SPDR® S&P Dividend ETF

Latest SPDR® S&P Dividend ETF News and Updates

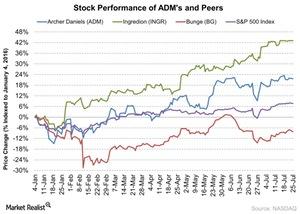

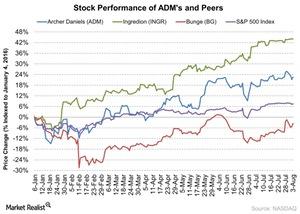

Archer Daniels Midland Stock Gained since Its 1Q16 Earnings

Archer Daniels Midland (ADM) is slated to report its 2Q16 results on August 2 before the market opens. The stock has gained 12% since its last quarter results.

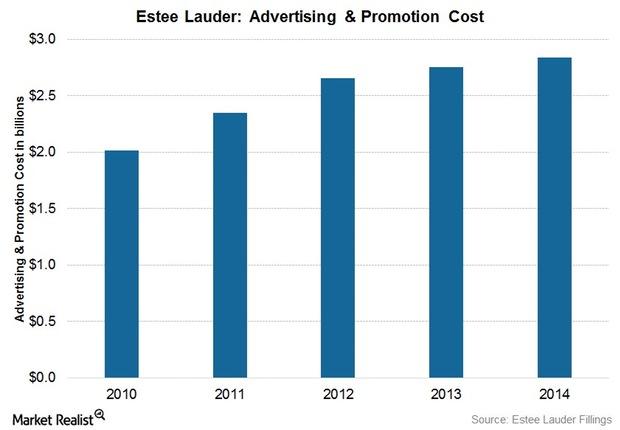

Estée Lauder’s Marketing Strategies to Reach New Consumers

Estée Lauder aims to partner with key brick-and-mortar retailers to strengthen their prestige beauty shopping e-commerce websites to better meet consumer online shopping preferences.

What Are Analysts’ Target Prices before ADM’s 2Q16 Results?

Around 77% of the analysts rate Archer Daniels Midland a “hold” and 23% gave it a “buy” rating. No analysts rated it as a “sell.”

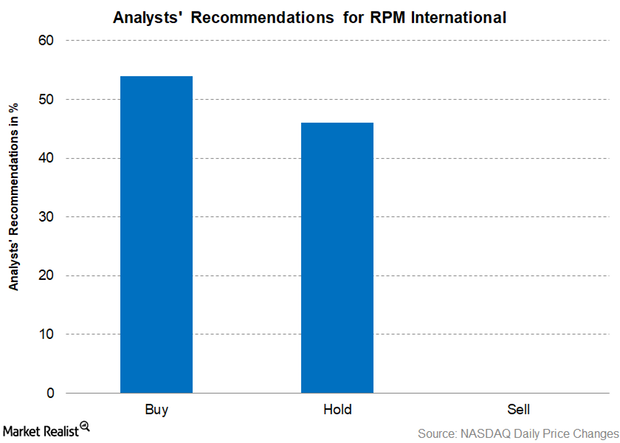

Analysts’ Consensus on RPM International

For RPM International, 54% of the analysts recommended a “buy,” 46% recommended a “hold,” and none of the analysts recommended a “sell.”

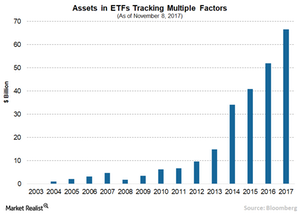

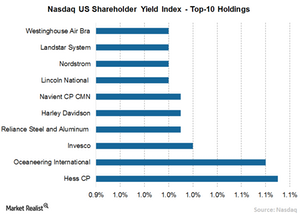

Can Smart Beta Go Wrong?

The smart beta approach aims to benefit from market inefficiencies to deliver higher risk-adjusted returns and improve diversification.

