Broadcom Inc

Latest Broadcom Inc News and Updates

Broadcom Wants to Acquire VMware — Will the Deal Go Through?

Broadcom is in talks to acquire VMware. Will the deal go through and what’s to come of VMware stock? Here's what investors can expect.

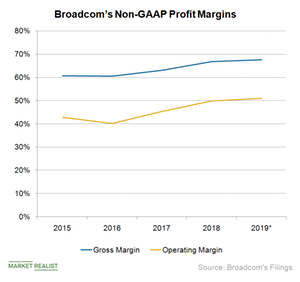

How Broadcom’s Acquisitions Could Improve Its Profitability

Broadcom’s profitability In the previous part of this series, we saw that Broadcom (AVGO) is likely to witness seasonal revenue decline as demand in its wireless segment, its second largest, falls. While revenue depends significantly on external factors such as customer demand, the pricing environment, and competition, profitability depends on internal factors such as cost control and product […]

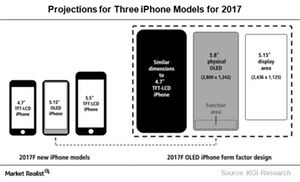

What’s All the Fuss about Apple’s iPhone 8?

Since 2017 marks the tenth anniversary of the iPhone, analysts and customers are expecting significant technology improvements in the iPhone 8.

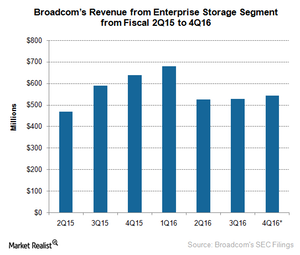

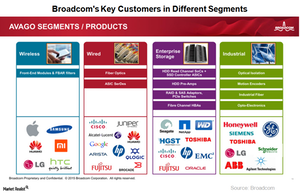

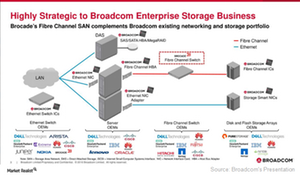

What Are Broadcom’s Plans for Its Enterprise Storage Business?

Broadcom’s latest acquisition of Brocade should double the size of its Enterprise Storage segment, which currently accounts for 13% of its revenue.

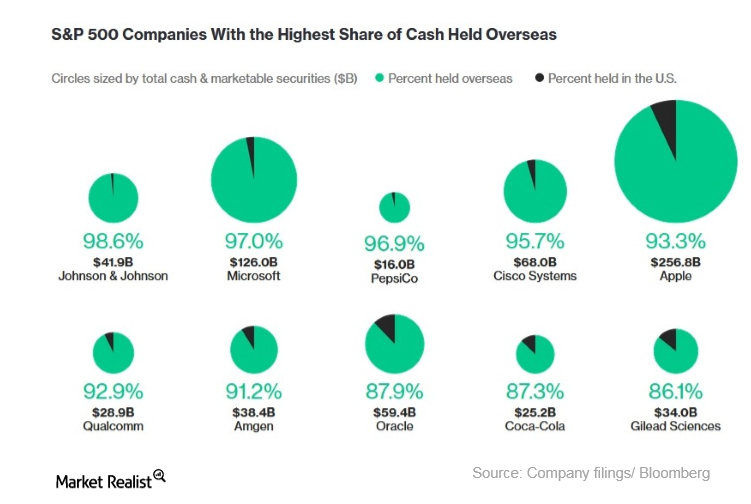

Where Does Broadcom Call Home?

Tax office in Singapore Broadcom (AVGO), which has proposed to acquire Qualcomm (QCOM), currently maintains large corporate offices in both the United States and Singapore. However, Broadcom is incorporated as a Singaporean company, so its tax office is in Singapore. Last year, the company said that it was considering shifting its corporate headquarters, or tax base, to […]

Broadcom Restructures CA Technologies’ Business Model

Broadcom (AVGO) has been growing its cash flow by acquiring companies that are market leaders with high cash flow.

