Ricky Cove

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ricky Cove

A Lesson from Currency Markets during Geopolitical Tensions

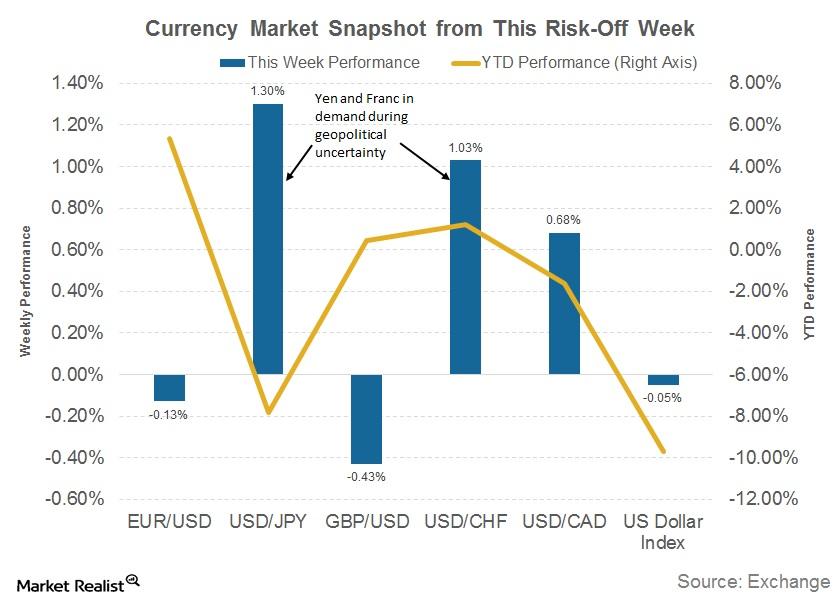

Last week’s rising geopolitical tensions between the United States and North Korea turned the tide for the yen. The Swiss franc also appreciated.

How Are Safe Havens Faring in This North Korea Fear?

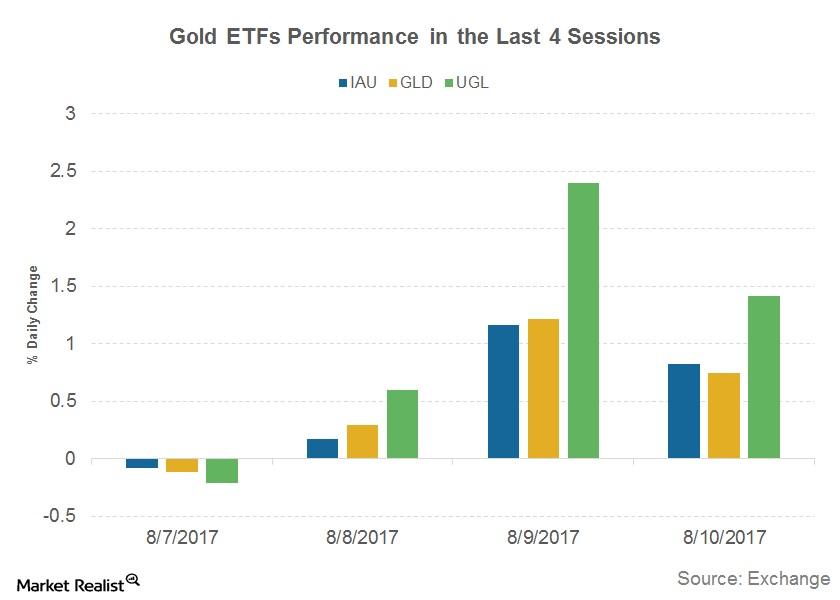

The safe havens that benefit the most in times of uncertainty include gold (GLD) and U.S. Treasuries (GOVT).

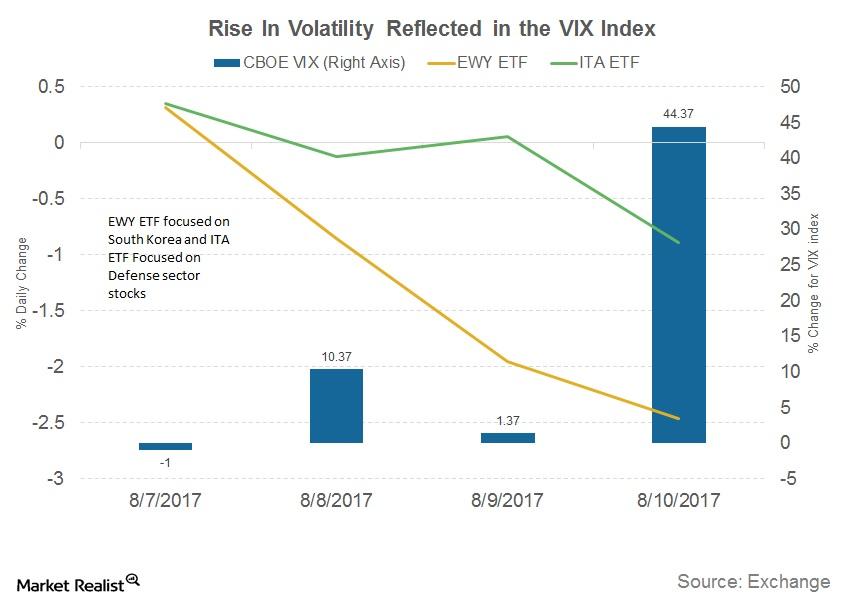

Which Stocks Will Benefit the Most from US-Korea Tensions?

Some companies benefit in times of uncertainty, and some sectors provide cover for investors.

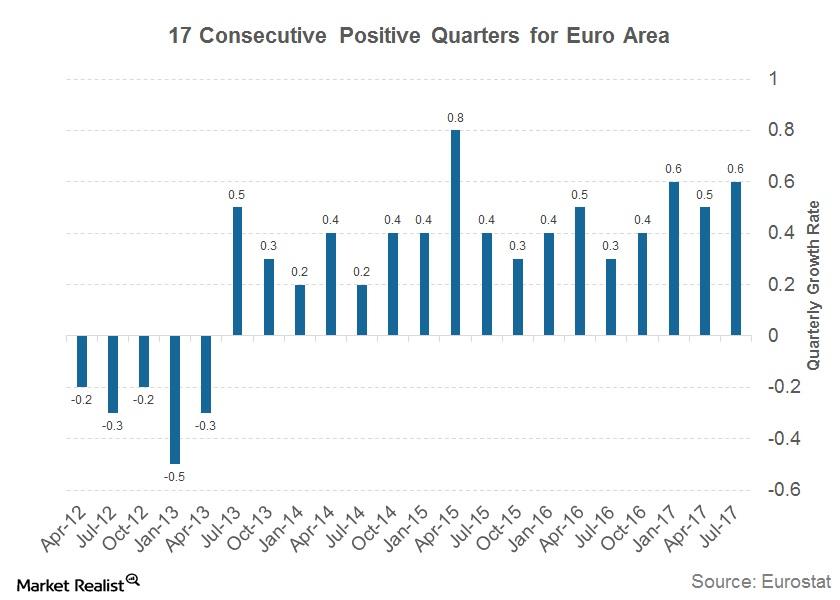

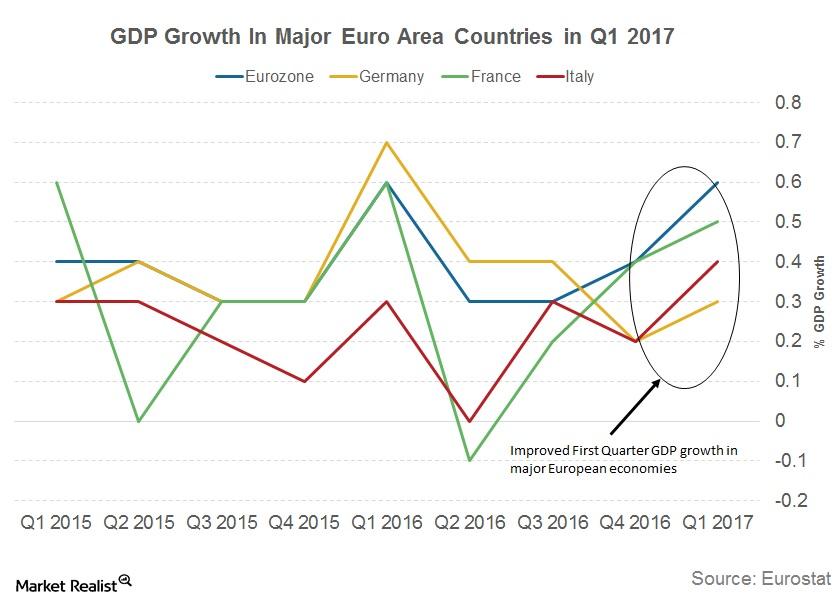

Is Strong Economic Expansion in the Eurozone Driving the ECB?

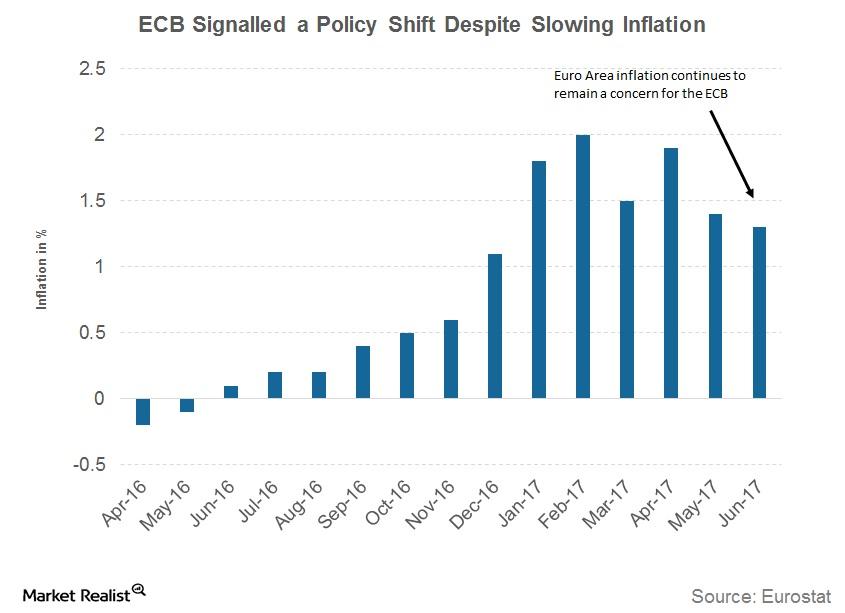

The European economy has expanded in the last 17 consecutive quarters. The Eurozone’s annual growth rate is 2.1%—the highest growth rate in the last six years.

Should We Be Worried about Greenspan’s Bond Market Warning?

Greenspan cites rapid inflation growth as the reason for a bond market collapse. But the markets and Fed officials think otherwise.

Can There Really Be a Bubble in the Bond Market?

Fundamentally, bonds (AGG) are a discount instrument and are generally never expected to be in a bubble. Let’s see why that’s the case.

