Texas Roadhouse Inc

Latest Texas Roadhouse Inc News and Updates

Did You Receive a Voucher From Texas Roadhouse? It Might Be a Scam

The Texas Roadhouse voucher scam is circulating on Facebook. It involves users being offered free meals in exchange for likes, follows, and shares.

Texas Roadhouse Founder and CEO Kent Taylor Dies at 65

Learn more about Texas Roadhouse founder Kent Taylor, including information on his COVID-19 response, his net worth, and his family life.

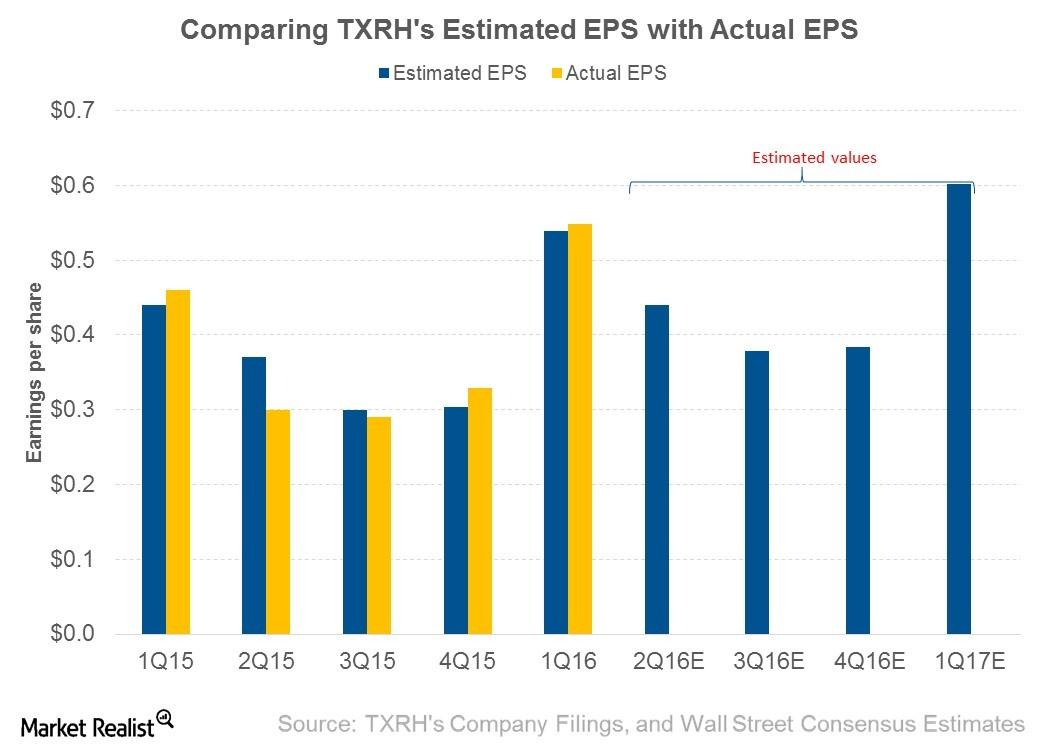

Texas Roadhouse’s 1Q16 EPS Was below Analyst’s Expectations?

In 1Q16, Texas Roadhouse posted EPS of $0.5. This was lower than analysts’ estimate of $0.54. The adjusted EPS was above analysts’ estimate at $0.55.

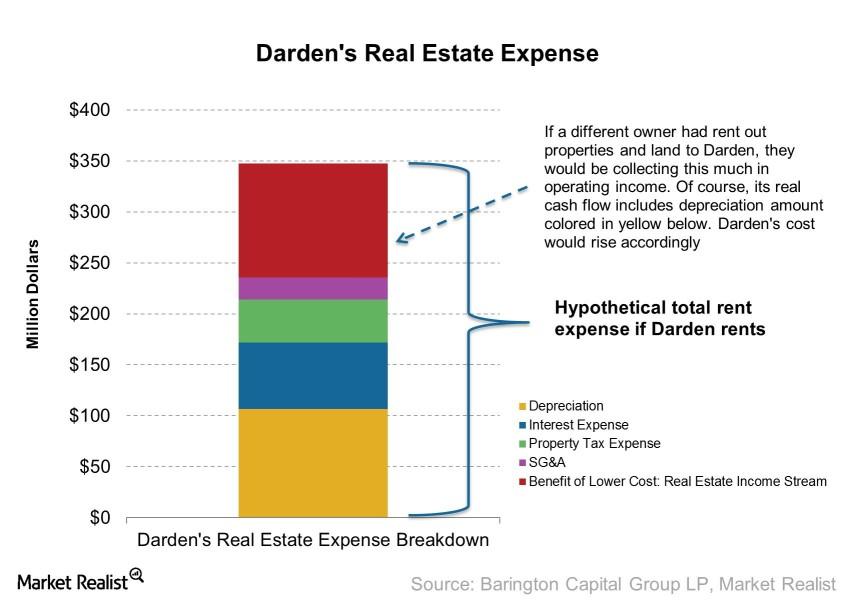

Darden analysis: Key benefits of a restaurant owning properties

Owning properties reduces real estate costs A restaurant business that owns its own building is a bit different from a restaurant business that rents its buildings or lands. From a business standpoint, you can think of a restaurant that owns its buildings as the sum of two businesses: restaurant and real estate. Because the real […]

The Restaurant Industry: An Overview

More Americans are eating out, and they’re eating out more often. The restaurant industry’s share of the food dollar is 51%, up from 25% in 1955.