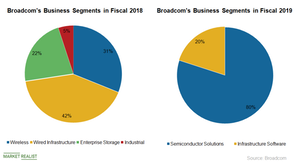

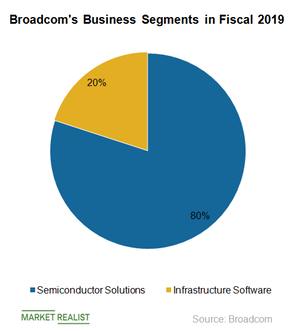

Here Are Broadcom’s New Business Segments in Fiscal 2019

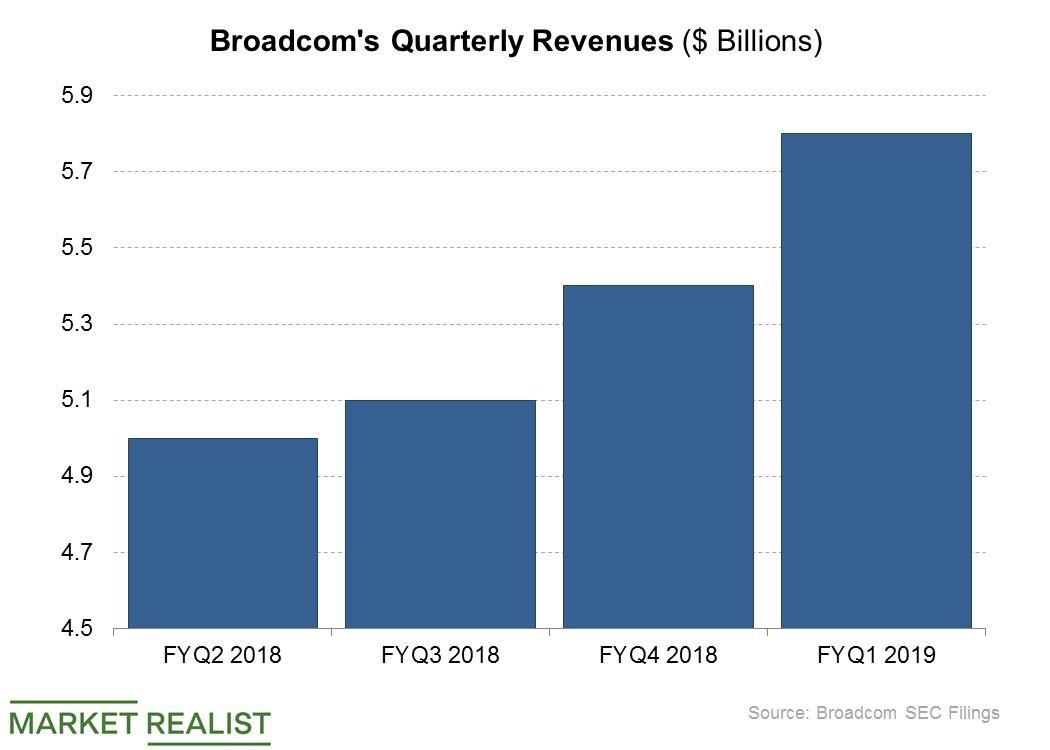

Broadcom’s (AVGO) fiscal 2019 first-quarter revenue is expected to be hit by declines in Apple’s (AAPL) iPhone sales and a slowdown in spending by hyperscale cloud customers.

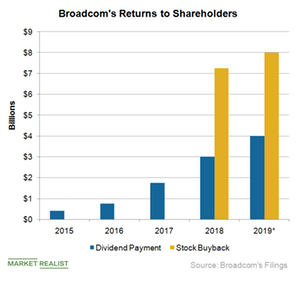

Checking In on Broadcom’s Stock Buyback

Broadcom’s capital allocation policy is to spend 50% of its trailing-12-month free cash flow in dividends and use the remaining for acquisitions and buybacks.

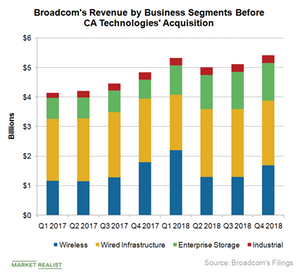

What Drove Broadcom’s Fiscal 2018 Revenue?

Broadcom (AVGO) has grown its business organically and through acquisitions.

