Ricky Cove

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ricky Cove

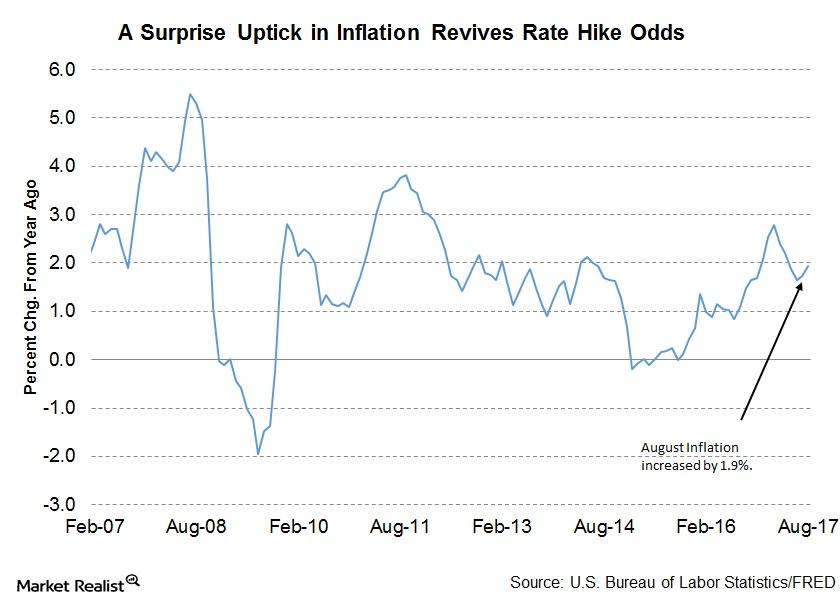

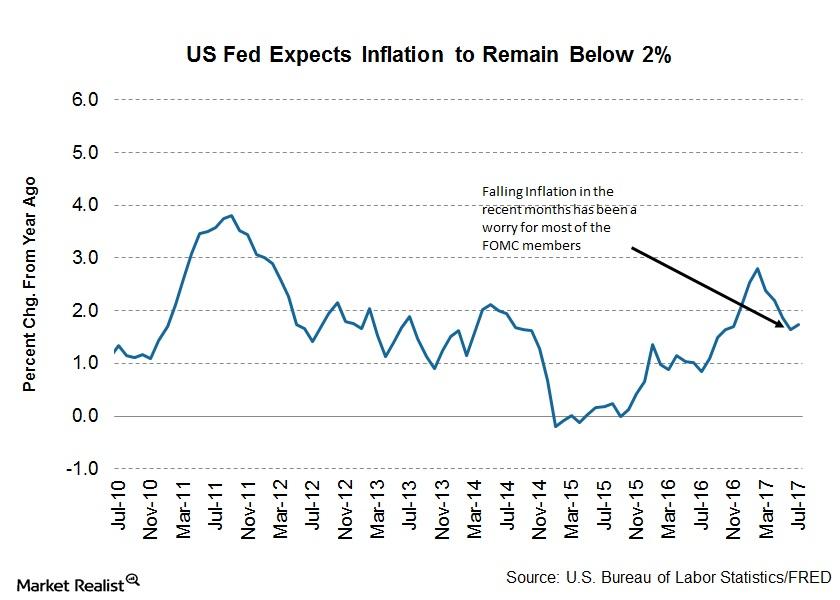

Will the Sudden Rise in Inflation Change the US Fed’s Outlook?

The consumer price inflation (CPI) data reported on Thursday indicated an increase of 0.4% in August. The year-over-year rate improved from 1.7% to 1.9% for August.

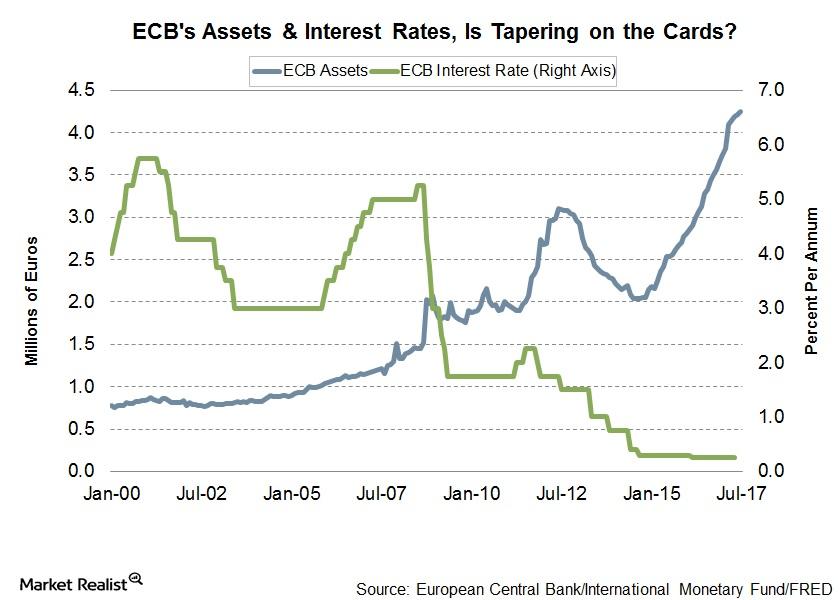

How ECB Tapering Could Impact European Bond Markets

The European bond market’s reaction to the ECB’s (European Central Bank) September 7 statement has so far been positive.

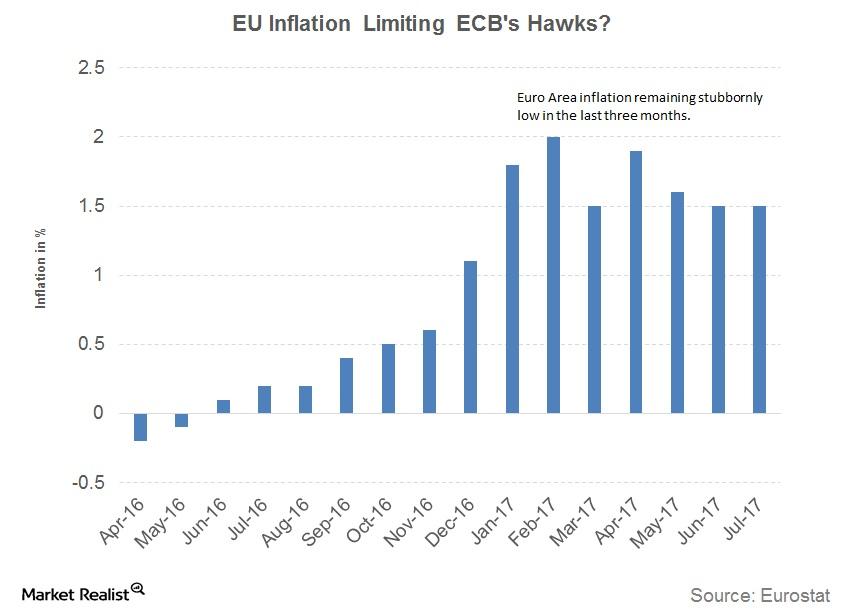

Why Did the ECB Downgrade Its Inflation Outlook?

In its September 7 policy meeting, the ECB (European Central Bank) downgraded the outlook for the EU economy’s inflation.

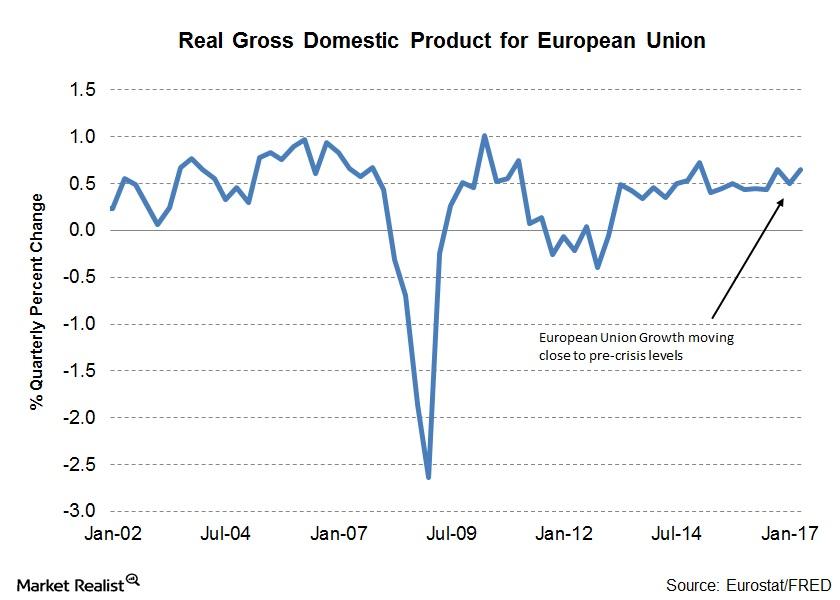

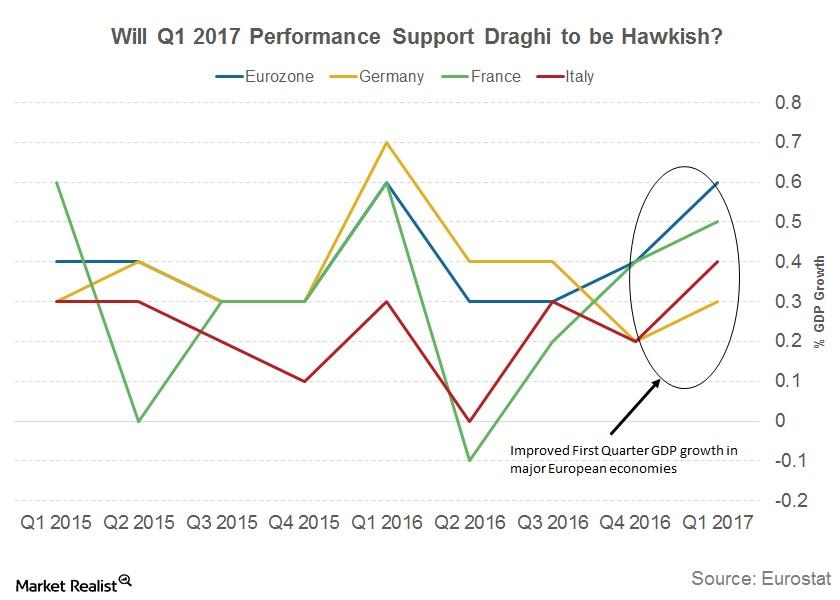

Why Strong European GDP Growth Momentum Gives Confidence to the ECB

In its September 7 meeting, the ECB (European Central Bank) governing council sounded optimistic about the strong growth momentum in the EU.