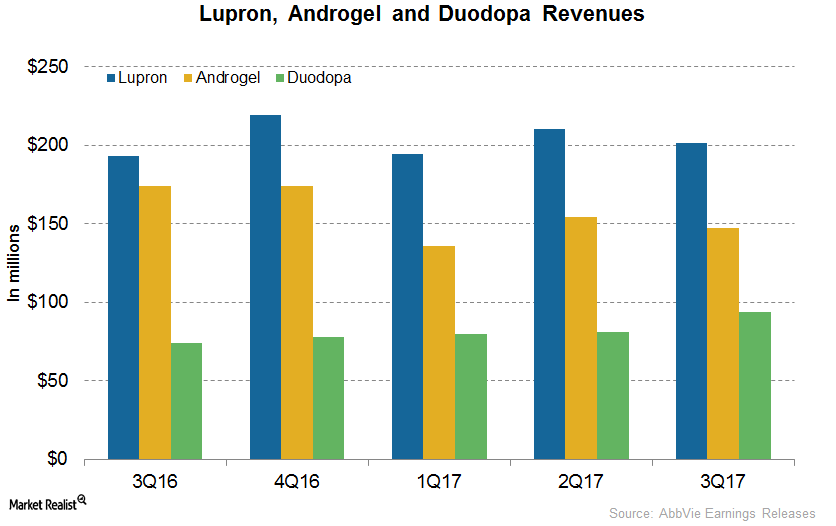

How AbbVie’s Drugs Performed in 3Q17

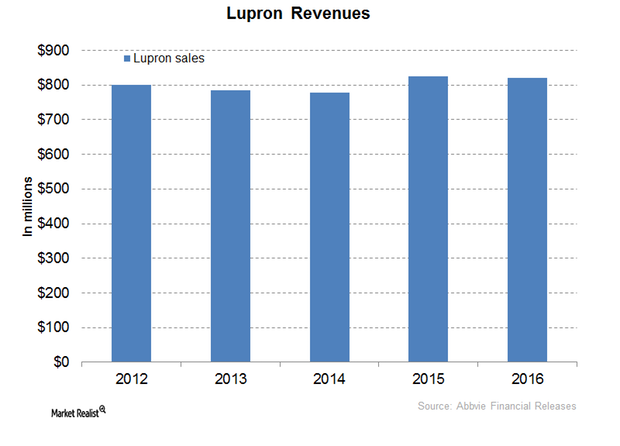

In 3Q17, AbbVie’s (ABBV) Lupron generated revenues of around $201 million, which reflected ~4% growth on a year-over-year (or YoY) basis.

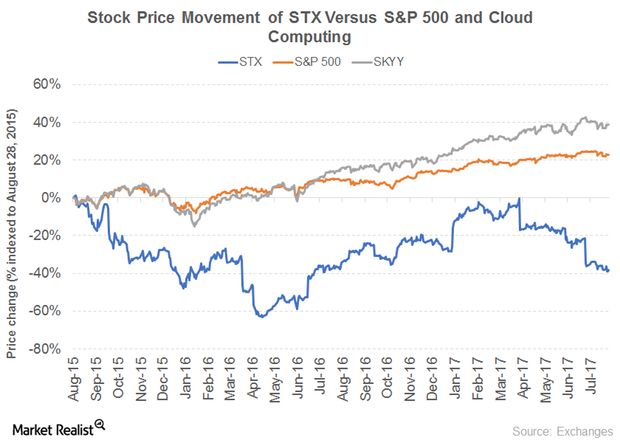

Can Seagate Sustain Its Dividend Yield?

What’s behind Seagate’s dividend yield Seagate Technology (STX) is a data storage technology and solutions provider. The company’s revenue, which has fallen over the years, seems to have recovered in 2017. Its revenue has fallen 3% in 2017, compared with a fall of 19% in 2016 due to intense competition in the data storage market. The company’s […]

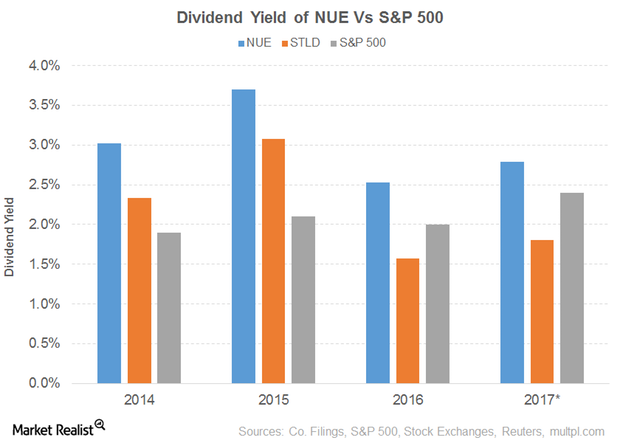

Dividend Yield of Nucor

Nucor’s (NUE) PE ratio of 21.8x is pitted against a sector average of 19.4x. The dividend yield of 1.5% is pitted against a sector average of 1.4%.

