PowerShares DB US Dollar Bullish ETF

Latest PowerShares DB US Dollar Bullish ETF News and Updates

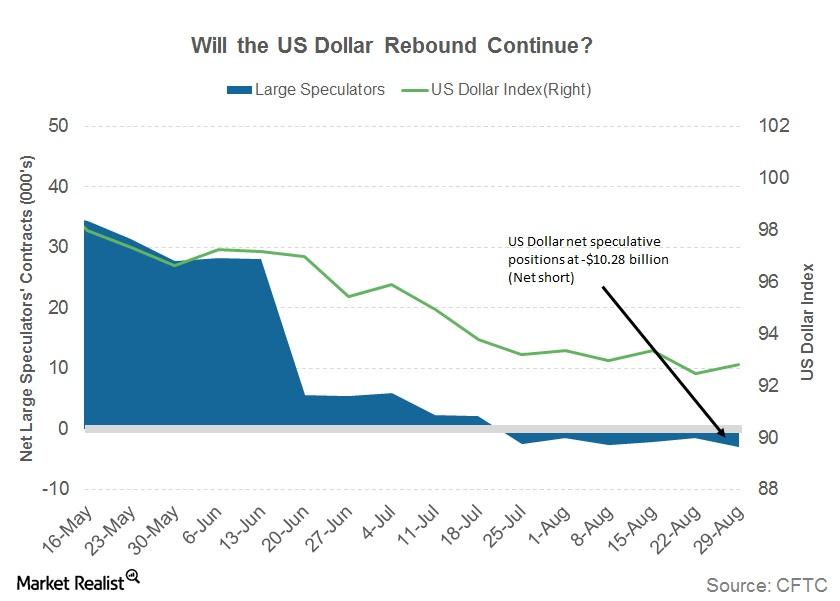

How to Make Sense of the US Dollar Rebound

The US Dollar Index (UUP) surprised the markets with its resilience despite a weak August jobs report.

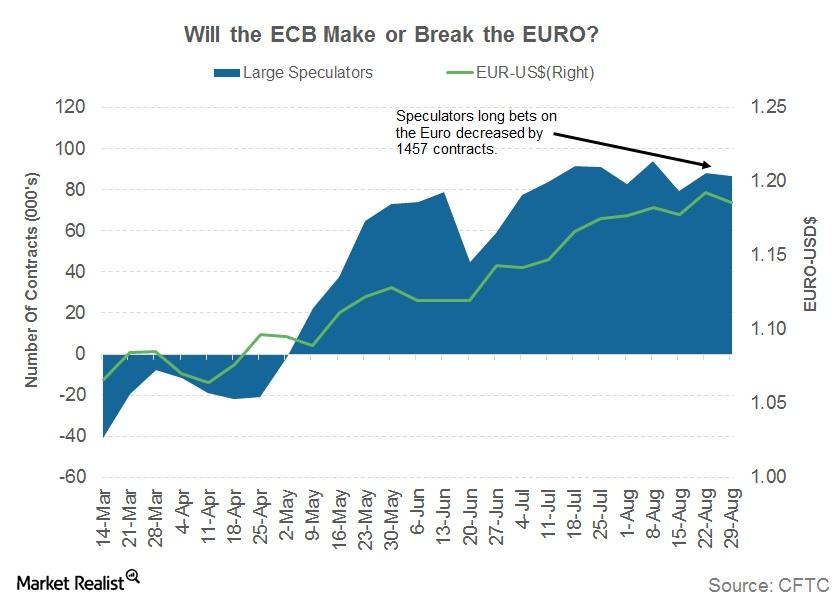

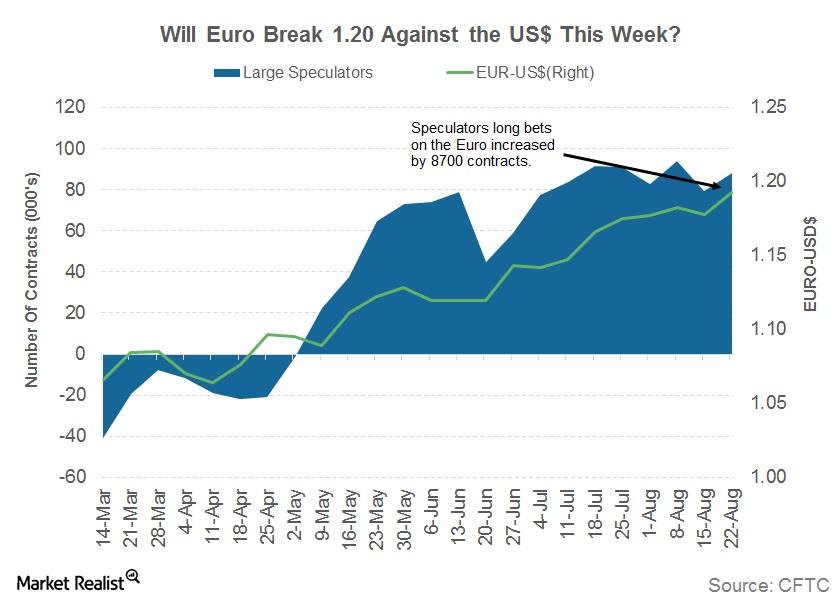

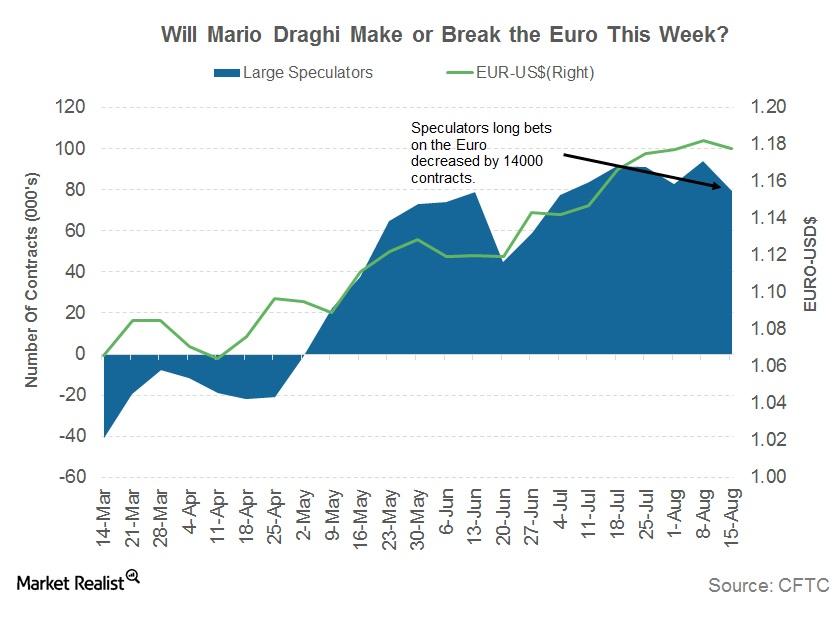

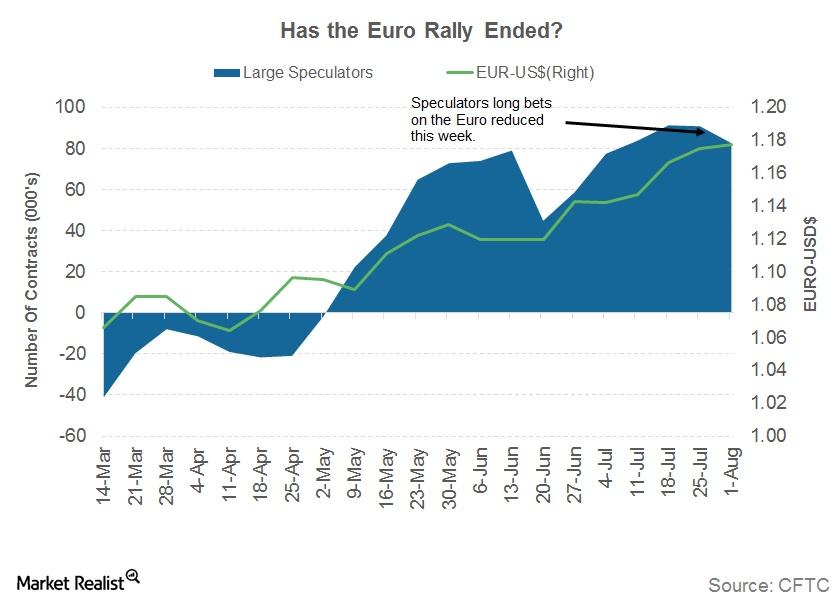

Why the Euro Could Remain Volatile This Week

The euro (FXE) closed the week ended September 1, 2017, at 1.19 against the US dollar (UUP). It lost 0.56% against the US dollar.

