Broadcom Taps Infrastructure Software Market with CA Technologies

Broadcom’s (AVGO) fiscal 2019 earnings will be driven by its integration of CA Technologies.

March 12 2019, Published 9:34 a.m. ET

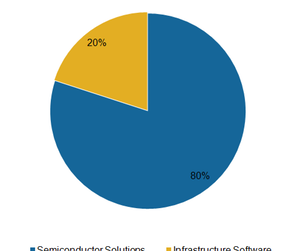

Broadcom’s business segments

Broadcom’s (AVGO) fiscal 2019 earnings will be driven by its integration of CA Technologies. This acquisition will change Broadcom’s reporting segments from the previous four segments (Wireless, Wired, Enterprise Storage, and Industrial and Other) to two segments: Semiconductor Solutions and Infrastructure Software.

CA Technologies’ business will be reported under the Infrastructure Software segment, which will contribute 20% toward Broadcom’s overall revenue.

Infrastructure Software

The Infrastructure Software segment will comprise the mainframe, enterprise, and SAN (storage area network) businesses. Broadcom has restructured CA Technologies’ business model from a perpetual licensing model, which goes on for several years, to a fully ratable subscription model that’s subject to renewal at specific intervals. A subscription is cheaper than perpetual licensing, making licensing more flexible and affordable for customers.

The Infrastructure Software segment offers a PLA (portfolio license agreement) solution, which adopts a cost-effective XaaS (everything-as-a-service) approach. The XaaS approach offers enterprise customers end-to-end software development solutions and a faster time to market. Barclays (BCS) has adopted Broadcom’s PLA solutions for its digital transformation initiatives.

XaaS market opportunity

More and more companies are undergoing digital transformations whereby they are migrating to cloud and DevOps technologies to improve IT processes through scalability and agility. International Data Corporation expects digital transformation spending to grow at an average annual rate of 16.7% to $1.97 trillion between 2017 and 2022.

A 2018 survey report by Deloitte Insights expects that the number of companies regarding XaaS as “critically important” will grow from 16% to 25% in the next year or two.

In the digital transformation era, the growing need for flexible and easy-to-adopt solutions will drive demand for Broadcom’s XaaS-based PLA offerings. CA’s strong enterprise software offerings and large customer base could help Broadcom tap the opportunity in the infrastructure software market.

Next, we’ll look at Broadcom’s Semiconductor Solutions segment.