Ricky Cove

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ricky Cove

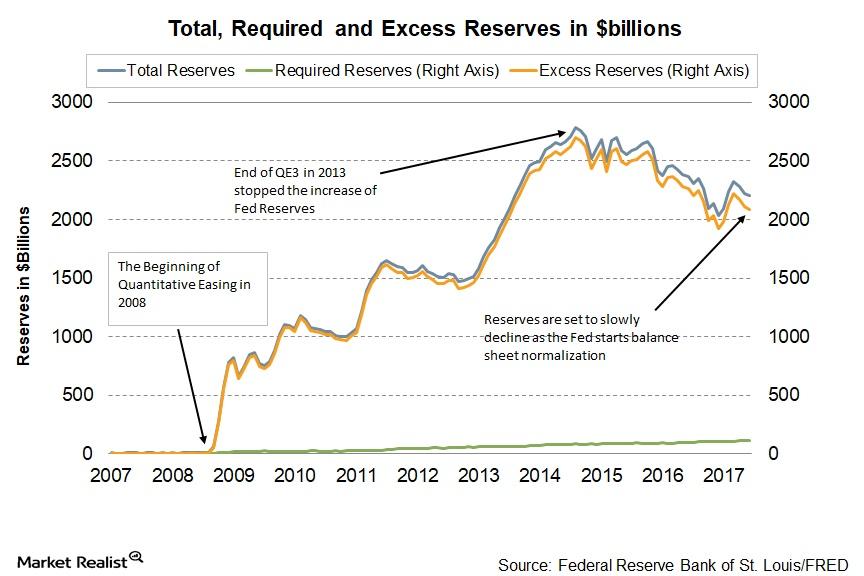

Why the Fed Has Initiated Balance Sheet Normalization

Atlanta Federal Reserve president and CEO, Raphael Bostic, recently spoke at a conference about the Fed’s balance sheet normalization program.

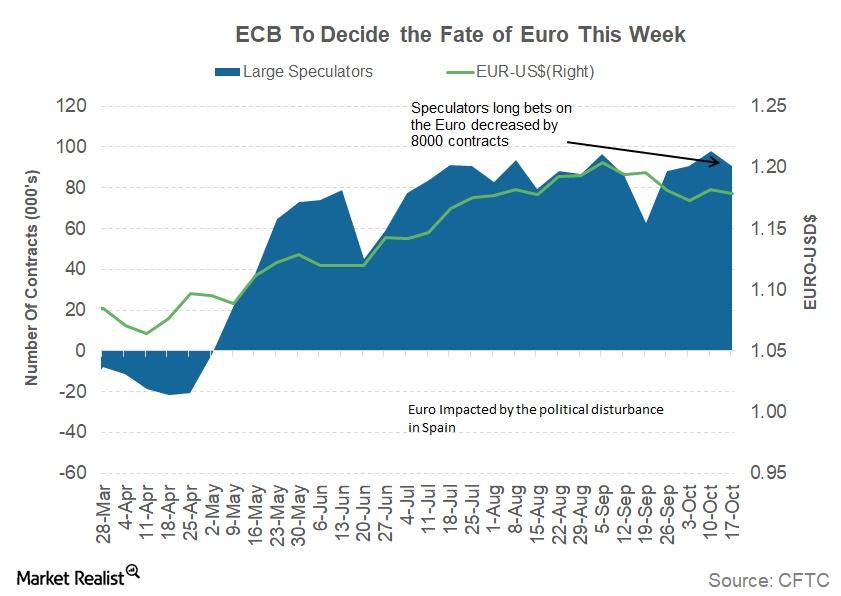

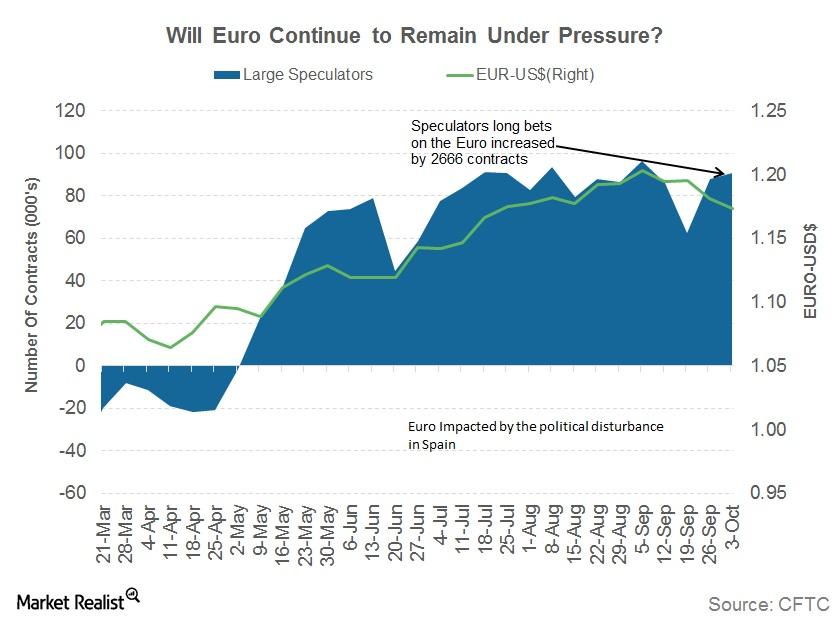

Why the Euro’s Troubles Could Continue This Week

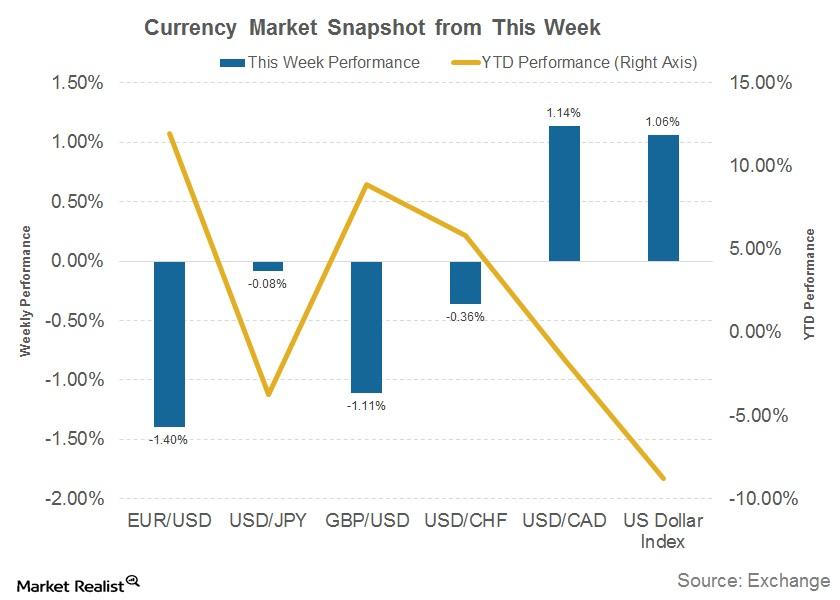

The euro-dollar (FXE) closed the week ending October 20 at 1.179 against the US dollar (UUP).

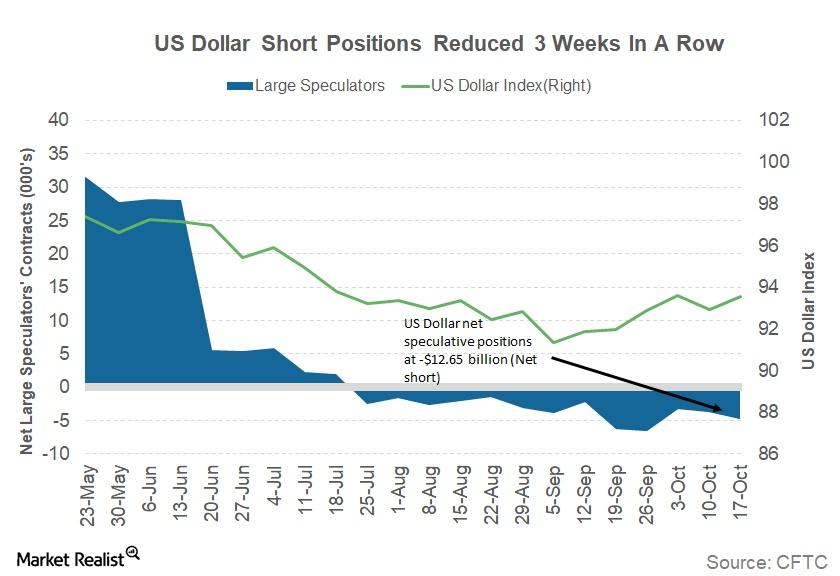

What to Expect from the US Dollar This Week

The US Dollar Index (UUP) has bounced back from the shallow low that it saw the previous week.

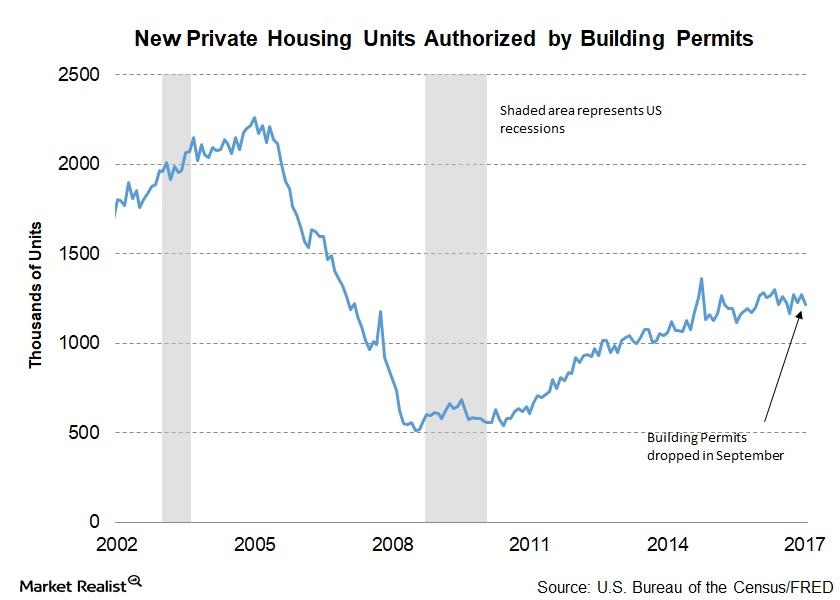

Is the Drop in September Building Permits Cause for Concern?

In September 2017, building permits were at a seasonally adjusted annual rate of 1.215 million—a fall from August’s 1.272 million and 4.3% below September 2016.

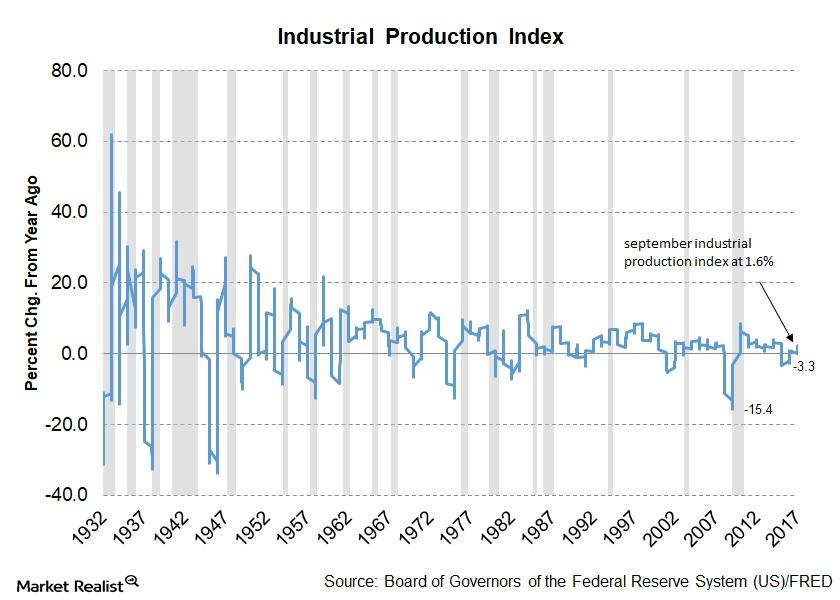

Which Industries Increased Production Last Month?

