Estée Lauder’s Aveda Haircare Brand’s Healthy Growth in 2Q16

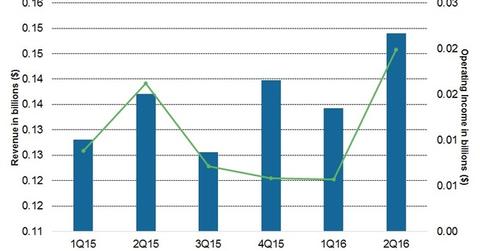

Estée Lauder’s (EL) haircare segment’s revenue increased 8.7% in reported terms and 14% on a constant-currency basis to $0.15 billion in fiscal 2Q16.

March 22 2016, Updated 11:05 a.m. ET

Fiscal 2Q16 revenue for the haircare segment

Estée Lauder’s (EL) haircare segment’s revenue increased 8.7% in reported terms and 14% on a constant currency basis to $0.15 billion in fiscal 2Q16. The increase in revenue was thanks to the Aveda and Bumble and bumble brands.

Estée Lauder’s haircare segment’s revenue also increased due to expanded global distribution, primarily in salons, freestanding stores, and travel retail for Aveda, and from specialty multibrand retailers for Bumble and bumble. According to chief financial officer Tracey Thomas Travis, Aveda delivered strong salon sales in Western Europe.

Operating income

Operating income for the haircare segment increased 22.8%. This increase was due to strong results from Aveda’s Thickening Tonic and Shampure dry shampoo and continued growth in existing products such as Aveda’s Be Curly.

Estée Lauder also sells ancillary products and services. Those sales increased 27.5% in reported terms and 28% in constant currency terms in fiscal 2Q16.

Stiff competition

Estée Lauder faces stiff competition from international and regional brands in haircare. International brands such as L’Oréal (LRLCY), Procter & Gamble (PG), and Unilever (UL) supply haircare products in large-format retail stores such as Walmart (WMT) and Macy’s (M), as well as in beauty salons.

Omni-channel initiatives

Estée Lauder aims to expand its retail store footprint through omni-channel initiatives and specialty multiline retailers. In fiscal 2Q16, Estée Lauder added 69 brand retailers and third-party sites worldwide. The company plans to expand the Aveda brand’s presence in travel retail. Bumble and bumble also experienced solid growth in the specialty multichannel.

In addition, EL launched numerous pilot programs and is building an omni-channel capability to connect consumers across its brand sites and freestanding stores. Estée Lauder makes up 0.2% of the SPDR S&P 500 Growth ETF (SPYG).[1. As of March 15, 2016]