PowerShares DB US Dollar Bullish ETF

Latest PowerShares DB US Dollar Bullish ETF News and Updates

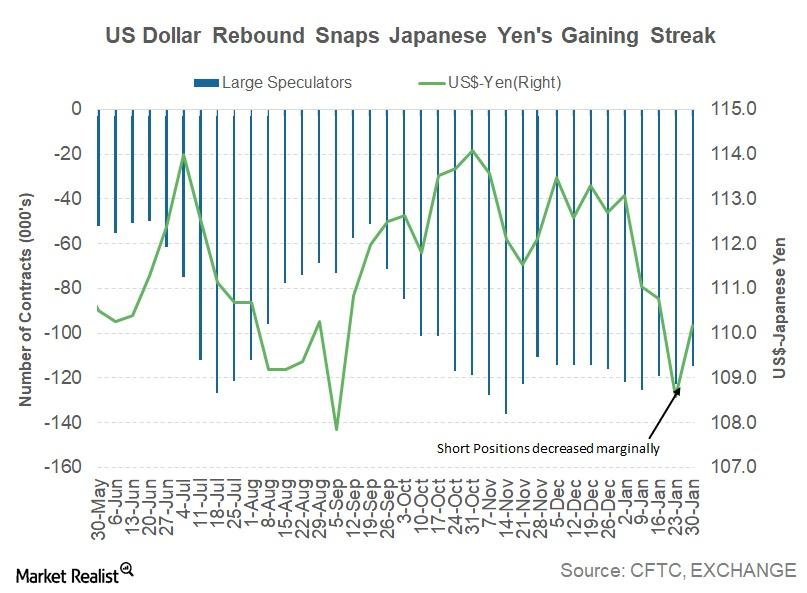

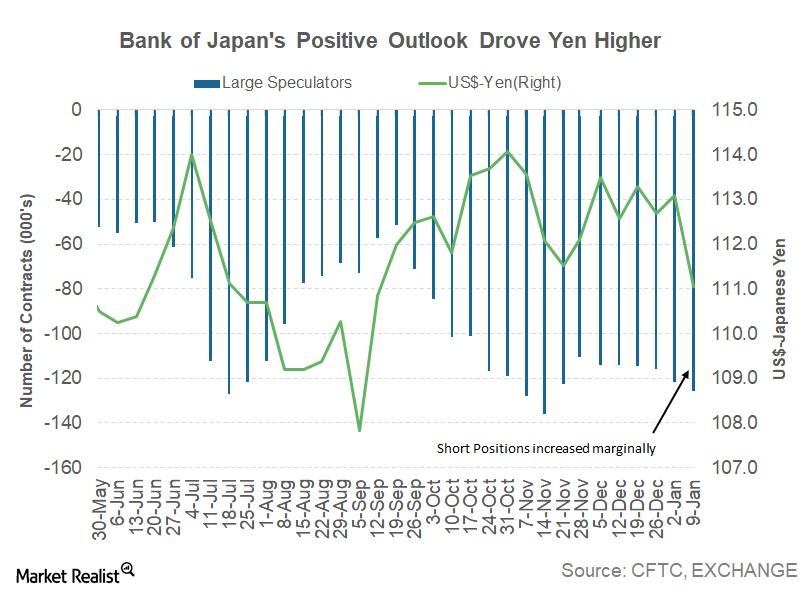

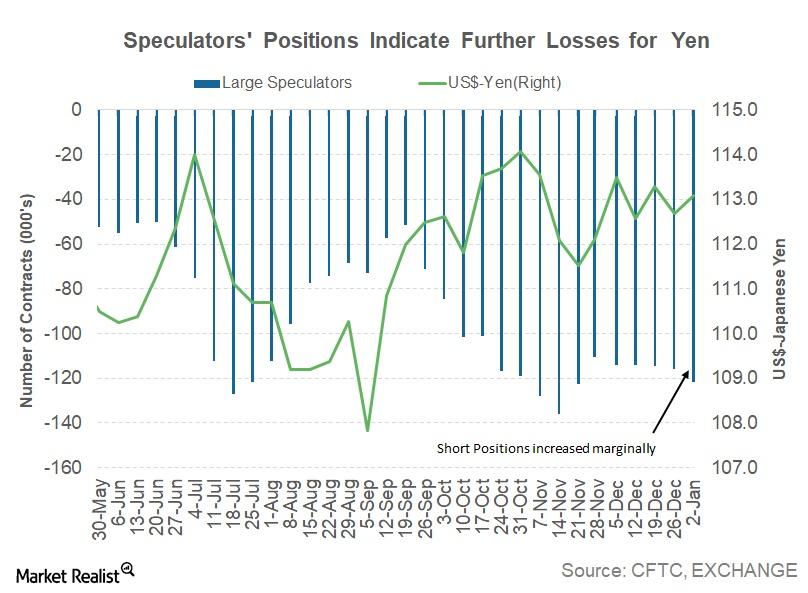

Why the Japanese Yen Depreciated against the Dollar Last Week

The Japanese yen (JYN) retracted against the US dollar last week as US dollar bulls tried to take control.

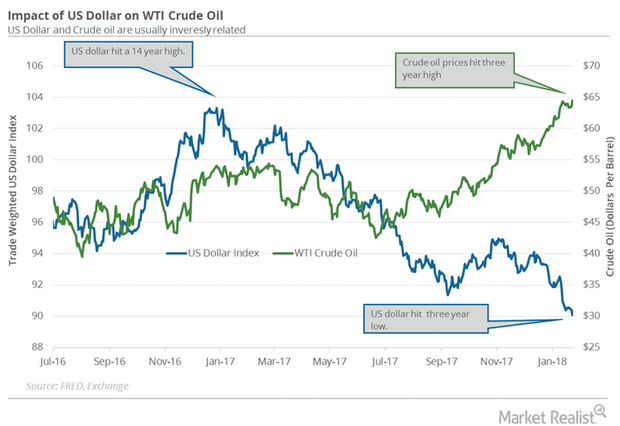

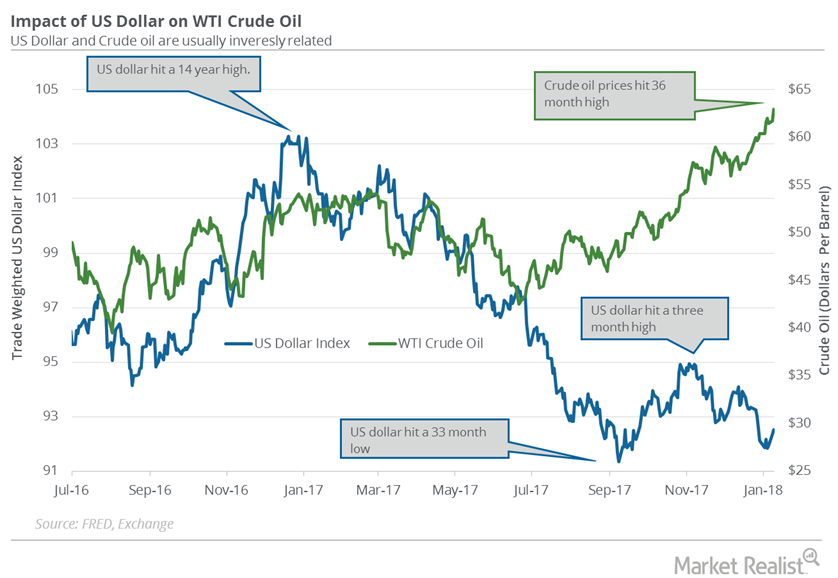

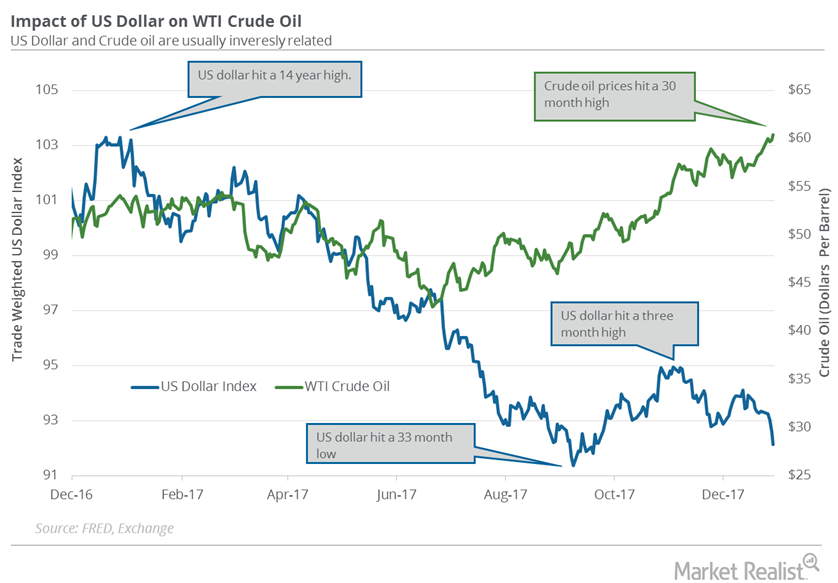

US Dollar Hit a 3-Year Low: Is It Bullish for Crude Oil?

