Global X DAX Germany ETF

Latest Global X DAX Germany ETF News and Updates

Euro Reaches 23-Month Peak: Could It Climb Higher?

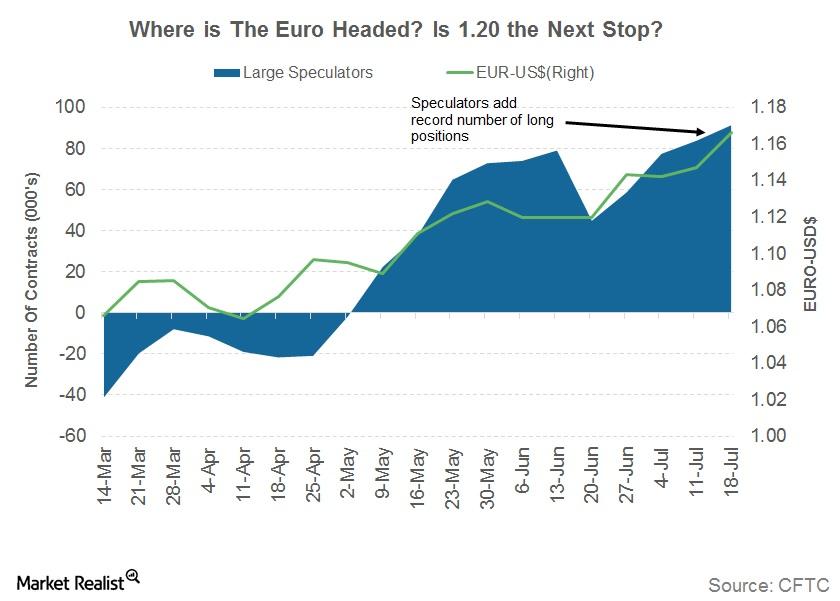

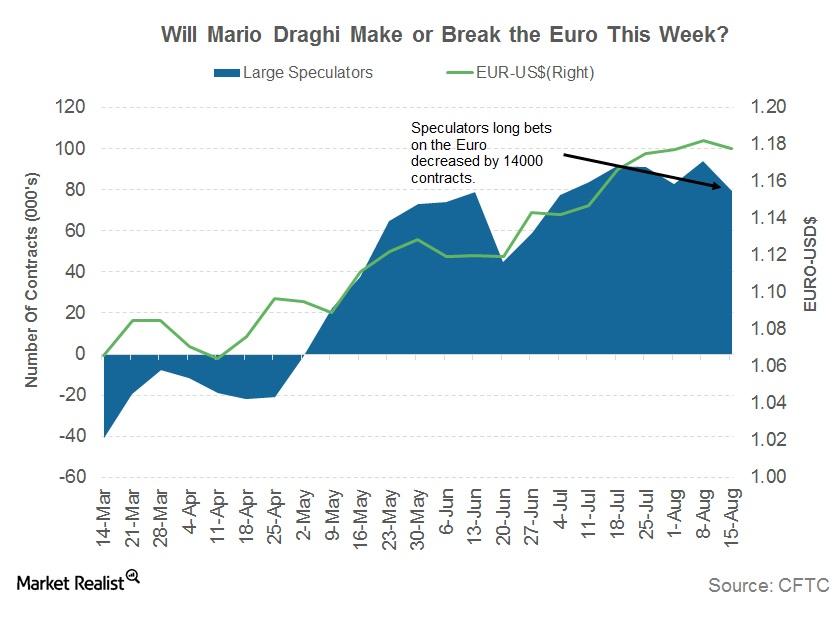

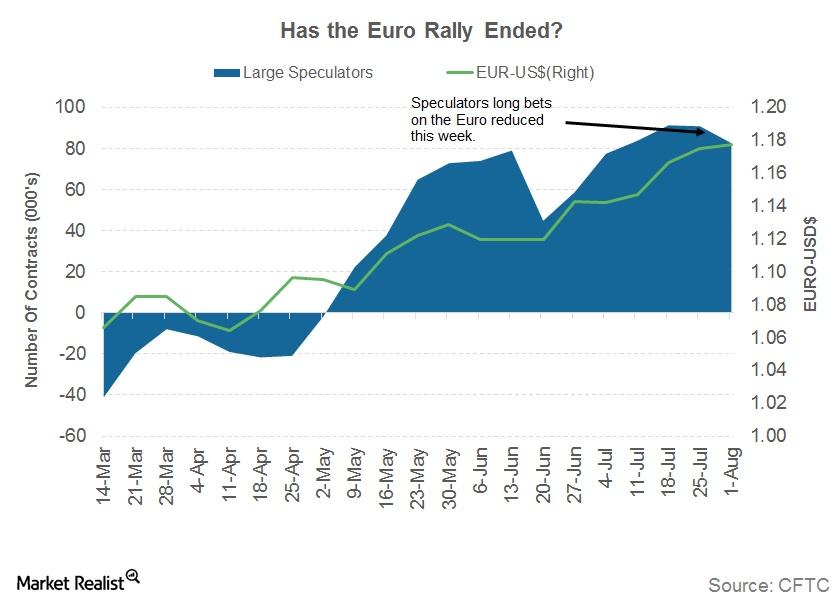

Euro rallies to a 23-month peak Last week, the euro (FXE) closed at 1.17, appreciating by 1.7% against the US dollar (UUP). The currency has appreciated by more than 10% against the US dollar this year, making it one of the strongest developed market currencies. Improving economic conditions and a stable political climate turned the […]

