Ricky Cove

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ricky Cove

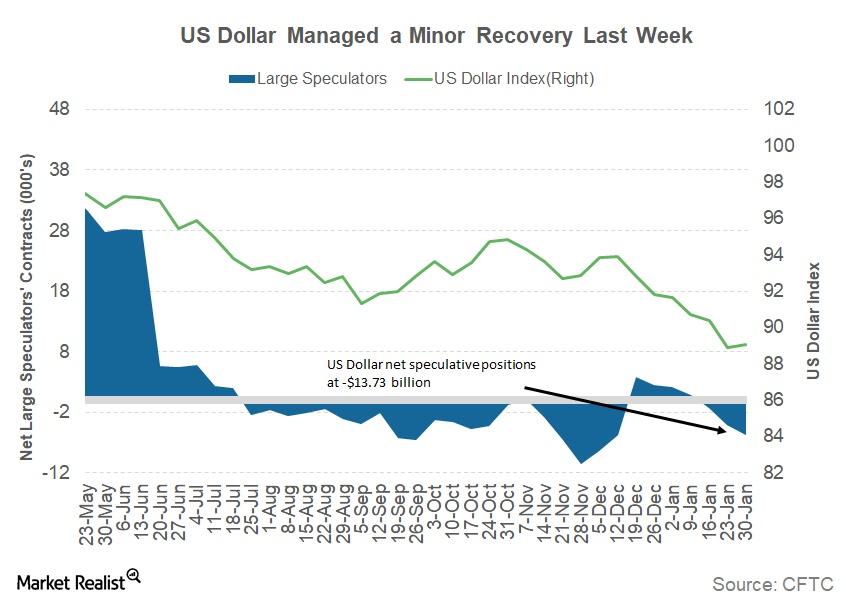

Have We Seen a Short-Term Bottom for the Dollar?

The US Dollar Index (UUP) managed to close in positive territory in the week ended February 8, 2018, after posting seven consecutive weekly losses.

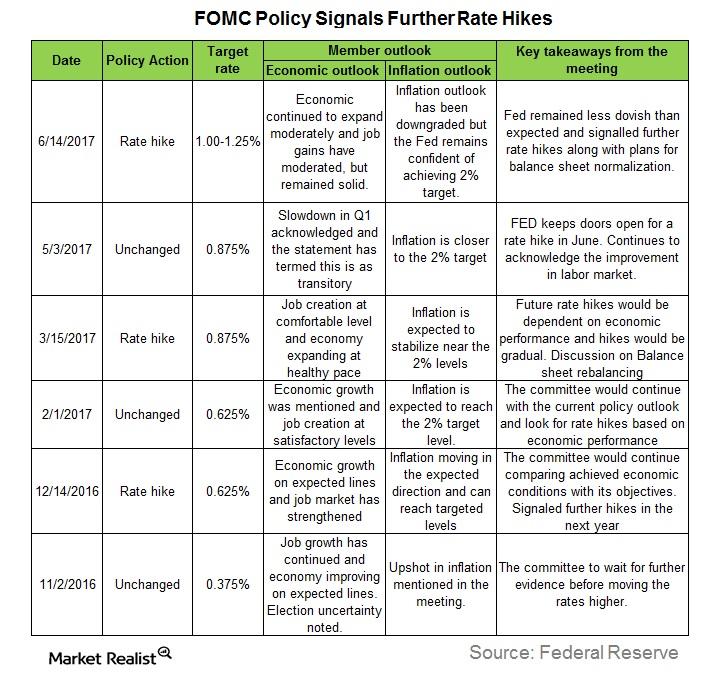

Is the Fed Sure What It’s Doing?

In this series, we’ll analyze Fed members’ comments in June 2017 to better understand their outlooks on the US economy and how they justify their hawkish or dovish stances.

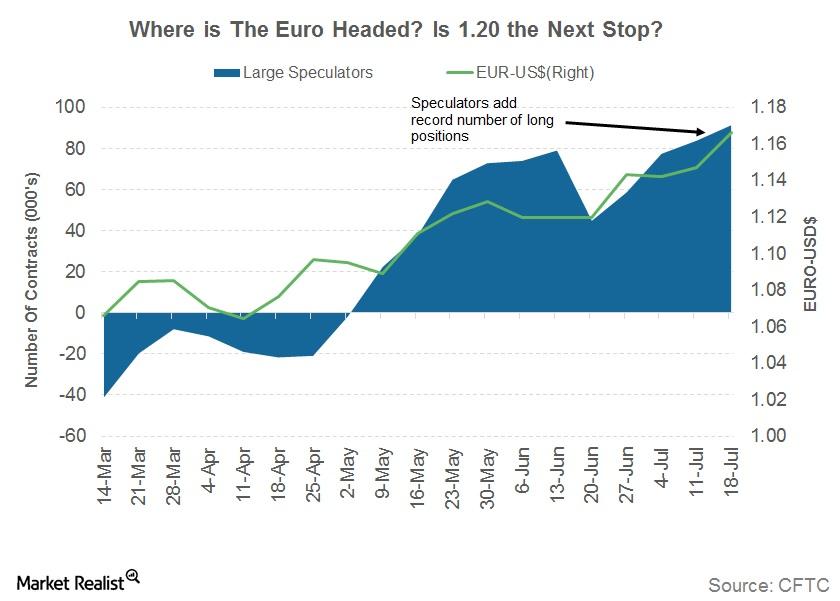

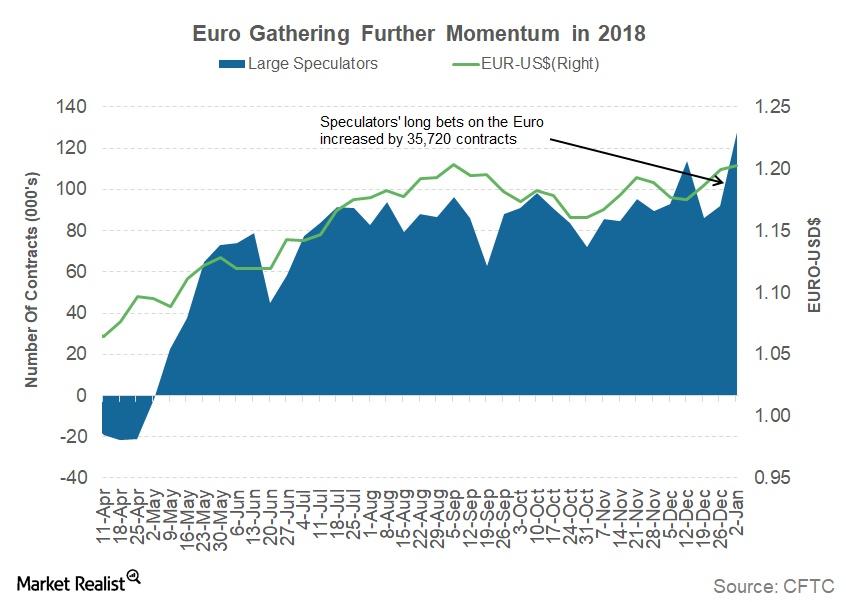

Euro Reaches 23-Month Peak: Could It Climb Higher?

Euro rallies to a 23-month peak Last week, the euro (FXE) closed at 1.17, appreciating by 1.7% against the US dollar (UUP). The currency has appreciated by more than 10% against the US dollar this year, making it one of the strongest developed market currencies. Improving economic conditions and a stable political climate turned the […]

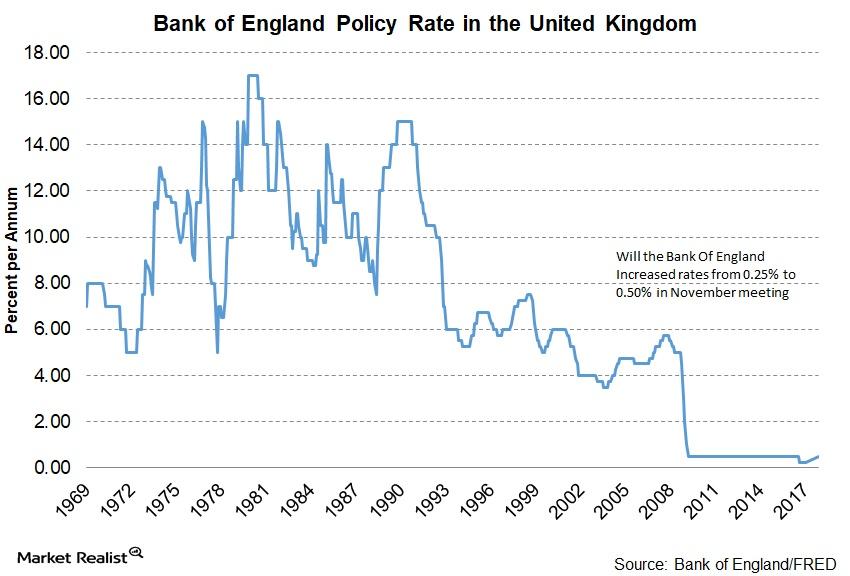

Bank of England Raises Interest Rate to 0.50%

The BOE (Bank of England) in its November meeting increased its benchmark interest rates from 0.25% to 0.50%.

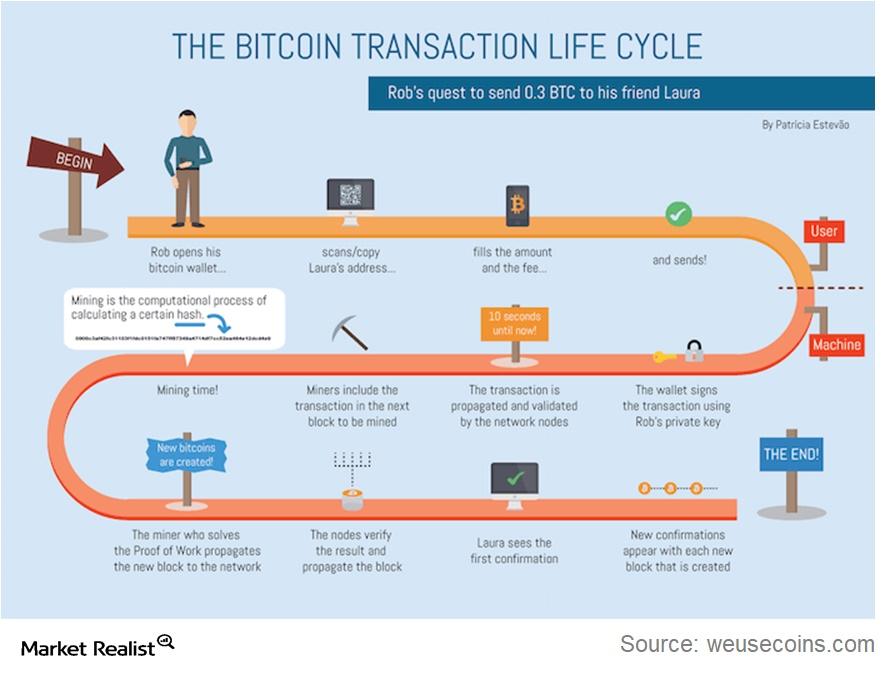

How to Transact in Bitcoin and Other Cryptocurrencies

If you have purchased bitcoin currency, and it’s now in your digital wallet, there will likely be a time that you’ll want to conduct a transaction with it.