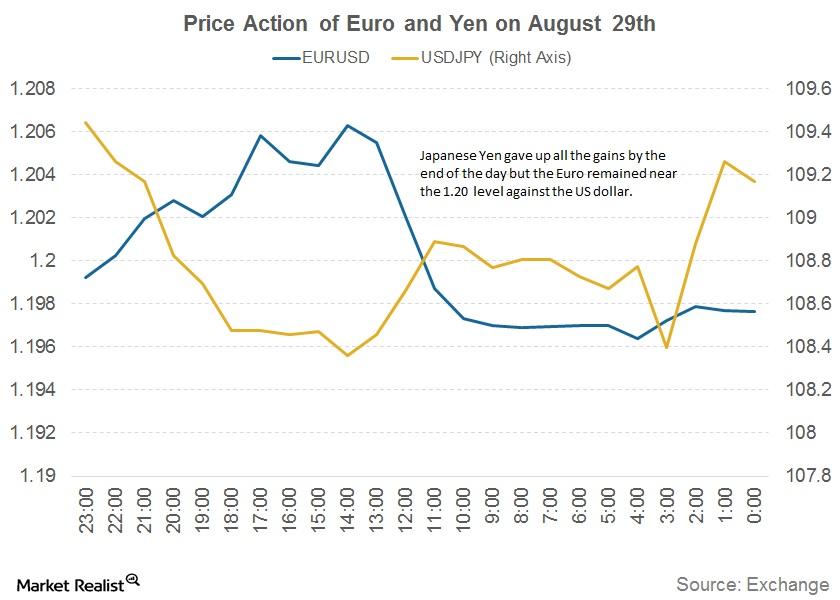

Why the Euro Is Turning Out to Be a Preferred Safe Haven

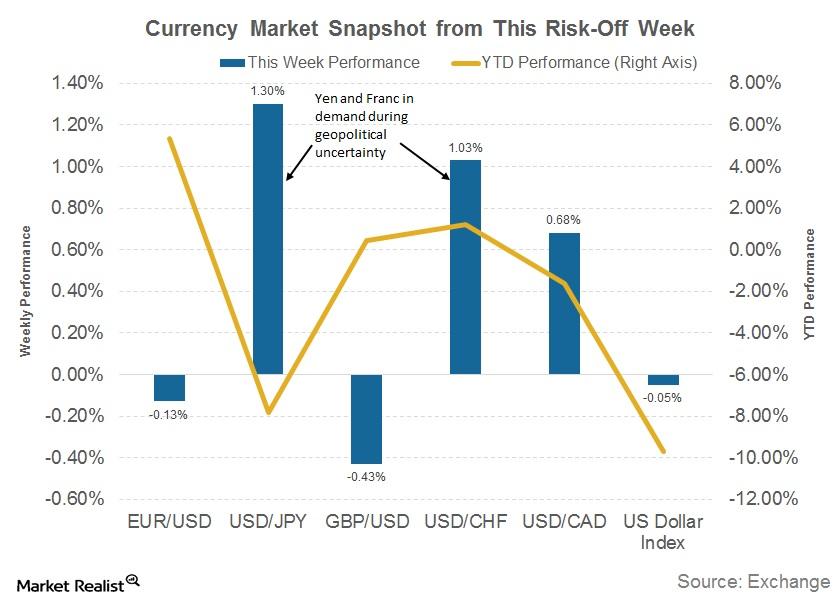

Volatility in the currency markets spiked after news of the North Korean missile launch on August 29. Demand for safe haven currencies like the Japanese yen (FXY) and Swiss franc (FXF) picked up in the Asian session.

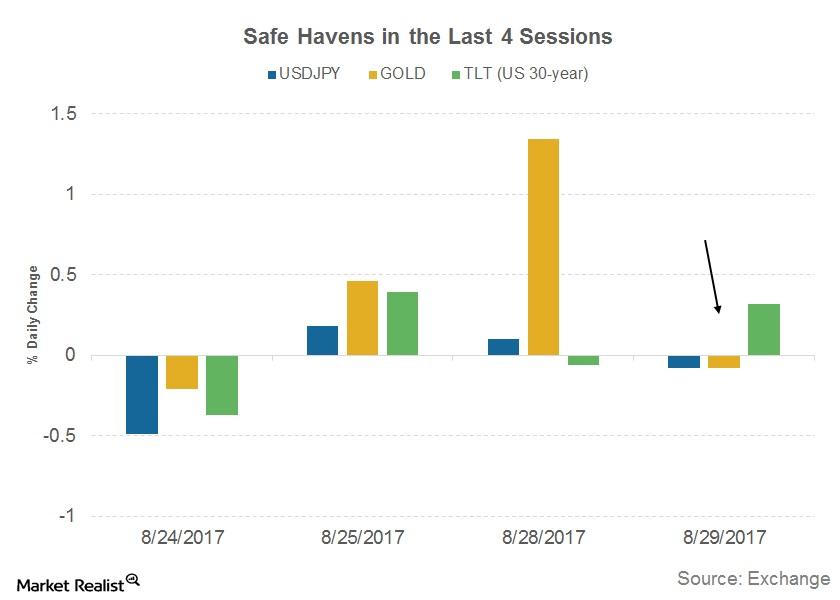

North Korea Tensions: Will Demand for Safe Havens Rise?

In the financial markets, there are a few financial assets whose demand increases dramatically in times of uncertainty.

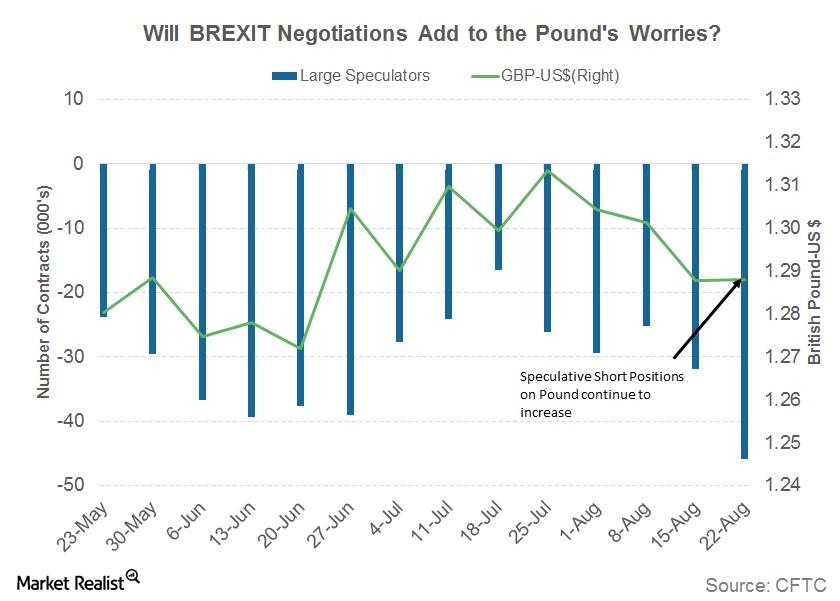

Round 3: Will Brexit Negotiations Help the British Pound?

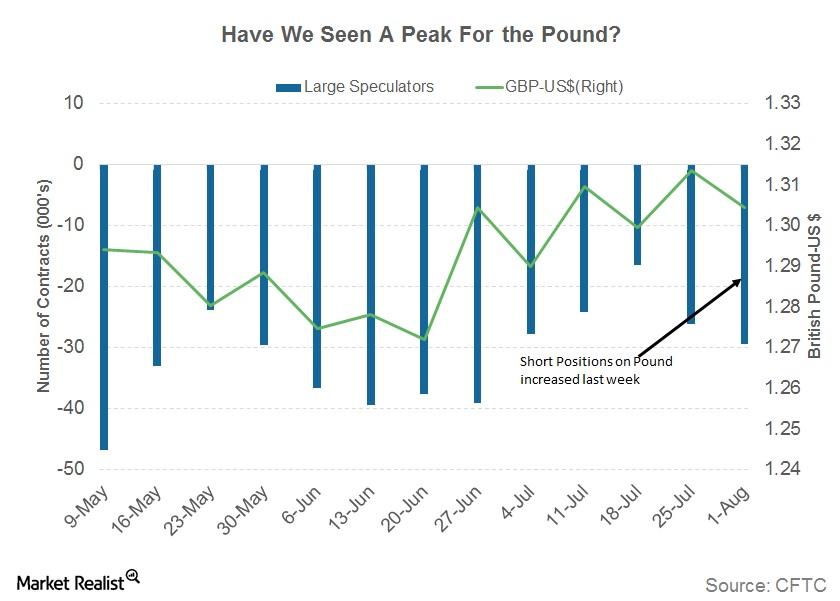

The British pound (FXB) remained unchanged against the US dollar for the week ending August 25. The pound (GBB) closed the week at 1.2887.

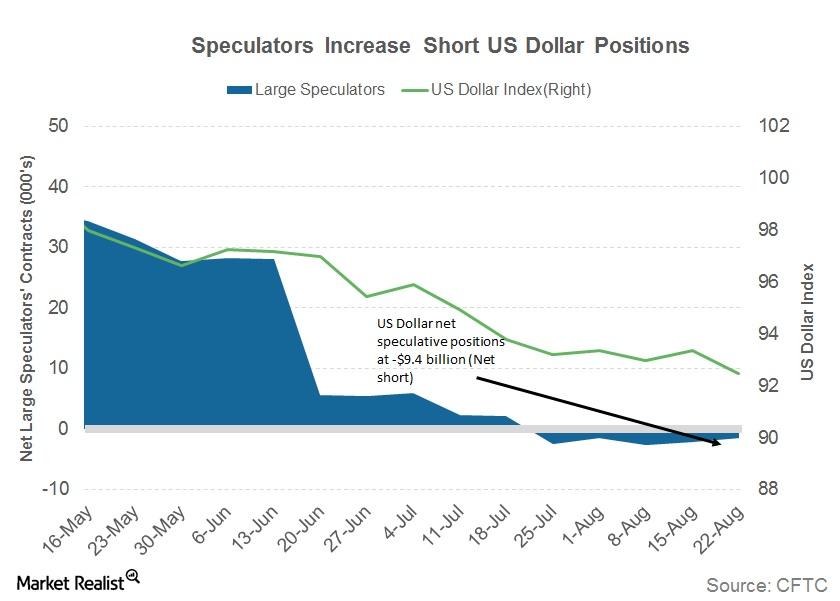

Is the US Dollar Dying a Slow Death?

The US Dollar Index closed the week ending August 25 at 92.68—compared to 93.36 in the previous week.

Mario Draghi Didn’t Stop the Appreciating Euro

European Central Bank President Mario Draghi gave didn’t comment about removing monetary stimulus in his speech at the Jackson Hole symposium.

