Must-know: positions traded by Soros Fund Management in 3Q14

Soros deploys a global macro investment strategy, investing in a wide range of markets and asset classes globally.

Nov. 26 2019, Updated 7:04 p.m. ET

13F filing

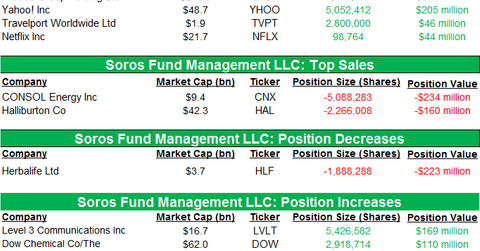

Soros Fund Management, founded and owned by billionaire investor George Soros, filed its 13F this week and traded new positions in the third quarter. The new positions and sales are outlined in the table below.

3Q14 portfolio

The third quarter portfolio consisting of 241 stocks was valued at $13.3 billion, a slight increase from $13.2 billion in the second quarter.

During 3Q14, Soros Fund Management added positions in Alibaba Group Holding (BABA), Yahoo! (YHOO), Travelport Worldwide Limited (TVPT), and Netflix, Inc. (NFLX). Top positions that saw an increase were Level 3 Communications, Inc. (LVLT), Dow Chemical Company (DOW), and Phillips 66 (PSX). Soros sold its stakes in CONSOL Energy Inc. (CNX) and Halliburton Company (HAL), and it significantly trimmed its position in Herbalife (HLF).

Fund background

A privately held firm that operates the Quantum Group of Funds, Soros Fund Management LLC was founded in 1969 by George Soros. Soros deploys a global macro investment strategy, investing in a wide range of markets and asset classes globally. Recent reports noted Soros Fund Management has invested $500 million in a strategy run by Bill Gross at the Denver-based Janus Capital Group, Inc. This amount will be managed through Quantum Partners LP, a private investment vehicle.

In the next part of this series, we will highlight the addition of a position in Alibaba Group Holding Ltd.