What’s Driven Estée Lauder’s Operating Margin

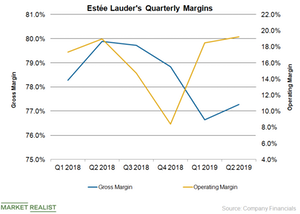

While Estée Lauder’s (EL) gross margin narrowed significantly in the second quarter of fiscal 2019 (ended December 31), its expense management initiatives improved its operating margin.

Feb. 6 2019, Updated 4:35 p.m. ET

Fiscal 2019 second-quarter margin

While Estée Lauder’s (EL) gross margin narrowed significantly in the second quarter of fiscal 2019 (ended December 31), its expense management initiatives improved its operating margin. The company’s gross margin narrowed YoY (year-over-year) to 77.3% from 79.9%, primarily due to its new accounting standards. Its favorable product mix and strategic pricing were offset by currency headwinds and obsolescence.

Operating margin expansion

Estée Lauder’s operating margin improved YoY to ~19.3% in fiscal 2019’s second quarter from 19.0%, reflecting its improved operating expense rate partially offset by the company’s gross margin.

Its operating expense rate improved by about 280 basis points due to the adoption of new revenue recognition standards, a lower selling expense rate, and reduced general and administrative expenses. The company’s selling expenses as a percentage of sales improved, primarily in North America, as a result of lower demonstration costs. Estée Lauder’s general and administrative expenses improved as a percentage of sales thanks to the company’s expense management.

However, its second-quarter operating margin was impacted by increased advertising and promotional spending to support new product launches, expand consumer reach, and advertise on digital and social media. It was also impacted by impairment charges of $38 million related to goodwill and other intangible assets associated with the company’s Smashbox reporting unit.

Continued efforts to improve margins

Through its Leading Beauty Forward program (started in 2016), Estée Lauder is modifying its cost structure and redirecting cost savings to growth initiatives. The program, which aims to optimize select corporate functions, supply chain networks, and support structures, is expected to result in total restructuring and other charges of $900 million–$950 million and annual net benefits of $350 million–$450 million. The company also intends to exit underperforming businesses. Next, we’ll discuss analysts’ reaction to Estée Lauder’s fiscal 2019 second-quarter results.