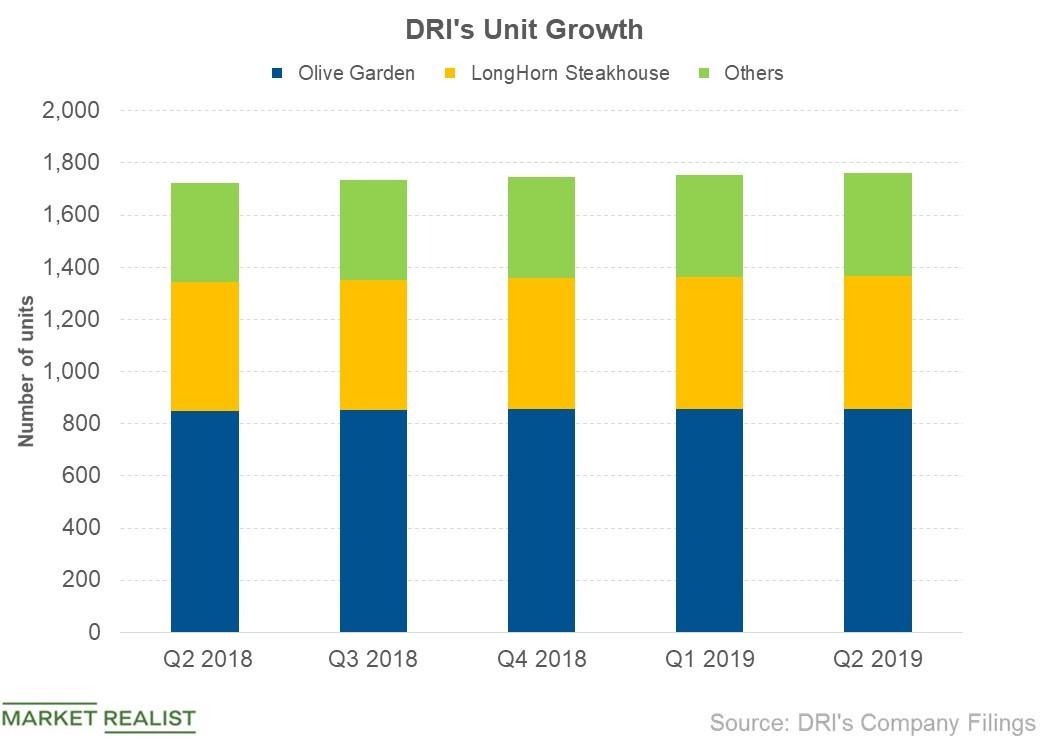

How Is Darden Restaurants Expanding Its Business?

At the end of the second quarter of fiscal 2019, Darden Restaurants (DRI) operated 1,762 restaurants.

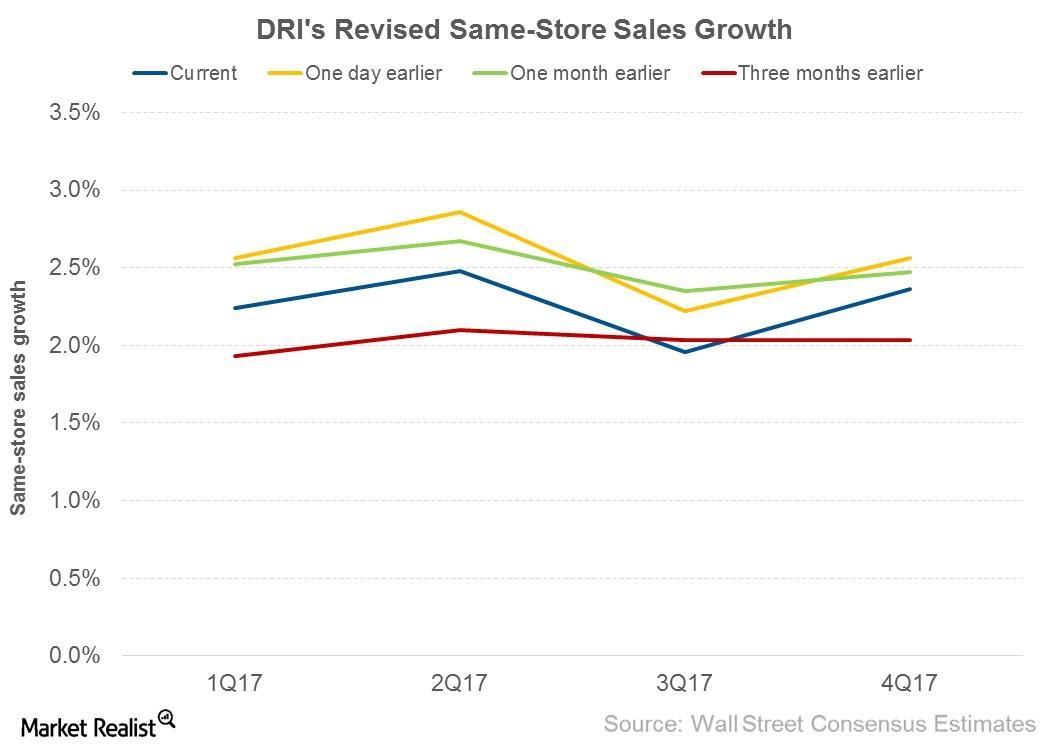

Darden Restaurants Updates Guidance after Fiscal 4Q16 Earnings

After fiscal 4Q16 results, Darden Restaurants’ (DRI) management has revised its same-store sales growth guidance for fiscal 2017 to the range of 1%–2% as compared to earlier estimates of 1%–3%.

