Key Performance Drivers for Colgate’s Stock Price

Colgate’s stock price has always been fairly stable primarily due to its oral care business.

July 27 2015, Published 11:24 a.m. ET

Colgate’s stock returns

Colgate (CL) operates in the household and personal care product businesses. The company has a market capitalization of $60.5 billion[1. Updated as of July 16, 2015] with revenues of $17.3 billion in 2014.

Also, Colgate has a strong history of paying dividends on its common stock every year since 1895. This is one of the stock’s attractive features. Read more on Colgate’s dividend policies and other shareholder payouts in part 14 of this series.

Colgate’s total shareholder returns

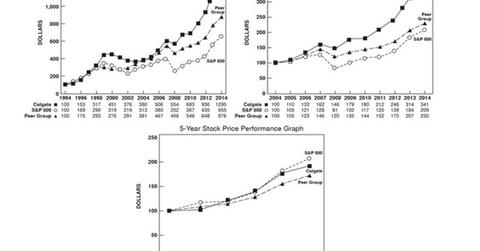

Total shareholder returns over the period December 31, 2013, to June 30, 2015, were reported at ~3.6%, compared to ~15.1% for the S&P 500 Index and ~5.6% for its peer group[2. Peer Group consists of, Avon Products, Inc., The Clorox Company, Kimberly-Clark Corporation, The Procter & Gamble Company, Unilever N.V., Reckitt Benckiser Group PLC, and Beiersdorf AG].

Total shareholder returns over the period December 31, 2009, to June 30, 2015, were reported at ~81.6%, compared to ~107.7% for the S&P 500 Index and ~61.6% for its peer group.

Total shareholder returns over the period December 31, 2004, to June 30, 2015, were reported at ~225%, compared to ~112% for the S&P 500 Index and ~119%[3. All figures from Company Website] for its peer group.

The above graph shows Colgate’s stock price performance compared to the S&P 500 Index and CL’s peer group. Colgate’s stock has underperformed relative to the S&P 500 Index in 2014 and 2015, primarily due to the appreciation of the US dollar compared to foreign currencies. As mentioned earlier in the series, Colgate derives over 80% of its sales from outside the US.

Oral care dominance

Colgate’s stock price has always been fairly stable primarily due to its oral care business. According to Kantar’s Brand Footprint report, Colgate remains the number one health and beauty brand and is the only brand in any category to be purchased by more than half of the world’s households. This is partly because toothpaste is more immune to market disruptions and is a necessity, in contrast to products such as Estee Lauder (EL) cosmetics.

Future stock price drivers

Colgate aims to focus on its core oral care business in emerging markets like Brazil, India, and China. Increasing disposable incomes have led to significant change in the purchasing patterns for consumer staples (XLP) products, especially in India. However, if emerging markets currencies continue to depreciate versus the US dollar, this could affect Colgate’s sales and stock price. However, Colgate may be able to overcome this by moderately increasing the prices of products in emerging markets.

Colgate and Clorox (CLX) are both part of the SPDR S&P Dividend ETF (SDY) with portfolio weights of 0.9% and 1.2%[4. Updated as on July 16, 2015], respectively.