Barclays PLC

Latest Barclays PLC News and Updates

Barclays CEO Jes Staley Will Still Get Paid After His Resignation

Barclays CEO Jes Staley resigned amid an investigation into his relationship with Jeffrey Epstein. What's his net worth?

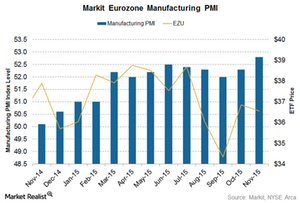

Credit Suisse and Barclays Are Bullish on European Equity for 2016

Credit Suisse (CS) strategists forecast 10% earnings growth in Europe versus a 6.8% growth expected from the US.

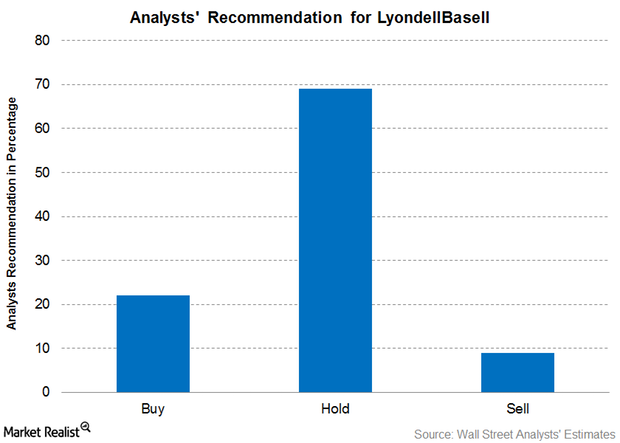

How Wall Street Analysts Rate LyondellBasell ahead of 1Q18 Earnings

The analyst consensus target price for LyondellBasell is $116.82, implying a return potential of 8.5% over the closing price of $107.68 as of April 20, 2018.

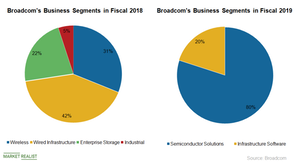

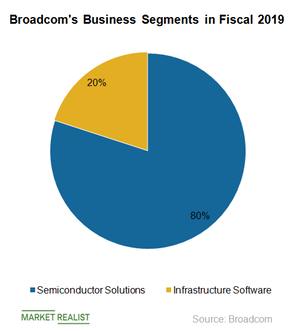

Here Are Broadcom’s New Business Segments in Fiscal 2019

Broadcom’s (AVGO) fiscal 2019 first-quarter revenue is expected to be hit by declines in Apple’s (AAPL) iPhone sales and a slowdown in spending by hyperscale cloud customers.

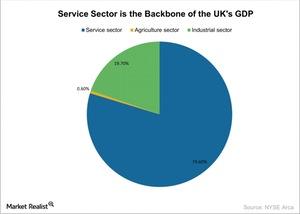

Which Sectors in the UK Will the ‘Brexit’ Decision Affect Most?

The financial sector has contributed heavily to the UK economy. Financial institutions like HSBC and Barclays will face challenges doing business in the EU.