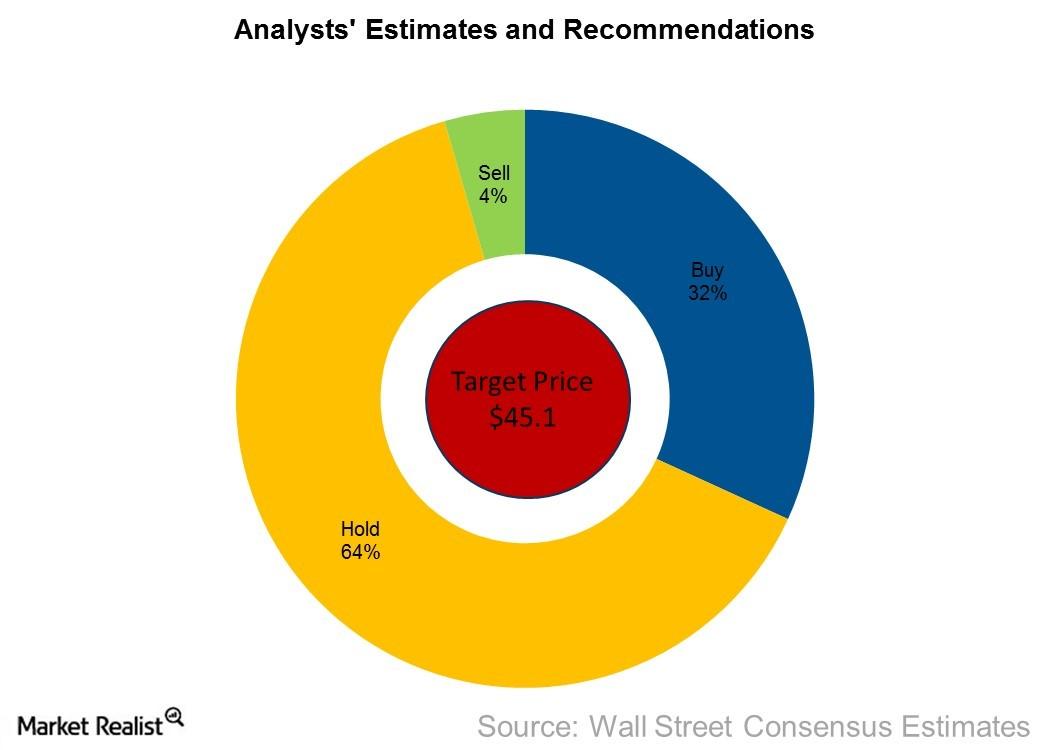

What Do Analysts Recommend for Texas Roadhouse?

The rise in EPS estimates for the next four quarters has prompted analysts to increase their price target for TXRH for the next 12 months to $45.1 from their earlier estimate of $44.8.

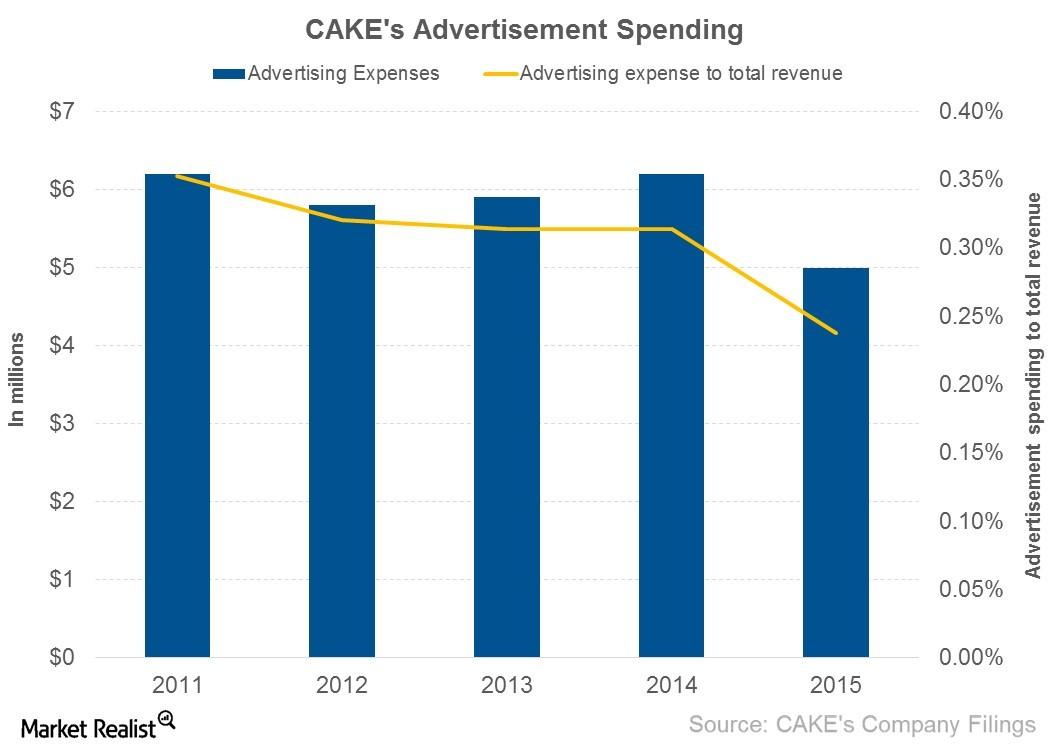

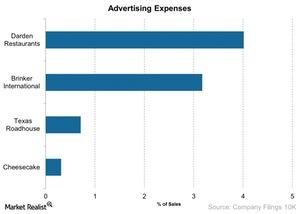

What Is The Cheesecake Factory’s Marketing Strategy?

