Estée Lauder Expands Business through Brand Acquisitions

Estée Lauder’s management aims to generate at least 1% of its total sales growth through acquisitions over the next three years.

Sept. 23 2015, Updated 4:04 a.m. ET

Estée Lauder’s acquisitions history

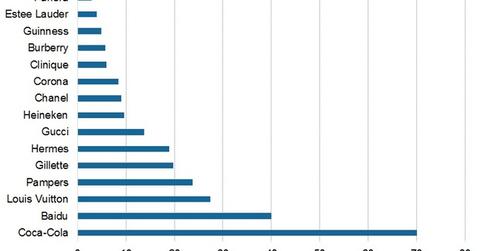

Estée Lauder (EL) believes in continually reviewing acquisition and investment opportunities. In 1994, Estée Lauder acquired a 51% stake in MAC, a makeup artist cosmetics brand, and in 1998, it acquired the entire brand for an estimated $60 million. The brand’s popularity has grown significantly to appeal to a diverse consumer base. According to a Millward Brown report, EL is among the top 15 brands to sustain through category turbulence.

In 1995, Estée Lauder acquired Bobbi Brown in a move to develop Bobbi Brown’s retail (XRT) line, Essentials, worldwide. EL also bought Aveda in 1997 for $300 million. Aveda creates high-performance, botanically based products for beauty professionals and consumers. La Mer, Jo Malone, Tom Ford Beauty, and SmashBox are among other acquired brands of Estée Lauder.

Recent acquisition spree

The beauty and personal care sector has seen a high level of merger and acquisition activity in the last two years. In November 2014, EL completed its acquisition of Le Labo, a high-end fragrance and sensory lifestyle brand. In January 2015, EL completed its acquisition of GLAMGLOW, a Hollywood skincare brand focused on face-acting treatment masks designed to deliver stunning, camera-ready results.

Other players in this sector are also on an merger and acquisition spree. Coty (COTY) recently entered into a definitive merger agreement with 43 of Procter & Gamble’s (PG) beauty brands. To learn more about this deal, please read “Procter & Gamble Divestitures: Is 43-Brand Coty Deal the Last?”

Also, global luxury goods conglomerate LVMH Moet Hennessey Louis Vuitton (LVMUY) (MC.PA), parent of beauty products giant Sephora, acquired e-commerce start-up Luxola.

Inorganic growth via mergers and acquisitions

As Estée Lauder integrates acquired brands, it continually seeks new ways to leverage production and sourcing capabilities to improve its overall supply chain performance. The company’s management aims to generate at least 1% of its total sales growth through acquisitions over the next three years. Its merger and acquisition strategy focuses on small brands with global appeal and brands with the potential to be developed further into big names.

EL and PG have exposure in the Consumer Staples Select Sector SPDR ETF (XLP) with ~12.6%[1. Updated August 10, 2015] of the total weight of the portfolio.