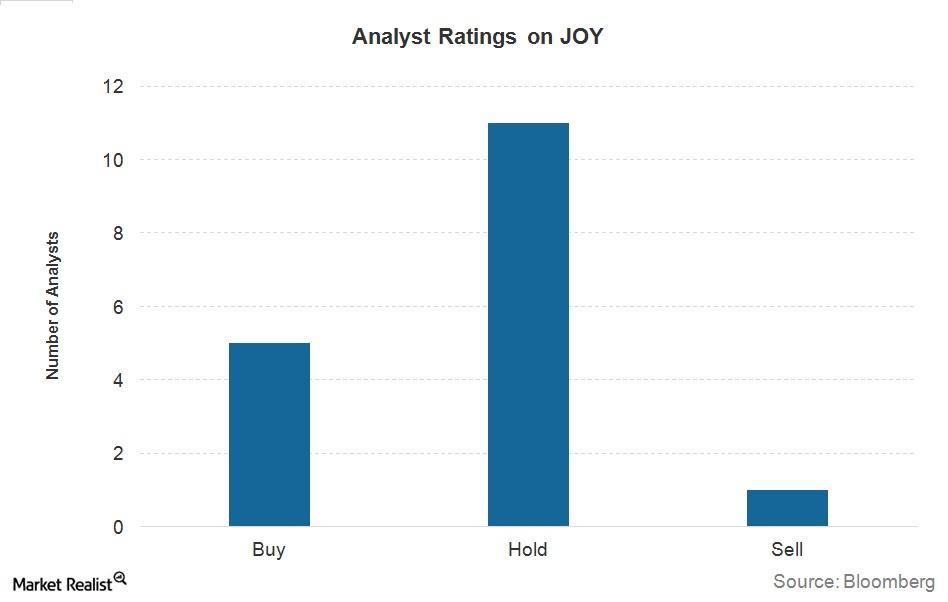

The Word on the Street: What Analysts Are Recommending for Joy Global Now

Of the 17 analysts surveyed by Bloomberg, only five issued “buy” recommendations for Joy Global, while 11 issued “holds,” and one issued a “sell.”

Analysts Lower Target Price on FedEx after Its 2019 Outlook Cut

Most analysts reduced their target prices on FedEx after the delivery giant trimmed its fiscal 2019 earnings outlook.

Broadcom Taps Infrastructure Software Market with CA Technologies

Broadcom’s (AVGO) fiscal 2019 earnings will be driven by its integration of CA Technologies.

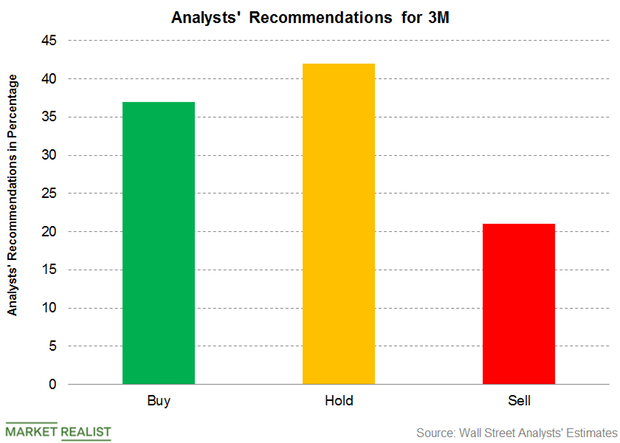

3M: Analysts Revised the Target Price

For 3M stock, 37% of the analysts recommended a “buy,” 42% recommended a “hold,” and 21% recommended a “sell.”

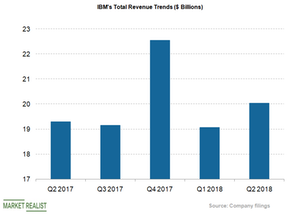

Can IBM’s Blockchain Retain Its Market Share?

According to a report by the IDC, total spending on the blockchain platform is expected to climb by 122% to $2.1 billion.

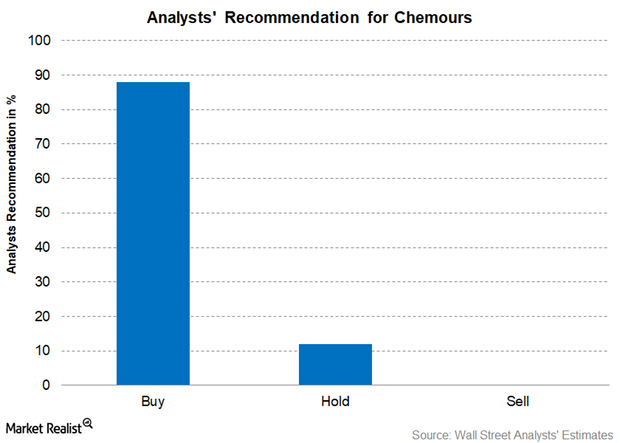

Chemours: Analysts’ Recommendations and More

For Chemours, 88% of the analysts recommended a “buy,” 12% of the analysts recommended a “hold,” and none of the analysts recommended a “sell.”

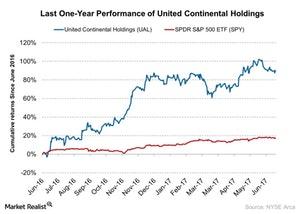

Why Barclays Thinks UAL Earnings Could Improve

UAL is currently trading at $76. Its 52-week high is $83.04, and its 52-week low is $37.64.