The US Dollar Index (UUP) fell 0.34% to 90.09 on January 23—the lowest level since December 2014. The fall supported crude oil prices on January 23, 2018.

Is Bitcoin a Bubble?

The price of bitcoin (SOXL) (SOXX) has risen 69,278.6% over the last five years. On the other hand, in the last seven days, it has plummeted 27% to $12,466.

Is Bitcoin Ready to Replace Real Currency?

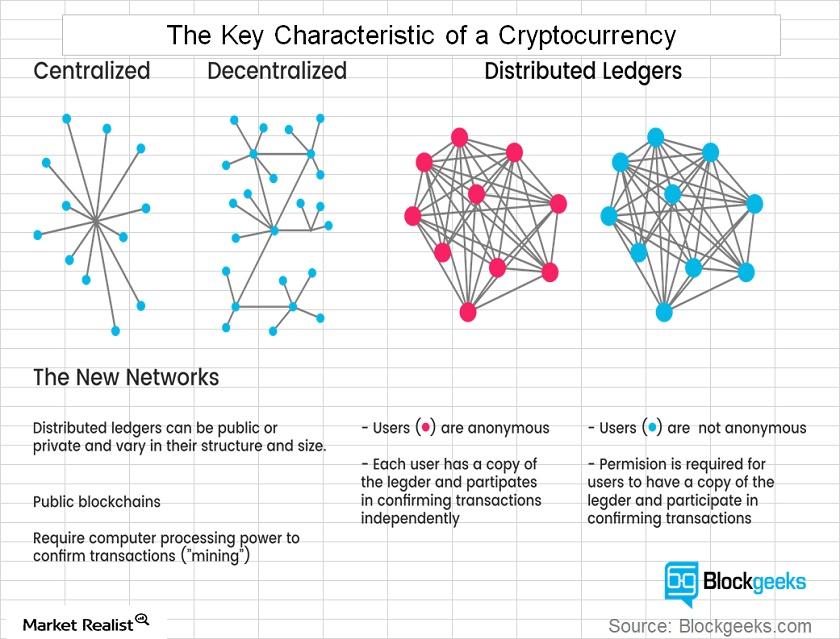

Despite the higher number of transactions that need to be updated regularly by users, the transaction capacity is intentionally kept very low by the bitcoin founders.

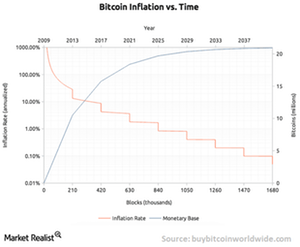

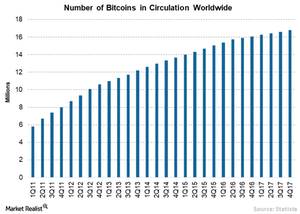

Why the Number of Bitcoins Is Limited

The founders of bitcoin have set a limit of 21 million bitcoins that can be mined over a period of time. Of those, 16.8 million are already in circulation.

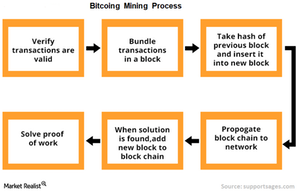

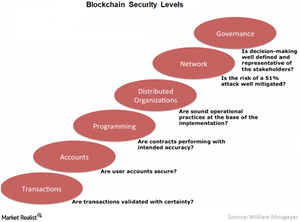

How Blockchain Technology Could Reduce Criminal Activities

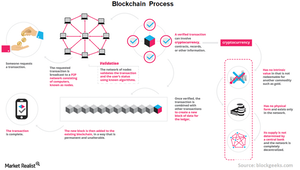

Before updating data on a blockchain, users must agree about the veracity of the transaction through a process called consensus.

How Digital Assets Could Generate Income

Blockchain technology holds a lot of promise due to its many advantages such as transparency, faster transactions at lower costs, and a reliable system.

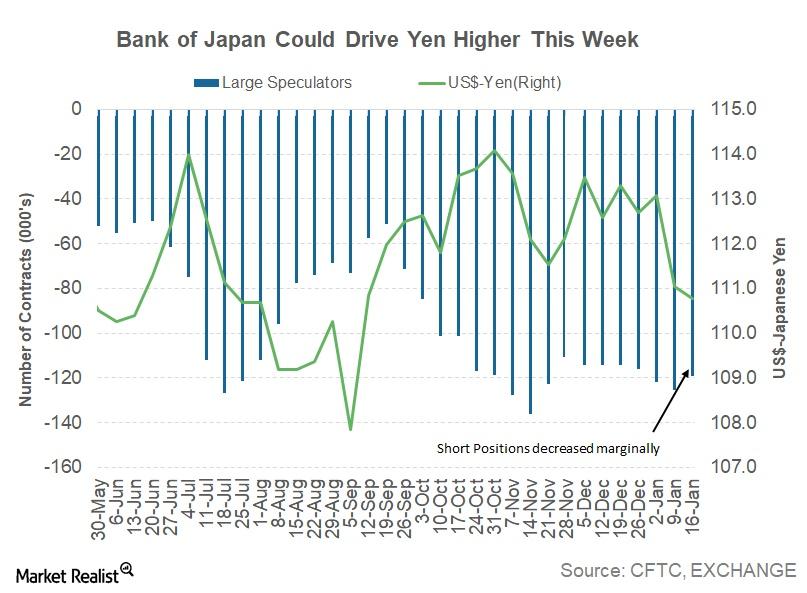

Could the Bank of Japan Drive the Yen Lower this Week?

The Japanese yen (JYN) registered its second consecutive weekly gain against the US dollar.

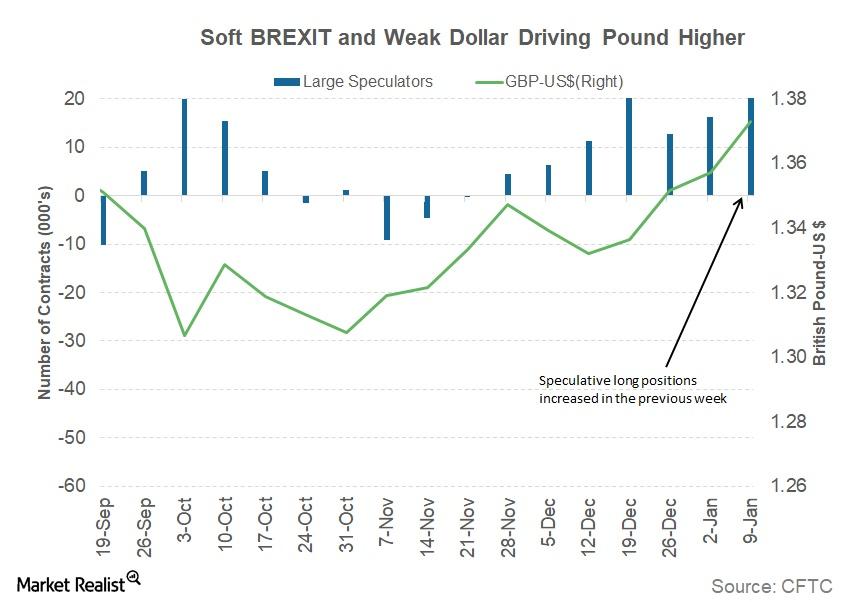

Factors that Drove the British Pound over 1.38 against the Dollar

During the week ended January 29, 2018, British equity markets (BWX) were supported by the prospect of a soft Brexit.