What to Expect from the Euro This Week

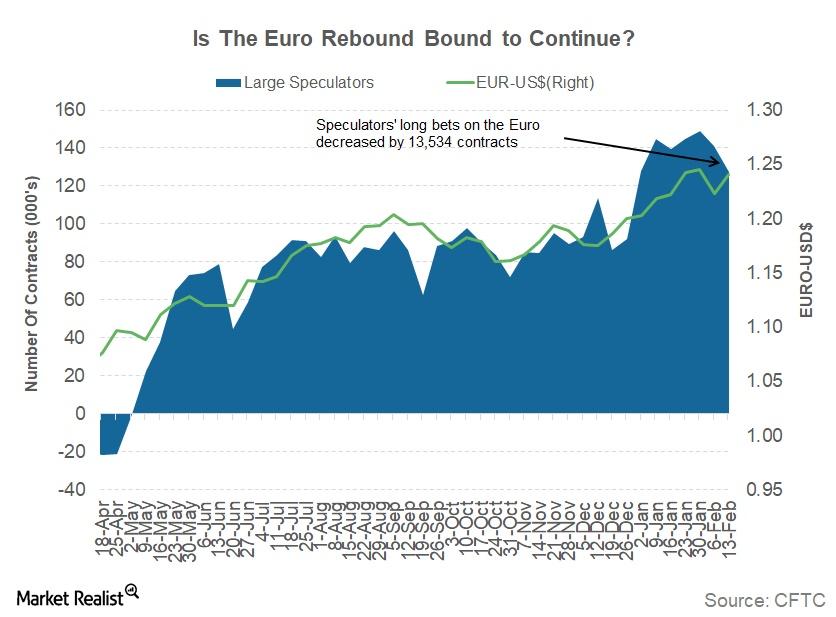

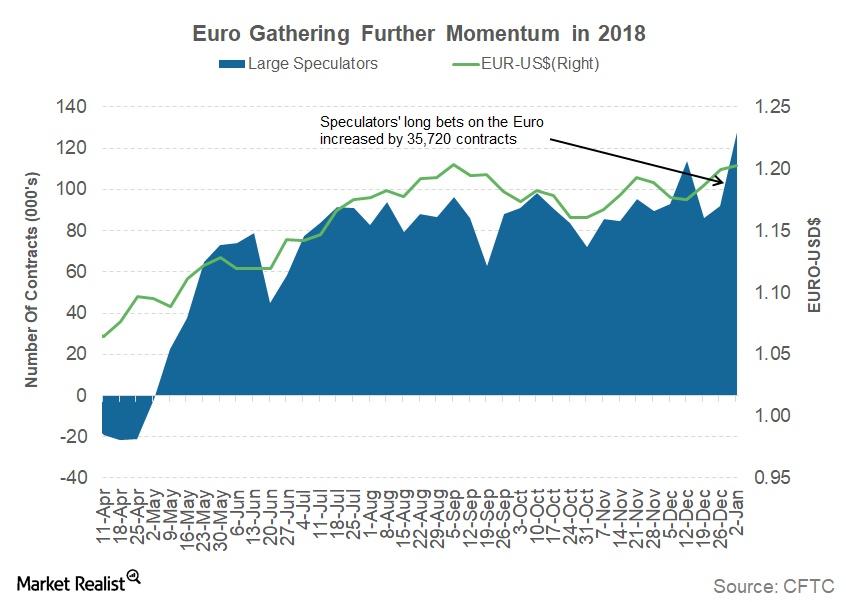

The euro-dollar (FXE) exchange rate closed the week ending February 16 at 1.24, an appreciation of 1.4% against the US dollar (UUP).

Politics and Central Bank Comments Could Drive the Euro Higher

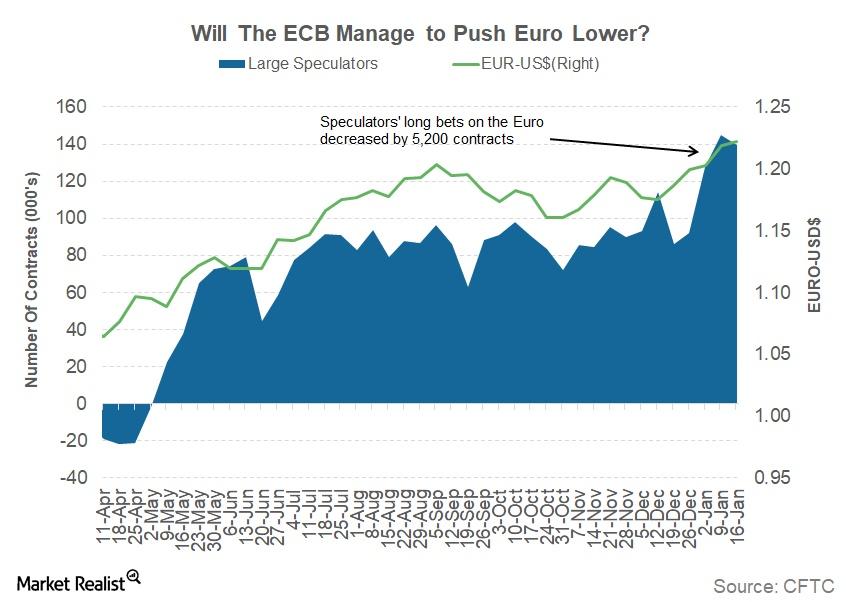

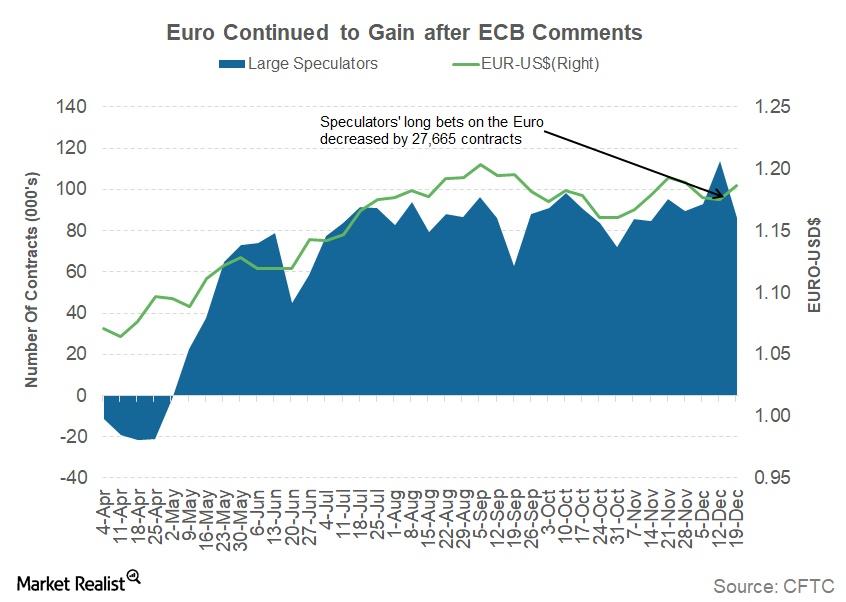

The Eurozone’s inflation data published on January 17 indicated that prices increased 1.4% in December 2017, which is still below the long-term average.

What Factors Are Driving the Euro Higher?