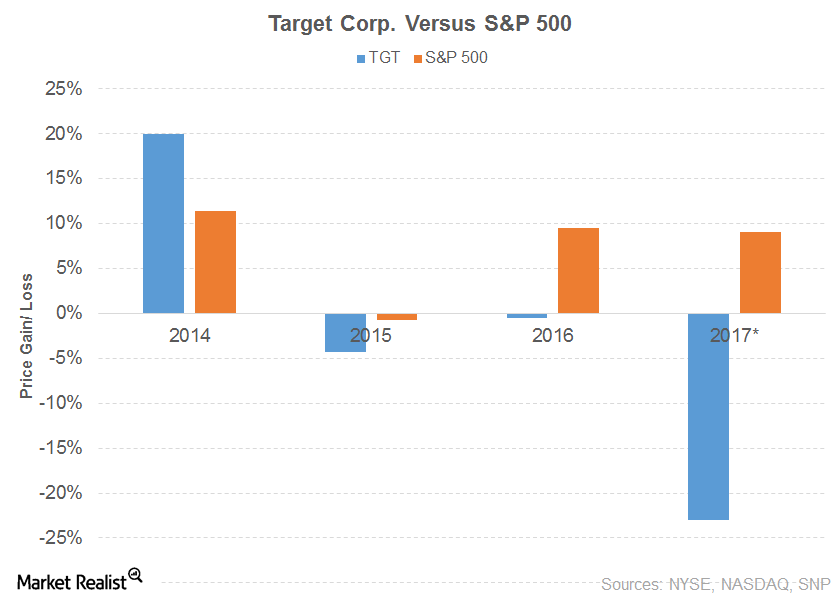

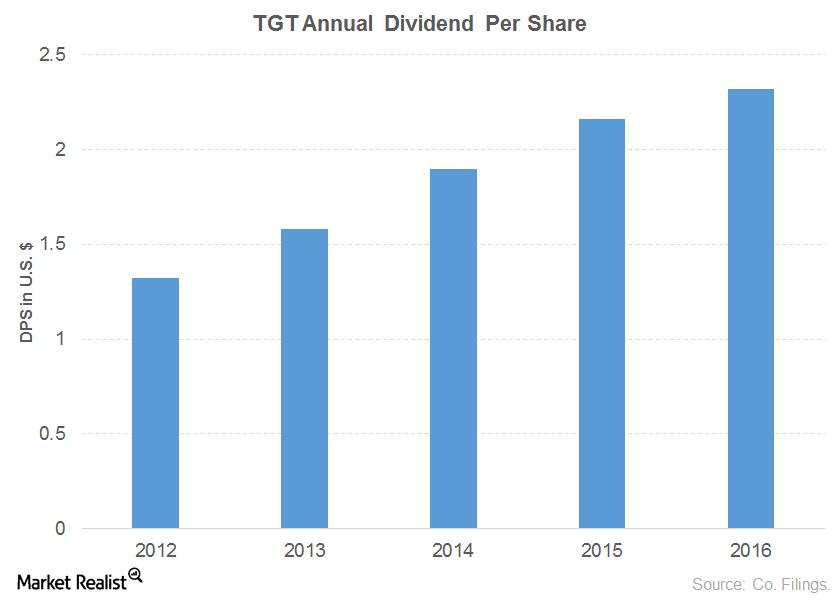

Target’ s Performance as a Dividend Aristocrat

Target’s (TGT) sales for 2016 fell 6.0% due to lower comparable store sales and weak store traffic.

How Are Dividends of Caterpillar and Walmart Trending?

Caterpillar’s (CAT) growth of 7.0% in total sales and revenues for the first half of 2017 were mainly driven by sales of the machinery, energy, and transportation segment.