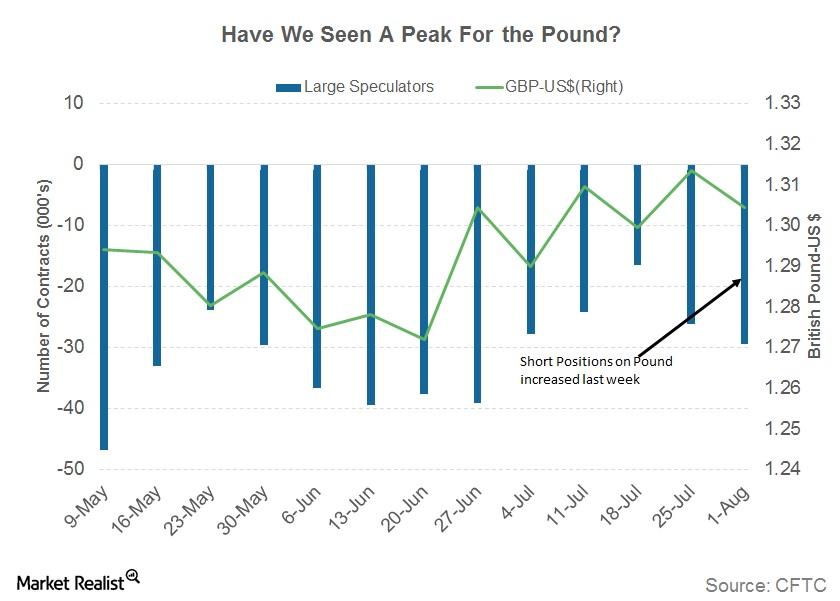

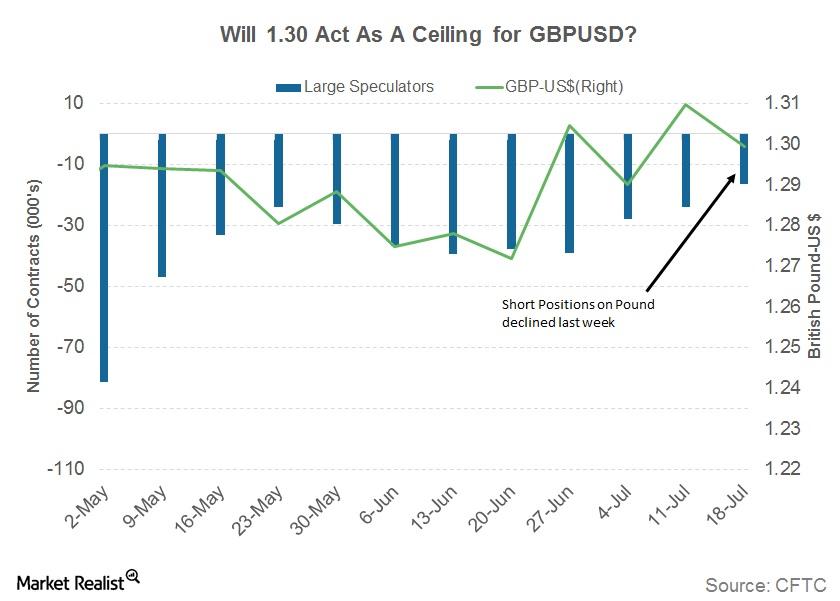

Chart in Focus: A Look at the British Pound

The British pound recorded another multi-month high of 1.3266 against the US dollar before the Bank of England announced its inflation report and interest rate decision on August 3.

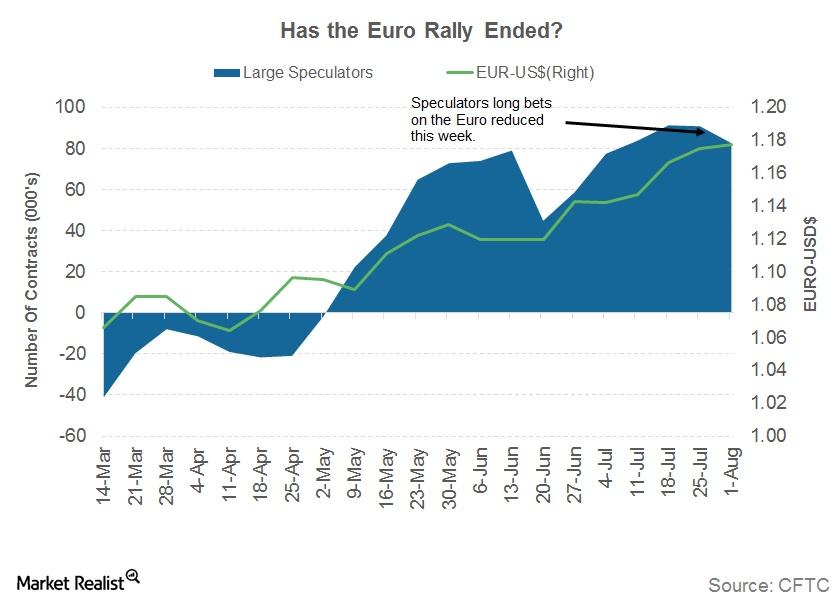

Is the Euro Running Out of Steam?

The German DAX (DAX) was up ~1.1%, Euro Stoxx (FEZ) was up ~1.1%, and France’s CAC was up ~1.4% in the week ended August 4, 2017.

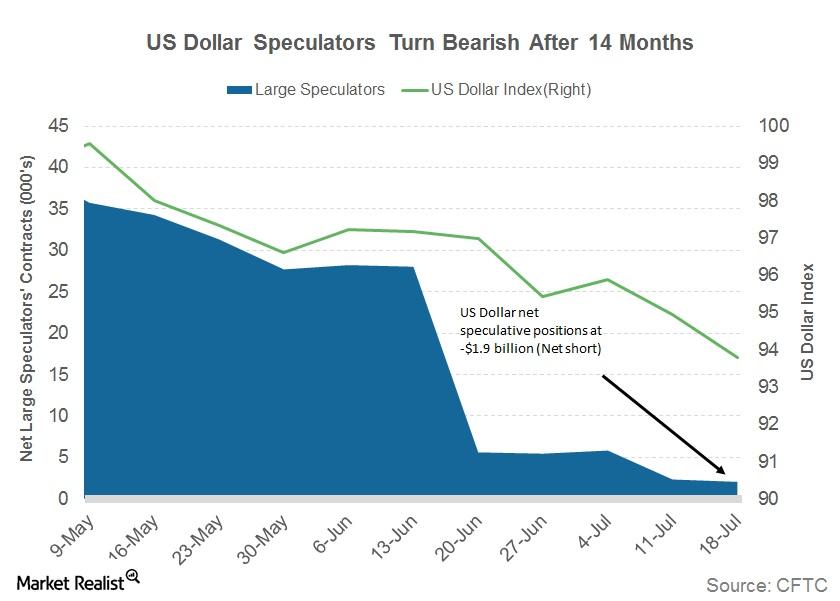

What to Expect from the US Dollar

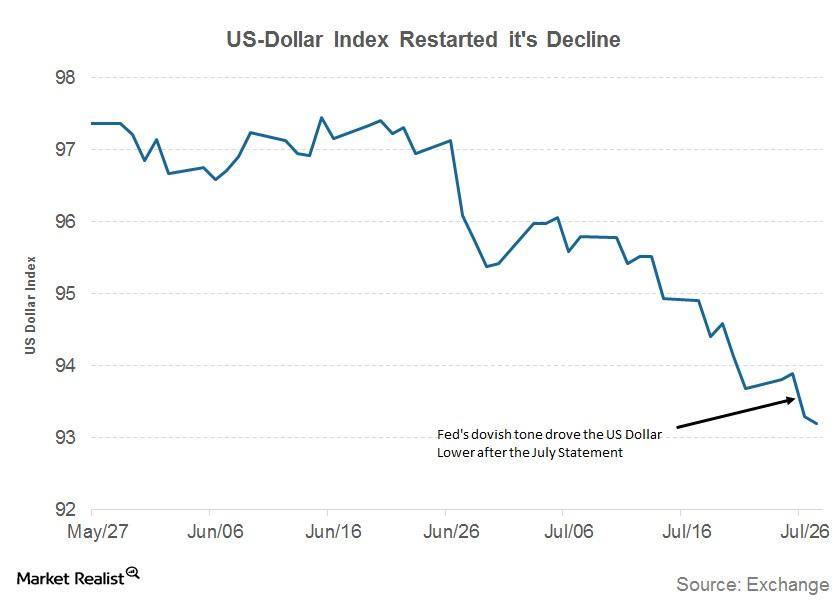

The US Dollar Index (UUP) continued to slide in the previous week due to the FOMC’s dovish statement and weaker-than-expected economic data.

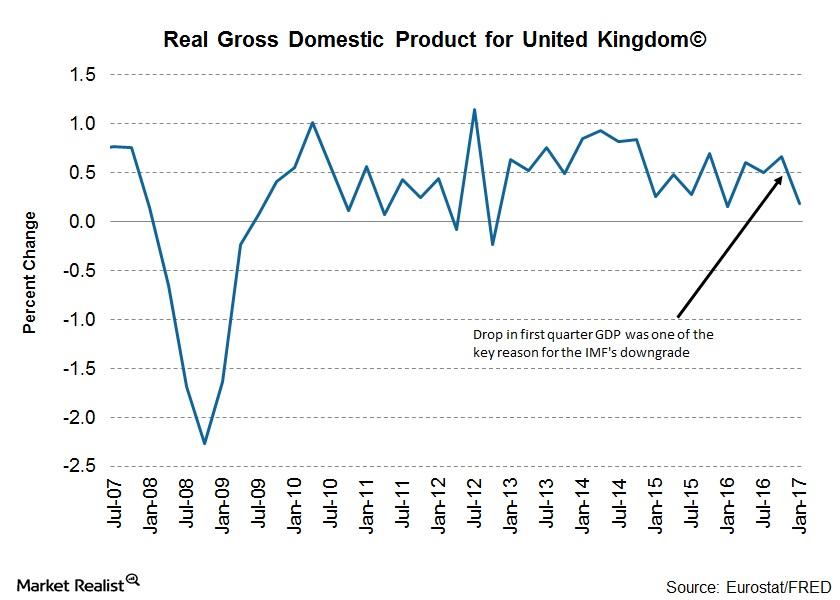

International Monetary Fund Sees Renewed Brexit Pain for the UK

International Monetary Fund slashes UK growth forecast In its World Economic Outlook update, released on July 23, the International Monetary Fund (or IMF) downgraded its growth outlook for the United Kingdom. The IMF said that it expects the UK economy (EWU) to grow at a rate of 1.7% this year, compared with its previous forecast […]

Why the International Monetary Fund Expects Continued Euro Growth

Growth projections for Euro area upgraded The International Monetary Fund (or IMF) has revised its growth projections for France, Germany, Italy, and Spain. Growth projections for Germany (FGM), France (EWQ), and Italy (EWI) were upgraded by 0.2% for 2017, and 0.1% for 2018. Spain (EWP) had a higher upgrade to growth expectations, with a change of […]

