Estee Lauder Cos Inc

Latest Estee Lauder Cos Inc News and Updates

Estée Lauder Has an Extensive Portfolio — Here's Everything It Owns

Estée Lauder is force to be reckoned with in the beauty and cosmetic industry. The company has grown over time and now owns several brands and companies.

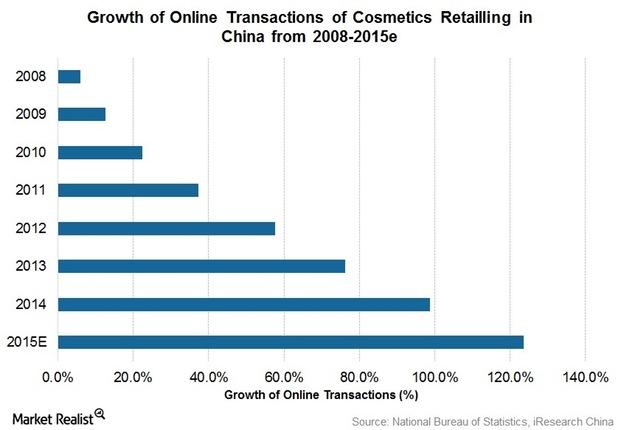

Estée Lauder Sees Positive Outlook in China

International brands such as Estée Lauder (EL), L’Oréal (LRLCY), Procter & Gamble (PG), Shiseido (SSDOY), and Nivea (BDRFF) dominate the cosmetics market in China.

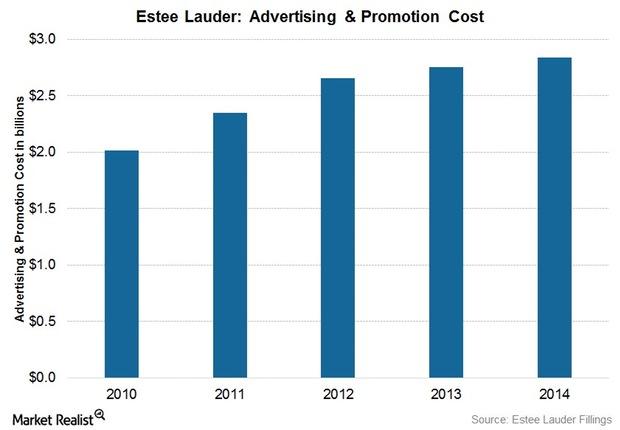

Estée Lauder’s Marketing Strategies to Reach New Consumers

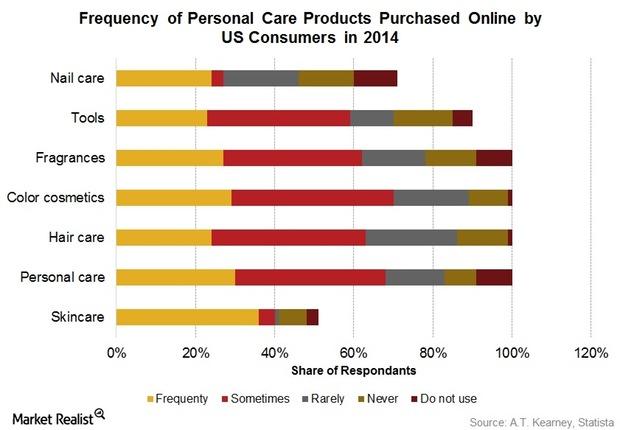

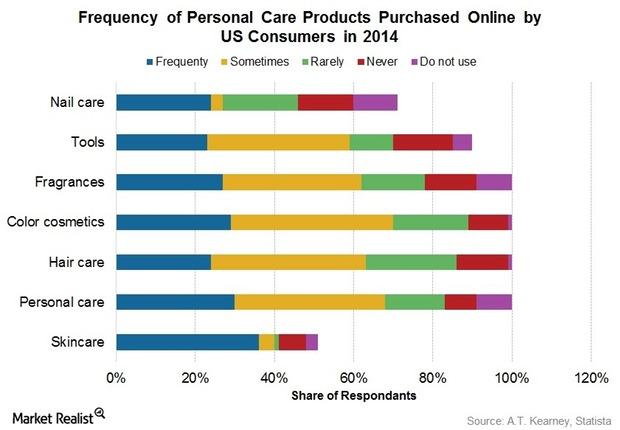

Estée Lauder aims to partner with key brick-and-mortar retailers to strengthen their prestige beauty shopping e-commerce websites to better meet consumer online shopping preferences.

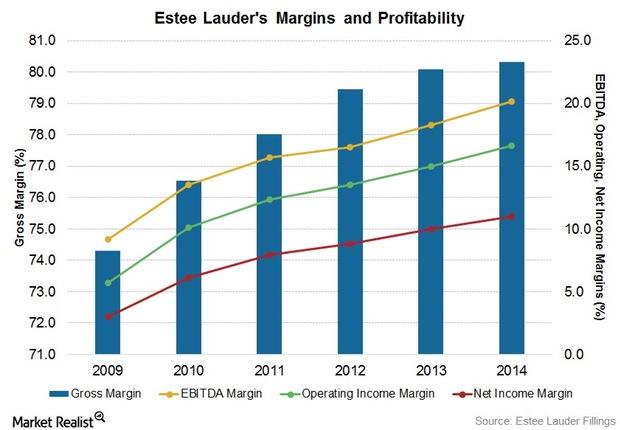

Why Estée Lauder’s Margins and Profitability Are Rising

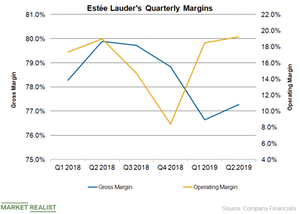

Despite currency headwinds, Estée Lauder’s (EL) worldwide gross profit margin increased to 80.3% in fiscal 2014 from 80.1% in fiscal 2013.

