate portfolio

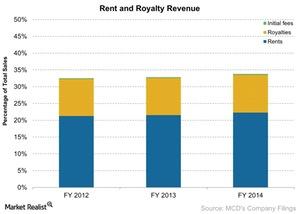

One of the key reasons why McDonald’s (MCD) stock has remained firm is because of its real estate portfolio. McDonald’s purchases real estate and leases it to its franchise, usually for the use of running McDonald’s restaurant. McDonald’s collects rents on these leases. Income from rents makes up for about one-fifth of McDonald’s revenue.

What sets McDonald’s apart?

- As of 2Q15, McDonald’s had $38.3 billion in property and equipment on its balance sheet, which is about 40% of its market capitalization.

- This value is recorded on the balance sheet at cost, so the value of the real estate could be much higher.

- Unlike the revenue from restaurants, which moves with customer trends and the economy, rents provide a stable source of revenue for McDonald’s.

- These leases are long-term leases, usually for about 20 years, and usually rents escalate.

- The large real estate portfolio is what sets McDonald’s apart from its peers.

Real estate spinoff

- Recently, one of McDonald’s board members, Miles D. White, stated that the company is nearing a decision about its real estate assets, according to the Wall Street Journal.

- Active investors have been urging McDonald’s to consider spinning off its real estate assets into a REIT (real estate investment trust) to unlock value to investors.

- A REIT is a pool of real estate assets trades publicly on a stock exchange.

- Setting up a REIT would mean transferring the ownership of the real estate McDonald’s owns to a third party.

- McDonald’s management had maintained that spinning off the real estate assets would harm the company more than creating value for investors.

- This makes it less likely for a real estate spin-off, but McDonald’s management stated that it’s open to boosting shareholders value as well.

- In June 2015, Darden (DRI) also announced that it would spin off 430 of its restaurants to a REIT.

Darden forms about 1% of the First Trust Consumer Discretionary Alpha Fund (FXD). FXD also holds 1% of Starbucks (SBUX) and 1% of Domino’s (DPZ).