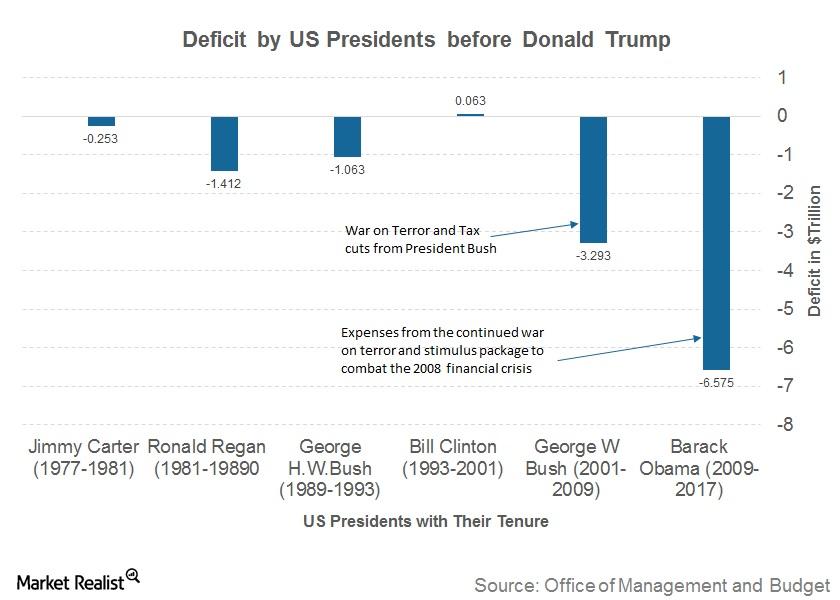

How the US’s Debt Has Become So Big

The US debt-to-GDP ratio now stands at 106.1%, which means that the total US debt is more than the annual US GDP.

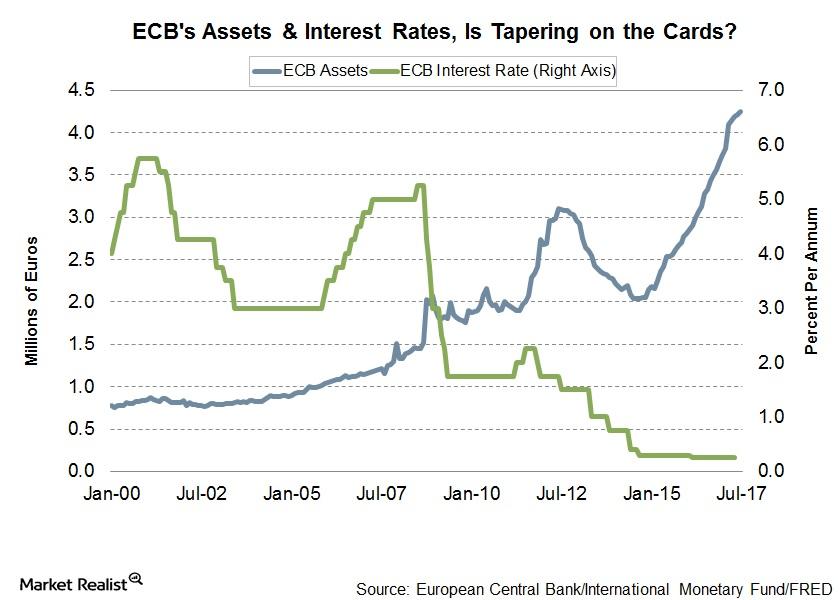

Will ECB’s Tightening Lead to Bond Market Sell-Off?

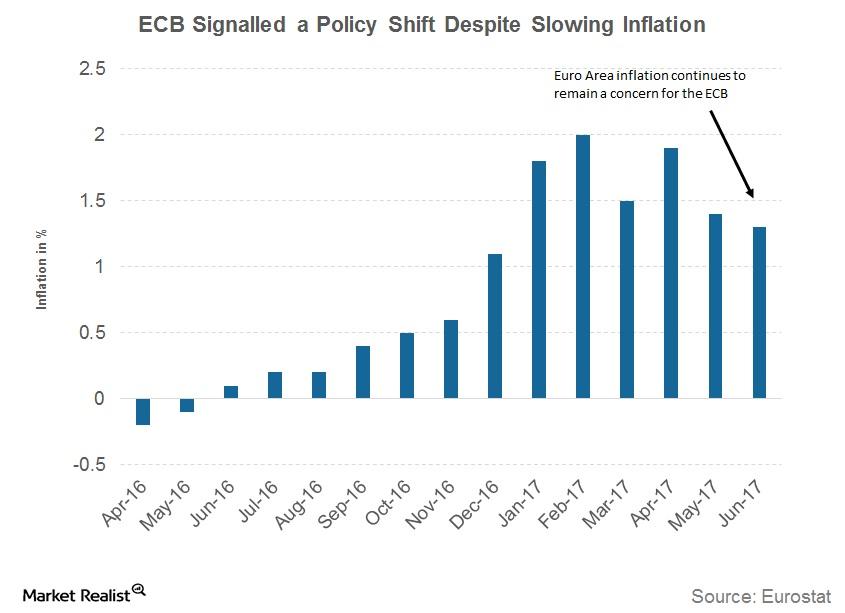

If the European economy continues to improve at the current pace, the QE program could be scaled down to 40.0 billion euros per month.

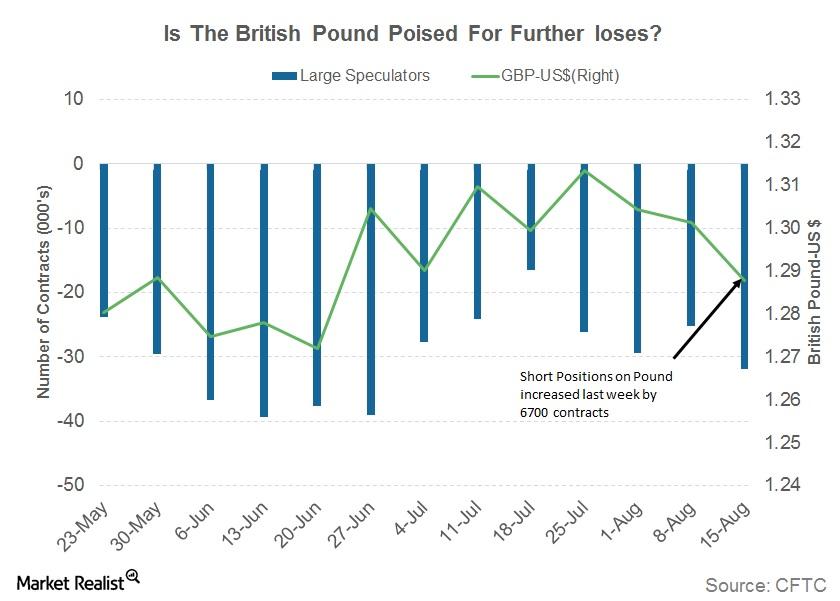

Here’s Why the British Pound Could Be Headed for Further Losses

The British pound (FXB) was one of the worst performers in the week ending August 18.

Will Draghi Lift or Drown the Euro This Week?

The euro-dollar pair (FXE) closed the week ending August 18 at 1.18 against the US Dollar (UUP).

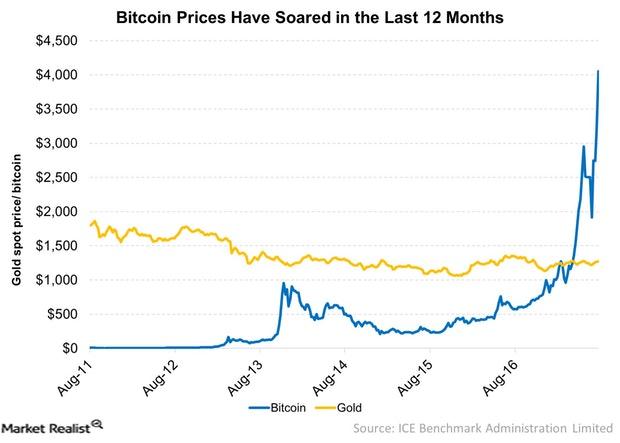

Bitcoin Might Not Replace Gold as a Safe-Haven Asset

Bitcoin is a global digital payment system that offers lower transaction fees than other online payment systems. It’s operated by a decentralized authority.

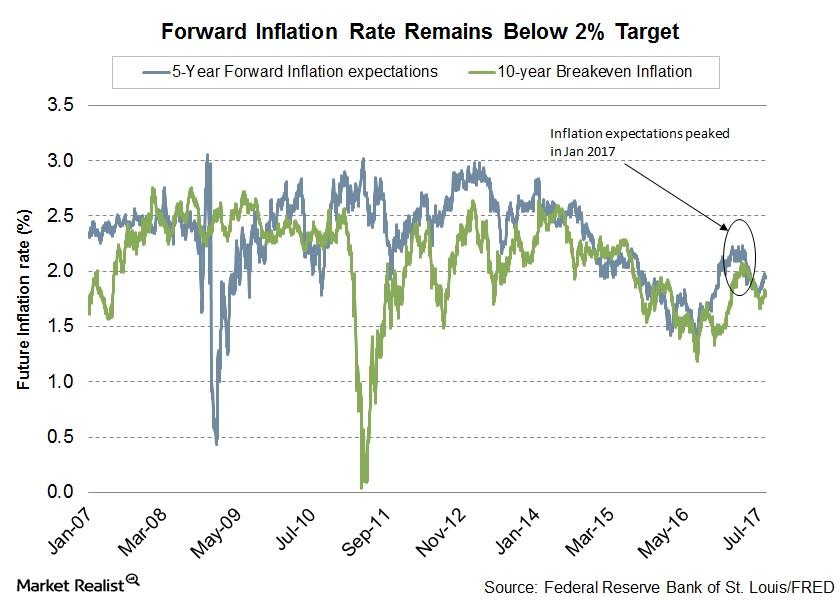

New York Fed President William Dudley Discussed Inflation

In his speech on August 10, New York Fed President William Dudley joined the group of FOMC members to ease concerns about slowing inflation (TIP).