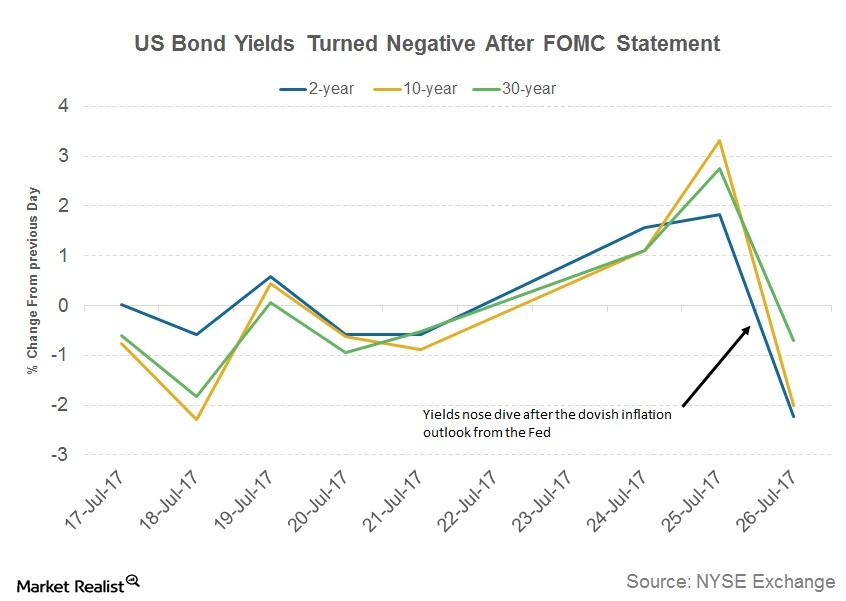

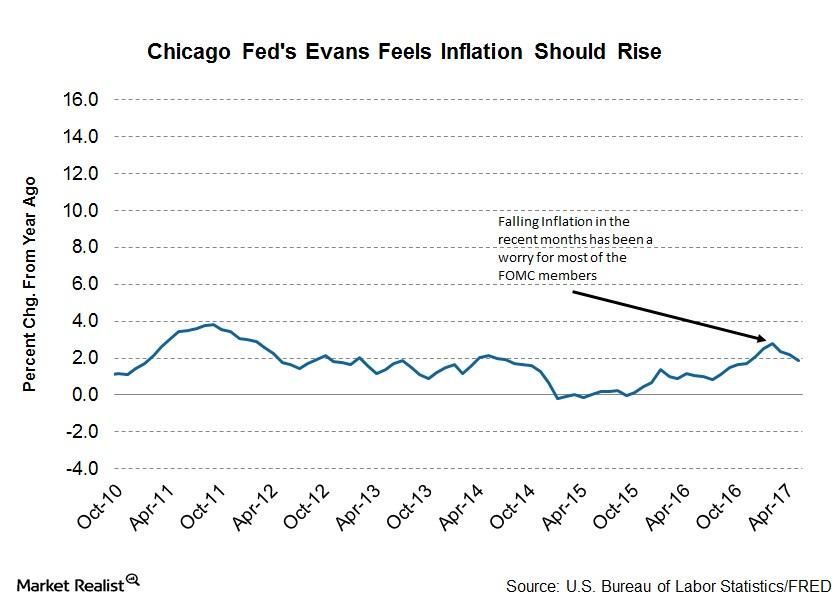

Why Bond Prices Rose after the FOMC’s Statement

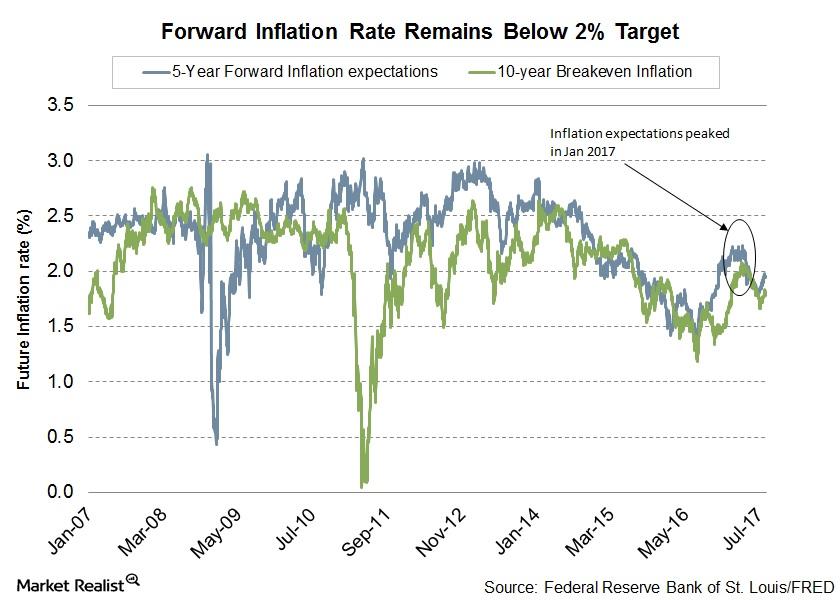

US government bonds gained after the FOMC (Federal Open Market Committee) indicated in its July 2017 statement that near-term inflation could remain below its 2% target.

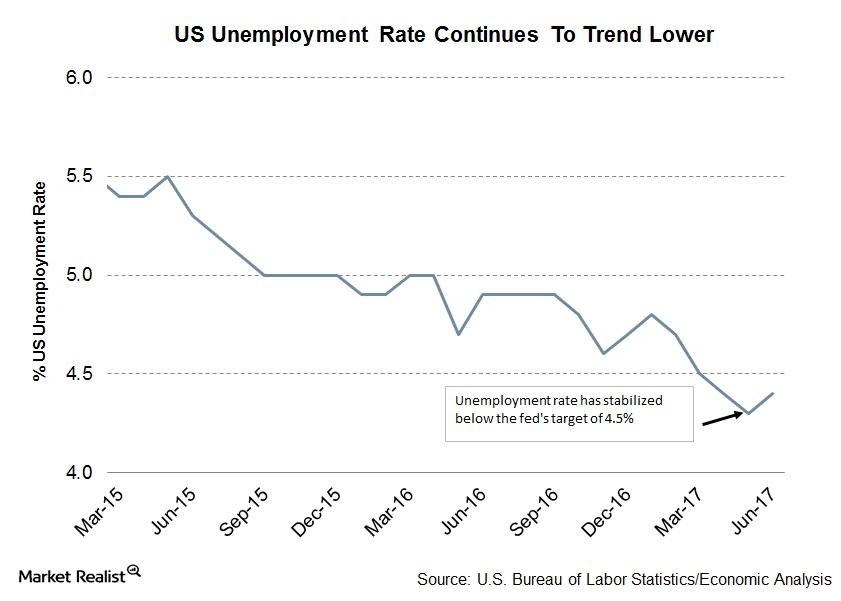

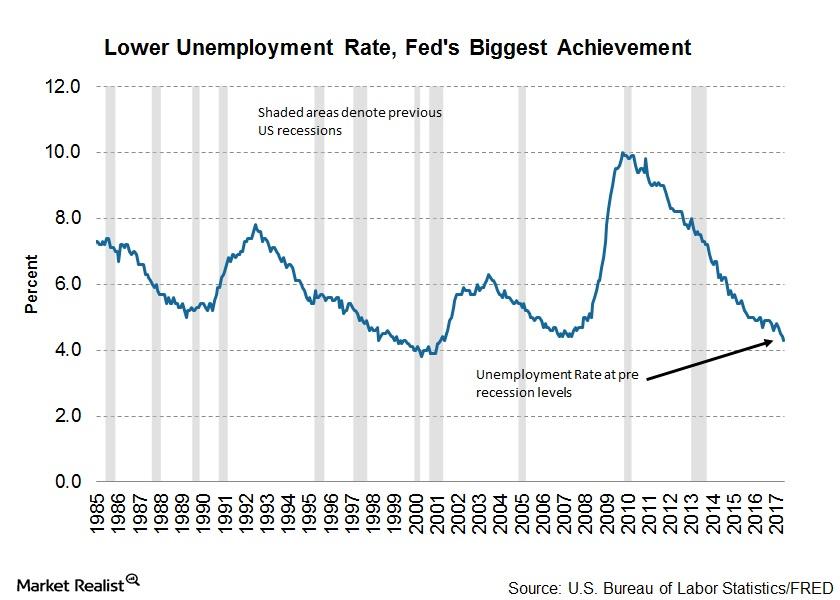

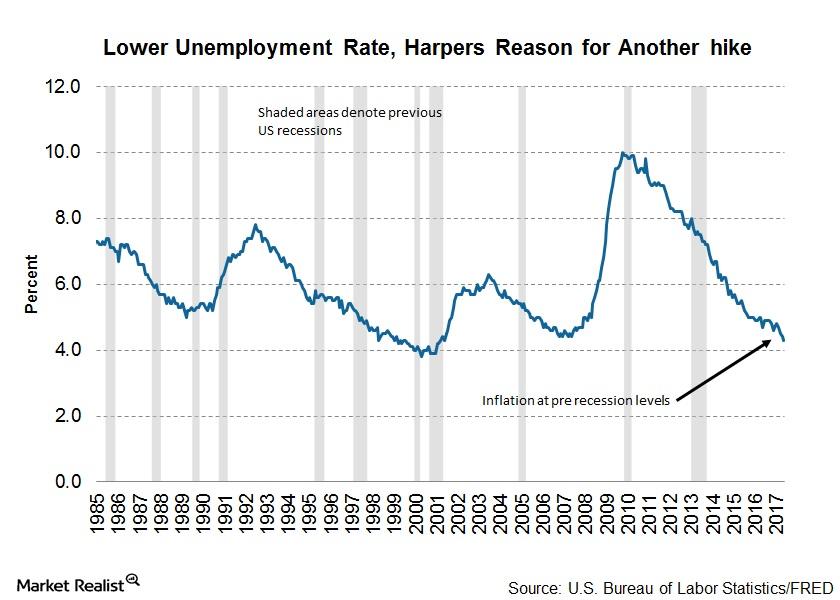

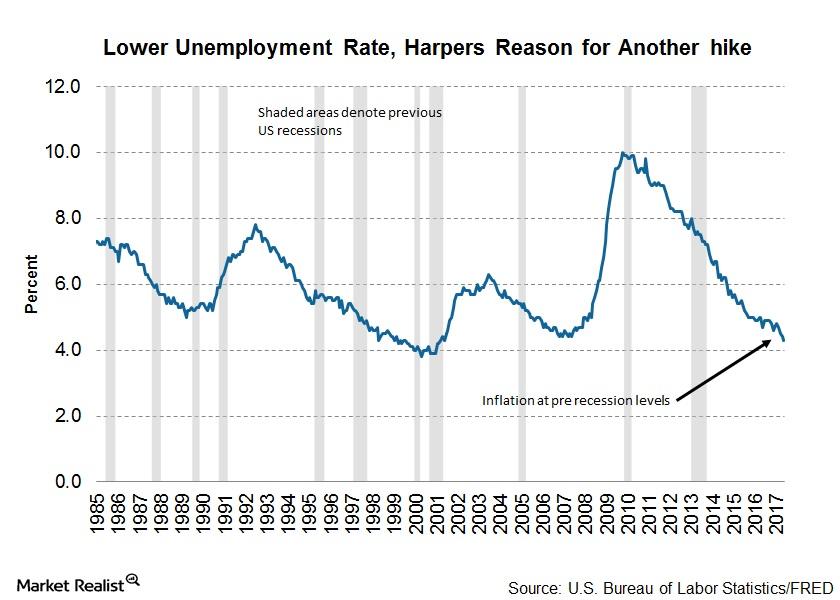

US Unemployment: The Fed’s Favorite Metric Continues to Improve

In a statement following the conclusion of its two-day monetary policy meeting, the FOMC stated that US labor market growth was solid.