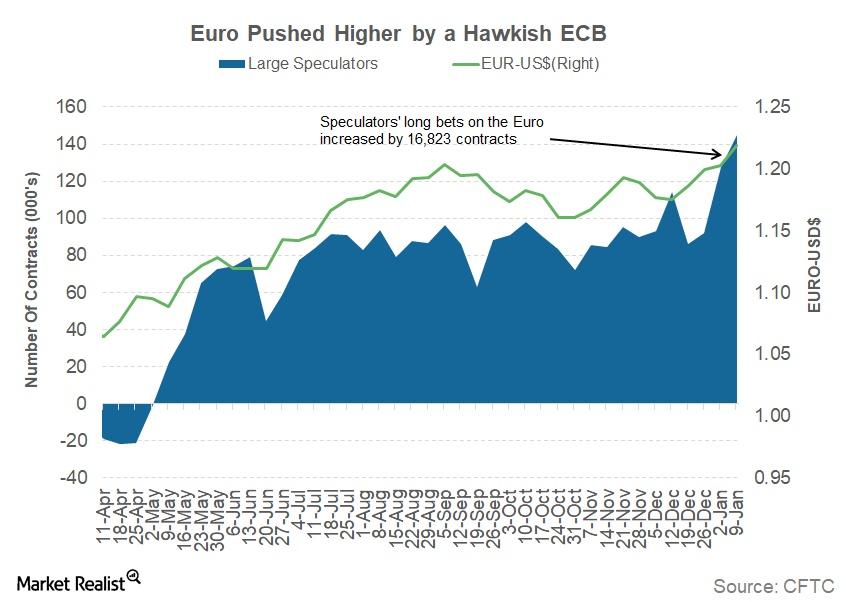

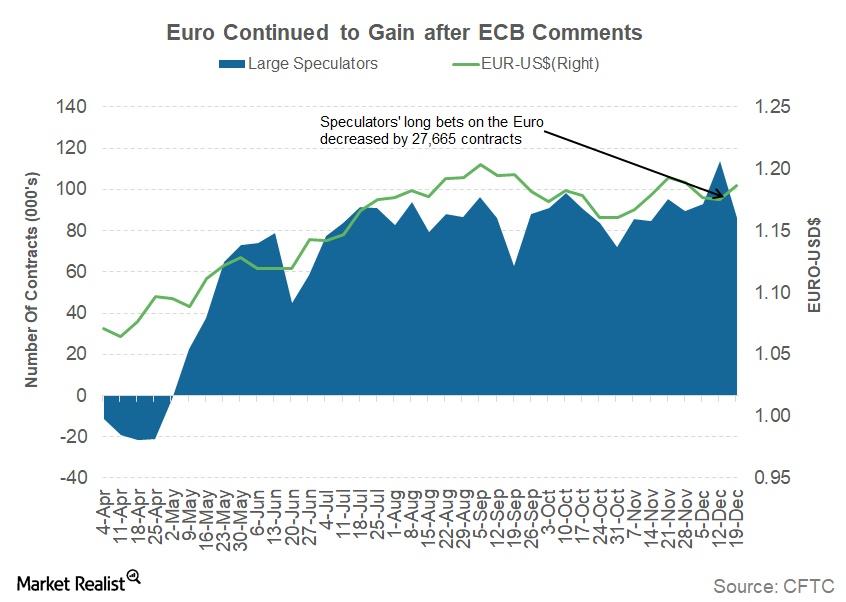

Politics and Central Bank Comments Could Drive the Euro Higher

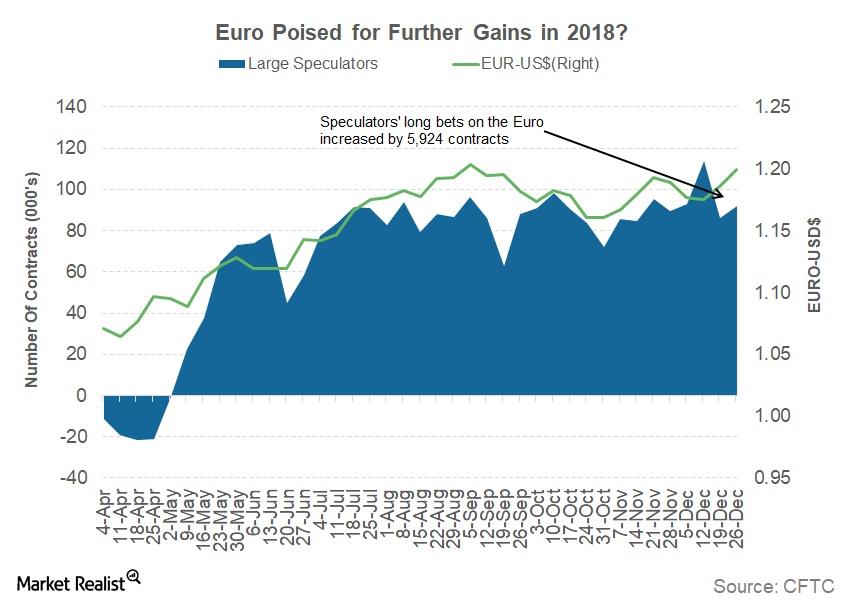

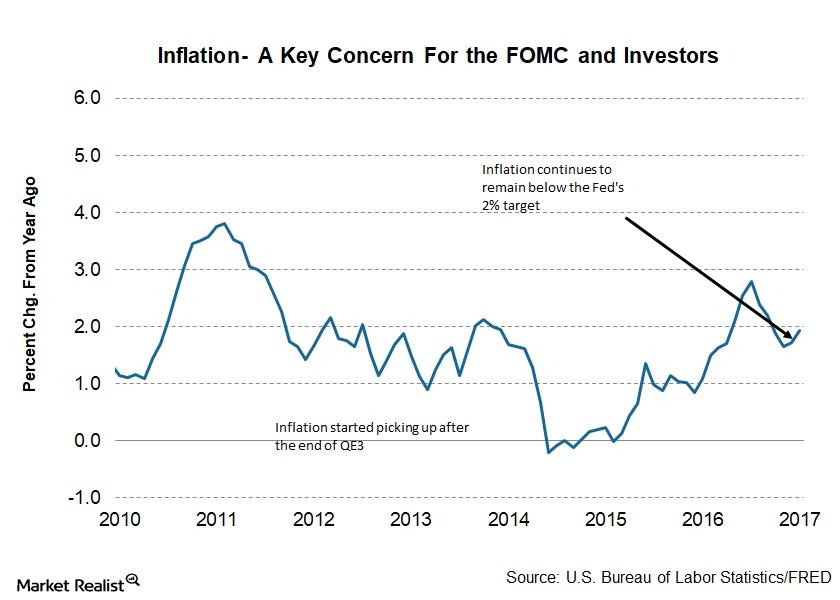

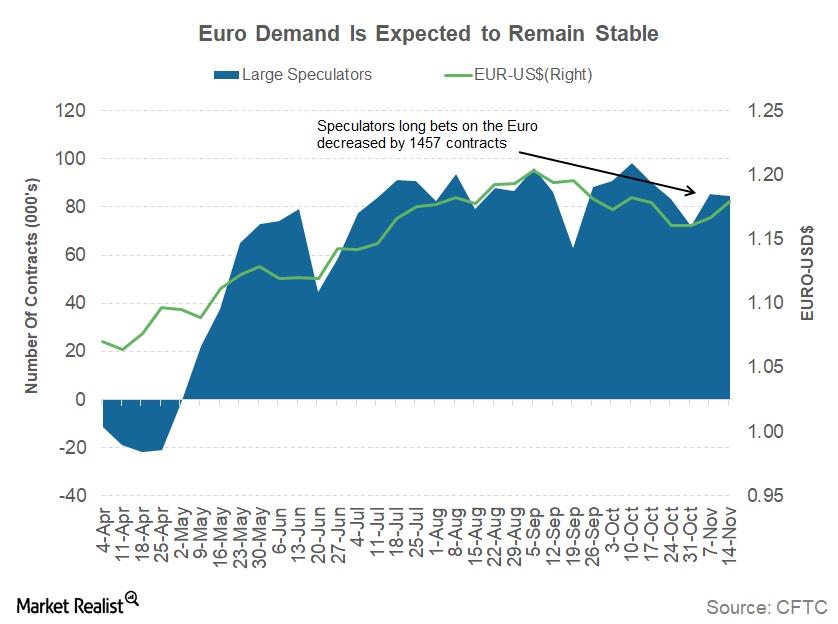

The Eurozone’s inflation data published on January 17 indicated that prices increased 1.4% in December 2017, which is still below the long-term average.