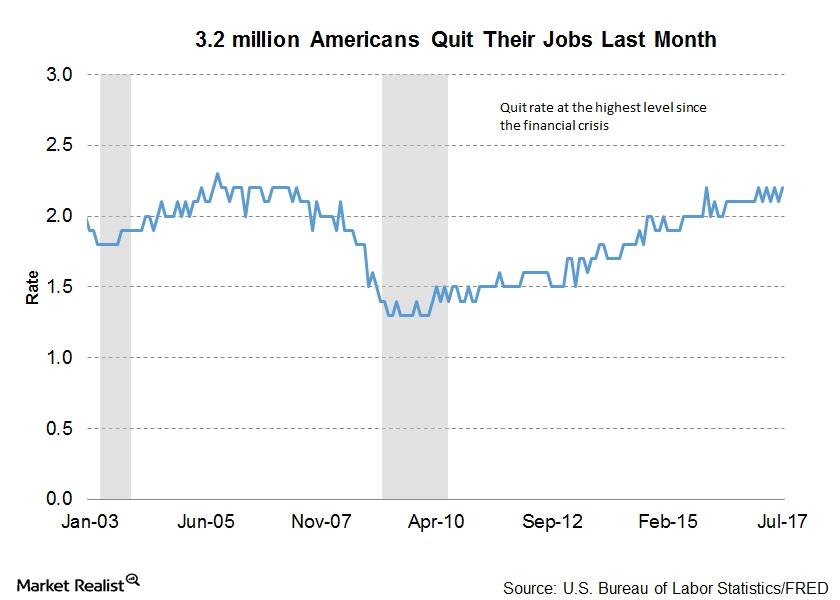

Why Are So Many Americans Quitting Their Jobs?

As per the latest JOLTS report, about 3.2 million Americans quit their jobs voluntarily last month. This is an increase of 0.1 million from the previous month.

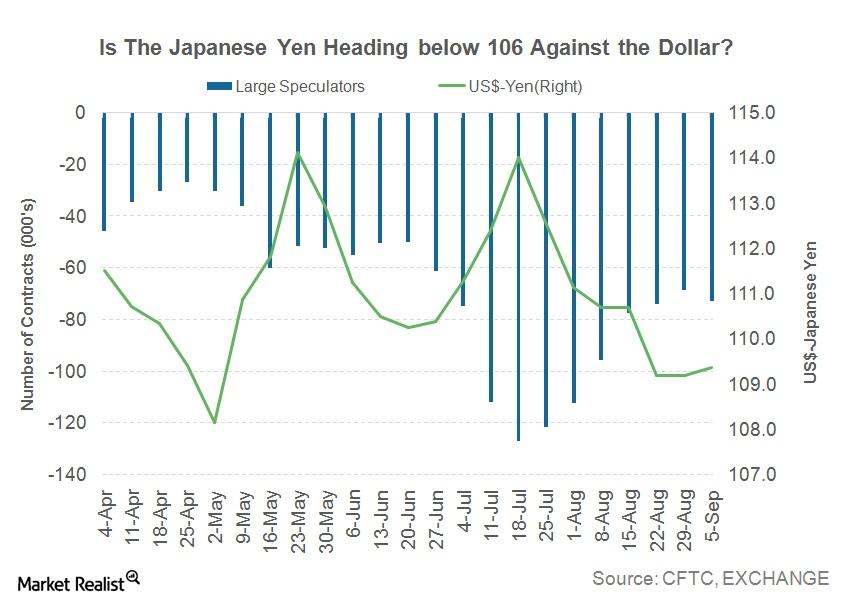

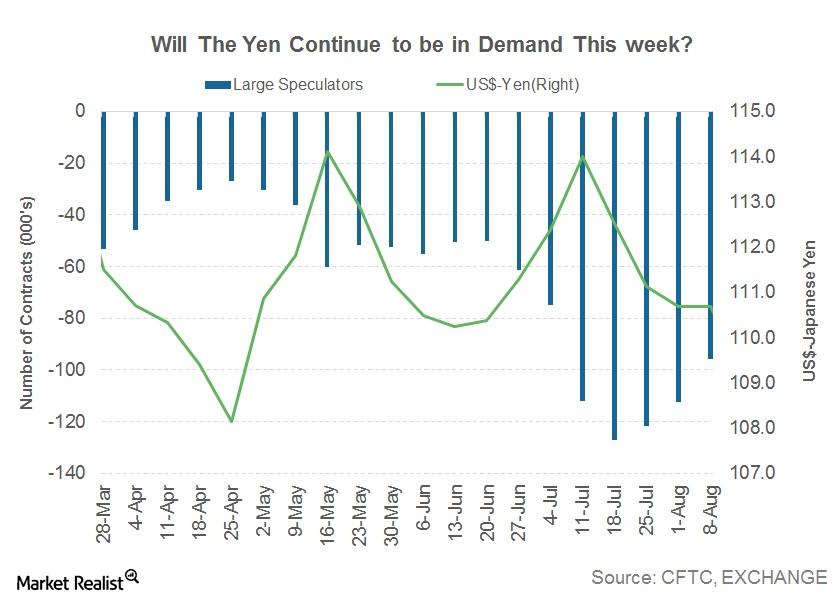

What Drove the Japanese Yen below 108 Last Week?

The Japanese yen gained ground against the US dollar last week, closing at 107.8 against the US dollar, which appreciated 0.56%.

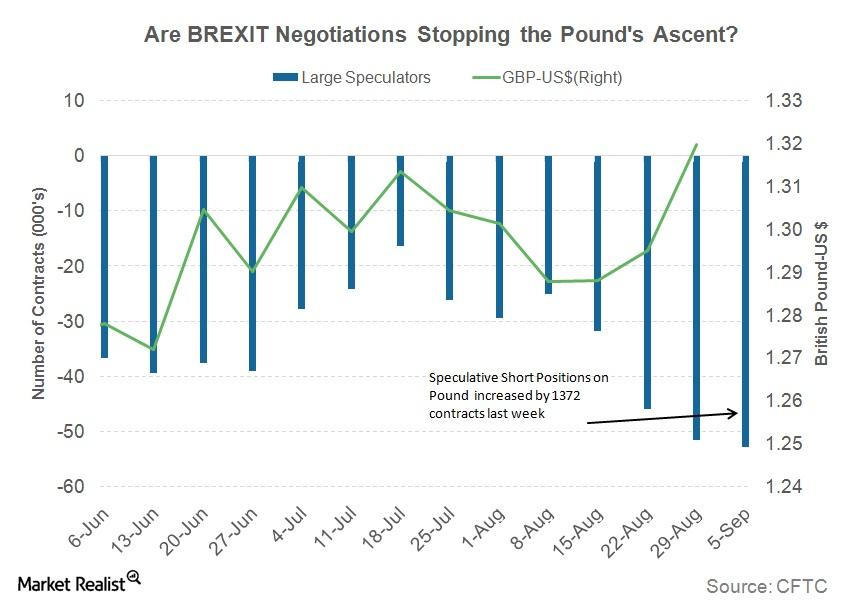

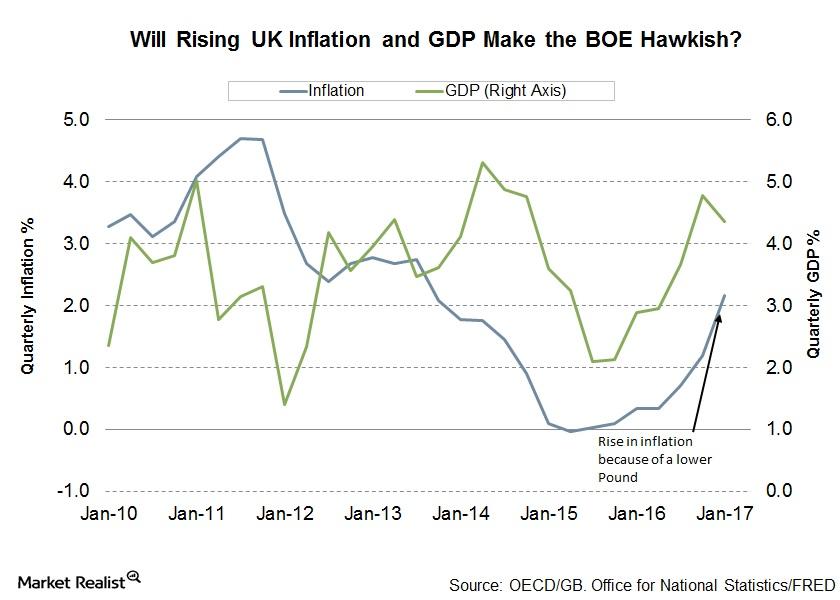

The Reason behind the Sharp Gains in the British Pound

The British pound (FXB) appreciated against the US dollar for the week ended September 8, 2017. The pound closed at 1.32, appreciating 1.9% against the US dollar.

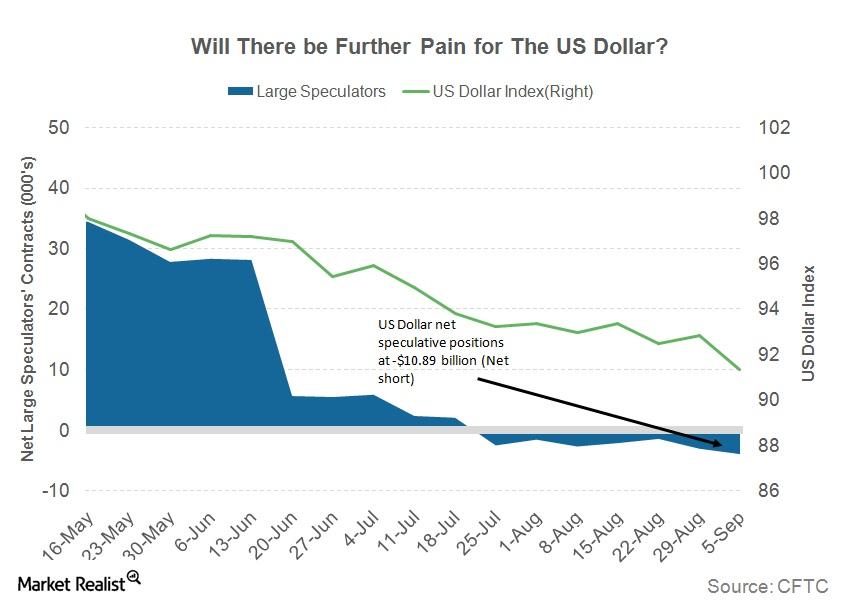

Why the US Dollar Could Be Poised for Further Losses

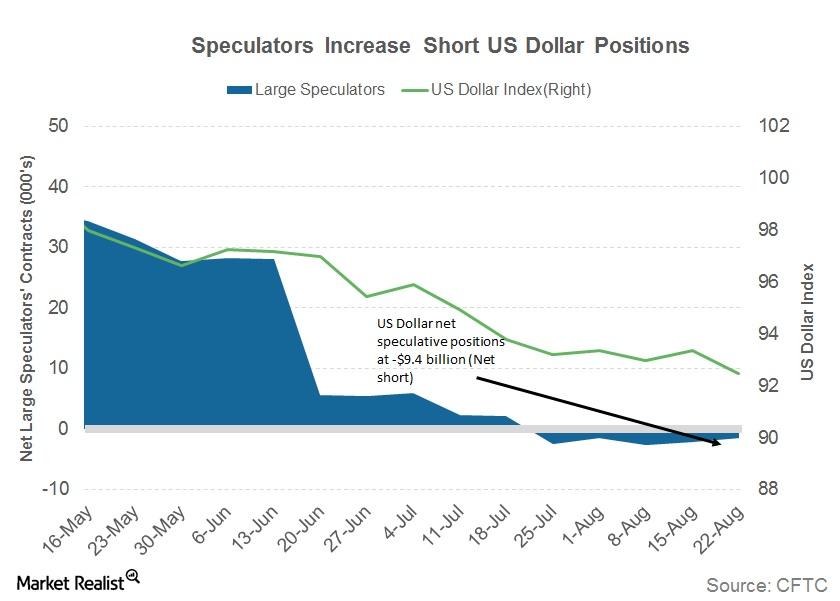

The US Dollar Index (UUP) failed to hold onto its gains from the previous week as investors were convinced that the Fed most likely wouldn’t make any changes to its monetary policy this year.