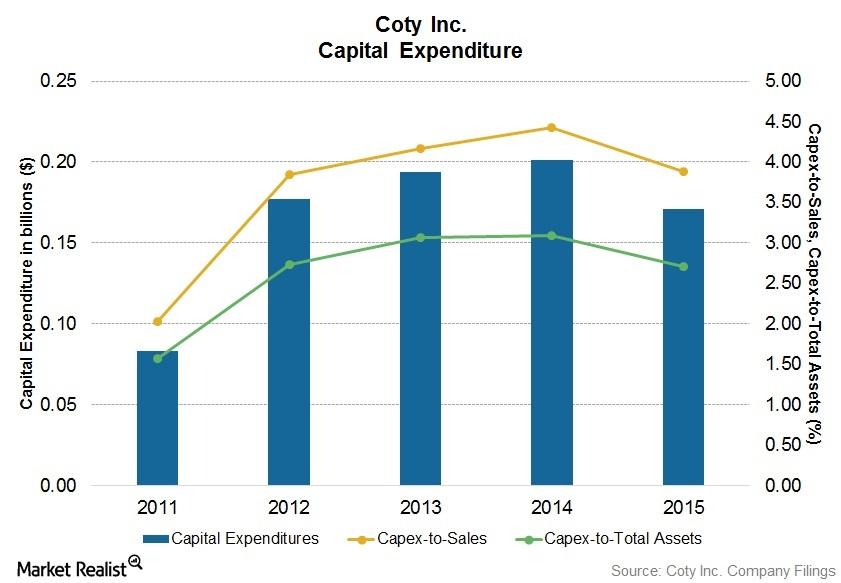

Why Coty’s Capital Expenditure Could Rise

Coty Inc.’s capital expenditure decreased 15.2% to $0.17 billion in fiscal 2015, compared to $0.20 billion in fiscal 2014.

Estée Lauder’s Growth Initiative: Leading Beauty Forward

With increasing competition from L’Oréal, Shiseido, and Coty, Estée Lauder continues to expand its position in Western Europe and emerging markets.

Business Overview of Estée Lauder

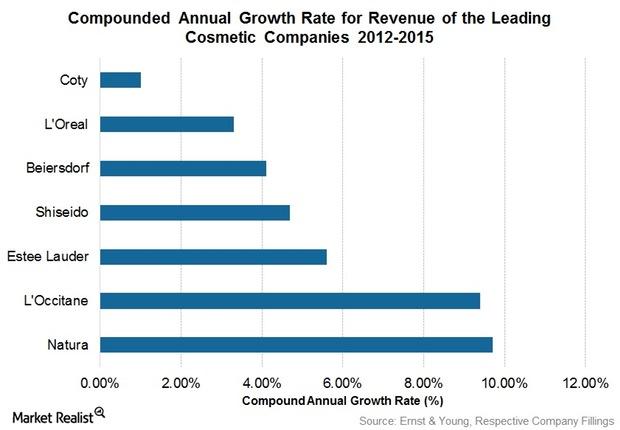

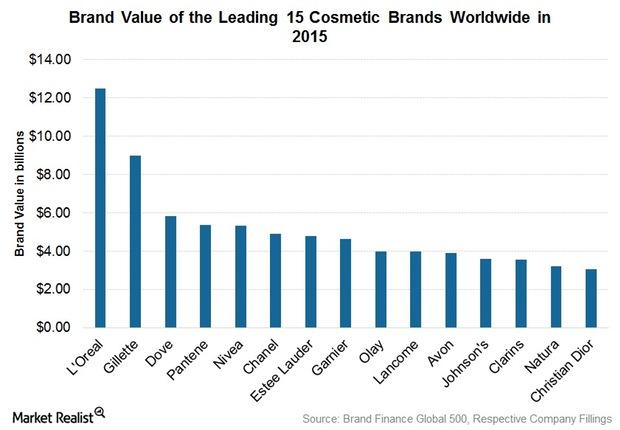

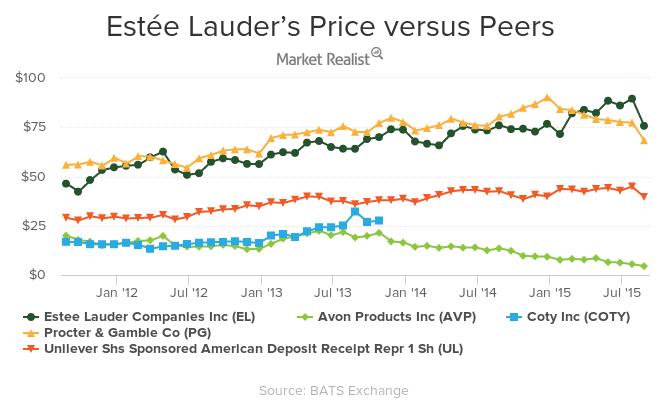

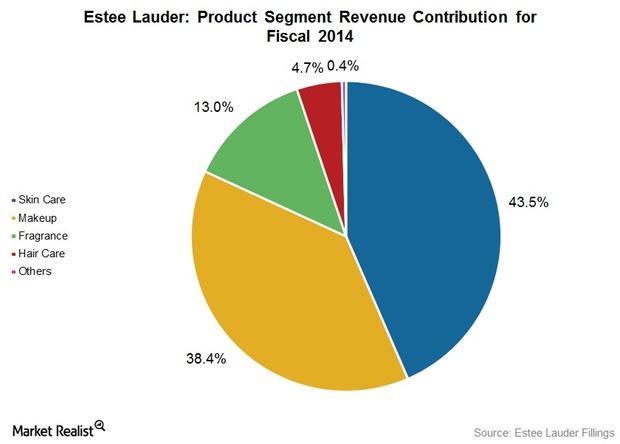

Estée Lauder’s sales growth was ranked third-highest globally among leading cosmetic companies between the years 2012 to 2015, with net revenue of $11 billion in fiscal year 2014.

