PowerShares DB US Dollar Bullish ETF

Latest PowerShares DB US Dollar Bullish ETF News and Updates

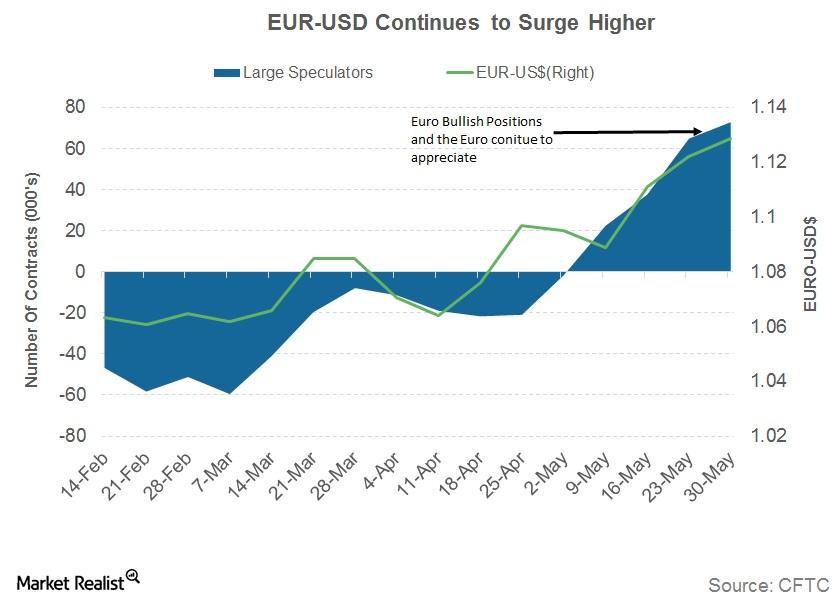

Will the ECB Stop the Surging Euro?

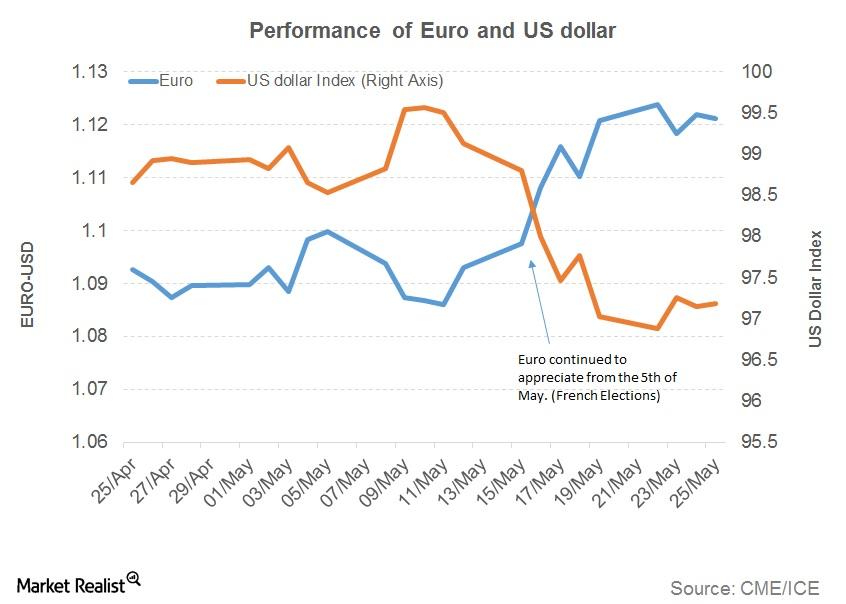

Last week (ended June 2), the euro continued to appreciate against the US dollar.

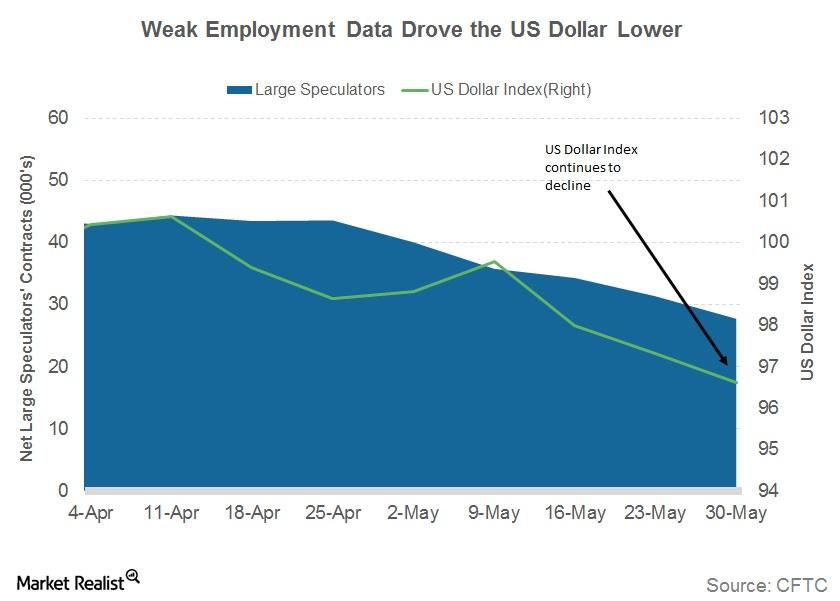

How the Weak Jobs Data Could Spell Doom for the US Dollar

The US dollar came into focus after the weak US jobs data on June 2. The payroll data was a negative surprise, with only 138,000 jobs being added in May.

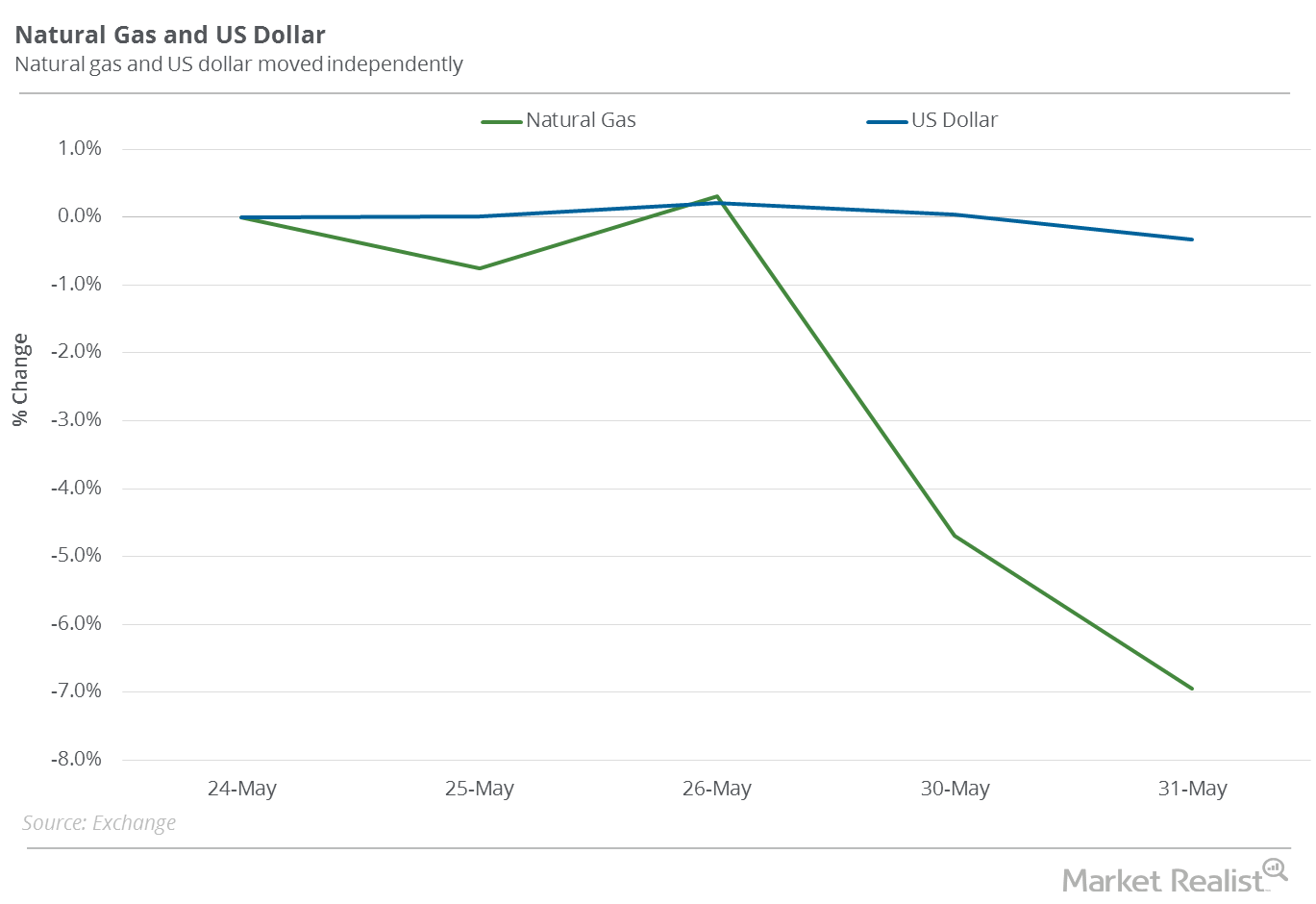

Is the US Dollar a Factor in Natural Gas’s Current Downturn?