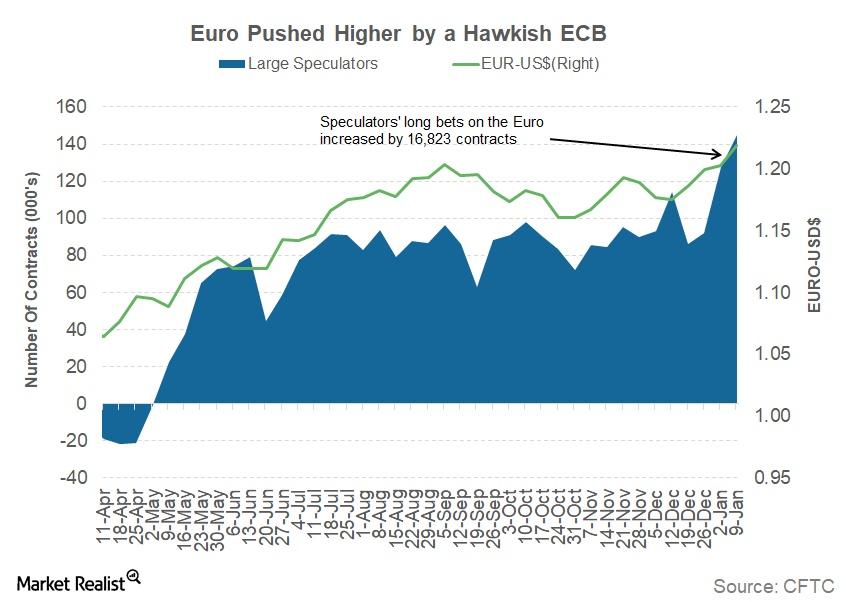

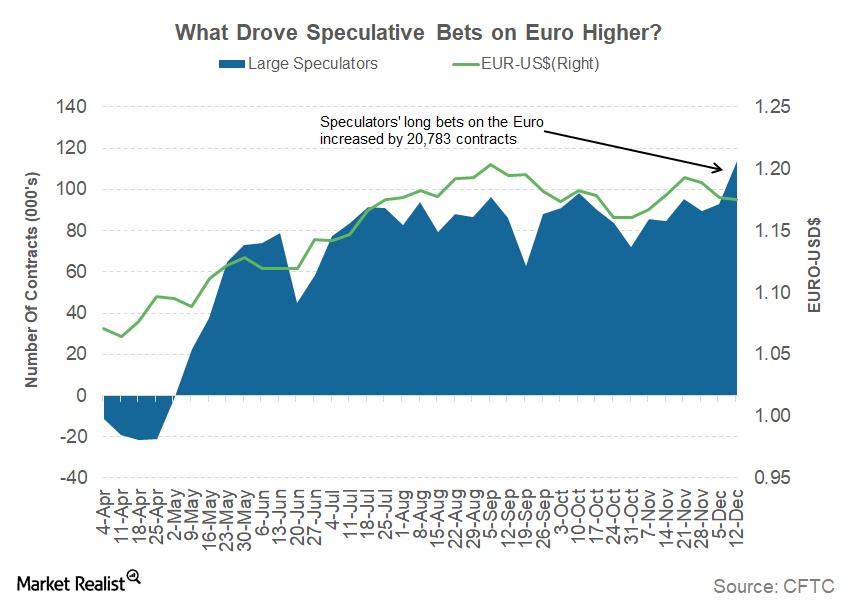

According to the January 12 Commitment of Traders report, speculators increased their long euro positions by 16,823 contracts last week.

Factors That Are Driving the Euro Higher

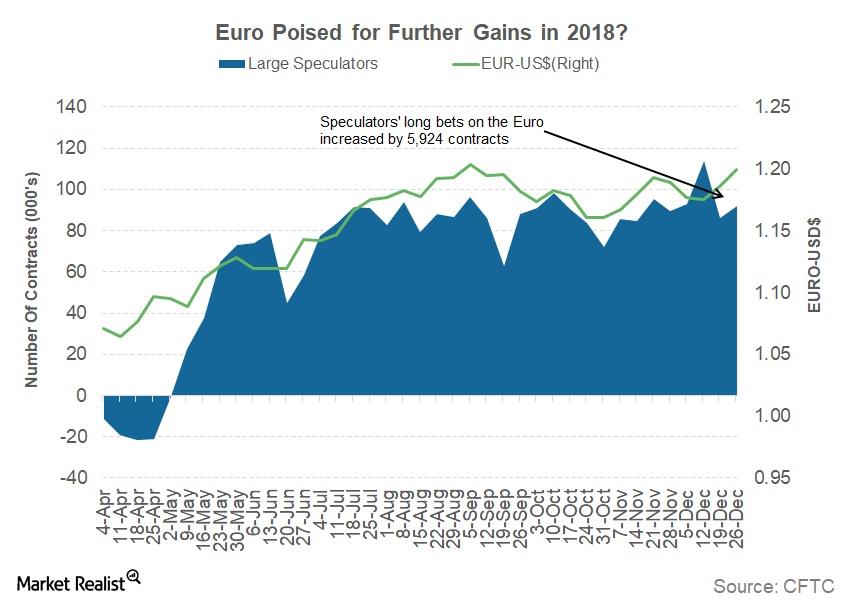

The euro appreciated 0.27% against the US dollar (UUP) after posting double-digit gains against the US dollar in 2017.

What to Make of the Surprising Gains in the Euro in 2017

The euro–dollar (FXE) pair closed 2017 at 1.1998. It appreciated by 13% against the US dollar and posted close to 10% gains against the other major global currencies.

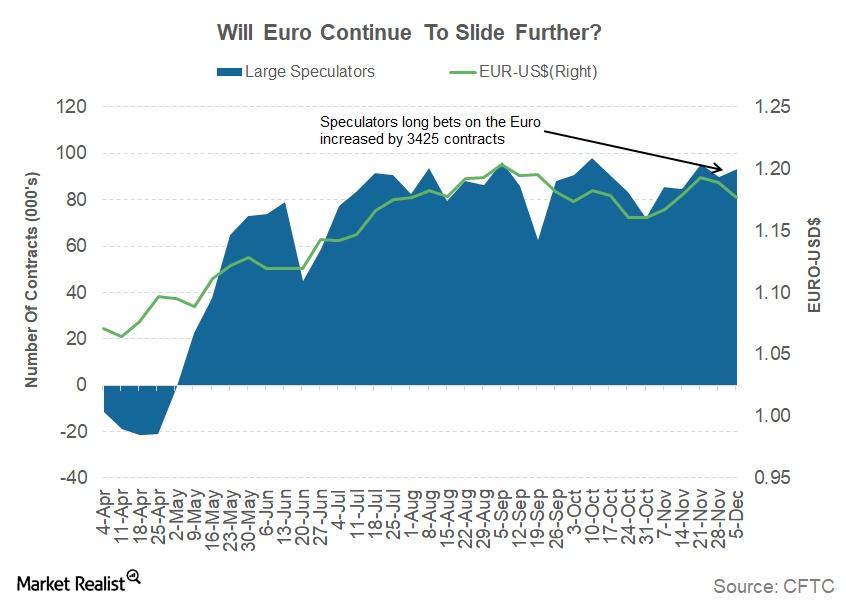

Here’s What Drove the Euro Higher Last Week

The euro (FXE) closed the week ended December 22, 2017, at 1.1864, appreciating 0.94% against the dollar (UUP).

What Drove the Euro Higher Last Week?