The Cheesecake Factory (CAKE) is competing in a highly competitive restaurant business, where innovation is absolutely necessary to keep up.

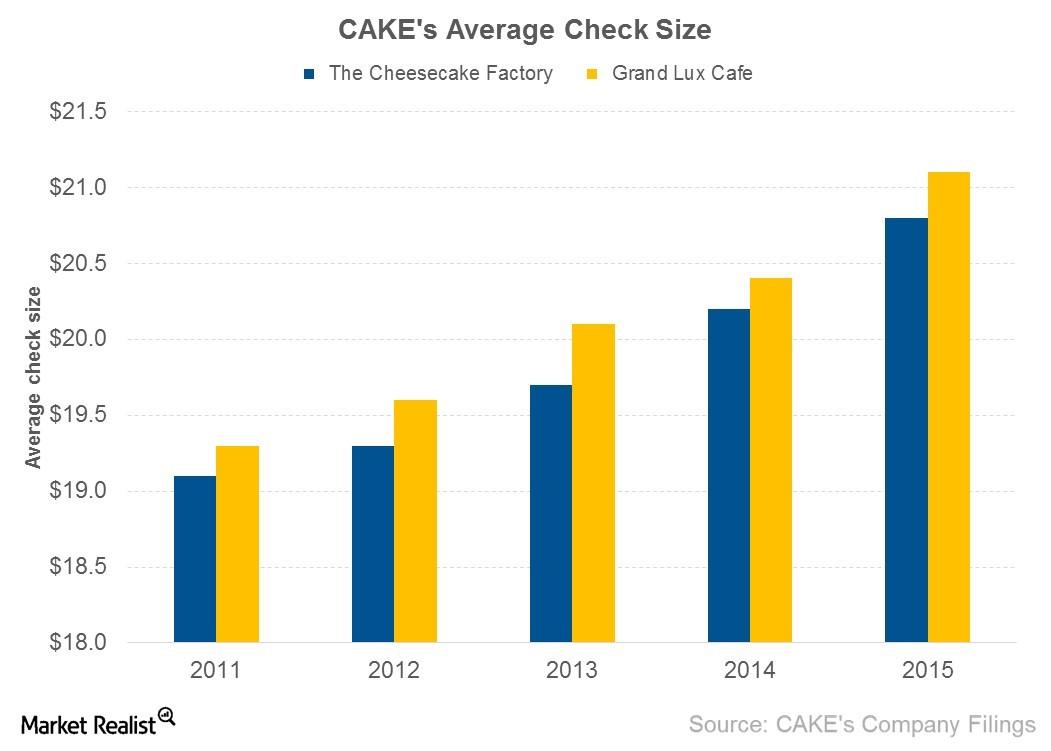

CAKE’s Average Check Has Increased Year-over-Year

In 1992, when CAKE was listed, its average check size was at $13.6. By the end of 2015, the company’s average check size had increased to $20.8.

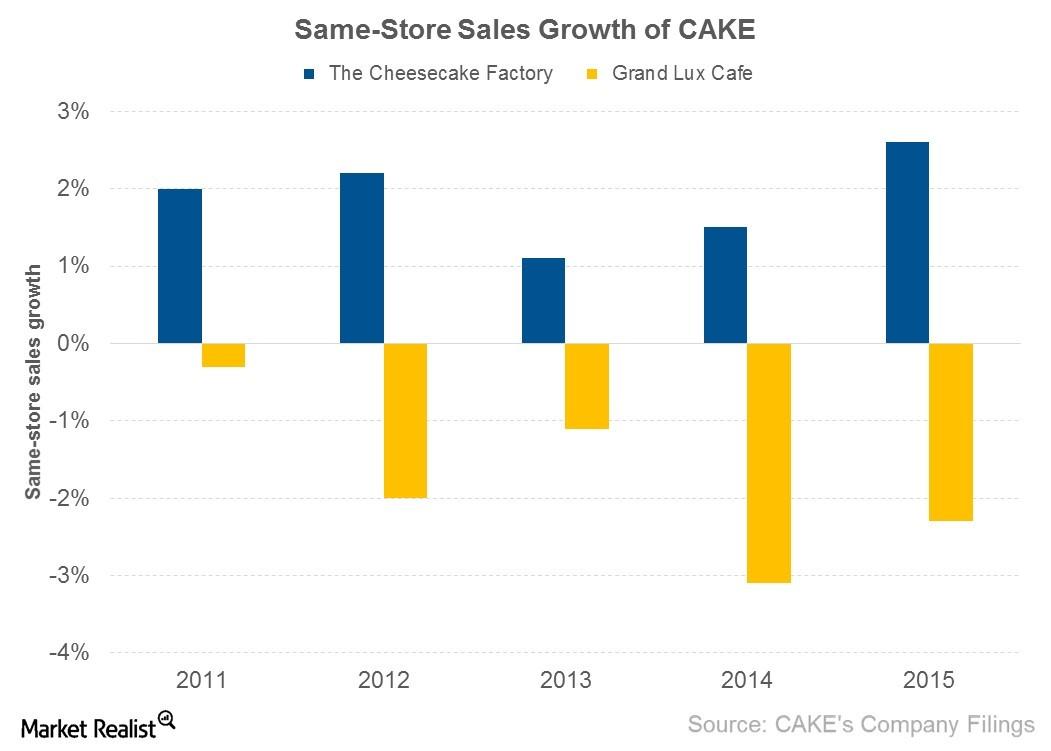

What’s Been the Main Driver of CAKE’s Same-Store Sales Growth?

In the last five years, The Cheesecake Factory’s (CAKE) same-store sales growth was in the range of 1%–3%, largely driven by rises in its menu prices.