The US dollar (UUP) (UDN) (USDU) fell 0.3% between May 24 and May 31, 2017.

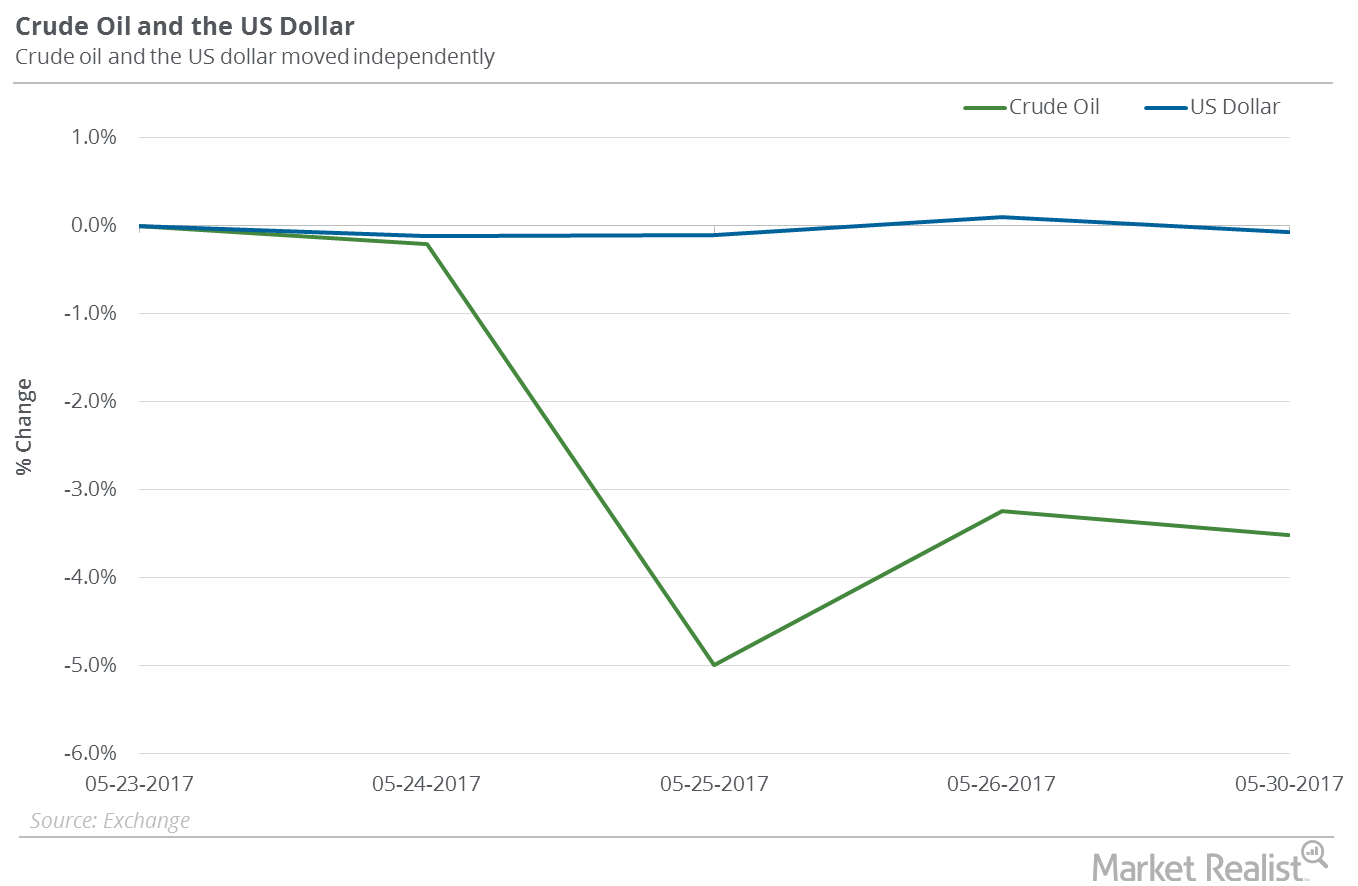

Is the US Dollar Impacting Oil’s Downturn?

In the trailing week, the US dollar fell 0.1%. Despite a fall in the US dollar, crude oil July futures fell 3.5% between May 23 and May 30, 2017.

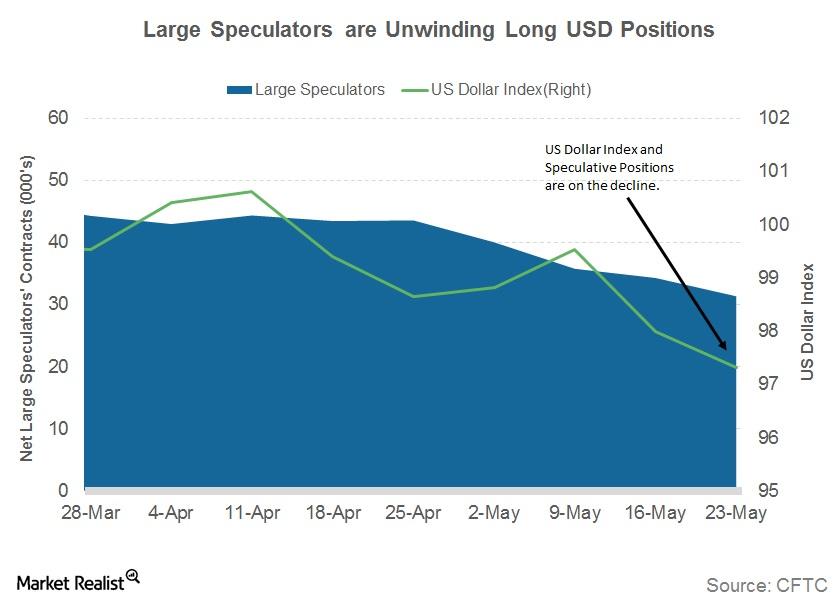

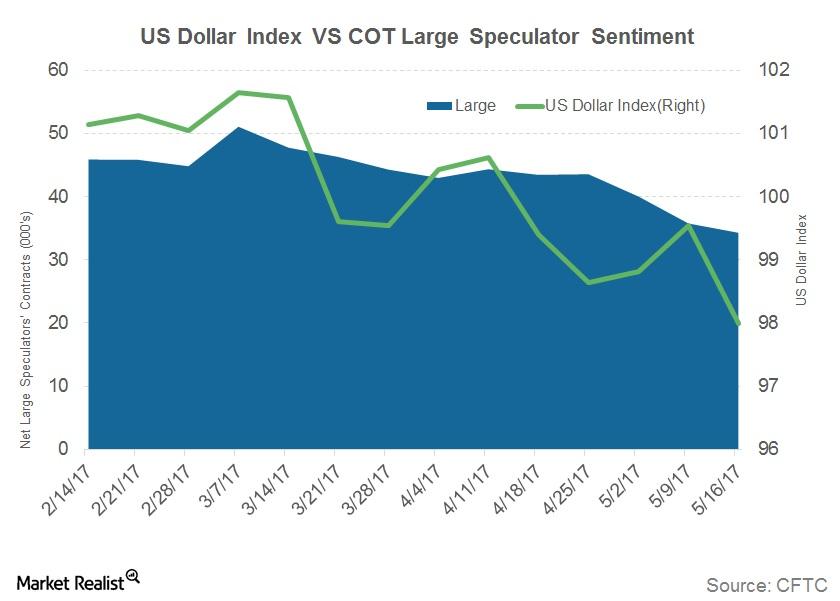

What the Falling US Dollar Could Indicate for Investors

The US dollar (UUP) has continued to lose its value with respect to its trading partners. The US Dollar Index fell 1.6% in the week ended May 26, 2017.

Forex Markets: Will the Euro Dominate?