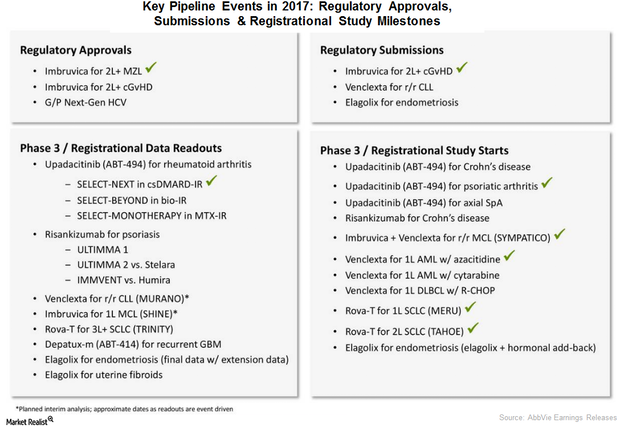

An Update on AbbVie’s Clinical Pipeline in 2017

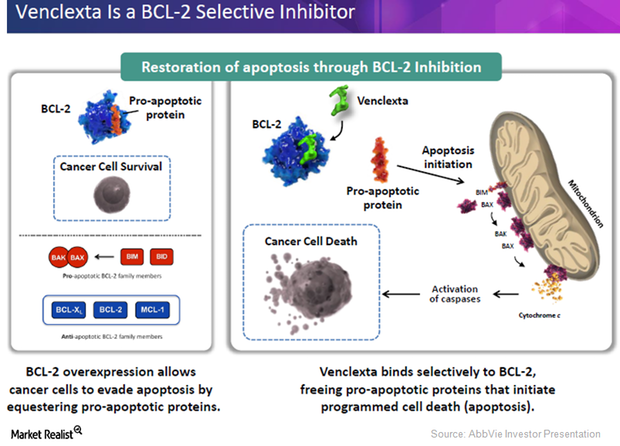

In December 2016, the European Commission granted Venclyxto conditional marketing approval for the treatment of CLL in the presence of 17p deletion or TP53 mutation.

Consumer Discretionary: Which Are the Top Dividend Growers?

Consumer Discretionary Select Index sales, earnings, and dividends have grown at a CAGR (compound annual growth rate) of 6%, 7.2%, and 10.7%, respectively between 2012 and 2017.

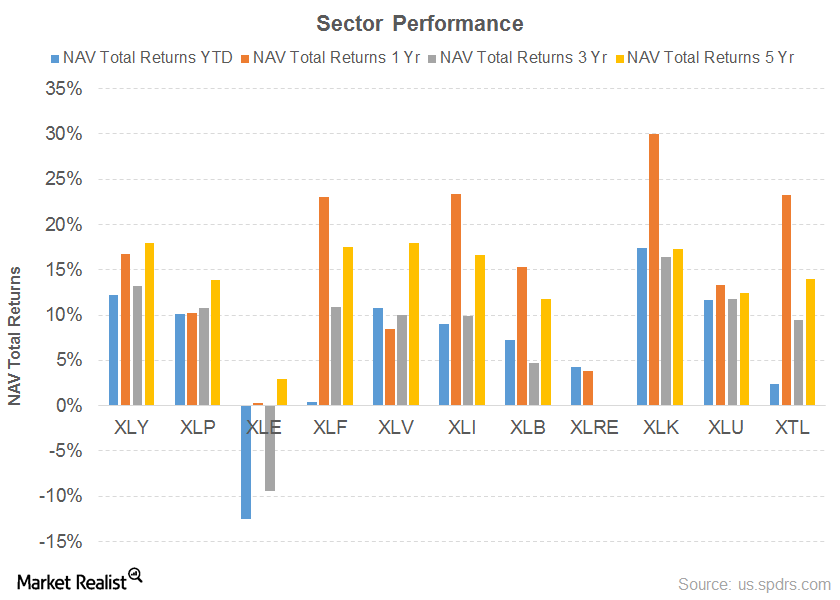

How Are the Defensive and Cyclical Sectors Performing?

If we compare the performances of the defensive sectors, we can see that their YTD performance and one-year performances have been reasonably uniform with the exception of the energy and telecom sectors.