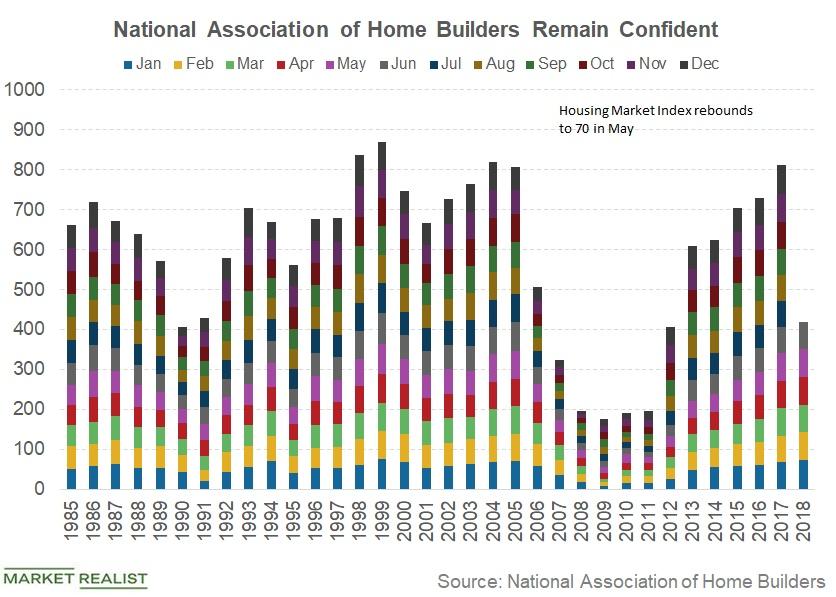

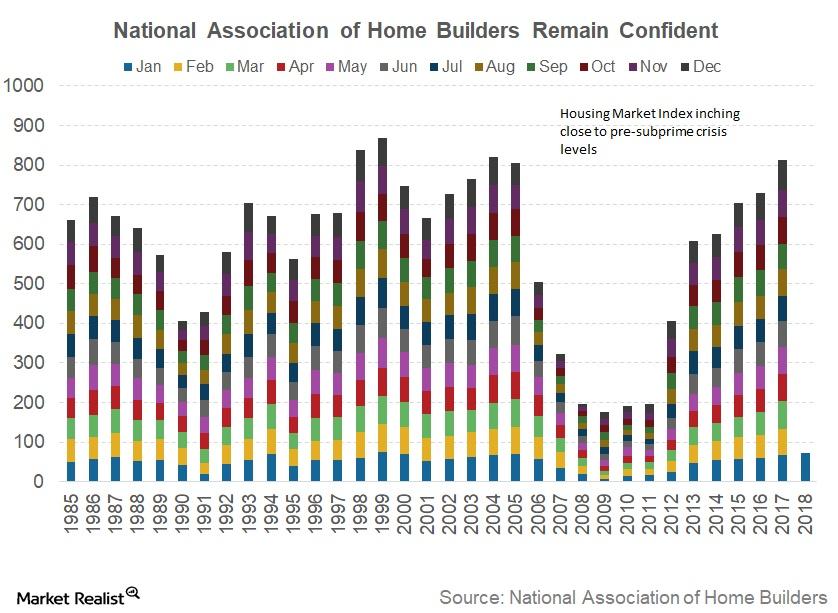

What American Builders Were Worried about in June

The HMI was reported to have decreased by two points to 68 in June as compared to a May reading of 70.

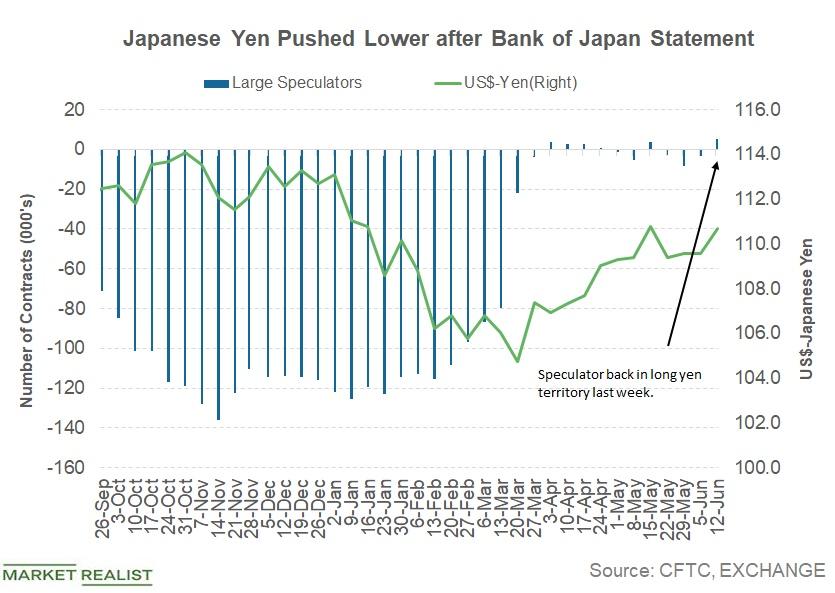

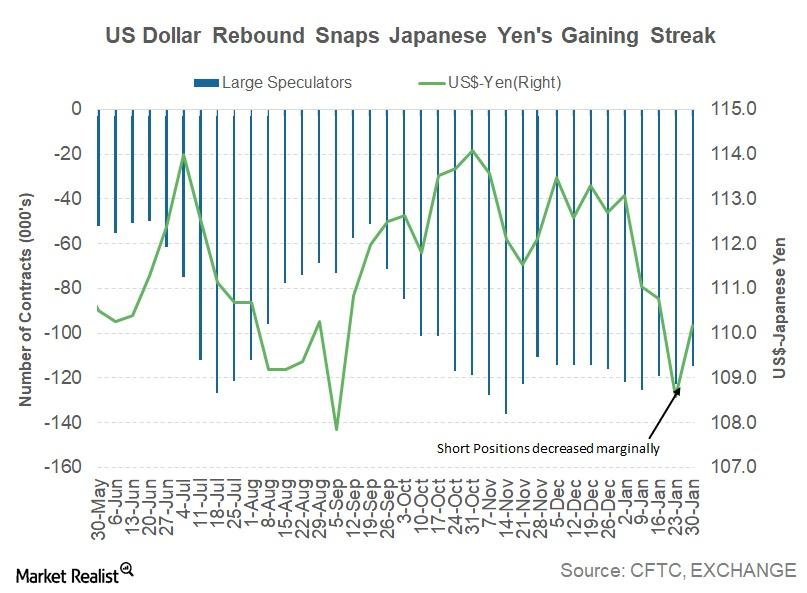

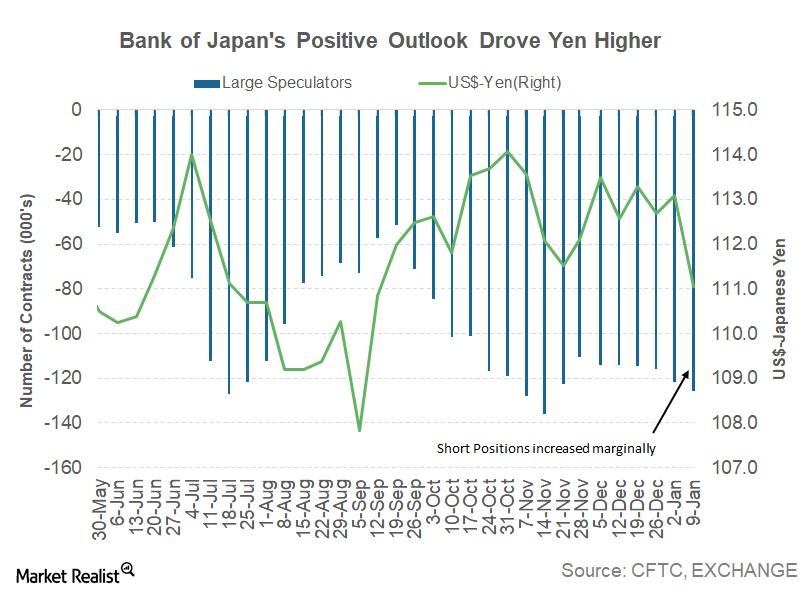

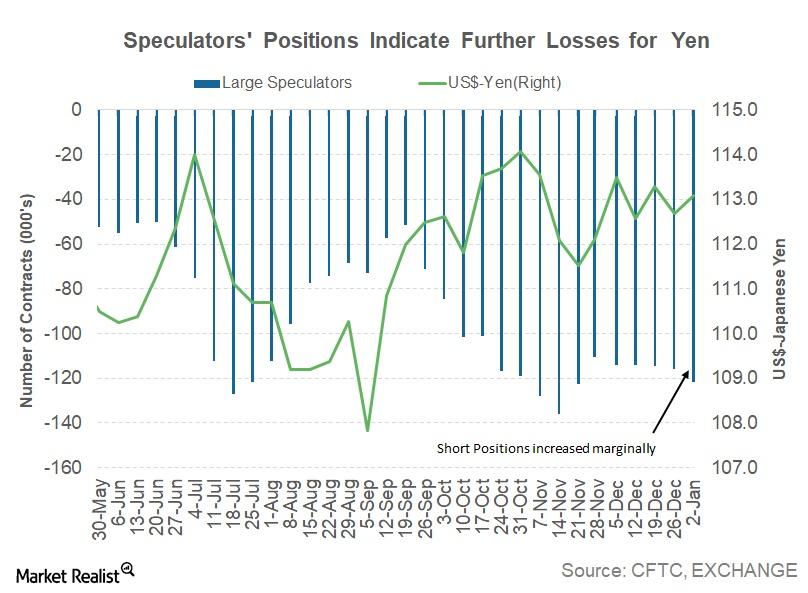

Why the Yen Depreciated against the Dollar

Last week, the Japanese yen (JYN) succumbed to the US dollar’s strength. The Japanese yen (FXY) closed the week at 110.67.

What Are the Implications of Iran Nuclear Deal Exit?

In this series, we’ll analyze how the US exit from the Iran deal has affected markets and how recent developments could affect oil prices and volatility.

Why the US Workforce’s Quit Rate Has Remained High

January’s JOLTS (Job Openings and Labor Turnover Survey) data, which contains information about job openings and total separations, was reported on March 16.