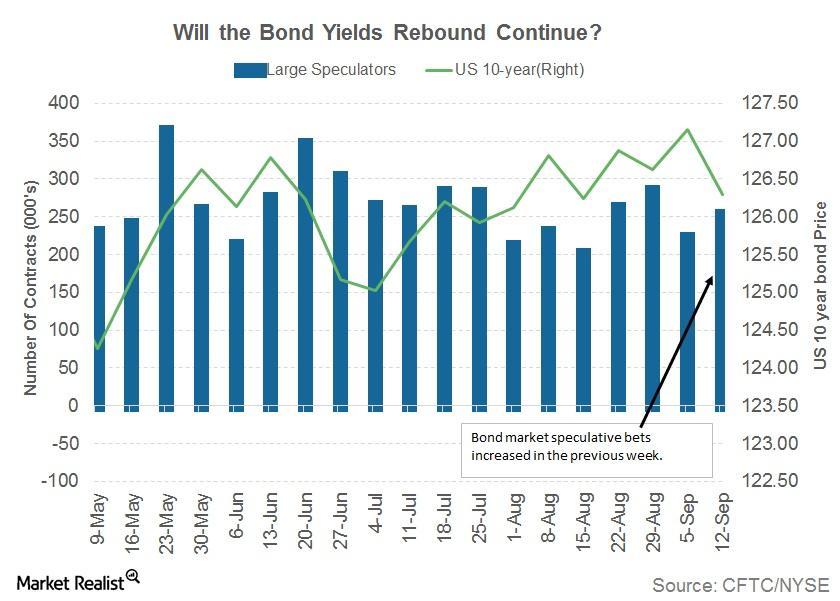

The total net speculative bullish positions on the euro (EUFX) increased from 93,106 contracts to 113,889 contracts in the previous week.

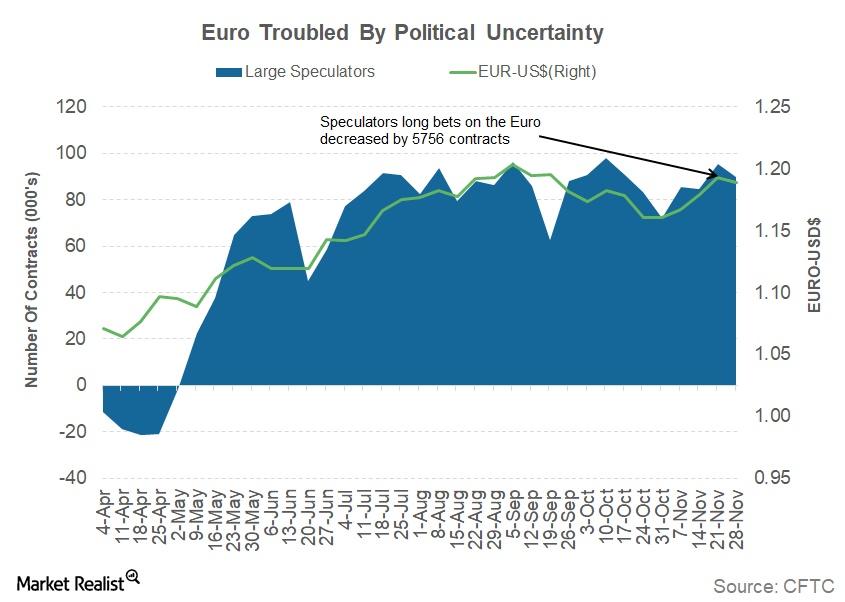

Why the Euro Continued to Fall Last Week

The euro-dollar (FXE) closed the week ending December 8 at 1.18, depreciating by 1.1% against the US dollar (UUP).

Are Politics Holding the Euro Back?

The euro-dollar (FXE) closed the week ending December 1 at 1.19, depreciating by 0.33% against the US dollar (UUP).

What Drove the Euro Higher against the Dollar Last Week?

The euro-dollar (FXE) closed the week ending November 17 at 1.2, appreciating by 1.1% against the US dollar (UUP).

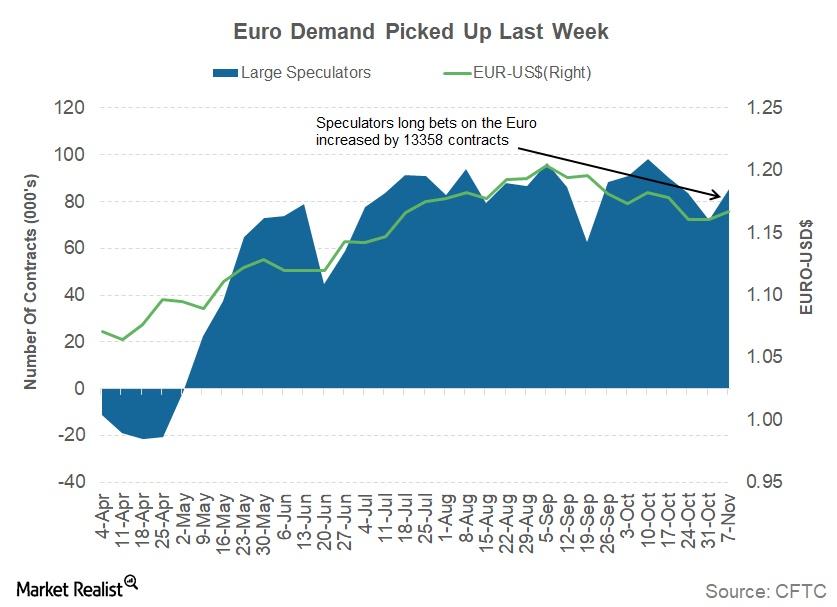

How Euro Managed to Bounce Back Last Week

The euro-dollar (FXE) pair closed the week ending November 10 at 1.2, appreciating 0.48% against the US dollar (UUP).