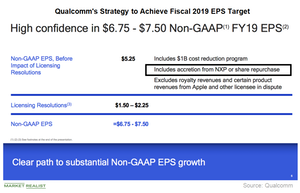

How Successful Has Qualcomm’s $30 Billion Buyback Been?

Qualcomm (QCOM) is a leader in the mobile market, with its chips powering 95% of the world’s smartphones.

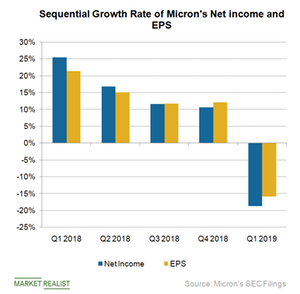

What’s Unique about Micron’s Stock Buyback Program?

Micron, a pure-play memory chipmaker, has one of the semiconductor industry’s most cyclical stocks.

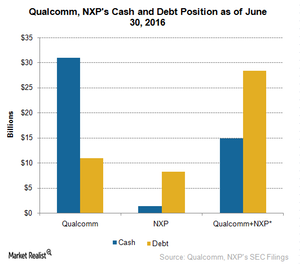

How Would Qualcomm Fund a Possible Acquisition of NXP?

If Qualcomm (QCOM) looks to buy NXP Semiconductors (NXPI), the deal could be valued at just above $30 billion or as high as $46 billion.

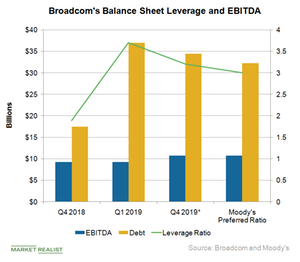

Broadcom’s Acquisitions Burden Its Balance Sheet with High Debt

At the end of fiscal 2018, Broadcom’s cash reserves stood at $4.3 billion, and long-term debt stood at $17.5 billion.

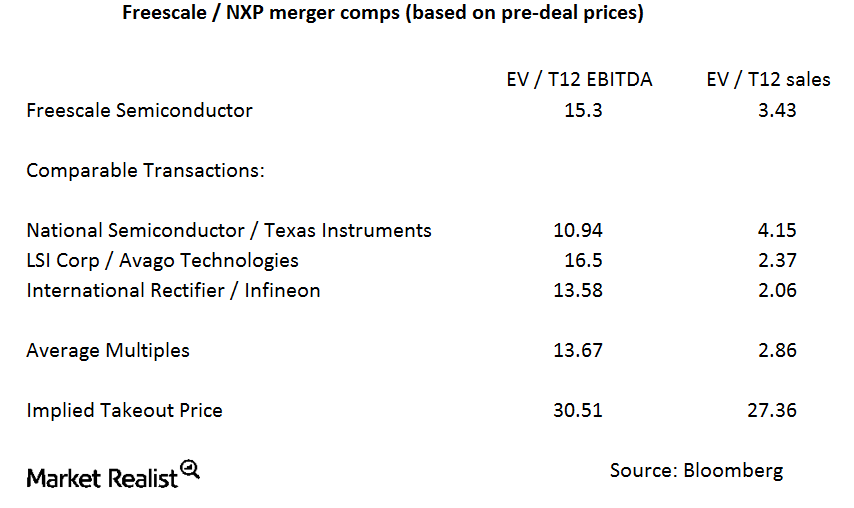

Why is the Freescale–NXP merger premium so low?

The companies were asked about the takeover premium and the background to the transaction on the conference call, but they refused to comment.

What’s behind Semiconductor Stocks’ Rise?

Most semiconductors stocks had risen more than 2% as of midday today, with several factors having raised investors’ optimism about the sector’s growth.

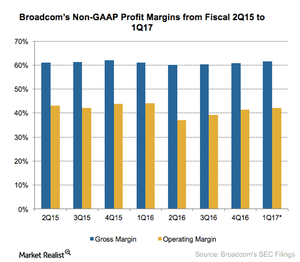

Why Broadcom Is One of the Most Profitable Semiconductor Companies

Until now, Broadcom’s profits were a product of a favorable product mix, low costs, and high volumes.