The Federal Reserve released its September industrial production report on October 17. The report indicated that key sectors in the US economy increased production in September.

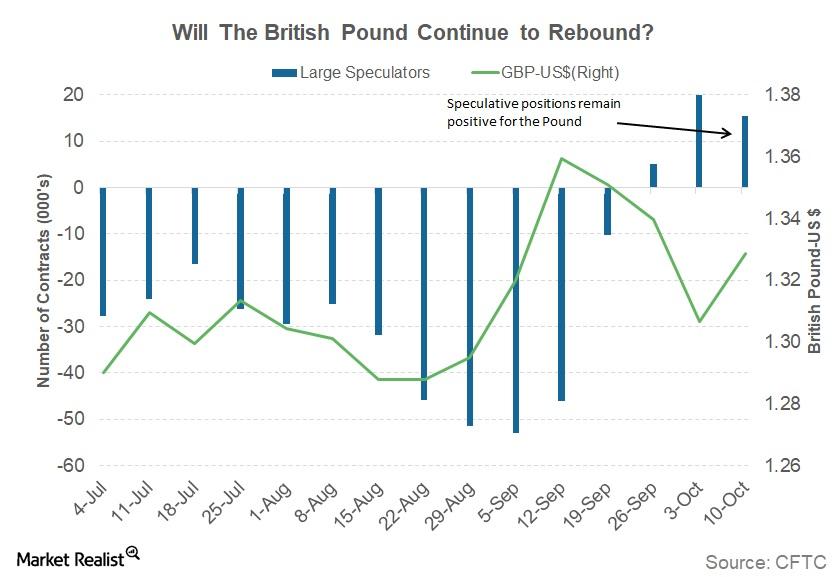

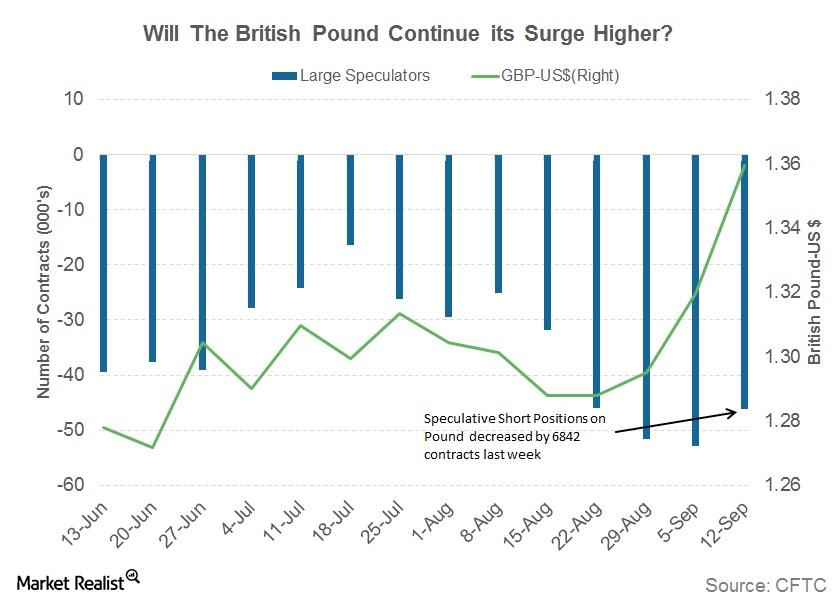

Why the British Pound Appreciated by 1.5% Last Week

The British Pound (FXB) appreciated by more than 2% against the US dollar last week. The pound (GBB) closed for the week at 1.3288, appreciating by 1.69% against the US dollar (UUP).

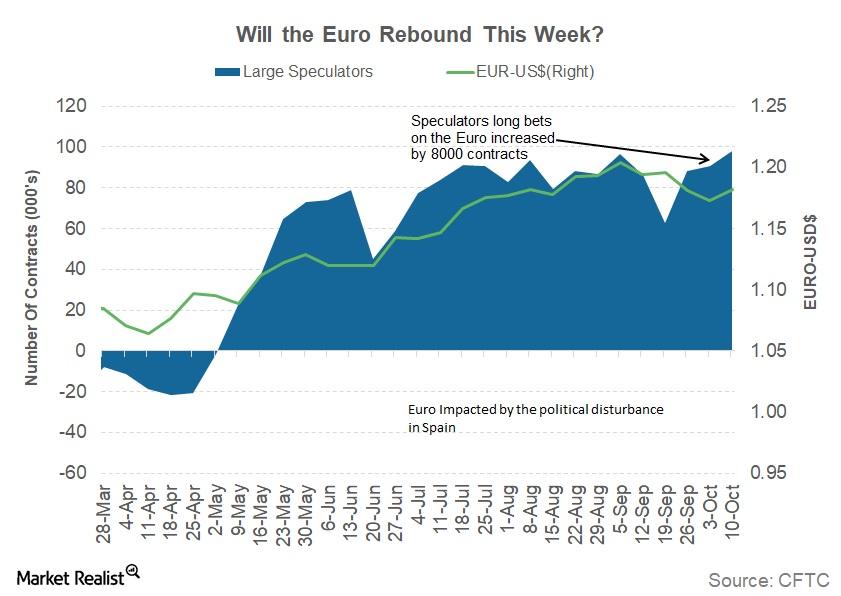

Will the Euro Regain Its Momentum this Week?

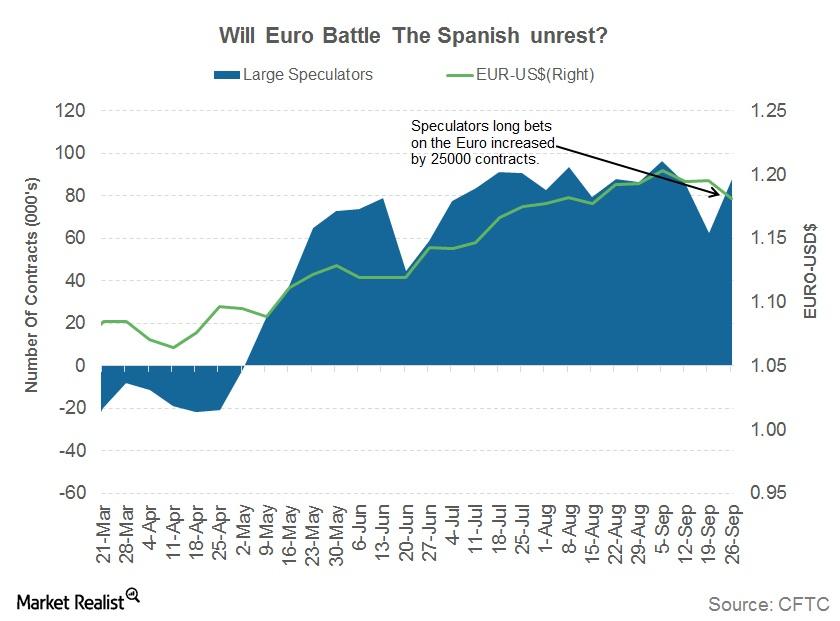

The euro-dollar (FXE) pair closed the week ending October 13 at 1.1822 against the US dollar (UUP). The shared currency managed to rebound from an 11-week low the week before, affected by political turmoil in Spain.

Has the US Dollar Rally Ended for Now?

The US Dollar Index (UUP) turned lower again in last week after a surprise rally following the October jobs report on October 6.

Why a December Rate Hike Shouldn’t Be Taken for Granted

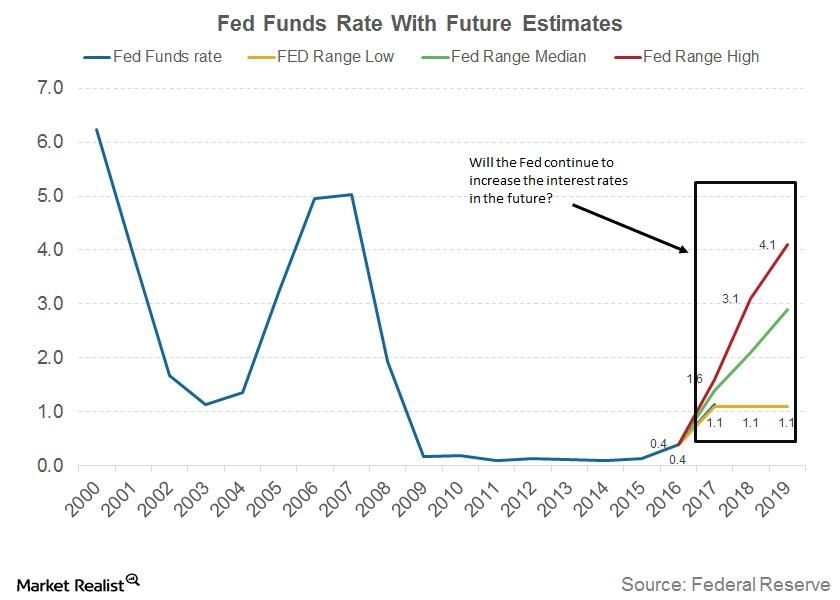

Not all members of the FOMC, according to the minutes of the meeting, were on the same page with respect to a December interest rate hike.

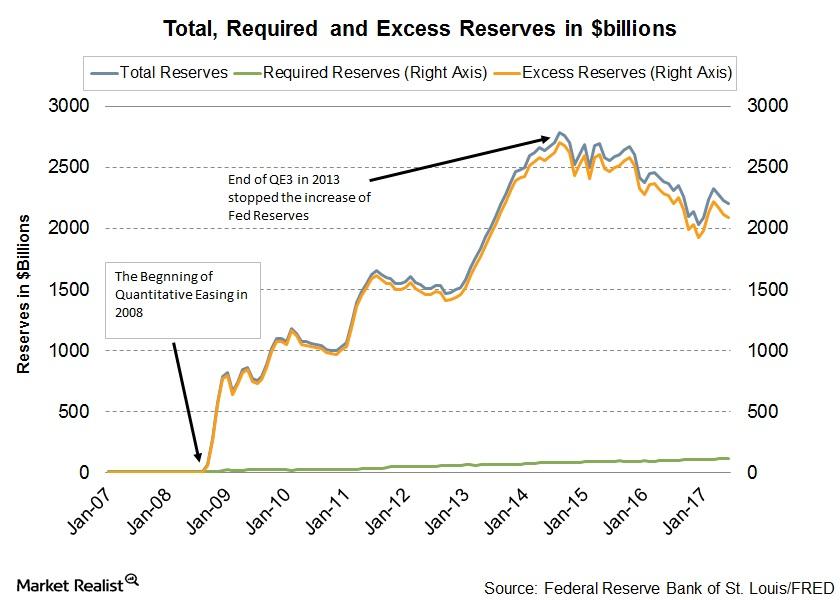

Why FOMC Members Aren’t Worried about the Market Reaction to Balance Sheet Trimming

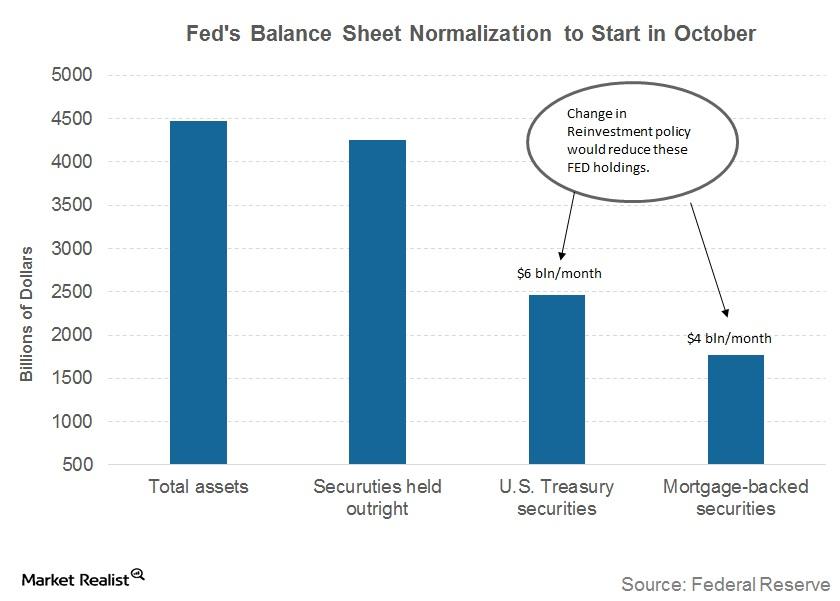

The September meeting minutes indicated that the members underscored that the reduction in the Fed’s balance sheet would be gradual.