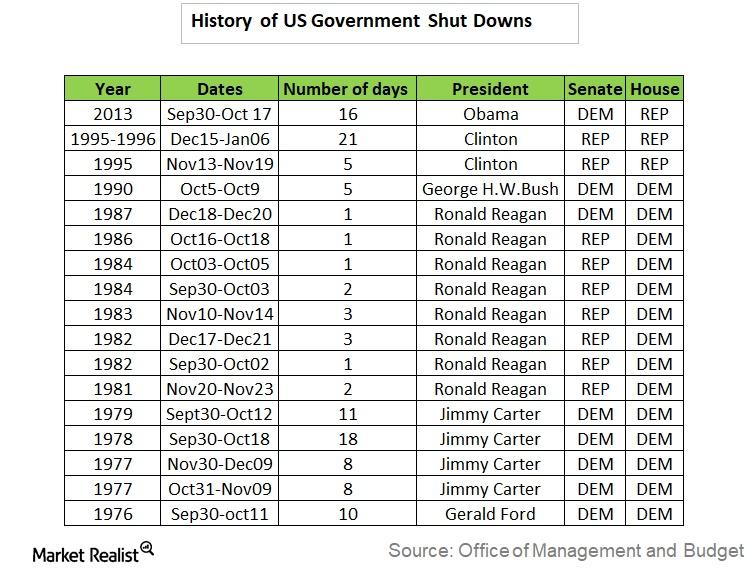

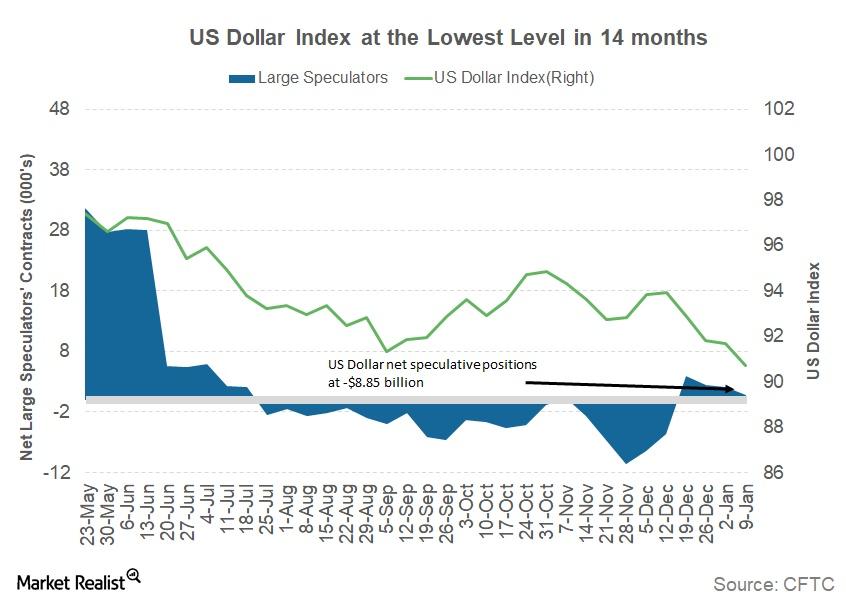

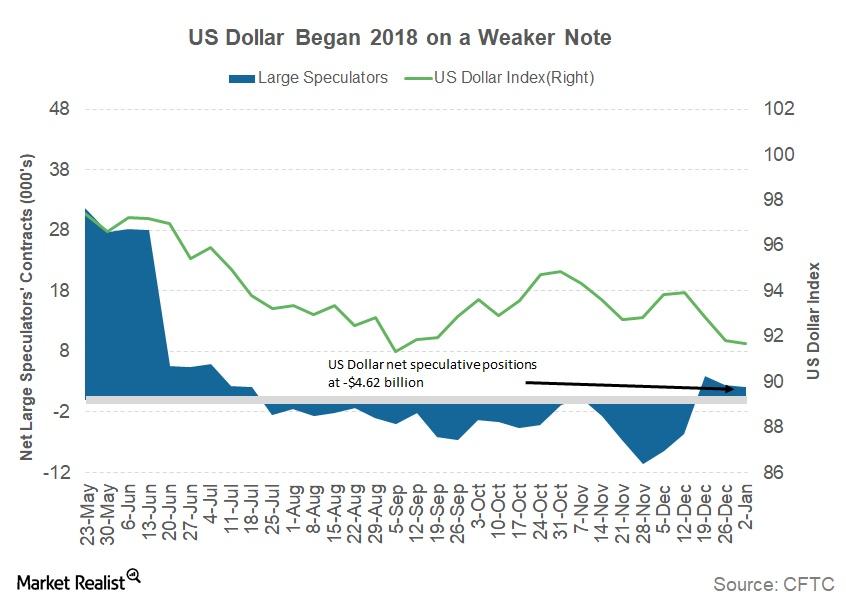

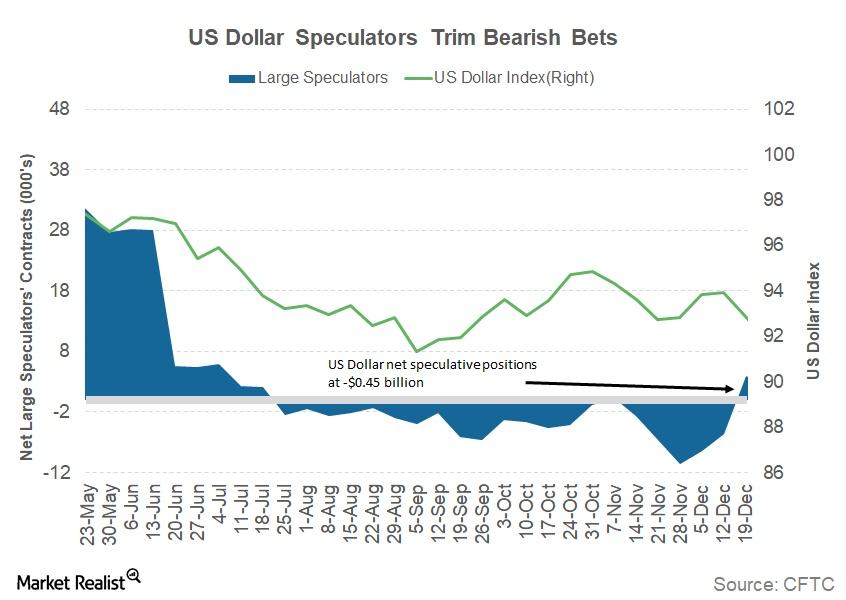

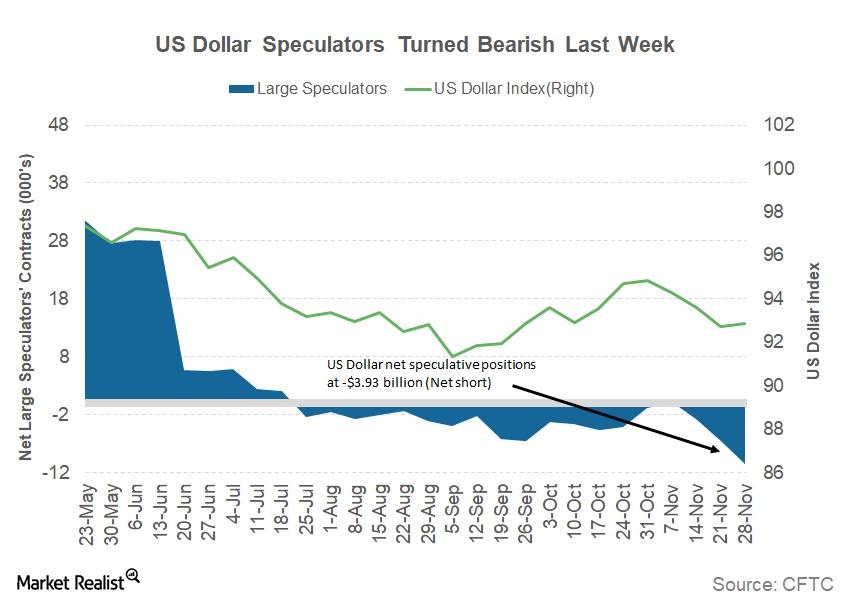

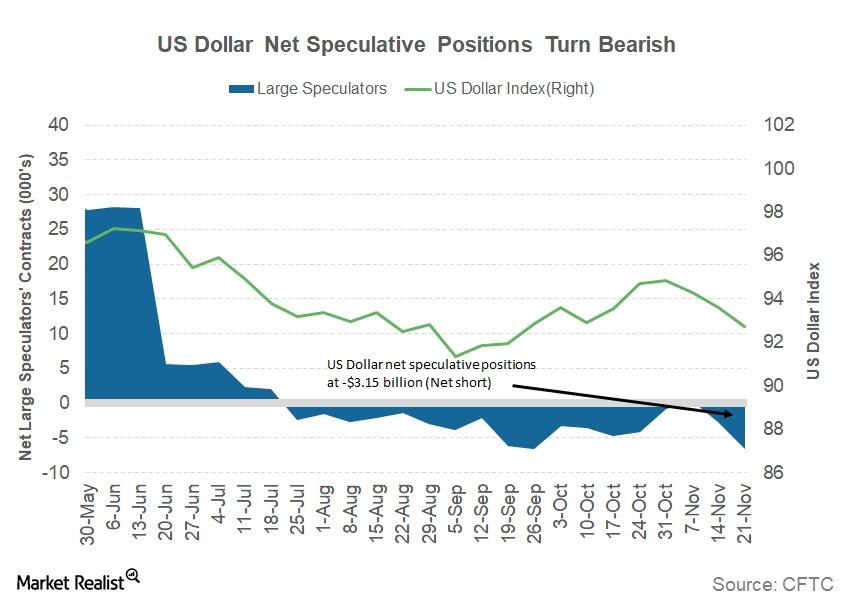

How the US Dollar Could React to a US Government Shutdown

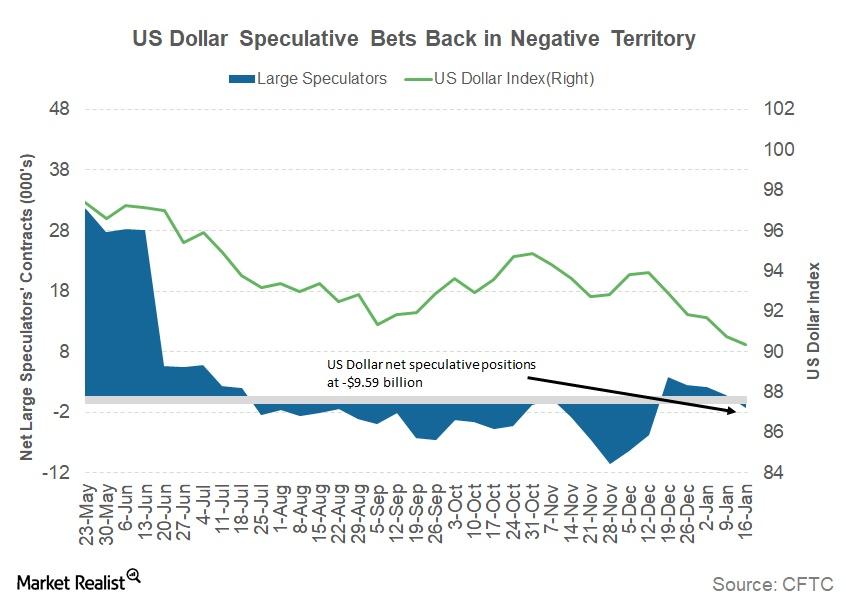

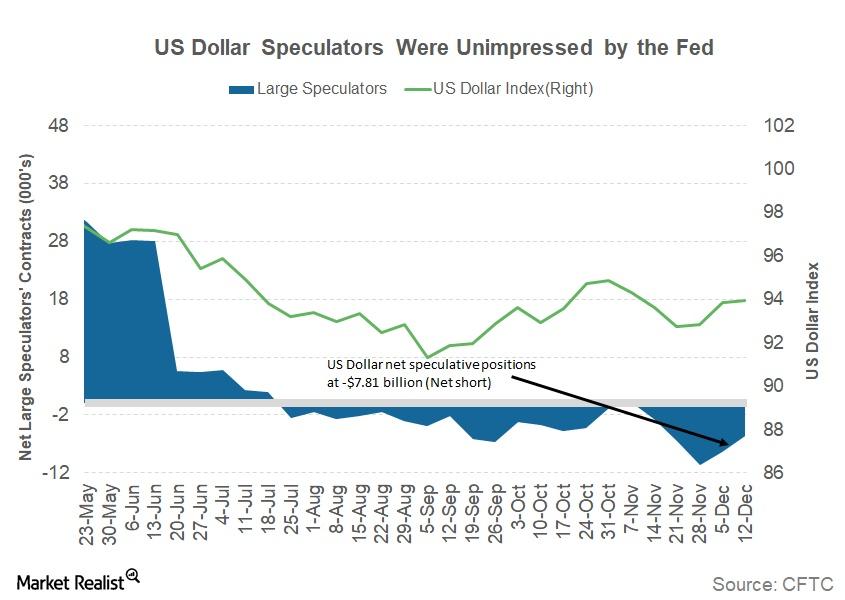

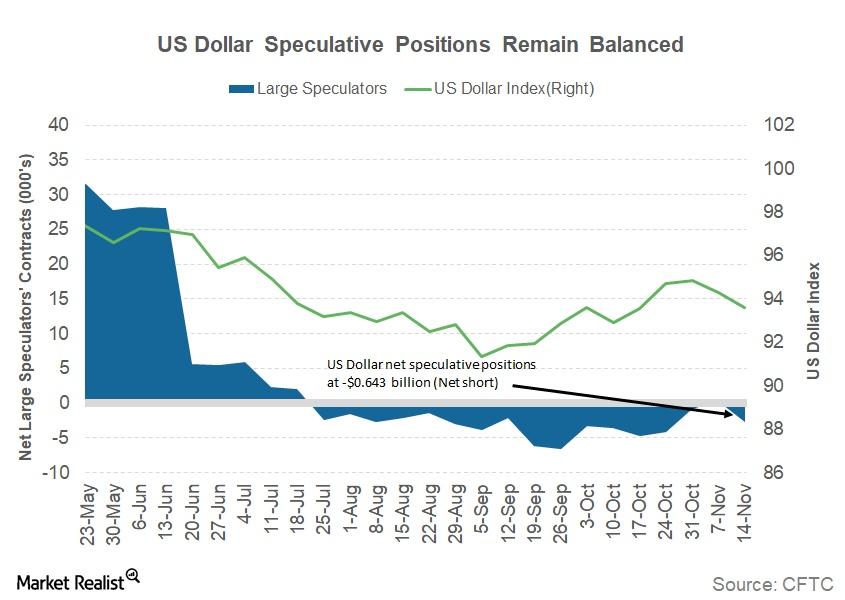

According to the January 19 Commitment of Traders report, released by the Chicago Futures Trading Commission, large speculators have turned bearish on the US dollar.

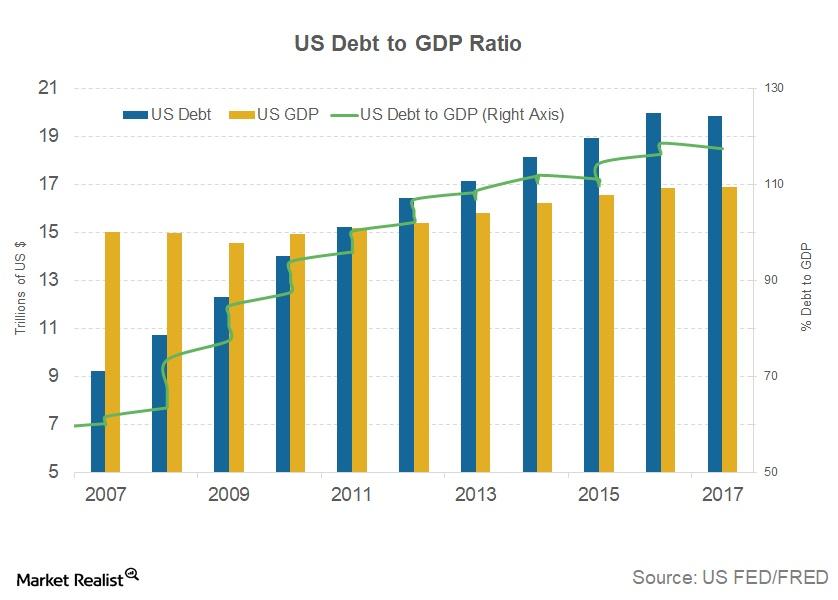

What Could Happen if the US Debt Ceiling Isn’t Raised