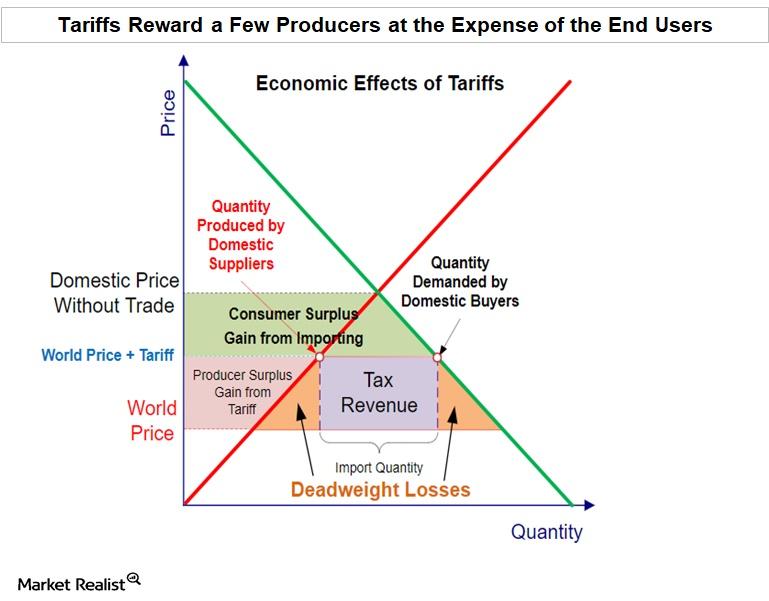

Why Economist Argue That Tariffs Are Bad for the Economy

The recently proposed import tariffs on steel and aluminum imports by US President Donald Trump are an effort to protect the interests of US manufacturers.

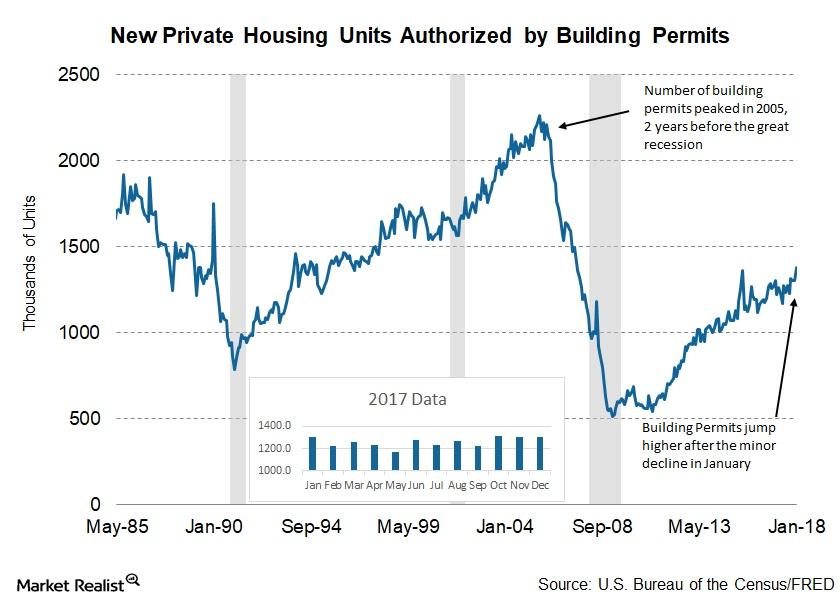

Why the Rebound in Building Permits Is Positive for the US Economy

The Conference Board uses the number of building permits issued as one of the key constituents of its LEI (Leading Economic Index) model.

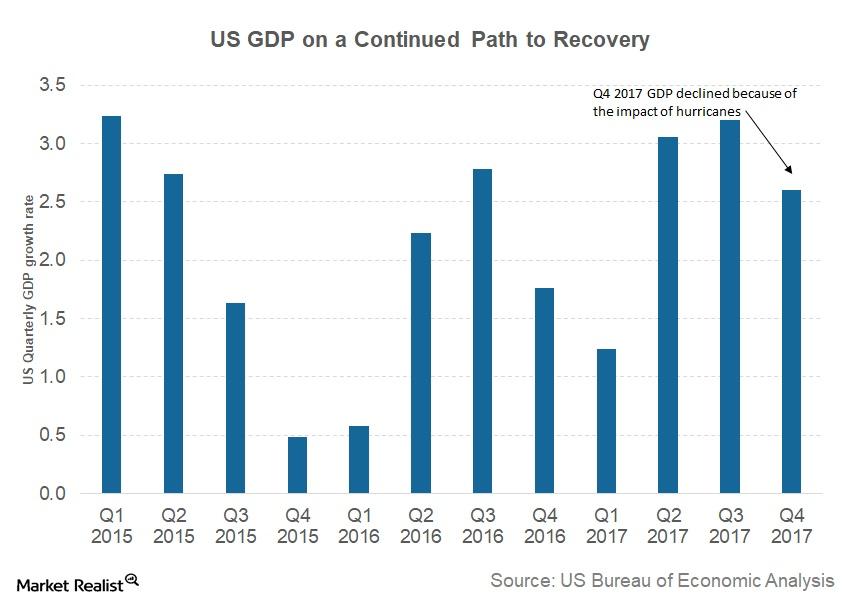

FOMC’s Review of Economic Situation Signals Strong US Economy

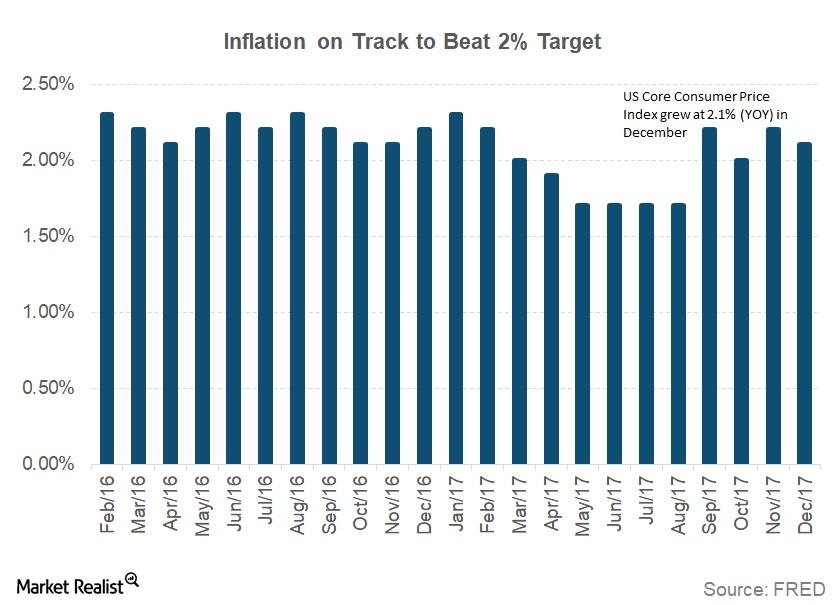

As per the FOMC staff report, inflation (TIP) in the US remained below the 2% target.

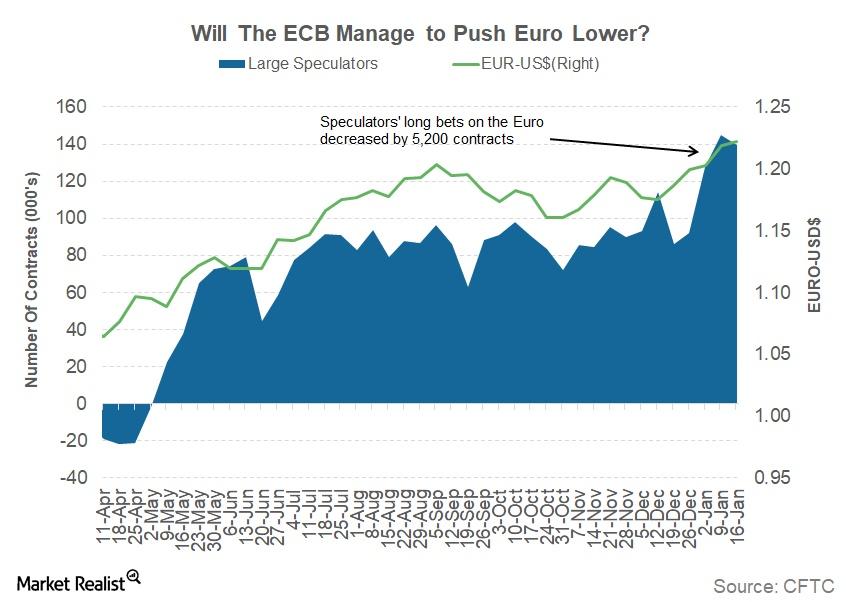

What to Expect from the Euro This Week

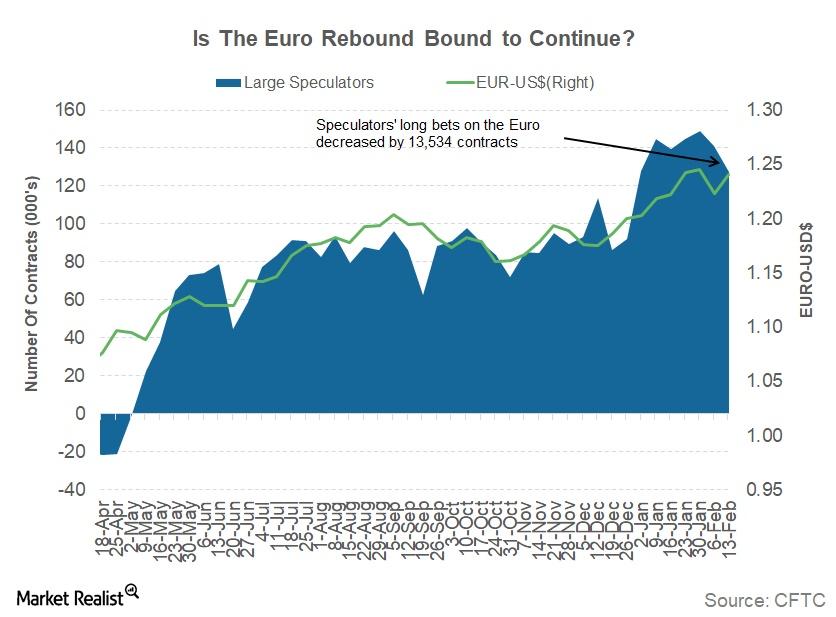

The euro-dollar (FXE) exchange rate closed the week ending February 16 at 1.24, an appreciation of 1.4% against the US dollar (UUP).