Estée Lauder’s Efforts to Expand Its Geographical Presence

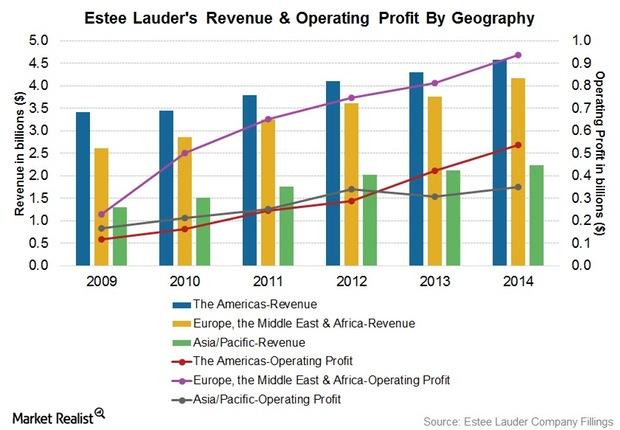

Estée Lauder aims to expand its geographical market share in China, the Middle East, Eastern Europe, Brazil, and South Africa by focusing on consumers who purchase in travel retail channels.

Estée Lauder Could Face the Same Fate as Ulta Beauty

Recently, CNBC reported that Piper Jaffray had downgraded Estée Lauder stock to “neutral” from “overweight.” EL has corrected about 7% so far in October.

Why Did Ulta Beauty Stock Fall after Its Q2 Results?

Ulta Beauty (ULTA) stock fell about 22% after its lower-than-expected second-quarter results on Thursday. Ulta Beauty posted net sales of $1.67 billion.

These Consumer Staples Stocks Marked Stellar Gains in Q1

The Consumer Staples Select Sector SPDR ETF (XLP) rose 10.5% in the first quarter of 2019.

What’s Driven Estée Lauder’s Operating Margin

While Estée Lauder’s (EL) gross margin narrowed significantly in the second quarter of fiscal 2019 (ended December 31), its expense management initiatives improved its operating margin.

Boston Properties Maintained Profitability with Development Projects

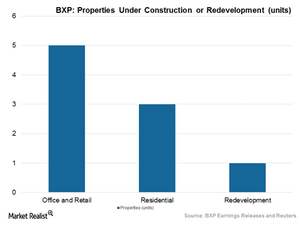

BXP leased properties with a total area of 926,000 square feet in 2Q17.

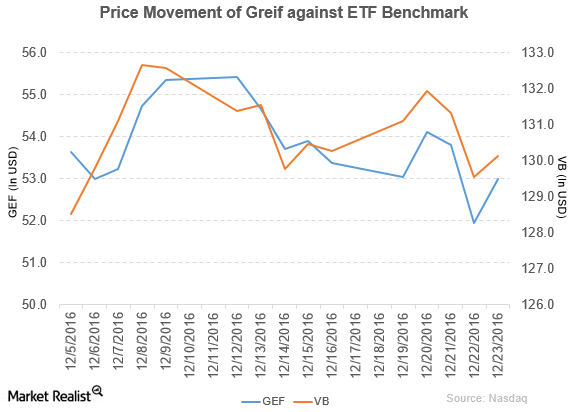

BMO Capital Downgrades Greif to ‘Underperform’

Greif (GEF) fell 0.69% to close at $53 per share during the third week of December 2016.

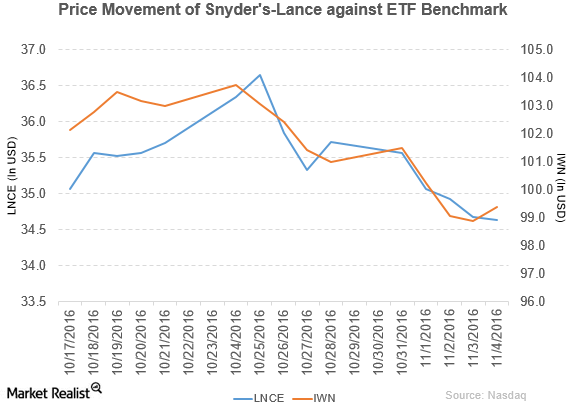

Snyder’s-Lance Declares Dividend of $0.16 per Share

Snyder’s-Lance (LNCE) has a market cap of $3.4 billion. It fell 0.12% to close at $34.64 per share on November 4, 2016.