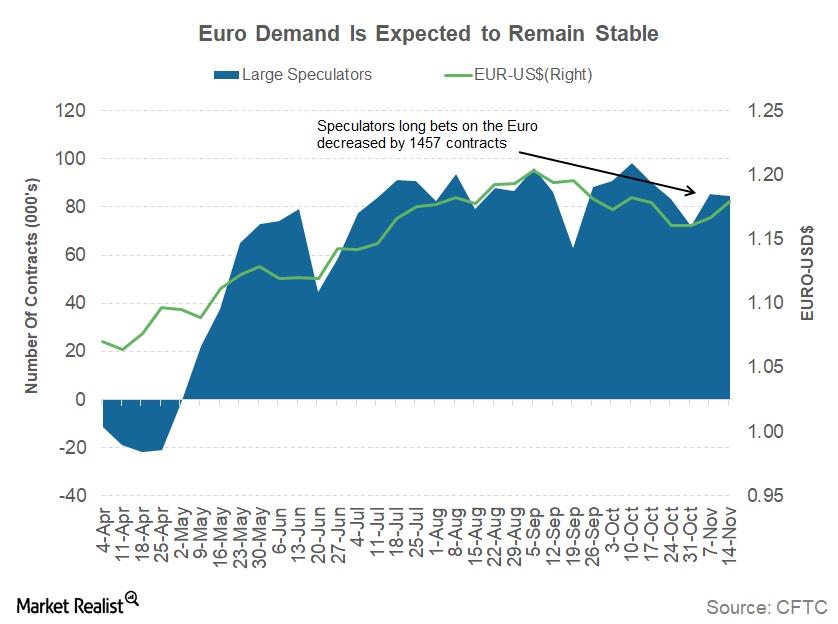

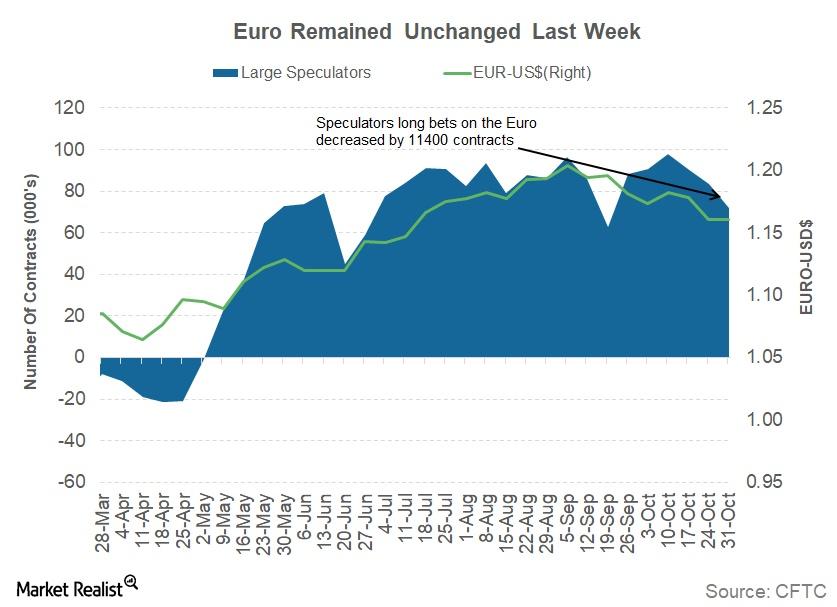

Why the Euro Is Likely to Remain Quiet this Week

The euro-dollar pair (FXE) closed the week ending November 3 at 1.1609 against the US dollar (UUP). Worries about a possible escalation of tensions in Spain’s Catalonia region proved futile.

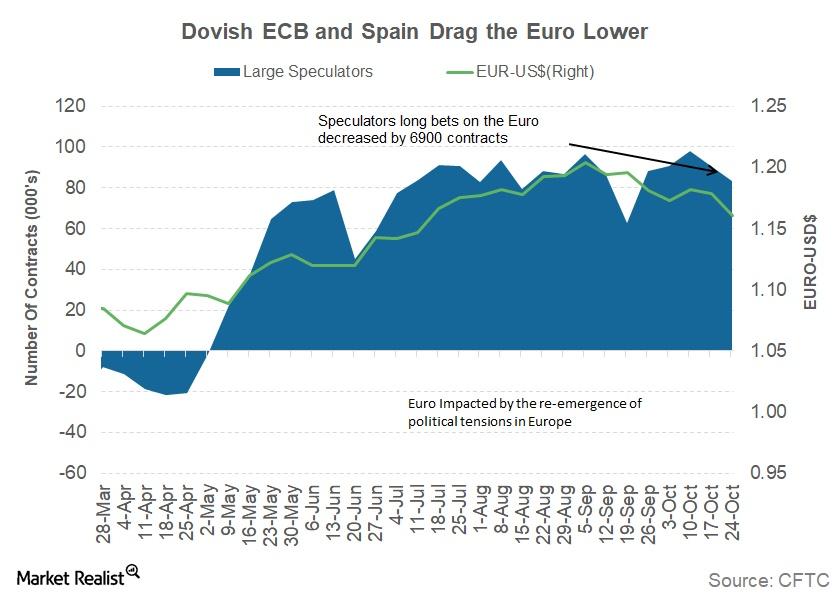

How Political Drama and ECB’s Dovish Statement Affected the Euro

The euro-dollar (FXE) pair closed the week ending October 27 at 1.16 against the US dollar (UUP).

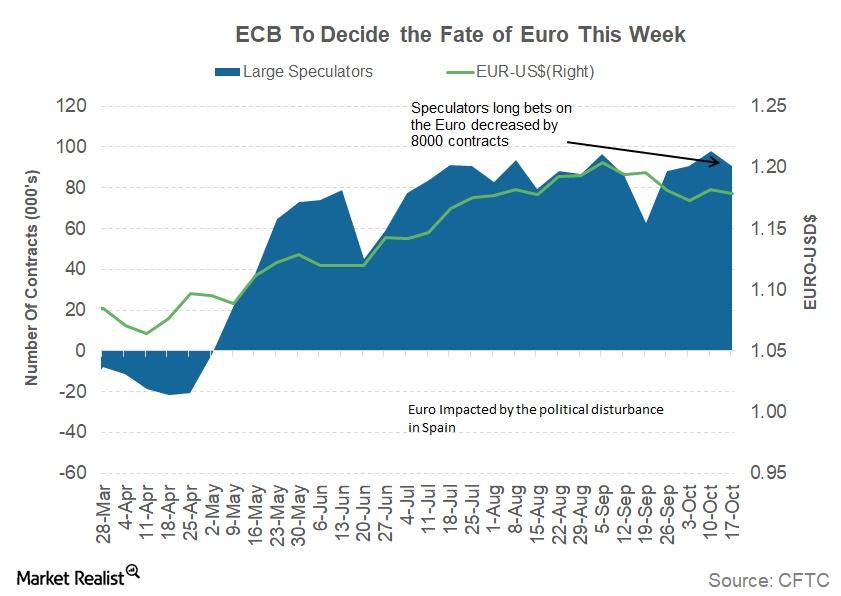

Why the Euro’s Troubles Could Continue This Week

The euro-dollar (FXE) closed the week ending October 20 at 1.179 against the US dollar (UUP).

