PowerShares DB US Dollar Bullish ETF

Latest PowerShares DB US Dollar Bullish ETF News and Updates

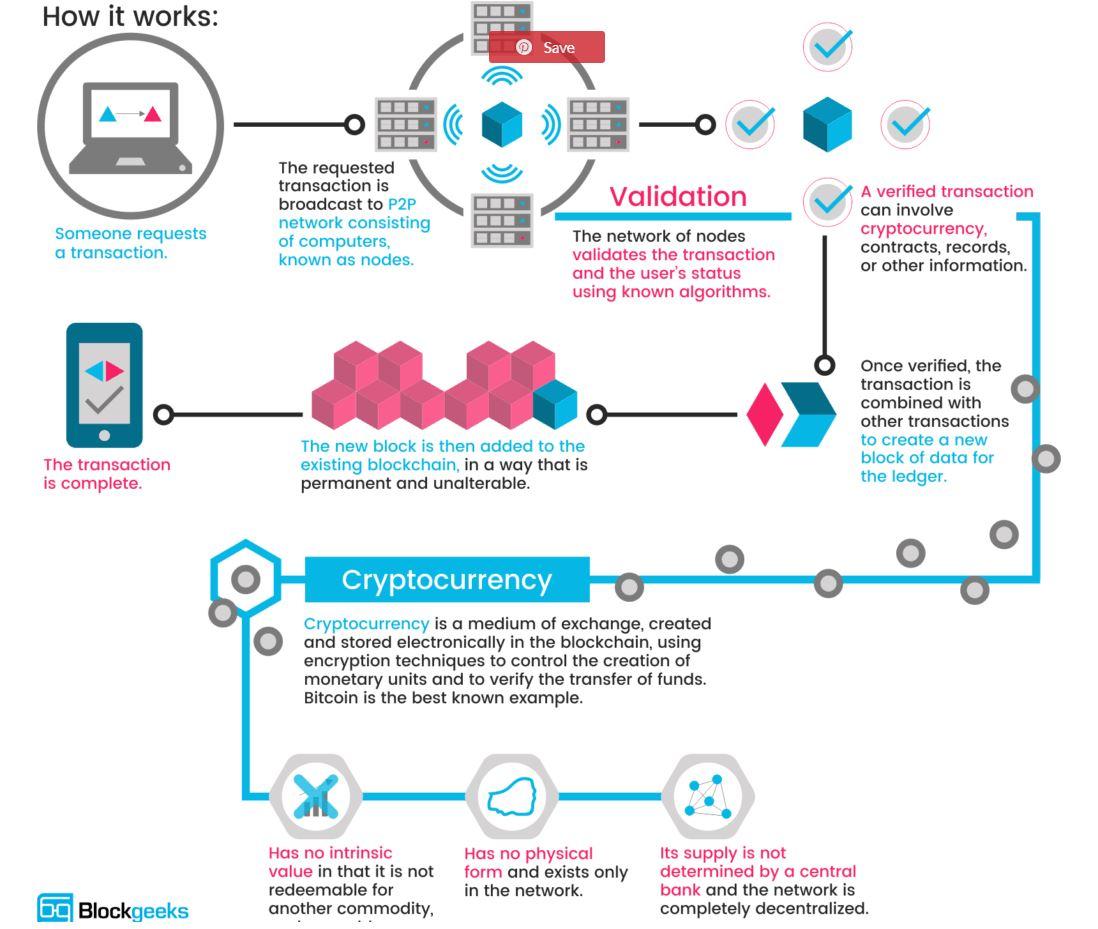

Is Blockchain Technology Really the New Internet?

It’s important that we understand the core technology behind cryptocurrencies if we want to appreciate the ingenuity of the bitcoin creation.

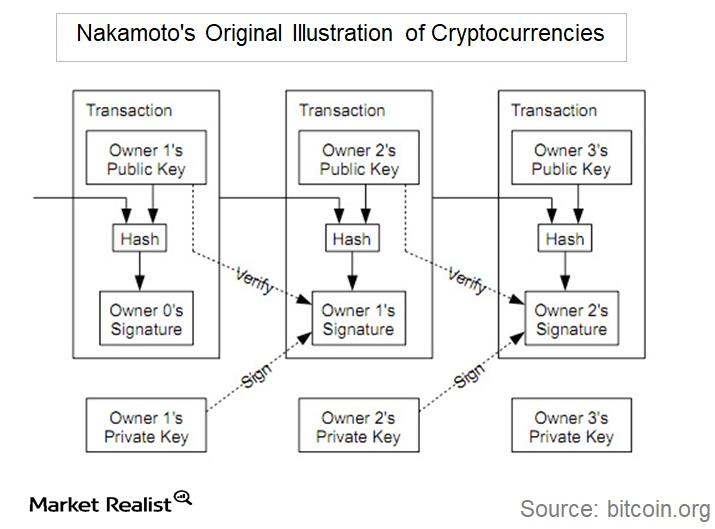

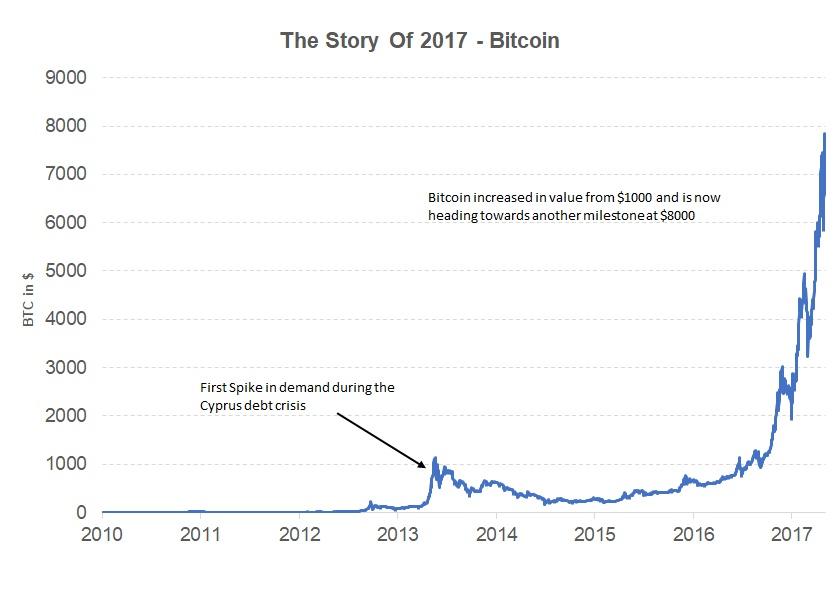

How the First Bitcoin Was Created

Satoshi Nakamoto is considered to be the founder of bitcoin, but the actual identity of Satoshi Nakamoto is not known.

How Did Bitcoin Come to Be?

The idea behind bitcoin is simple: to create a new platform for transactions that are independent of central banks and involve minimal transaction costs.