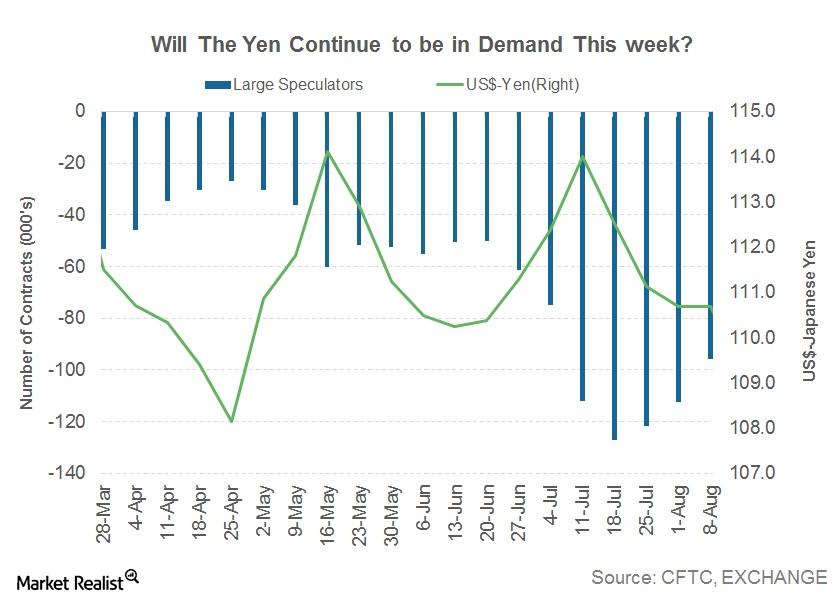

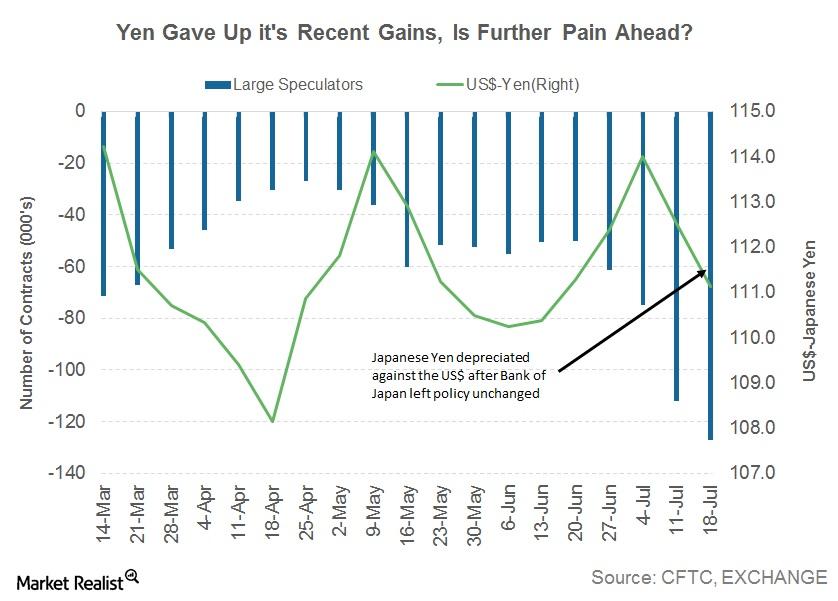

Will the Japanese Yen Appreciate Further This Week?

The Japanese yen (JYN) was back in demand as geopolitical tensions took center stage last week.

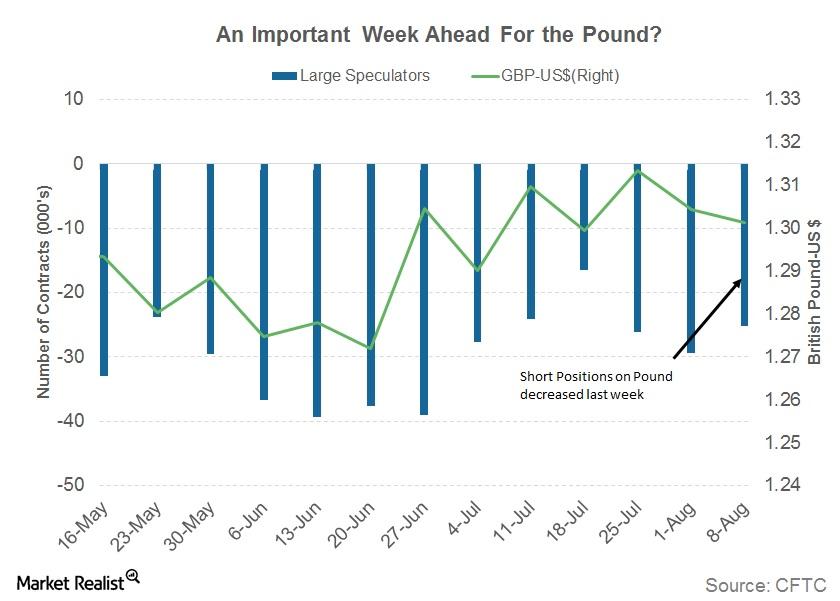

Why the British Pound Has an Important Week Ahead

The British pound (FXB) had another negative week as a dovish statement from the Bank of England continued to drag the currency lower.

A Lesson from Currency Markets during Geopolitical Tensions

Last week’s rising geopolitical tensions between the United States and North Korea turned the tide for the yen. The Swiss franc also appreciated.

How Are Safe Havens Faring in This North Korea Fear?

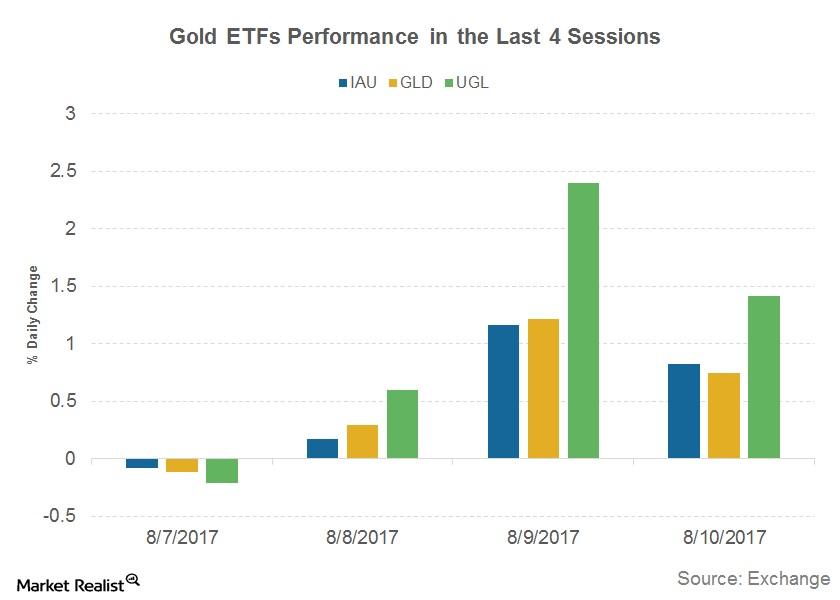

The safe havens that benefit the most in times of uncertainty include gold (GLD) and U.S. Treasuries (GOVT).

Crude Oil Futures Fell despite OPEC’s Meeting and API Data

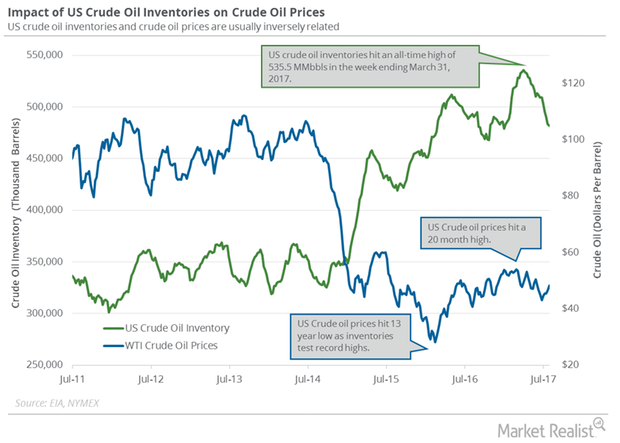

September US crude oil futures contracts fell 0.4% to $49.17 per barrel on August 8. Brent crude oil futures fell 0.4% to $52.14 per barrel on the same day.

Chart in Focus: A Look at the British Pound

The British pound recorded another multi-month high of 1.3266 against the US dollar before the Bank of England announced its inflation report and interest rate decision on August 3.

Is the Euro Running Out of Steam?

The German DAX (DAX) was up ~1.1%, Euro Stoxx (FEZ) was up ~1.1%, and France’s CAC was up ~1.4% in the week ended August 4, 2017.

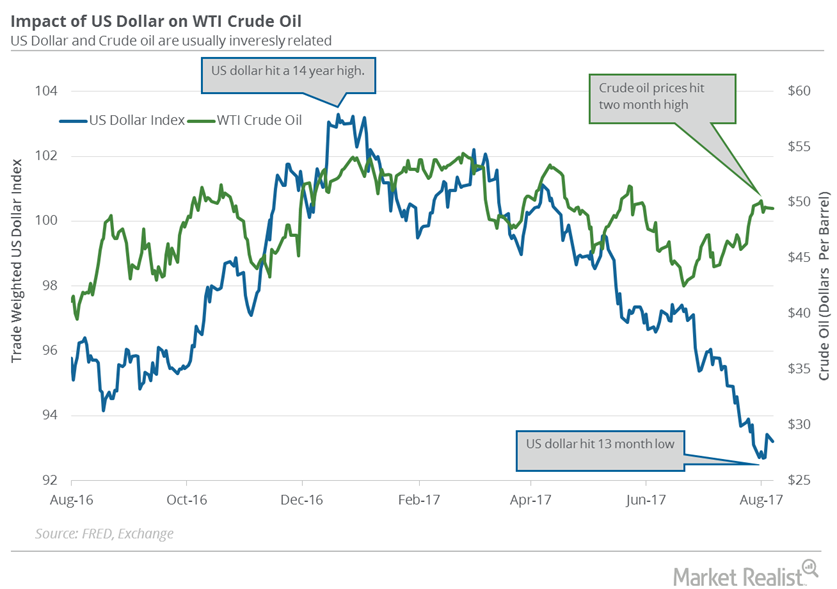

US Dollar Recovers from a 13-Month Low

The US Dollar Index rose 0.77% to 93.7 on August 4, 2017. The US dollar rose due to the better-than-expected rise in US unemployment data.