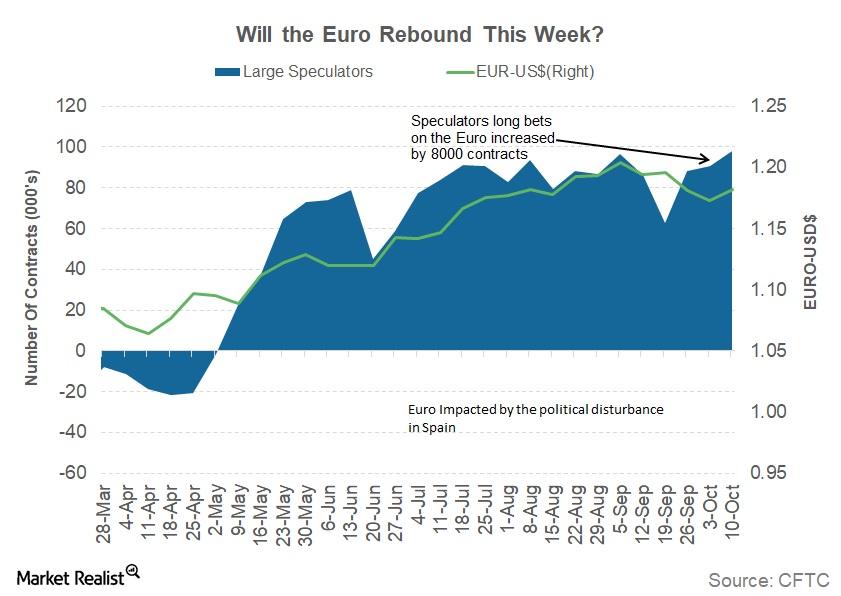

Will the Euro Regain Its Momentum this Week?

The euro-dollar (FXE) pair closed the week ending October 13 at 1.1822 against the US dollar (UUP). The shared currency managed to rebound from an 11-week low the week before, affected by political turmoil in Spain.

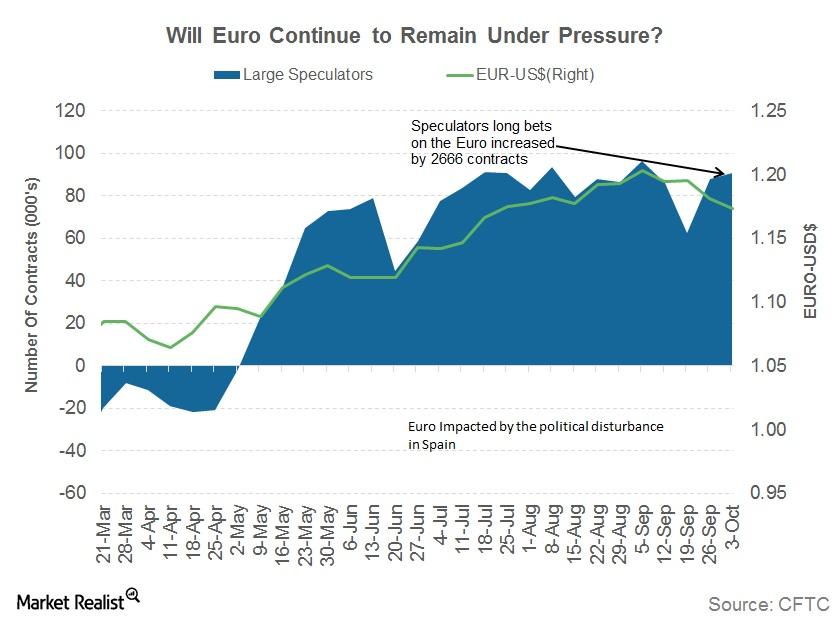

A Look at the Catalonia-Troubled Euro This Week

It’s possible that political pressures could keep the euro under pressure as the economic calendar remains light in the Eurozone.

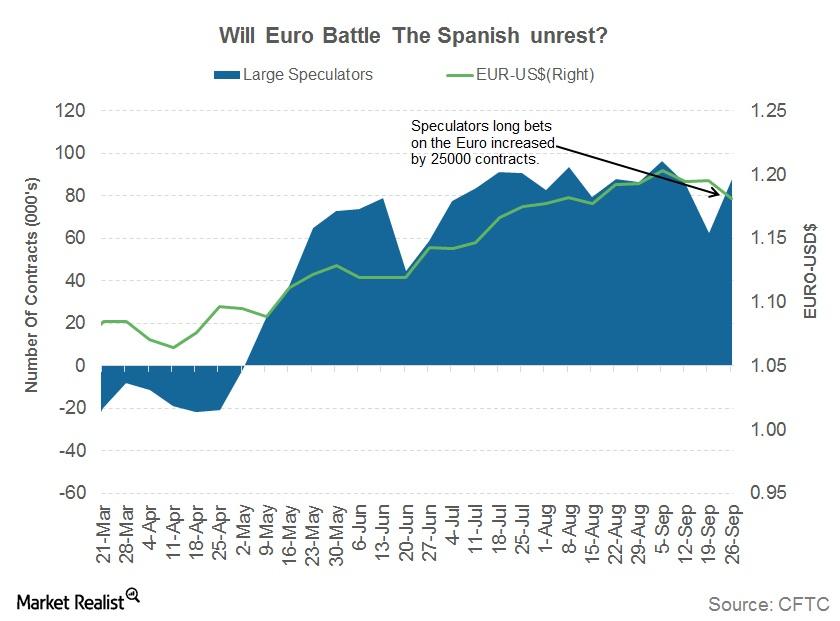

Will Spanish Unrest Drag the Euro Lower?

The euro-dollar (FXE) closed the week ending September 29 at 1.1814 against the US dollar (UUP). German election results had a minor negative impact on the shared currency.

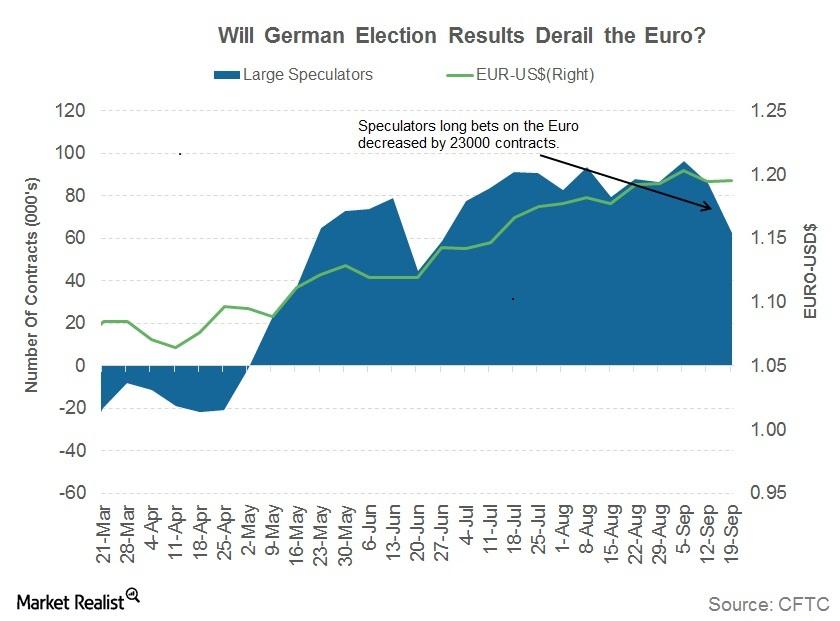

Will a Coalition Government in Germany Derail the Euro?

