Procter & Gamble’s Efforts to Reduce Capex

Less capex has been required since P&G reduced the number of brands as well as the research and development, marketing, and innovation costs associated with them.

July 20 2015, Updated 8:05 p.m. ET

Continuing to improve the financial condition

The Procter & Gamble Company, or P&G (PG), has a broad-based business in household and personal care products. Over the past few years, the company has been trying to cut capital spending. Eventually, in fiscal 2014[1. Fiscal year ending June 30, 2014] P&G’s capital spending fell by $1.6 billion from the previous year.

Since A.G. Lafley’s return as CEO, P&G’s financial condition has continued to improve.

P&G is the number one consumer staples company, making up ~12.3%[2. All ETF weights are as of June 27, 2015] of the Consumer Staples Select Sector SPDR ETF (XLP). Peers Colgate-Palmolive (CL), Kimberly-Clark (KMB), and Estee Lauder (EL) together make up ~6.8% of XLP.

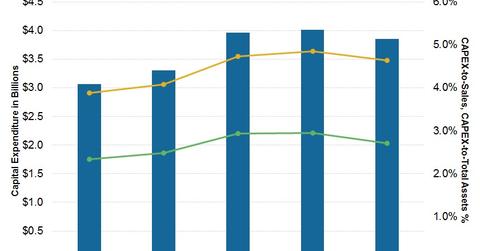

The above graph highlights P&G’s capital expenditures, capex-to-sales, and capex-to-total assets.

Lower capital expenditure

P&G spent ~$3.8 billion as capex in fiscal 2014. Capital spending as a percentage of net sales decreased by 30 basis points to 4.6% in 2014. P&G’s capital spending primarily supports growth plans, capacity expansion, innovation, and the implementation of cost controls to deliver cash savings in the future.

Less capex has been required since P&G reduced the number of brands as well as the research and development, marketing, and innovation costs associated with them.

P&G, like its peers CL, KMB, and EL, addresses adverse currency movements by increasing the price of products in local currencies. This will likely result in lower or negative volume growth. Future capacity expansion will be less necessary in this case, resulting in less capex.

Excess cash allocated to shareholders

Operating cash flow provides the primary source of cash to fund operating needs and capital expenditures. P&G’s objective has always been to provide maximum shareholder returns. Free cash flow is used first to fund shareholder dividends. Other discretionary uses include share repurchases and acquisitions to complement its portfolio of businesses, brands, and geographies.

Read more about P&G’s high dividend payouts in the next article.