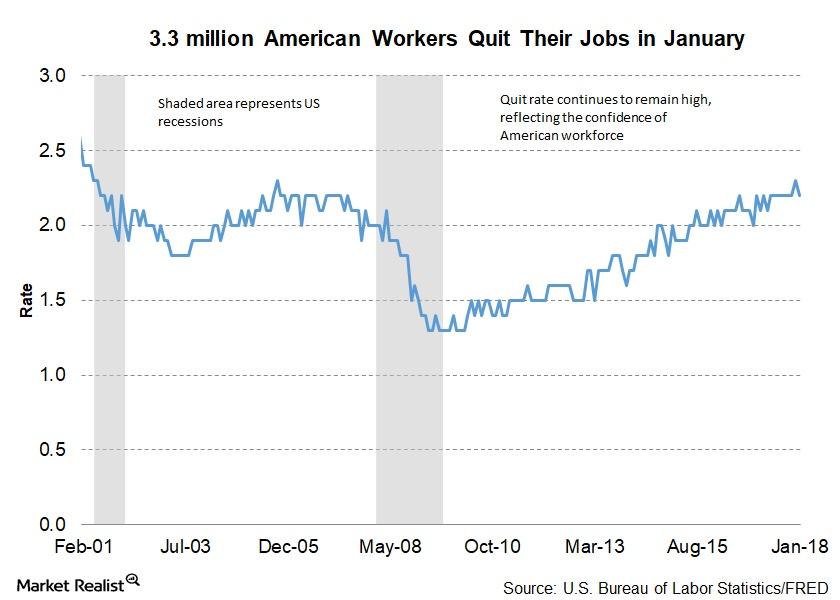

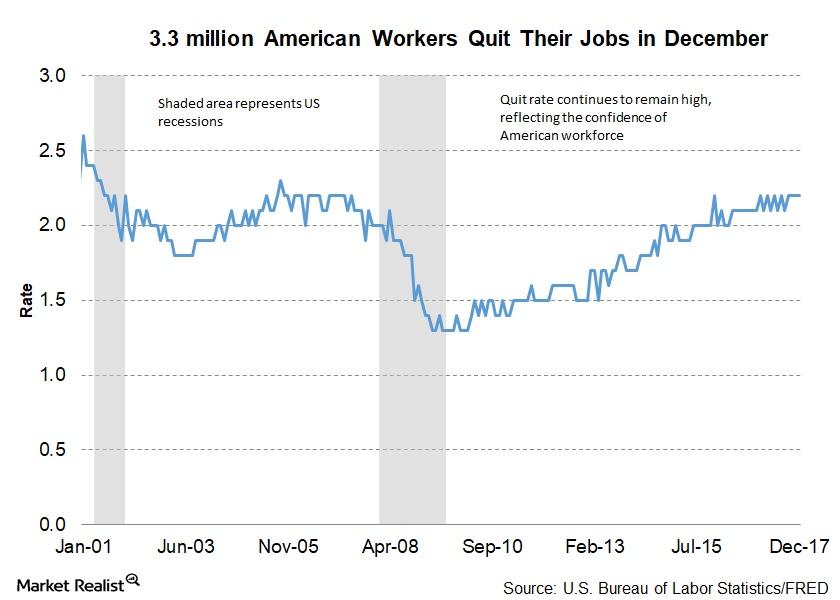

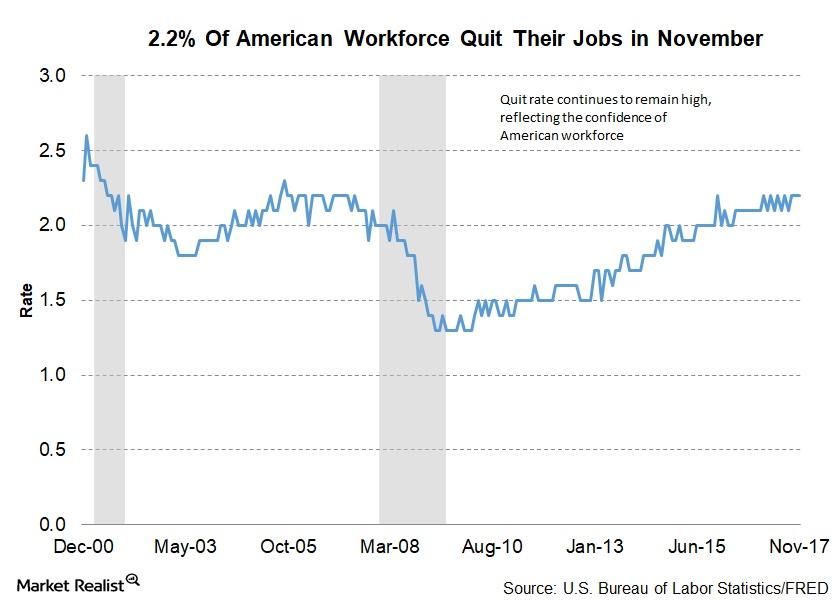

Why Quit Rate Indicates a Strong US Employment Market

As per the latest JOLTS report, total separations for December were 5.2 million, which is 3.6% of the total workforce.

Why the Japanese Yen Depreciated against the Dollar Last Week

The Japanese yen (JYN) retracted against the US dollar last week as US dollar bulls tried to take control.

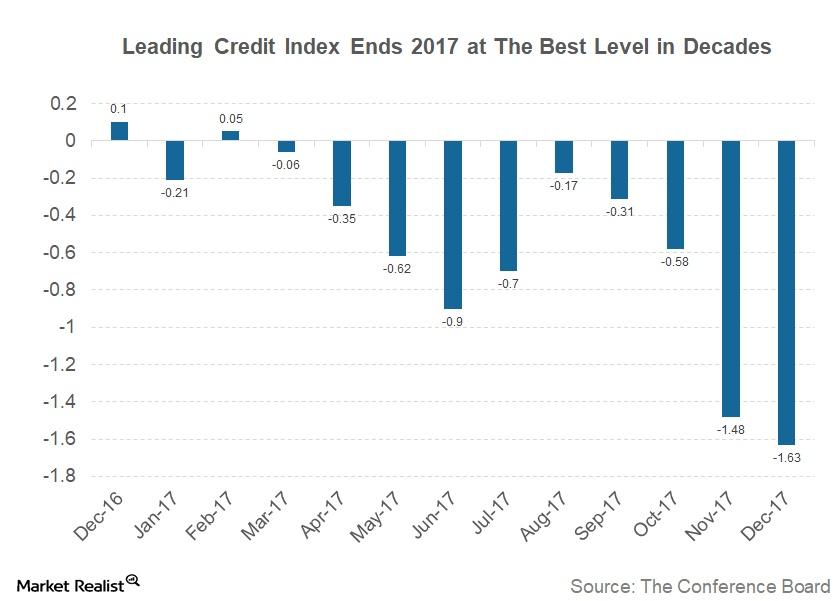

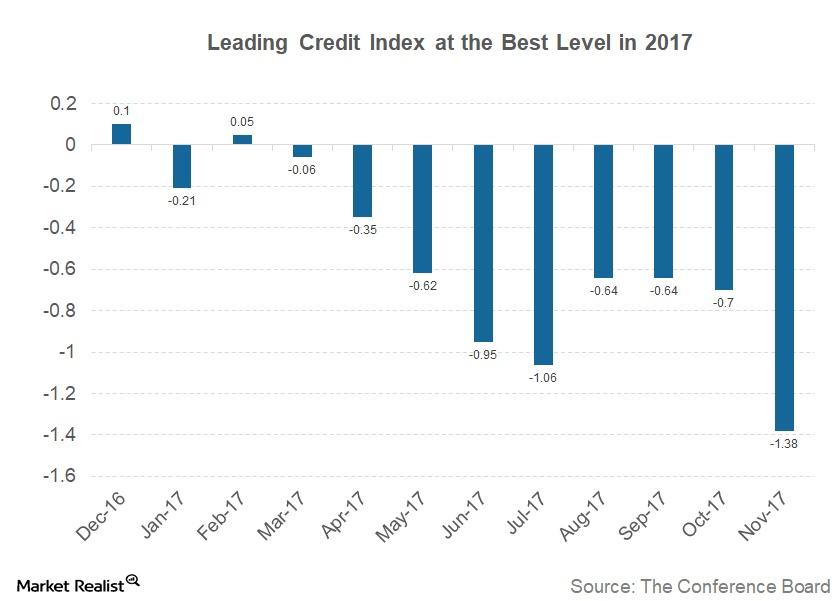

Is the Leading Credit Index Signaling Any Business Cycle Changes?

This constituent of the LEI is an economic model, constructed by modeling changes in six financial market instruments.

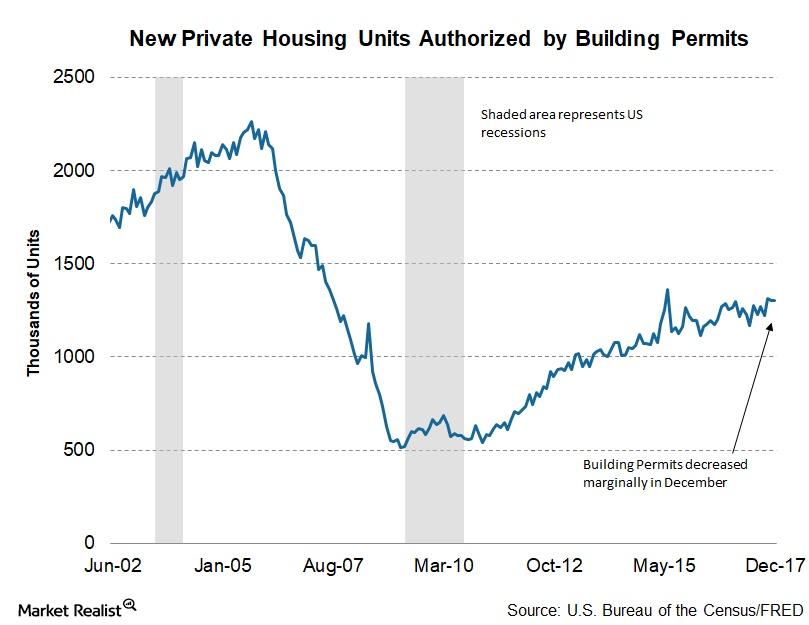

Why Building Permits Didn’t Change in December

For 2017, 1,263,400 housing units have been authorized by building permits—a 4.7% increase from 1,206,600 housing units in 2016.

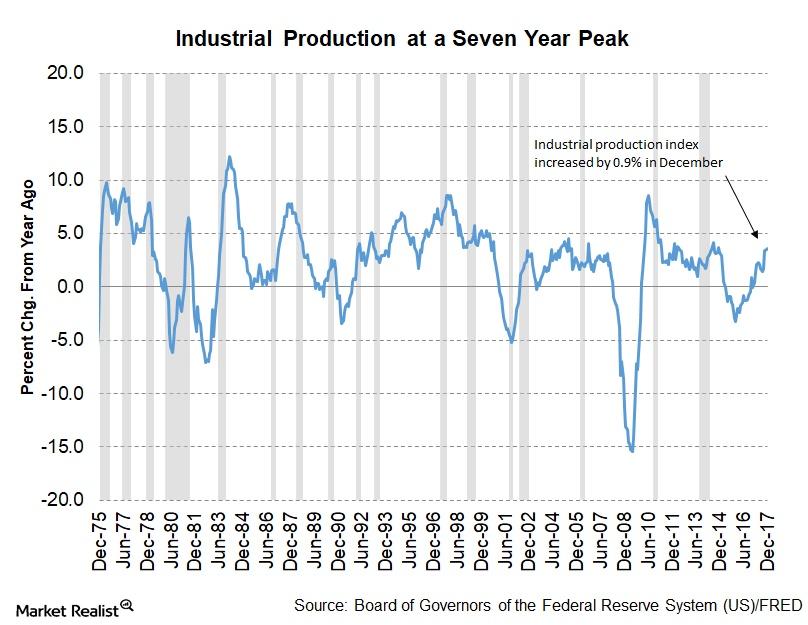

What Drove Industrial Production Higher in December 2017

The Fed’s December industrial production report was released on January 17. The report indicated that industrial production continued to improve throughout 2017.

