Here Are Broadcom’s New Business Segments in Fiscal 2019

Broadcom’s (AVGO) fiscal 2019 first-quarter revenue is expected to be hit by declines in Apple’s (AAPL) iPhone sales and a slowdown in spending by hyperscale cloud customers.

Nov. 20 2020, Updated 5:21 p.m. ET

Broadcom’s business segments

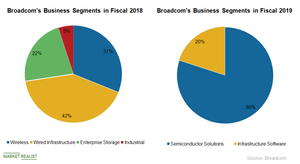

Previously, we saw that Broadcom’s (AVGO) fiscal 2019 first-quarter revenue is expected to be hit by declines in Apple’s (AAPL) iPhone sales and a slowdown in spending by hyperscale cloud customers. The weakness in these two markets will likely impact Broadcom’s Semiconductor Solutions segment.

Semiconductor Solutions

In fiscal 2019, Broadcom is expected to earn 80% of its revenue from Semiconductor Solutions, which includes its traditional hardware businesses of Wired, Wireless, Enterprise Storage, and Industrial. The company is diversifying its wireless business beyond Apple to a larger smartphone market. It will supply its Wi-Fi 6-capable chip “BCM43752” for Samsung’s (SSNLF) flagship Galaxy S10-series. It has also announced the BCM43752 Wi-Fi 6 chip for the mass market. Broadcom’s wireless business could gain from increasing content in premium phones and unit share gain in mid-range phones.

All four of Semiconductor Solutions segment’s businesses will likely benefit from the transition to 5G (fifth generation) technology. Broadcom has developed its complete 5G switching portfolio, which consists of six devices: Monterey, Quartz, Qumran2a, Jericho2, Jericho2c, and Ramon. The portfolio is designed to meet the high-performance requirements of new Ethernet-based 5G New Radios and base stations.

Infrastructure Software

In fiscal 2019, Broadcom is expected to earn 20% of its revenue from Infrastructure Software, which includes licenses offered by CA Technologies. This segment is offering its PLA (Portfolio License Agreement) solution, which adopts a cost-effective XaaS (Everything-as-a-Service) approach over the Saas (Software-as-a-Service) licensing model. The XaaS offers enterprise customers end-to-end software development solutions and a faster time to market. Broadcom’s PLA solutions have been adopted by Barclays (BCS) for its digital transformation initiatives.

The above factors are expected to drive Broadcom’s revenue in fiscal 2019. Next, we will look at the company’s profitability.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!