The failure of US Congress to raise the debt ceiling would result in a partial government shutdown. The US Treasury wouldn’t be able to issue any government debt, and it could end up borrowing from its retirement savings fund.

Your Guide to the US Debt Ceiling

The current debt ceiling is likely to be breached on January 19, and once that happens, the US Treasury must stop issuing any new debt (SHY).

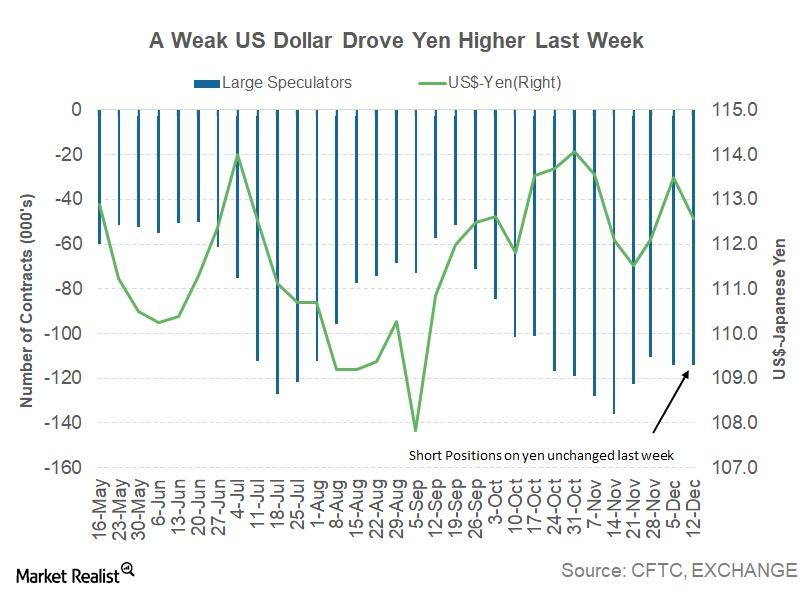

Why the Japanese Yen Finally Appreciated against the US Dollar

During the week ended January 12, the yen (FXY) closed at 111.04 against the US dollar (UUP), compared to 113.08 in the week ended January 5, appreciating by 1.8%.