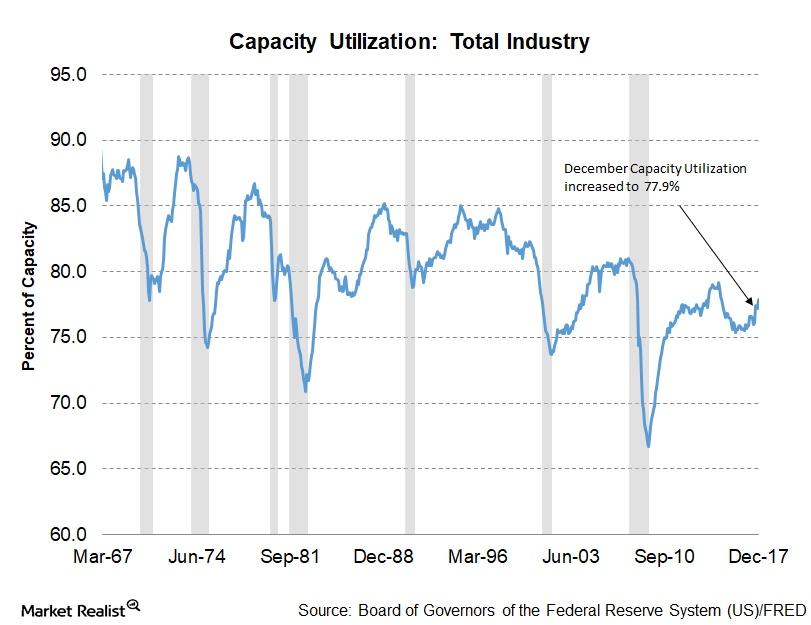

Capacity Utilization Trends across US Industries in December

Capacity utilization and the US economy Among the key macroeconomic indicators published by the Federal Reserve, US industries’ capacity utilization is particularly important for understanding the health of each industry. Changes to this indicator can help forecast any changes to the business cycle, product demand, and workforce demand. Increasing levels of capacity utilization could translate to a higher number […]

How Confident Are Homebuilders at the Beginning of 2018?

Comments from NAHB members indicated that homebuilders are optimistic about the future demand and projected increased activity in the housing sector.

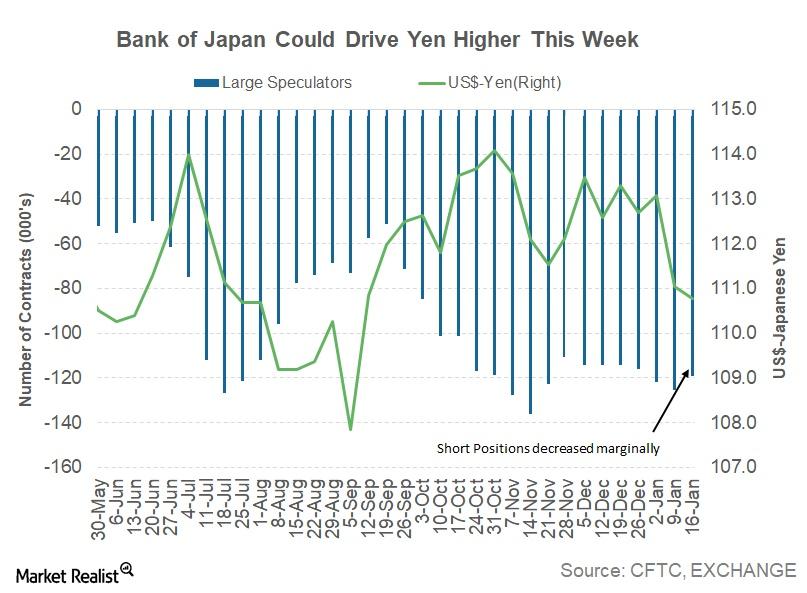

Could the Bank of Japan Drive the Yen Lower this Week?

The Japanese yen (JYN) registered its second consecutive weekly gain against the US dollar.

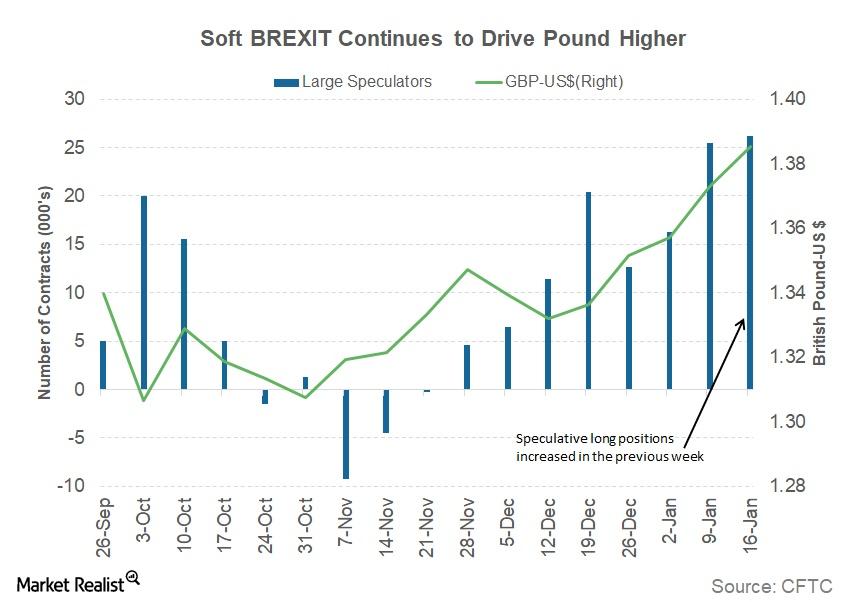

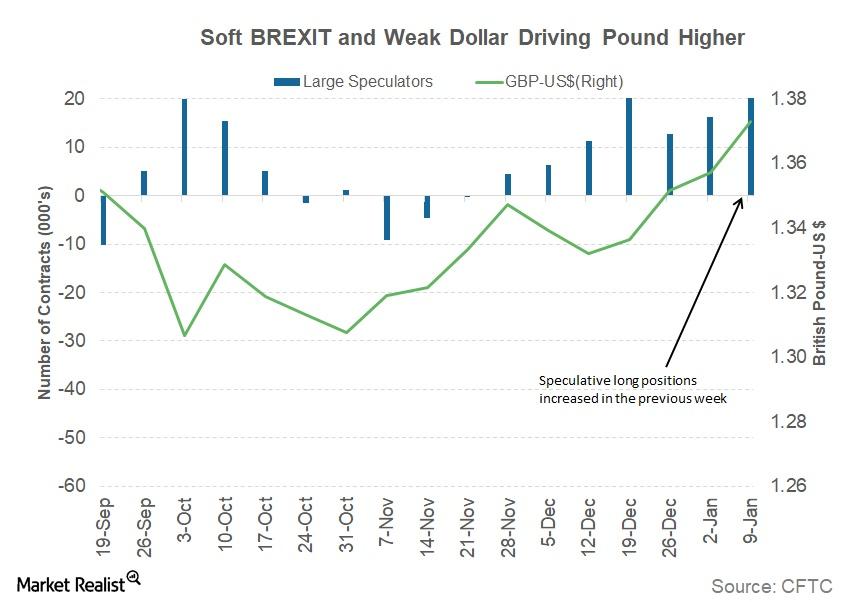

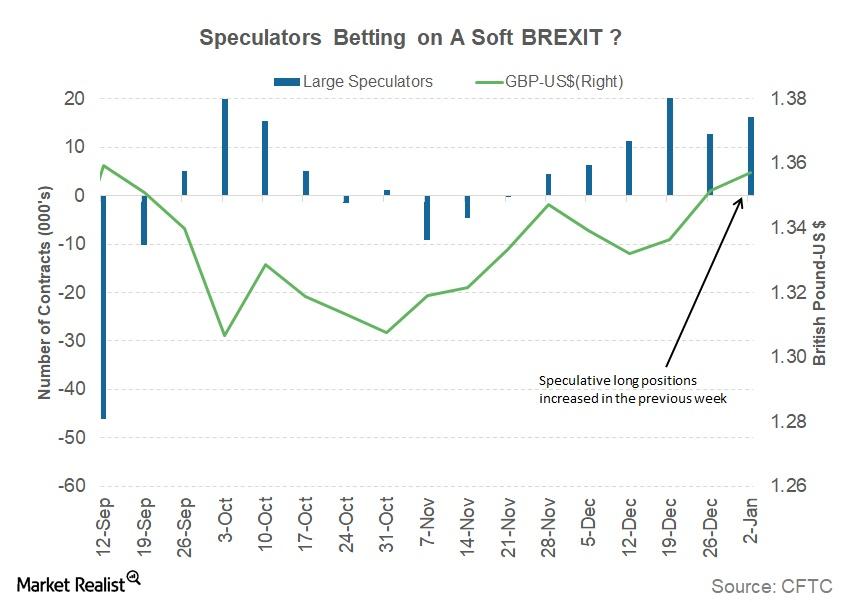

Factors that Drove the British Pound over 1.38 against the Dollar

During the week ended January 29, 2018, British equity markets (BWX) were supported by the prospect of a soft Brexit.

Politics and Central Bank Comments Could Drive the Euro Higher

The Eurozone’s inflation data published on January 17 indicated that prices increased 1.4% in December 2017, which is still below the long-term average.