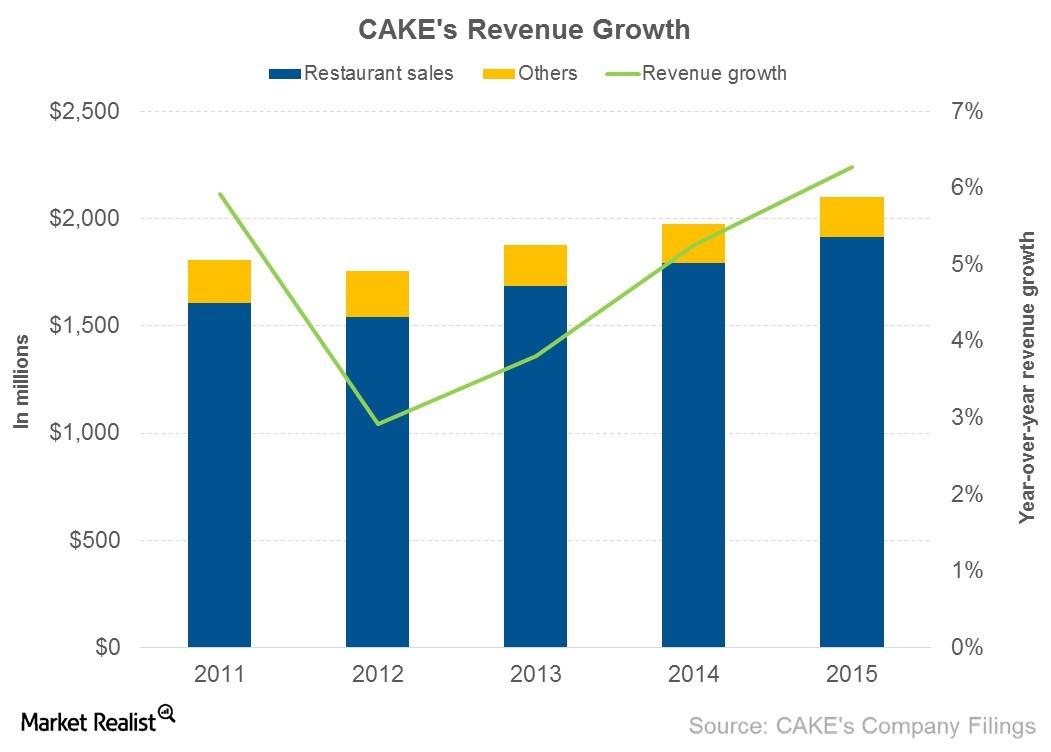

What’s Driving The Cheesecake Factory’s Revenue Growth?

The Cheesecake Factory earns its revenue from its company-owned restaurant sales, franchisee fees and royalties, and its bakery operations.

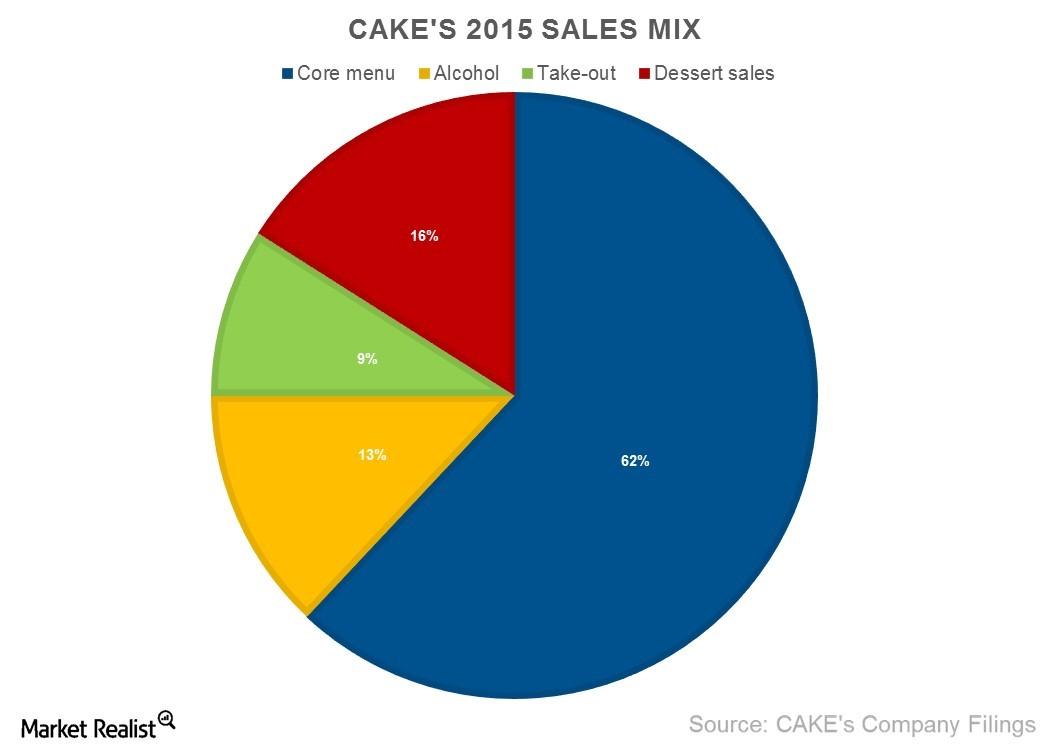

The Cheesecake Factory Is Not Just about Desserts

The Cheesecake Factory has positioned itself as an upscale casual dining concept that focuses on providing a distinctive, high-quality dining experience.