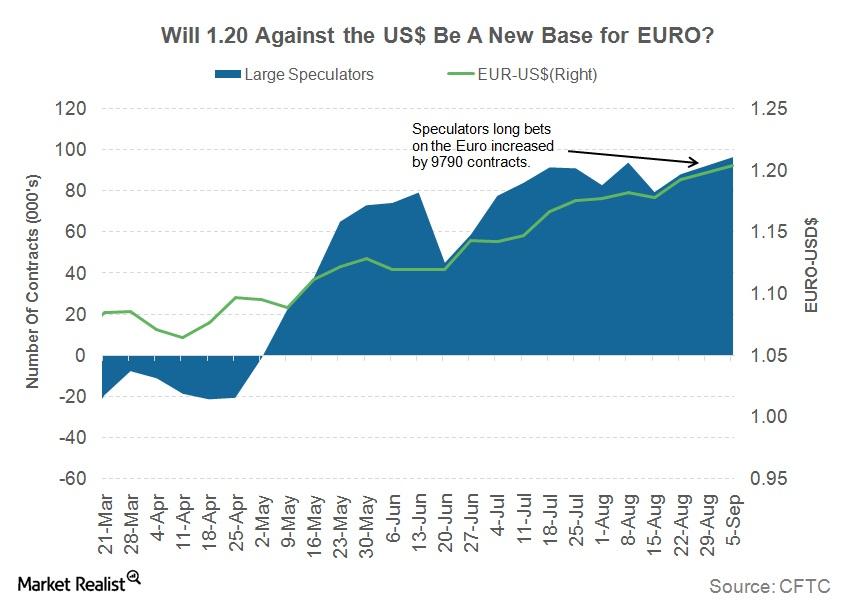

Why the Euro Rose to a 3-Year High Last Week

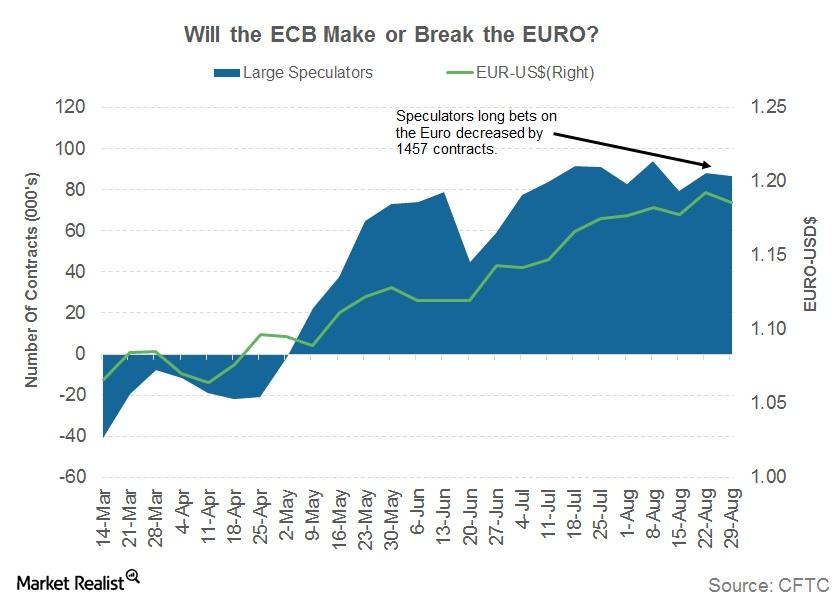

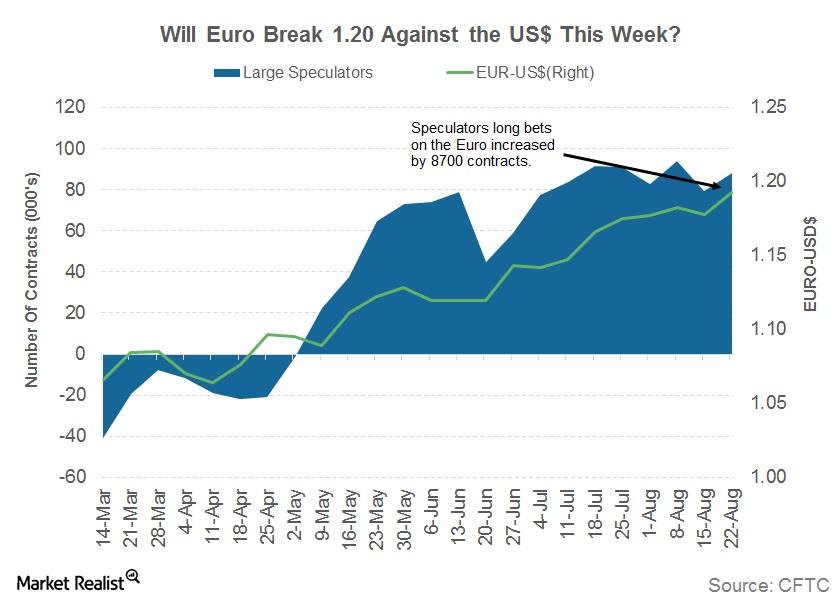

The euro closed the week ended September 8, 2017, at ~1.20 against the US dollar. It rose 1.48% against the US dollar as euro bulls took charge.

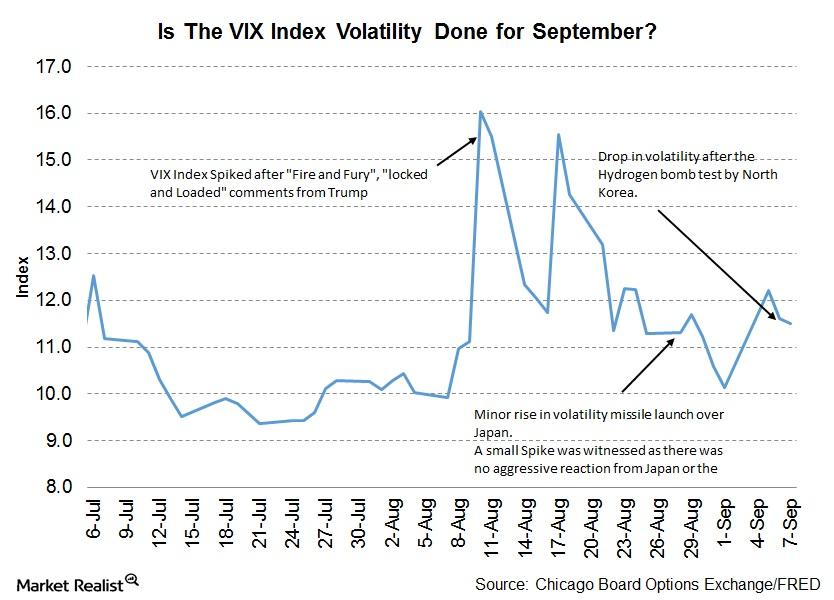

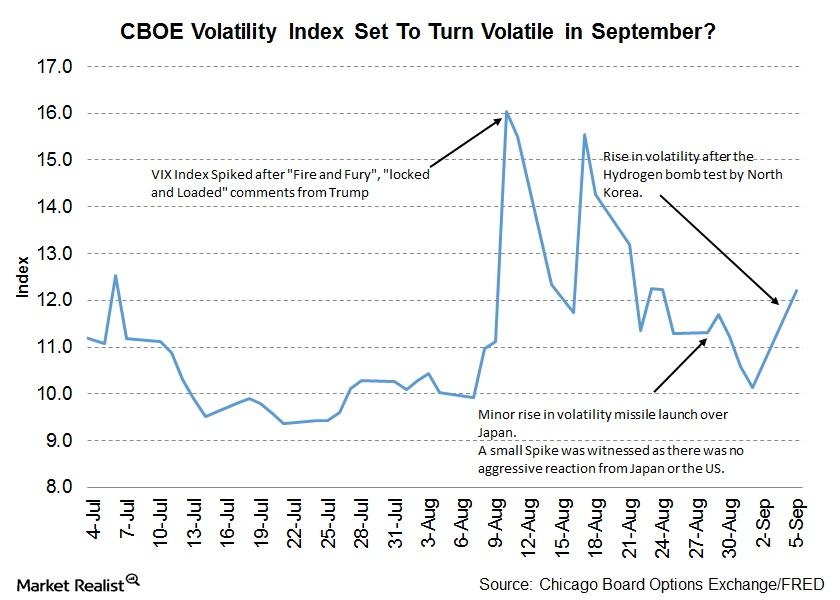

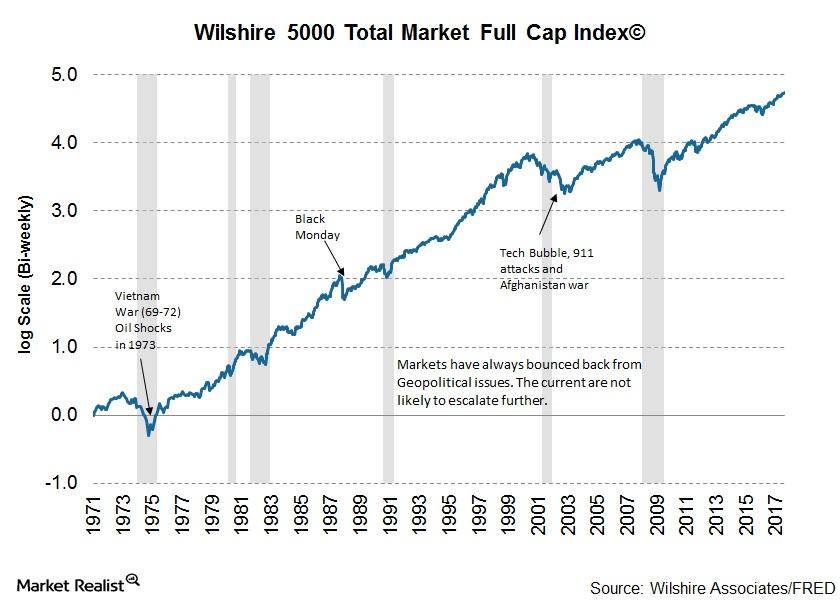

More Temporary Relief from North Korea Tensions?

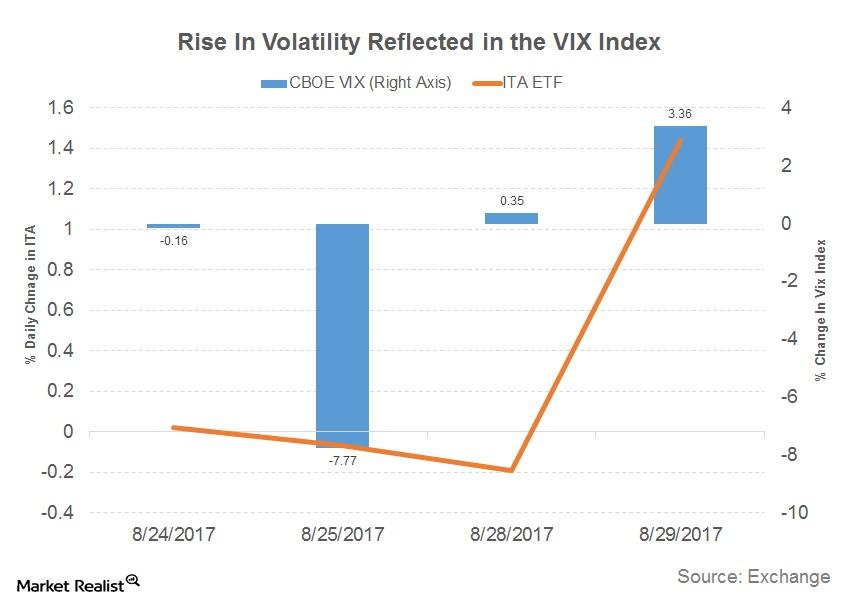

This week volatility (VXX) has continued to stick to its trend of sudden spikes and then dropping immediately.