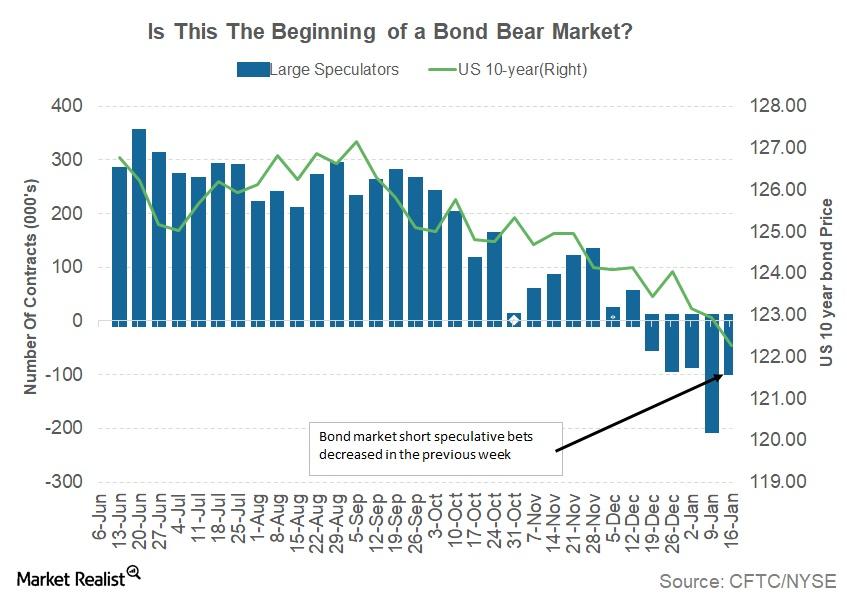

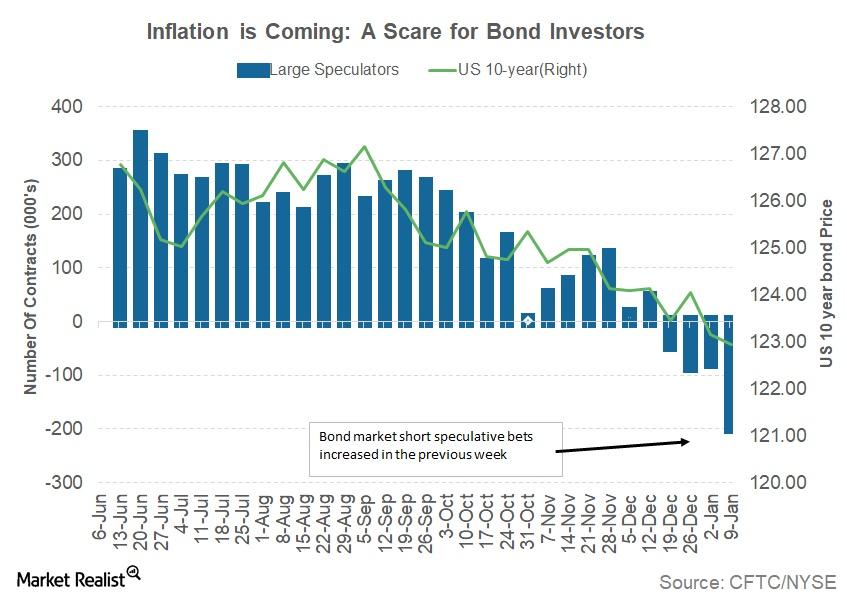

Are Bond Yields Set to Move Higher this Week?

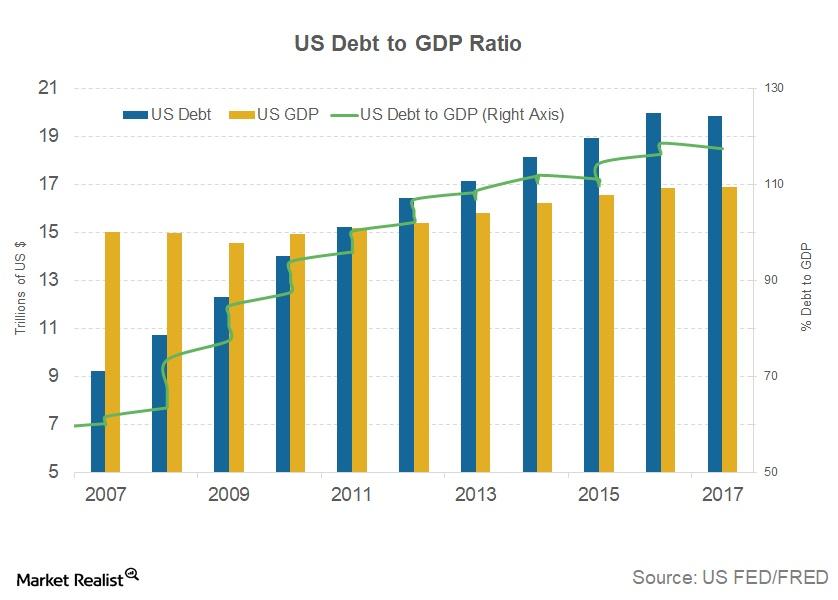

The US Treasury is not able to issue any more debt until the debt ceiling is raised, which could increase the volatility in the bond markets.

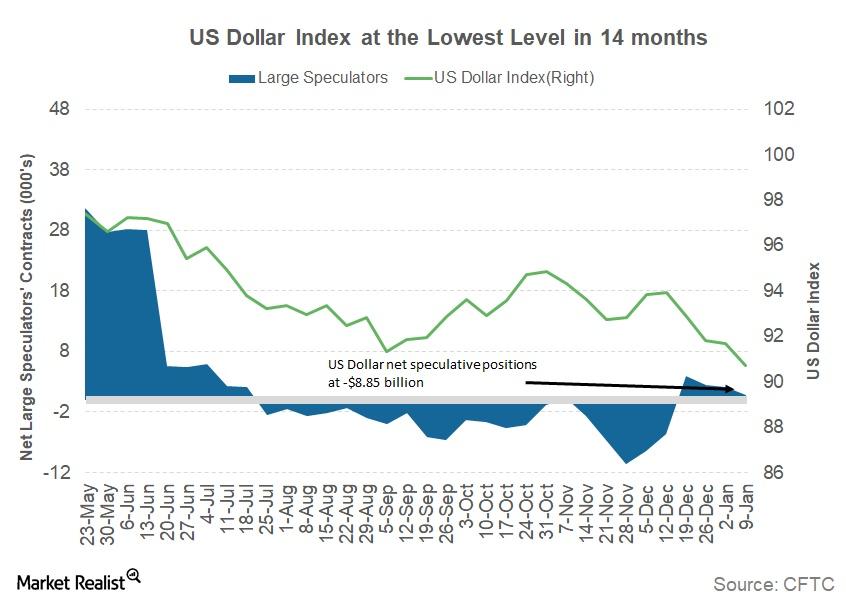

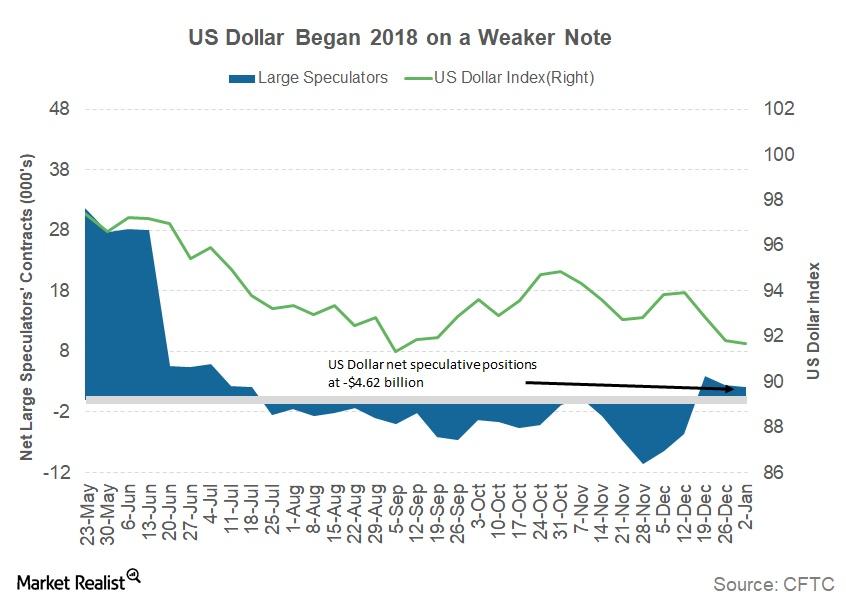

How the US Dollar Could React to a US Government Shutdown

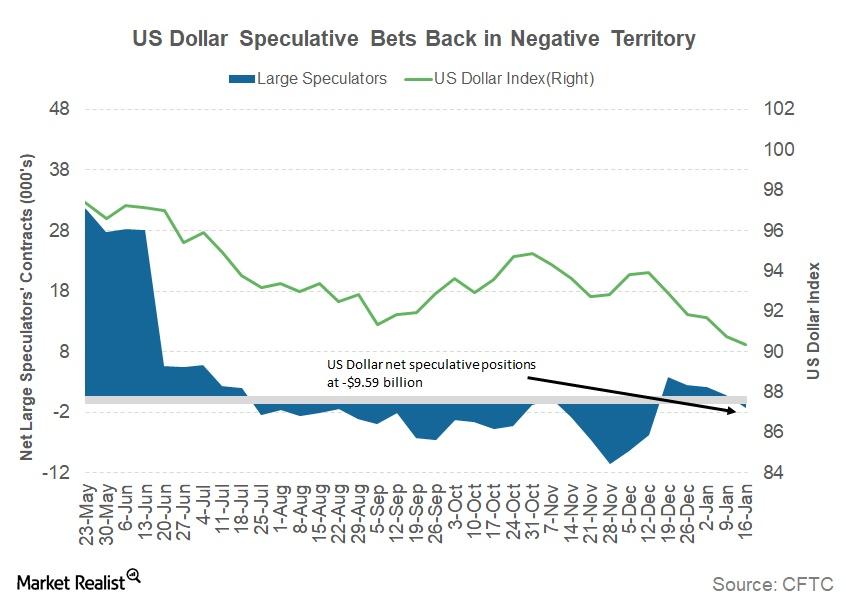

According to the January 19 Commitment of Traders report, released by the Chicago Futures Trading Commission, large speculators have turned bearish on the US dollar.

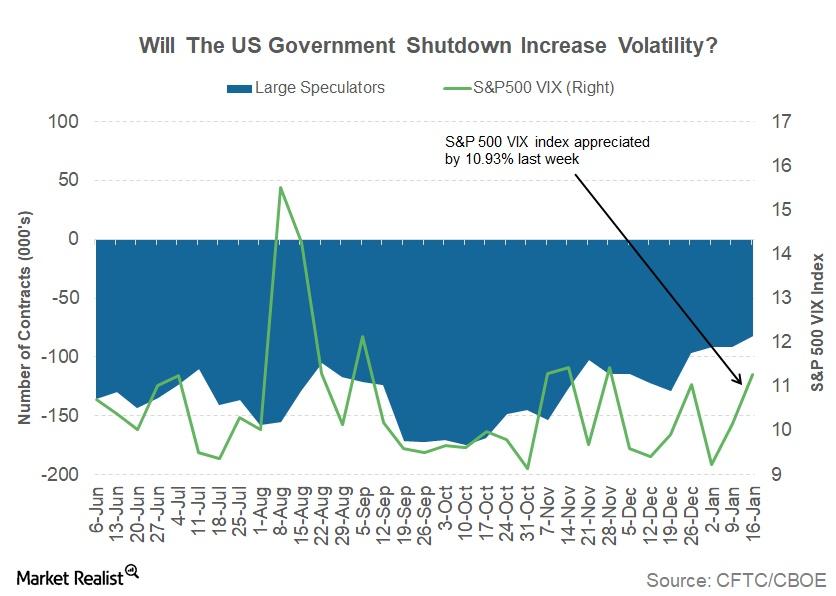

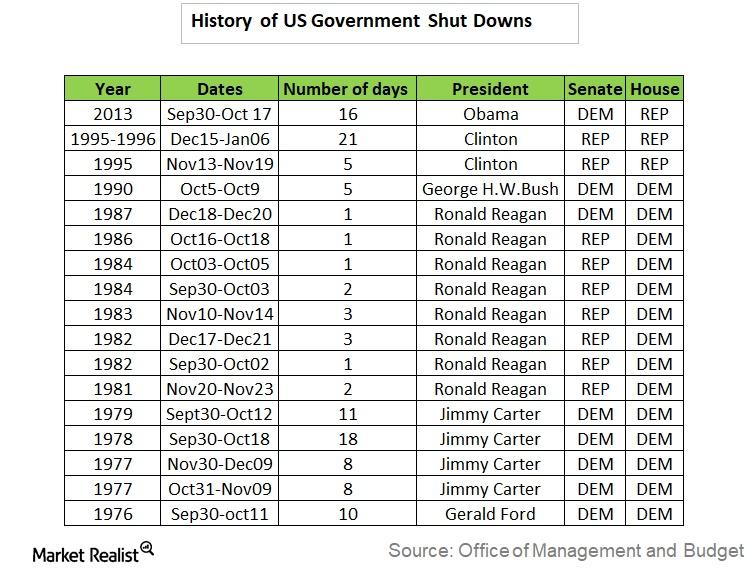

Could the US Government Shutdown Impact Market Volatility?