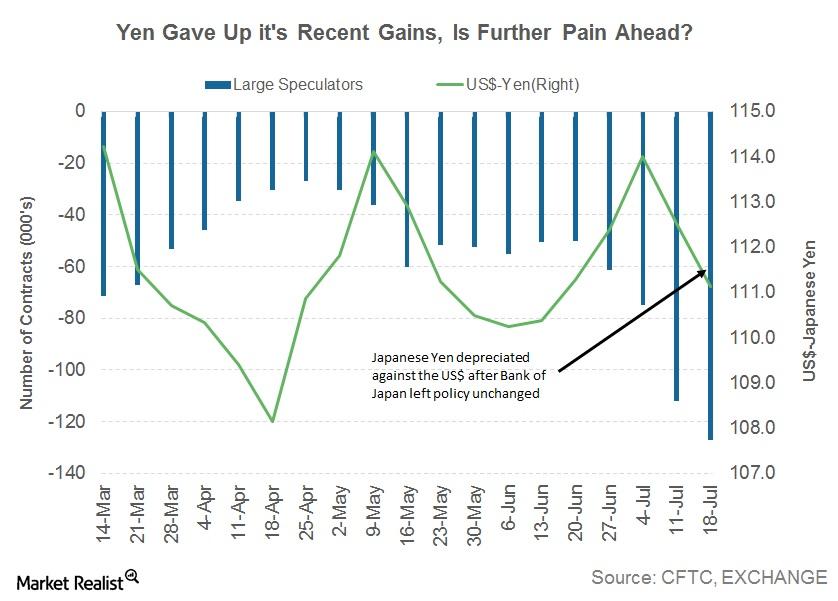

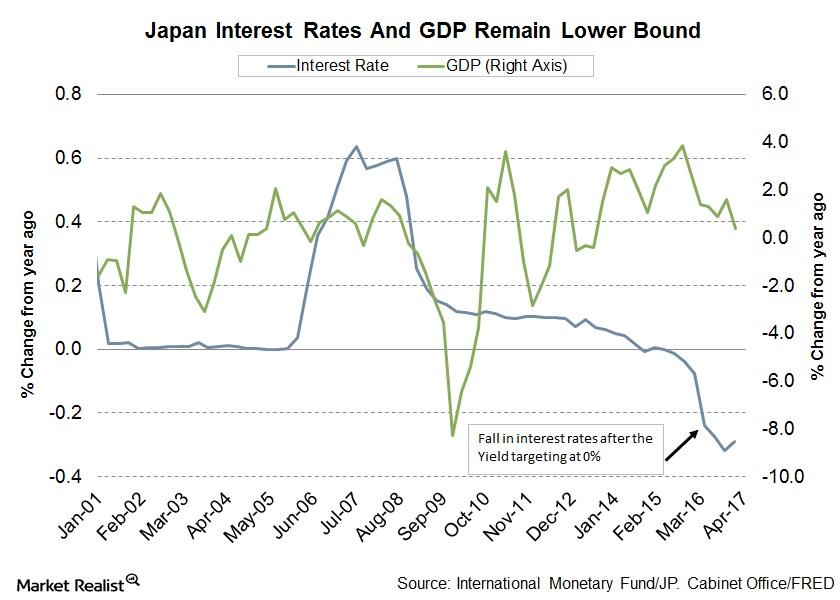

The Japanese Yen Could Keep the US Dollar Company

Another week of appreciation The Japanese yen (JYN) had another positive week, posting gains of 1.3% and closing at 111.12 against the US dollar (UUP). The previous week’s close for the currency pair was 112.53. This strength was primarily driven by the US dollar, rather than positive news from the Japanese economy. Most of the […]

Why the British Pound Failed to Stay above 1.30

Investors not confident the Bank of England will raise rates The British pound (FXB) has had a roller coaster ride over the last few weeks, as mixed signals were given by the Bank of England. After a hawkish tone at its June meeting, the Bank of England has turned dovish in recent weeks. The British pound […]

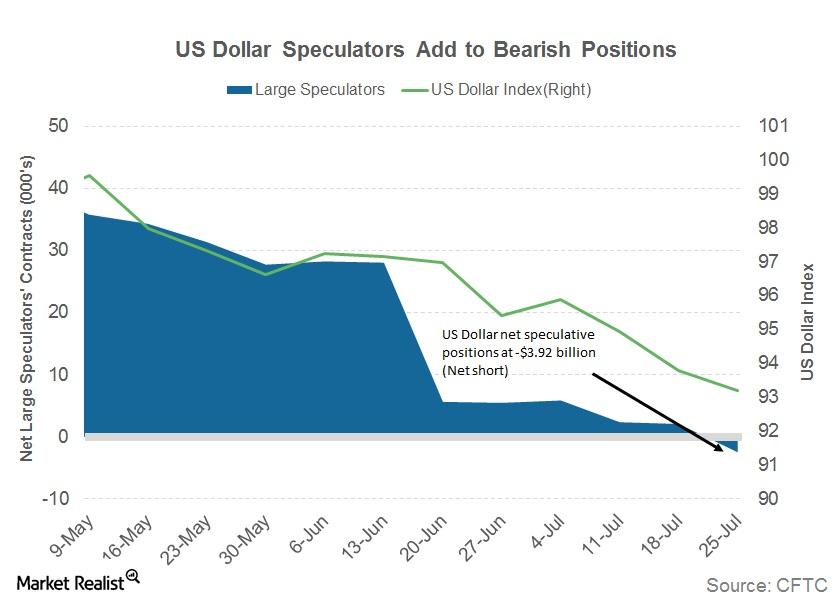

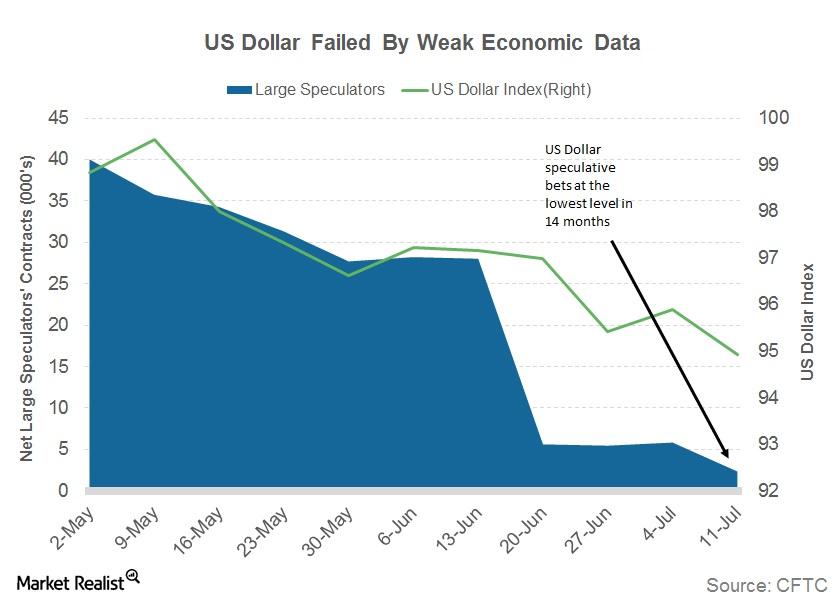

This Is Why the US Dollar Could Slide Further

US Dollar index reaches a 14-month low The US Dollar Index (UUP) continued with its fall as investors preferred major peers. In the week ended July 21, the US Dollar Index closed at 93.78, falling 1.7% from the week prior. It is headed for its fifth consecutive month of loss this year. Conflicting news from […]

Why the US Dollar Took a Hit after the FOMC’s July Statement

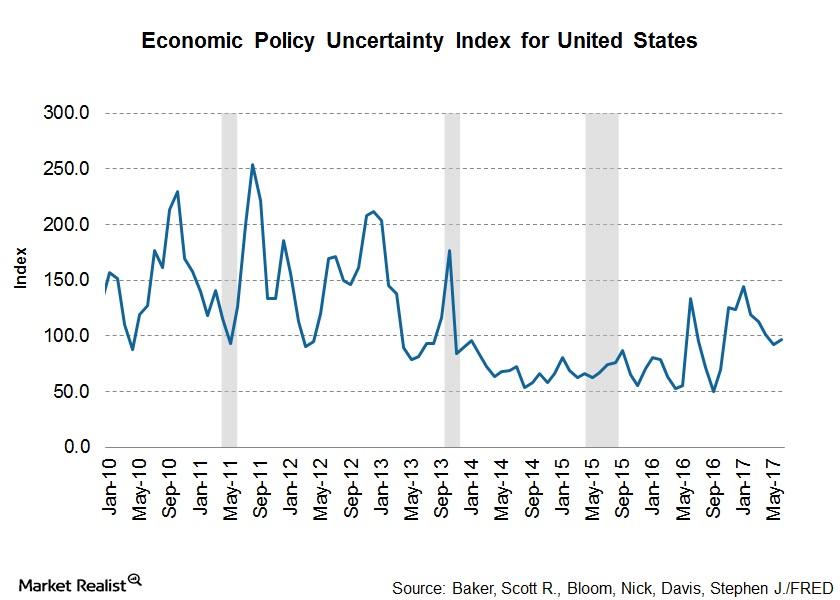

Most of the statement released by the Federal Open Market Committee (or FOMC) following its two-day monetary policy meeting was in line with the market’s expectations.

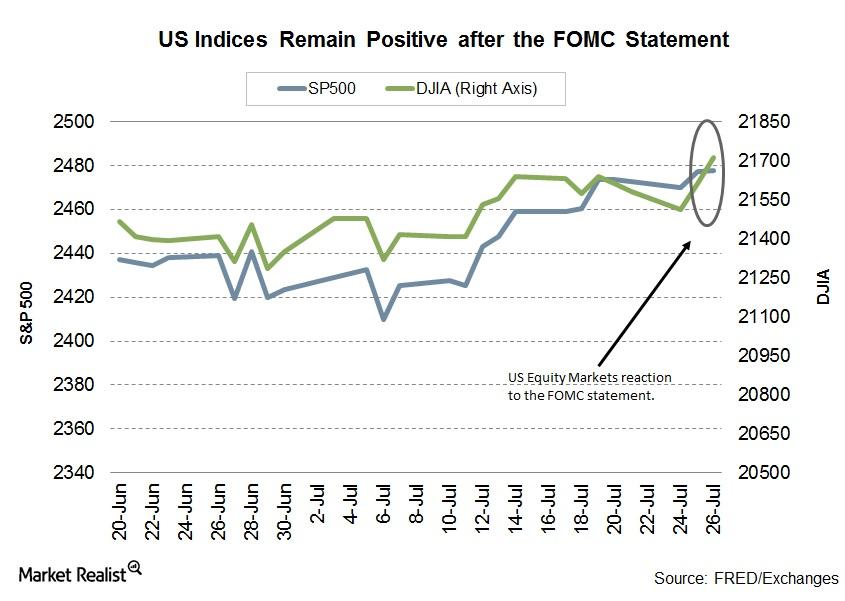

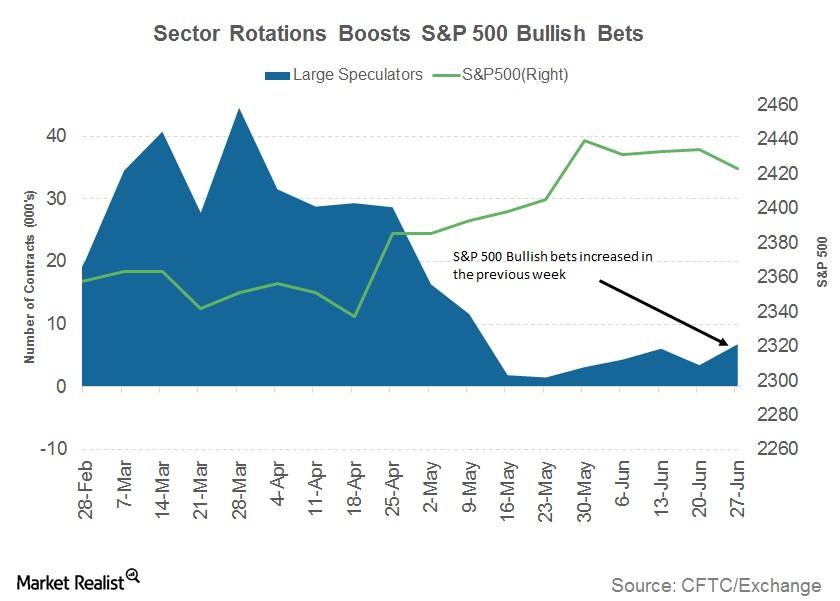

Why Equity Markets Celebrated the FOMC’s Statement

In a week dominated by corporate earnings, which have been driving the US markets higher, the FOMC’s dovish stance in its July statement sweetened the deal for equity investors.