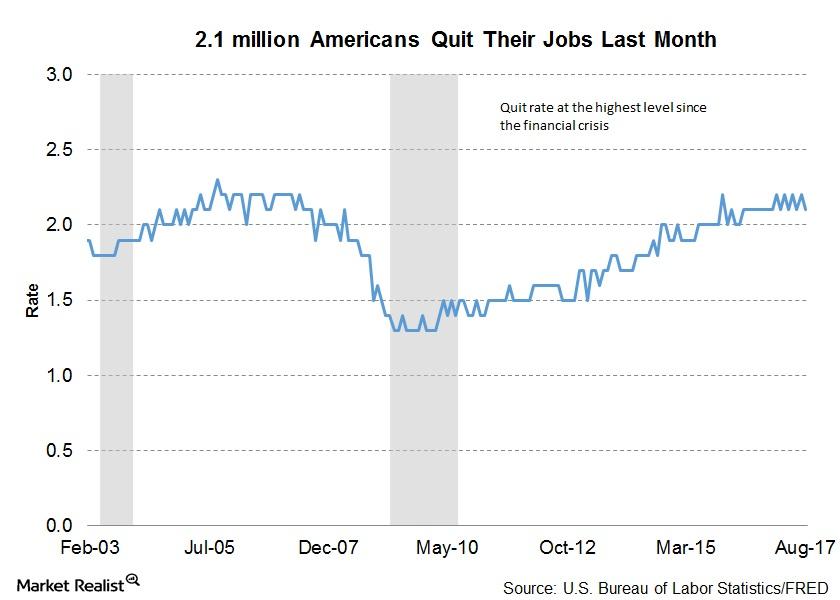

How Many Americans Quit Their Jobs in August?

As per the latest JOLTS report, about 2.1 million Americans quit their jobs voluntarily in August, which was a decrease of 70,000 from the previous reading.

A Look at the Catalonia-Troubled Euro This Week

It’s possible that political pressures could keep the euro under pressure as the economic calendar remains light in the Eurozone.

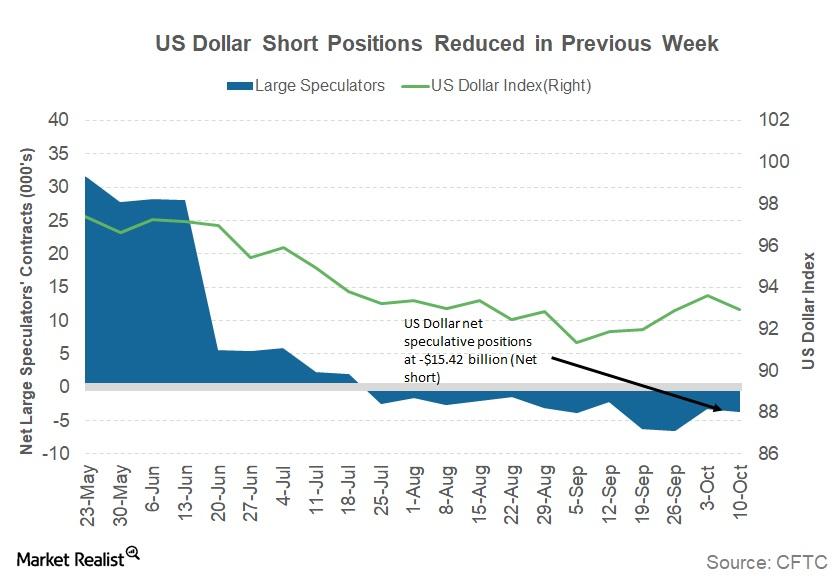

Are Investors Positioning for a US Dollar Rally?

The US Dollar Index (UUP) closed at 93.64 last week, a gain of 0.82% and the fourth consecutive weekly rise. The dollar didn’t react to a loss of 33,000 jobs in September.

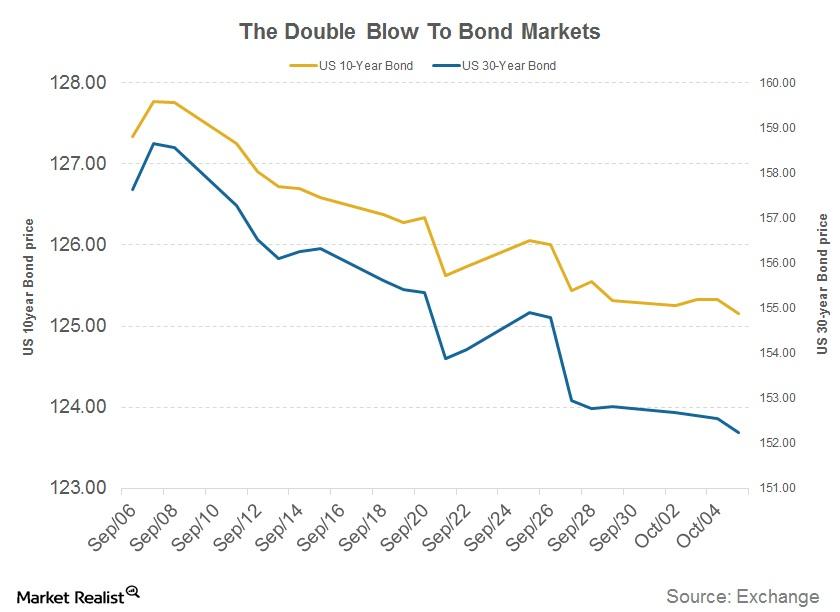

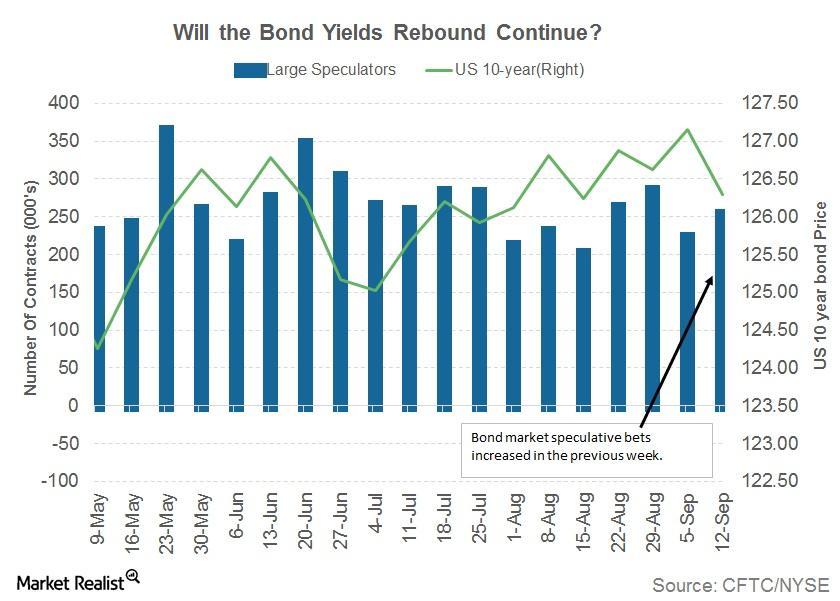

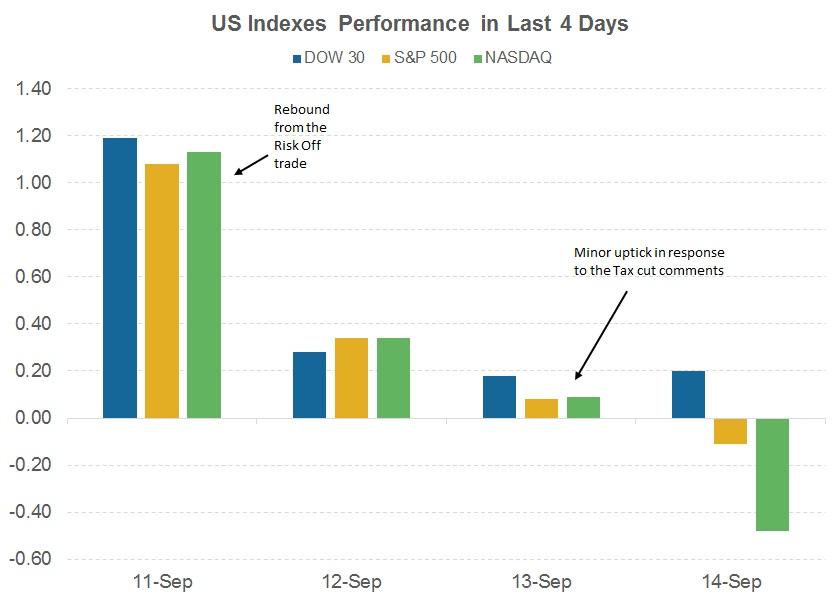

A Double Blow for Bond Markets?

The announcement of the GOP tax reform plan added to the pressure on bond markets.

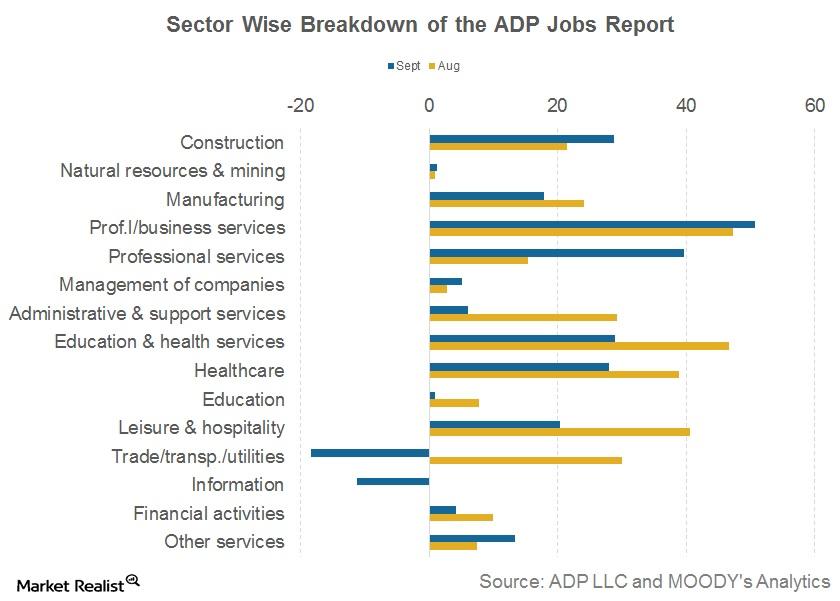

Which Job Sectors Saw the Most Impact from Hurricanes Last Month?