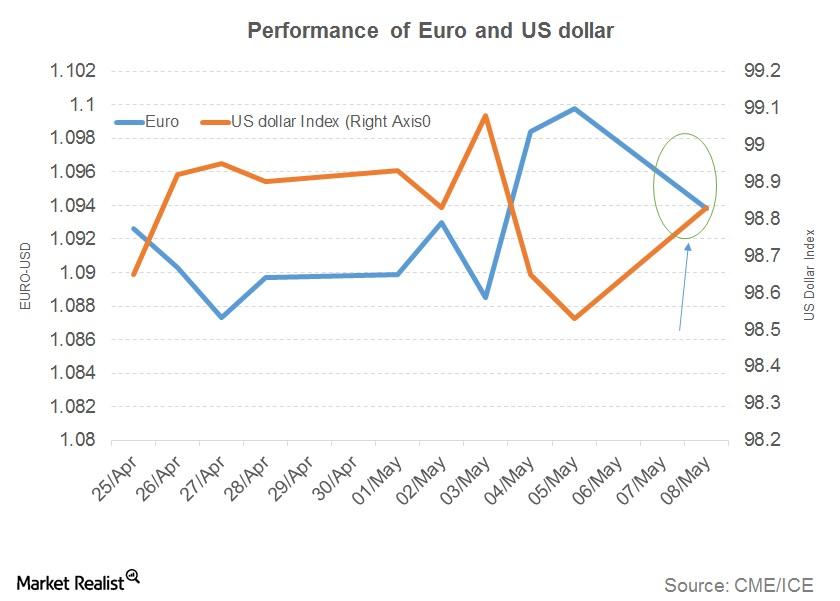

The euro-US dollar (FXE) continued to rise and claimed a new six-month peak above 1.1250 after the FOMC minutes didn’t revive the US dollar (UUP) on May 23.

Is the US Dollar the Only Positive for US Economy Right Now?

The US dollar (UUP) continued to trend lower against its trading partners with the US Dollar Index (DXY) losing 2.1% in the week ending May 19, 2017.

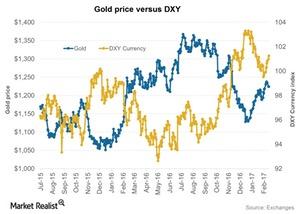

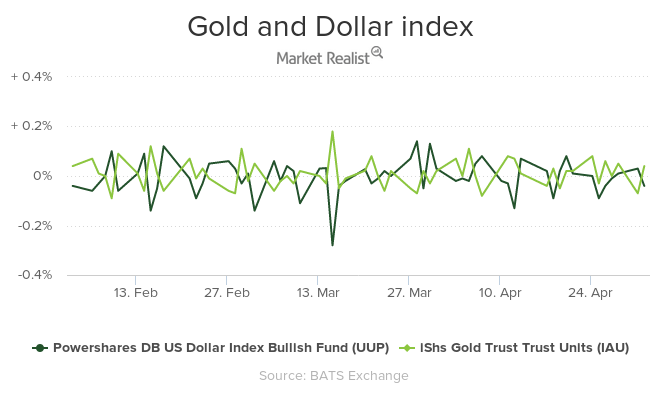

What’s the Correlation between the Dollar and Gold in Last 5 Days?

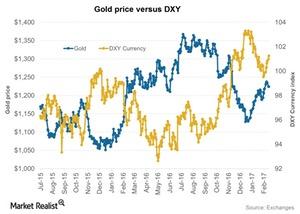

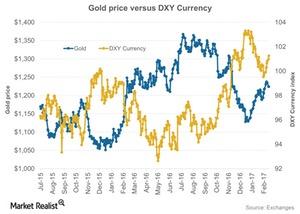

One of the critical elements that plays on precious metals besides the overall market sentiment is the US dollar.

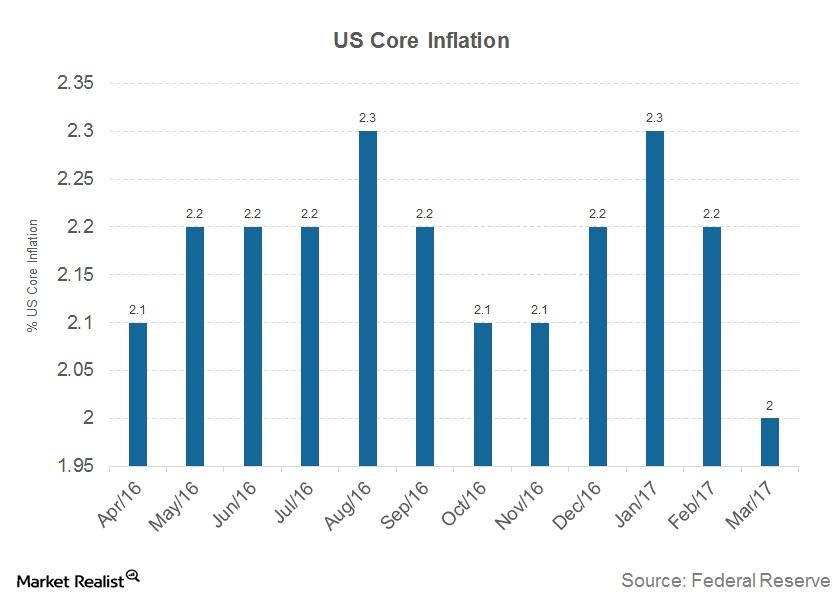

Why Charles Evans Thinks It’s Important to Reach Inflation Goals

Charles L. Evans, president of the Federal Reserve Bank of Chicago, said it’s extremely important that the Fed reach its inflation (VTIP) goal.

How the Dollar’s Revival Is Impacting Precious Metals in May

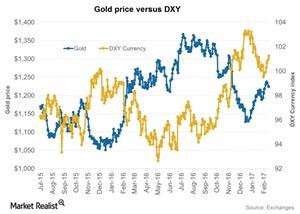

The US Dollar Index, which prices the dollar against a basket of six major world currencies, has risen ~0.46% on a trailing-five-day basis.

How Fixed Income, Currency Markets Reacted to the French Election

European bonds (BWX) started showing signs of celebration late May 5 as opinion polls pointed toward an Emmanuel Macron win in the French presidential election.

Will the Dollar Get Burned by Another Rate Hike?

While the US dollar has seen a decline in 2017, the increased possibility of a Fed rate hike in June could give the currency some breathing room.

Global Tremors, the Dollar, and Gold in Early May

Geopolitical risks had been playing on haven bids for precious metals, but now, we may be seeing to be a temporary respite—however brief—from global worries.

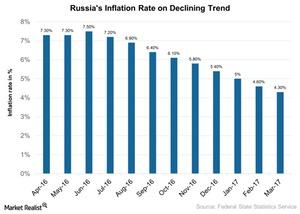

Russian Economy Gains Traction as Inflation Nears Target

Russia’s central bank recently lowered its key interest rate by half a percentage point to 9.25% in April 2017.

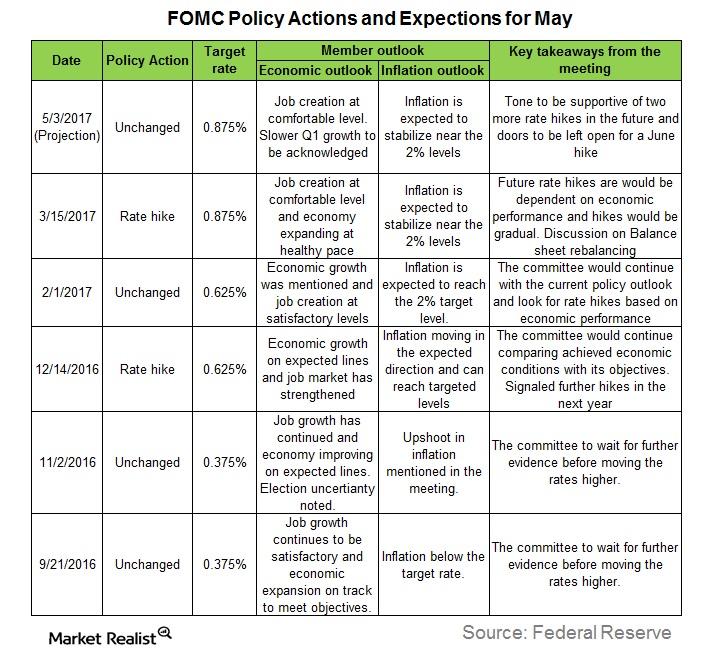

Will the FOMC Remain Hawkish?

In its last meeting in March, the Fed increased interest rates (SCHZ) by 0.25% and sounded hawkish about the US economy.