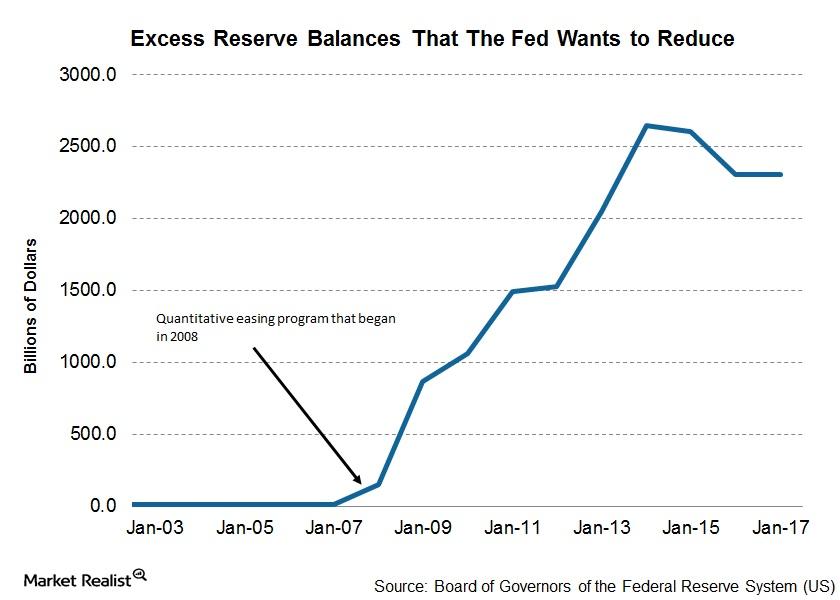

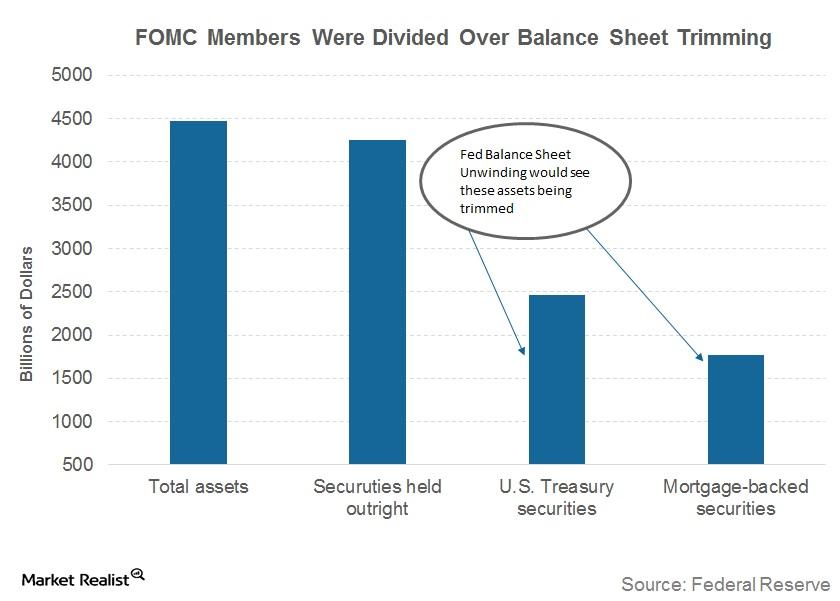

Will the US Balance Sheet Unwind Affect the Markets?

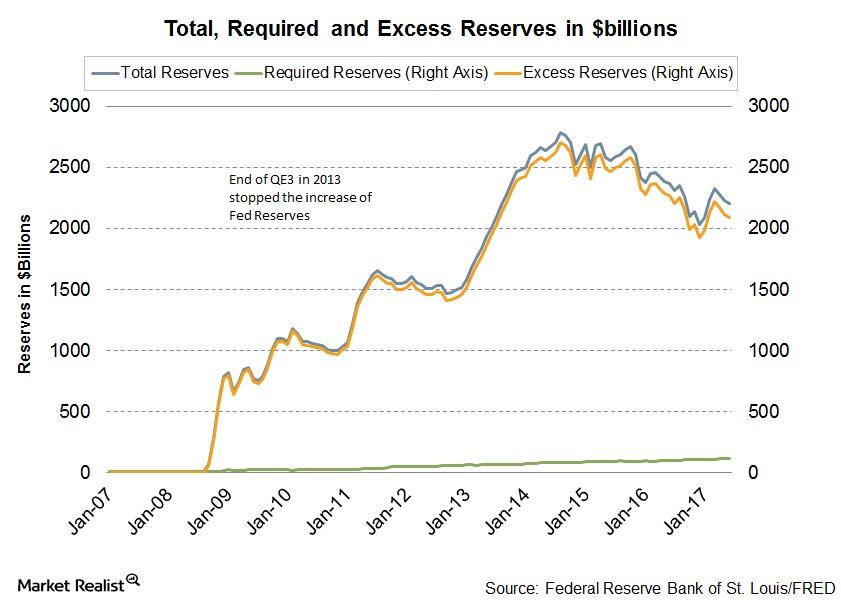

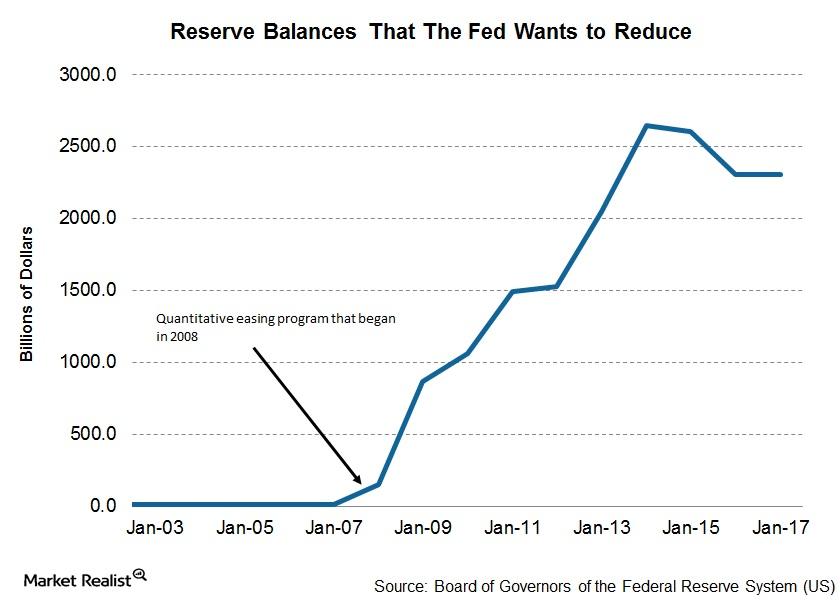

After the July FOMC meeting statement was released, market participants came to believe that the Fed would begin the process of balance sheet normalization soon.

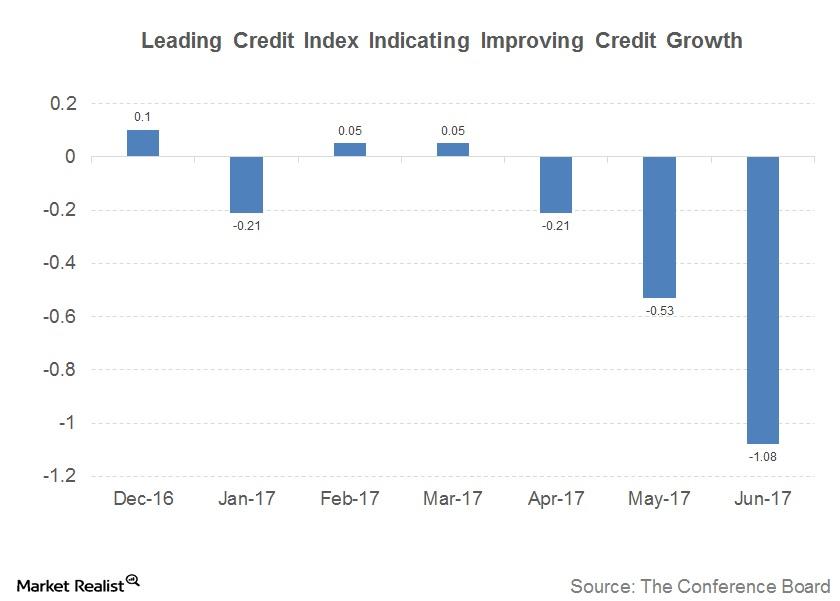

What the Conference Board LEI Tells Us about the Market

The Leading Credit Index is one of the constituents of The Conference Board Leading Economic Index (or LEI), which is reported by The Conference Board on a monthly basis.

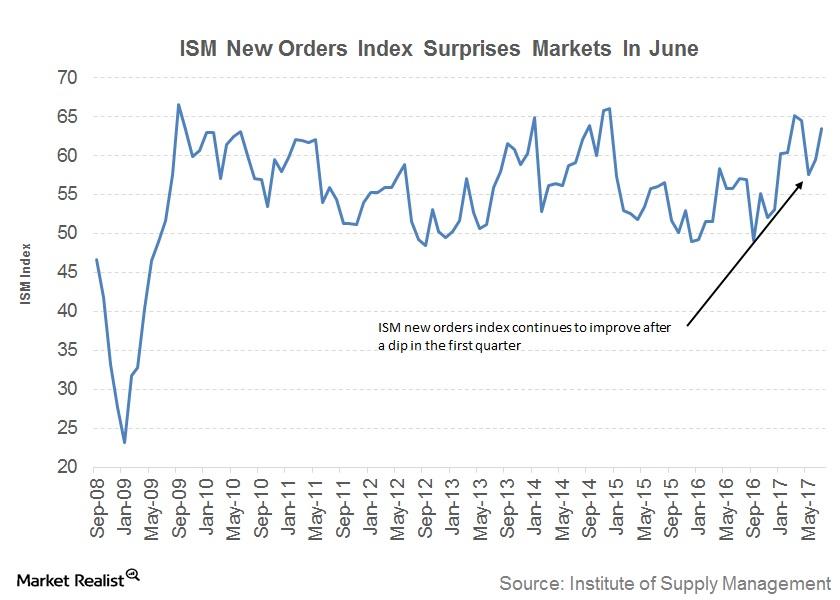

What the ISM New Orders Index Indicates for the US Economy

The Institute of Supply Management (or ISM) New Orders Index indicates the number of new orders from customers.