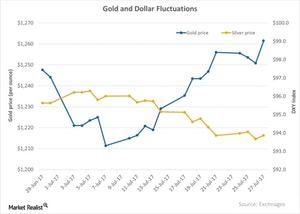

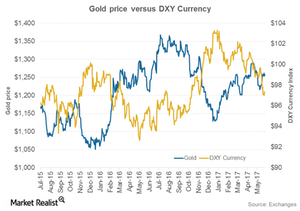

How the US Dollar Affected Gold

The US dollar has been on a downward swing over the past week.

What to Expect from the US Dollar

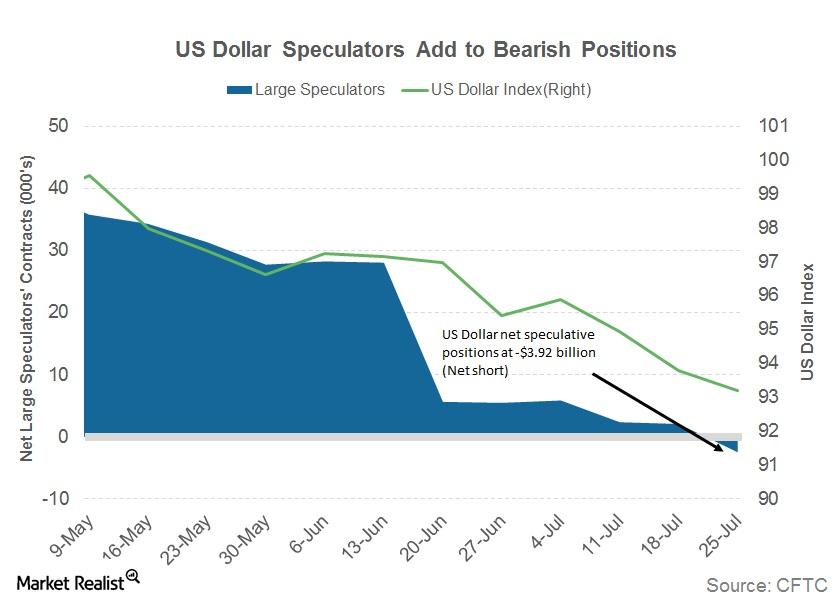

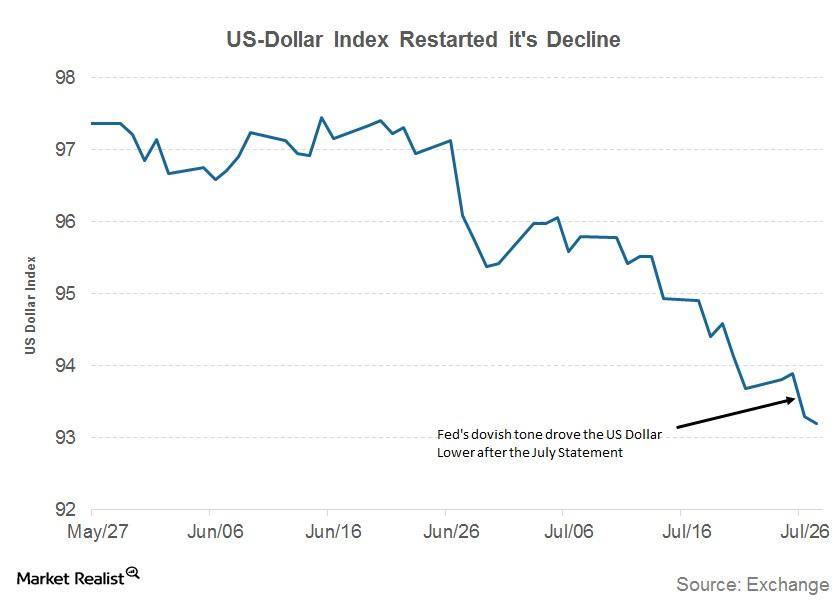

The US Dollar Index (UUP) continued to slide in the previous week due to the FOMC’s dovish statement and weaker-than-expected economic data.

The Japanese Yen Could Keep the US Dollar Company

Another week of appreciation The Japanese yen (JYN) had another positive week, posting gains of 1.3% and closing at 111.12 against the US dollar (UUP). The previous week’s close for the currency pair was 112.53. This strength was primarily driven by the US dollar, rather than positive news from the Japanese economy. Most of the […]

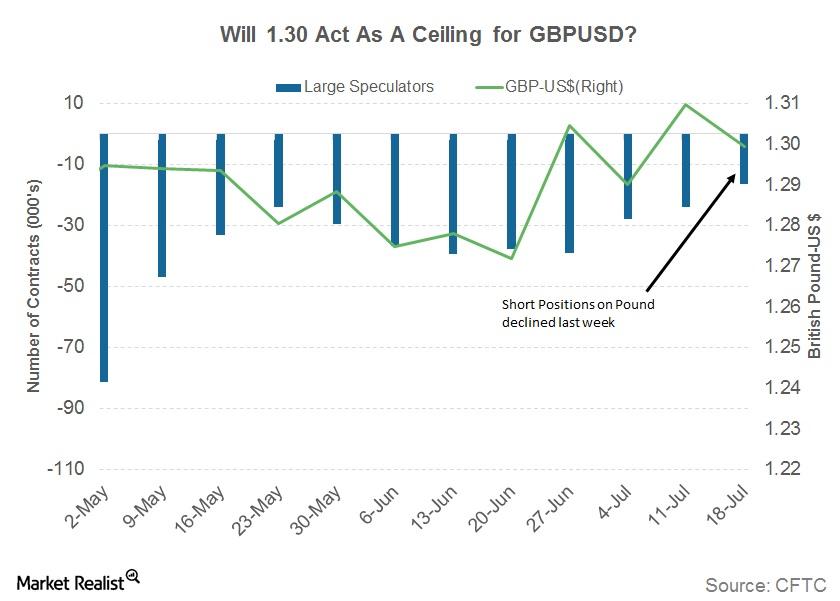

Why the British Pound Failed to Stay above 1.30

Investors not confident the Bank of England will raise rates The British pound (FXB) has had a roller coaster ride over the last few weeks, as mixed signals were given by the Bank of England. After a hawkish tone at its June meeting, the Bank of England has turned dovish in recent weeks. The British pound […]

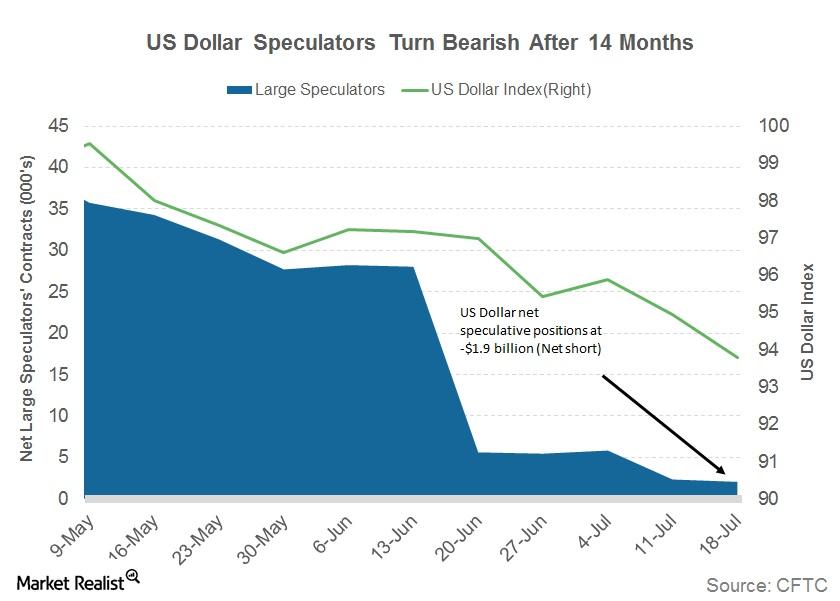

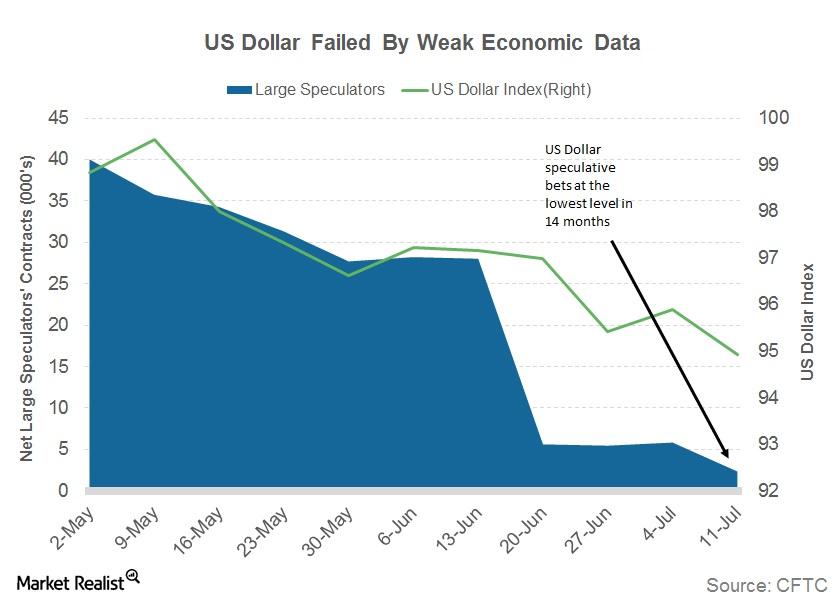

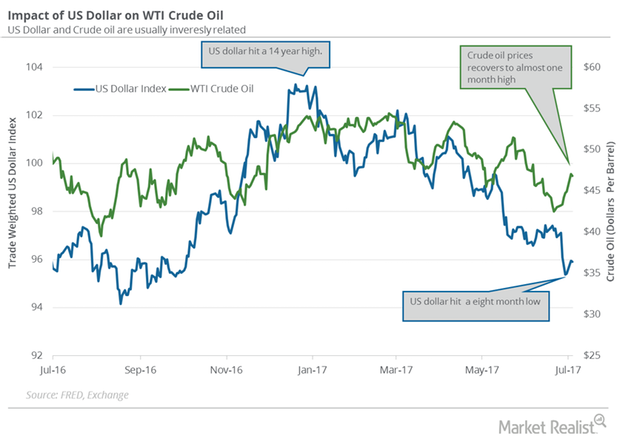

This Is Why the US Dollar Could Slide Further

US Dollar index reaches a 14-month low The US Dollar Index (UUP) continued with its fall as investors preferred major peers. In the week ended July 21, the US Dollar Index closed at 93.78, falling 1.7% from the week prior. It is headed for its fifth consecutive month of loss this year. Conflicting news from […]