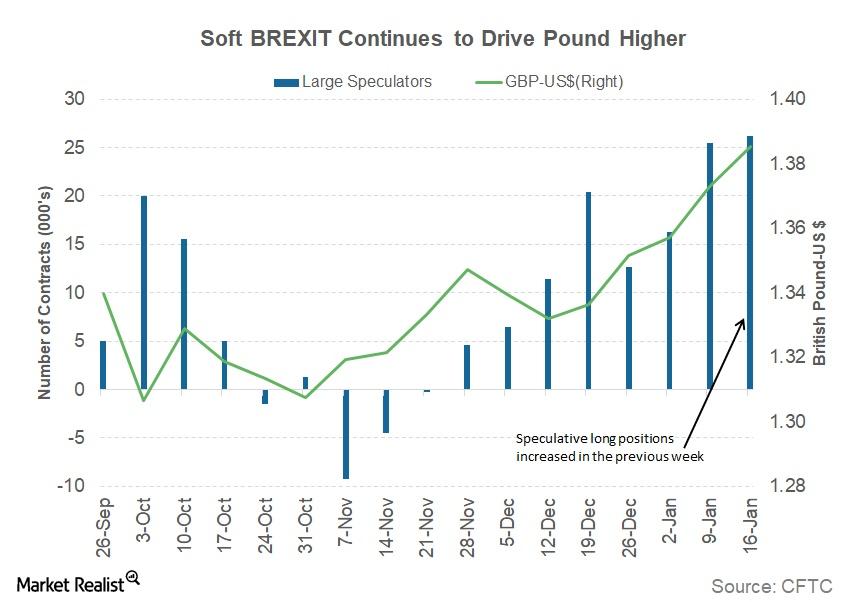

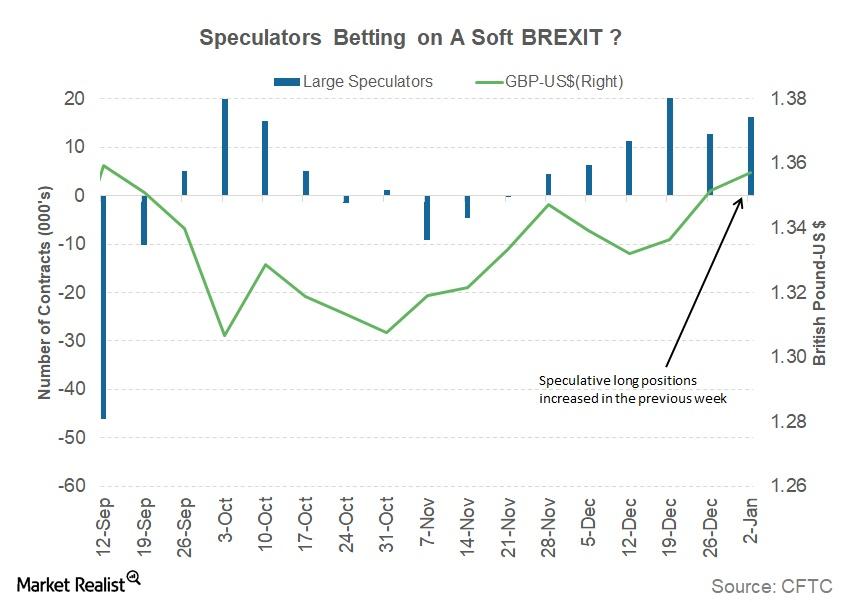

Why a Soft Brexit Possibility Is Driving the British Pound Higher

The gains in the British pound were driven by the higher chances of a soft Brexit deal, which could see economic relations between the UK and the EU remain mostly unchanged.

What Factors Are Driving the Euro Higher?

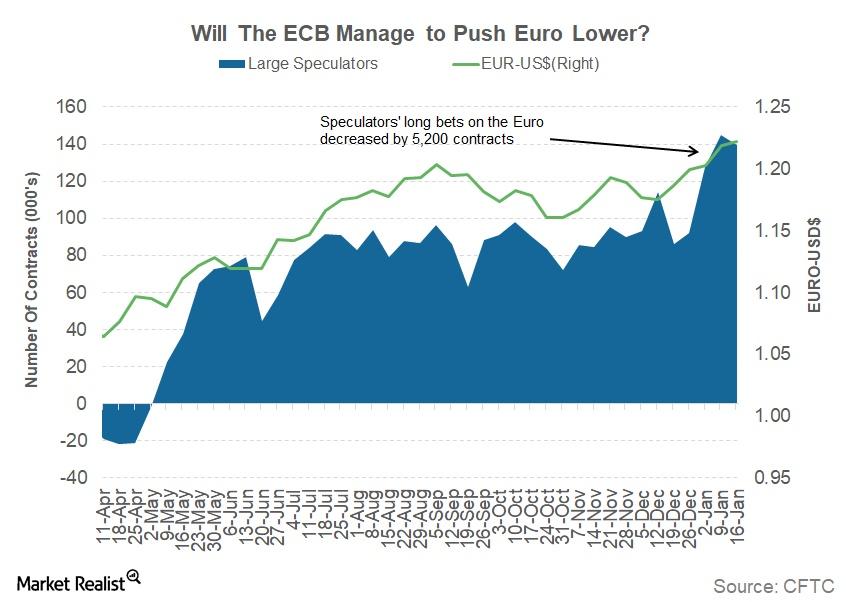

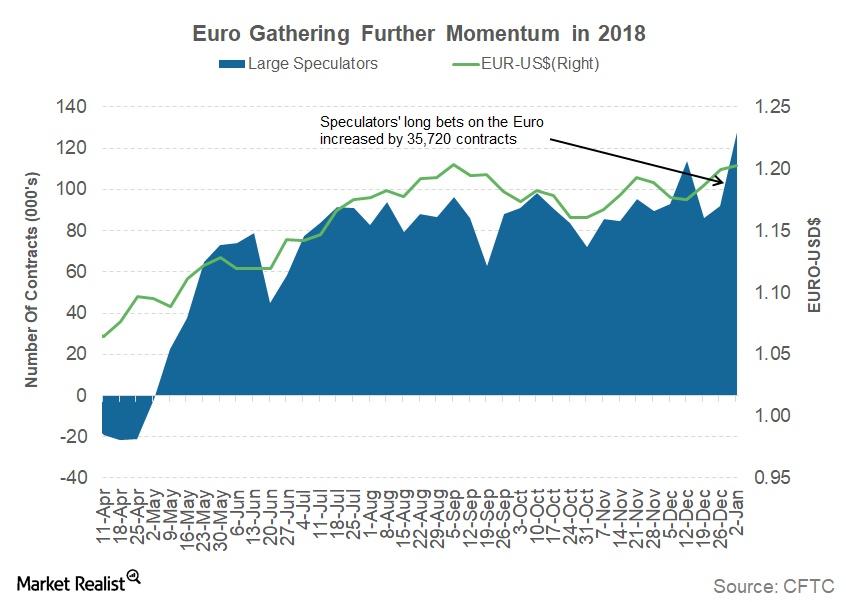

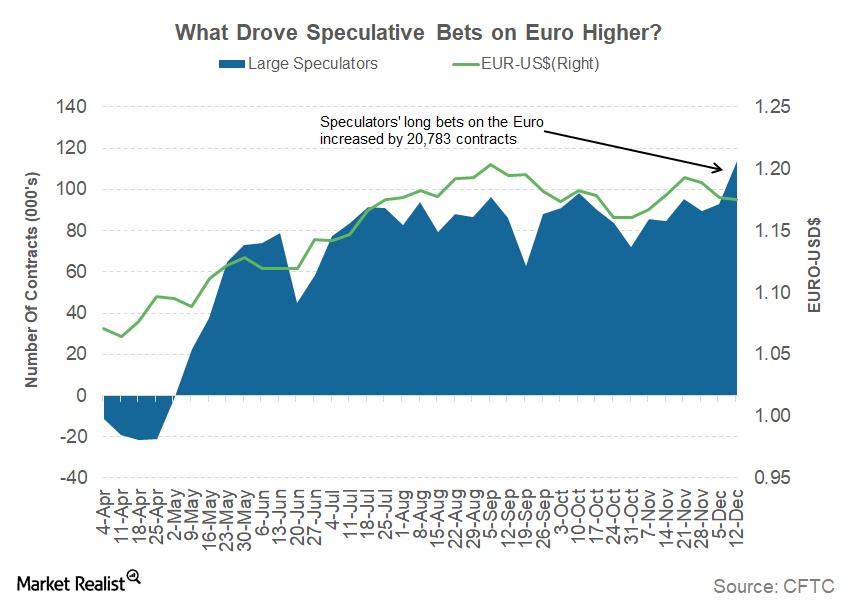

According to the January 12 Commitment of Traders report, speculators increased their long euro positions by 16,823 contracts last week.

Why the US Dollar Is Losing Its Appeal

The US Dollar Index (UUP) continued its decline, posting a fourth consecutive weekly loss during the week ended January 12.