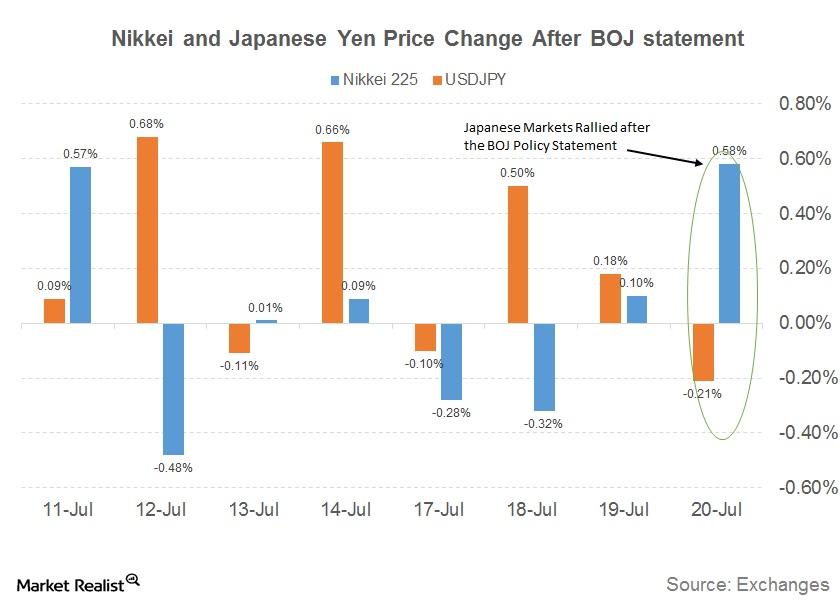

Why Japanese Markets Surged after the Bank of Japan’s Inaction

In its July 2017 monetary policy statement on July 20, 2017, the Bank of Japan reported that it had left interest rates unchanged at -0.1%.

The Bank of Japan Cuts Its Inflation Forecast

According to the statement it released at the end of its two-day meeting on July 20, 2017, the Bank of Japan has left its monetary policy unchanged.

Have Yellen and US Economy Failed the US Dollar?

The US Dollar Index (UUP) closed at 94.9, depreciating by 0.90% last week.

Why the Fed Isn’t Satisfied with Labor Market Conditions

Despite the strong growth in employment numbers, the Fed’s latest monetary policy report had some comments about slow wage growth.

Will Market Shocks Really Be Minimal to Balance Sheet Unwinding?

In its June policy meeting, the Fed has signaled that it will stop replacing maturing securities and slowly reduce the size of its balance sheet.

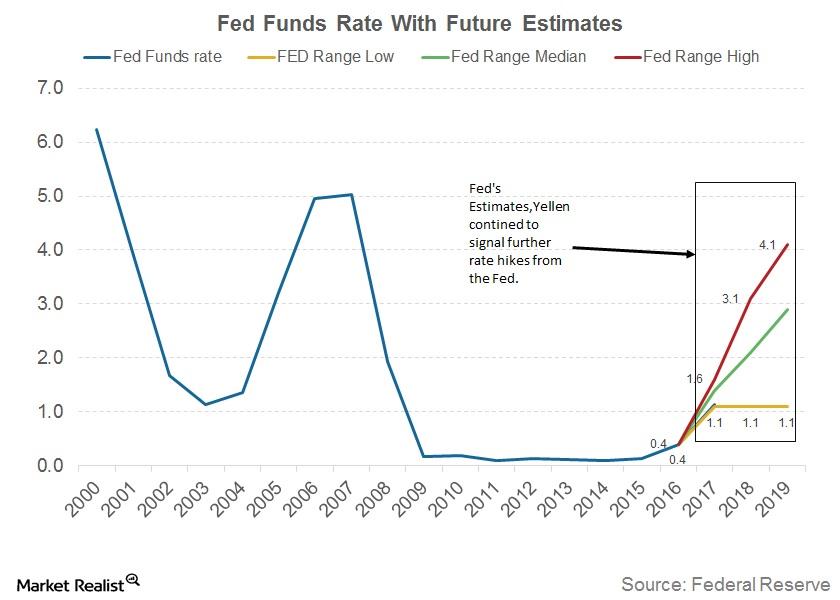

Why Fed’s Yellen Feels Gradual Rate Hikes Are Warranted

The tone of Yellen’s responses before the committee confirmed that the Fed is set to stay its course on monetary tightening, leading to policy normalization.

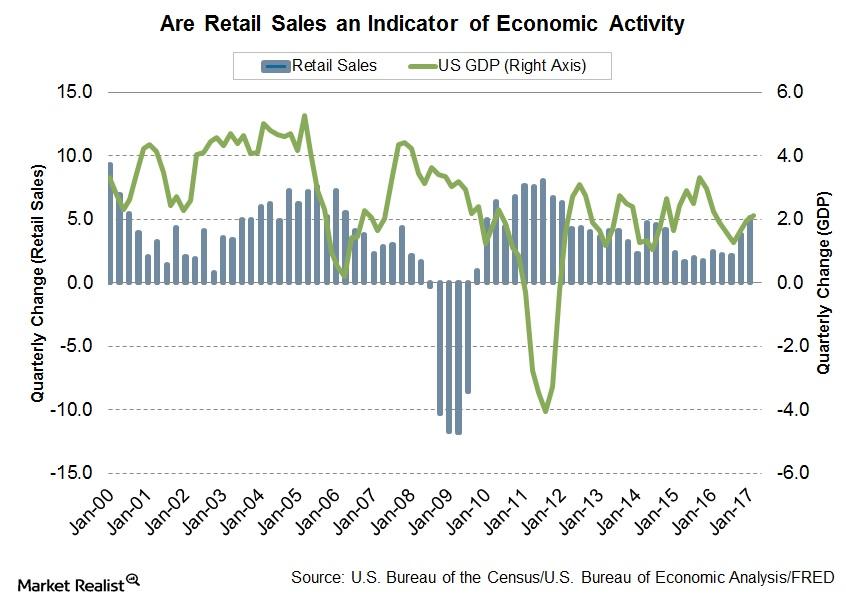

Why Retail Sales Are an Important Indicator of Economic Growth

In this series, we’ll explore the trends in consumer spending in recent months and try to shed some light on the retail sales data that will be released on July 14.Macroeconomic Analysis Is the British Pound Facing the Risk of Stagnation?

Economic data from the United Kingdom showed unexpected signs of a slowdown last week, with weaker-than-expected data reported in trade, production, and house prices.

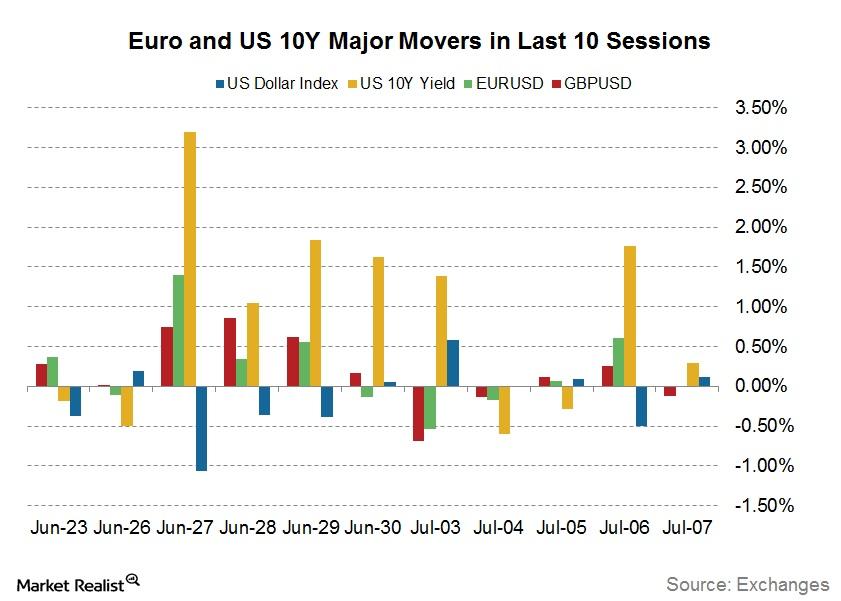

How Central Bankers Are Rattling Bonds and Currencies

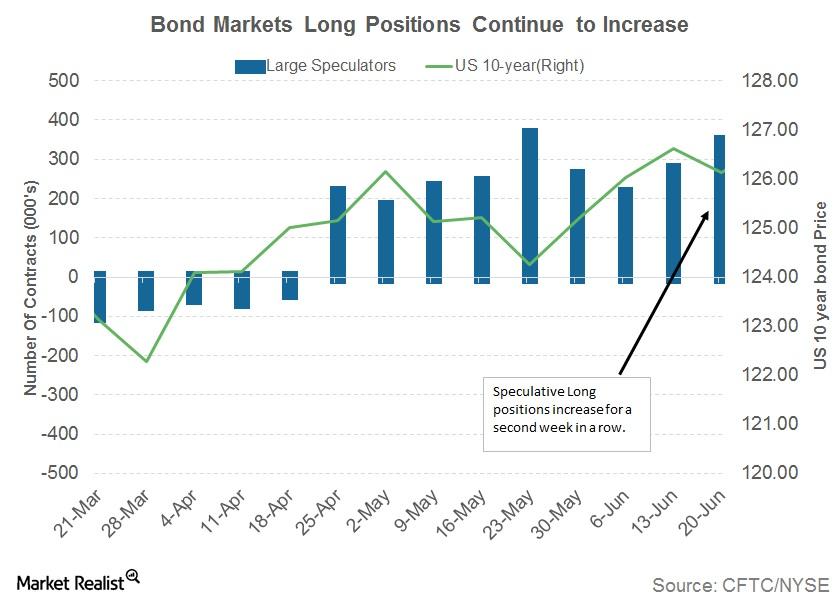

Since the FOMC minutes and the hawkish turn of events at the European Central Bank and the Bank of England, bond yields across the board have been trending higher.

Why FOMC Members Were Divided about Balance Sheet Shrinking

The FOMC June meeting minutes that were released on July 5, 2017, indicated that the FOMC members were divided over when to begin shrinking the Fed’s bloated balance sheet.