As per the September ADP Employment Report, there was a major drop in the number of jobs created in the trade, transport, and utility sector.

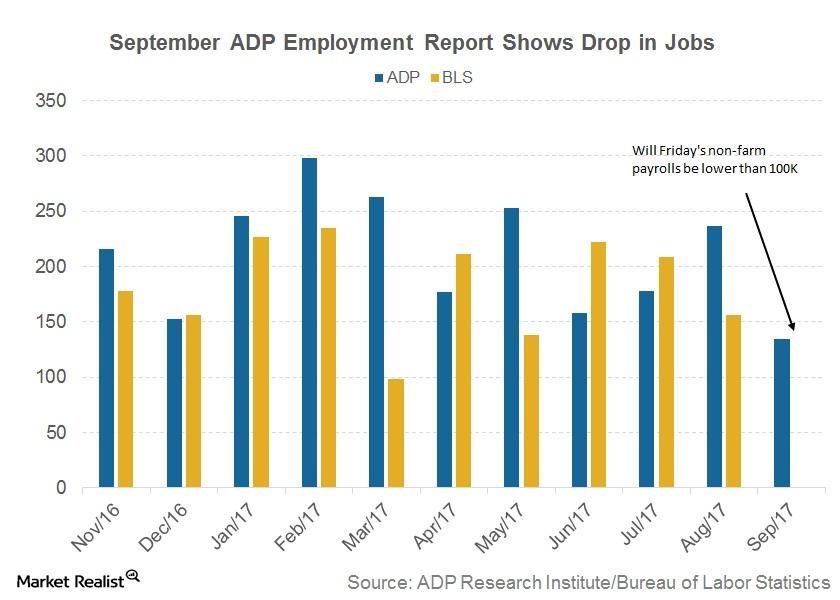

ADP Jobs Data Dragged Lower by Hurricanes in September

As per the September ADP National Employment Report, the US private sector added 135,000 jobs during the month. The figure is a sharp decrease from 228,000 in August.

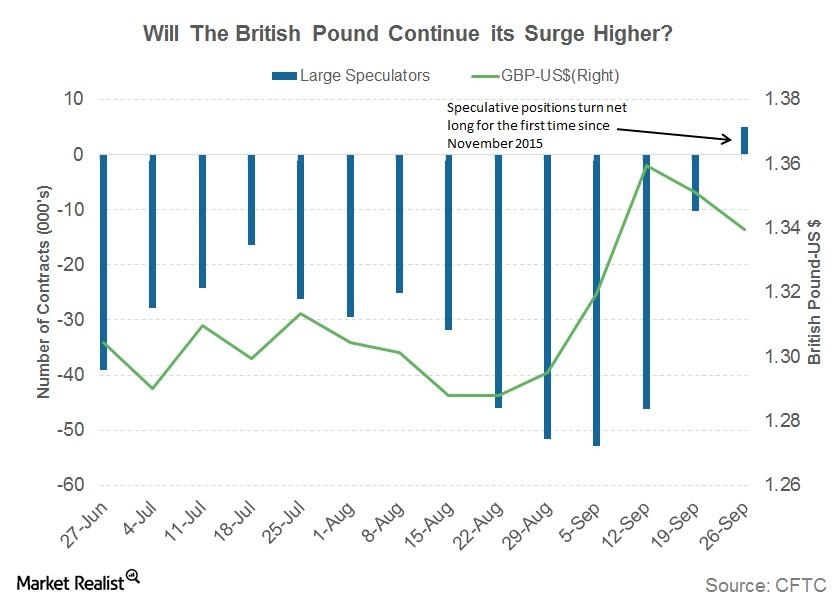

Why British Pound Speculators Turned Bullish after 22 Months

The British pound (FXB) depreciated against the US dollar for the week ended September 29. The pound (GBB) posted a weekly close of 1.3397, depreciating by 0.71% against the US dollar (UUP).

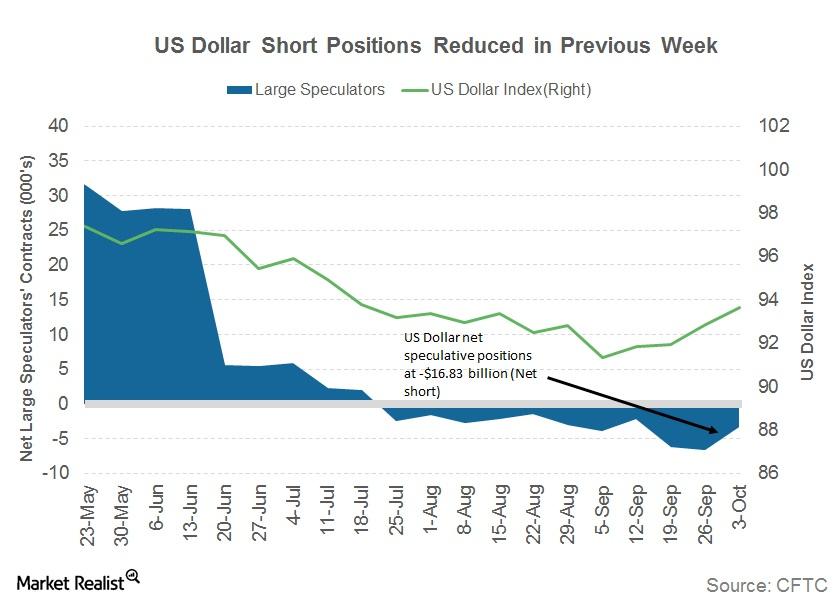

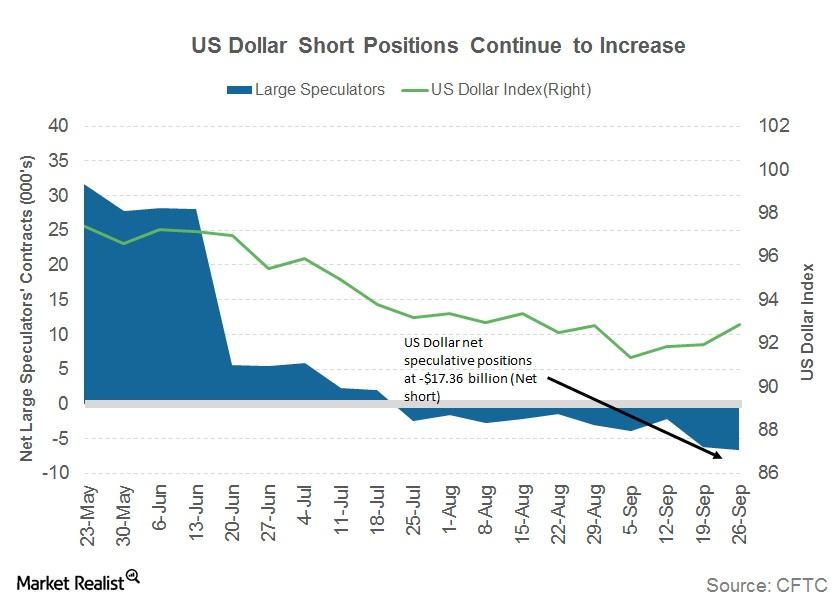

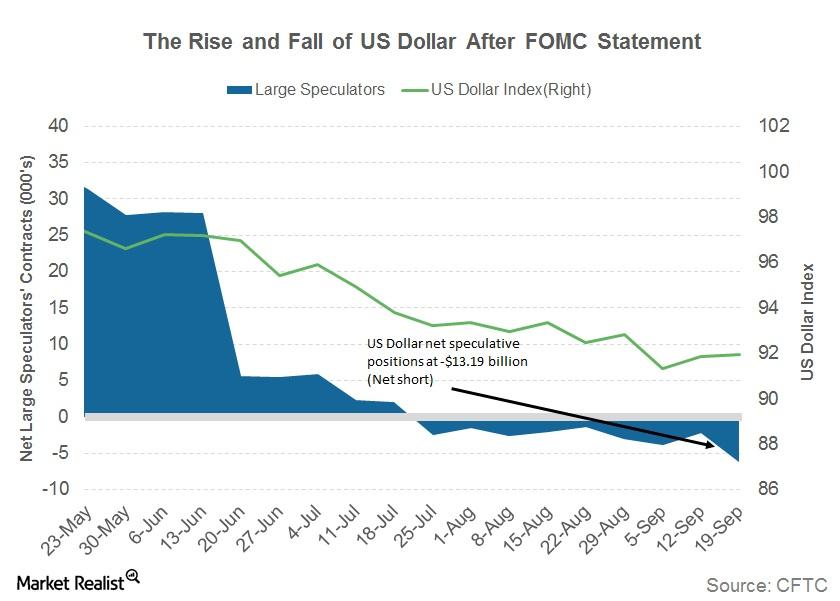

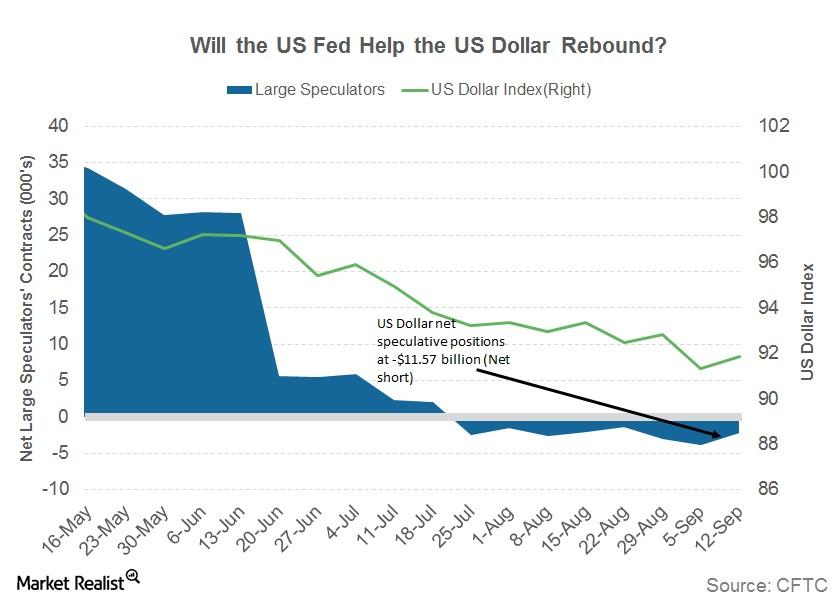

Why Speculators Continue to Bet against the US Dollar

The US Dollar Index (UUP) continued its rally last week, closing at 92.88 and posting a gain of 0.99% for the week.