Intel-Qualcomm Competition Extends to 5G and Automotive

Qualcomm (QCOM) has already taken the mobile market from Intel (INTC). Qualcomm is now venturing into the server processor market.

Qualcomm Lifts Its Dividend amid Coronavirus Risk

Qualcomm stock (NASDAQ:QCOM) rose about 8.6% on Tuesday. Notably, the semiconductor giant announced a rise in its dividend.

AMD Stock Fell Due to Disappointing Guidance

AMD reported upbeat fourth-quarter results on Tuesday after the market closed. The company posted better-than-expected revenue and earnings in the quarter.

Analyzing Broadcom’s Acquisitions in the Software Sector

Broadcom has been making many acquisitions in the software industry. The semiconductor giant seems to be drifting away from its core chip business.

Is Apple the Most Suitable Buyer for Broadcom’s RF Chip?

Broadcom (AVGO) stock rose by 0.3% on Tuesday, after reports that Apple (AAPL) could buy Broadcom’s RF (radio-frequency) chip business.

Why Is Microchip Stock Rising Today?

Microchip stock rose in pre-market trading today after the company updated its financial guidance for the third quarter of fiscal 2020.

Qualcomm to Expand 5G Chip Tech Next Year

Qualcomm (QCOM) will expand its 5G chip technology next year. Qualcomm will soon power the mid-priced smartphones with its 5G wireless data networks.

Coupa Index Flashes Red Light on Economy after PMI

Today, the third-quarter Coupa Business Spend Index was released. It’s a relatively new economic indicator that offers insights into corporate spending.

JPMorgan and Bank of America: Time to Buy Stocks

In August, JPMorgan Chase (JPM) and Bank of America Merrill Lynch (BAC) suggested that investors not buy just yet. Their opinions are now changing.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

Symantec Rewards Shareholders with Special Dividend

Yesterday, Symantec (SYMC) inked an all-cash deal with Broadcom (AVGO) to sell its Enterprise Security unit for $10.7 billion.

Symantec Stock Surges Over 10% on Broadcom Buyout Talks

Symantec stock is gaining momentum and is up over 10% in premarket trading on the news of its acquisition deal with Broadcom.

Qualcomm Faces Multifold Impact of the Huawei Ban

Qualcomm has been among the hardest hit by the Huawei ban, and now it will suffer the effects of the newest round of tariffs.

Trade War: Trump’s Advisers Think It’s a ‘Prosperity Killer’

President Trump’s advisers want him to focus on strengthening the economy, even if he has to ease up a little on his trade war rhetoric.

China Wants Huawei Ban Lifted, Trump Talks 5G with India

Discussing 5G with India could be part of President Trump’s mind game before his meeting with President Jinping.

Broadcom Stock Is Technically Stronger than Peers

Broadcom (AVGO) stock gives a glimpse of the health of semiconductor stocks. It moves in tandem with the VanEck Vectors Semiconductor ETF (SMH). Semiconductor stocks rose in the first four months of 2019 over the anticipation of growth in the second half.