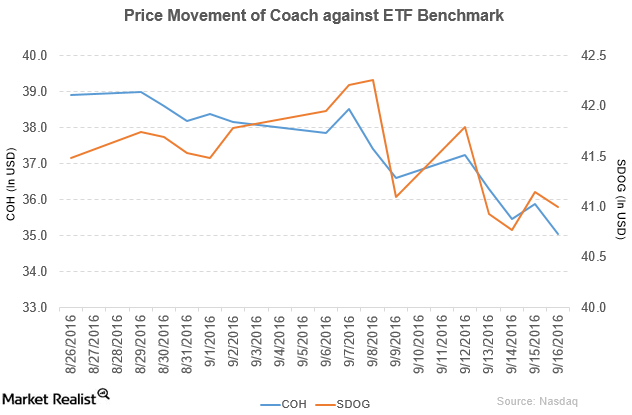

Morgan Stanley Downgrades Coach to ‘Underweight’

Coach (COH) fell 4.2% to close at $35.04 per share during the second week of September 2016.

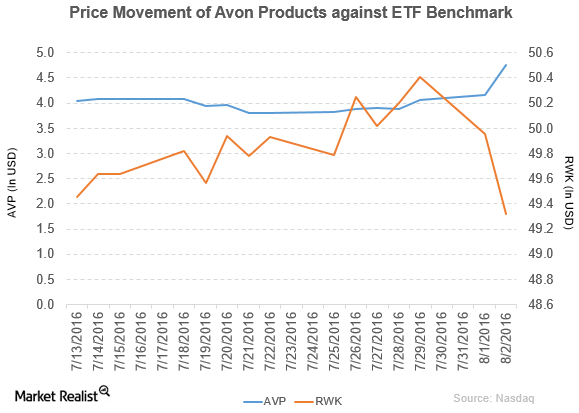

Avon’s Beauty Sales Show Fewer Are Dolling Up with Its Products

Avon Products (AVP) has a market cap of $2.1 billion. It rose by 14.4% to close at $4.76 per share on August 2, 2016.

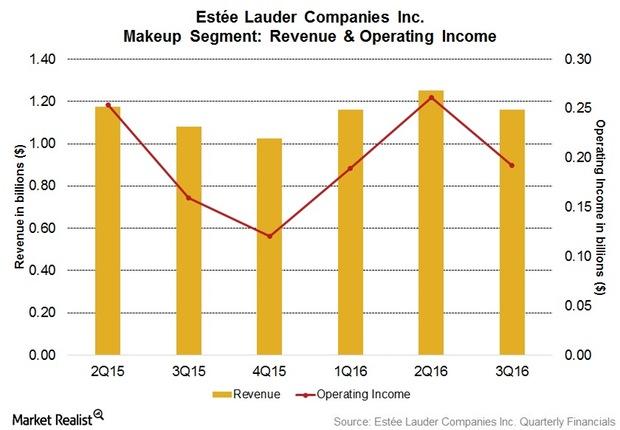

Estée Lauder’s Makeup Segment Boosted Its Operating Income

Estée Lauder’s makeup segment’s net revenue rose 7.3% in reported terms and 11% in constant currency terms to $1.2 billion in fiscal 3Q16.

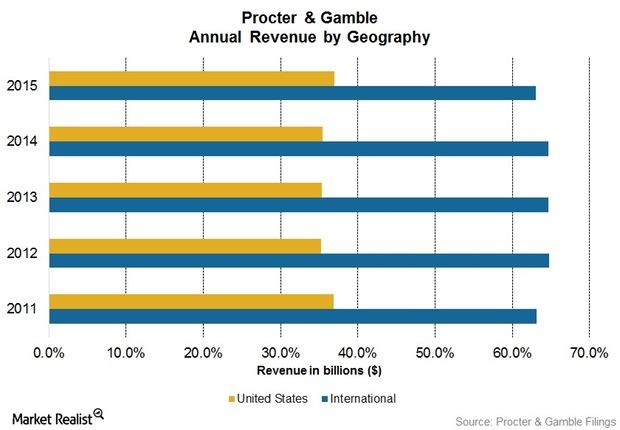

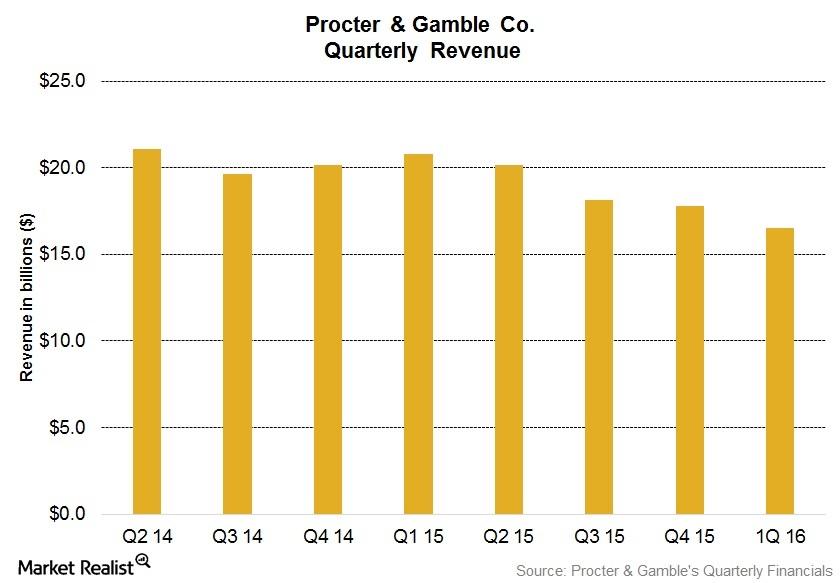

Will Negative Foreign Exchange Affect Procter & Gamble in 3Q16?

Since December 2015, FX (foreign exchange) headwinds have increased $0.3 billion after tax. That includes devaluations in Argentina, Russia, and Mexico.