Why the US Debt Ceiling Fight Has Been Postponed

The key reason for the debt ceiling deal was to approve aid to Hurricane Harvey victims. A US government shutdown could have adversely impacted relief operations.

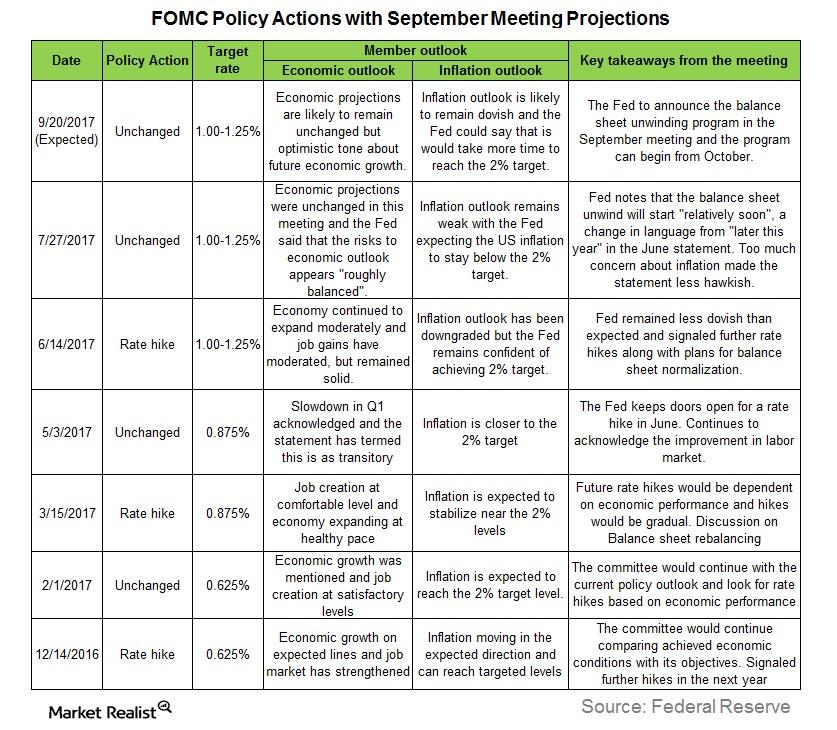

Could the Federal Reserve Surprise the Markets in September?

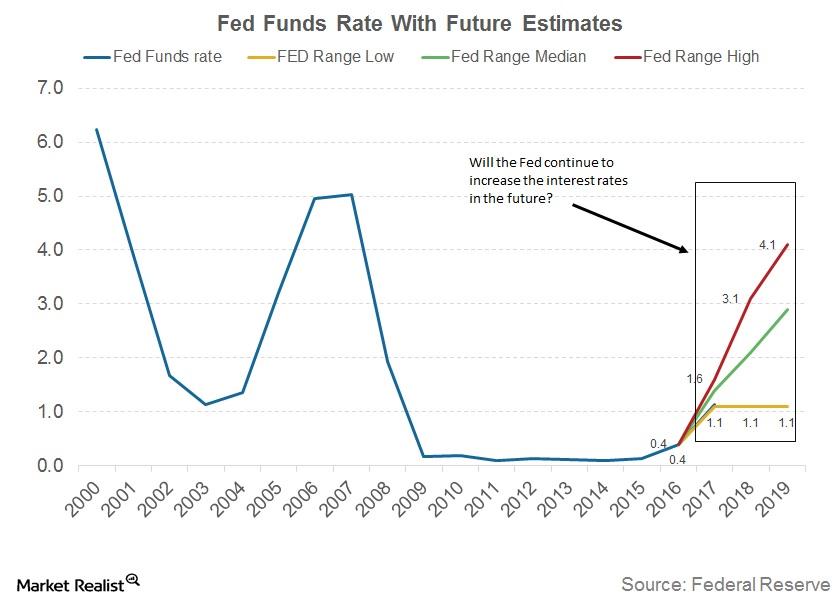

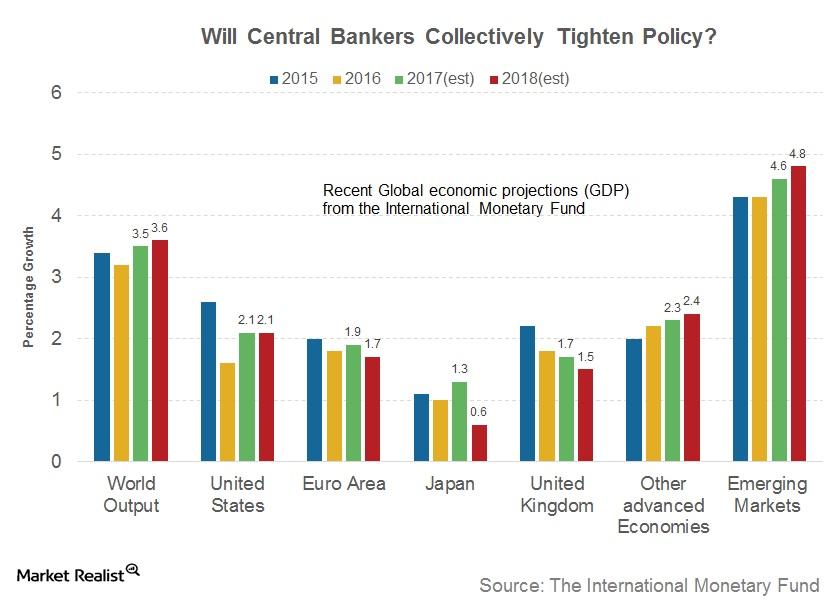

The US Federal Open Market Committee (or FOMC) is scheduled to meet on September 19 and 20 to discuss the current economic climate in the US and to decide whether any monetary policy adjustments are necessary.

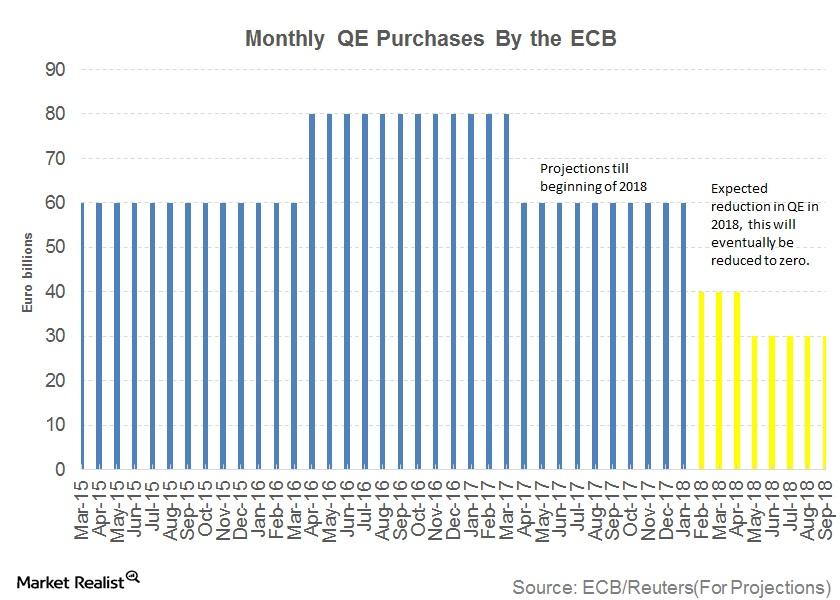

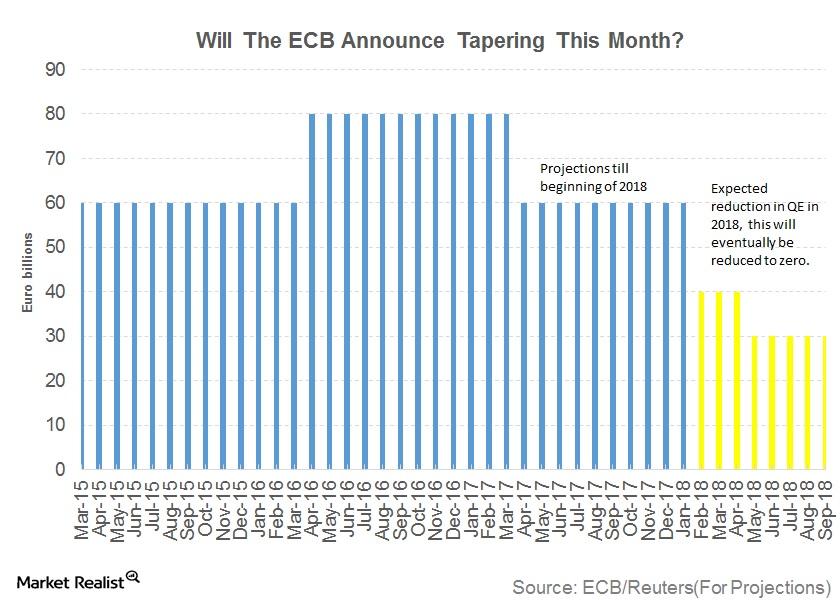

Will the ECB Surprise Markets with a Tapering Announcement?

The governing council of the European Central Bank (or ECB) is scheduled to meet on September 7 in Frankfurt, Germany. The meeting will be followed by a press conference.

Why September Could Be Volatile for Financial Markets

August was a volatile month, filled with economic, political, and geopolitical uncertainty. September could turn out to be another nail-biter for the financial markets.

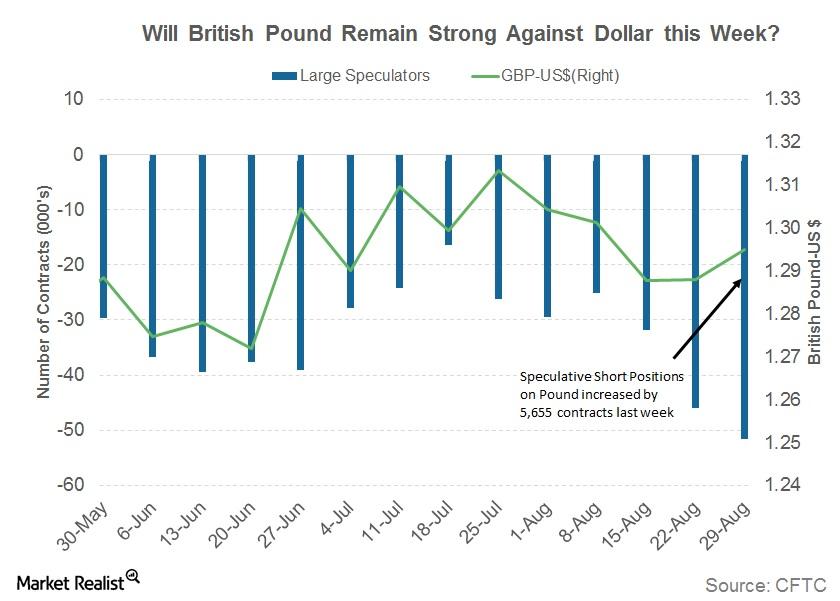

Can the British Pound Continue to Remain Strong This Week?