Gauging the Role of the US Dollar in the April 19 Fall of Precious Metals

Another important phenomenon that played on the fall of precious metals on Wednesday, April 19, was the upswing of the US dollar.

Will the US Dollar Rally?

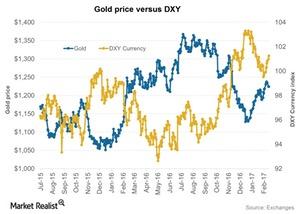

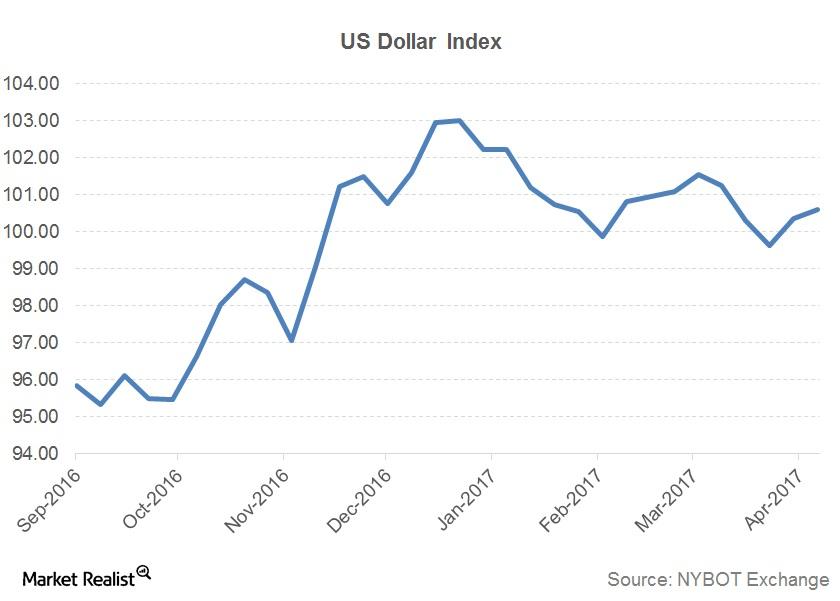

After the election results were announced in the US, the Dollar Index (UUP) surged to levels above the 103 mark in anticipation of fiscal stimulus, tax breaks, improving economic conditions, and the possibility of rate hikes.

US Dollar Could Impact Natural Gas Prices

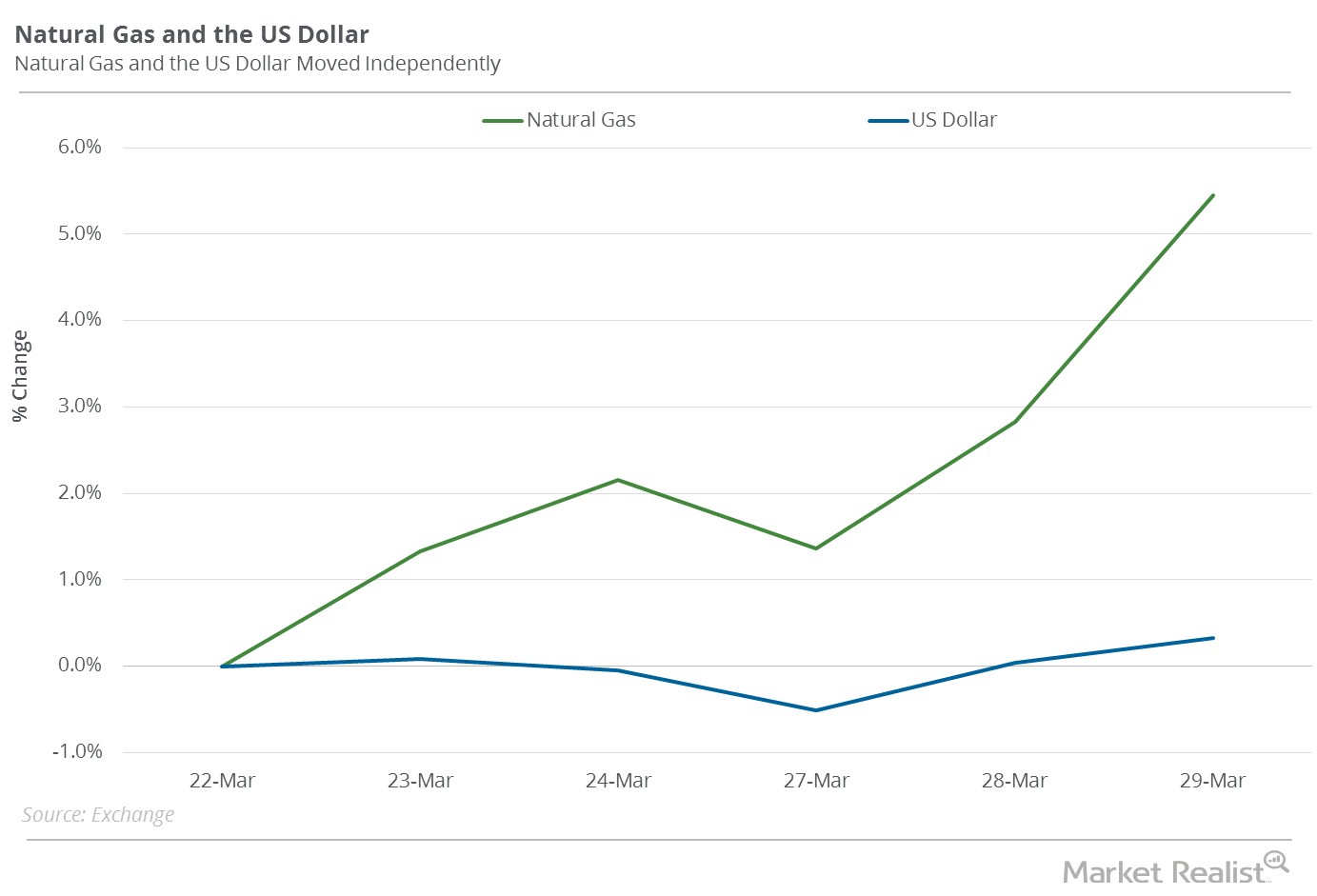

Between March 22 and March 29, 2017, natural gas (GASX) (FCG) (GASL) May futures rose 5.4%. The US dollar rose 0.3% during that period.

Understanding the Fall in the US Dollar and How Precious Metal Reacted

All four precious metals witnessed a rise in price on Monday, March 20, as the US dollar slipped to its six-week low.

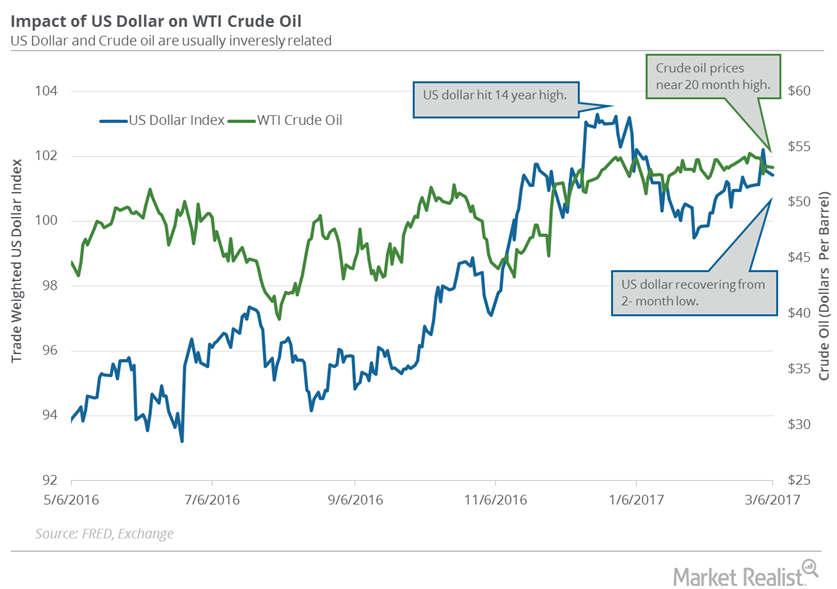

Janet Yellen and the US Dollar Impacted Crude Oil Prices

The US dollar and crude oil (ERY) (ERX) (DIG) (XES) are usually inversely related. A weaker US dollar makes crude oil more affordable for oil importers.