Why the US Dollar Took a Hit after the FOMC’s July Statement

Most of the statement released by the Federal Open Market Committee (or FOMC) following its two-day monetary policy meeting was in line with the market’s expectations.

US Dollar Is near a 13-Month Low: What’s Next?

The US dollar hit 93.68 on July 21, 2017—the lowest level in 13 months. The US dollar has fallen more than 8% in 2017.

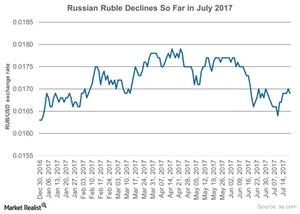

How Has the Ruble Performed in July 2017?

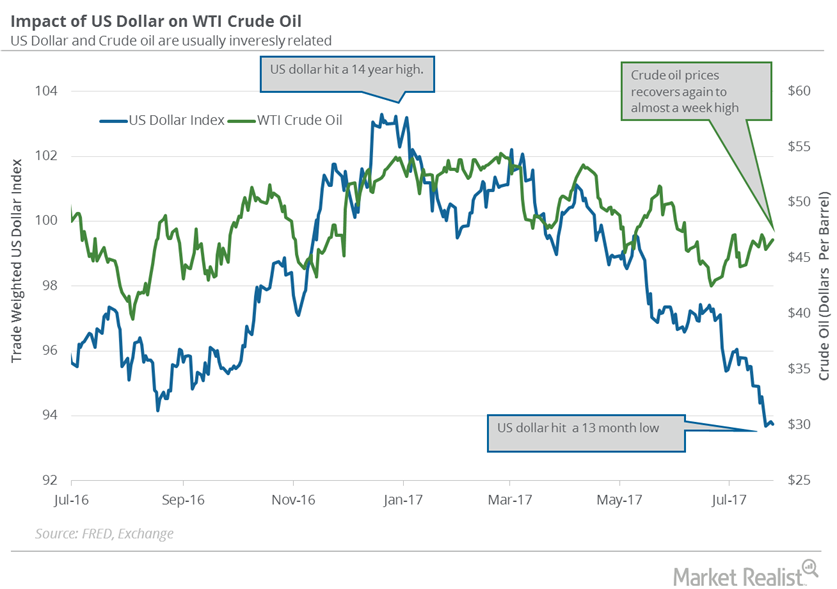

The Russian ruble (ERUS) tends to move in line with crude oil prices (USO) (UCO).

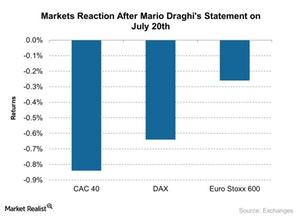

Euro Surged, Market Fell after Draghi’s Statement

When ECB president Mario Draghi announced that the interest rate remained unchanged at 0.0%, the euro fell nearly 0.30% against the US dollar.

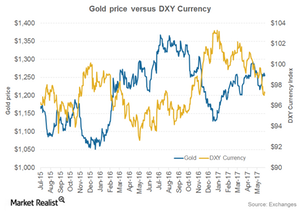

How the Euro Pushed the Dollar Lower and What It Meant for Gold

July 20, 2017, was an up day for the euro, which put downward pressure on the US dollar as represented by the U.S. Dollar Index (or DXY).

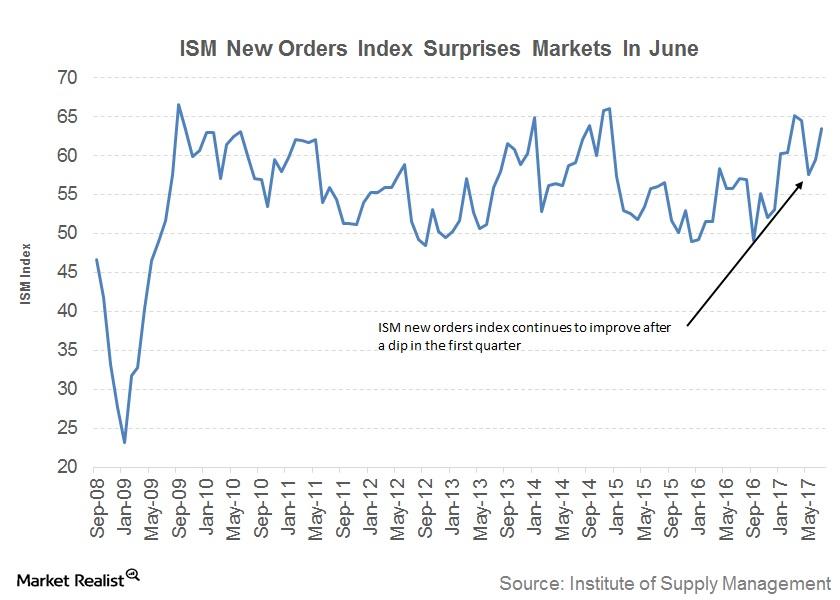

What the ISM New Orders Index Indicates for the US Economy

The Institute of Supply Management (or ISM) New Orders Index indicates the number of new orders from customers.

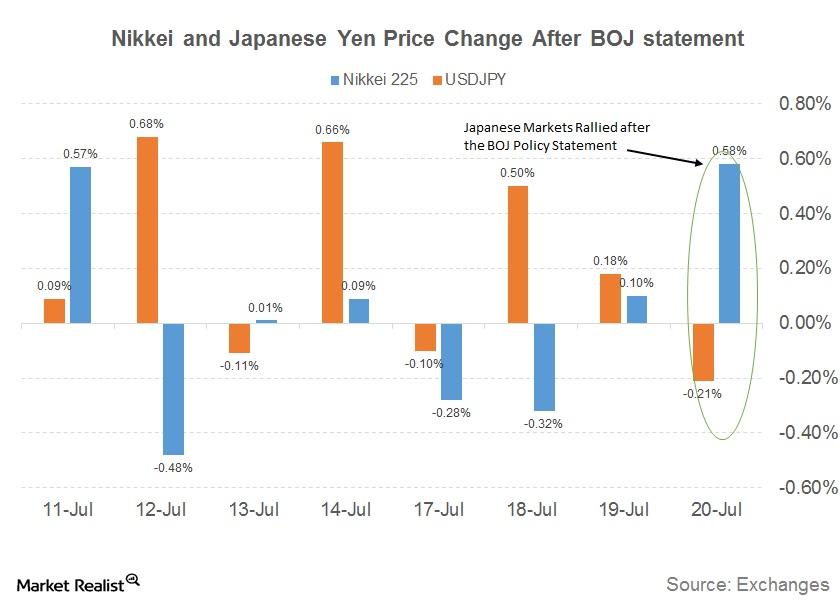

Why Japanese Markets Surged after the Bank of Japan’s Inaction

In its July 2017 monetary policy statement on July 20, 2017, the Bank of Japan reported that it had left interest rates unchanged at -0.1%.

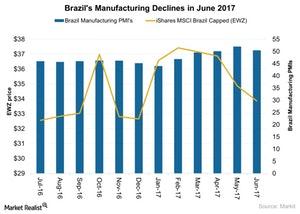

Inside Brazil’s June Manufacturing Activity

The Brazil Manufacturing PMI (purchasing managers’ index) fell slightly in June 2017 due to political turmoil in the country’s government.

Have Yellen and US Economy Failed the US Dollar?

The US Dollar Index (UUP) closed at 94.9, depreciating by 0.90% last week.

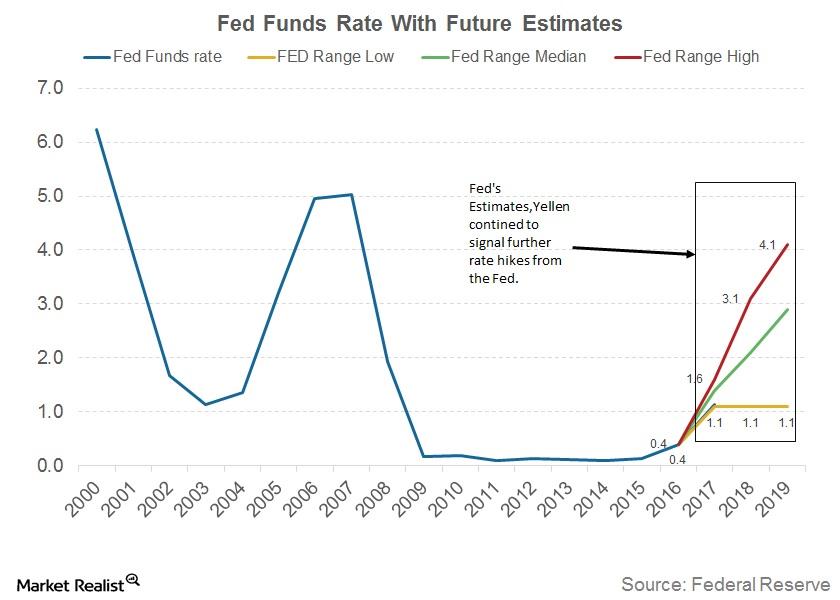

Why Fed’s Yellen Feels Gradual Rate Hikes Are Warranted

The tone of Yellen’s responses before the committee confirmed that the Fed is set to stay its course on monetary tightening, leading to policy normalization.Macroeconomic Analysis Is the British Pound Facing the Risk of Stagnation?