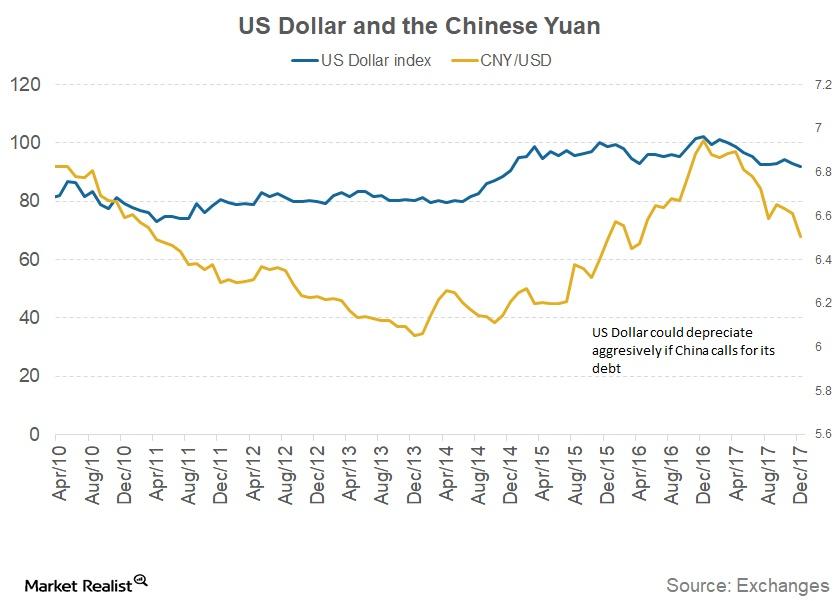

What Could Happen If China Wants Its Money Back?

If the Chinese government decides to sell its US debt (GOVT) holdings, it could lead to another possible global financial crisis.

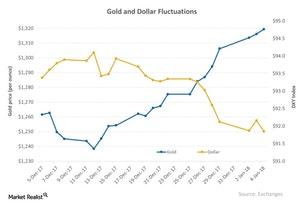

The Dollar and Its Relationship to Precious Metals

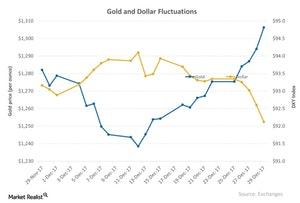

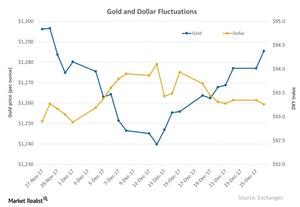

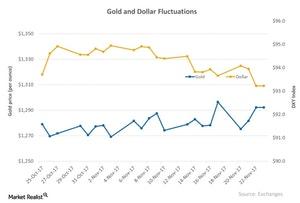

The US dollar rose 0.18% on Tuesday, January 9, 2018, which led to the lower price of spot gold (GLD) and silver.

Can the Japanese Yen Rise against the US Dollar?

The Japanese yen (JYN) is the only currency that is unable to capture the weakness in the US dollar (UUP).

Will the Pound Gain with Signs of a Soft Brexit?

The British pound (FXB) (GBB) continued to appreciate against the US dollar in the first week of 2018, rising 0.41% against the dollar (UUP).

Factors That Are Driving the Euro Higher

The euro appreciated 0.27% against the US dollar (UUP) after posting double-digit gains against the US dollar in 2017.

Why the US Dollar Began 2018 with Losses

The US Dollar index (UUP) began 2018 on a negative note, posting losses against most of the major currencies.

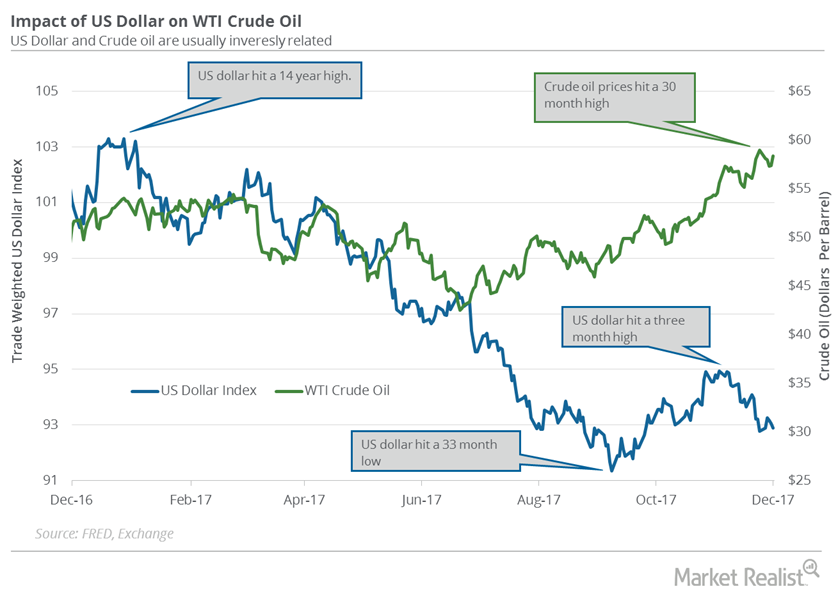

US Dollar Recovering from 3-Month Low: Bearish for Crude Oil?

The US Dollar Index fell ~9.8% in 2017. The dollar fell partly due to the improving economy outside the US. It was the worst annual drop since 2003.

What November Job Openings Say about US Economy

As per the January JOLTS report, there were 5.9 million job openings at the end of November.

Analyzing Precious Metals: Dollar Had Its Worst Year since 2003

Although most of the upswing in precious metals has been due to the rise in geopolitical risks in 2017, the dollar has been the most crucial factor.

What to Make of the Surprising Gains in the Euro in 2017

The euro–dollar (FXE) pair closed 2017 at 1.1998. It appreciated by 13% against the US dollar and posted close to 10% gains against the other major global currencies.

How Could the US Dollar Fare in 2018?

The US dollar’s long-term outlook looks marginally better in 2018 than in 2017.

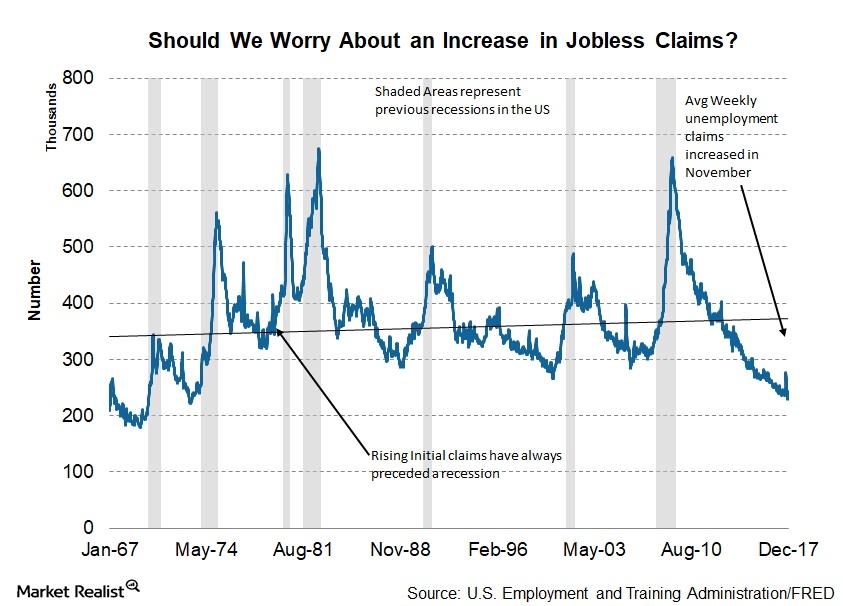

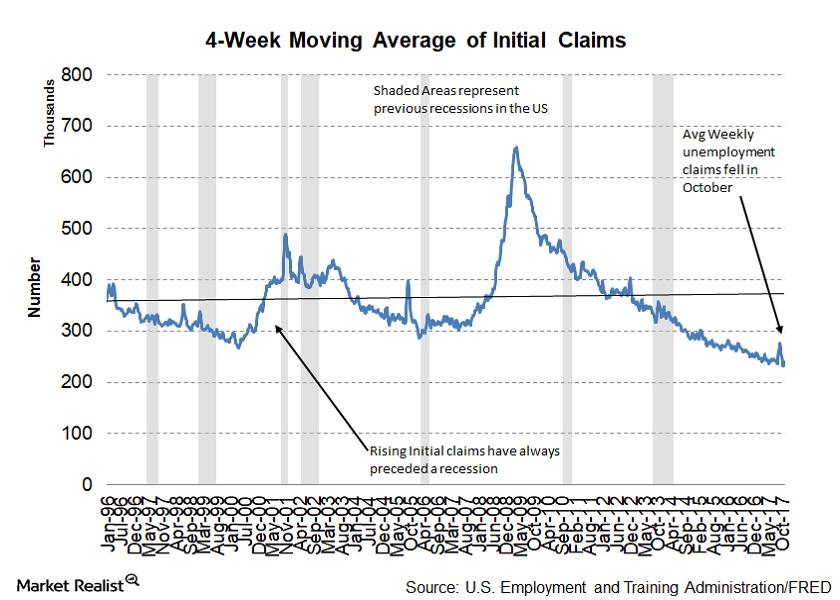

Should We Worry about Rising Unemployment Claims?