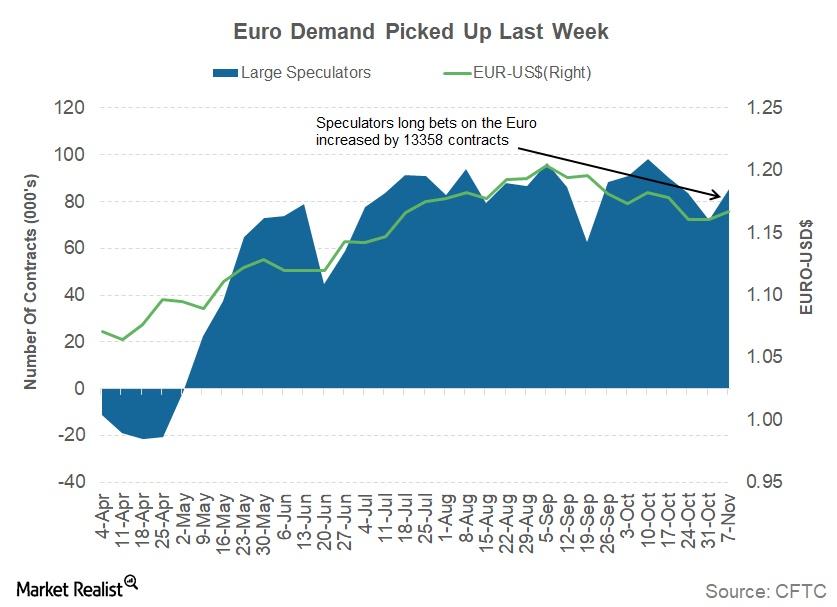

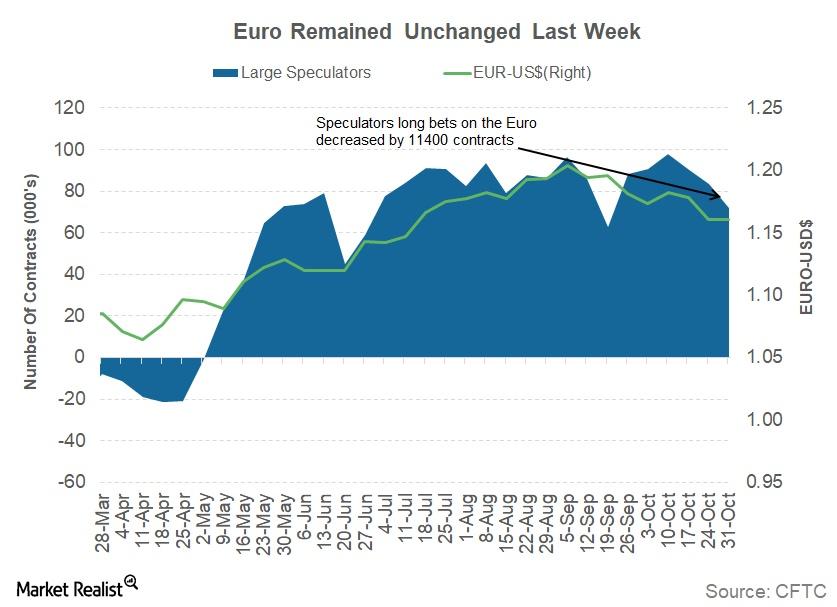

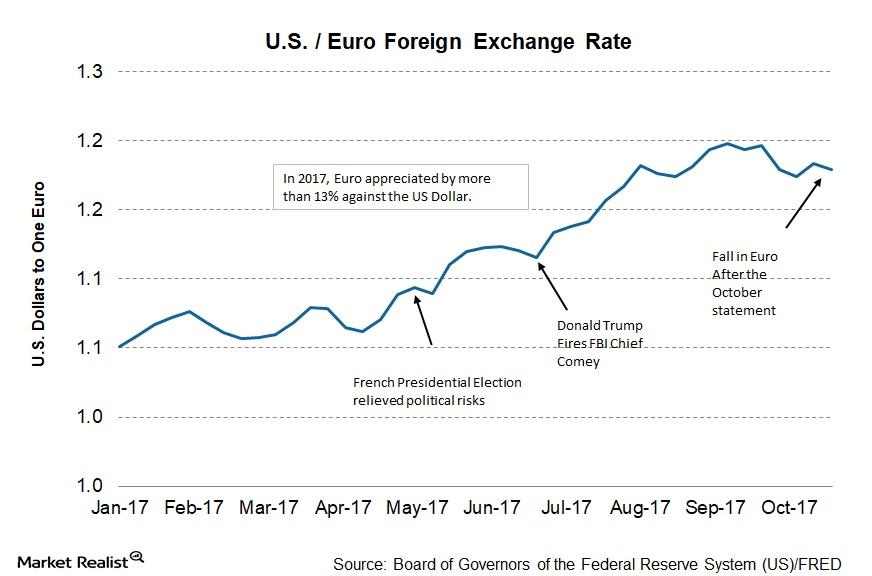

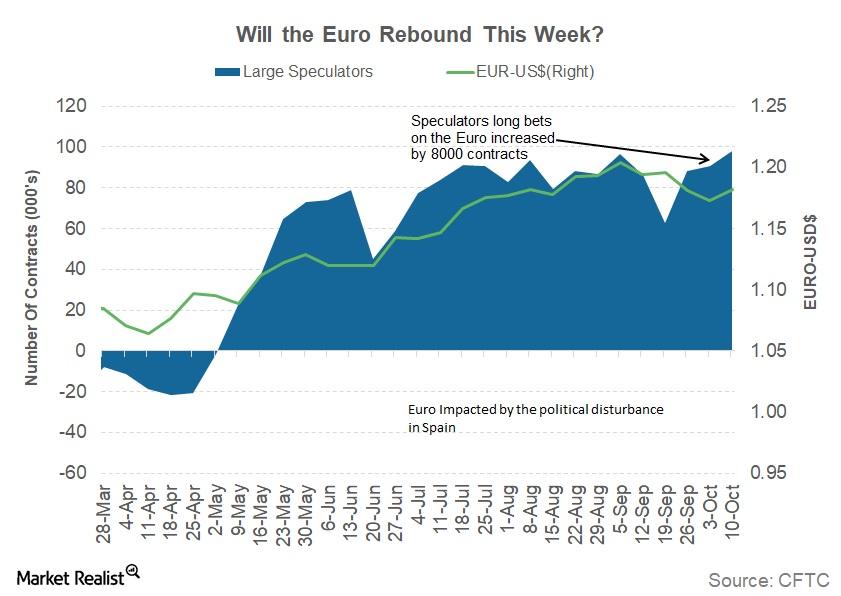

How Euro Managed to Bounce Back Last Week

The euro-dollar (FXE) pair closed the week ending November 10 at 1.2, appreciating 0.48% against the US dollar (UUP).

Will US Dollar Survive Tax Reform Uncertainty?

The US Dollar Index (UUP) lost steam last week after posting three consecutive weekly gains.

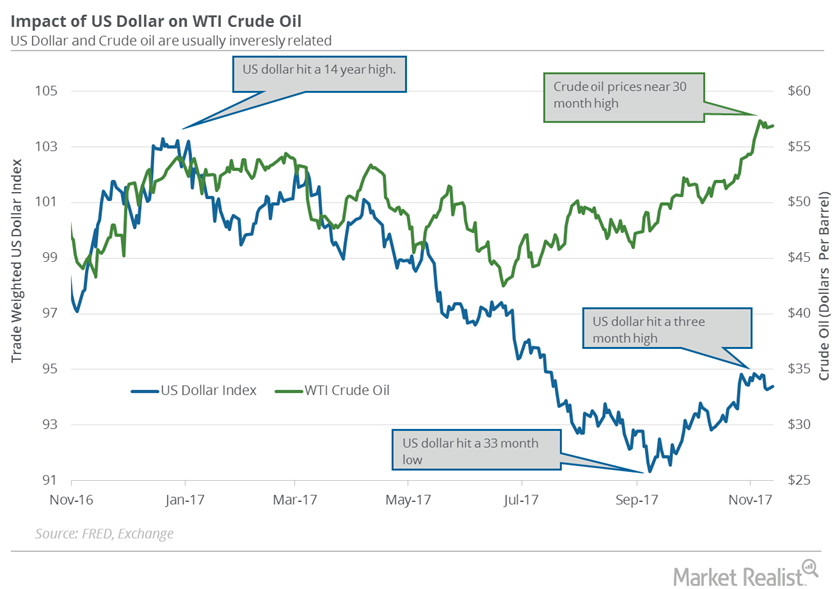

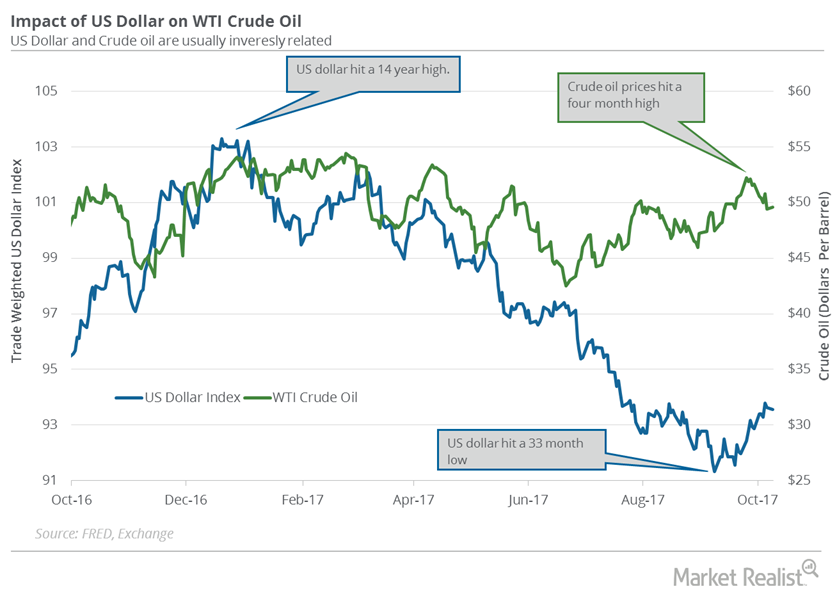

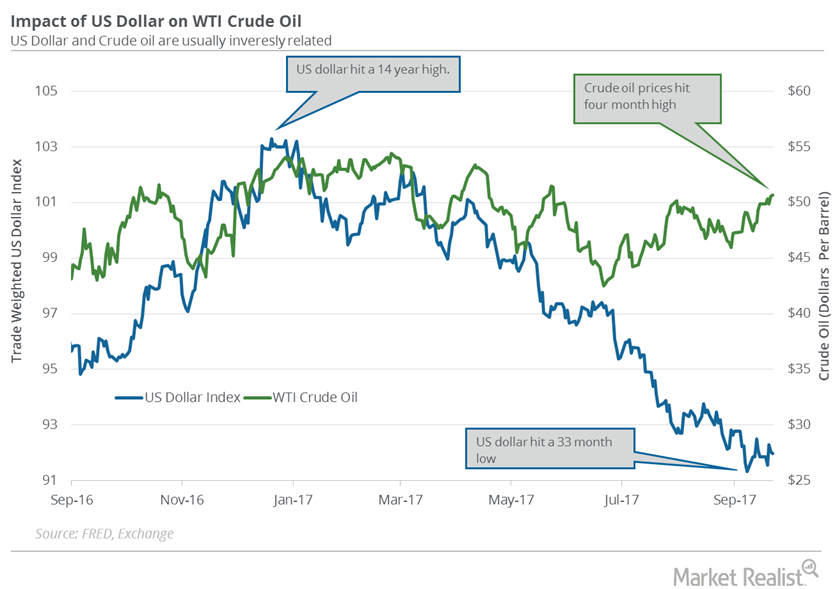

US Dollar Could Pressure Crude Oil Futures This Week

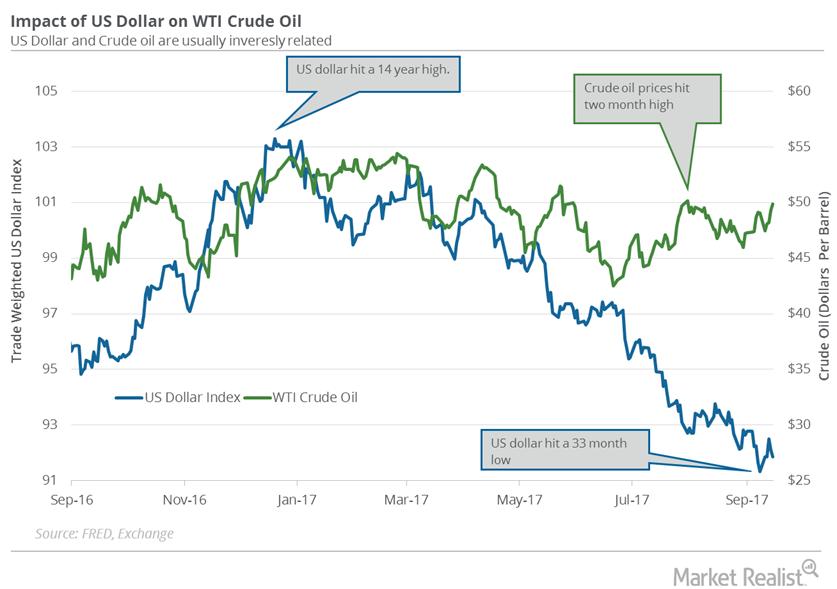

The US Dollar Index rose 0.13% to 94.4 on November 13, 2017. It limited the upside for US crude oil (UWT) (DWT) prices on the same day.

