Is the Euro Running Out of Steam?

The German DAX (DAX) was up ~1.1%, Euro Stoxx (FEZ) was up ~1.1%, and France’s CAC was up ~1.4% in the week ended August 4, 2017.

Aug. 8 2017, Updated 1:06 p.m. ET

Sharp fall in the euro after US jobs data

The euro-dollar (FXE) pair witnessed a sharp fall after the US non-farm payroll (or NFP) data beat expectations. The euro depreciated by 0.83% against the US dollar (UUP) after the NFP data was released. The euro closed the week ended August 4, 2017, at 1.1772 compared to 1.1752 in the week before.

Economic data from the European Union remained upbeat with inflation, retail sales, and factory orders beating expectations. There was a minor drop in manufacturing activity reported in the previous week, but that should not be a concern in the long run.

The larger question is, will the euro continue this bull run? The euro has appreciated more than 10% against the US dollar in 2017, not because of its own strength but because of the US dollar’s weakness.

Signs of exhaustion of this euro rally are still not imminent. However, if we look back at the recent euro rallies, they have mostly been interrupted by the European Central Bank. A stronger euro makes European exports more expensive, which is something the ECB would like to avoid.

European equity markets (VGK) remained upbeat, in line with global markets. The German DAX (DAX) was up ~1.1%, Euro Stoxx (FEZ) was up ~1.1%, and France’s CAC was up ~1.4% in the week ended August 4, 2017.

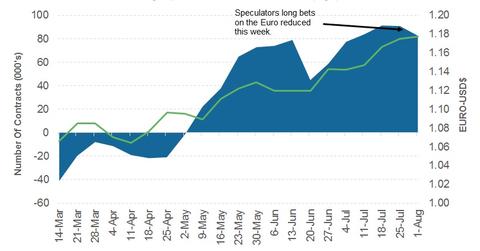

Euro speculators took a breather this week

According to the latest Commitment of Traders (or COT) report, released on August 4 by the Chicago Futures Trading Commission (or CFTC), currency market speculators have reduced 8,205 euro long contracts up to Tuesday in the same week.

The total net speculative bullish positions on the euro (EUFX) stand at 82,637 contracts compared to 90,842 contracts in the previous week.

The week ahead

Economic data is limited so far this week, with the German industrial production and trade balance reports being on tap. There is not much on the US calendar as well.

If there is a follow-through from Friday’s euro weakness, we can expect a further correction. However, the loss could be limited. The euro is likely to experience some downward pressure only if Mario Draghi, president of the European Central Bank, talks it down at the Jackson Hole symposium later this month.