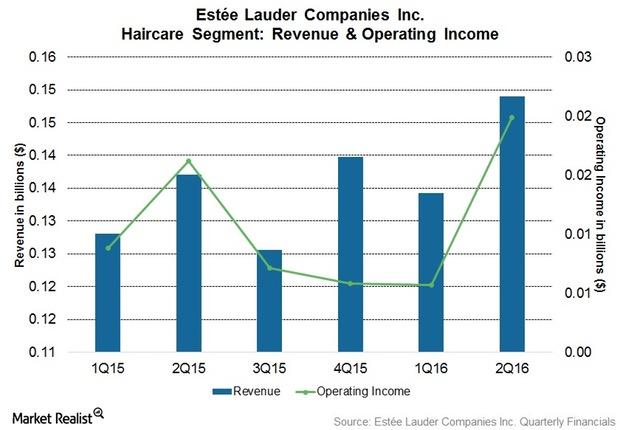

Estée Lauder’s Aveda Haircare Brand’s Healthy Growth in 2Q16

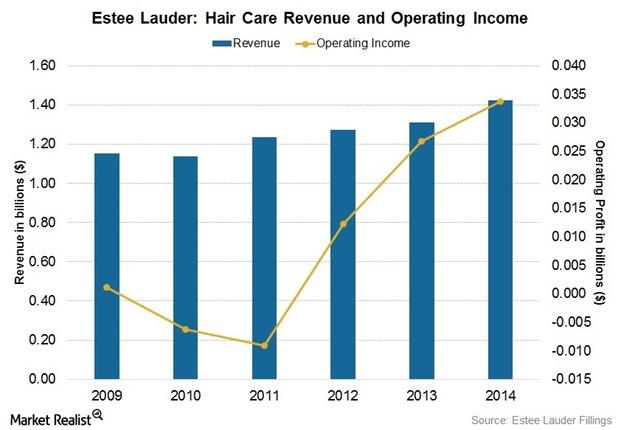

Estée Lauder’s (EL) haircare segment’s revenue increased 8.7% in reported terms and 14% on a constant-currency basis to $0.15 billion in fiscal 2Q16.

P&G’s Gillette Files a Lawsuit against Dollar Shave Club

P&G alleges that Dollar Shave Club is violating Gillette’s intellectual property by selling its razors.

Assessing Coty’s Strengths and Opportunities

Coty operates in over 130 countries through key distribution channels in both the prestige and mass markets channels.

Coty’s Marketing Strategies to Reach New Consumers

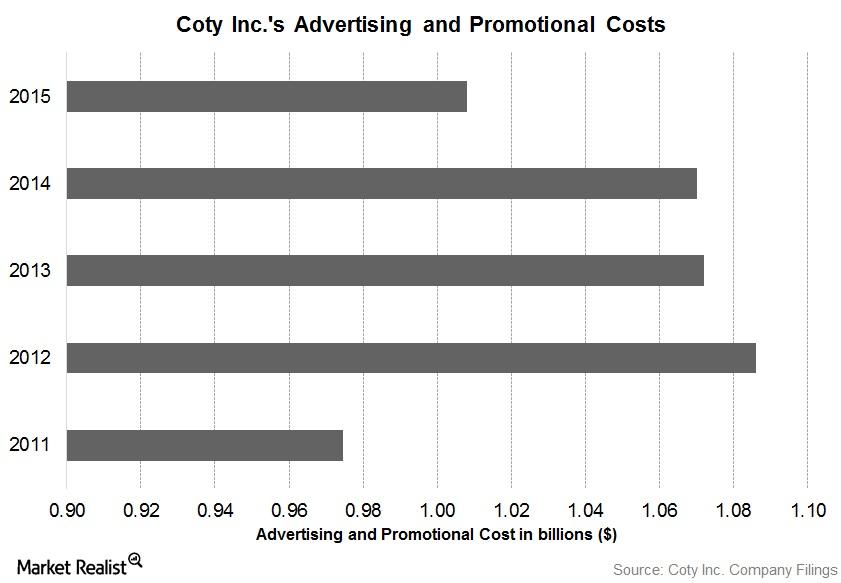

Coty plans to expand with a multipronged strategy that includes digital marketing efforts through websites, brand sites, social networking campaigns and blogs, and e-commerce.

How Coty Is Improving Its Distribution Channels

Coty sells its products through a multichannel distribution strategy across several price points in prestige and mass market channels of distribution.

Coty Inc.’s Heritage and Power Brand Portfolio

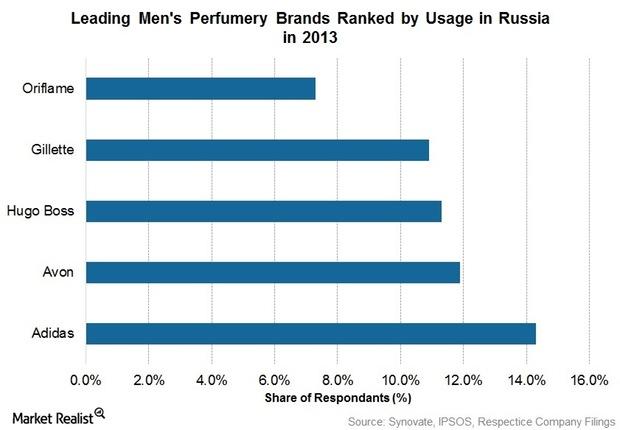

Coty’s biggest licensed brand in the global mass skin and beauty care segment, Adidas maintains a significant presence in deodorants. It faces stiff global competition from Unilever’s Axe deodorants.