The British pound (FXB) appreciated marginally against the US dollar for the week ended September 1, 2017.

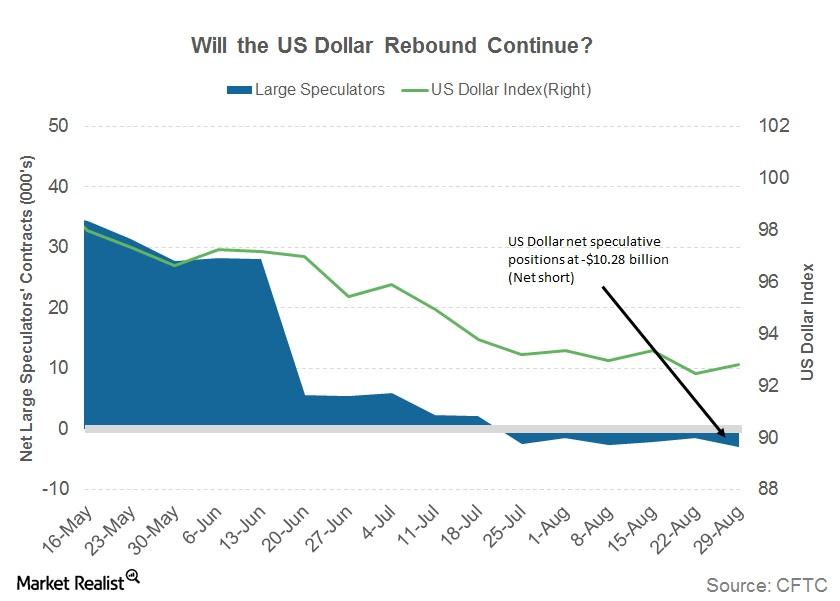

How to Make Sense of the US Dollar Rebound

The US Dollar Index (UUP) surprised the markets with its resilience despite a weak August jobs report.

Why the Euro Could Remain Volatile This Week

The euro (FXE) closed the week ended September 1, 2017, at 1.19 against the US dollar (UUP). It lost 0.56% against the US dollar.

Stanley Fisher’s Solution for Low Interest Rates

Stanley Fisher, vice chair of the U.S. Federal Reserve, has shared his views on low interest rates and some solutions to get rates back to normal levels.

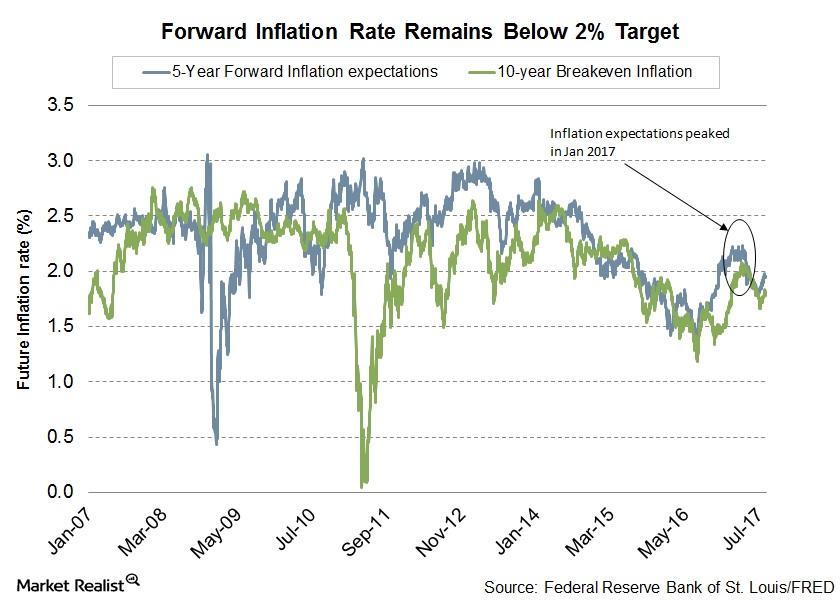

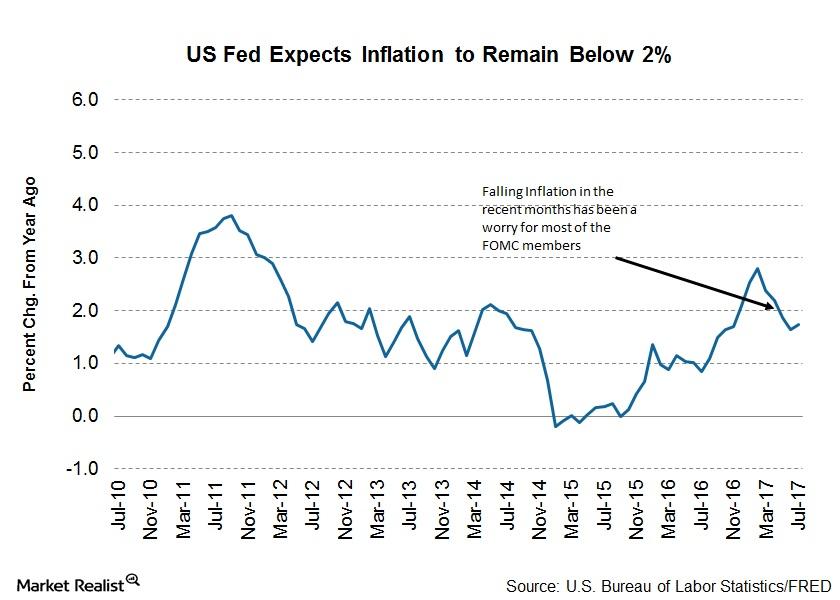

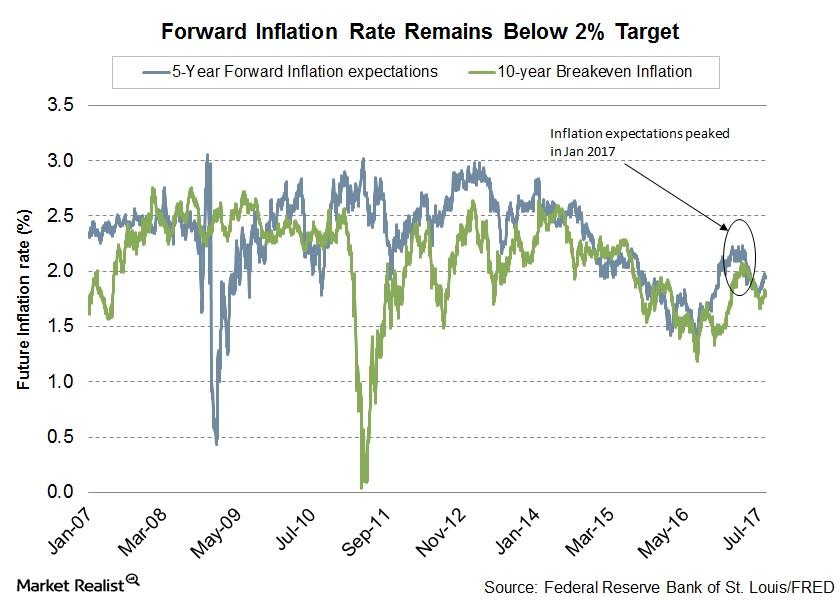

Here’s Why the US Inflation Rate Is Troubling the Fed

In its latest monetary policy statement, the Fed admitted it would take longer than expected for inflation to reach its 2.0% target.

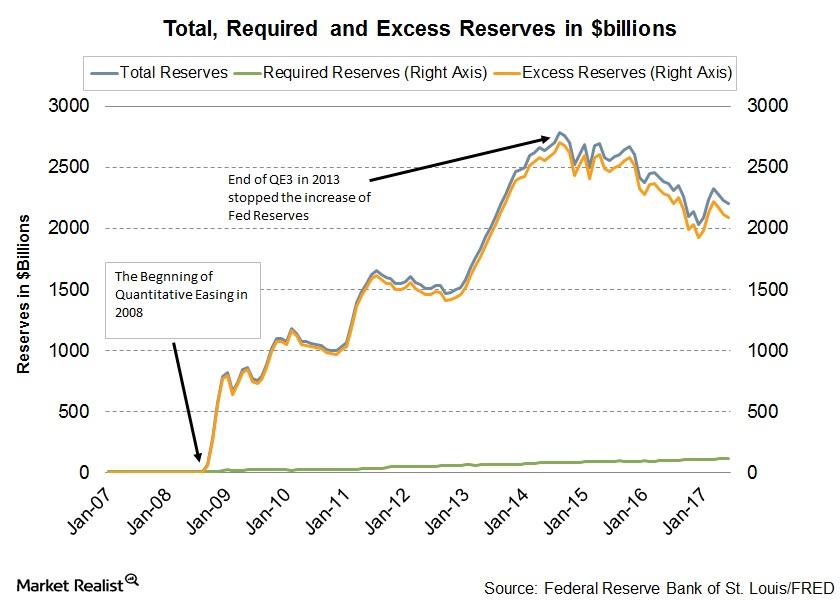

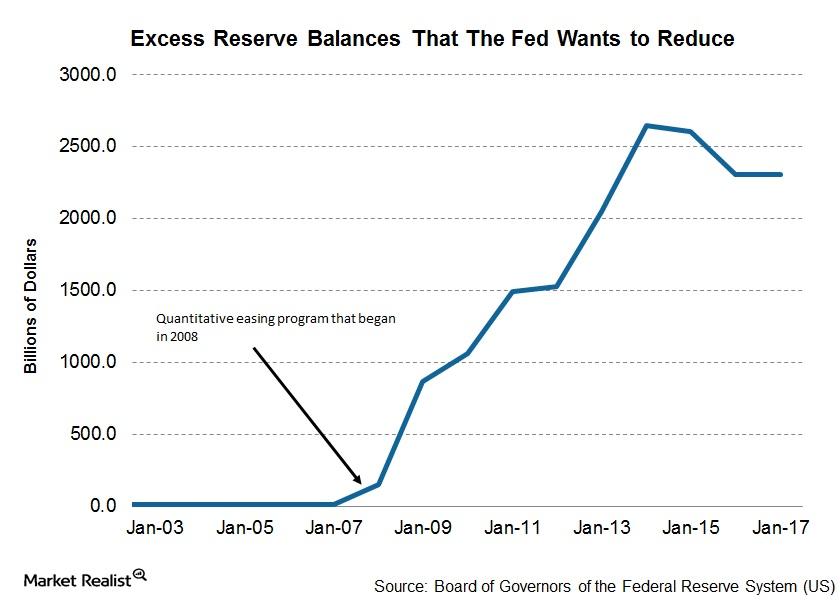

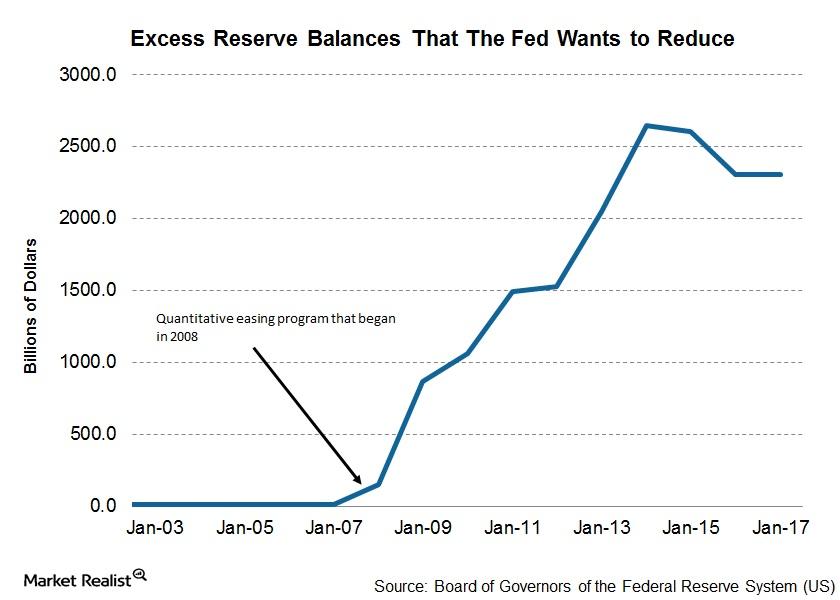

Could the Fed Announce Balance Sheet Shrinking in September?