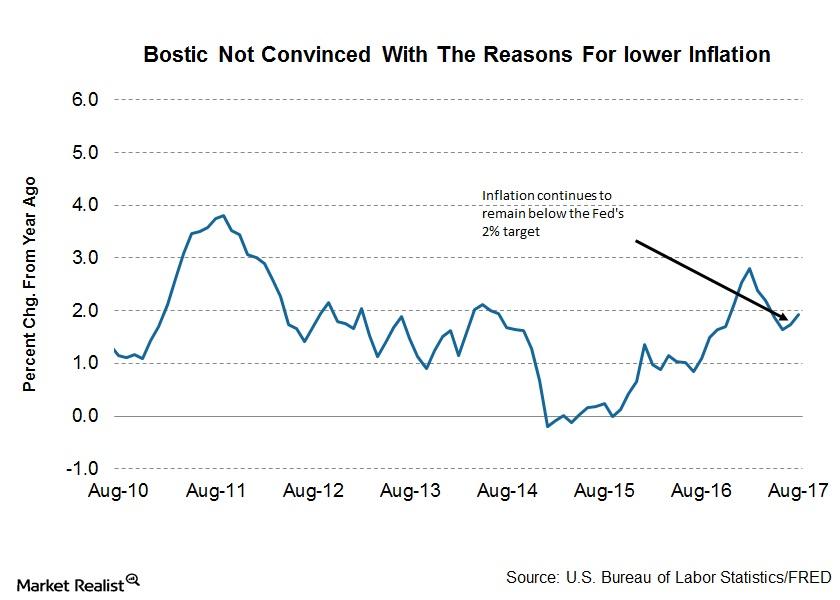

Why FOMC’s Raphael Bostic Is Not Happy with Low Inflation Explanations

Bostic dealt with various reasons that have been cited as reasons for the lower level of inflation—even questioning the common ones.

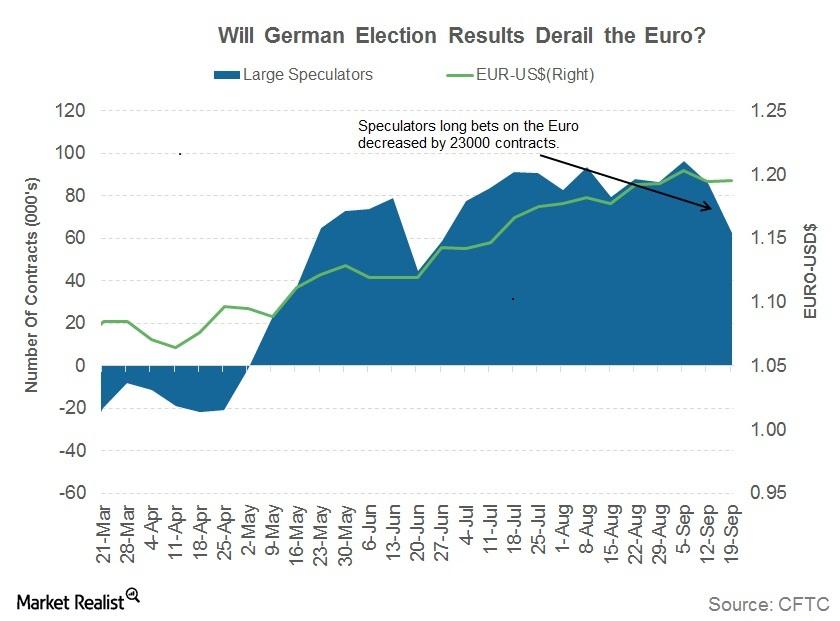

Will Spanish Unrest Drag the Euro Lower?

The euro-dollar (FXE) closed the week ending September 29 at 1.1814 against the US dollar (UUP). German election results had a minor negative impact on the shared currency.

Why FOMC’s John Williams Sees No Impact of Balance Sheet Unwinding on Markets

In the long run, Williams said it would be difficult to predict how markets would react to the Fed’s balance sheet unwinding program.

FOMC’s James Bullard Has Three Questions for US Monetary Policy

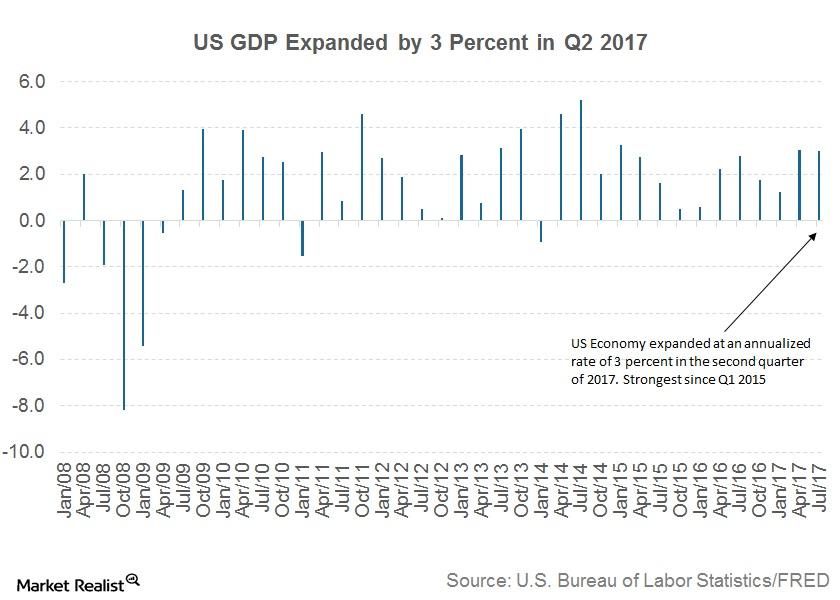

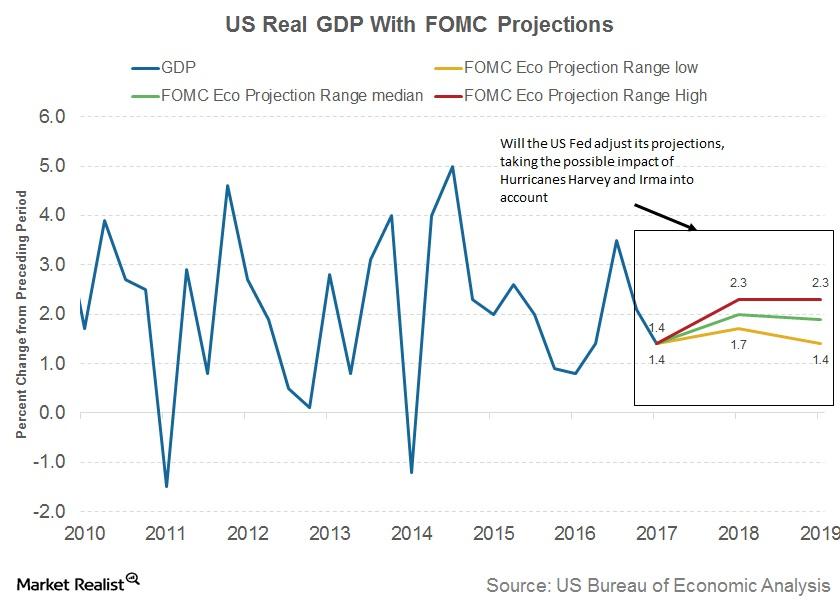

Bullard said that the current growth rate in the US economy is likely to remain consistent with recent quarterly growth—near the 2% mark.

Could Rising Interest Rates Help the US Dollar?

Double dose of optimism for the US dollar The US dollar (UUP) was being written off before the beginning of September, as the Fed was expected to stay on hold and other major central banks were expected to start policy normalization. However, the Fed had a surprise in store for the market. The FOMC’s (Federal Open […]

Would Markets Be Prepared for a Central Bank Surprise?

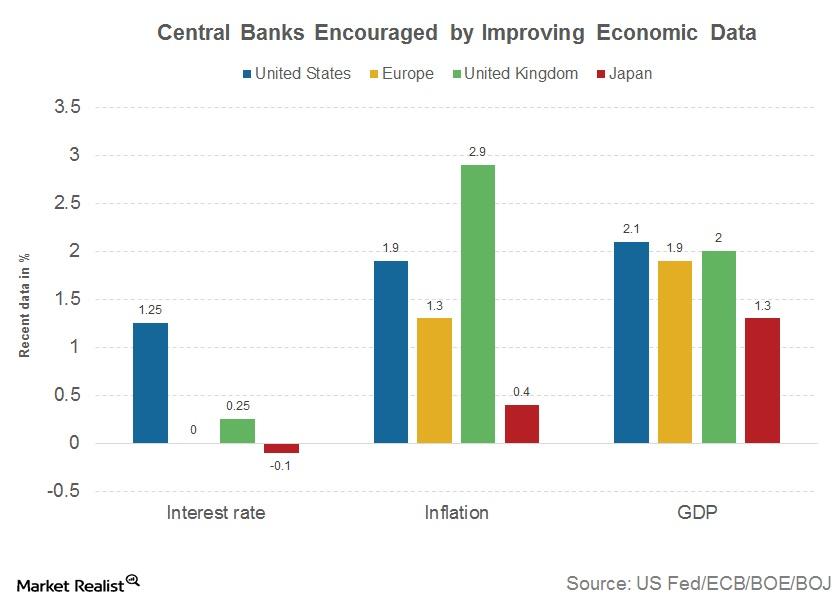

Three central banks on a path to tightening After years of ultra-loose monetary policy, global markets are beginning to realize they may have to wave goodbye to easy money. In their efforts to save the global system from the 2007 financial crisis, and to revive economic growth, US, EU, UK, and Japanese central banks resorted […]

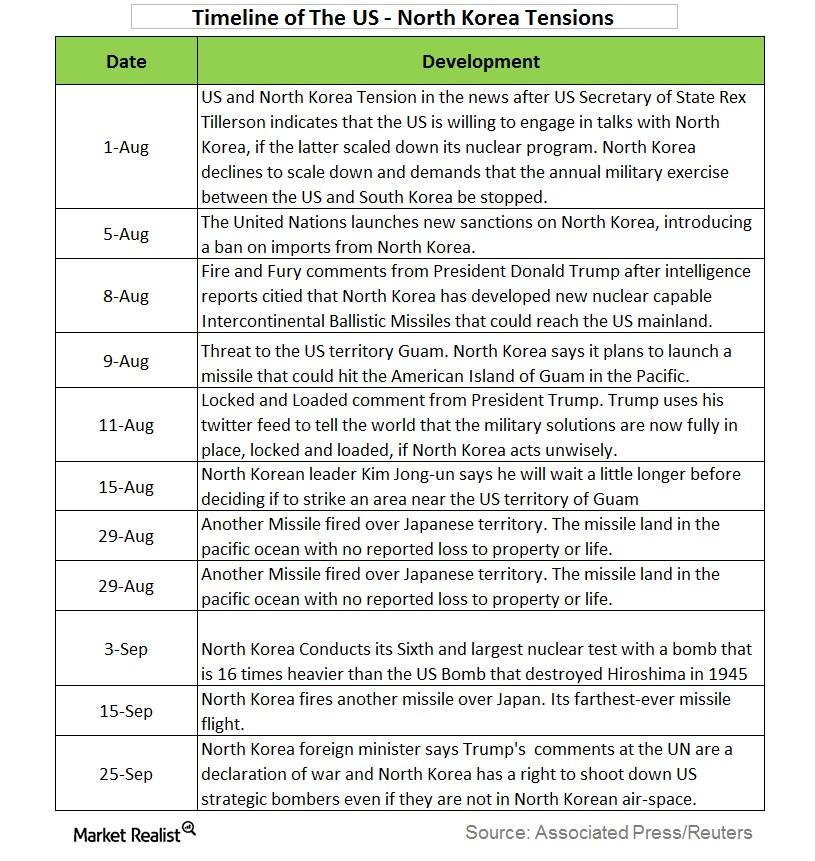

Effects of the North Korea–US Tension on Investors

Rising North Korea tensions In the last two months, tensions between the United and North Korea have continued to escalate, with both sides refusing to back down. North Korea has initiated a series of missile and nuclear tests, worsening tension in the region, and the US president has responded to these tests with strong warnings. […]