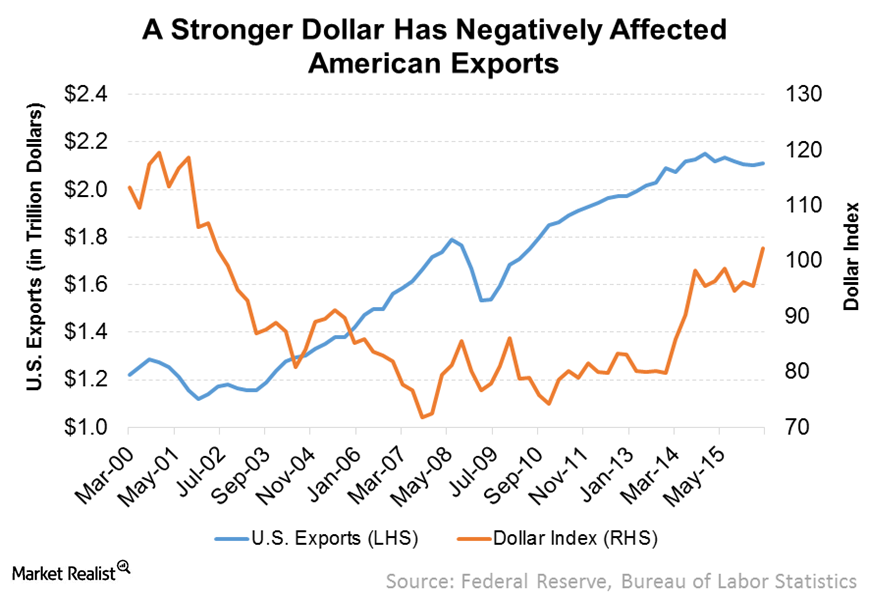

We Are in a New World of Persistent Dollar Strength

OppenheimerFunds That was then: For the longest time, we insisted that the strength of the dollar was the equalizer in a deleveraging world. If the Fed were to be the only major country in the world raising interest rates, then the dollar would appreciate significantly. Dollar strength would prove to be a headwind to U.S. […]

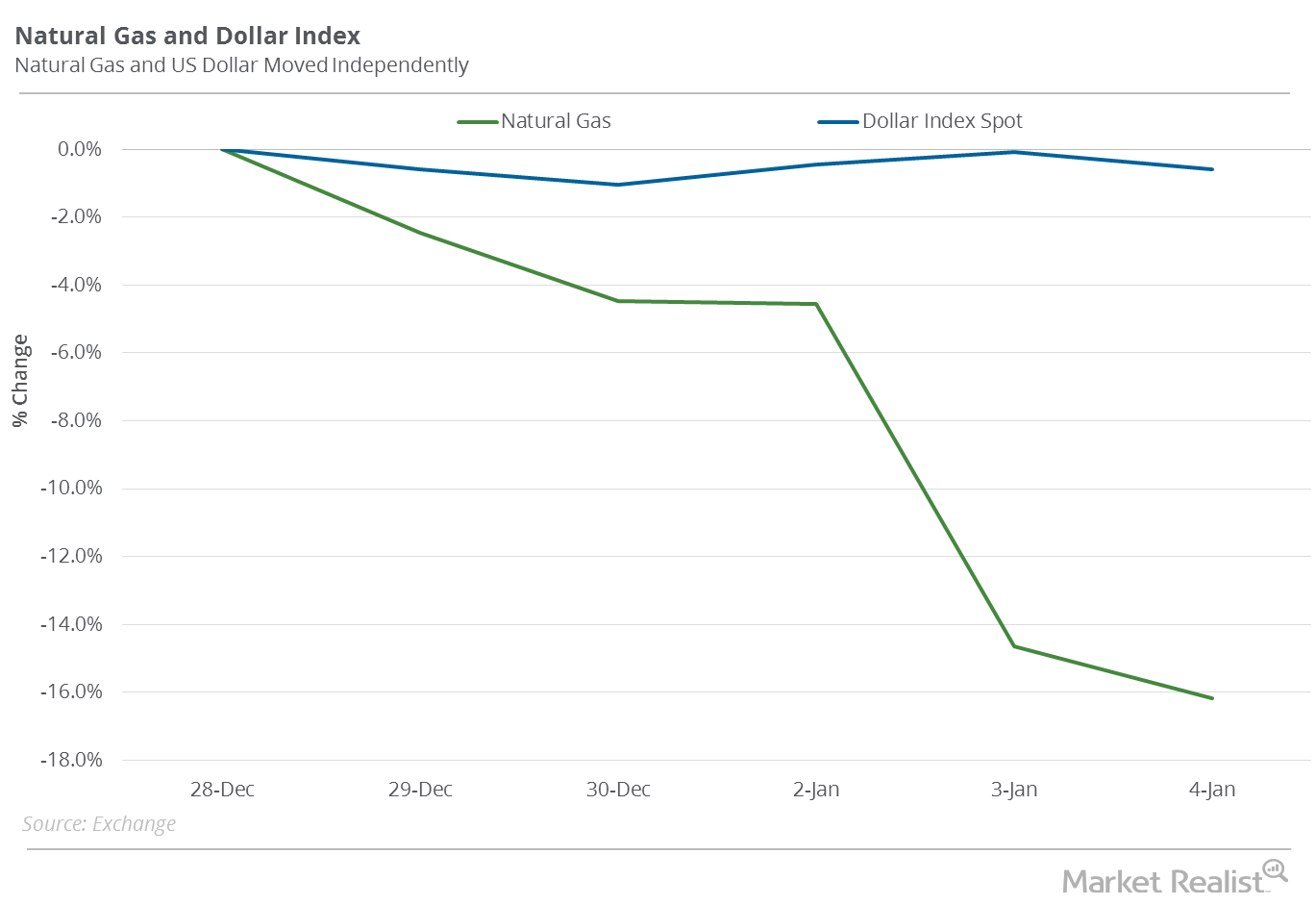

Does the US Dollar Impact Natural Gas Prices?

In the past four trading sessions, natural gas futures and the US Dollar Index moved in opposite directions one out of four times.

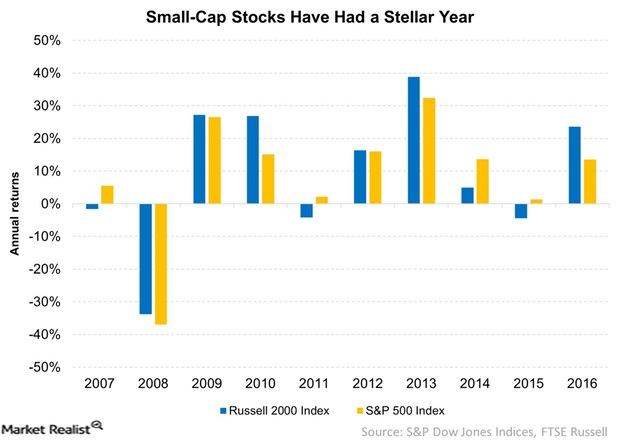

Why Did Small-Cap Stocks Have a Stellar Year in 2016?

Small-cap stocks have outperformed large caps on a regular basis since 1926. Small-cap stocks had a stellar year in 2016.

Why Was November Important for Global Financial Markets?

Trump’s unexpected presidential victory caused short-term uncertainty about markets and policies. His win reinforced a reflationary theme in global markets.

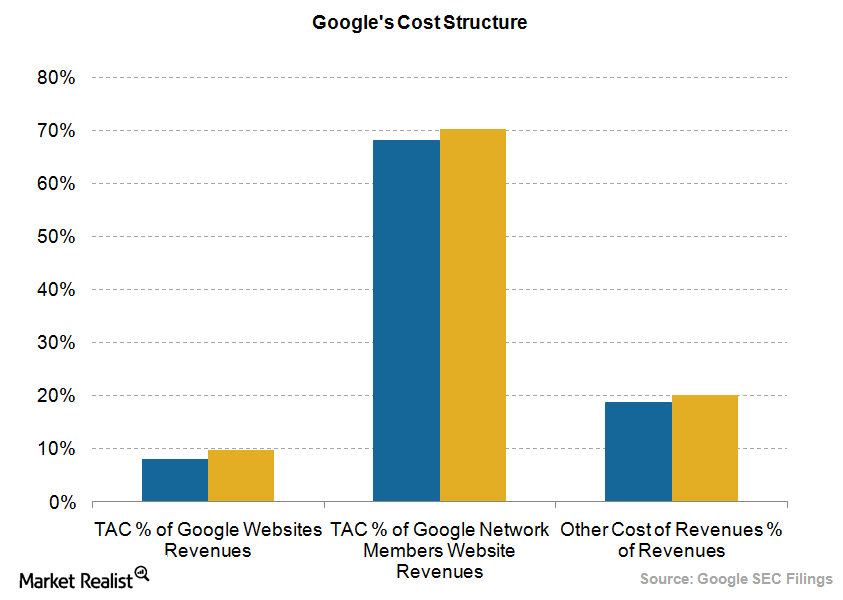

Understanding Google’s Rapidly Growing Expenses

Despite its impressive revenue growth, Google’s (GOOGL) overall costs grew at an even higher rate last quarter.