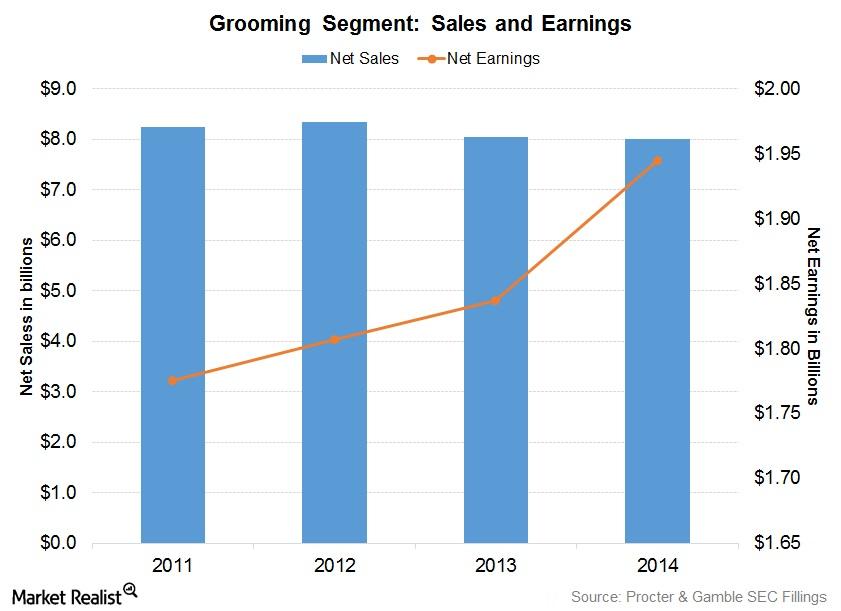

P&G’s Grooming and Hair Care Brands Lead Market

P&G’s Gillette, Fusion, and Venus are its largest male and female grooming brands. It has continued to grow with ProGlide and FlexBall in the US.

Estée Lauder Expands Business through Brand Acquisitions

Estée Lauder’s management aims to generate at least 1% of its total sales growth through acquisitions over the next three years.

Estée Lauder’s Social and Digital Marketing Strategies

In addition to social media initiatives, Clinique’s “Forecast” mobile application provides weather information and skincare tips related to weather conditions.

Assessing Estée Lauder’s Strengths and Opportunities

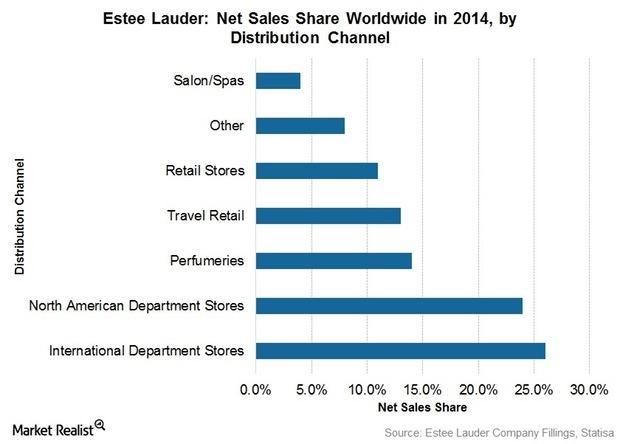

Estée Lauder’s large geographical footprint diversifies its revenue stream, which is one of its chief strengths.

Estée Lauder’s Growth Barriers: Weaknesses and Threats

The abundance of counterfeit goods and accessories is adversely affecting the sales of Estée Lauder’s products. This also hurts EL’s brand image.

Estée Lauder’s Gains in the Hair Care Business

Estée Lauder’s Aveda brand manufactures innovative plant-based hair care products. This helps to attract customers and adds to Estée Lauder’s brand value.

Porter’s Five Forces Model: Estée Lauder’s Competitive Analysis

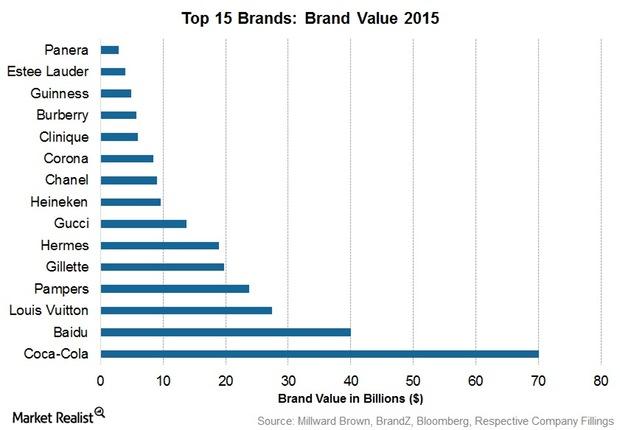

Highly competitive in the beauty and cosmetics market, Estée Lauder’s revenue reached $11 billion in fiscal year 2014. However, the cosmetics company faces stiff competition from L’Oréal, Coty, and Avon (AVP).

Estée Lauder’s Most Promising Brands

Catering to the premium market, Estee Lauder’s heritage brands include Aramis and Designer Fragrances, Clinique, and Origins.