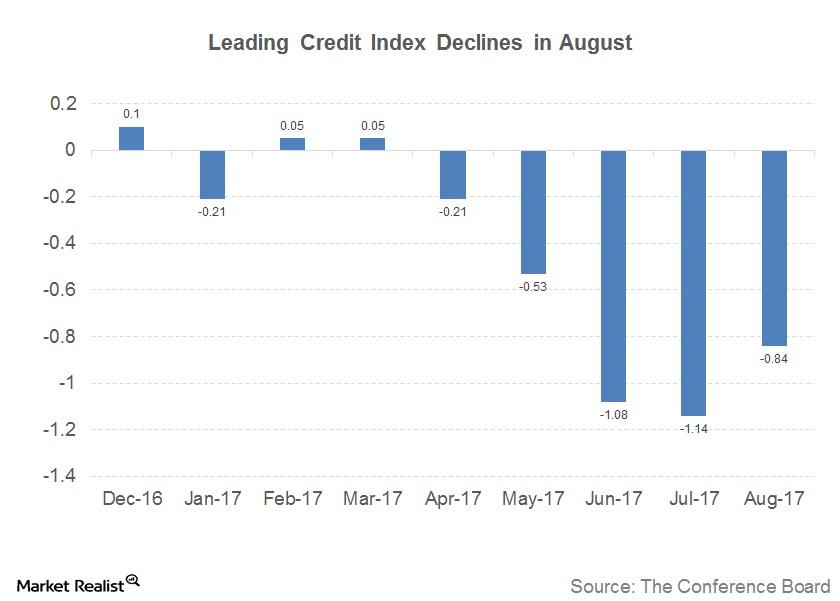

Understanding the Leading Credit Index

Understanding the Leading Credit Index The Conference Board LCI (Leading Credit Index), a constituent of the LEI (Leading Economic Index), is constructed based on the performance of six financial market instruments. These components track lending conditions in the US economy. Performance of the LCI Improving credit conditions are considered positive for the economy. When the LCI […]

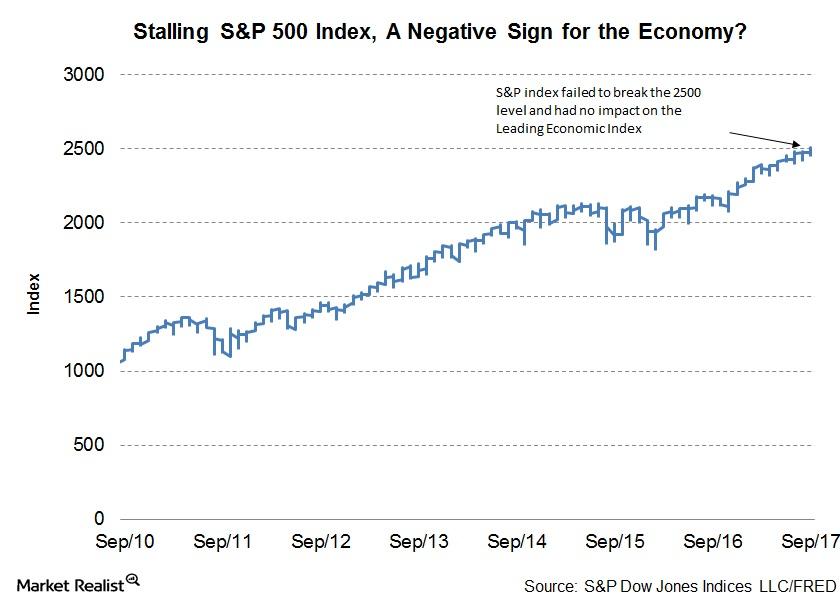

The Link between the S&P 500 and the Leading Economic Index

The S&P 500 is stuck The S&P 500 (IVV) index has been stuck near the 2,500 level for more than a month now. The recent war of words between US president Donald Trump and North Korean foreign minister Ri Yong Ho has increased risk aversion. However, the index has been resilient despite the rise in volatility. […]

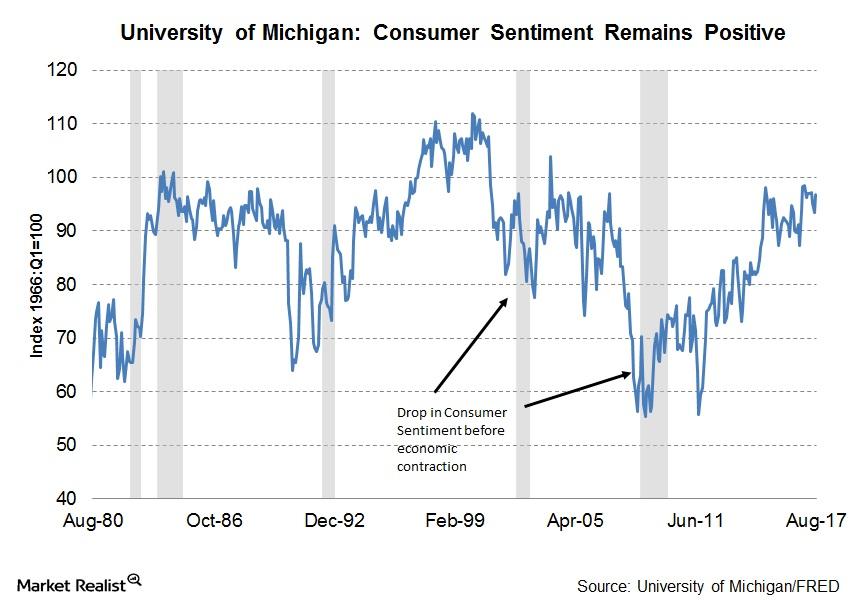

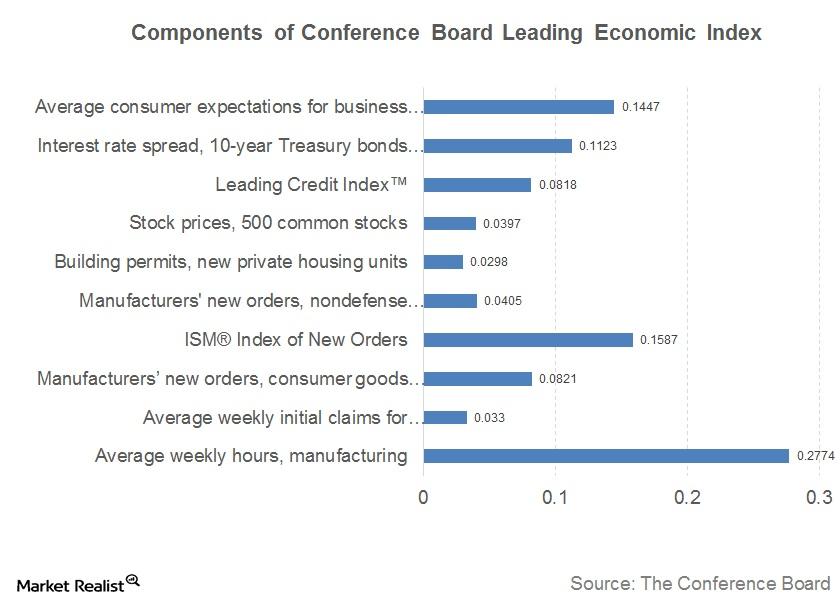

Consumers’ Business Condition Expectations Continue to Improve

Consumer expectations for business conditions Consumer expectations data, which forms the only non-leading component of the Conference Board Leading Economic Index (or LEI), is collected through two different surveys. One of these surveys is conducted by the University of Michigan and Reuters, where consumer expectations for economic conditions in the next 12 months are collected, […]

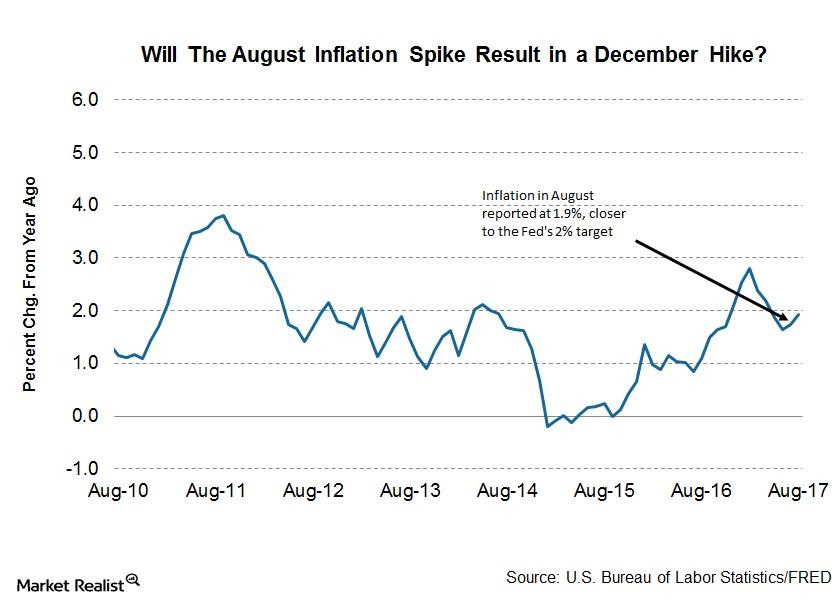

How Credit Spreads May React to the Fed’s September Statement

Another rate hike in 2017 The FOMC’s (Federal Open Market Committee) meeting on September 20 changed the outlook for bond markets (BND). It suggested that the Fed could be looking at another rate hike by the end of this year, along with a balance sheet unwinding program. Gains in August inflation (TIP) boosted Fed members’ […]

Tracking the Conference Board Leading Economic Index

In this series, we’ll analyze each component of the Conference Board Leading Economic Index and understand its implications for the consumer discretionary (XLY), industrial (XLI), and housing (XHB) sectors and the overall market (SPY).

Will a Coalition Government in Germany Derail the Euro?

The euro-dollar (FXE) closed the week ending September 22 at 1.2 against the US dollar (UUP).

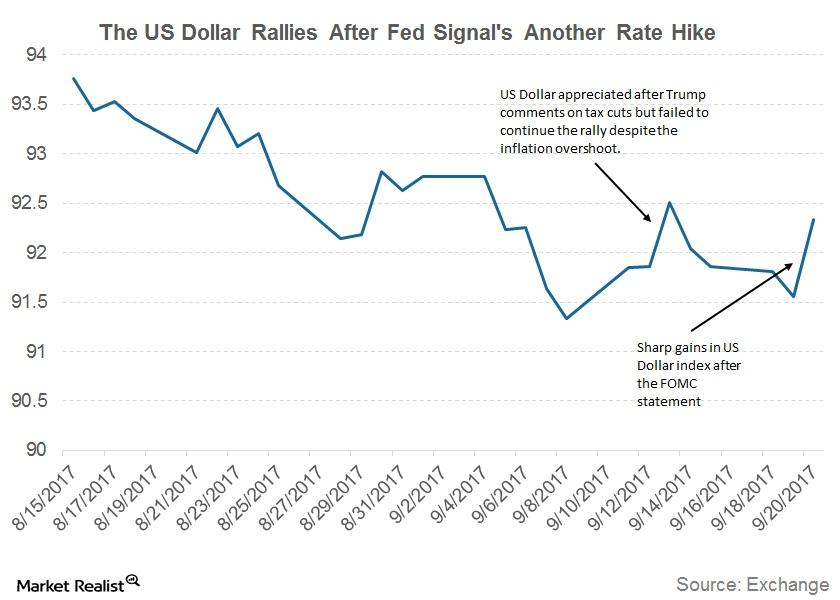

Why the US Dollar Failed to Rally despite Increased Rate Hike Odds

The US Dollar Index (UUP) failed to rally aggressively despite a hawkish surprise from the US Fed.