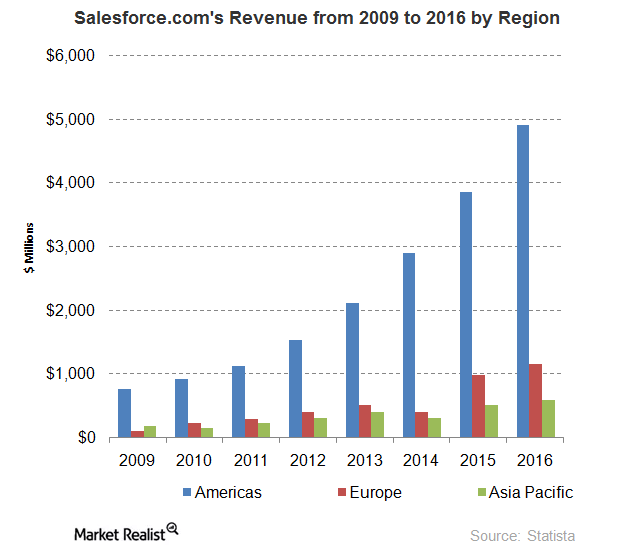

What Trump’s Victory Could Mean for Salesforce

Trump has planned a reduction in the current tax structure, and both immigration and taxation impact the IT sector—especially software sector.

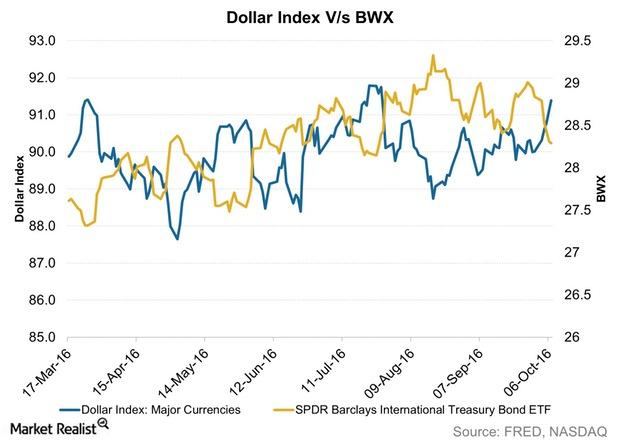

How Does a Strong Dollar Impact International Bonds?

When we talk about the relationship between the US dollar and bonds and how currency movements impact bonds, we’re essentially talking about international bonds.

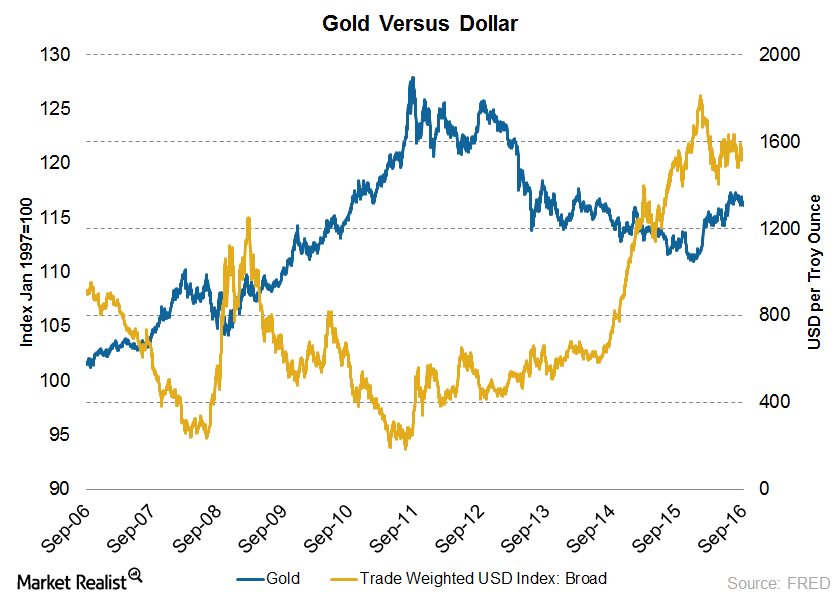

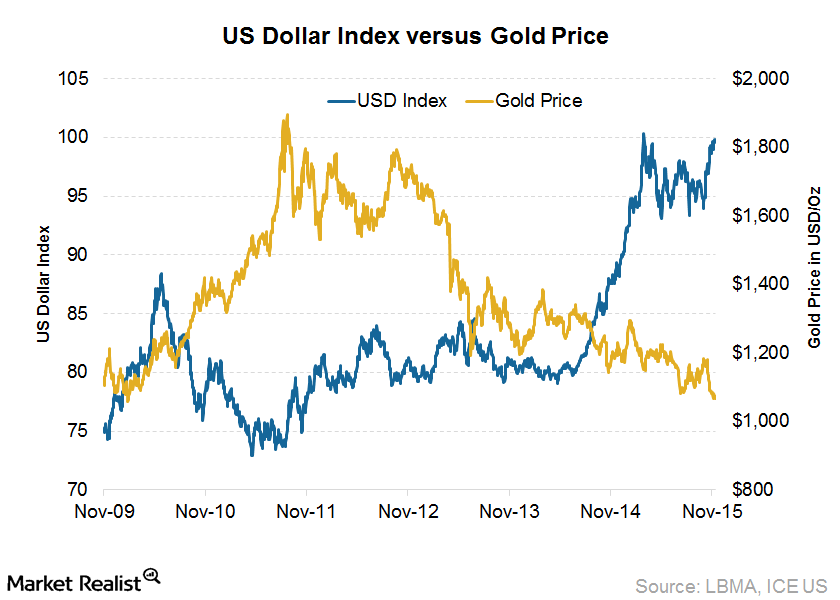

How Did the Dollar’s Move Affect the Price of Gold?

Gold is valued in dollars. As a result, the stronger dollar, driven by the recovery of the US economy, is pushing the gold prices further down.

Jackson Hole: An Important Takeaway and What It Means for Gold

Yellen Channels Doobie Brothers’ “What Were Once Vices Are Now Habits” Another aspect of Janet Yellen’s Jackson Hole speech furthered our conviction for strong gold prices in the long term. She described all of the unconventional monetary policies implemented since the financial crisis (e.g., zero rates, QE, etc.) as components of the Fed’s “toolkit”. Perhaps […]

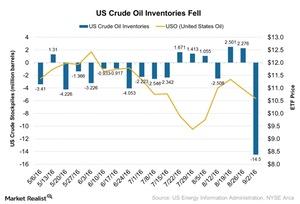

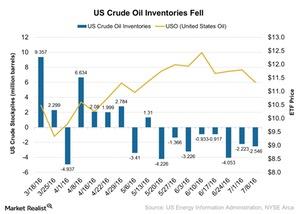

Crude Oil Prices Jumped as Inventories Fell

According to the EIA’s report on September 8, 2016, US crude oil inventories fell by 14.5 MMbbls for the week ended on September 2, 2016.

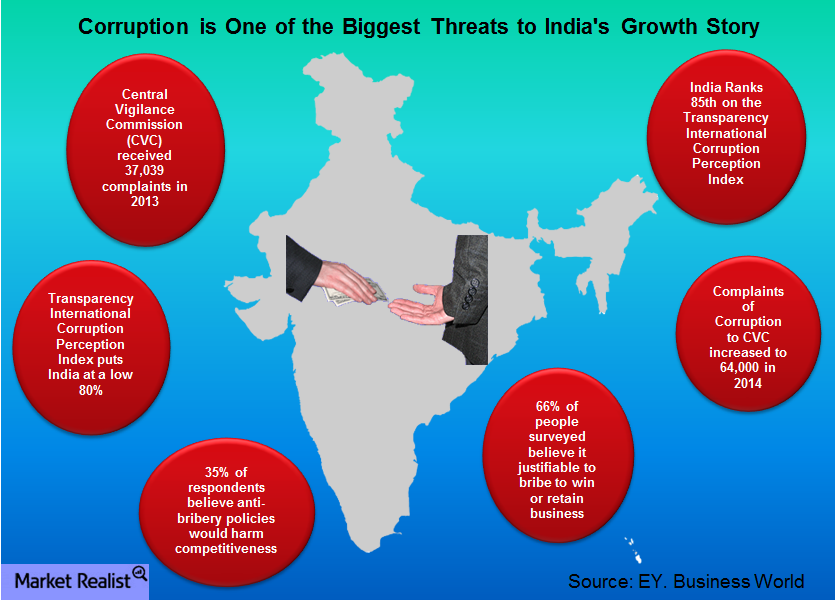

What Could Threaten India’s Growth?