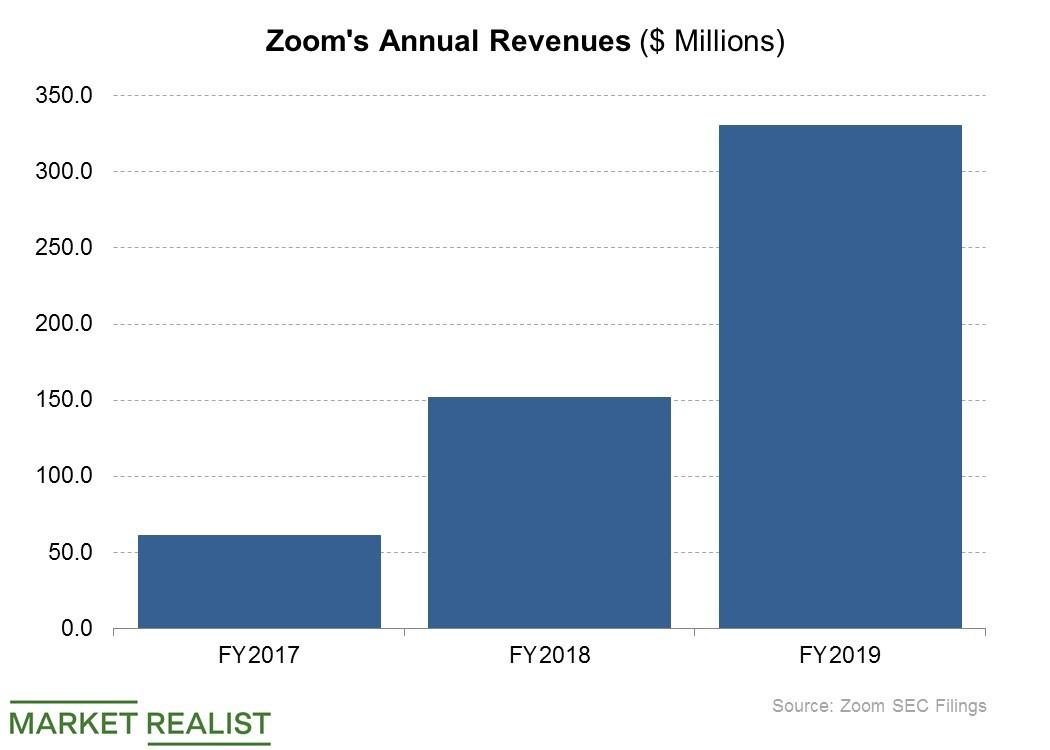

A Look at Zoom’s Most Prominent Customers

Zoom Video Communications (ZM) serves customers of all sizes, from sole businesses to Fortune 50 organizations.

Where Does Apple-Qualcomm Truce Leave Broadcom?

Broadcom (AVGO) is a leading supplier of smartphone components.

Broadcom Taps Infrastructure Software Market with CA Technologies

Broadcom’s (AVGO) fiscal 2019 earnings will be driven by its integration of CA Technologies.

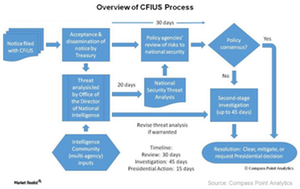

Broadcom Didn’t Convince CFIUS to Approve the Qualcomm Takeover

A day after CFIUS began its review, Tan visited the senior members of the government agency to discuss the matter.

Why the Technology Industry Opposed the Broadcom–Qualcomm Deal

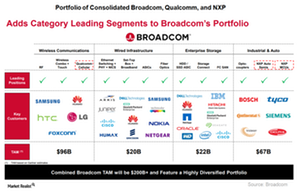

Broadcom (AVGO) failed to crack the technology industry’s biggest acquisition of Qualcomm for $117 billion due to intervention by President Trump.

What Mergers and Acquisitions Could Open Up for Qualcomm

Qualcomm is looking to venture into automotive, servers, IoT (Internet of Things), and laptops.

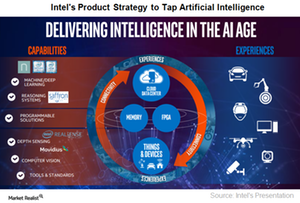

Nvidia and Intel: The Benefits of Artificial Intelligence

Nvidia’s GPUs are preferred by many data center and cloud companies for their AI tasks. That saw its data revenue grow in the triple digits in 2017.

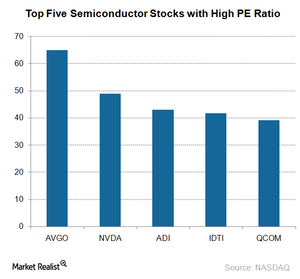

Why Semiconductor Stocks with High PE Ratios Are So Important to Investors

As of December 22, 2017, Broadcom (AVGO) had the highest PE ratio of 65x, followed by NVIDIA (NVDA) at 48.85x.

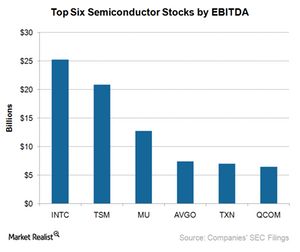

Reading the Most Profitable Semiconductor Companies

In calendar 3Q17, Intel (INTC) was the most profitable semiconductor company, with a last-12-month EBITDA of $25.3 billion.