The euro-dollar (FXE) closed the week ending September 22 at 1.2 against the US dollar (UUP).

Why Was the Euro a Silent Spectator Last Week?

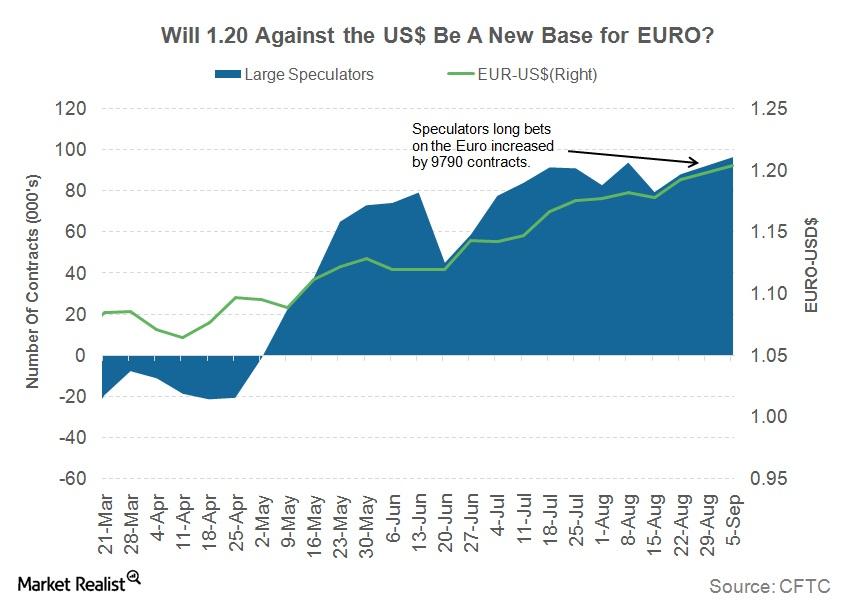

As per the latest Commitment of Traders (or COT) report, released on Friday, September 15 by the Chicago Futures Trading Commission (or CFTC), speculators turned bullish on the euro during the week.

Why the Euro Rose to a 3-Year High Last Week

The euro closed the week ended September 8, 2017, at ~1.20 against the US dollar. It rose 1.48% against the US dollar as euro bulls took charge.

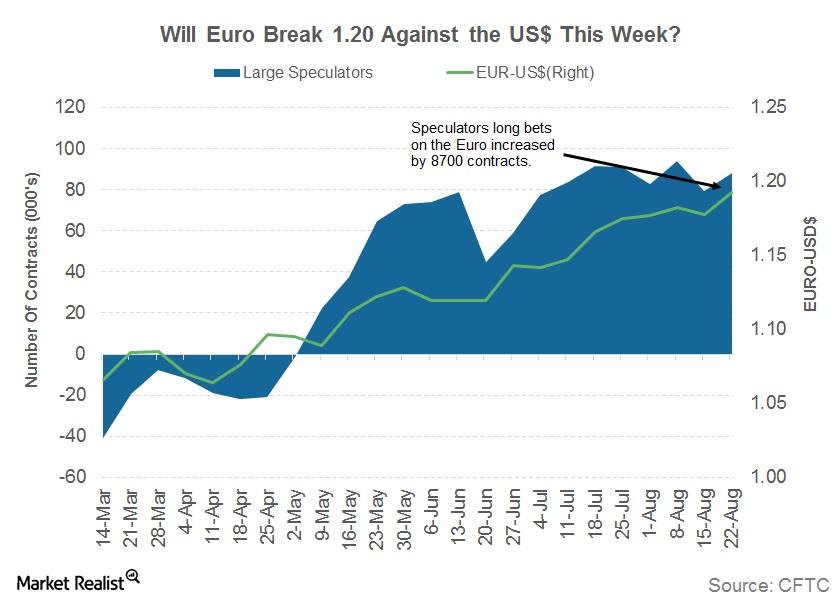

Why the Euro Could Remain Volatile This Week

The euro (FXE) closed the week ended September 1, 2017, at 1.19 against the US dollar (UUP). It lost 0.56% against the US dollar.

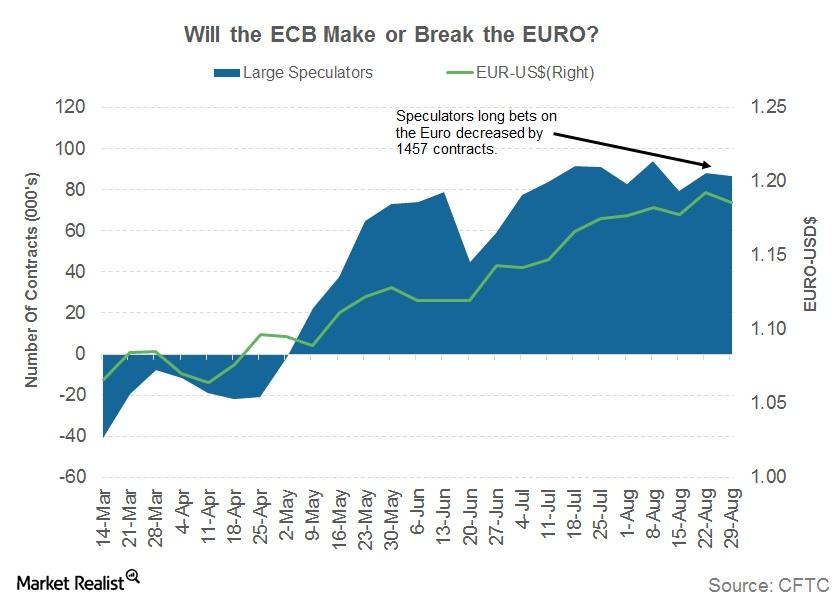

Mario Draghi Didn’t Stop the Appreciating Euro

European Central Bank President Mario Draghi gave didn’t comment about removing monetary stimulus in his speech at the Jackson Hole symposium.

Will Draghi Lift or Drown the Euro This Week?

The euro-dollar pair (FXE) closed the week ending August 18 at 1.18 against the US Dollar (UUP).

Is the Euro Running Out of Steam?

The German DAX (DAX) was up ~1.1%, Euro Stoxx (FEZ) was up ~1.1%, and France’s CAC was up ~1.4% in the week ended August 4, 2017.

Will Weak Data from the EU Derail the Euro?

The euro (FXE) remained confined to a narrow range against the US dollar (UUP) in the previous week.

Is Long Euro the Theme for Forex Markets?

The euro (FXE) remained in a narrow trading range against the US dollar (UUP) between the levels of 1.130 and 1.115 for the last five weeks.

Will the ECB Stop the Surging Euro?