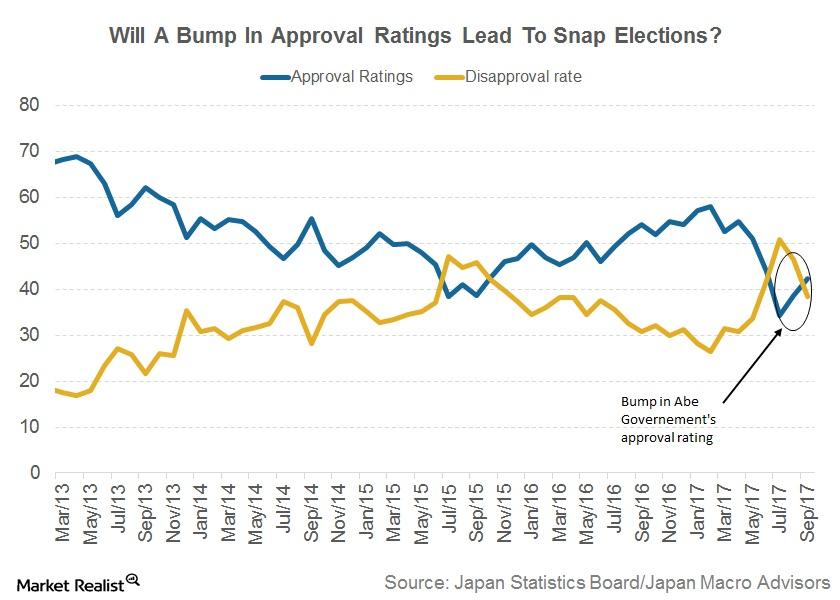

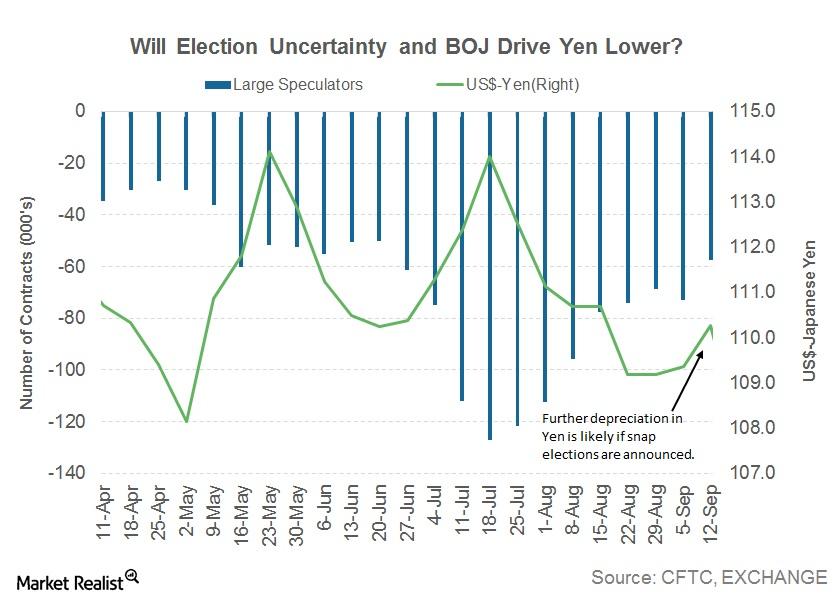

Bank of Japan Sees Rising Political Uncertainty as a Risk

According to news reports, Japanese Prime Minister Shinzo Abe could be calling for a snap election next month to capitalize on the increased approval ratings in August.

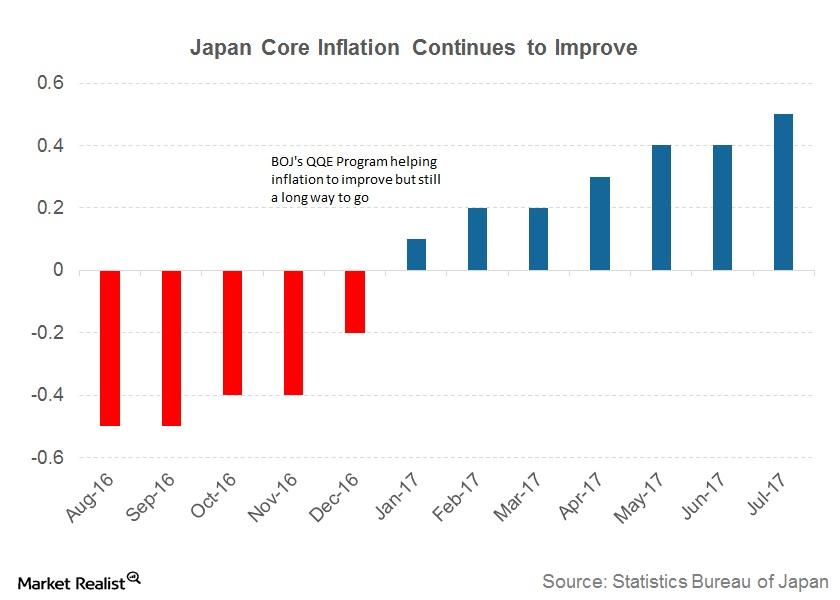

Why Rising Japanese Inflation Isn’t Good Enough for Bank of Japan

The BOJ’s (Bank of Japan’s) qualitative and quantitative easing (or QQE) programs and a negative interest rate are helping to slowly revive Japanese inflation.

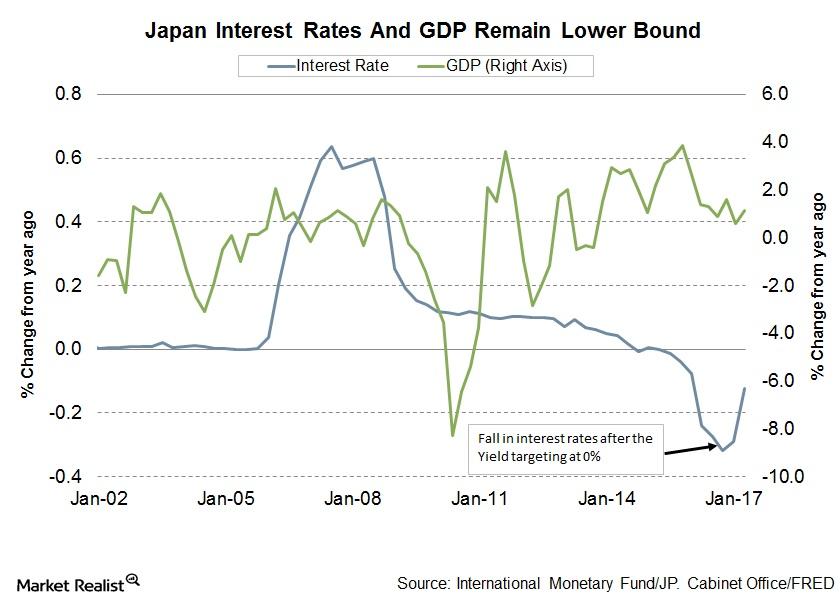

Update on the Bank of Japan’s September Policy Meeting

The Bank of Japan left its policy unchanged at its September meeting. By an 8–1 majority vote, the policy board decided to leave its policy and its QQE with a yield curve control unchanged.

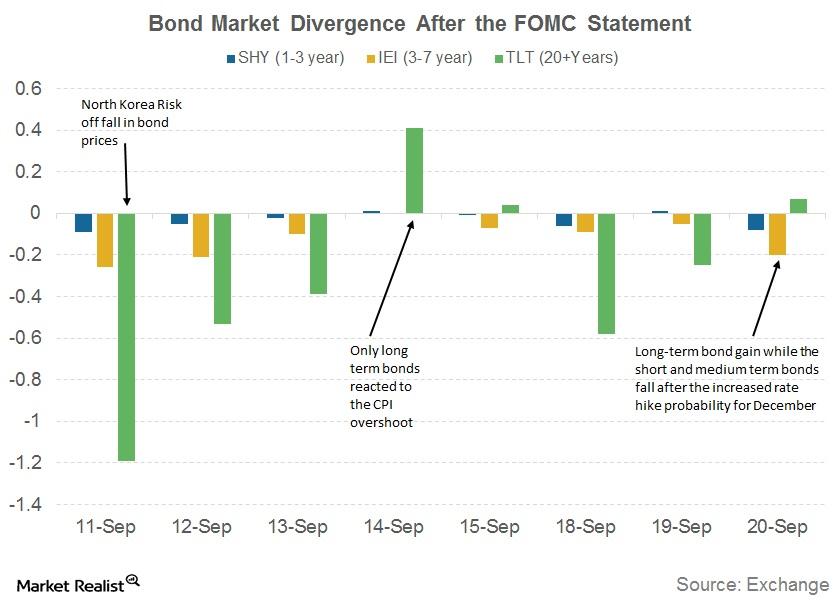

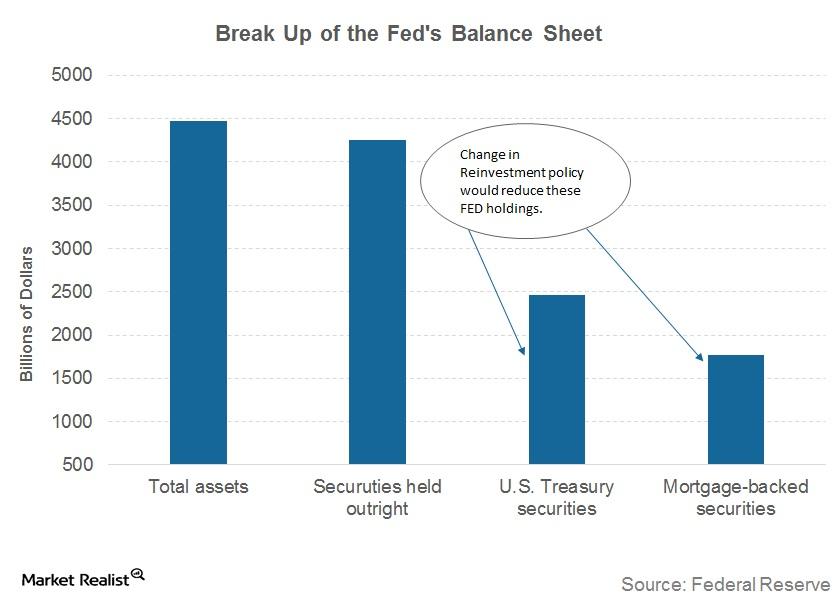

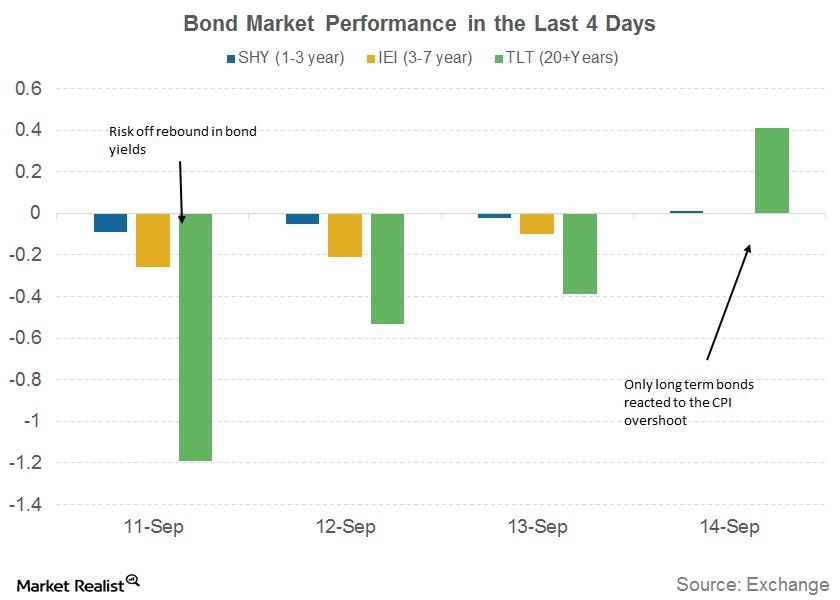

Why Maturity Bonds Reacted Differently to the Fed’s September Statement

The Fed’s balance sheet has $4.4 trillion in bond market securities, and it intends not to reinvest a small portion of the maturing securities every month.