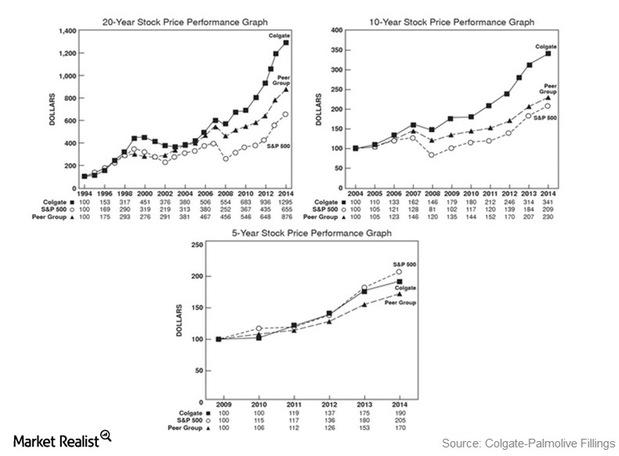

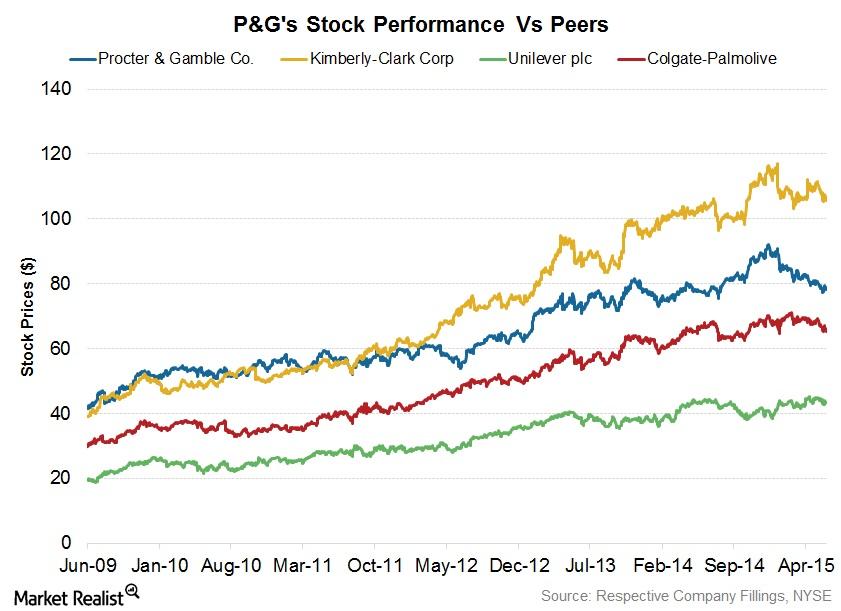

Key Performance Drivers for Colgate’s Stock Price

Colgate’s stock price has always been fairly stable primarily due to its oral care business.

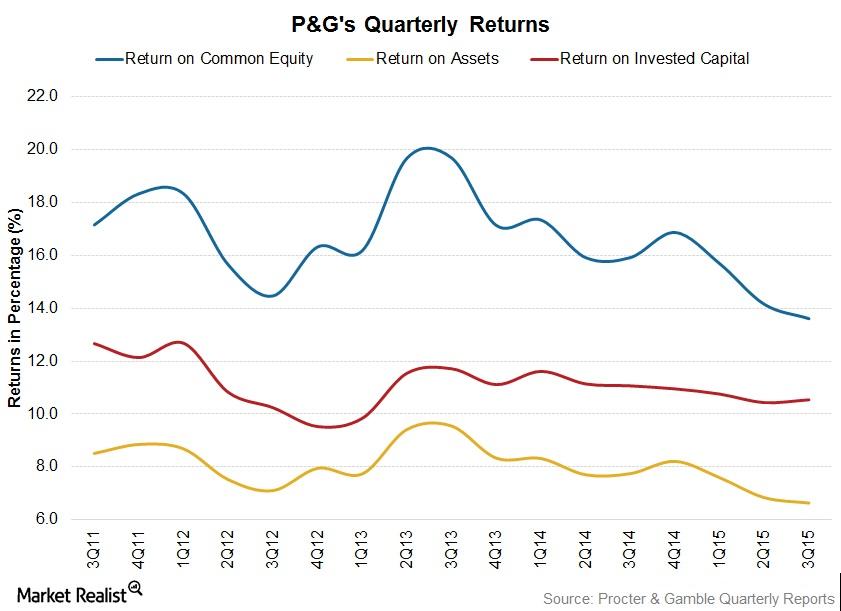

Procter & Gamble: Strategies to Improve Long-Term Profitability

Procter & Gamble continues to look at large developing markets where it thinks it can win enough market share to take a leadership position.