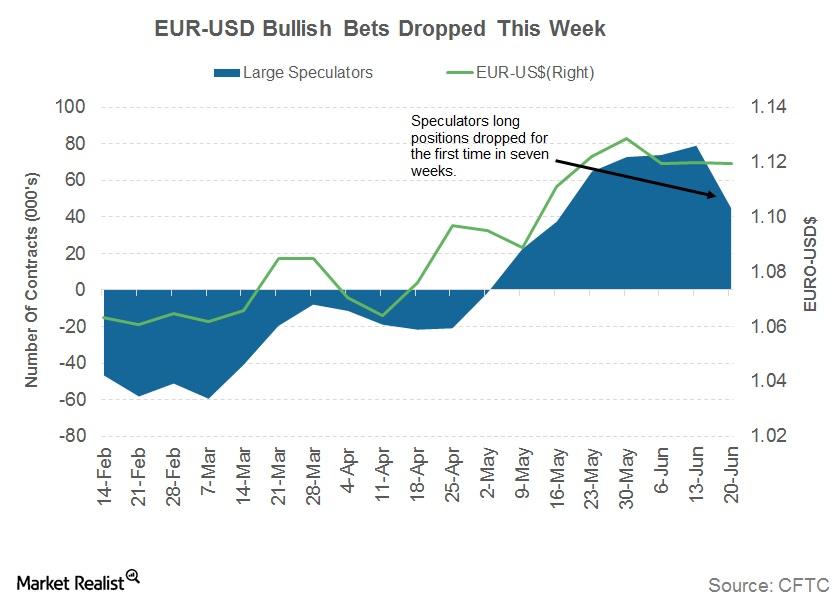

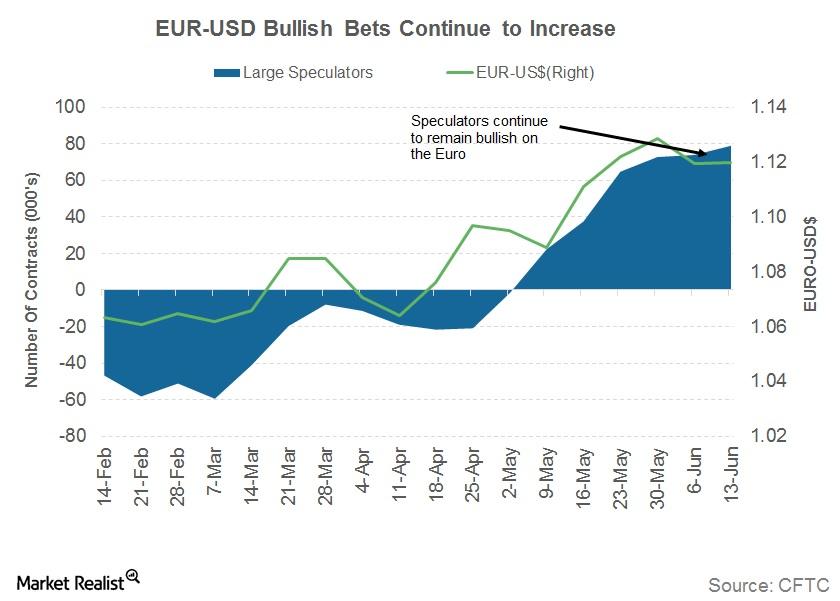

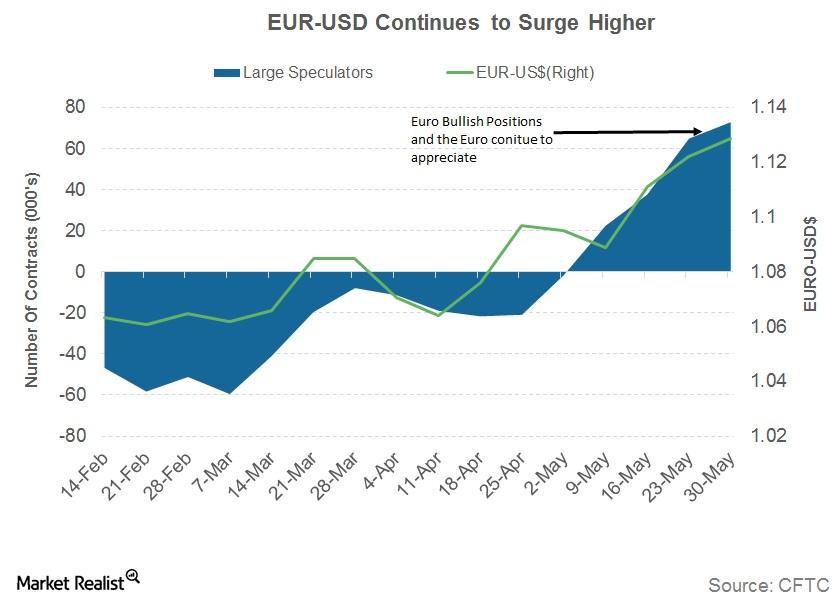

Last week (ended June 2), the euro continued to appreciate against the US dollar.

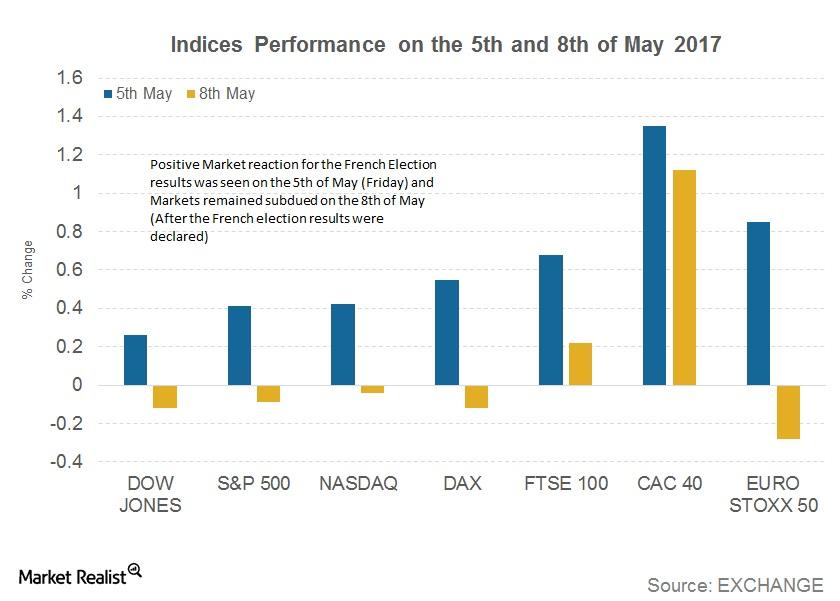

Will Market Optimism Continue after the French Election Results?

The celebration of Emmanuel Macron’s victory in the French election began when the markets opened in Asia on May 8, 2017. Asian markets excluding China (YINN) rose.