Average weekly claims and the economy Average weekly unemployment claims are a constituent of the Conference Board LEI (Leading Economic Index). Claims have a 3% weight in the LEI. Weekly unemployment claims, if adjusted for seasonality, give investors a clear understanding of changes in the employment market. Though the Bureau of Labor Statistics releases a monthly […]

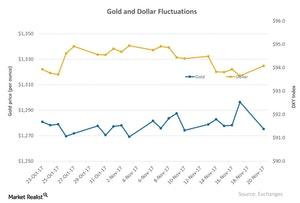

How the Dollar and Gold Moved in December

Gold and the US dollar are mostly inversely related to each other.

Will the US Dollar Help Crude Oil Bulls or Bears in 2018?

The US Dollar Index fell 0.5% to 92.12 on December 29, 2017—the fourth consecutive day of losses. It’s near a three-month low.

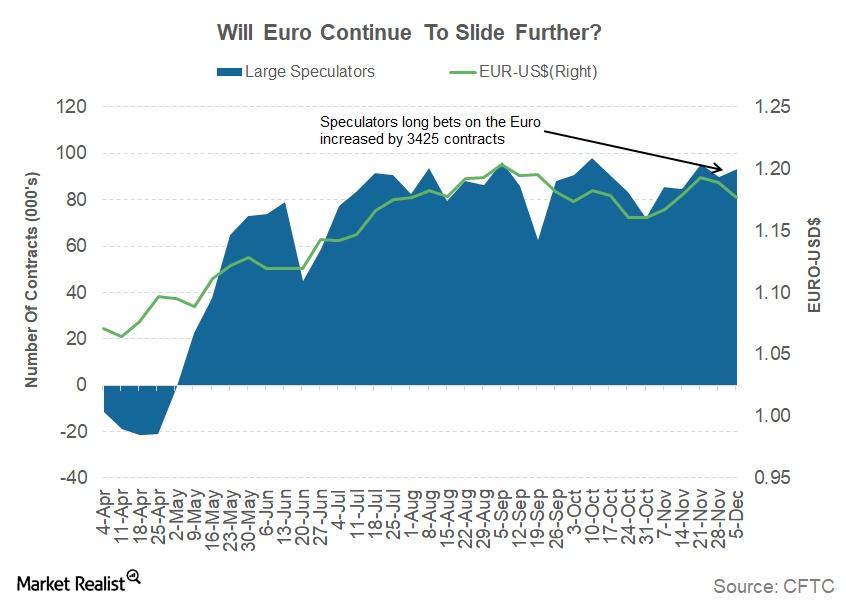

Here’s What Drove the Euro Higher Last Week

The euro (FXE) closed the week ended December 22, 2017, at 1.1864, appreciating 0.94% against the dollar (UUP).

Can the US Dollar Gain Back Lost Ground This Week?

The US Dollar index (UUP) failed to capitalize last week on the optimism from Congress passing the US tax reform bill.

How the Bank of Japan Could Have an Impact on the Yen This Week

For the week ended December 15, the Japanese yen (FXY) closed at 112.58 against the US dollar (UUP), appreciating by 0.79%.

What Drove the Euro Higher Last Week?

The total net speculative bullish positions on the euro (EUFX) increased from 93,106 contracts to 113,889 contracts in the previous week.

Why the US Dollar Resisted the Fed’s Latest Rate Hike

According to Reuters, the US dollar (USDU) net short positions increased to ~-$7.8 billion during the week ended December 15 compared to ~-$4.3 billion in the previous week.

Will the US Dollar Surge Higher after FOMC Meeting?

The US Dollar Index (UUP) continued its ascent against the other major currencies as investors positioned for a rate hike from the Fed and reacted to the increased possibility of tax reforms by the end of this year.

Why the Euro Continued to Fall Last Week

The euro-dollar (FXE) closed the week ending December 8 at 1.18, depreciating by 1.1% against the US dollar (UUP).

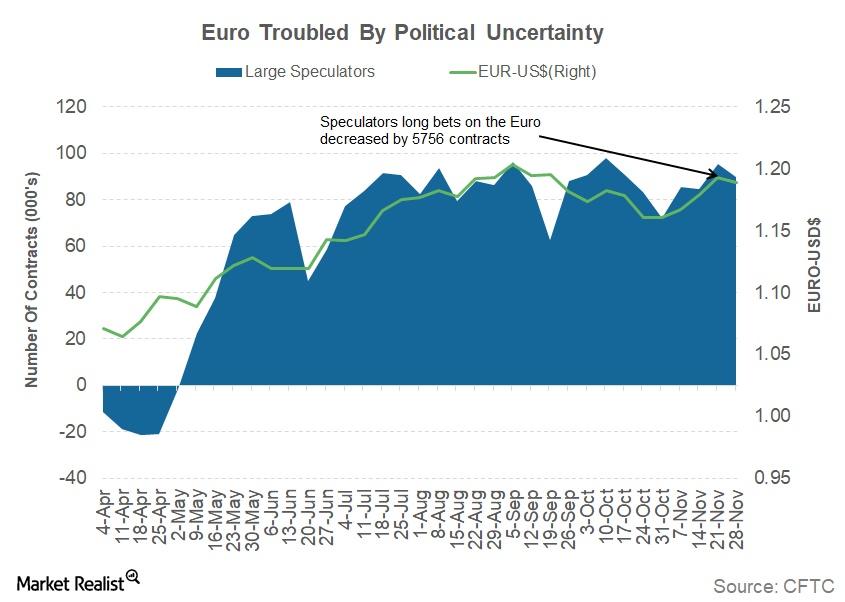

Are Politics Holding the Euro Back?

The euro-dollar (FXE) closed the week ending December 1 at 1.19, depreciating by 0.33% against the US dollar (UUP).

Will the US Dollar Surge on Tax Reform News?

The US Dollar Index (UUP) managed to close the week ending December 1 in positive territory with a gain of 0.14%.

How Could US Tax Bill Affect Dollar and Crude Oil Prices?

The US Dollar Index advanced 0.1% to 92.8 last week. Consequently, it pressured oil prices during the week.

San Francisco Fed John Williams and Monetary Policy Challenges

John Williams, president and CEO of the Federal Reserve Bank of San Francisco, spoke on November 16, 2017, at the 2017 Asia Economic Policy Conference in San Francisco.

Is the Dollar-Gold Relationship Getting Stronger?

Precious metals have been closely associated with the movement of the US dollar over the last few months.

What Decreasing Weekly Unemployment Claims Say about the US Economy

In the Conference Board Leading Economic Index, the average weekly unemployment claims have 3.0% weight.

Reasons behind a 3rd Weekly Loss for the US Dollar

The US Dollar Index (UUP) had another bad week as traders offloaded long dollar positions amid tax reform uncertainty last week.

How the Higher Dollar Has Affected Precious Metals

Precious metal slump All four precious metals saw a down day on Monday, November 20. Gold fell 1.6% to $1,275.30 per ounce, after touching a one-month high on Friday, November 17. The fall in precious metals was most likely due to the rise in the US dollar. The US Dollar Index rose 0.45% on Monday. Gold, silver, platinum, […]

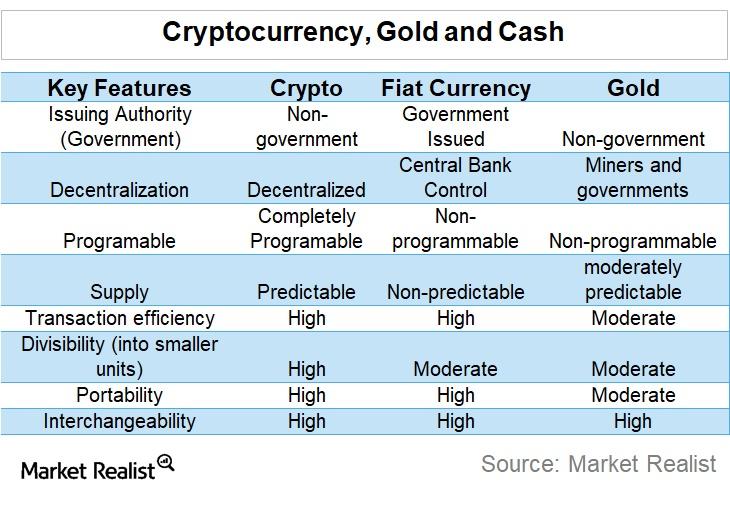

How Bitcoin Differs from Other Currencies

Bitcoin has been rallying for the past year, with some proponents advocating that it could replace fiat currencies in the future.

What Drove the Euro Higher against the Dollar Last Week?

The euro-dollar (FXE) closed the week ending November 17 at 1.2, appreciating by 1.1% against the US dollar (UUP).

Breaking down Bitcoin and Cryptocurrencies: Key Characteristics

In the case of bitcoin, the safety of the system is linked with the bitcoin algorithm, which miners keep solving to generate new coins and maintain the system.

Could US Dollar Recover This Week?

The US Dollar Index (UUP) continued to struggle as the fate of US tax reform remains uncertain.