Economic data from the United Kingdom showed unexpected signs of a slowdown last week, with weaker-than-expected data reported in trade, production, and house prices.

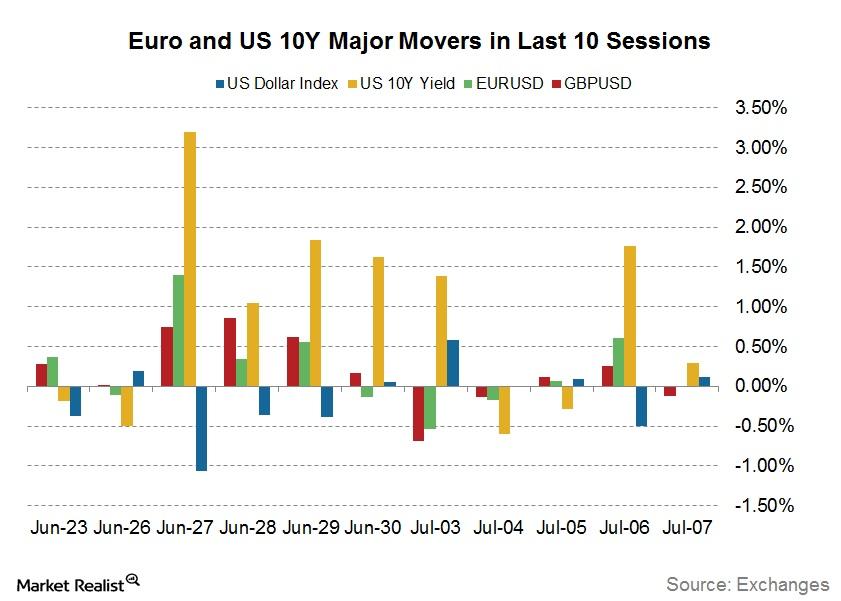

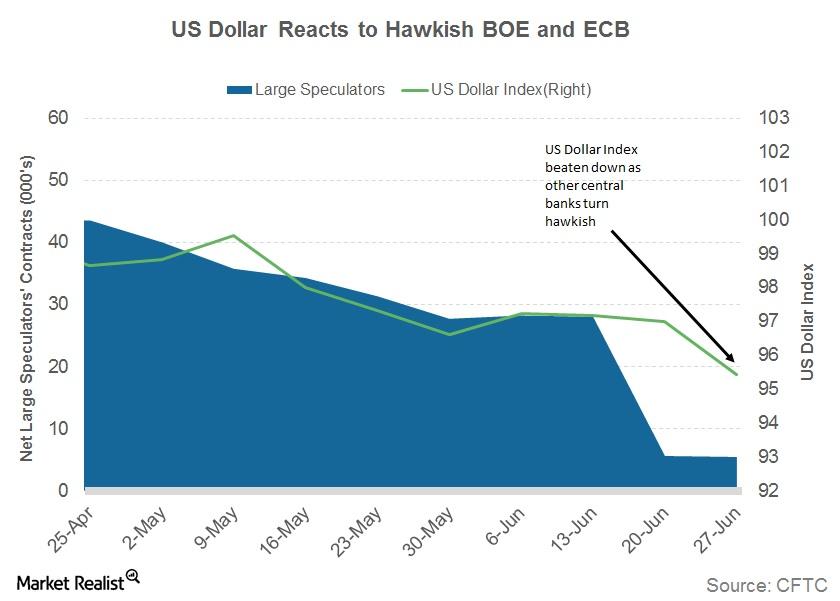

How Central Bankers Are Rattling Bonds and Currencies

Since the FOMC minutes and the hawkish turn of events at the European Central Bank and the Bank of England, bond yields across the board have been trending higher.

Confused Markets: Inside the ECB’s Struggle amid Miscommunication

The ECB (European Central Bank) in its recent monetary policy meeting on June 8 left its main refinancing rate at 0% and the interest rate at 0.25%.

Will the US Dollar Continue Its Bearish Momentum This Week?

August 2017 West Texas Intermediate crude oil futures contracts fell 0.5% and were trading at $46.83 per barrel in electronic trade at 1:45 AM EST on July 4, 2017.

Did the BOE and ECB Pressure the US Dollar This Week?

The currency markets are anticipating the June FOMC’s meeting minutes, which are expected to be hawkish.

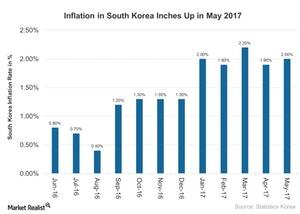

South Korea Reaches Target Inflation Rate in May 2017

South Korea’s (EWY) inflation rate rose to 2% in May 2017 as compared 1.9% in the previous month.

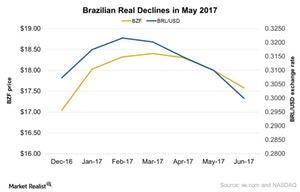

Slumping Commodity Prices Pressure the Brazilian Real in 2Q17

The Brazilian real dropped ~2% in May 2017 amid the country’s ongoing political instability.

Will Weak Data from the EU Derail the Euro?

The euro (FXE) remained confined to a narrow range against the US dollar (UUP) in the previous week.

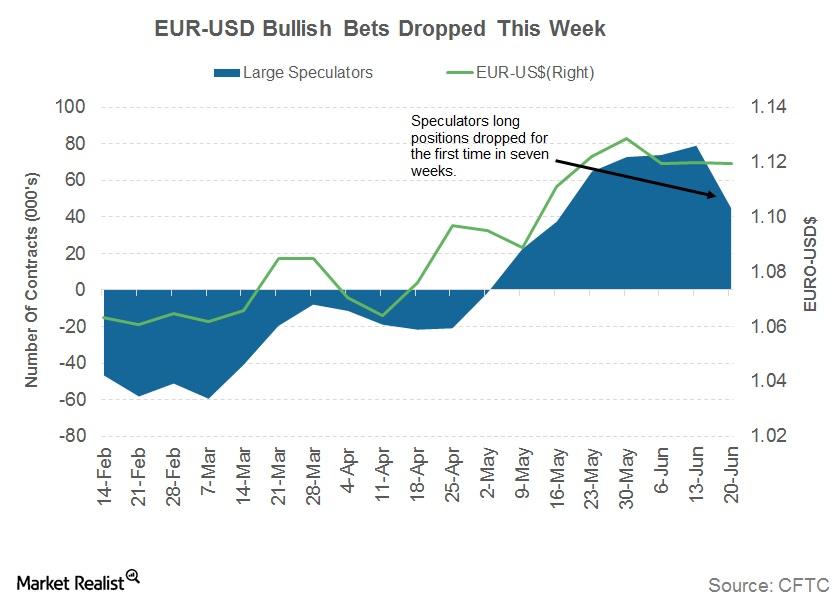

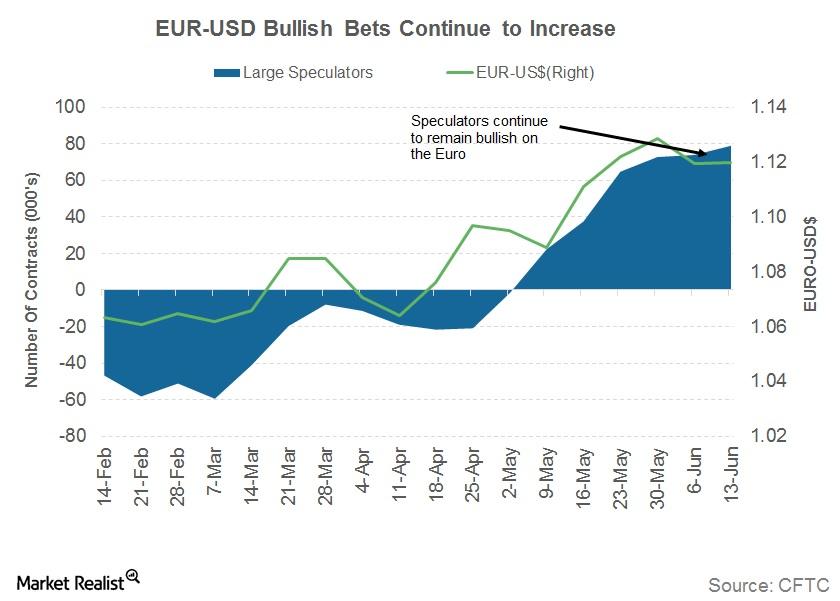

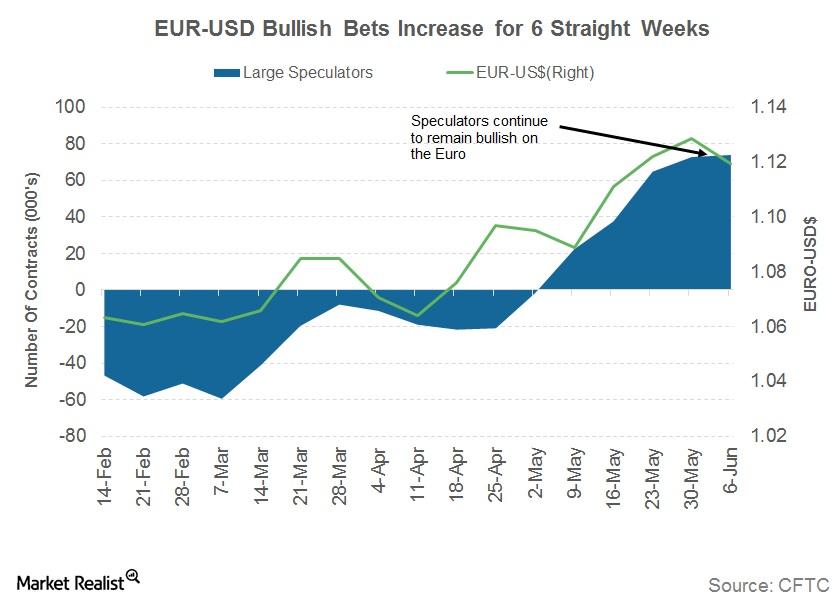

Is Long Euro the Theme for Forex Markets?