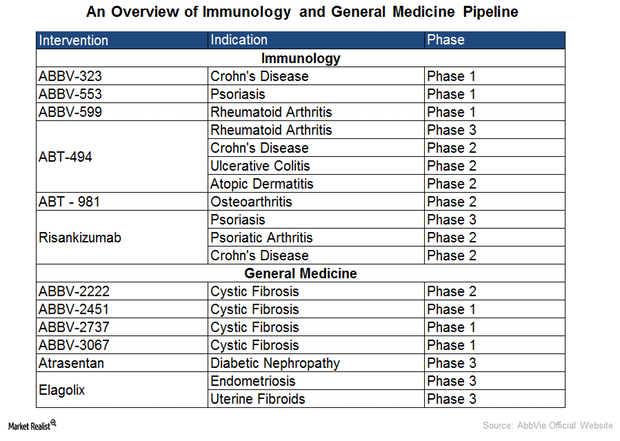

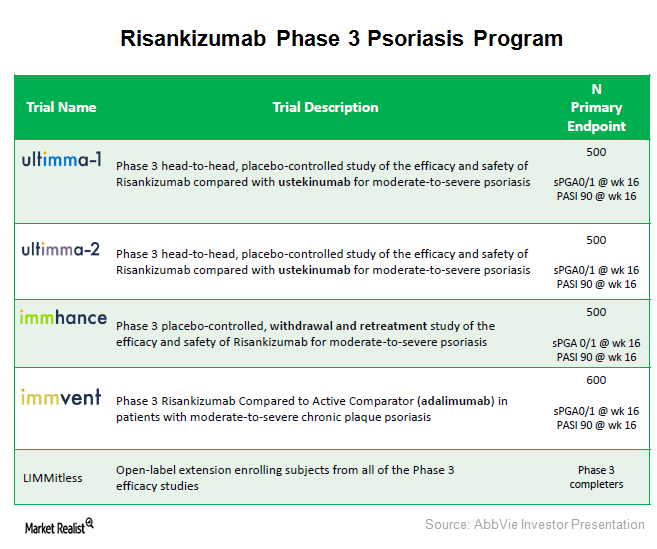

This Product Pipeline Brings Hope for AbbVie’s Future Growth

AbbVie (ABBV) has a focused immunology pipeline in order to address various dermatologic and gastrointestinal conditions.

Why Lupron Could Continue to Generate Steady Revenue

In 2016, AbbVie’s (ABBV) Lupron generated revenue of $821 million, a slight fall of 0.6% year-over-year (or YoY). In 1Q17, Lupron reported revenue of ~$194 million.

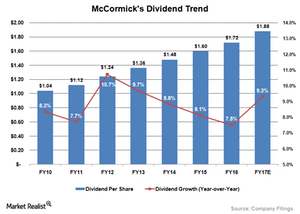

A Look at McCormick’s Strong Dividend History

In the past three fiscal years, McCormick has returned more than $1.0 billion to its shareholders in the form of dividends and share buybacks.

AbbVie Plans to Launch Psoriasis Therapy Risankizumab in 2019

AbbVie (ABBV) has completed enrollment in its Phase 3 pivotal trials testing investigational therapy risankizumab as a treatment option for psoriasis.

Shareholder Buyback: A Powerful Tool to Achieve Higher Income

What products single out specifically the share buyback companies?

ADM’s Stock Fell 2% Due to Weaker Performance in 2Q16

Archer Daniels Midland (ADM) reported its 2Q16 results on August 2. The stock didn’t react well to the results. It fell 2% on the same day.