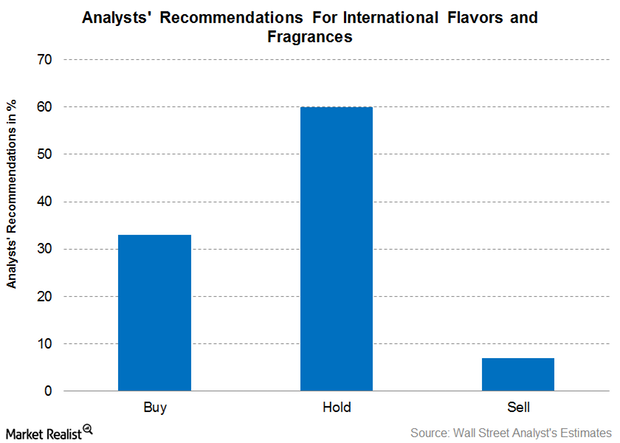

Analysts’ Recommendations for IFF after Its 1Q17 Earnings

As of May 9, about 33% of the analysts recommended a “buy” for International Flavors & Fragrances, 60% recommended a “hold,” and 7% recommended a “sell.”

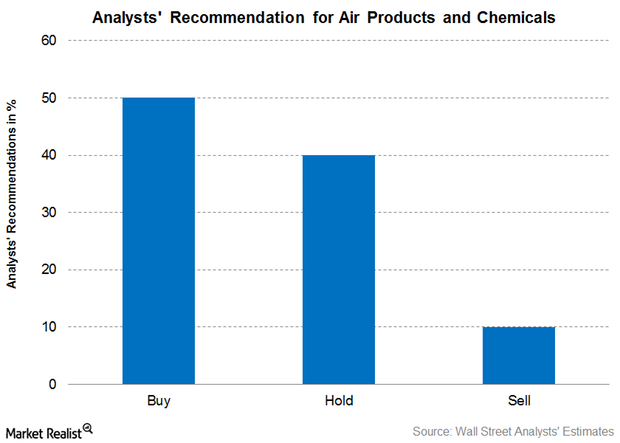

Analysts’ Latest Recommendations for Air Products & Chemicals

As of March 29, 2017, 20 brokerage firms were actively tracking Air Products & Chemicals (APD). About 50.0% of them recommended a “buy” for the stock.

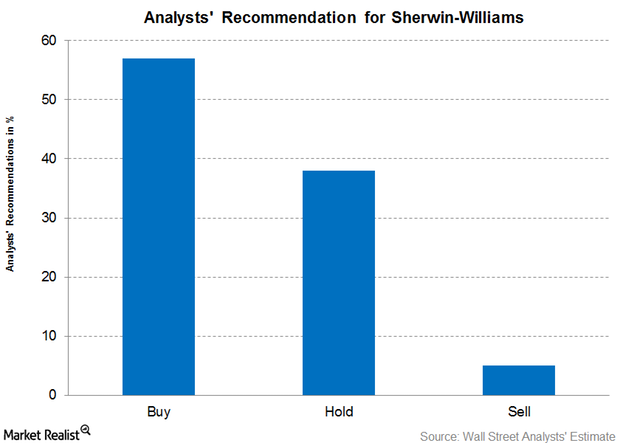

Analysts’ Latest Recommendations for Sherwin-Williams

As of February 27, 21 brokerage firms were actively tracking Sherwin-Williams stock—57% gave it a “buy,” 38% gave it a “hold,” and 5% gave it a “sell.”