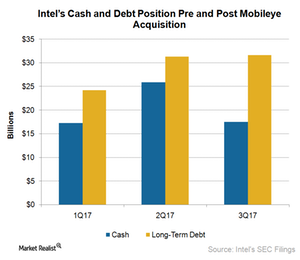

How Did the Mobileye Acquisition Impact Intel’s Balance Sheet?

Intel (INTC) is increasing its earnings through spending discipline and by focusing its expenses on projects with high ROI (return on investment).

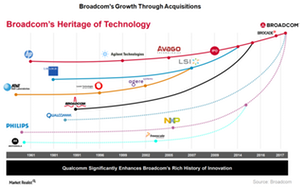

How Does Qualcomm Fit into Broadcom’s Business Model?

Broadcom climbed the ladder through acquisitions, while Qualcomm climbed the ladder through its technology advantage in the smartphone industry.

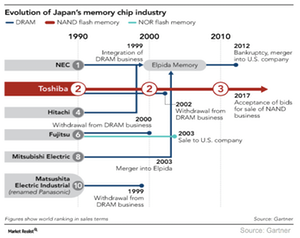

AVGO’s Bid for Toshiba’s Memory Business Surrounded by Hurdles

Broadcom (AVGO) is bidding for Toshiba’s (TOSBF) NAND (negative-AND) Flash business in order to expand in the network storage market.

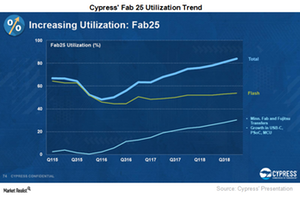

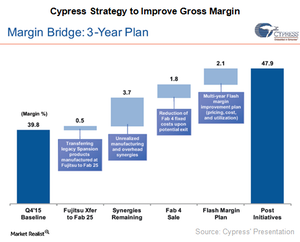

Cypress Semiconductor’s Strategy to Improve Gross Margin

Cypress Semiconductor (CY) aims to increase its gross margin from 40.0% currently to 43.0% by fiscal 4Q17 and 47.9% by fiscal 4Q18.

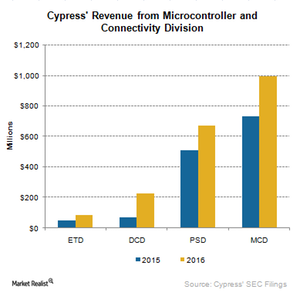

Why Cypress Semiconductor Restructured Its Business Segments

Cypress has combined its four business segments into two: MCD (Microcontroller and Connectivity Division) and MPD (Memory Products Division).

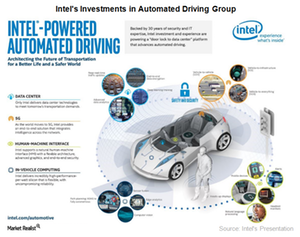

Could Intel Make the Mobileye Integration a Success?

Intel is looking to mitigate the integration risk by integrating its Automated Driving Group with Mobileye instead of integrating Mobileye into its business.

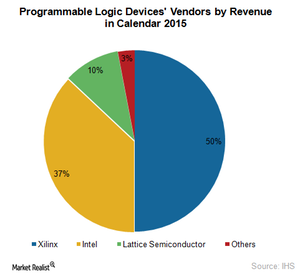

Does Consolidation in the FPGA Market Make Xilinx an Acquisition Target?

In the past, analysts have named Broadcom (AVGO), Qualcomm (QCOM), and Texas Instruments (TXN) as potential bidders for Xilinx.

Inside Cypress’s Strategy to Improve Its Gross Margin

Cypress reported strong revenues on the integration of Broadcom’s wireless IoT business, which improved its gross margin until the Spansion merger in 1Q15.

What’s the Strategy behind Broadcom’s Brocade Acquisition?

Broadcom is acquiring Brocade in order to benefit from the latter’s strong cash flow. This raises the question of why Brocade agreed to be acquired if its business was profitable.