Despite the impressive reform agenda and robust GDP growth, there are several challenges facing the Indian economy (PIN) (EPI).

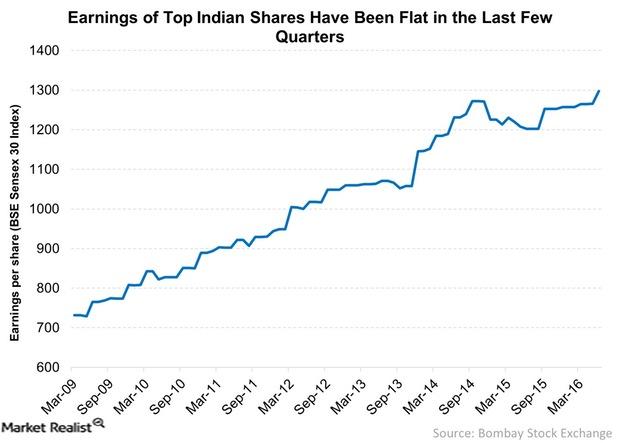

Can Indian Corporate Earnings Take a Turn for the Best?

Are Indian corporate earnings likely to turn around? Earnings have been flat since late 2014.

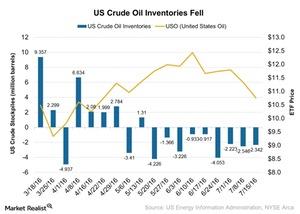

Why US Crude Oil Inventories Fell for 9th Consecutive Week

According to the July 20, 2016, U.S. Energy Information Administration report, US crude oil inventories declined by 2.3 MMbbls for the week ended July 15, 2016.

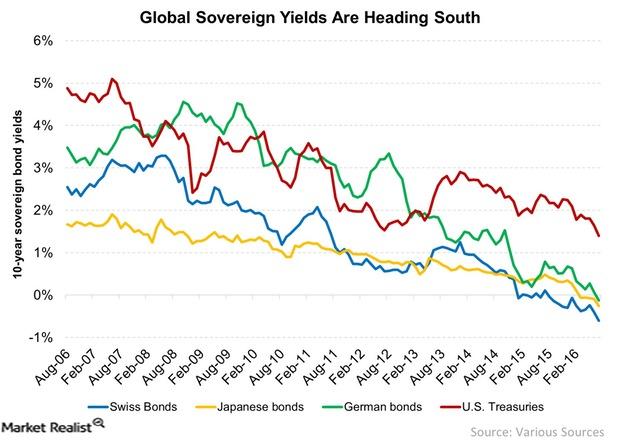

Low Yields: The Reason Lies outside the United States

The reason for low yields lies outside the United States. Global yields have been heading south over the last ten years.

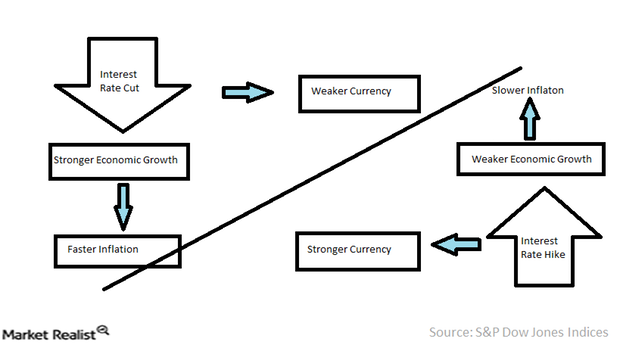

How Are Inflation, Interest Rates, and Foreign Exchange Related?

A low rate of inflation doesn’t guarantee a favorable exchange rate. But a high inflation rate is likely to have a negative effect on a currency’s value.

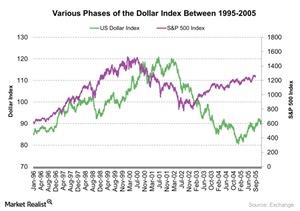

The Dollar Index and Economic Uncertainty: Is There Correlation?

The rally in the US Dollar Index can be correlated to two important events: the dot-com bubble crisis in 1999 and the Argentine debt crisis in 2001.

US Crude Oil Inventories Fell for the 8th Week: What It Means

According to the EIA’s report on July 13, 2016, US crude oil inventories fell by 2.5 MMbbls (million barrels) in the week ended July 8, 2016.

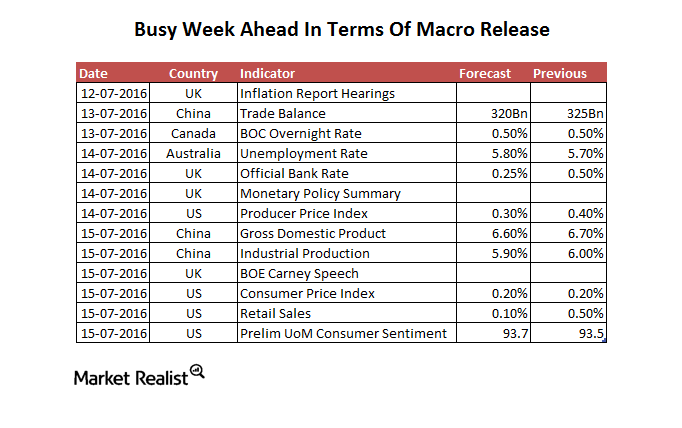

BOE Monetary Policy Will Be the Highlight This Week

The BOE is scheduled to release it monetary policy on July 14—the first after the United Kingdom decided to leave the European Union in a historic referendum.

Why Did the Bank of England Relax Regulatory Requirements?

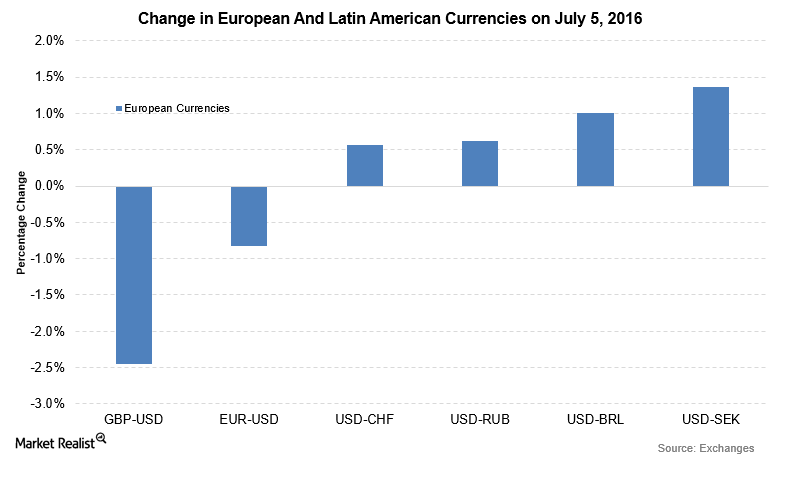

The BOE (Bank of England) released the Financial Stability Report on July 5, 2016. It warned multiple times about the repercussions of a Brexit.

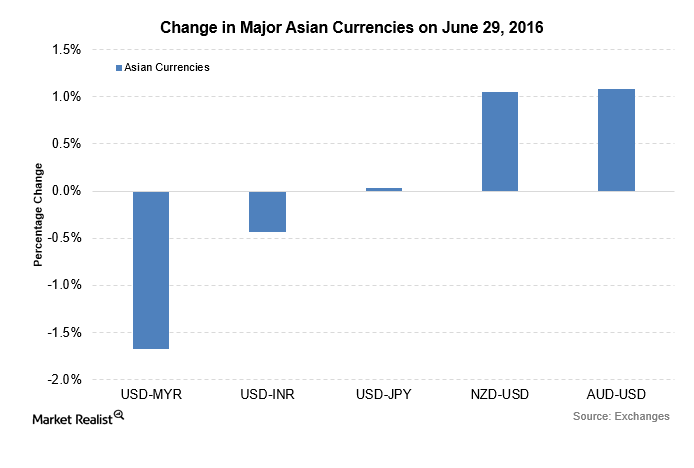

What Were the Best-Performing Currencies on June 29?

The Malaysian ringgit led the rise in Asian currencies as the US dollar-ringgit currency pair, which is inversely related to the ringgit, fell by 1.7%.