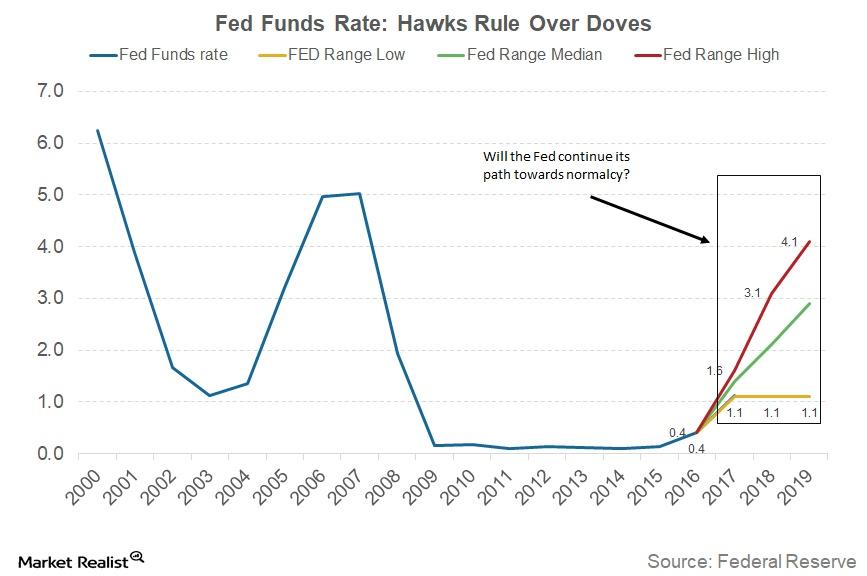

Key FOMC Insights and the New Fed Chair

The US FOMC left rates unchanged after the November 2017 meeting, as expected, setting the stage for a potential rate hike in December.

Did Job Openings Rise in September?

The Job Openings and Labor Turnover Survey (or JOLTS) report for September came out on November 7. Job openings remained unchanged at 6.1 million as of the last business day in September.

Why the Euro Is Likely to Remain Quiet this Week

The euro-dollar pair (FXE) closed the week ending November 3 at 1.1609 against the US dollar (UUP). Worries about a possible escalation of tensions in Spain’s Catalonia region proved futile.

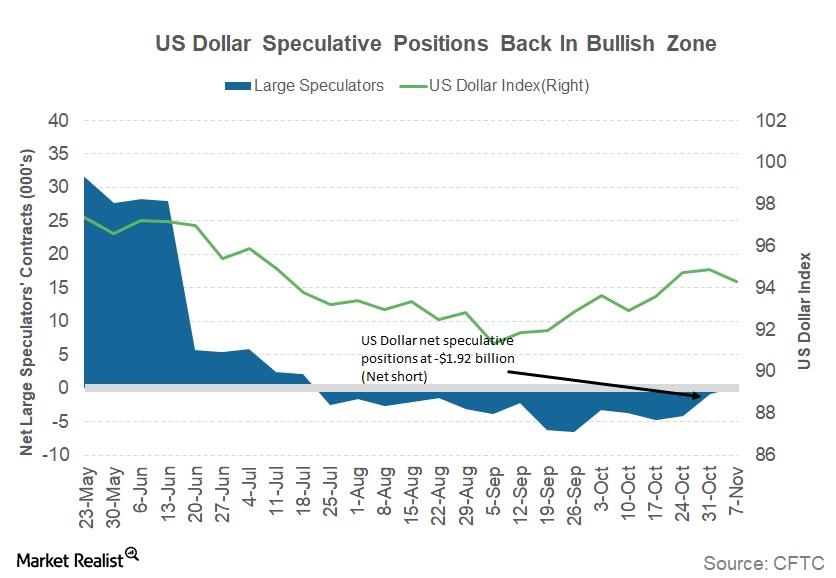

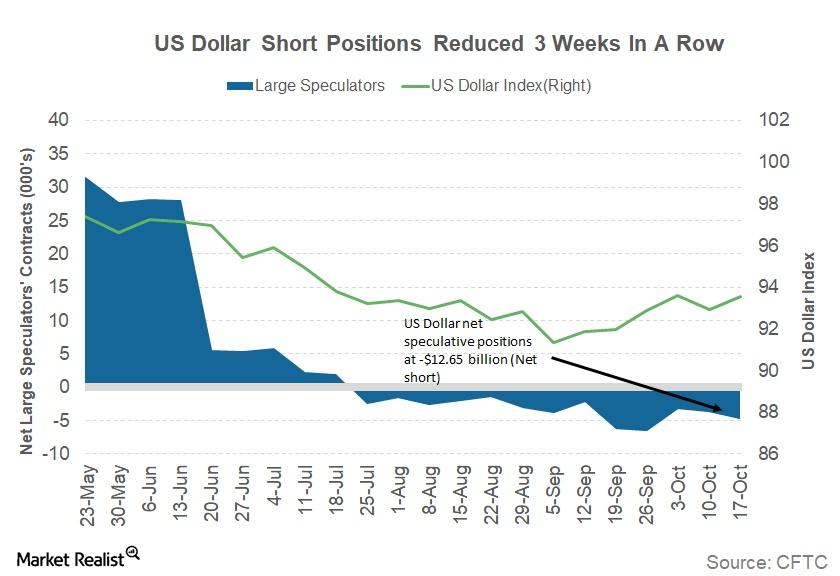

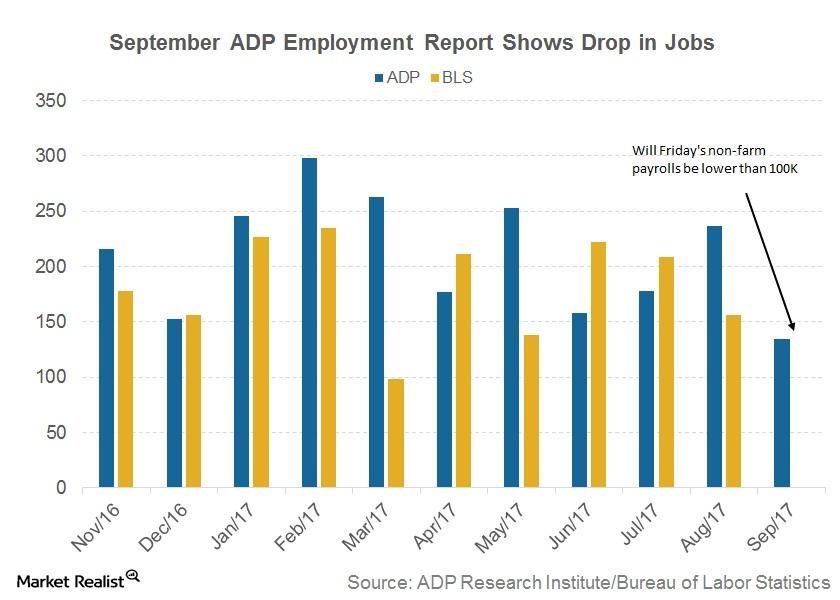

US Dollar Survived Dovish FOMC Statement, Lackluster Jobs Report

The US dollar index (UUP) remained supported last week despite a dovish FOMC statement and a lower-than-expected rise in monthly non-farm payrolls.

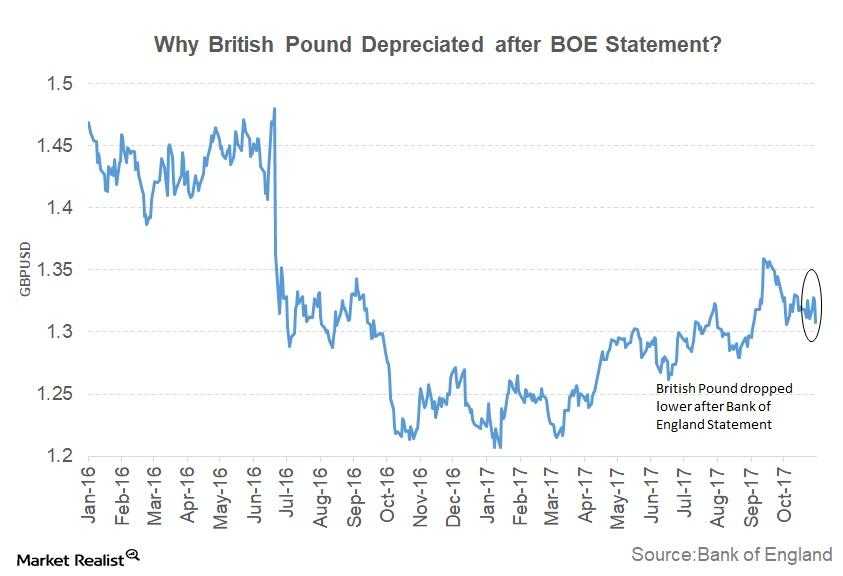

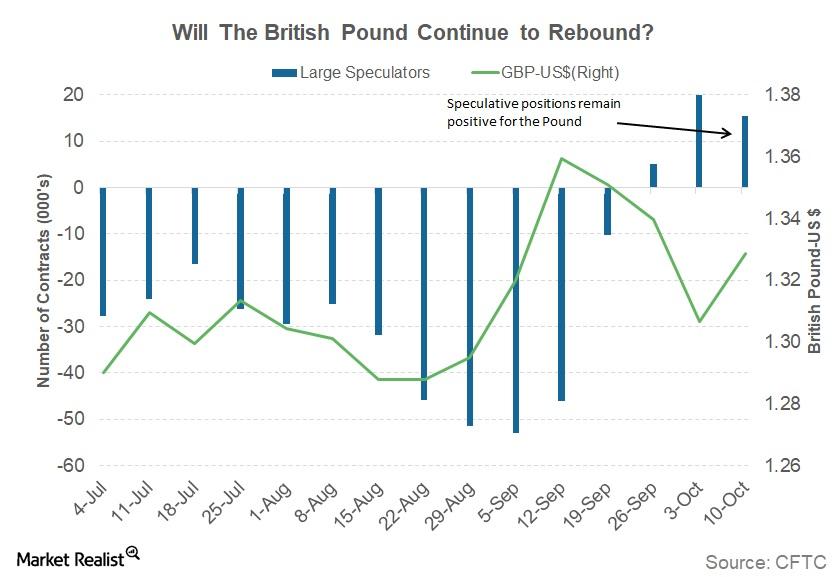

Why the British Pound Fell—Despite the Bank of England’s Rate Hike

The British pound depreciated 1.41% against the US dollar after the policy statement from the BOE (Bank of England) on November 2.