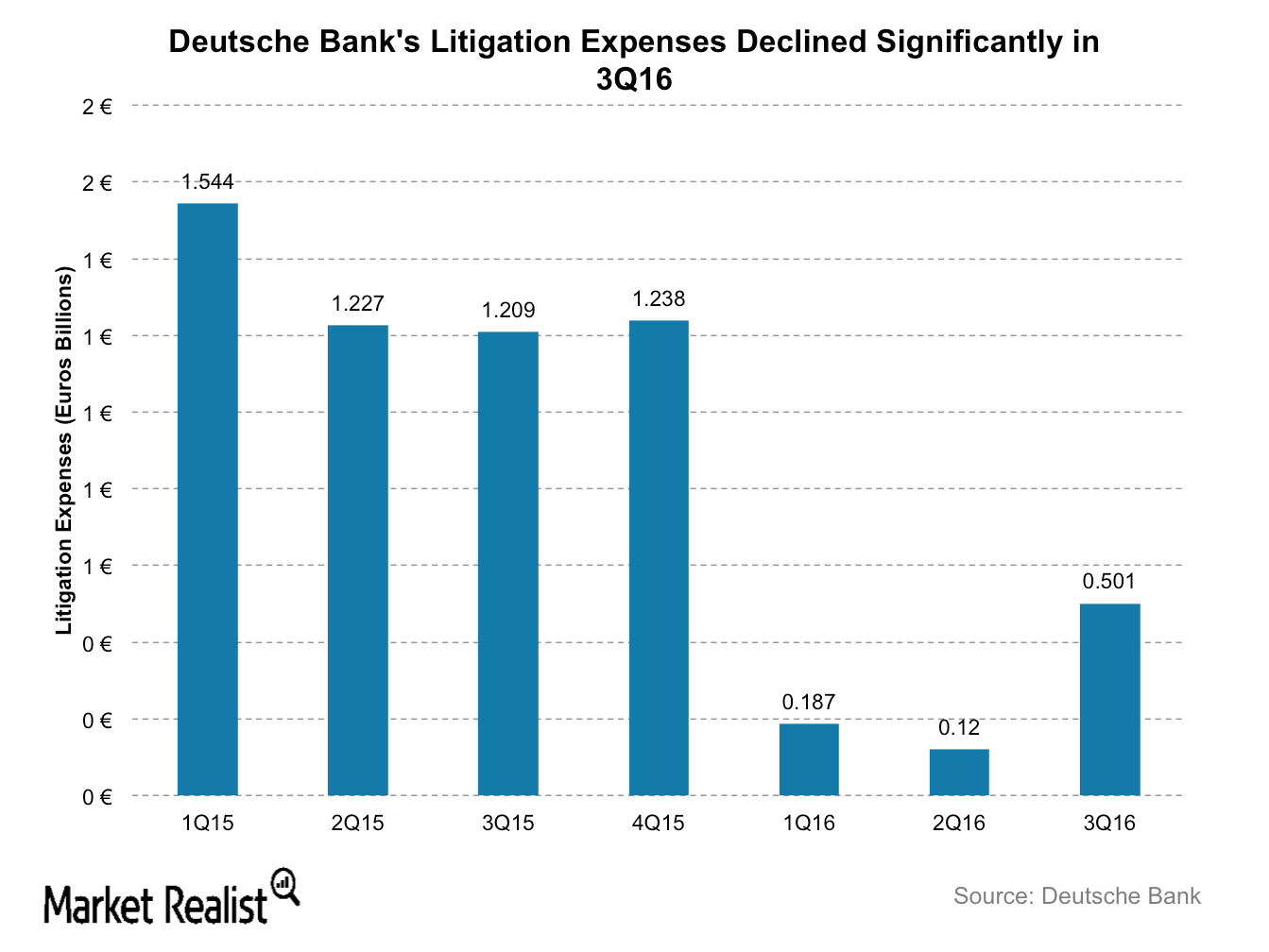

Can Trump Save Deutsche Bank from Bankruptcy?

Deutsche Bank could be the biggest beneficiary under Trump, having been on the brink of bankruptcy until its stock spiked nearly 20% after the election.