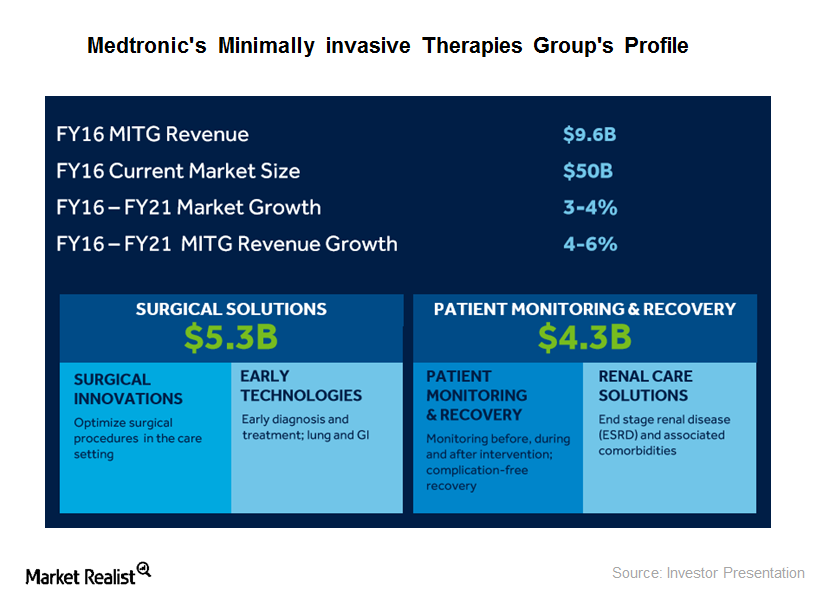

Medtronic’s Minimally Invasive Therapies Group: Major Drivers

Medtronic plans to launch more than 80 products over the next three years.

Venclexta: The First BCL-2 Inhibitor Cancer Therapy to Be Approved by the FDA

On April 11, 2016, Venclexta became the first BCL-2 inhibitor therapy to be approved by the FDA for chronic lymphocytic leukemia patients with 17p deletion.

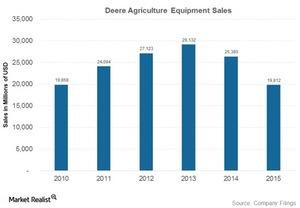

Why Did Deere & Company Consolidate Its Dealer Network?

Despite relying on dealers to sell its iconic tractors for almost a 100 years, Deere & Company (DE) began consolidating its dealer network in the mid-2000s.

Has Lincoln Electric Outperformed Its Peers?

For fiscal 2015, Lincoln Electric (LECO) successfully gave back $486 million to its shareholders.

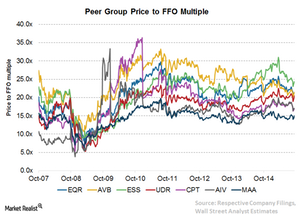

Why Essex Property Trust Trades at a High Price-to-FFO Multiple

A close look at Essex Property Trust’s trailing-12-month price-to-FFO multiple shows that it’s in line with its historical valuation.

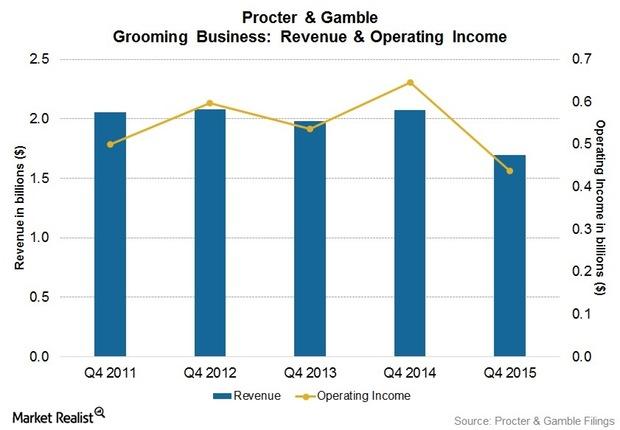

P&G’s Grooming and Hair Care Brands Lead Market

P&G’s Gillette, Fusion, and Venus are its largest male and female grooming brands. It has continued to grow with ProGlide and FlexBall in the US.

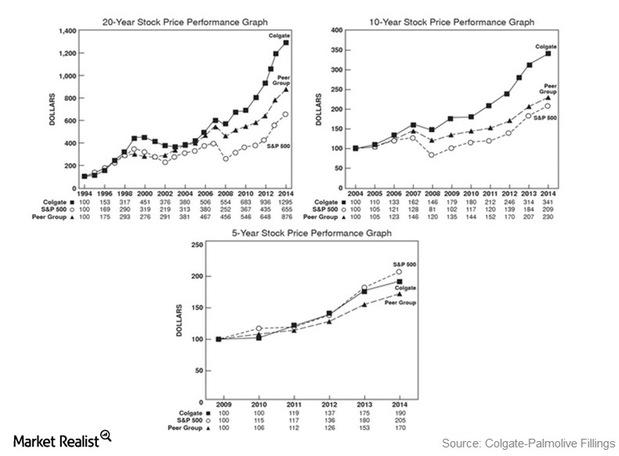

What Are Colgate’s Strengths and Opportunities?