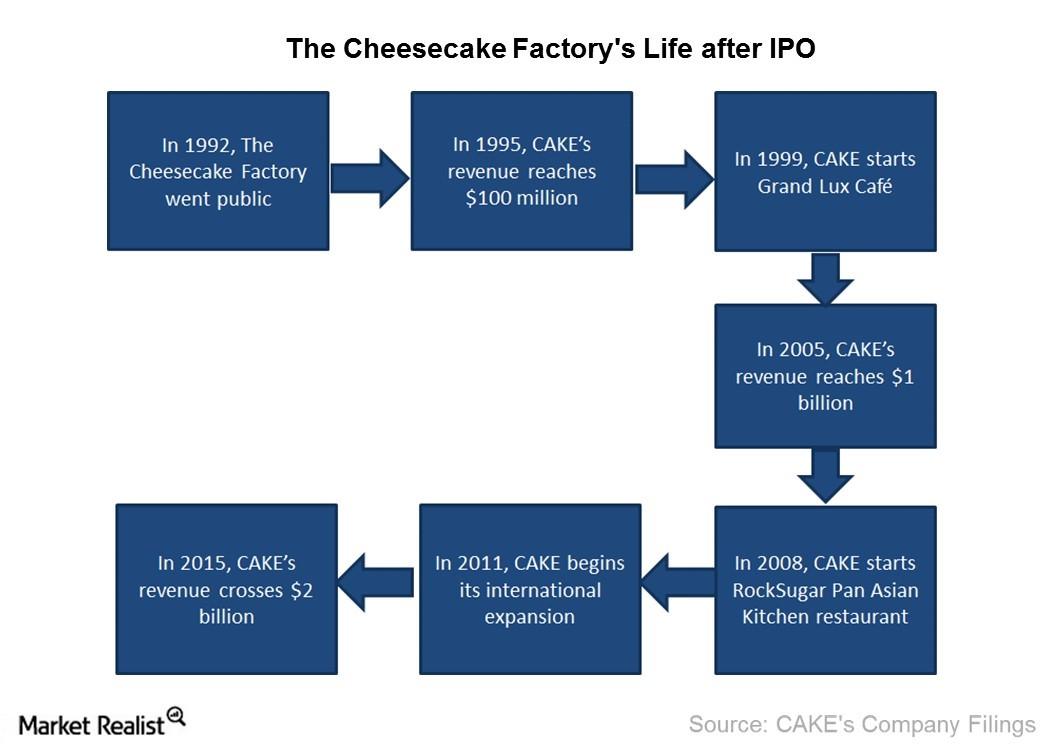

How Did The Cheesecake Factory Expand after Going Public?

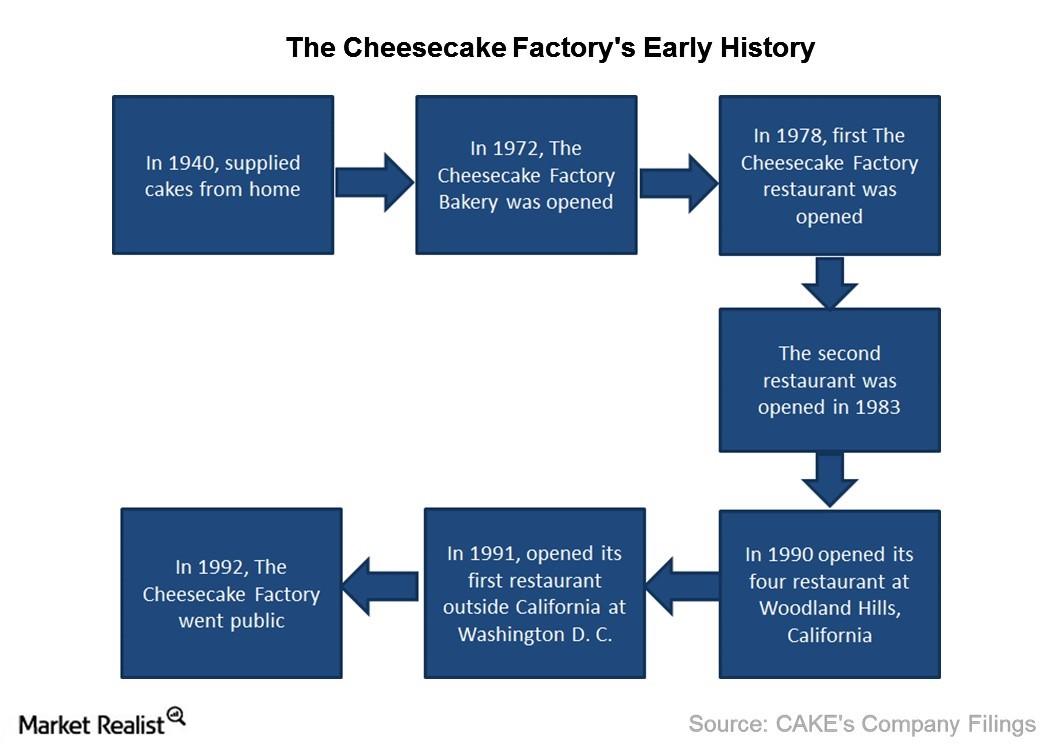

In February 1992, The Cheesecake Factory (CAKE) went public by offering 2.3 million shares at $20 per share. It closed its opening day at $27.3 per share.

A Must-Know Guide to The Cheesecake Factory

The Cheesecake Factory (CAKE) is a casual restaurant chain that was founded in 1978. The California-based company owns and operates 201 restaurants.

How Did The Cheesecake Factory Come to Exist?