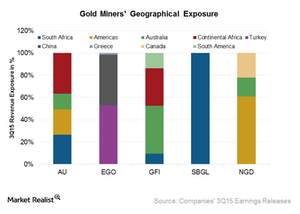

Gold Miners’ Geographic Exposure Impacts Growth Prospects

While gold miners try to limit their exposure to safe jurisdictions, it’s important to look at geographic exposure and its implications on their prospects.

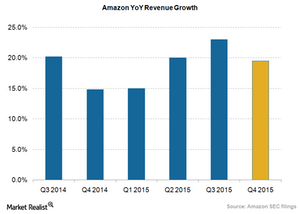

Strong Holiday Sales Will Likely Drive Amazon’s Growth in December

Amazon is the largest e-commerce player in the world. It could beat its own guidance for the December quarter. It will announce its earnings next month.

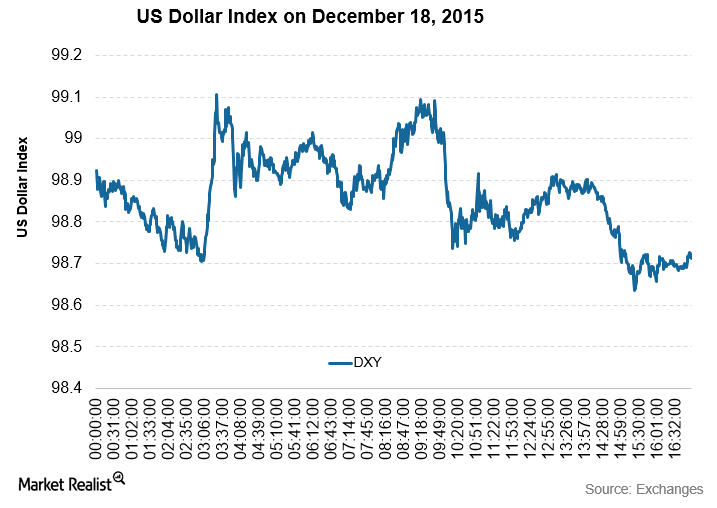

Dollar Index and Services PMI Both Fell

The US Dollar Index measures the strength of the US dollar against other major currencies. It fell by 0.58% on December 18, 2015. It was on a correction mode.

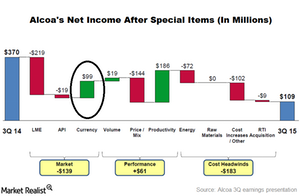

What Would a Stronger US Dollar Mean for Alcoa?

Alcoa’s value-add company will get a major portion of its revenues from Europe and is thus negatively impacted by a stronger US dollar.

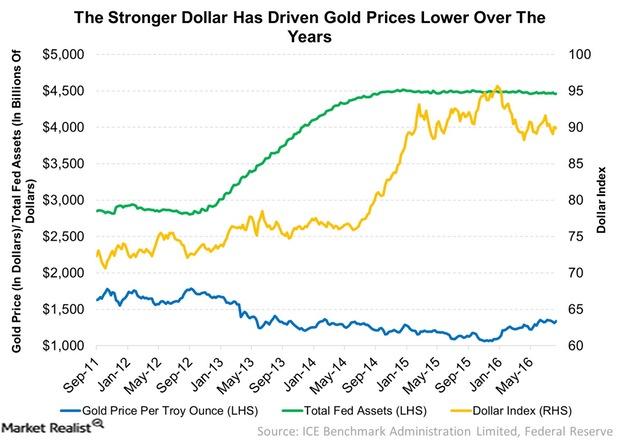

Why the Strong US Dollar Outlook Means Pressure for Gold Prices

Tracked by the Federal Reserve, the weekly US Dollar Index (UUP) measures the value of the dollar compared to its six significant trading partners.

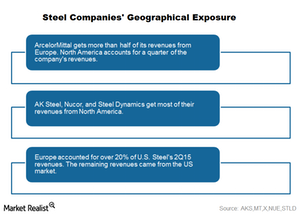

How Geographical Exposure Varies Between Steel Companies

A look at the geographical exposure of different steel companies, which are exposed to the overall economic activity of the regions in which they operate.

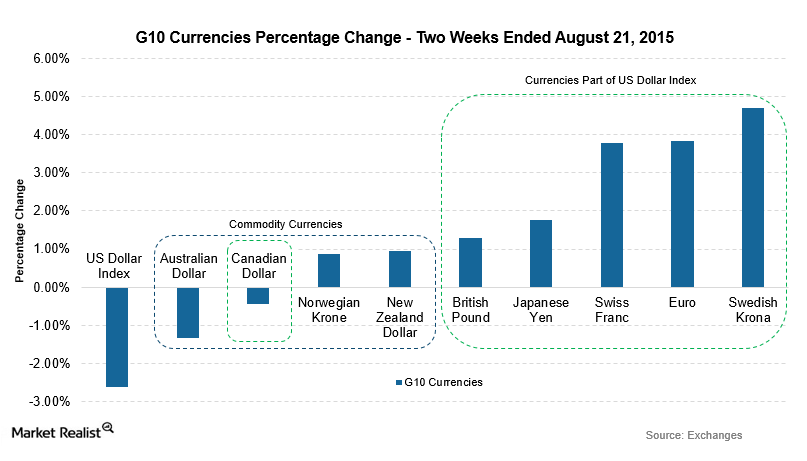

G10 Currencies Gain as US Dollar Index Sinks

The G10 currencies were impacted positively as the US dollar index dropped in value in the two weeks ending August 21, 2015.

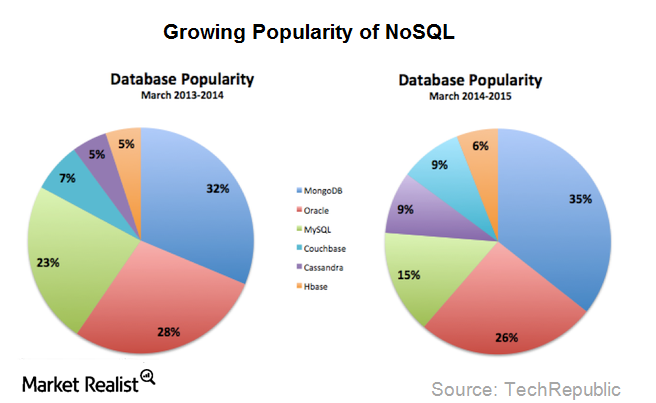

Open-Source Databases Pose a Threat to Oracle’s Dominance

The growing preference for open-source technologies and databases plays a crucial role in Oracle’s recent struggles.

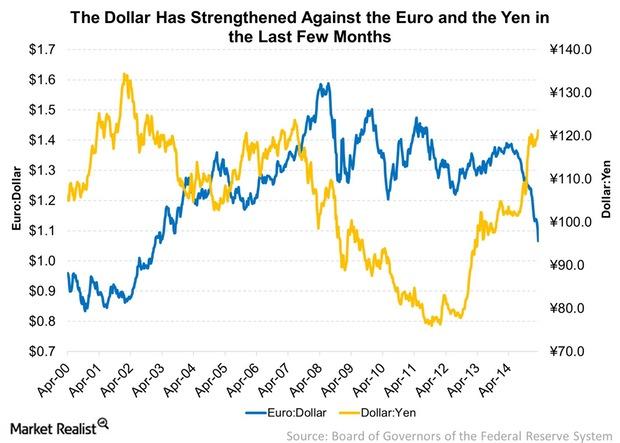

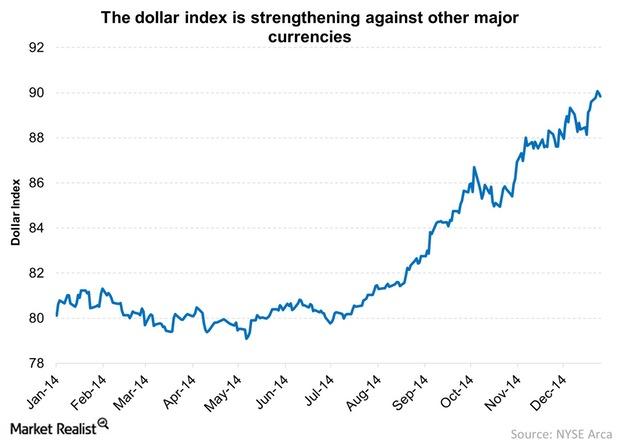

What’s Causing the US Dollar to Strengthen?

The strength in the US dollar is because of divergence in central bank policies. The US dollar is strengthening against most of the major currencies.

Key Catalysts Behind The US Dollar Rally In 2014

Can the US dollar rally continue? What does this mean for commodities? Russ answers these queries in his latest Ask Russ installment.