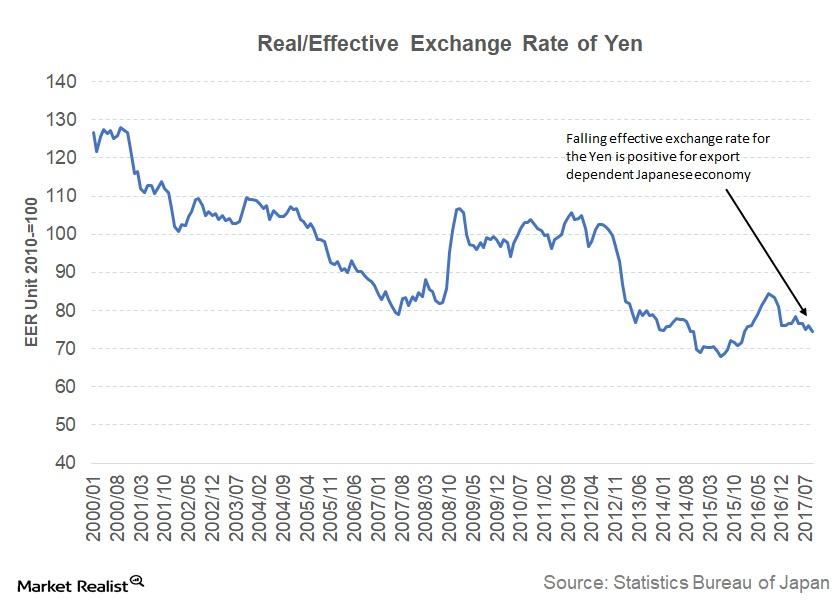

Japanese Yen Is Expected to Depreciate More

Since the Japanese election results, the Japanese yen has depreciated. The Bank of Japan is expected to continue the accommodative policy.

Eurozone Inflation Is Improving: Why Is ECB Still Dovish?

On a year-over-year basis, the Eurozone Inflation (VGK) (IEV) (EZU) Index stood at 1.5% in September 2017, the same as in August 2017.

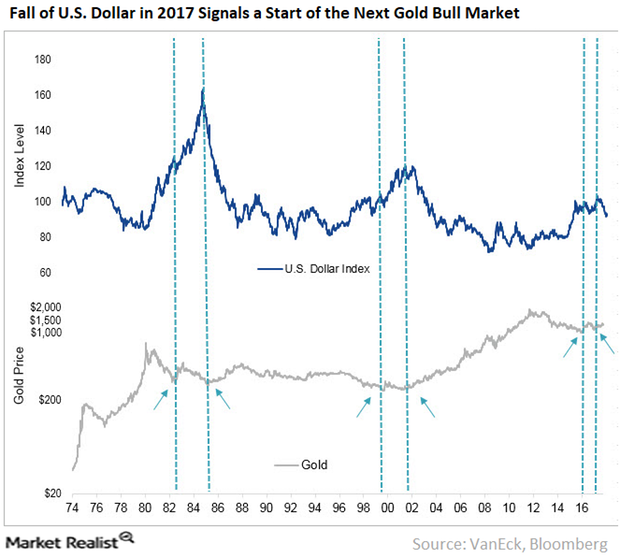

1 Technical Trend That Could Affect Gold Prices

Investor complacency doesn’t hide the fact that there are financial risks to QT. Forty percent of the Fed’s balance sheet unwind is in mortgage-backed securities at the same time that the housing market is showing signs of slowing.

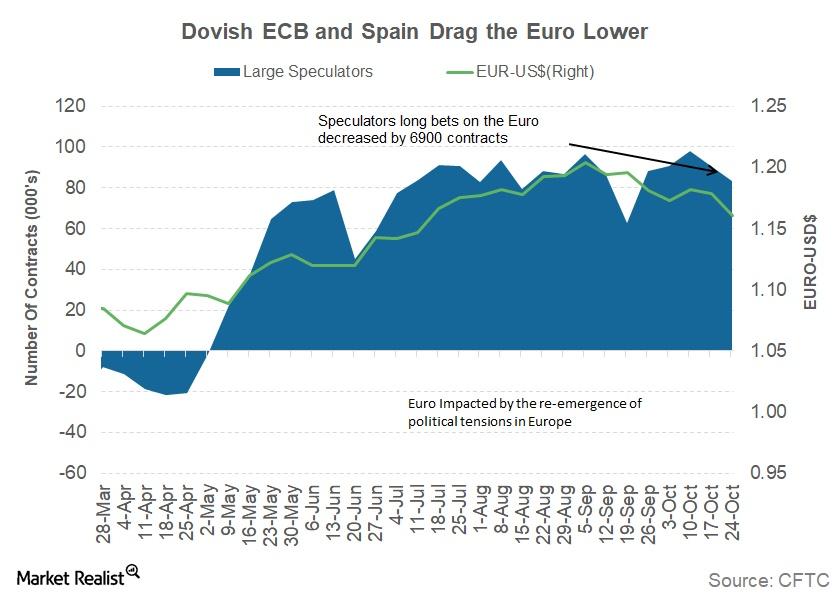

Why the ECB Isn’t Worried about the Appreciating Euro

In the ECB’s (European Central Bank) October policy meeting, the ECB didn’t explicitly talk about the appreciating euro.

How Political Drama and ECB’s Dovish Statement Affected the Euro

The euro-dollar (FXE) pair closed the week ending October 27 at 1.16 against the US dollar (UUP).

How the US Dollar Could React to November FOMC Meeting

The US Dollar Index (UUP) continued its ascent last week.

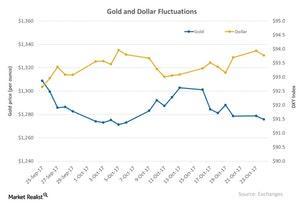

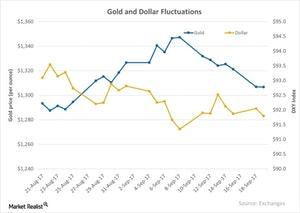

These Factors Are Affecting Gold

Gold, silver, platinum, and palladium have a five-day trailing loss of 0.67%, 0.44%, 1.1%, and 1.5%, respectively.

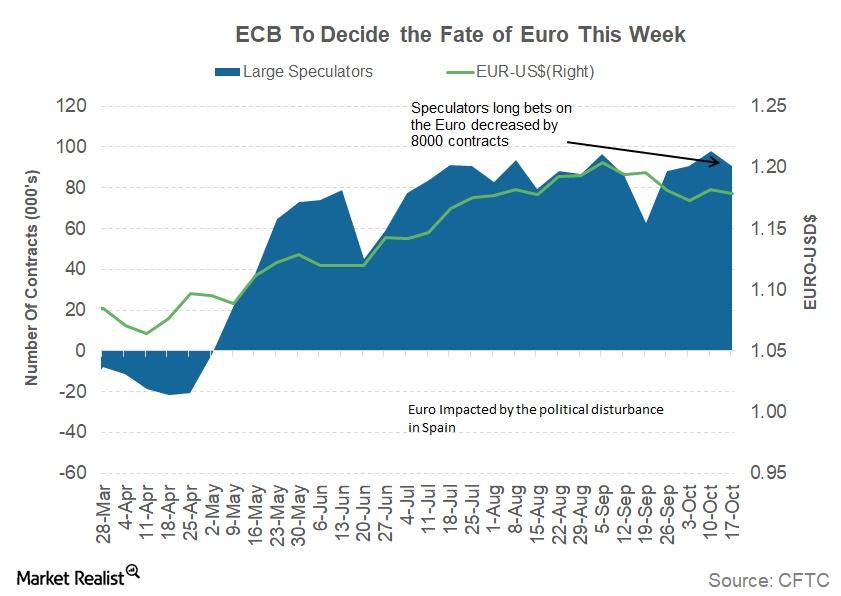

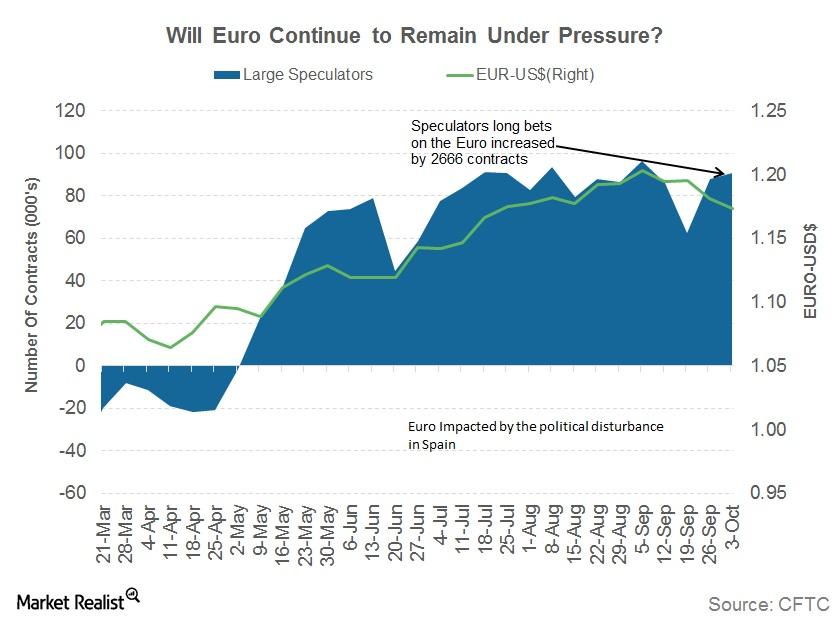

Why the Euro’s Troubles Could Continue This Week

The euro-dollar (FXE) closed the week ending October 20 at 1.179 against the US dollar (UUP).

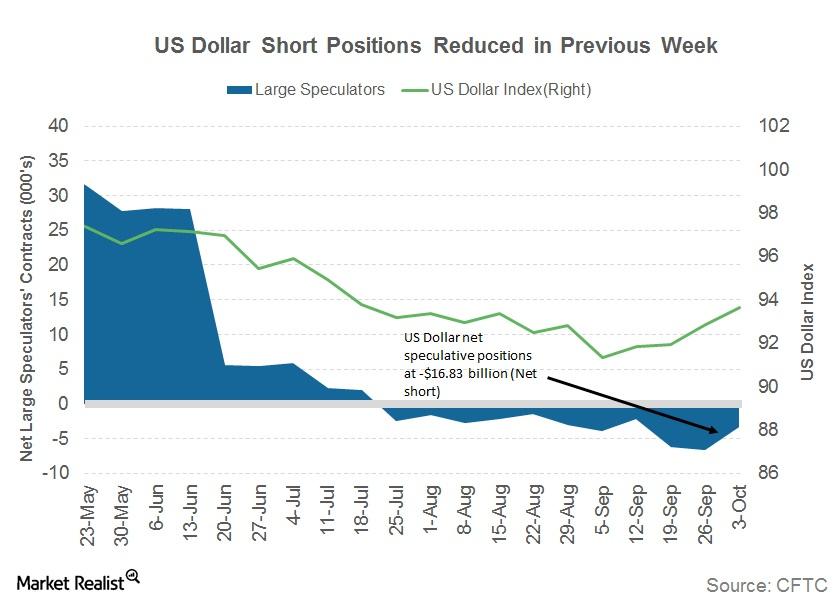

What to Expect from the US Dollar This Week

The US Dollar Index (UUP) has bounced back from the shallow low that it saw the previous week.