The Fed, in its efforts to normalize policy, announced that it is starting the balance sheet unwinding program soon.

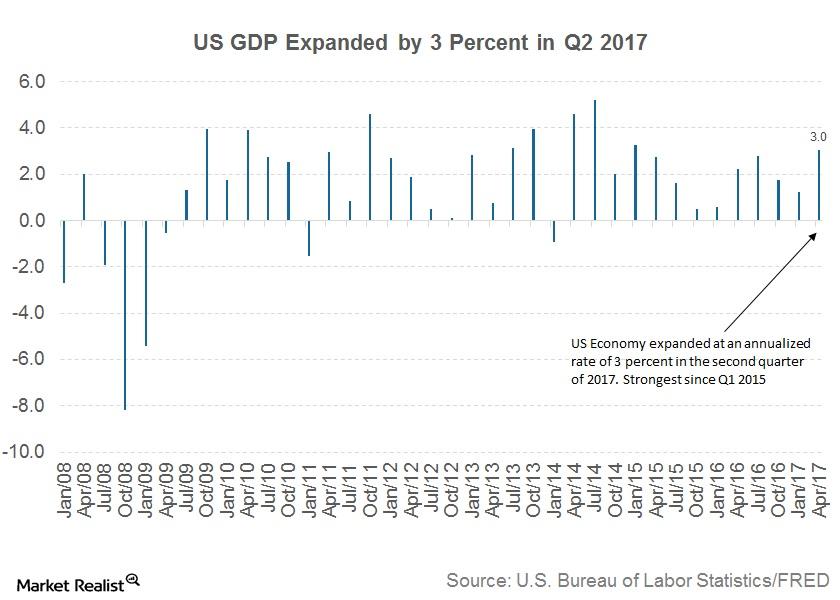

Why Improving Economic Conditions Aren’t Enough for the FED

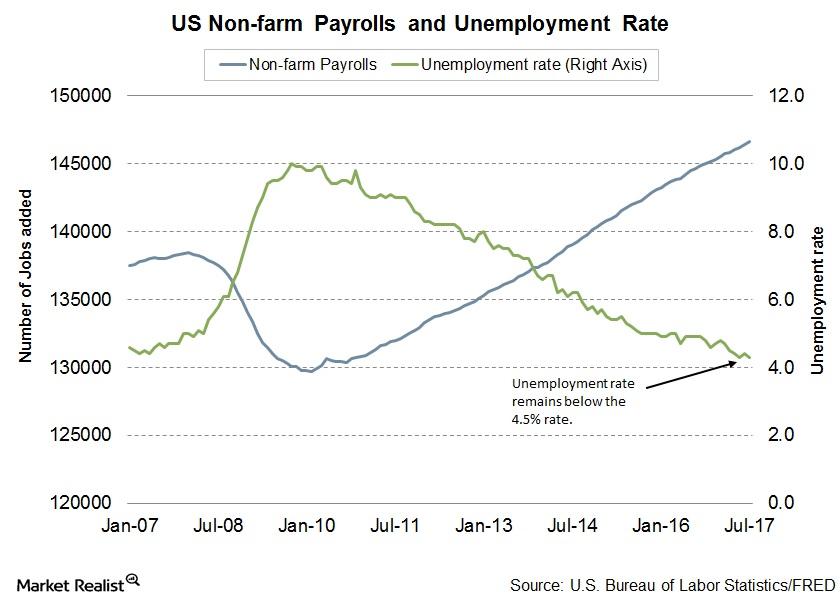

In the last few months, the performance of the US economy has been impressive. The unemployment rate fell to 4.3% in August.

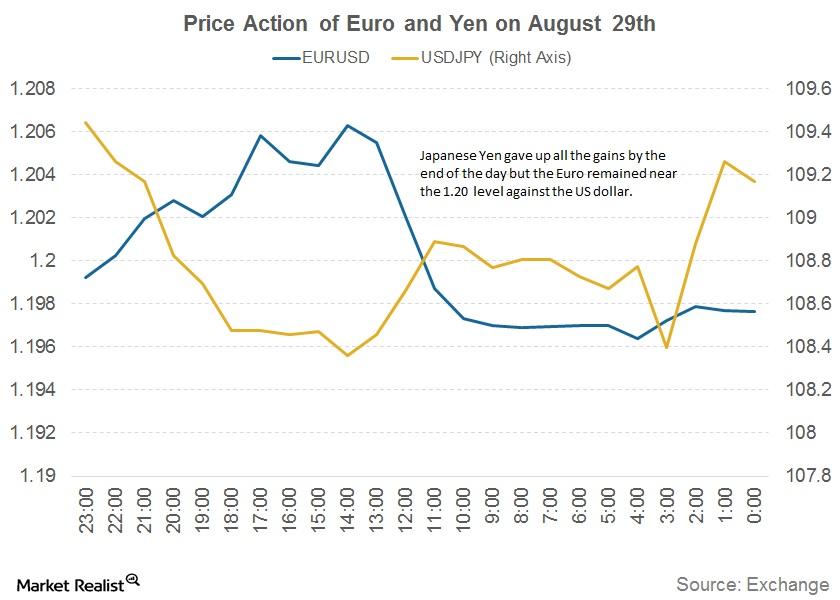

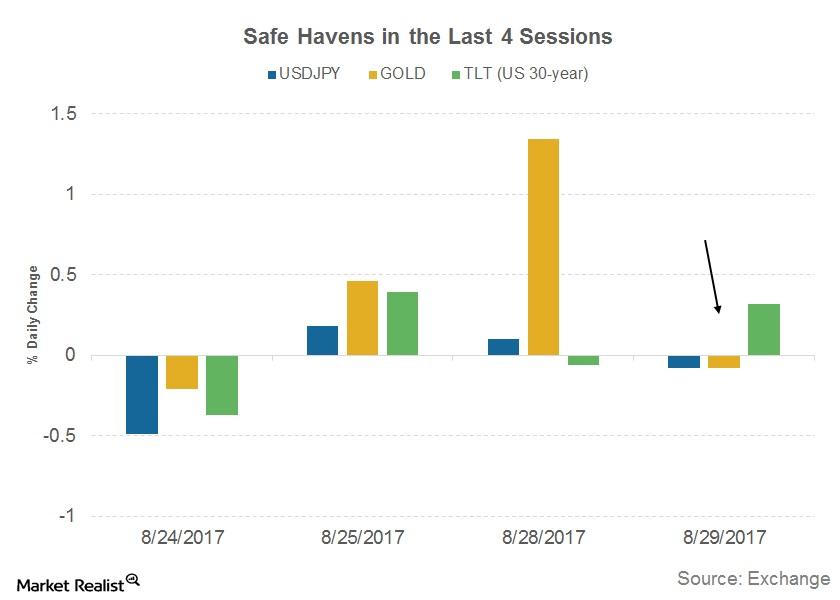

Why the Euro Is Turning Out to Be a Preferred Safe Haven

Volatility in the currency markets spiked after news of the North Korean missile launch on August 29. Demand for safe haven currencies like the Japanese yen (FXY) and Swiss franc (FXF) picked up in the Asian session.

North Korea Tensions: Will Demand for Safe Havens Rise?

In the financial markets, there are a few financial assets whose demand increases dramatically in times of uncertainty.

What Stocks Should Be on Your Radar amid Geopolitical Tensions

Renewed tensions arising out of North Korea’s missile launch on Tuesday had a major impact on volatility. Asian markets have declined more than 1% as risk aversion dominated markets.

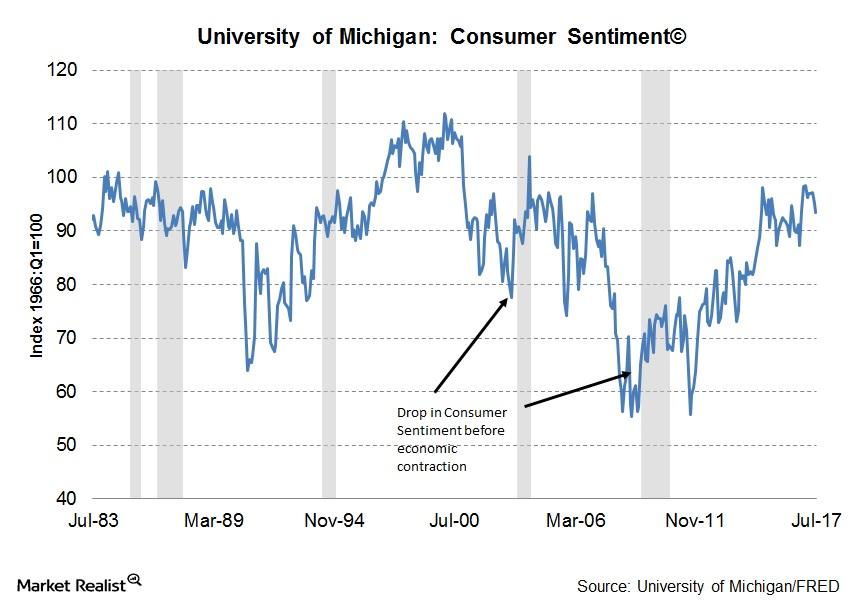

A Look at Consumer Expectations amid Risk Aversion

Consumer expectations for business conditions Consumer expectations form the only component of the Conference Board Leading Economic Index (or LEI) based on business expectations. Referring to consumer expectations regarding future economic conditions, their measurement is an average of two surveys. One survey, conducted by the Conference Board, records consumer expectations for business conditions six months […]

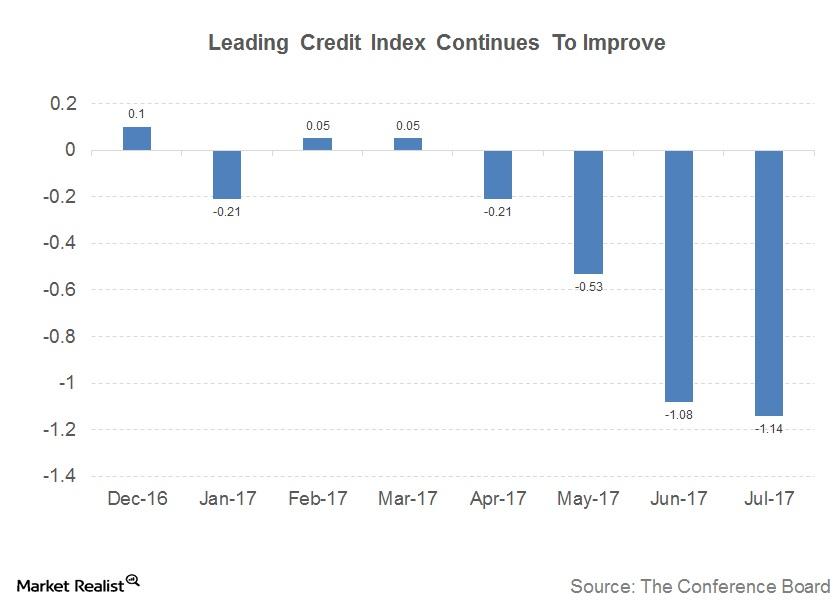

What Financial Markets Predict for the US Economy

Understanding the Leading Credit Index The Conference Board Leading Credit Index (or LCI), which tracks lending conditions in the economy, is reported monthly. The index has six constituents: 2-Year Swap Spread (SHY) (real time) LIBOR[1.London Interbank Offered Rate] 3-month (SCHO) less 3-month Treasury-bill (VGSH) yield spread (real time) debit balances in margin accounts at broker dealers […]