During the week ended January 19, 2018, global markets trended higher despite the possibility of a US government shutdown. The potential shutdown pushed volatility up.

Why Did the Consumer Price Index Rise in December?

According to the December CPI report released by the U.S. Bureau of Labor Statistics on January 12, consumer prices in December increased 0.1%.

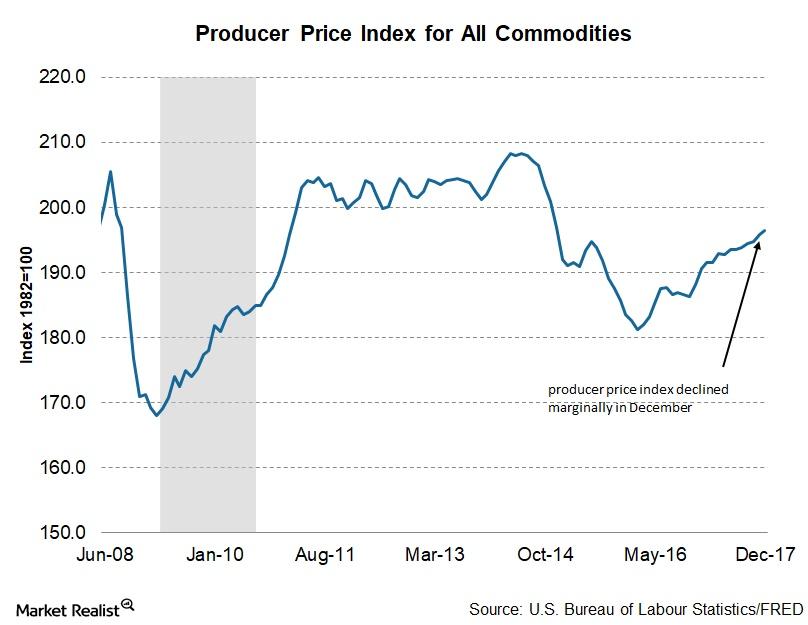

Analyzing the Producer Price Index in December

The December PPI fell 0.1% month-over-month—compared to a 0.4% increase in November and October. The final demand index rose 2.6% in 2017.

What Could Happen if the US Debt Ceiling Isn’t Raised

The failure of US Congress to raise the debt ceiling would result in a partial government shutdown. The US Treasury wouldn’t be able to issue any government debt, and it could end up borrowing from its retirement savings fund.

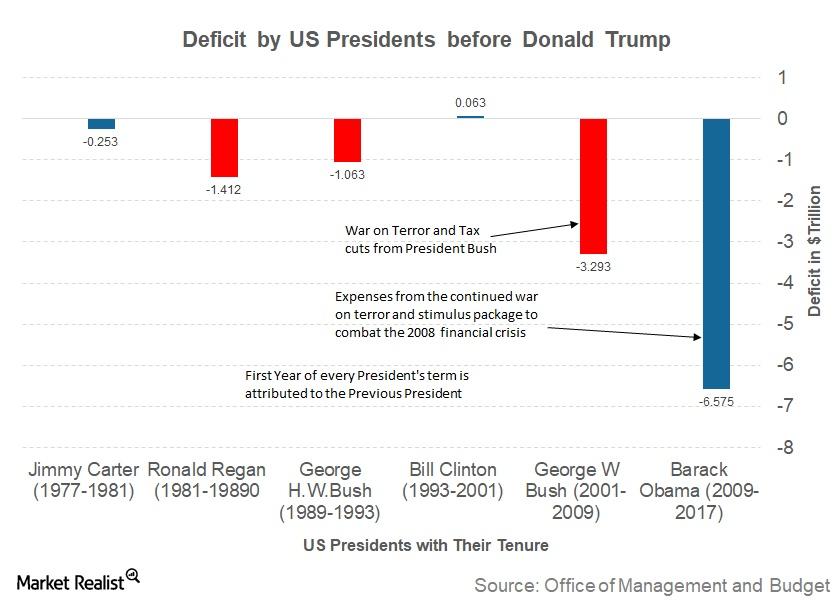

Why Is US Debt So High?

Most countries tend to issue debt to fund their deficits and keep paying interest on these borrowings. These revenues are generated through taxes from companies and individuals.

Your Guide to the US Debt Ceiling

The current debt ceiling is likely to be breached on January 19, and once that happens, the US Treasury must stop issuing any new debt (SHY).

Why the Japanese Yen Finally Appreciated against the US Dollar

During the week ended January 12, the yen (FXY) closed at 111.04 against the US dollar (UUP), compared to 113.08 in the week ended January 5, appreciating by 1.8%.

Why a Soft Brexit Possibility Is Driving the British Pound Higher

The gains in the British pound were driven by the higher chances of a soft Brexit deal, which could see economic relations between the UK and the EU remain mostly unchanged.

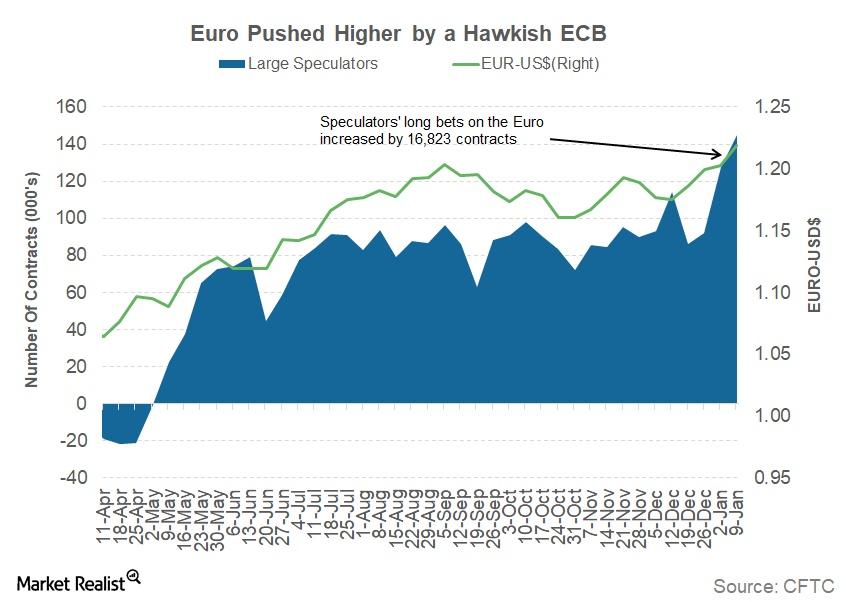

What Factors Are Driving the Euro Higher?

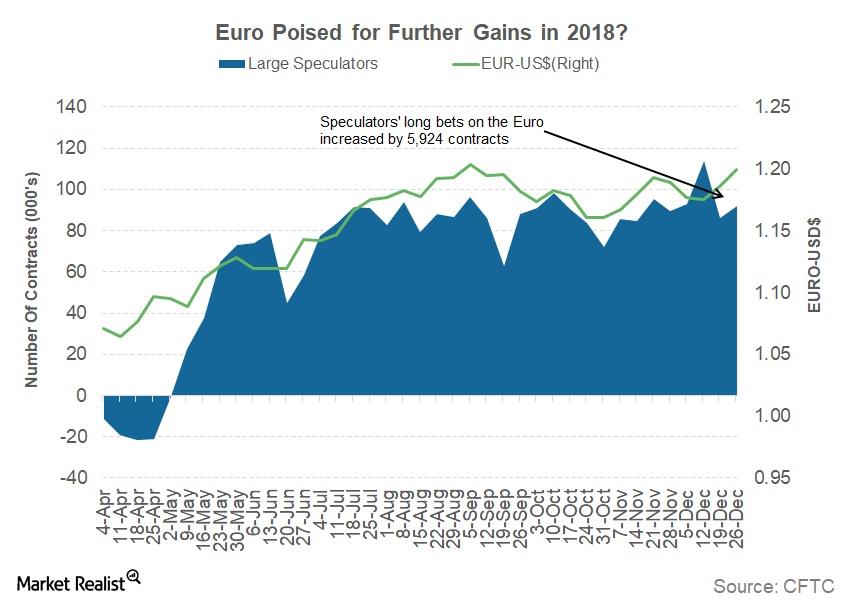

According to the January 12 Commitment of Traders report, speculators increased their long euro positions by 16,823 contracts last week.

Why the US Bond Market Moved Lower Last Week

The core CPI of 0.3% pushed the annual number up by 0.1% to 1.8%.

Why the US Dollar Is Losing Its Appeal

The US Dollar Index (UUP) continued its decline, posting a fourth consecutive weekly loss during the week ended January 12.

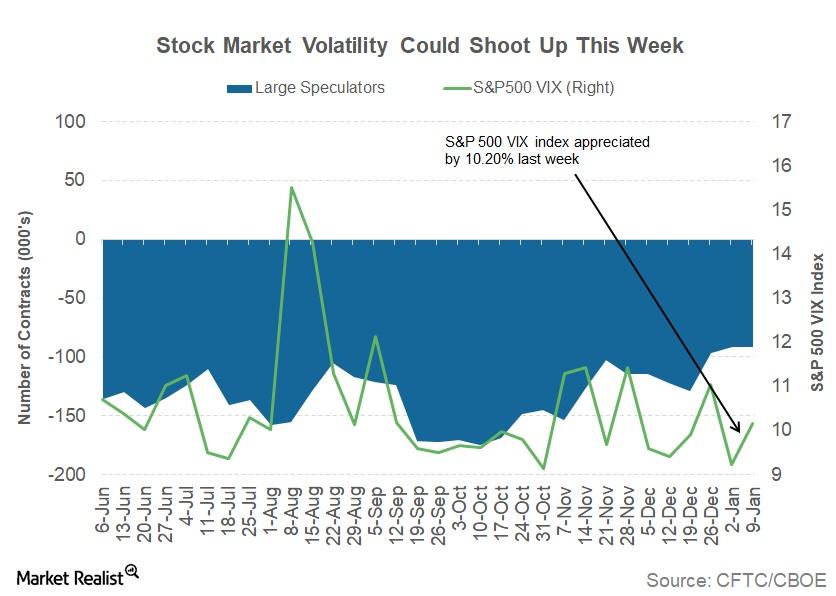

Could the Threat of a US Government Shutdown Spike Volatility?