The origin of The Cheesecake Factory dates back to the 1940s, when Evelyn Overton found a recipe in a local newspaper that inspired her original cheesecake.

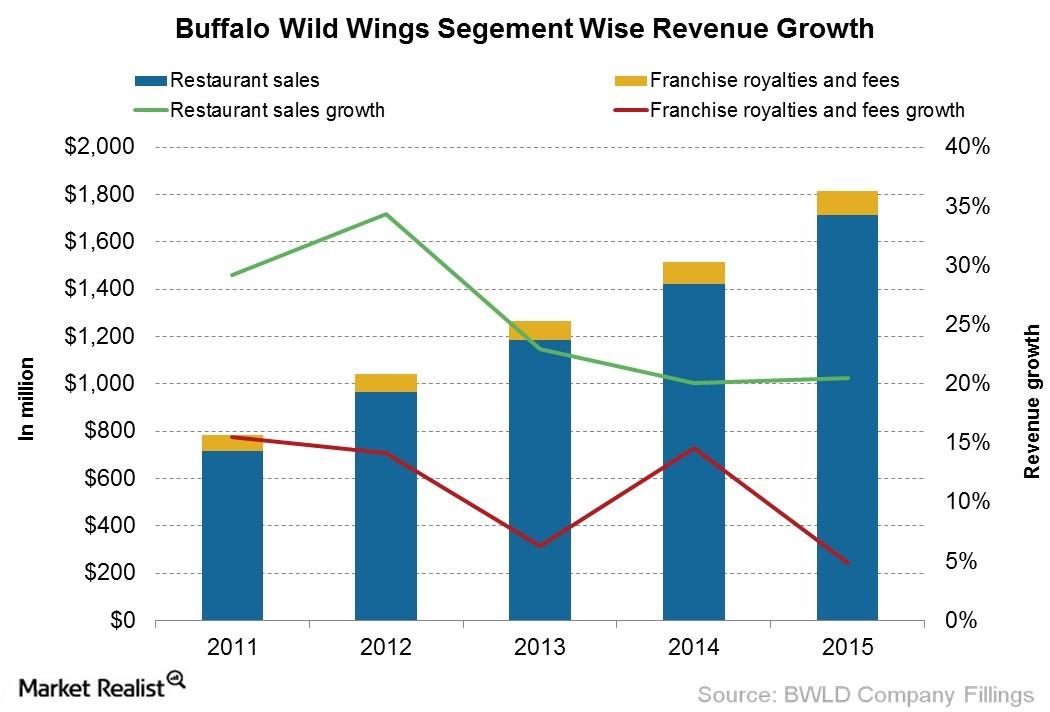

What’s Really Driving Buffalo Wild Wings’ Revenues?

From 2011 to 2015, Buffalo Wild Wings’ (BWLD) revenues increased from $784 million to $1.8 billion—a rise of over 131%.

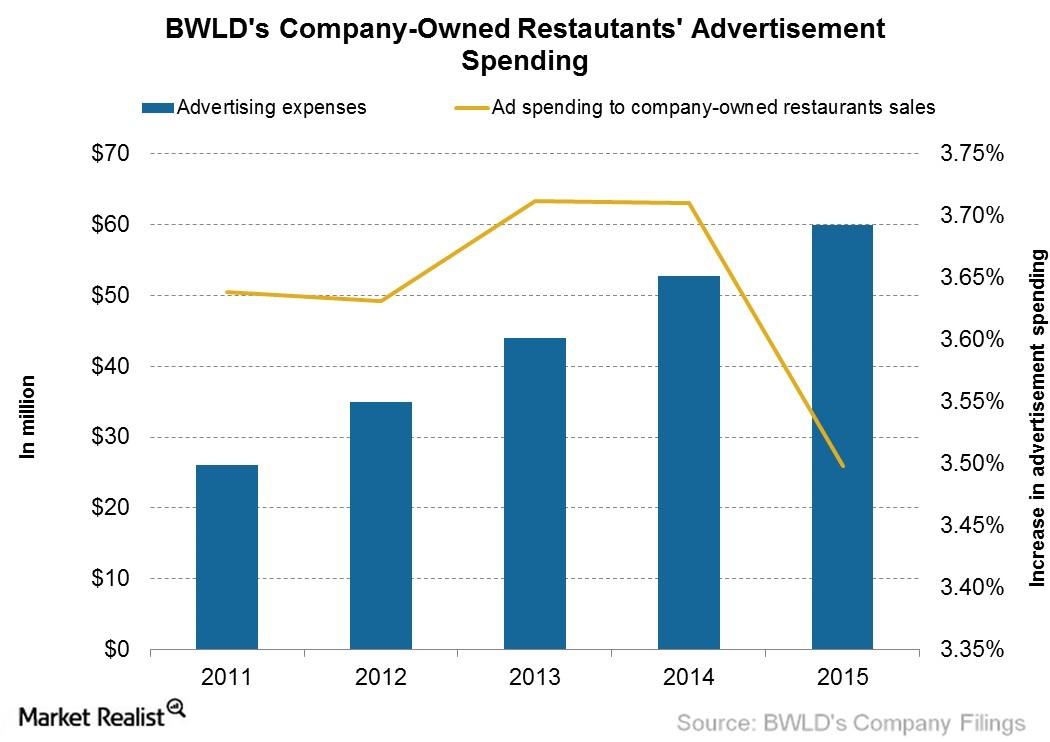

Inside Buffalo Wild Wings’ Marketing Strategies

Buffalo Wild Wings is competing in the highly competitive restaurant business, wherein innovation is a must to keep up with the changing needs of customers.