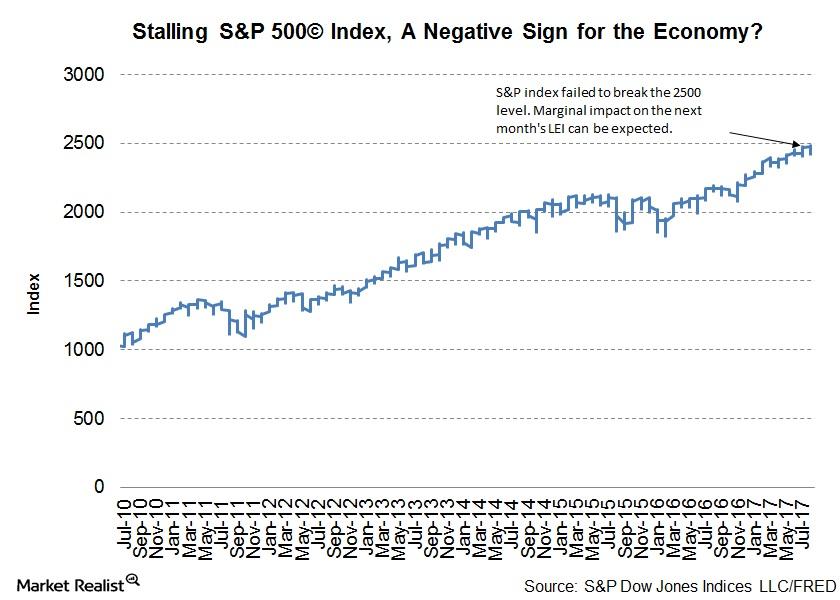

Could the S&P 500’s Stalled Ascent Derail Economic Expansion?

The risk scenario The S&P 500’s rally has stalled just shy of 2,500. Investors are drawn to to riskier assets such as equities when they expect further expansion in the economy. The S&P 500 (SPY), which comprises the 500 largest stocks in the United States, is a constituent of the Conference Board Leading Economic Index […]

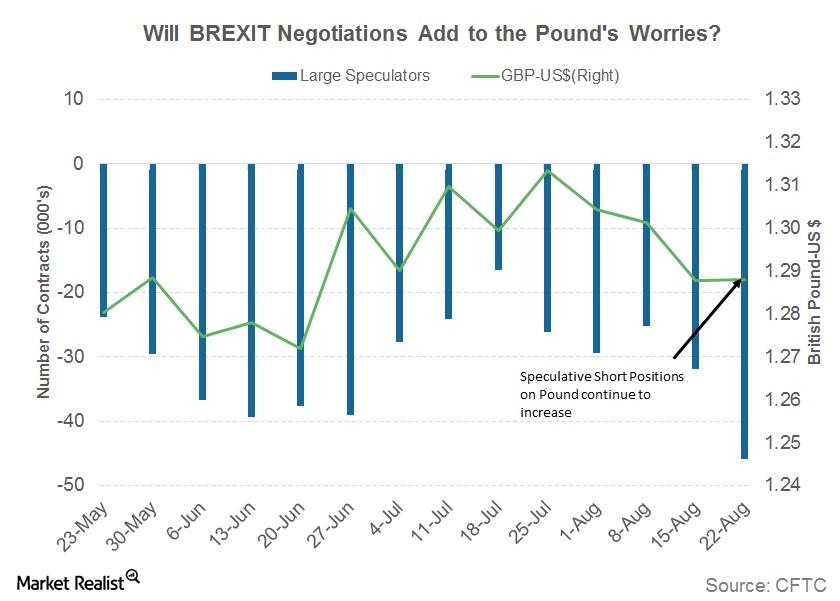

Round 3: Will Brexit Negotiations Help the British Pound?

The British pound (FXB) remained unchanged against the US dollar for the week ending August 25. The pound (GBB) closed the week at 1.2887.

Tax Reforms and Jobs Could Drive the Last Week of Summer

Any negative news from the jobs report will be foreshadowed by the tax reform news. It’s the last jobs report before the September FOMC meeting.

Is the US Dollar Dying a Slow Death?

The US Dollar Index closed the week ending August 25 at 92.68—compared to 93.36 in the previous week.

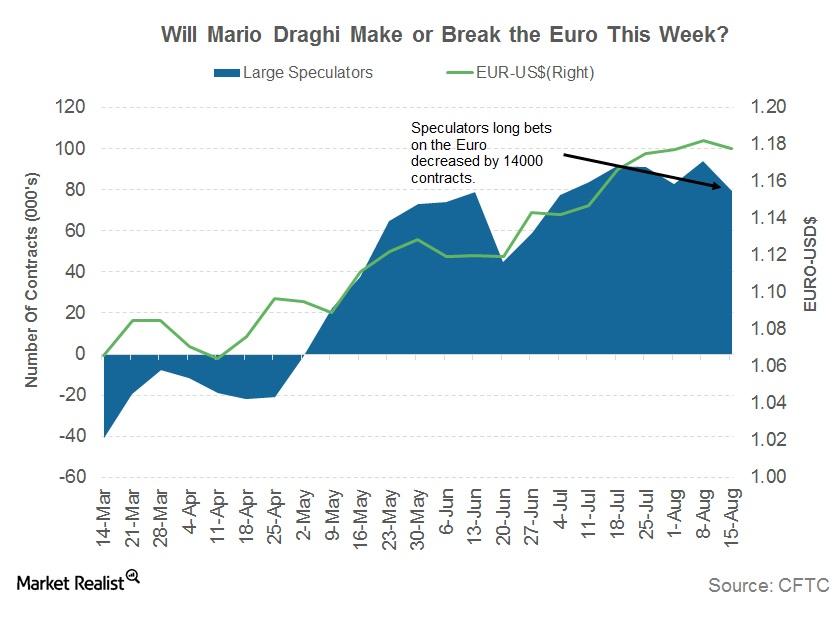

Mario Draghi Didn’t Stop the Appreciating Euro

European Central Bank President Mario Draghi gave didn’t comment about removing monetary stimulus in his speech at the Jackson Hole symposium.

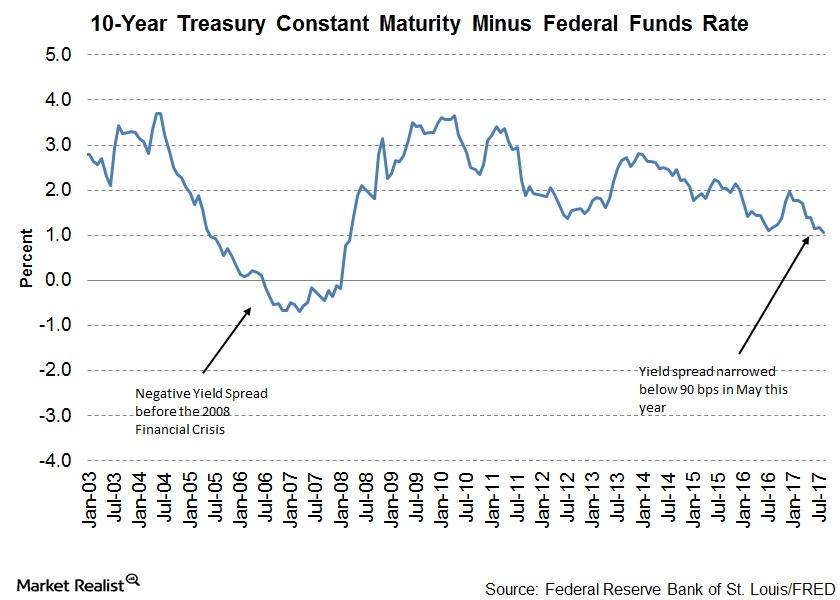

Why Interest Rate Spreads Are Growing

Reduced odds for another rate hike in 2017 Fears of flattening yield curves and rising interest rates have completely vanished in recent weeks. The FOMC’s (Federal Open Market Committee) July meeting statement confirmed the concerns about lagging inflation (TIP), making another rate hike in 2017 less likely. Focus has turned to the Fed’s balance sheet reduction […]

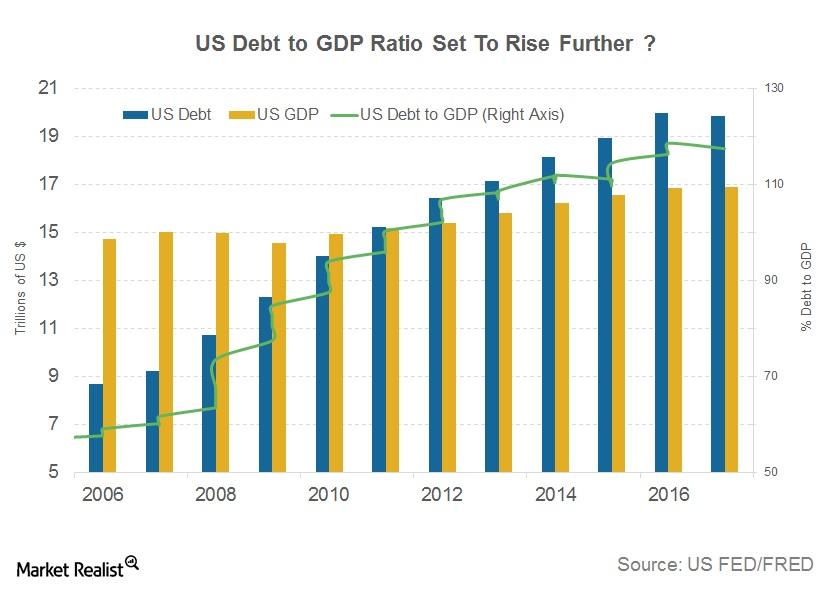

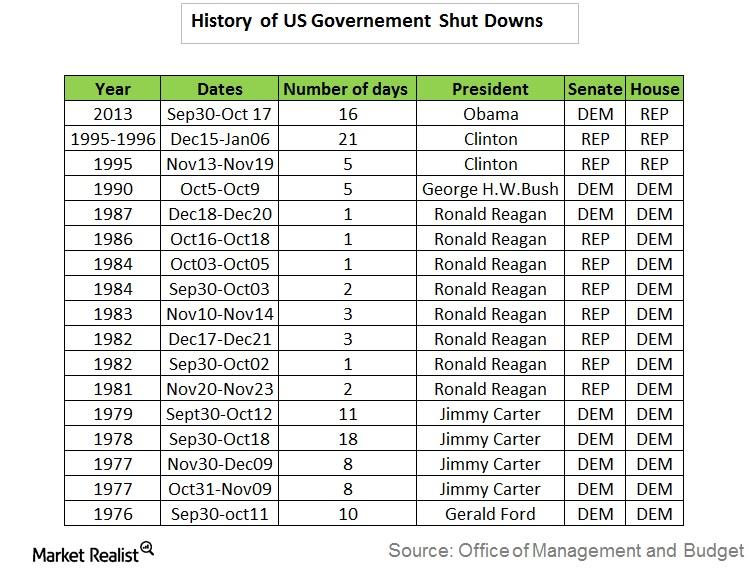

Why the US Government Has Been Shut Down Before

A failure to raise the debt ceiling will likely result in a US government shutdown and a default by the US, which would be catastrophic for the global economy and financial markets (VTI) (USMV).