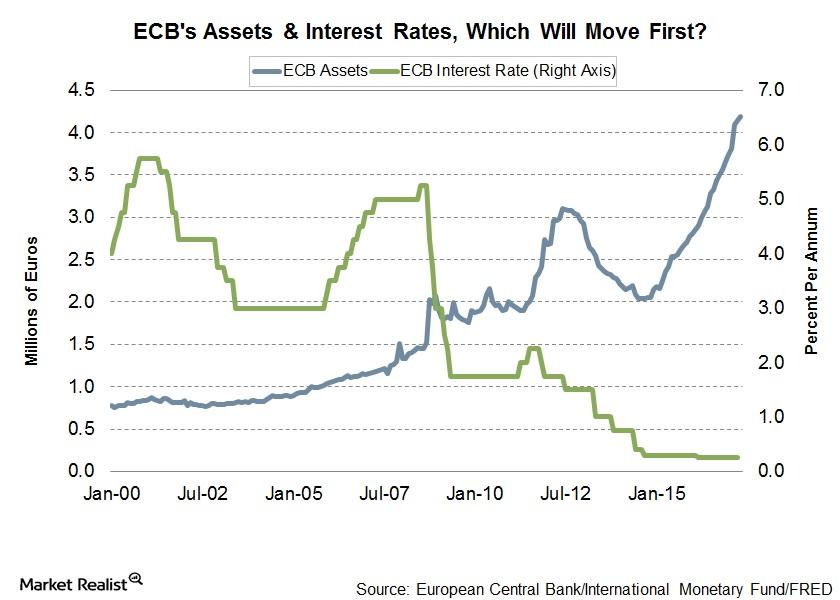

Confused Markets: Inside the ECB’s Struggle amid Miscommunication

The ECB (European Central Bank) in its recent monetary policy meeting on June 8 left its main refinancing rate at 0% and the interest rate at 0.25%.

Sector Rotation Could Be the New Theme for the S&P 500

According to the latest Commitment of Traders report, large speculators have increased their net bullish positions in the S&P 500 futures.

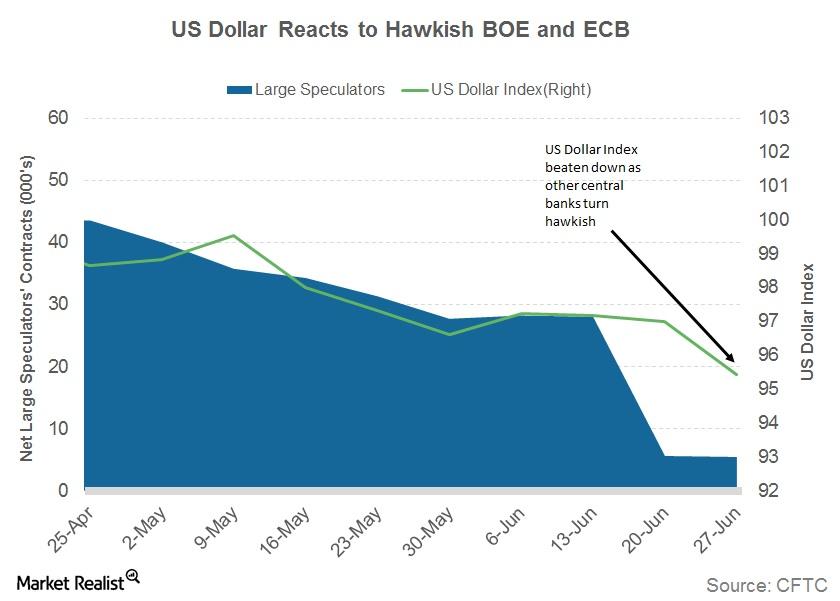

Did the BOE and ECB Pressure the US Dollar This Week?

The currency markets are anticipating the June FOMC’s meeting minutes, which are expected to be hawkish.

Why Bundesbank’s Weidmann Sees Political Pressures Ahead

At an event in Germany, Weidmann highlighted the risks of prolonged quantitative easing.

Why Minneapolis’s Fed President Voted Against a Rate Hike

In an essay published by Minneapolis’s Federal Reserve president, Neel Kashkari, after he voted against a rate hike in the Federal Open Market Committee’s (or FOMC) June 2017 meeting, he explained why he dissented.

Dallas’s Kaplan Discusses the Biggest Headwind for the US Economy

Dallas’s Federal Reserve president, Robert S. Kaplan, said that the rebound in the US economy is likely to continue for the rest of 2017.

Why NY’s Fed President Doesn’t Feel a Flattening Yield Curve Is Negative

New York’s Federal Reserve president, William C. Dudley, recently spoke at a business forum in New York and said that he was pleased with the current state of the US economy.

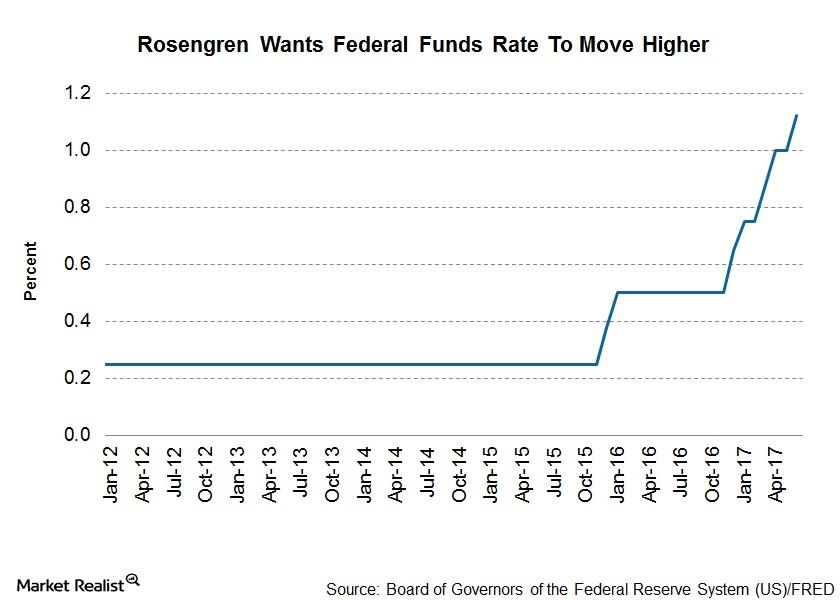

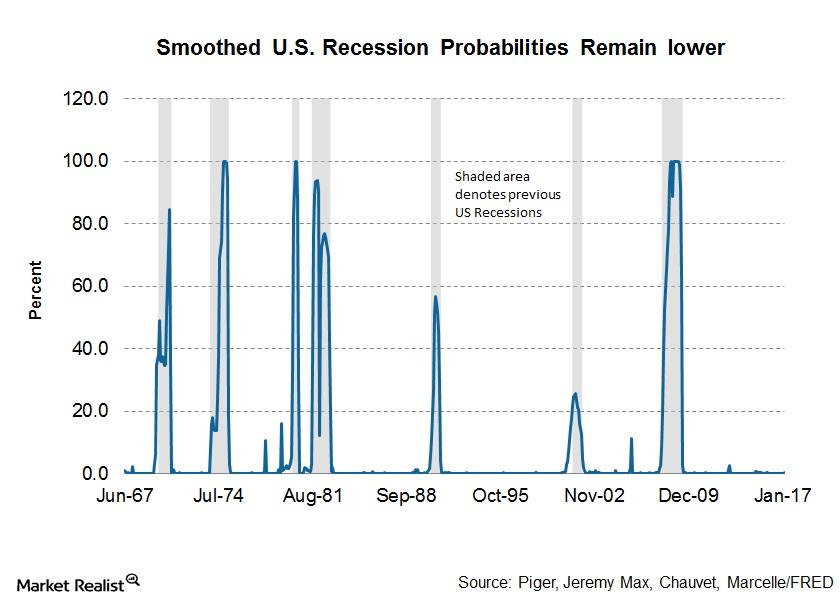

Why Boston’s Rosengren Feels It’s Hard to Fight Future Recessions

In Eric S. Rosengren’s view, monetary policy measures become incapable of fighting future negative shocks if interest rates (AGG) are already low.

Why Philadelphia’s Fed President Supports Another Rate Hike

In a recent interview with The Financial Times, the hawkish president of the Philadelphia Federal Reserve said that the Fed’s balance sheet’s unwinding could begin in September 2017.

Why Chicago’s Evans Sees Moderate Risks to Financial Stability

Chicago’s Federal Reserve president, Charles L. Evans, recently spoke at a Money Marketeers of New York University event about monetary policy challenges in a new inflation environment.

St. Louis’s Bullard Thinks Rebalancing Will Take 5 Years

At the Illinois Bankers Association’s annual conference in Nashville, organized on June 23, 2017, St. Louis’s Federal Reserve president, James Bullard, sounded dovish about the US economy.

Why Cleveland’s Fed President Worries about Another Recession

Loretta J. Mester, the president and CEO of the Cleveland Federal Reserve, spoke at the 2017 Policy Summit on Housing, Human Capital, and Inequality held on June 23, 2017.

Why Bond Traders Continue to Be Confused

US Treasuries (GOVT) had another roller coaster ride this week due in part to the conflicting views from Fed members and weaker-than-expected economic data.

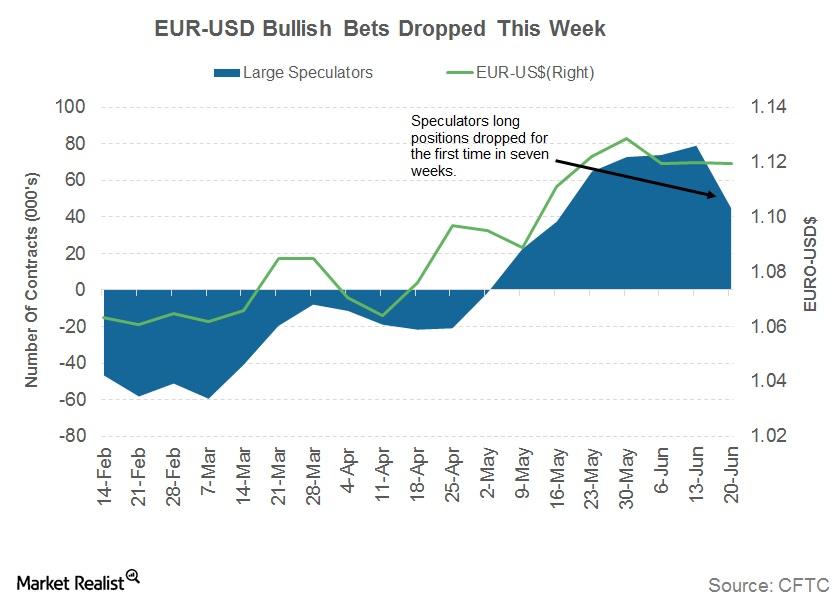

Will Weak Data from the EU Derail the Euro?

The euro (FXE) remained confined to a narrow range against the US dollar (UUP) in the previous week.