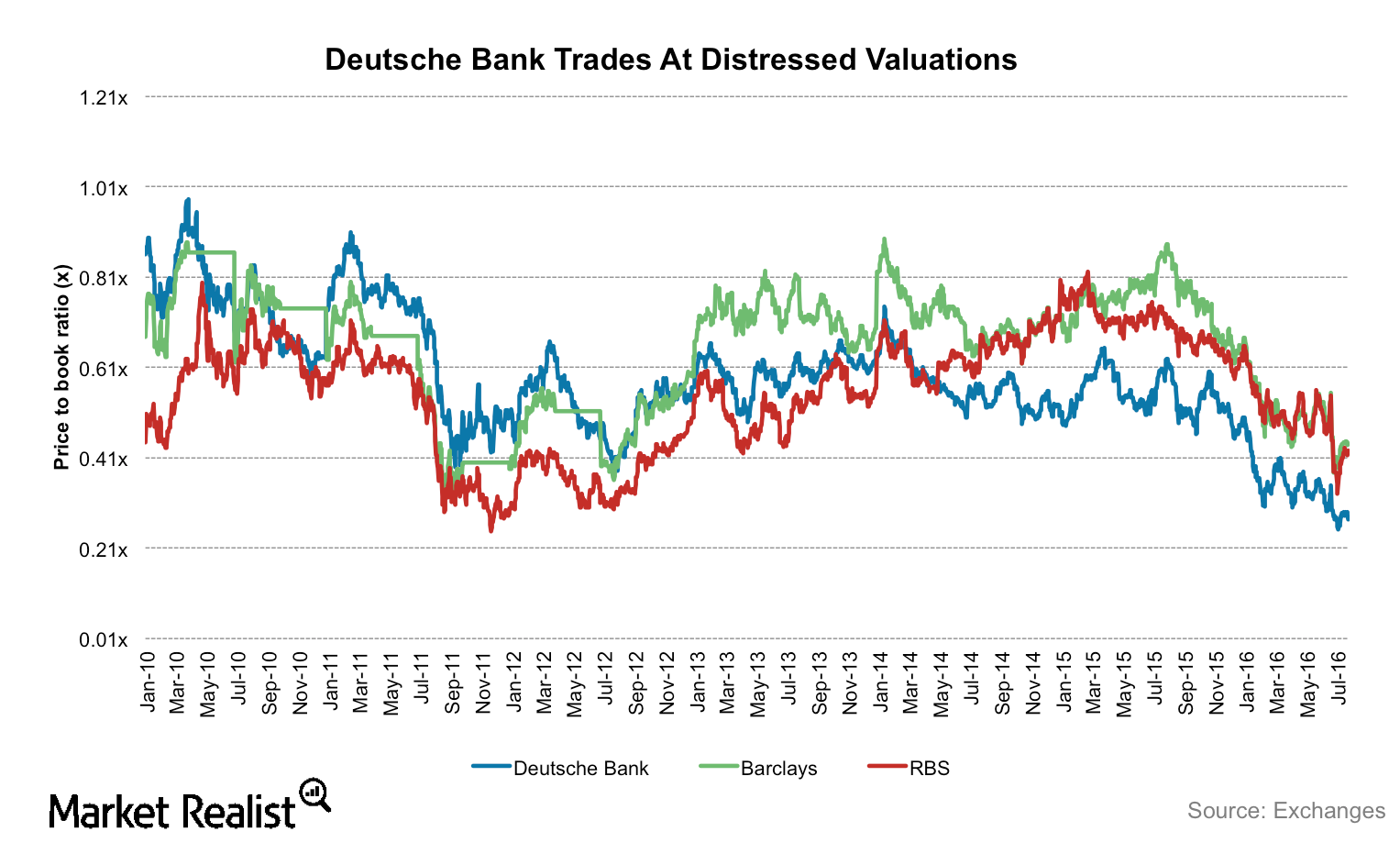

Do Distressed Valuations Offer a Good Chance to Buy Deutsche Bank?

Deutsche Bank’s (DB) shares are currently trading at distressed valuations. The bank’s shares are trading at the steepest discount to its book value, worse than the 2008 financial crisis.

Analysts Are Truly Divided on Chemours after Its 3Q16 Earnings

Among the analysts covering Chemours’ stock, 33.33% analysts recommended a “buy,” while 33.33% issued a “hold,” and the remaining 33.33% issued a “sell.”

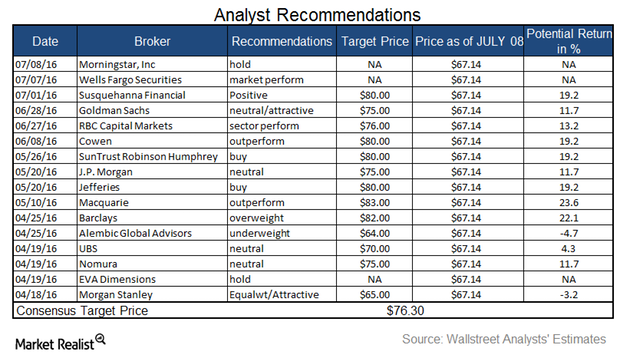

Analysts’ Ratings for Celanese before Its 2Q16 Earnings Release

On July 12, 2016, Celanese’s (CE) consensus 12-month target price was $76.30, indicating a return potential of 11.3% from that day’s closing price of $68.57.Company & Industry Overviews AEPGX’s Low Volatility and Low Returns: What Does This Mean?

The American Funds EuroPacific Growth Fund (AEPGX) has been in existence since April 1984.

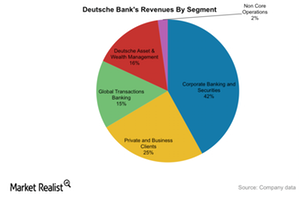

Understanding Deutsche Bank’s Segments

Deutsche Bank operates under five segments. Corporate Banking & Securities contributes 50% to Deutsche Bank’s revenues.