A strong market position and brand image are some of Colgate’s chief strengths. Colgate holds 44.4% of the global market share in toothpaste.

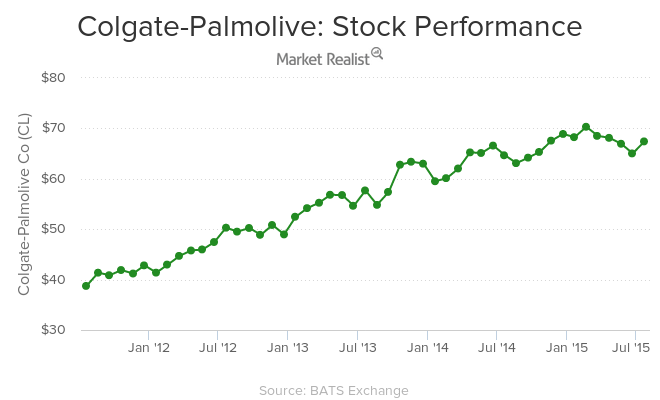

Key Performance Drivers for Colgate’s Stock Price

Colgate’s stock price has always been fairly stable primarily due to its oral care business.

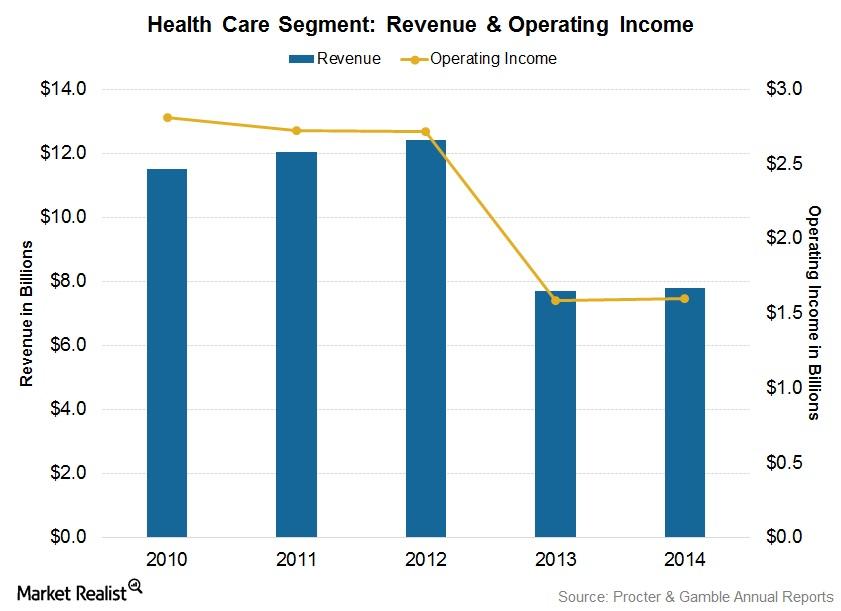

Crest and Oral-B: Stars in Procter & Gamble’s Health Care Segment

The Health Care segment is P&G’s smallest segment. The segment’s net revenue for the year ending June 30, 2014, was $7.8 billion, or 9.5% of the company’s total net revenue.

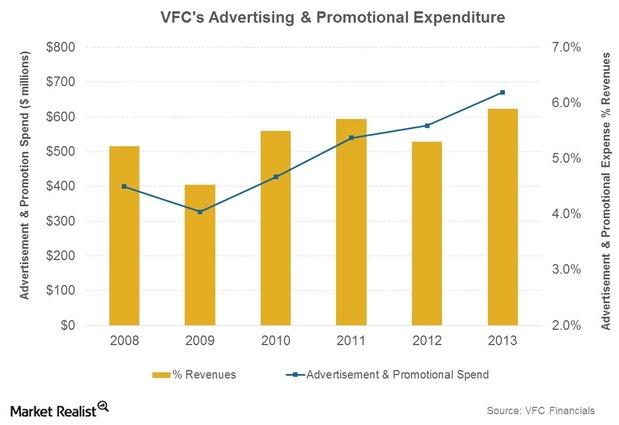

Discovering VF Corp.’s Marketing Edge

VFC’s marketing dollars are designed to get the most returns from its stores, other retailers (wholesale customers), and its e-commerce websites.