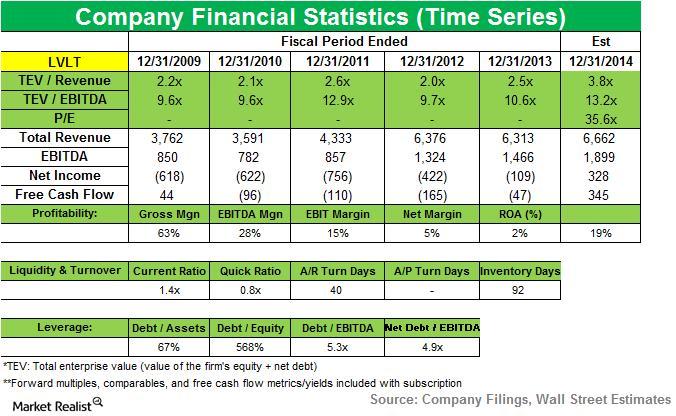

Level 3 Communications Inc

Latest Level 3 Communications Inc News and Updates

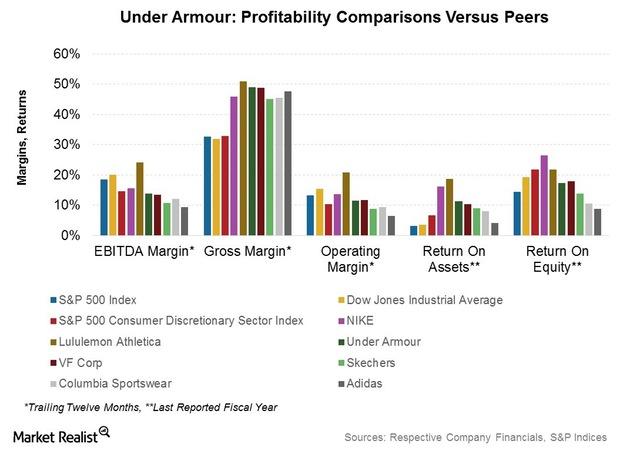

Key Drivers Impacting Under Armour’s Future Financial Performance

The impact of adverse forex movements on UA’s financial performance may be mitigated somewhat by the stronger retail environment in Europe.

Coatue Management adds new position in Level 3 Communications

Coatue Management added a new position in Level 3 Communications Inc. (LVLT) during the third quarter. The stock accounted for 1.46% of the fund’s 3Q14 portfolio.Company & Industry Overviews How Has 2016 Treated HLMNX So Far?

The HLMNX’s standard deviation, or the volatility of returns, in the one-year period until February 29 was 15.2%.

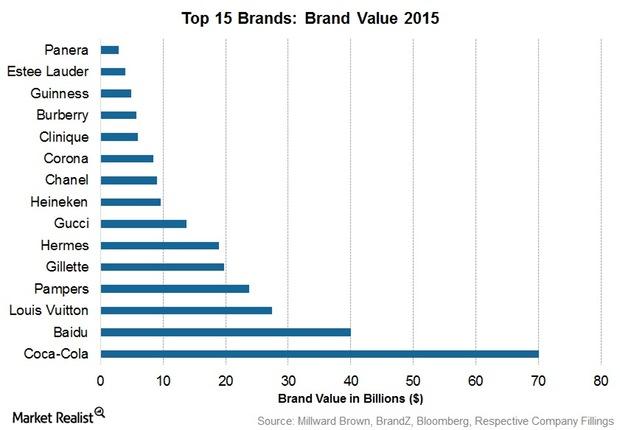

Estée Lauder Expands Business through Brand Acquisitions

Estée Lauder’s management aims to generate at least 1% of its total sales growth through acquisitions over the next three years.

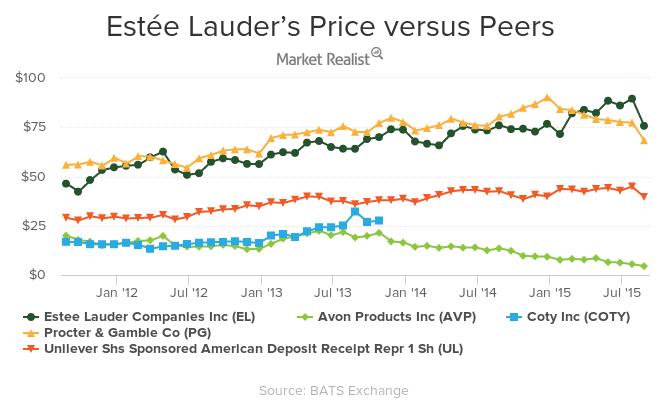

Porter’s Five Forces Model: Estée Lauder’s Competitive Analysis

Highly competitive in the beauty and cosmetics market, Estée Lauder’s revenue reached $11 billion in fiscal year 2014. However, the cosmetics company faces stiff competition from L’Oréal, Coty, and Avon (AVP).

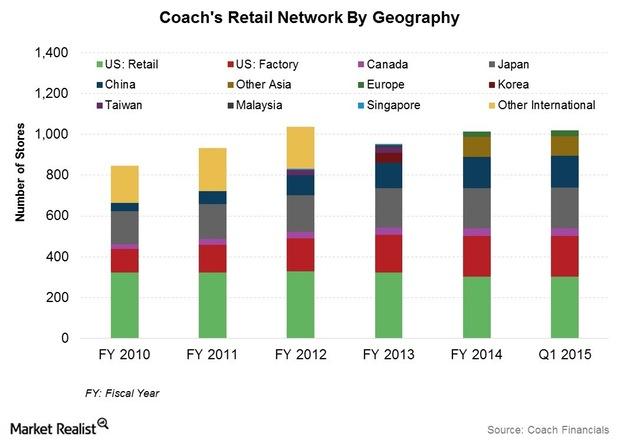

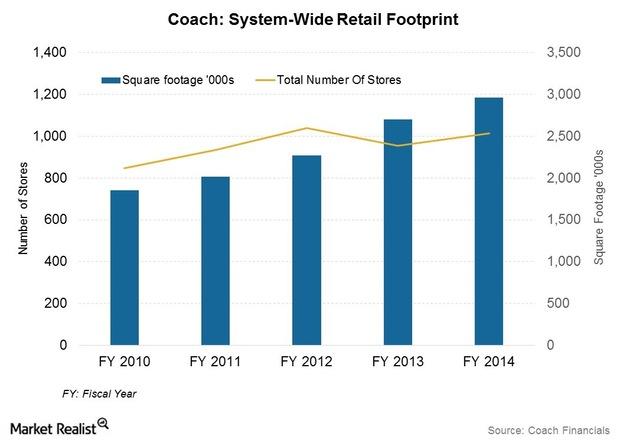

Design And Brand Positioning: Recent Changes At Coach

At Coach (COH), products are conceptualized by its New York-based design team. The team also directs the design of all Coach products.

Coach’s Pricing Strategies And Target Market

Coach’s pricing is lower than other luxury brands. This appeals to HENRYs, or high-earners, not rich yet, among other markets.