Why the British Pound Appreciated by 1.5% Last Week

The British Pound (FXB) appreciated by more than 2% against the US dollar last week. The pound (GBB) closed for the week at 1.3288, appreciating by 1.69% against the US dollar (UUP).

Will the Euro Regain Its Momentum this Week?

The euro-dollar (FXE) pair closed the week ending October 13 at 1.1822 against the US dollar (UUP). The shared currency managed to rebound from an 11-week low the week before, affected by political turmoil in Spain.

Has the US Dollar Rally Ended for Now?

The US Dollar Index (UUP) turned lower again in last week after a surprise rally following the October jobs report on October 6.

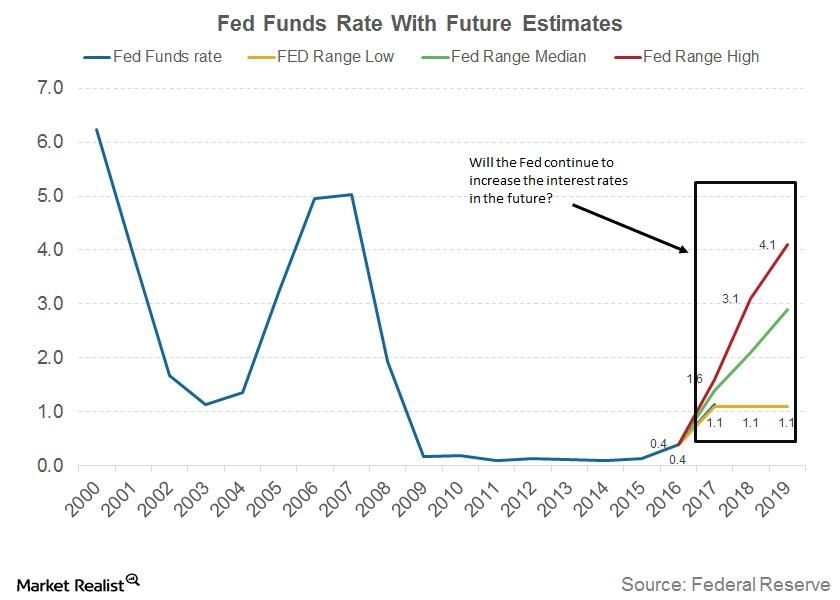

Why a December Rate Hike Shouldn’t Be Taken for Granted

Not all members of the FOMC, according to the minutes of the meeting, were on the same page with respect to a December interest rate hike.

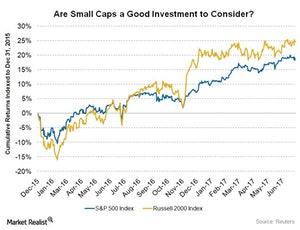

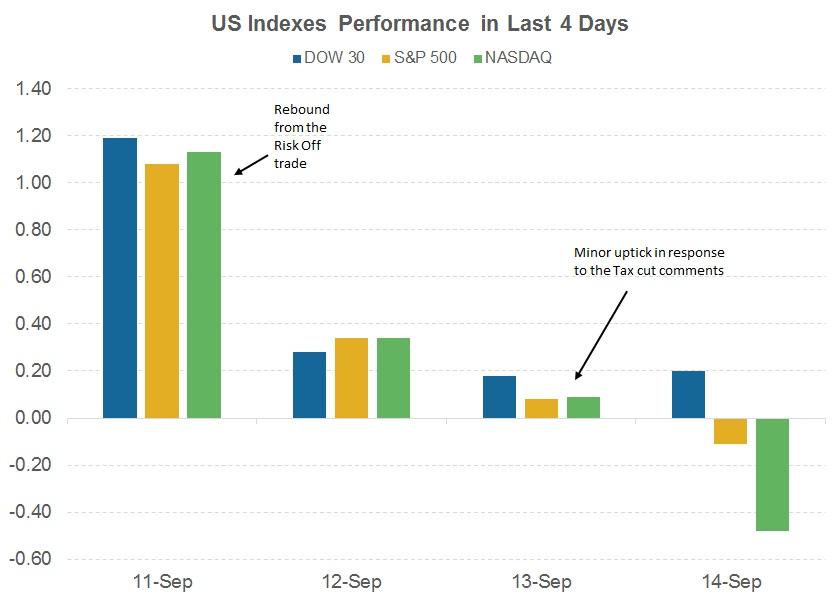

Are Small Caps Worth the Risk Right Now?

The small-cap stock universe started rallying after Trump’s victory in November.

US Dollar Is near a 10-Week High, Could Upset Crude Oil Bulls

The US Dollar Index fell 0.1% to 93.55 on October 9, 2017. However, it rose almost 1.1% last week. The US dollar (UUP) is near a ten-week high.

A Look at the Catalonia-Troubled Euro This Week

It’s possible that political pressures could keep the euro under pressure as the economic calendar remains light in the Eurozone.

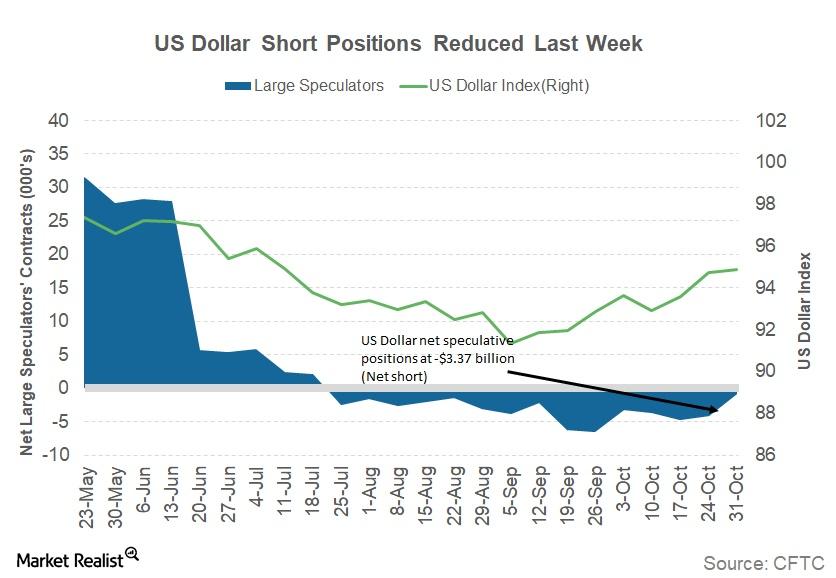

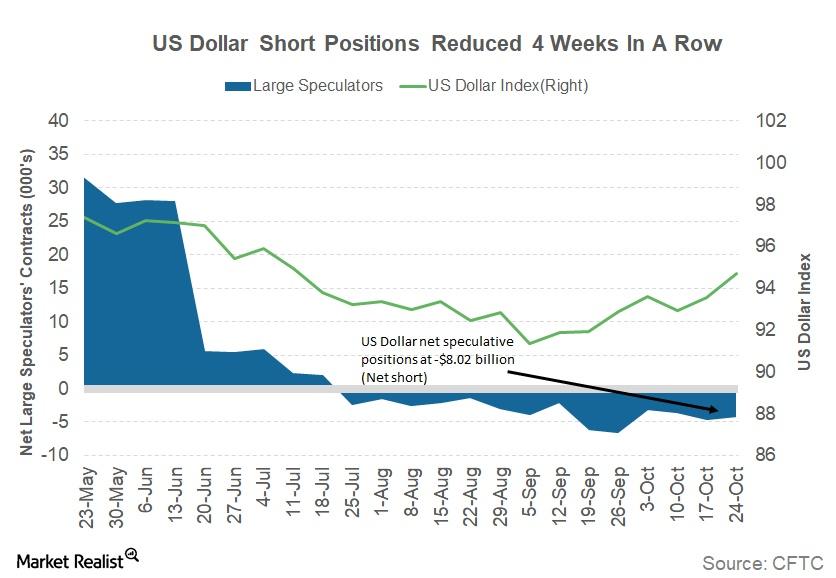

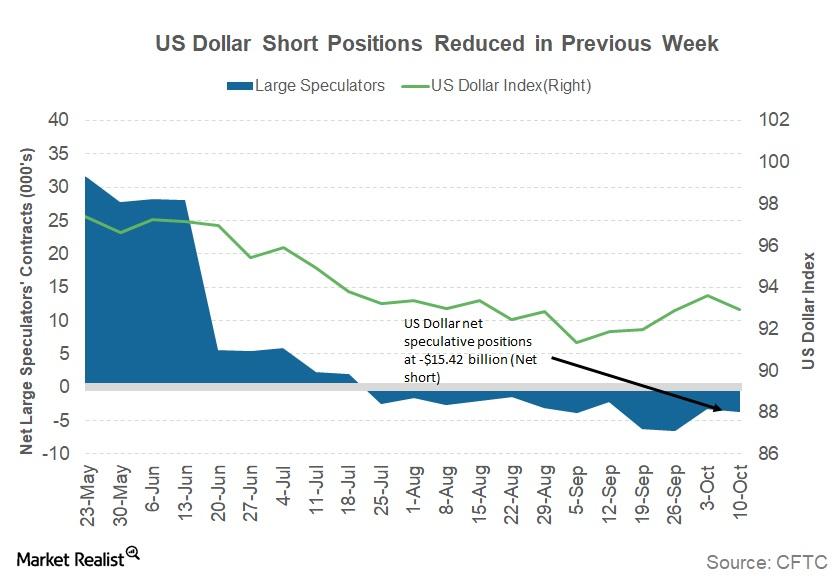

Are Investors Positioning for a US Dollar Rally?

The US Dollar Index (UUP) closed at 93.64 last week, a gain of 0.82% and the fourth consecutive weekly rise. The dollar didn’t react to a loss of 33,000 jobs in September.