Assessing the US Dollar’s Rally after the Latest Hawkish Fed Statement

The US dollar rallied after the latest FOMC (Federal Open Market Committee) meeting statement was released on September 20.

Do Markets Agree with Janet Yellen on Low Inflation?

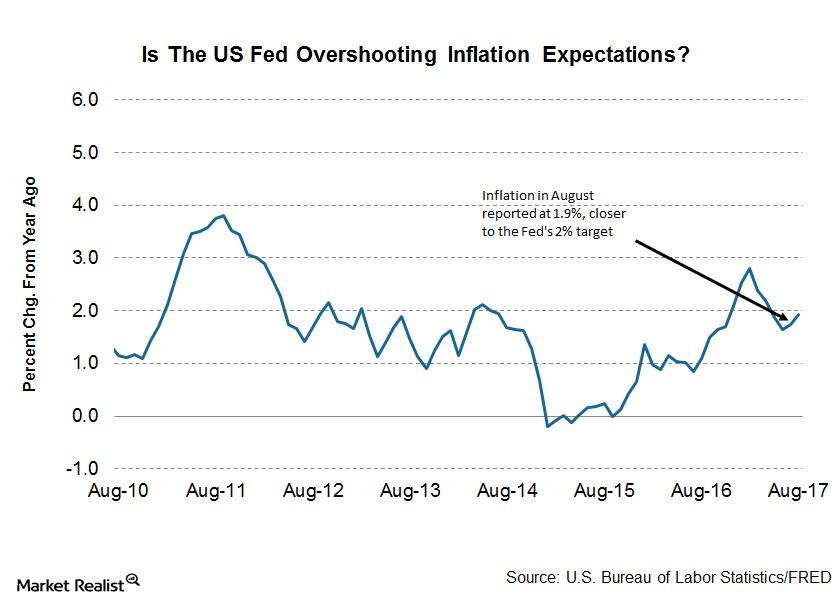

In her post-meeting press conference, US Federal Reserve Chair Janet Yellen seemed less worried than expected about the current state of US inflation.

Why Is FOMC Starting to Unwind Its Balance Sheet without a Target?

In the September 20 meeting, FOMC (US Federal Open Market Committee) finally announced the start date of its balance sheet unwinding program.

Is the Uptick in August Inflation Enough for a Fed Hike in December?

Slow US inflation growth has been a concern for the US Fed and was one of the key reasons that the Fed raised interest rates only twice in 2017.

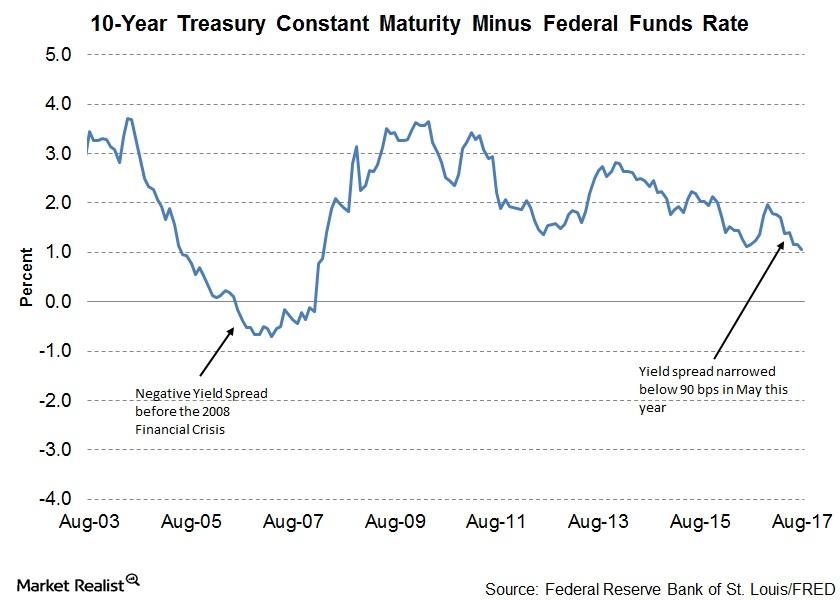

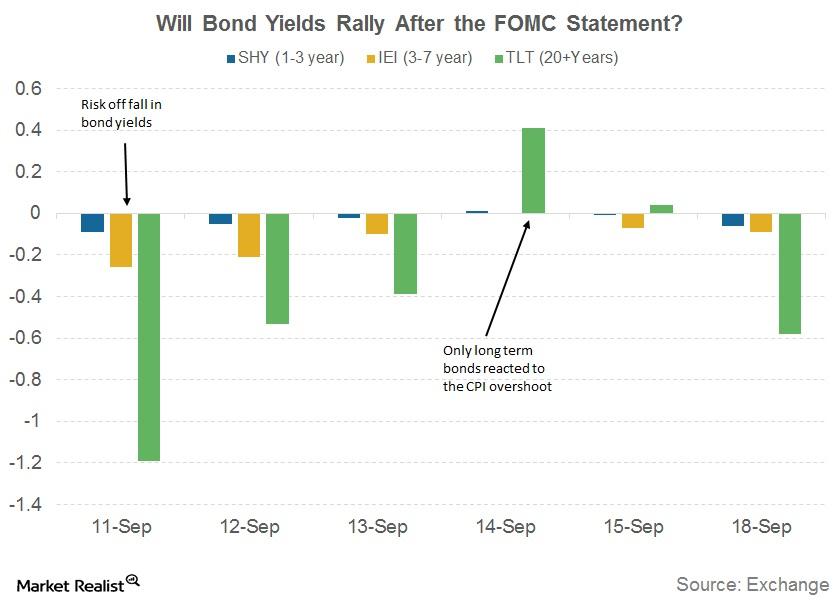

Will US Bond Yields Rally after the FOMC Statement?

The bond markets are the most impacted asset class by any changes to the Federal interest rates.

How Has the US Economy Fared since the Last FOMC Meeting?

Since the last FOMC meeting in July, economic conditions in the US have continued to improve.

Markets Are Confident on Fed Balance Sheet Trimming Announcement

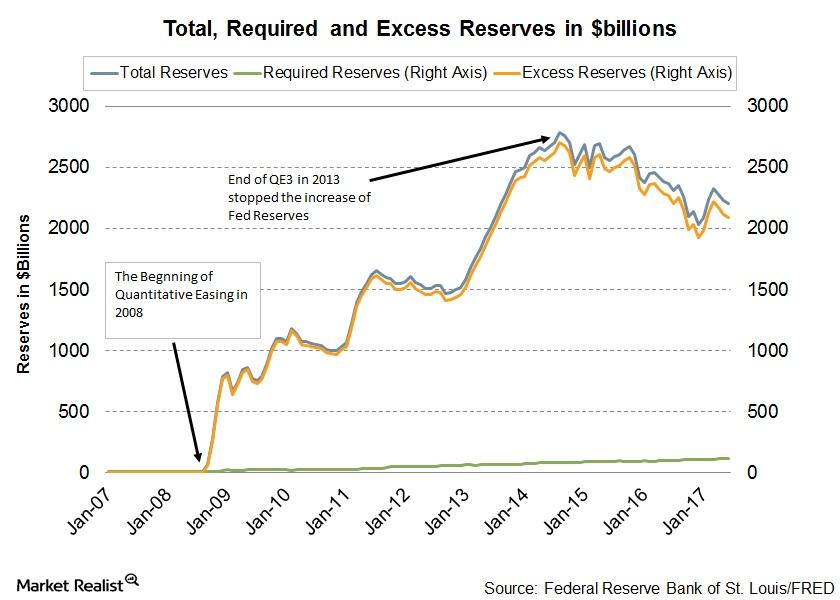

In its efforts to revive the US economy from the Great Recession, the US Fed started purchasing US government-backed securities in 2008.

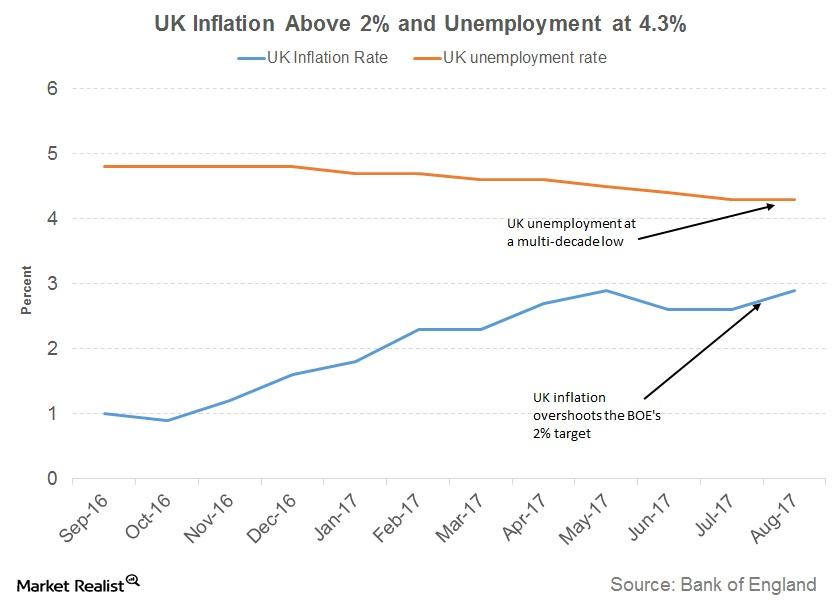

Will Inflation and Unemployment Push the BOE to Raise Rates?

Inflation in the United Kingdom has been on a higher trajectory with consumer prices in the United Kingdom rising 2.9% in August year-over-year.

Will Election Uncertainty Drive the Japanese Yen Lower?

The Japanese yen (JYN) continued to depreciate against the US dollar last week.

Why the British Pound Rallied to 15-Month High

The British pound (FXB) appreciated against the US dollar for the week ending September 15.

Why the US Dollar Saw a Sharp Rebound

The US Dollar Index (UUP) witnessed a sharp recovery last week, rebounding from a two-year low of 91.0.

Why Was the Euro a Silent Spectator Last Week?

As per the latest Commitment of Traders (or COT) report, released on Friday, September 15 by the Chicago Futures Trading Commission (or CFTC), speculators turned bullish on the euro during the week.

The Bond Market’s Reaction to New Rate Hike Hopes

After three weeks of continuous falls, US bond yields rose in the week of September 10. The benchmark ten-year US Treasury yield (BSV) rose by 10 basis points to 2.20% but remains far from the December 2016 high of 2.64%.

Understanding the Ups and Downs of the US Dollar

The US dollar has been on a roller coaster ride over the last ten trading sessions. The US dollar (UUP) index hit a low of 90.99 on September 8.