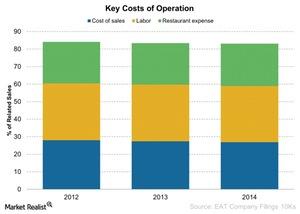

Brinker International’s Key Costs of Operations

Brinker incurs key costs of operations to run its company-owned restaurants, including cost of sales, labor and related costs, and rent and other costs.

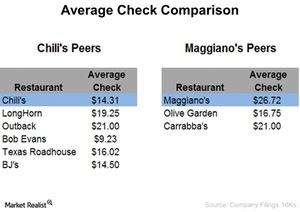

Average Checks at Chili’s and Maggiano’s – Why Do They Matter?

The average check at Chili’s in 2014 was $14.31, lower than its main peers. Maggiano’s average check was $26.72, the highest among its peers.

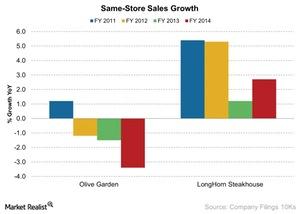

Olive Garden and LongHorn Steakhouse’s Same-Store Sales Growth

LongHorn Steakhouse’s same-store sales increased to 2.7% in 2014 year-over-year from 1.2% in 2013. This is lower compared to fiscal 2012 and fiscal 2011.

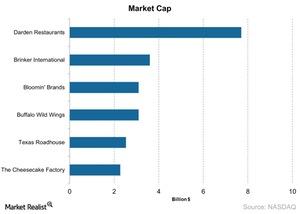

Business Overview of Darden Restaurants

As of 2014, Darden Restaurants owned 1,520 restaurants, excluding more than 700 Red Lobster locations.

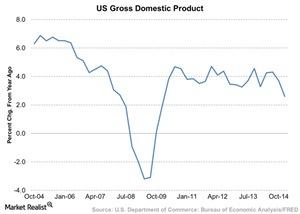

Why US Gross Domestic Product Growth Impacts Restaurants

The restaurant industry is part of the consumer discretionary sector. This sector does well when the economy is expanding.

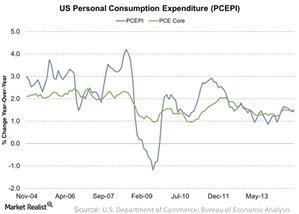

How Inflation Impacts The Restaurant Industry

Low inflation means low interest rates. This makes it affordable for restaurants to borrow and expand units.

Pivotal Government Regulations That Affect Texas Roadhouse

In addition to the factors we’ve discussed, regulations can also affect the company’s profits. Let’s look at some of the regulations that apply to TXRH.

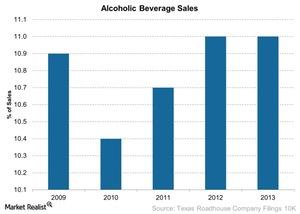

Understanding Texas Roadhouse’s Marketing Approach

A company can increase its marketing and promotional activities to bring in more customers and obtain operating leverage.

A Closer Look At Texas Roadhouse’s Steak-Focused Menu

In the last part of this series, we briefly covered Texas Roadhouse’s (TXRH) steak-focused menu. Let’s look at it in more detail in this article.

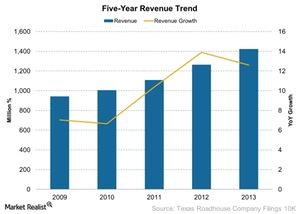

A Must-Read Business Overview Of Texas Roadhouse

In this overview of Texas Roadhouse, we’ll look at the company’s financial performance, value drivers, competition, unit growth, and other key information.

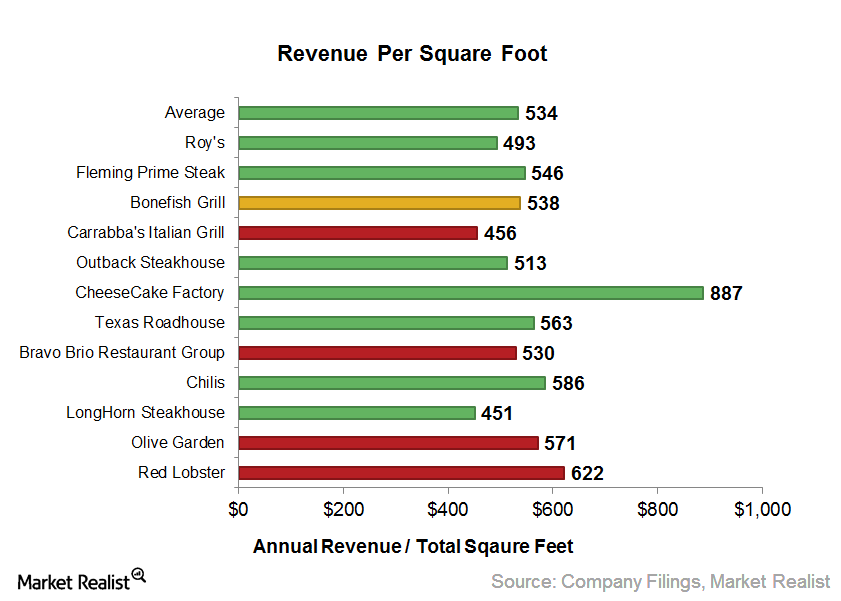

Darden analysis: Why revenue per square foot is essential

Average revenue per square foot To get a better picture of Darden’s business, we further looked into casual dining restaurants’ average revenue per square foot—the square feet of restaurants across primarily the United States and their guest traffic. This will help us decide whether Darden’s Olive Garden and Red Lobster brands should pick up a […]