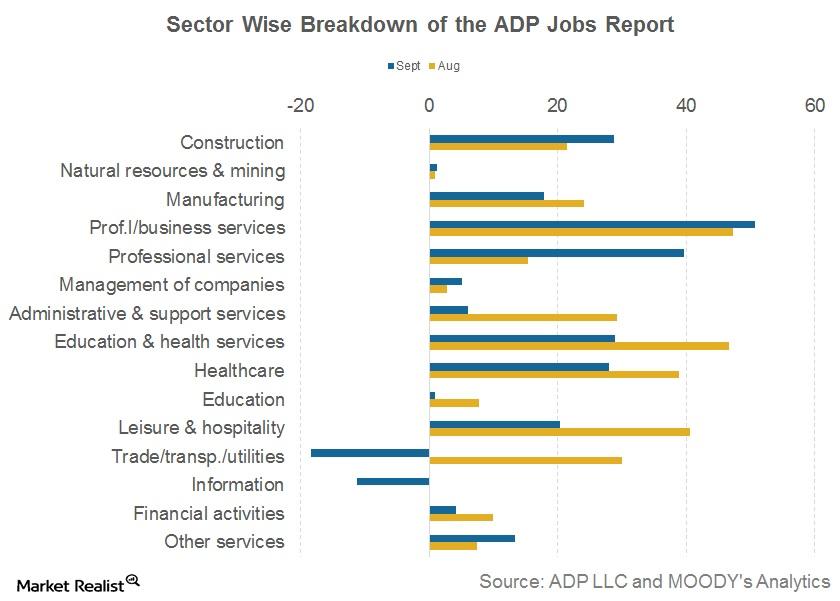

Which Job Sectors Saw the Most Impact from Hurricanes Last Month?

As per the September ADP Employment Report, there was a major drop in the number of jobs created in the trade, transport, and utility sector.

ADP Jobs Data Dragged Lower by Hurricanes in September

As per the September ADP National Employment Report, the US private sector added 135,000 jobs during the month. The figure is a sharp decrease from 228,000 in August.

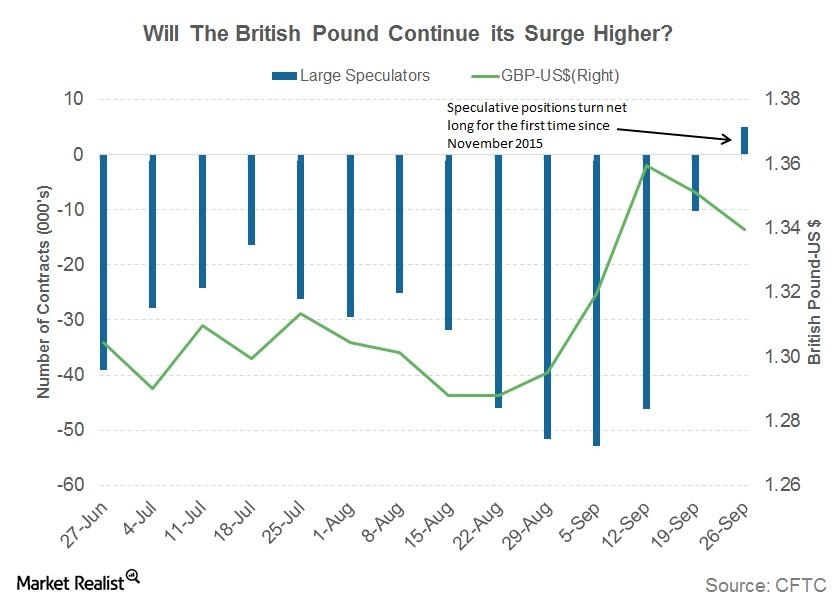

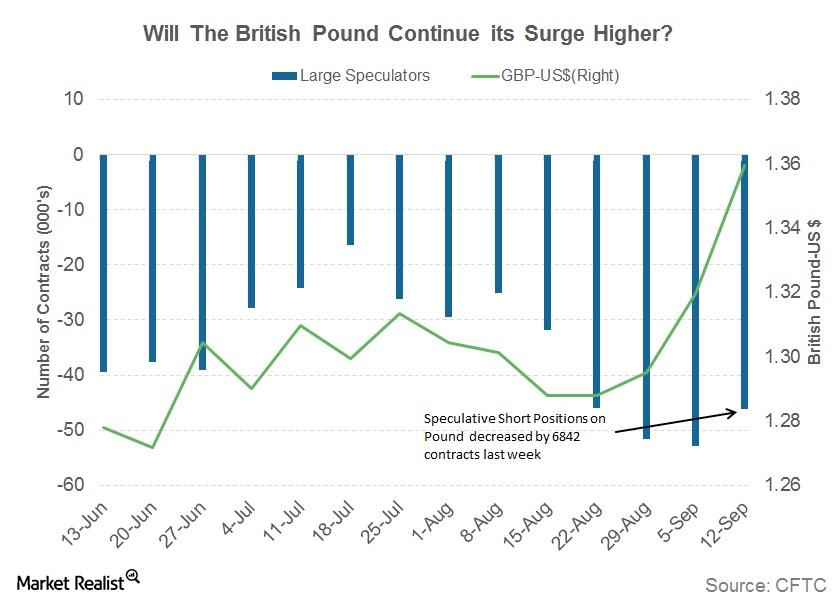

Why British Pound Speculators Turned Bullish after 22 Months

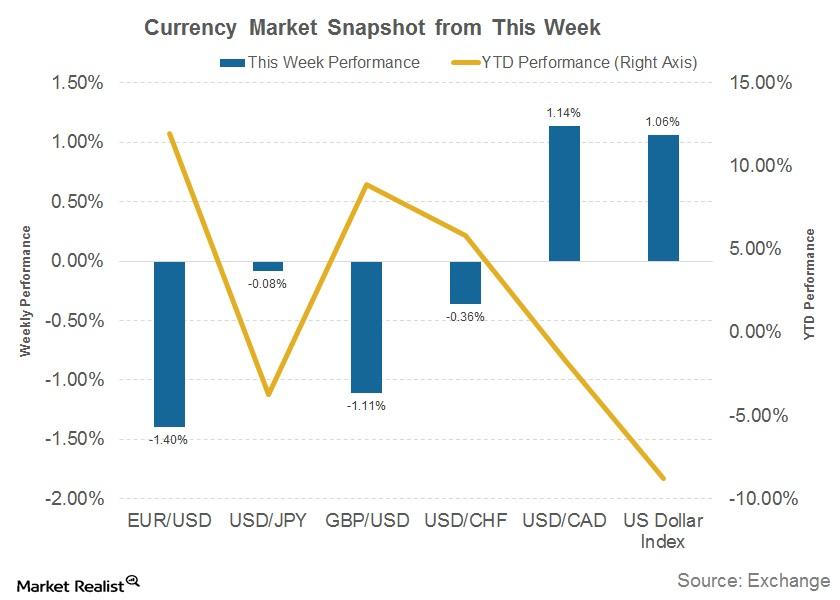

The British pound (FXB) depreciated against the US dollar for the week ended September 29. The pound (GBB) posted a weekly close of 1.3397, depreciating by 0.71% against the US dollar (UUP).

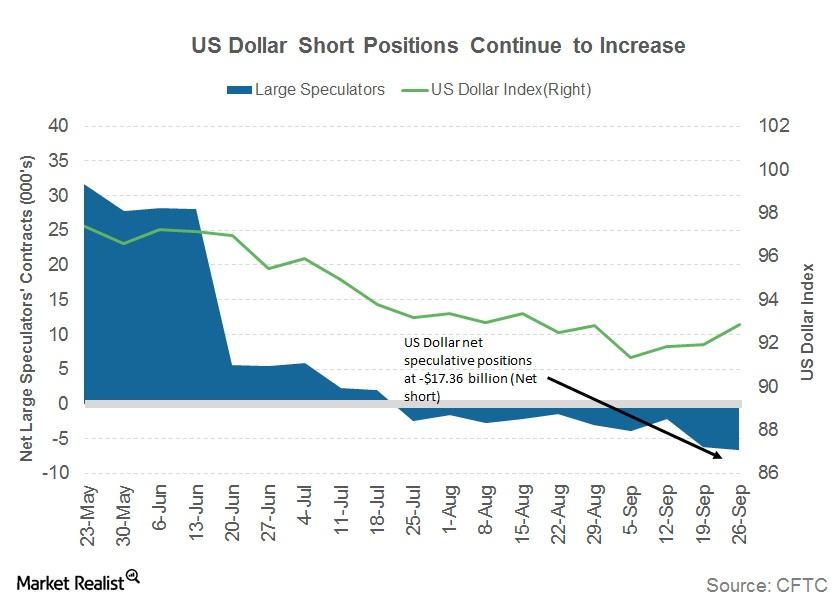

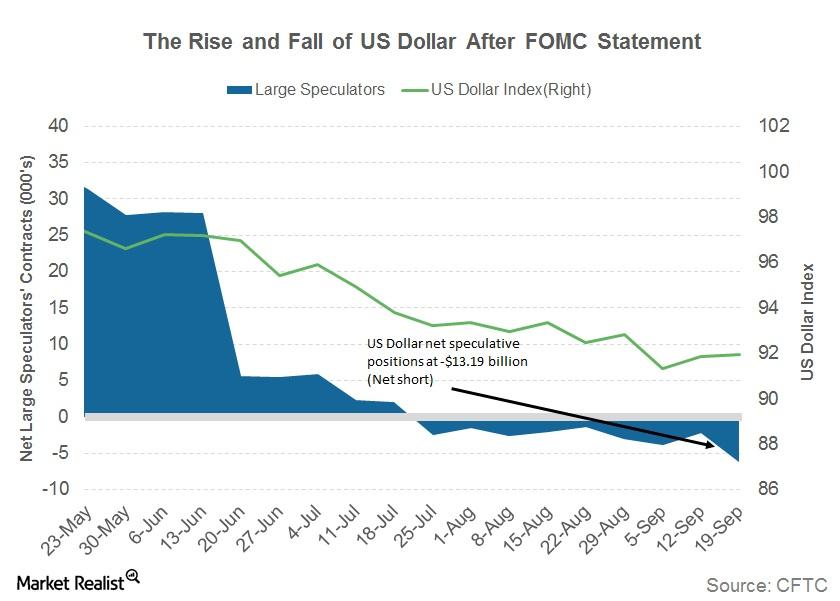

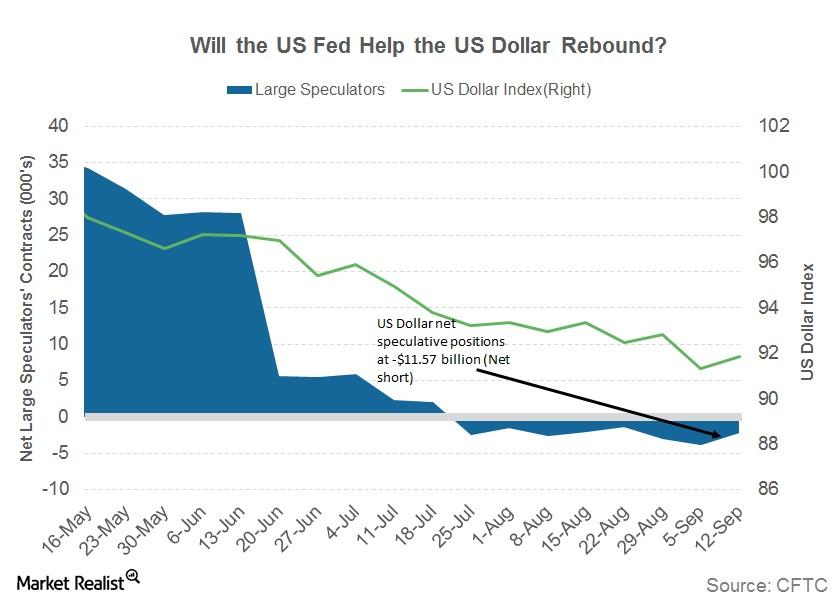

Why Speculators Continue to Bet against the US Dollar

The US Dollar Index (UUP) continued its rally last week, closing at 92.88 and posting a gain of 0.99% for the week.

