Herbalife Nutrition Ltd

Latest Herbalife Nutrition Ltd News and Updates

Are Bill Ackman’s Investment Strategies Successful?

In the first quarter of 2020, activist hedge fund manager Bill Ackman made a windfall profit of $2 billion. He was short on the market in March 2020.

Short-term effects of changes to Herbalife’s marketing plan

Pershing Square Capital Management commented on Herbalife’s marketing plan in its latest shareholder letter.

How Carl Icahn and Bill Ackman View Herbalife

Carl Icahn is a great believer in Herbalife. He has been a substantial investor in this stock since January 2013.

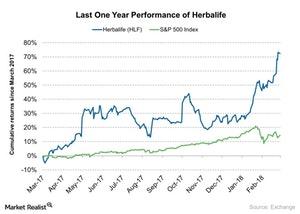

Why Bill Ackman’s Pershing Square Had a Rough 2017

Bill Ackman’s Pershing Square Capital Management saw negative returns in 2017 for the third consecutive year.

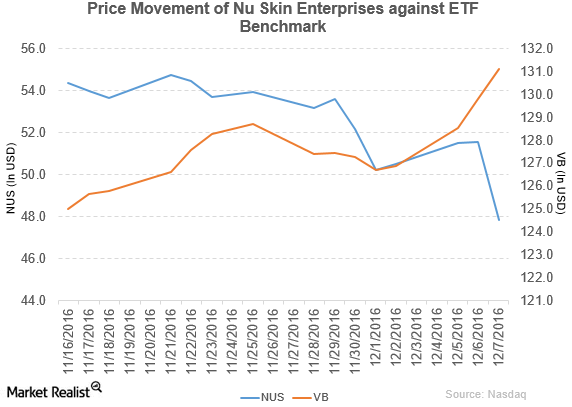

Nu Skin Enterprises Made Changes in Its Management

Nu Skin Enterprises (NUS) has a market cap of $2.6 billion. It fell 7.2% to close at $47.85 per share on December 7, 2016.

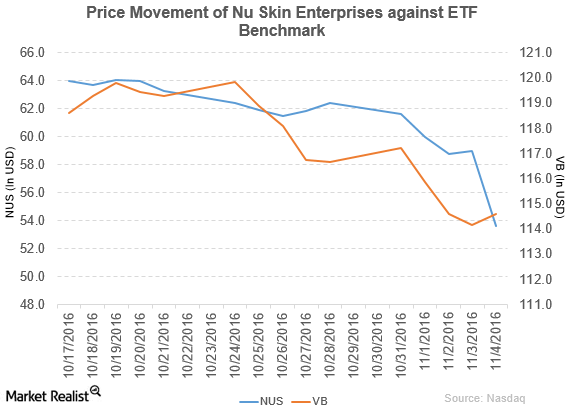

Nu Skin Enterprises Declares Its 3Q16 Results and Quarterly Dividend

Nu Skin Enterprises (NUS) has a market cap of $3.0 billion. It fell by 9.1% to close at $53.61 per share on November 4, 2016.Consumer Why Ackman targeted Herbalife’s nutrition clubs

Ackman has campaigned against Herbalife since December 2012. He has released numerous presentations and reports alleging the nutritional company’s multilevel marketing model is a fraud and a “pyramid scheme.”Consumer Must-know: An overview of Herbalife’s direct selling model

The founder and CEO of Pershing Square Capital Management, William Ackman, issued a presentation about global nutrition company Herbalife Ltd. (HLF).