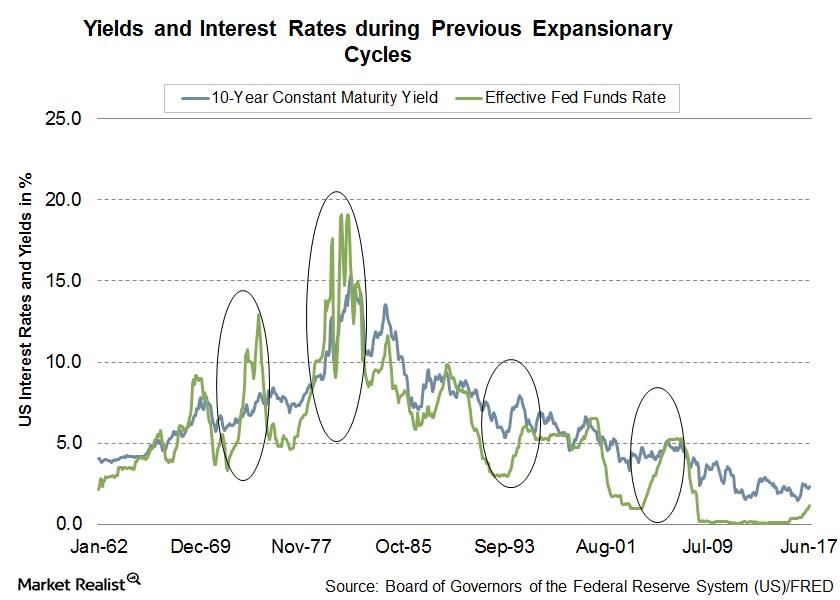

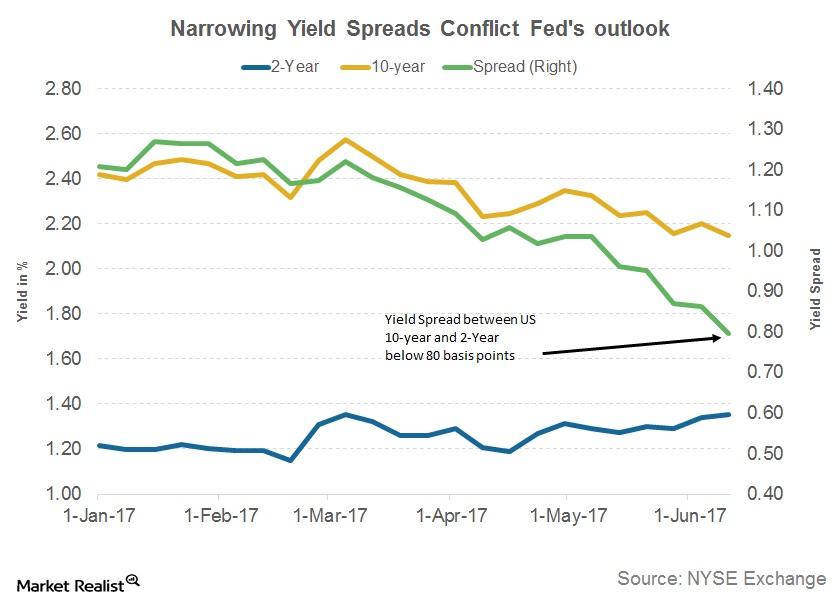

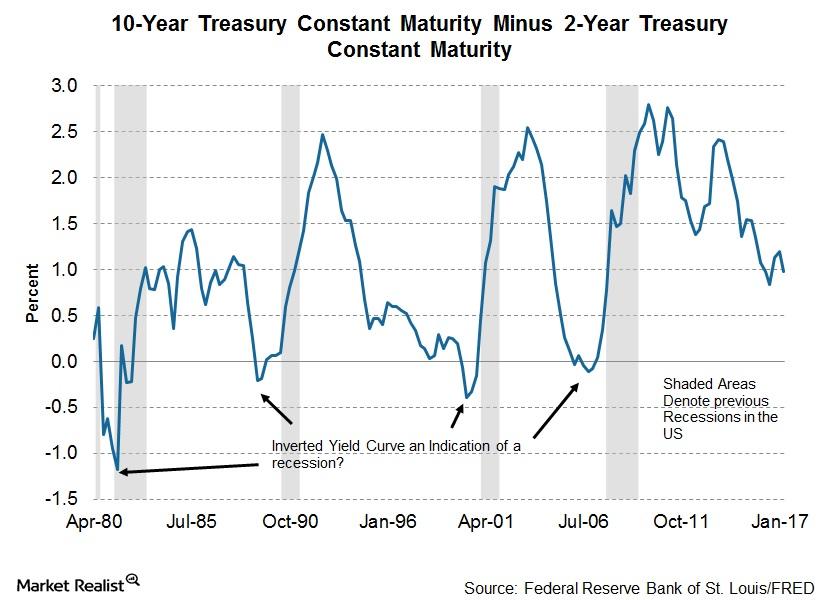

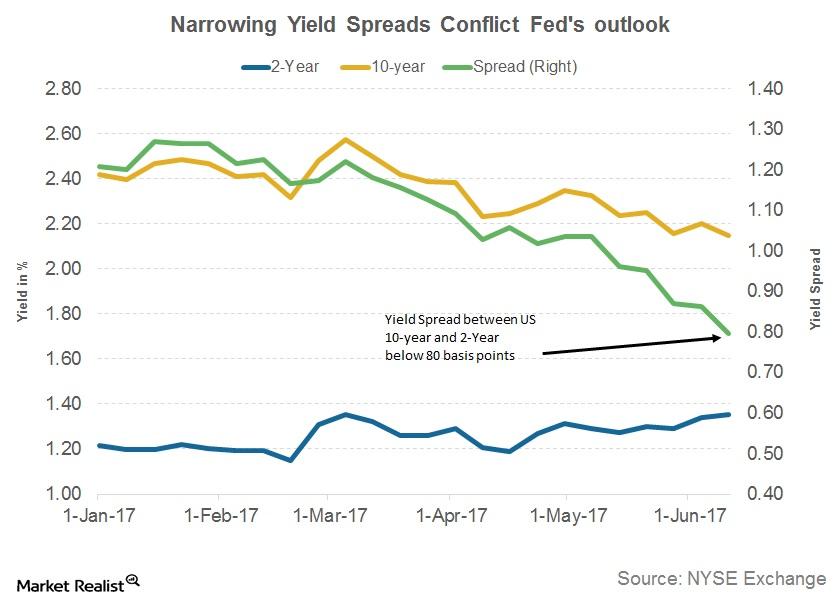

Is a Flattening Yield Curve a Sign of an Impending Recession?

Yields in the shorter timeframe such as the two-year yield (SHY) and T-notes (SCHO) are rising more than the ten-year or the 30-year (TLT) yields.

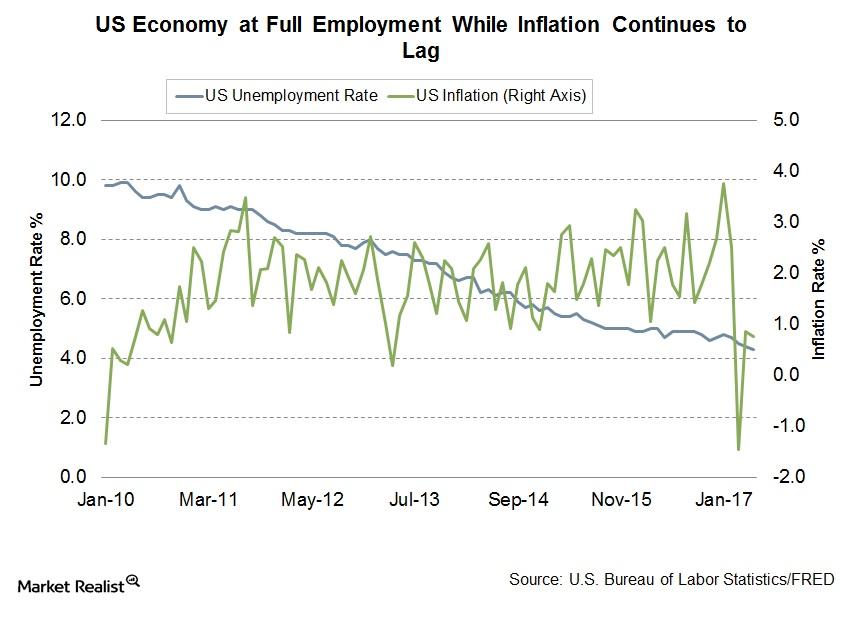

How the Federal Reserve Contributes to a Flattening Yield Curve

The US unemployment rate is close to the desired 4.5% and inflation has moved closer to the Fed’s target rate of 2.0%.

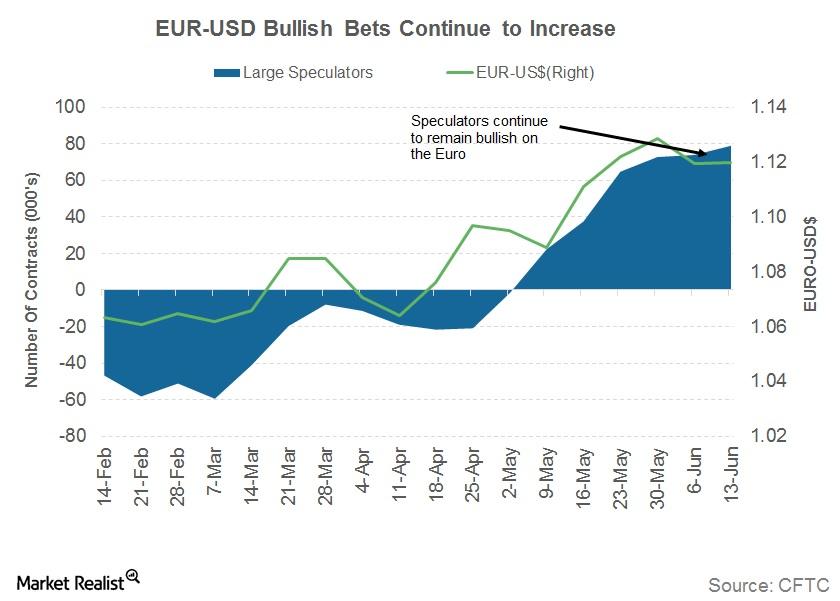

Is Long Euro the Theme for Forex Markets?

The euro (FXE) remained in a narrow trading range against the US dollar (UUP) between the levels of 1.130 and 1.115 for the last five weeks.

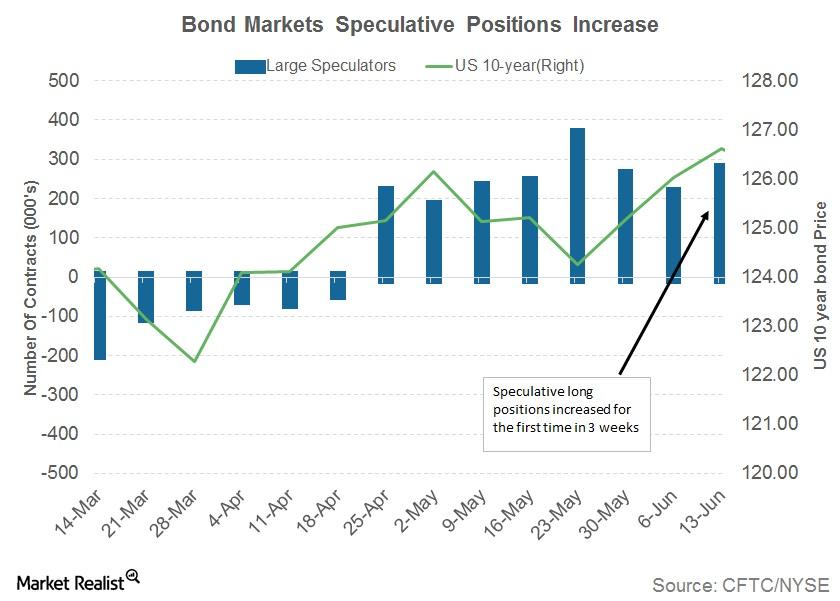

What Does Rise in US Interest Rates Mean for Bond Markets?

US Treasuries (GOVT) had a mixed response to the FOMC statement and the Fed’s interest rate hike.

What Narrowing Yield Spreads of US Treasuries Could Indicate

The US ten-year yield fell to 2.1% after the weak US data report, US inflation showed a decline of 0.1%, and retail sales fell by 0.3% for May 2017.