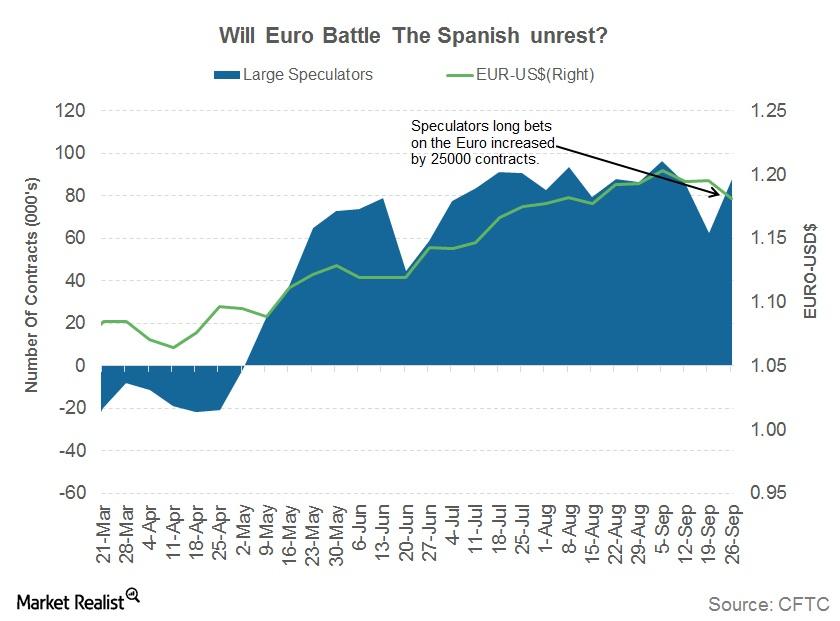

Will Spanish Unrest Drag the Euro Lower?

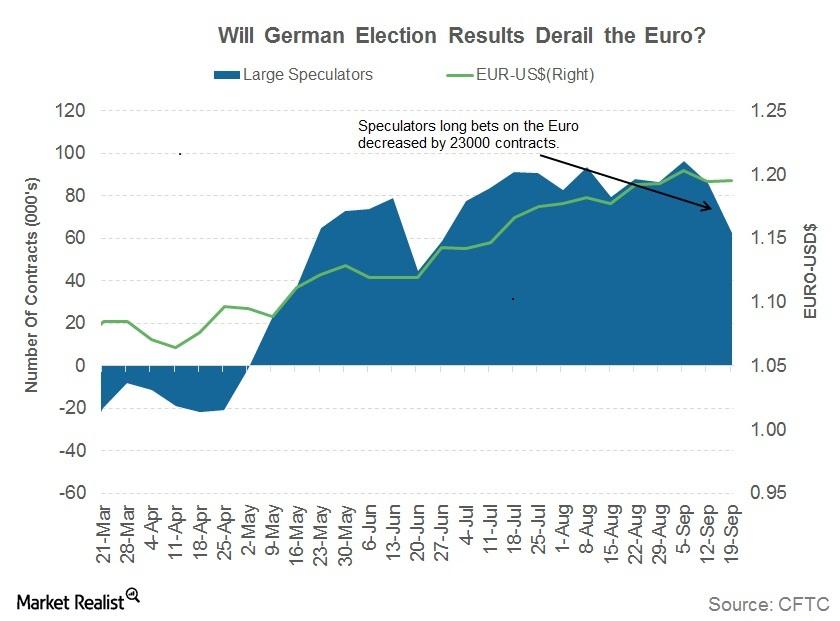

The euro-dollar (FXE) closed the week ending September 29 at 1.1814 against the US dollar (UUP). German election results had a minor negative impact on the shared currency.

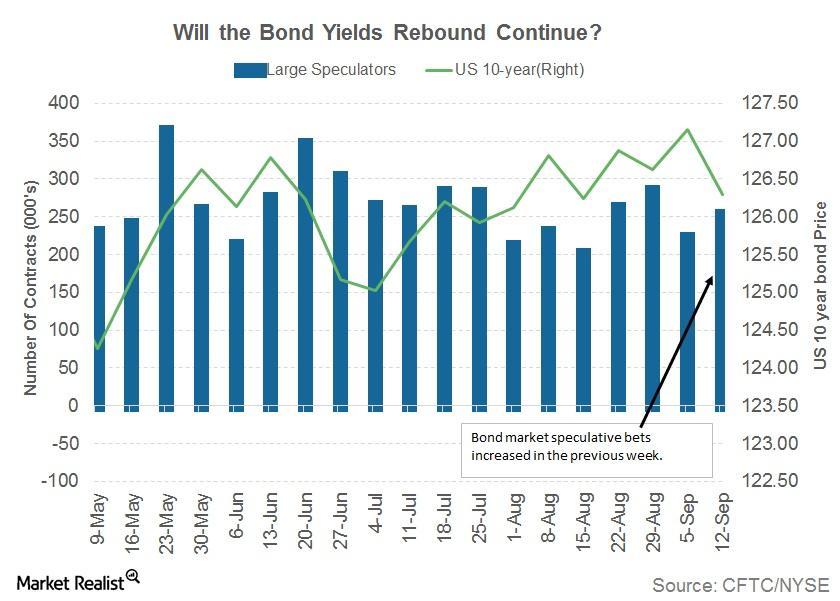

Could Rising Interest Rates Help the US Dollar?

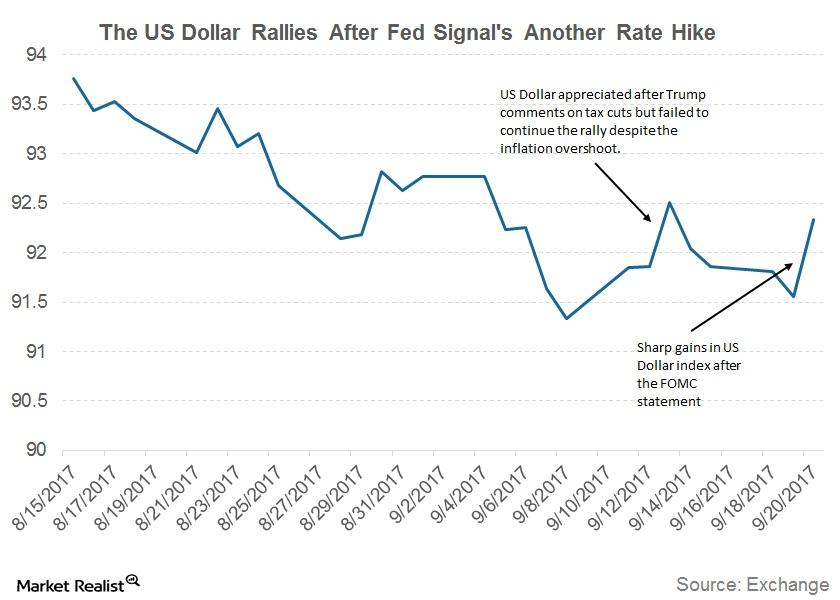

Double dose of optimism for the US dollar The US dollar (UUP) was being written off before the beginning of September, as the Fed was expected to stay on hold and other major central banks were expected to start policy normalization. However, the Fed had a surprise in store for the market. The FOMC’s (Federal Open […]

Will a Coalition Government in Germany Derail the Euro?

The euro-dollar (FXE) closed the week ending September 22 at 1.2 against the US dollar (UUP).

Why the US Dollar Failed to Rally despite Increased Rate Hike Odds

The US Dollar Index (UUP) failed to rally aggressively despite a hawkish surprise from the US Fed.

US Dollar Could Help Crude Oil Futures

The US Dollar Index fell 0.1% to 91.97 on September 22, 2017. However, the US dollar rose 0.7% on September 20, 2017, after the FOMC’s meeting.

Precious Metals, Miners and the Scaling Dollar

Later in the day on September 20, after rising gold prices fell on the US Federal Reserve’s indication of one more interest rate hike in 2017.

Assessing the US Dollar’s Rally after the Latest Hawkish Fed Statement

The US dollar rallied after the latest FOMC (Federal Open Market Committee) meeting statement was released on September 20.