The euro (FXE) remained in a narrow trading range against the US dollar (UUP) between the levels of 1.130 and 1.115 for the last five weeks.

Has the ECB Been Successful in Taming the Euro?

The euro (FXE) closed the week at 1.1196 to the US dollar (UUP), posting a 0.76% loss compared to the previous week.

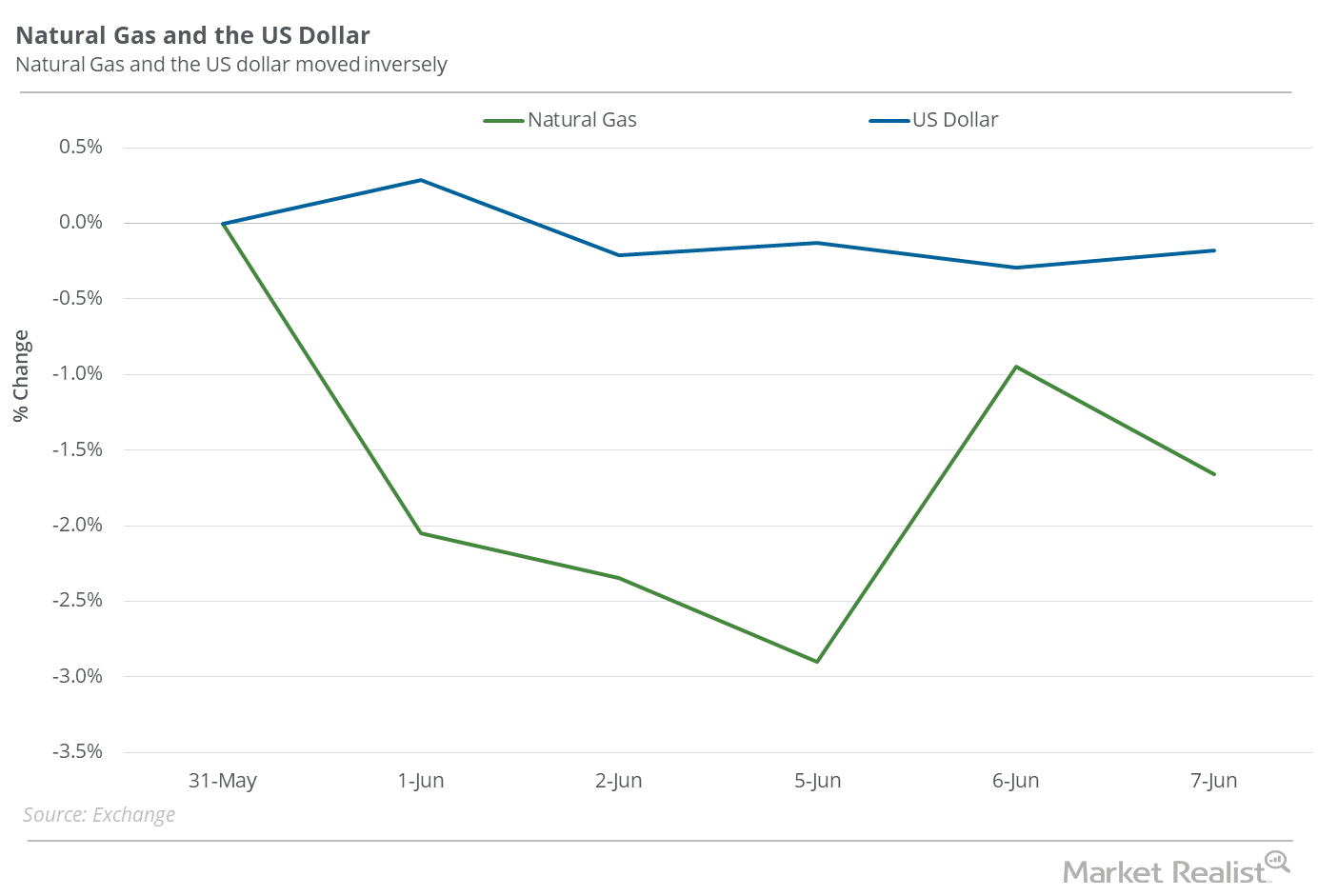

Is Natural Gas Reacting to the US Dollar?

Between March 3, 2016–June 7, 2017, natural gas active futures rose 84.1% while the US dollar fell 0.8%.

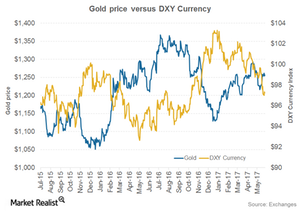

The Ups and Downs of the Dollar and Gold

On June 6, 2017, the US Dollar Index plunged to its lowest level in seven months, which helped dollar-denominated precious metals regain value.

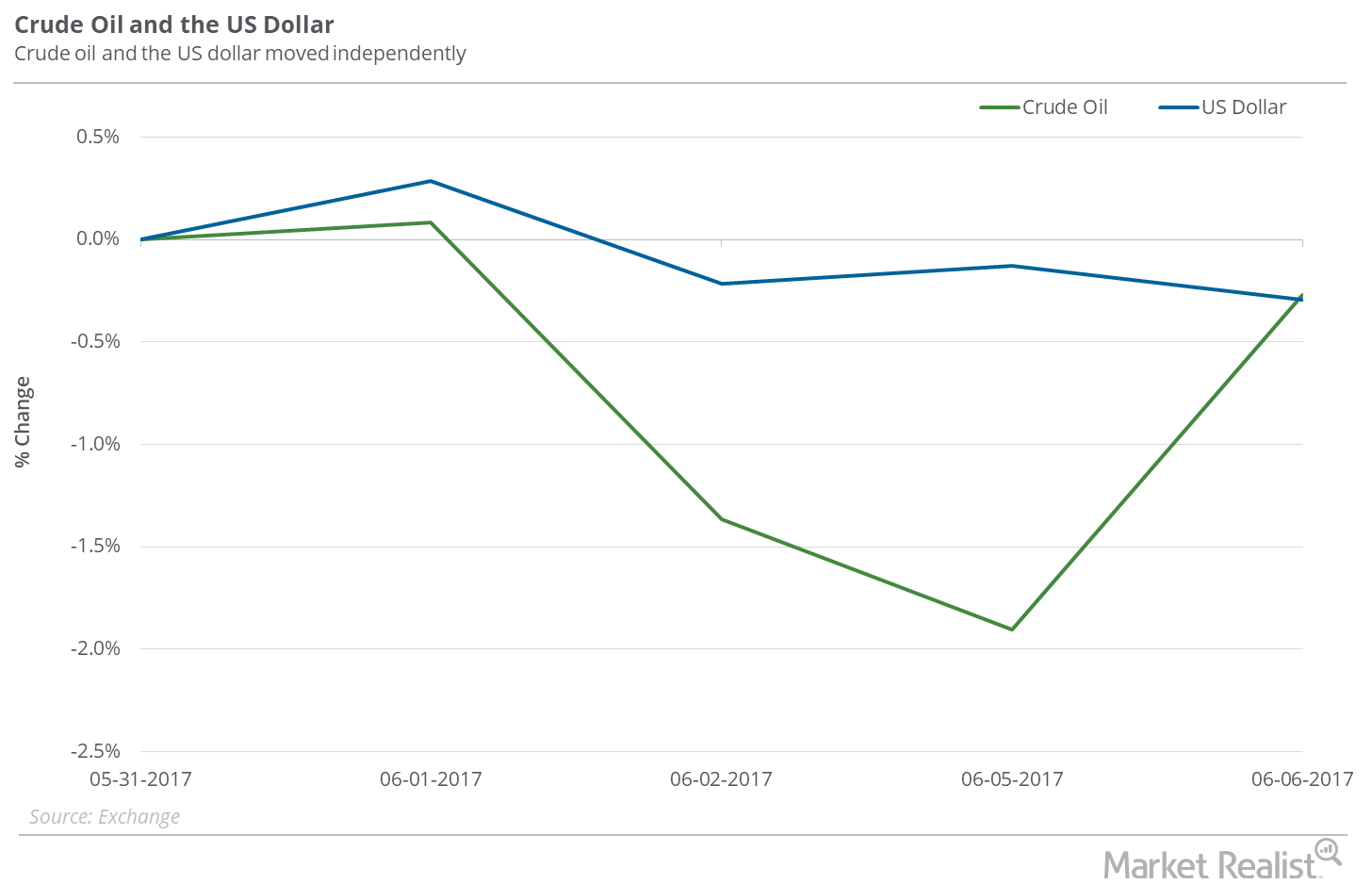

Is Crude Oil Ignoring the Falling Dollar?

Between May 30 and June 6, 2017, the US dollar (UUP) (USDU) (UDN) fell 0.7%, and crude oil (USO) (OIIL) July futures fell 3%.

What’s the Correlation between the Dollar and Gold?

The rise in gold on June 6 also boosted the other three precious metals. Silver futures for August delivery were 1.4% higher for the day and closed at $17.6 per ounce.