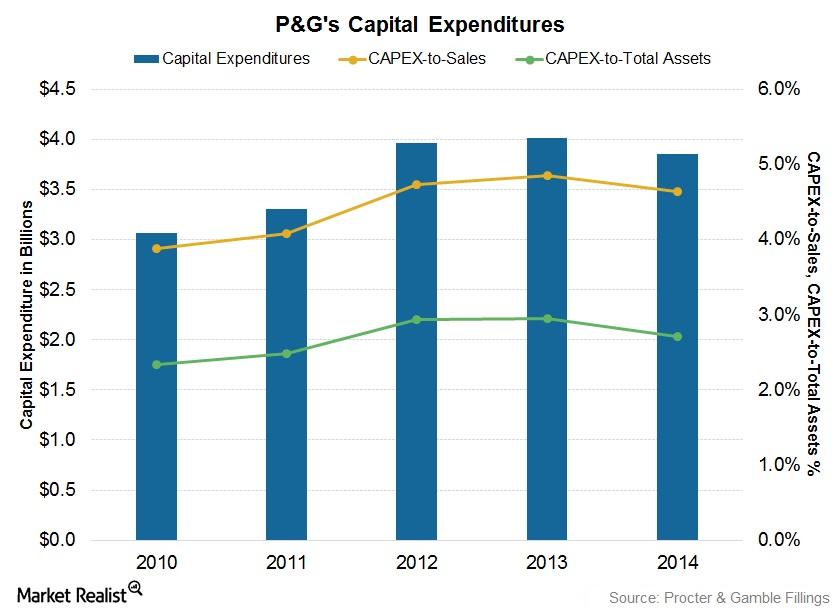

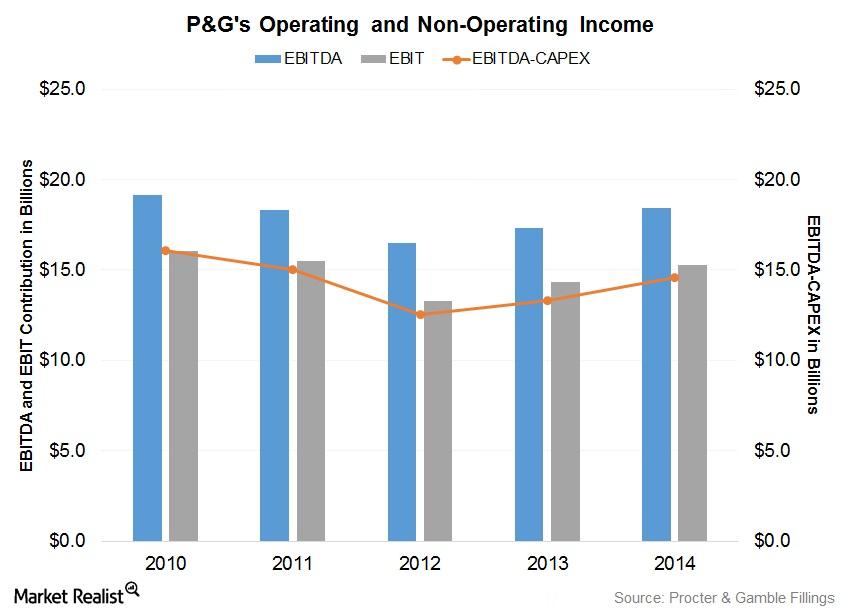

Procter & Gamble’s Efforts to Reduce Capex

Less capex has been required since P&G reduced the number of brands as well as the research and development, marketing, and innovation costs associated with them.

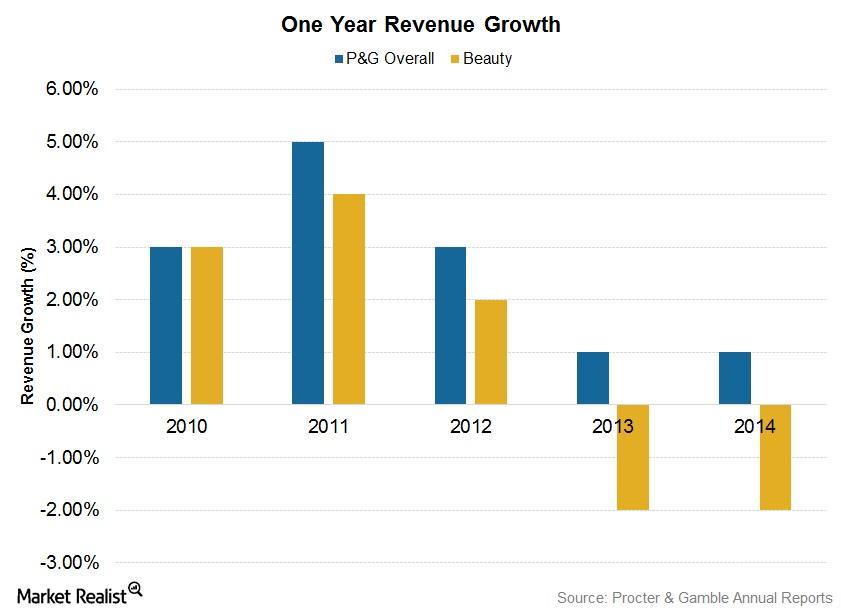

Procter & Gamble: Beauty Segment Sales Trail Overall Growth

Procter & Gamble’s Beauty segment includes products such as deodorants, cosmetics, personal cleansing, skin care, and hair care.

Why Procter & Gamble Dominates in Grooming Products

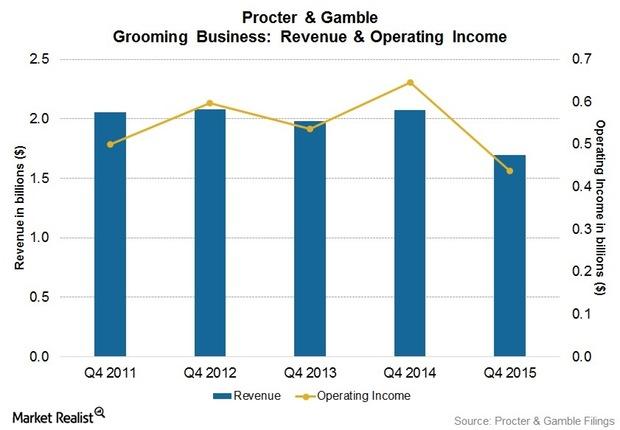

In the six months ending December 31, 2014, P&G’s net sales stood at $40.3 billion. Of this, 9.6% came from the Grooming segment.

How Innovation is Helping Procter & Gamble Develop Premium Brands

In 2001, P&G established an innovation strategy program called “Connect and Develop.” The program has allowed the company to better understand consumer behaviour.

Porter’s Five Forces: Procter & Gamble’s Competitive Position

In examining Porter’s five forces at work at P&G, we find that three competitive forces are horizontal in nature and two are vertical.