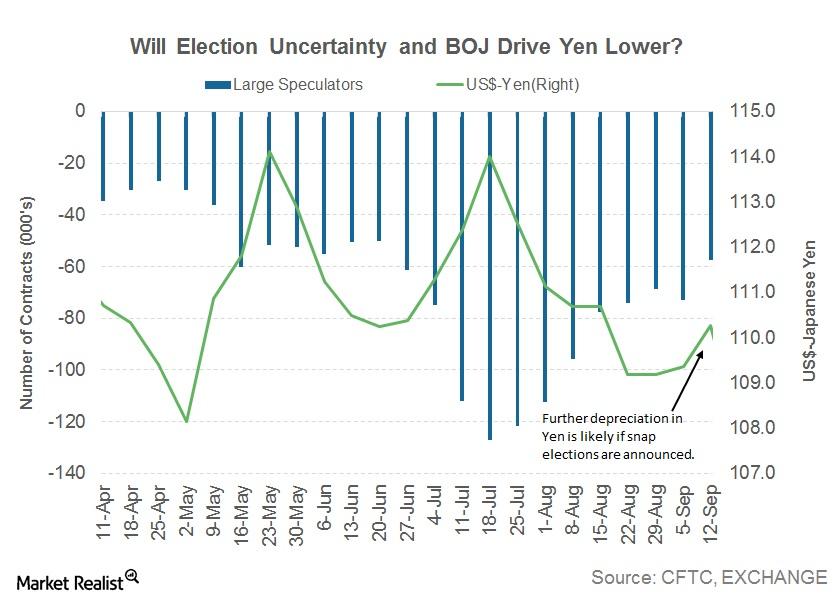

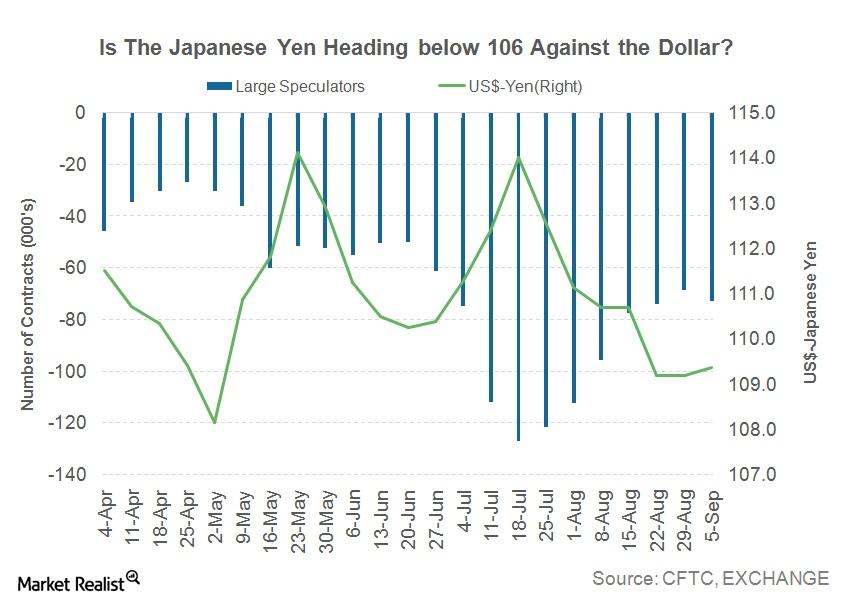

Will Election Uncertainty Drive the Japanese Yen Lower?

The Japanese yen (JYN) continued to depreciate against the US dollar last week.

Why the British Pound Rallied to 15-Month High

The British pound (FXB) appreciated against the US dollar for the week ending September 15.

Will the FOMC Meeting Drive the US Dollar and Crude Oil Futures?

The US Dollar Index fell 0.27% to 91.86 on September 15. It’s near a 33-month low. Prices fell due to the surprise decline in US retail sales in August.

Why the US Dollar Saw a Sharp Rebound

The US Dollar Index (UUP) witnessed a sharp recovery last week, rebounding from a two-year low of 91.0.

Why Was the Euro a Silent Spectator Last Week?

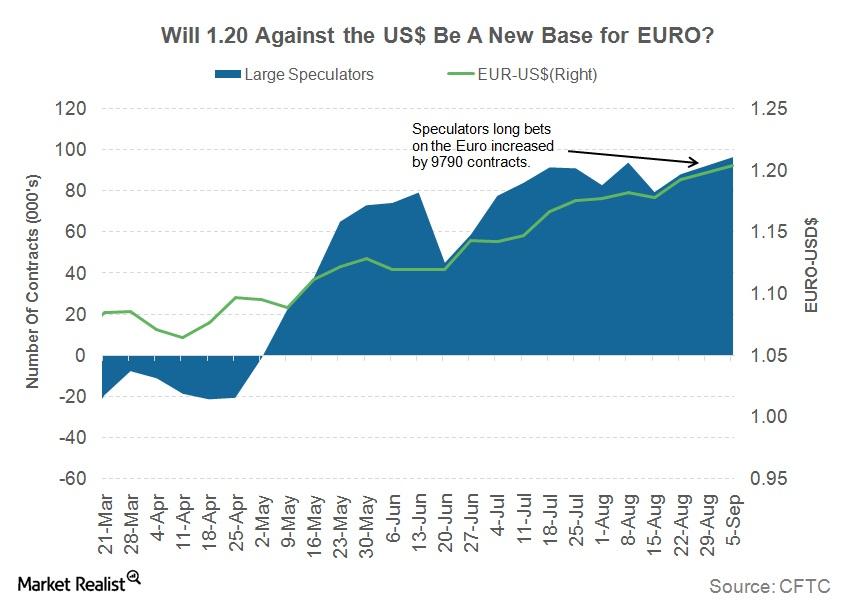

As per the latest Commitment of Traders (or COT) report, released on Friday, September 15 by the Chicago Futures Trading Commission (or CFTC), speculators turned bullish on the euro during the week.

Understanding the Ups and Downs of the US Dollar

The US dollar has been on a roller coaster ride over the last ten trading sessions. The US dollar (UUP) index hit a low of 90.99 on September 8.

What Drove the Japanese Yen below 108 Last Week?

The Japanese yen gained ground against the US dollar last week, closing at 107.8 against the US dollar, which appreciated 0.56%.

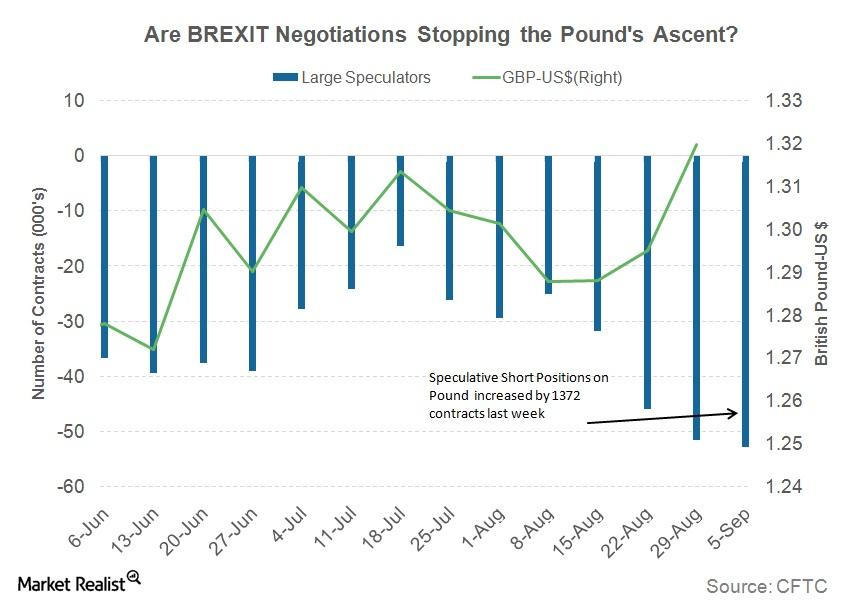

The Reason behind the Sharp Gains in the British Pound

The British pound (FXB) appreciated against the US dollar for the week ended September 8, 2017. The pound closed at 1.32, appreciating 1.9% against the US dollar.

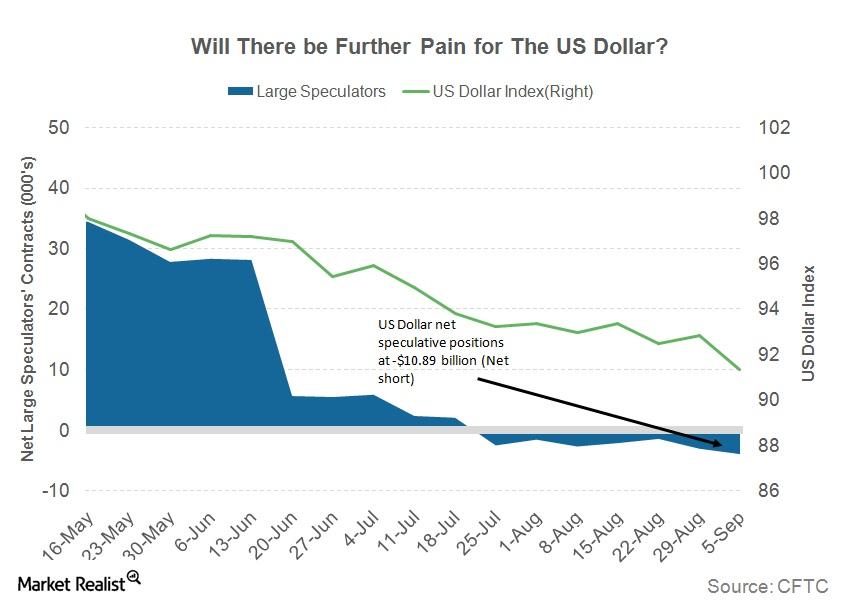

Why the US Dollar Could Be Poised for Further Losses

The US Dollar Index (UUP) failed to hold onto its gains from the previous week as investors were convinced that the Fed most likely wouldn’t make any changes to its monetary policy this year.

Why the Euro Rose to a 3-Year High Last Week

The euro closed the week ended September 8, 2017, at ~1.20 against the US dollar. It rose 1.48% against the US dollar as euro bulls took charge.

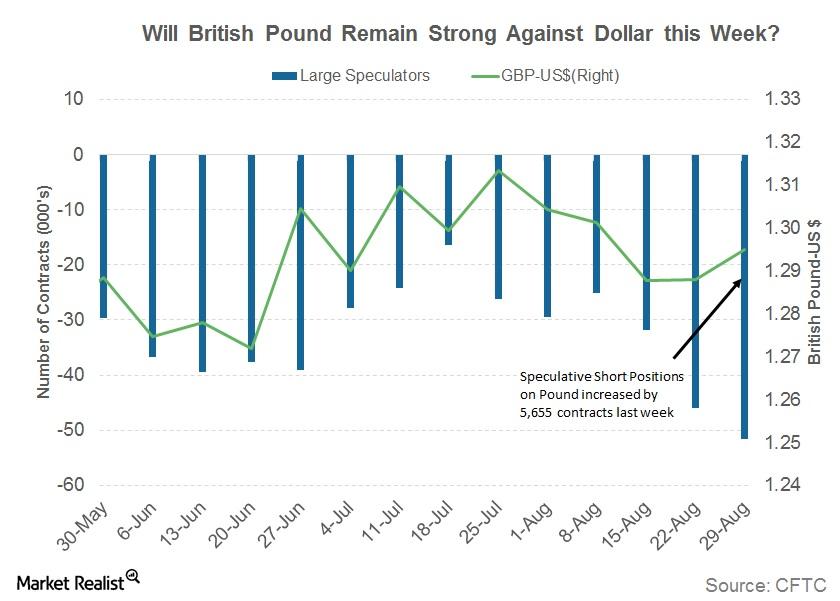

Can the British Pound Continue to Remain Strong This Week?

The British pound (FXB) appreciated marginally against the US dollar for the week ended September 1, 2017.