The Dow Jones Industrial Average appreciated ~1.6% for the week ended January 12, 2018, while the S&P 500 (SPY) returned ~1.3%. The tech-heavy NASDAQ (QQQ) posted a weekly gain of ~1.4%.

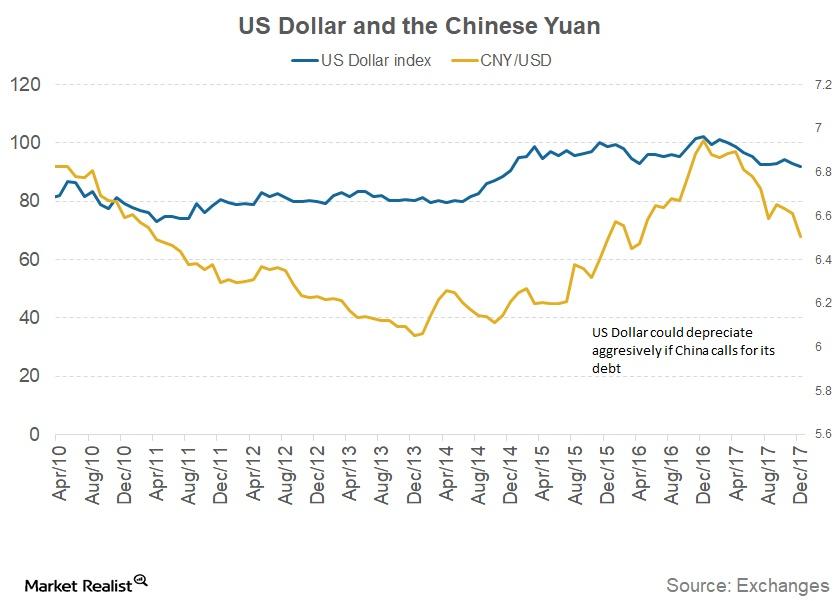

What Could Happen If China Wants Its Money Back?

If the Chinese government decides to sell its US debt (GOVT) holdings, it could lead to another possible global financial crisis.

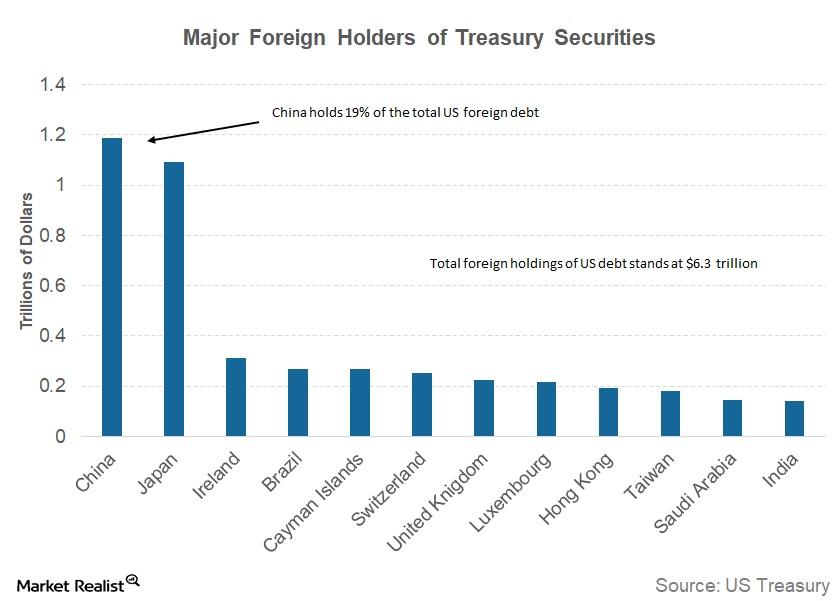

Which Countries Hold the Most US Debt?

The United States holds the largest trade deficit in the world. The United States has had a trade deficit for more than four decades and continues to increase the deficit every year.

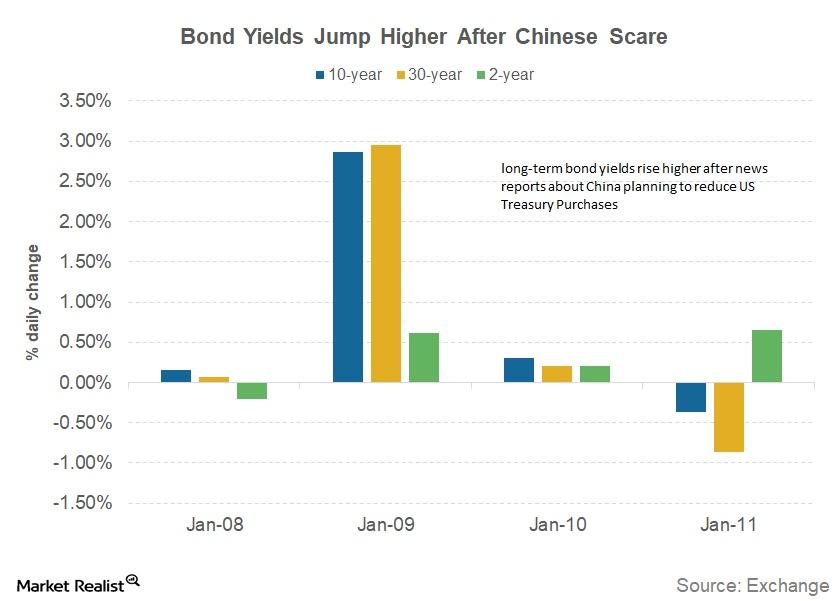

The US Bond Market and the Big Scare from China

On January 10, 2018, Bloomberg News broke a story that the Chinese government could be planning to slow down its purchases of US government debt (GOVT).

Can the Japanese Yen Rise against the US Dollar?

The Japanese yen (JYN) is the only currency that is unable to capture the weakness in the US dollar (UUP).

Will the Pound Gain with Signs of a Soft Brexit?

The British pound (FXB) (GBB) continued to appreciate against the US dollar in the first week of 2018, rising 0.41% against the dollar (UUP).

Factors That Are Driving the Euro Higher

The euro appreciated 0.27% against the US dollar (UUP) after posting double-digit gains against the US dollar in 2017.

Why the US Dollar Began 2018 with Losses

The US Dollar index (UUP) began 2018 on a negative note, posting losses against most of the major currencies.

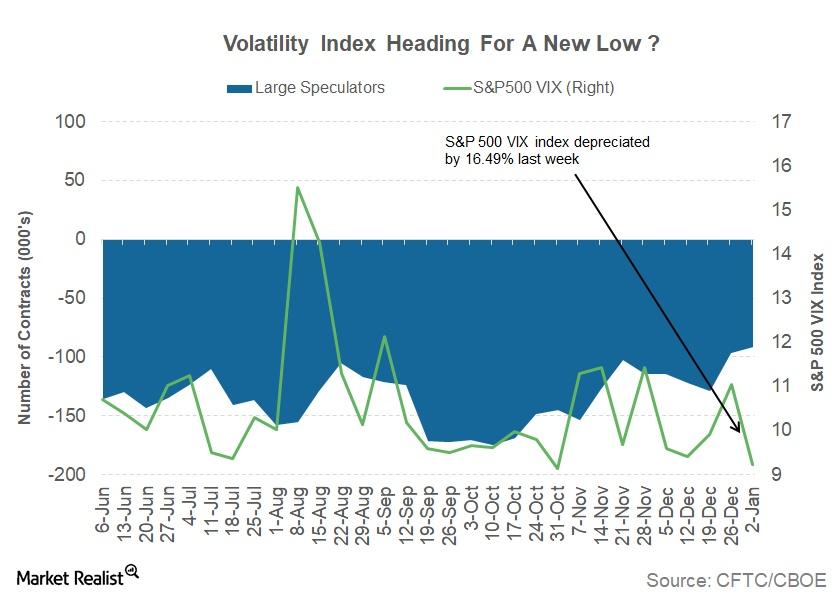

Why Volatility Fell 16% in Week 1 of 2018

Every segment of the global financial markets began 2018 on a positive note. The global equity rally extended in the first week of the year.

How Many Americans Quit Their Jobs in November?

As per the latest JOLTS report, about 3.2 million American workers quit their jobs voluntarily in November.

What November Job Openings Say about US Economy

As per the January JOLTS report, there were 5.9 million job openings at the end of November.

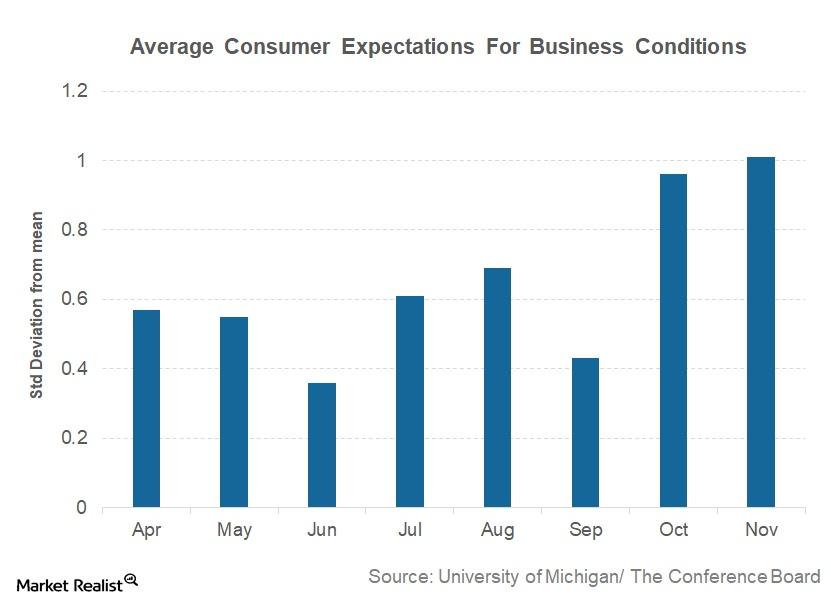

Why Consumer Expectations Continued to Increase in November

Consumer expectations for business conditions Average consumer expectations for business conditions form the only component of the Conference Board LEI (Leading Economic Index) that is not a leading indicator. Consumer expectations are based on two separate surveys. One survey is conducted by the University of Michigan and Reuters, while the second survey is conducted by […]

What to Make of the Surprising Gains in the Euro in 2017

The euro–dollar (FXE) pair closed 2017 at 1.1998. It appreciated by 13% against the US dollar and posted close to 10% gains against the other major global currencies.

How the Leading Credit Index Tracks US Credit Conditions

Understanding the Leading Credit Index The Conference Board LCI (Leading Credit Index), a constituent in the LEI (Leading Economic Index), is published every month and tracks credit conditions in the US economy by following changes in six financial market instruments: the two-year swap (SHY) spread (real time) the three-month LIBOR[1.Intercontinental Exchange London Interbank Offered Rate] (SCHO) […]