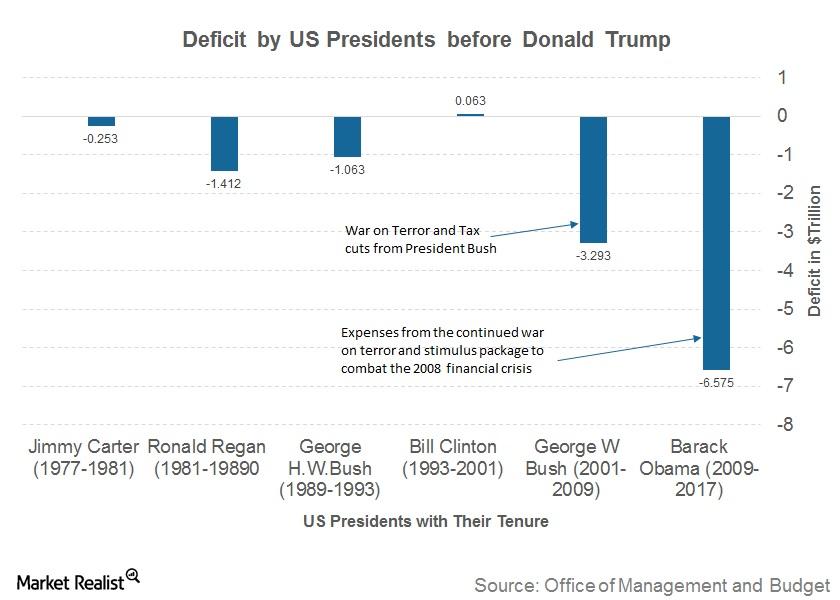

How the US’s Debt Has Become So Big

The US debt-to-GDP ratio now stands at 106.1%, which means that the total US debt is more than the annual US GDP.

Will Jackson Hole in 2017 Be the Beginning of the End of Monetary Accommodation?

This year’s theme for the annual Jackson Hole Symposium is “Fostering a Dynamic Global Economy.”

Why Draghi Is a Person of Interest at Jackson Hole

ECB President Mario Draghi is scheduled to speak at this year’s Jackson Hole Symposium on August 25—after a hiatus of three years.

Here Are the Short-Term Risks to the Bond Markets

The key risk faced by bond markets is a sudden fall in prices.

Will the Fed Repeat Its Taper Tantrum Mistakes?

In this cycle of expansion after the great recession, the Fed has started the process of monetary tightening.

Will a Hawkish Bank of England Raise Interest Rates Soon?

In the recent Bank of England (or BOE) policy meeting, interest rates were left unchanged at 0.25%.

Will ECB’s Tightening Lead to Bond Market Sell-Off?

If the European economy continues to improve at the current pace, the QE program could be scaled down to 40.0 billion euros per month.

Washington or Wyoming: What Will Drive Markets This Week?

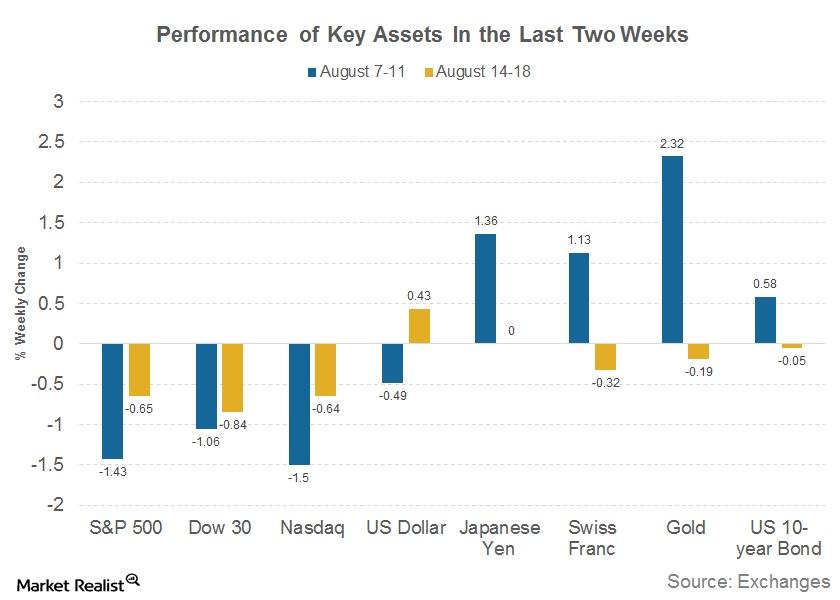

The last two weeks have been eventful for financial markets (SPY).

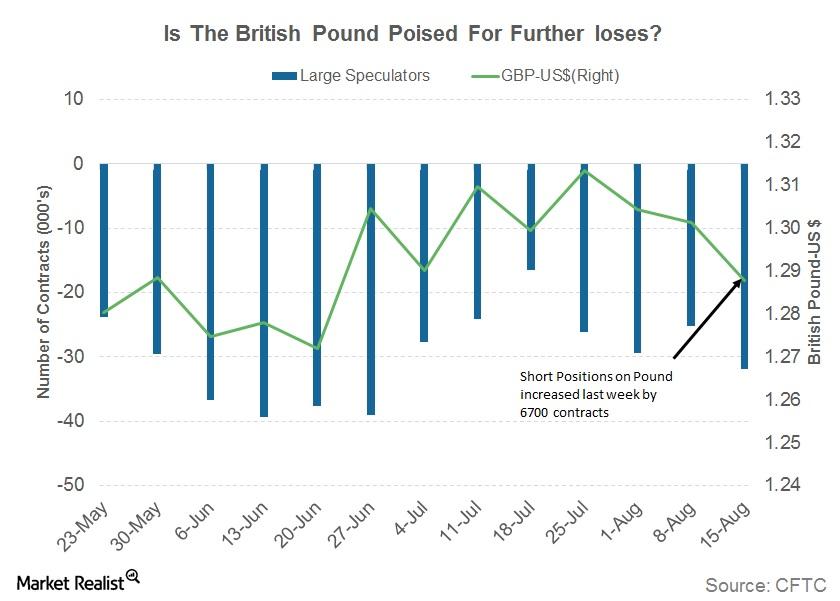

Here’s Why the British Pound Could Be Headed for Further Losses

The British pound (FXB) was one of the worst performers in the week ending August 18.

Will Draghi Lift or Drown the Euro This Week?

The euro-dollar pair (FXE) closed the week ending August 18 at 1.18 against the US Dollar (UUP).

The Fed Could Announce Balance Sheet Reduction Plan in September

In its June meeting, FOMC (Federal Open Market Committee) members detailed plans to shrink the $4.5 trillion balance sheet.

Why Inflation Remains a Huge Concern for FOMC Members

Members of the FOMC (Federal Open Market Committee) attributed the recent slowdown in inflation growth to idiosyncratic factors.

New York Fed President William Dudley Discussed Inflation

In his speech on August 10, New York Fed President William Dudley joined the group of FOMC members to ease concerns about slowing inflation (TIP).

Will the Japanese Yen Appreciate Further This Week?

The Japanese yen (JYN) was back in demand as geopolitical tensions took center stage last week.

Do Financial Markets Have Another Tense Week Ahead?

Equity markets in the US and across the globe reported heavy losses as risk aversion set in.

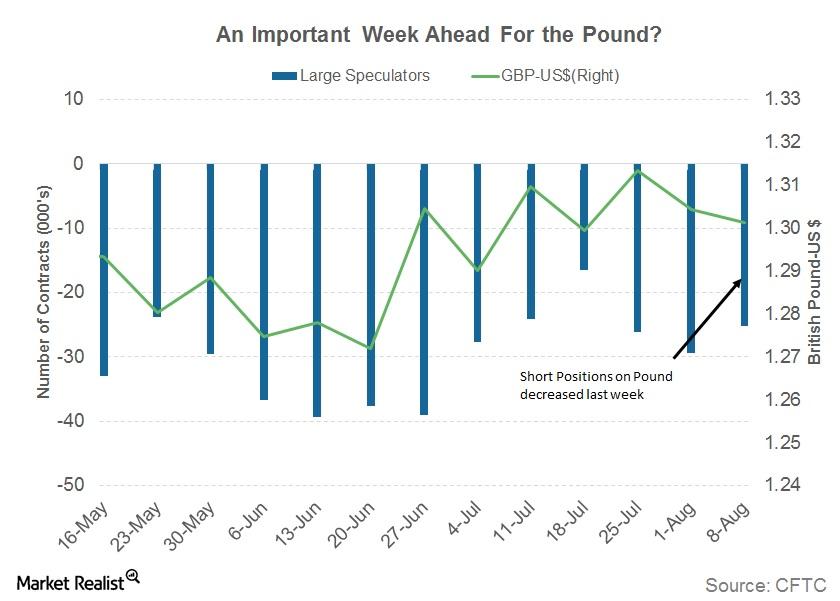

Why the British Pound Has an Important Week Ahead

The British pound (FXB) had another negative week as a dovish statement from the Bank of England continued to drag the currency lower.

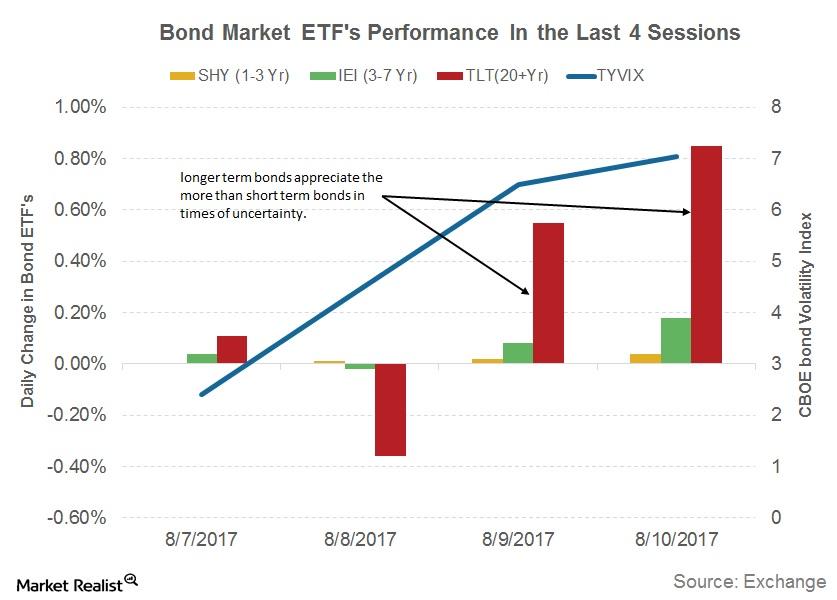

Will Bond Yields Continue to Fall amid Geopolitical Tensions?

Bonds, especially U.S. Treasuries (GOVT), are considered one of the safest assets in which to park your funds in times of uncertainty.