Why Improving Economic Conditions Aren’t Enough for the FED

In the last few months, the performance of the US economy has been impressive. The unemployment rate fell to 4.3% in August.

Sept. 1 2017, Published 10:38 a.m. ET

US economic conditions continue to improve

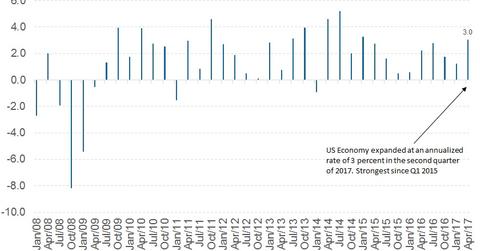

In the last few months, the performance of the US economy has been impressive. There was remarkable growth in GDP, with the recent report indicating a growth rate of 3.0% in the second quarter. The unemployment rate fell to 4.3% in August and is expected to remain below the long-term full employment level of 4.5%. Business confidence remains robust with the August report at 56.3. Services and manufacturing PMI (Purchasing Managers’ Index) numbers are also above the recent averages.

Consumer confidence and retail sales show no signs of concern with the August consumer confidence number at 97.6, which is a seven-month high. Retail sales continue to improve, recording a 4.2% year-over-year rise in July.

Factors that are a drag on the US economy

In recent months, there have been minor hiccups in the housing (REZ) and durable goods (XLI) orders. Economic reports released in August indicated an unexpected fall in housing starts (REM) to 1.16 million in the month of July compared to 1.21 million in June. New home sales fell to a seven-month low of 571,000. The other economic metric that failed to impress was the durable goods orders, which fell 6.8% in July. The fall in these economic indicators may not be a cause for worry right now. They have been increasing consistently over the last six months, and a minor pullback may not impact the Fed’s decision with regard to monetary tightening.

Inflation and fiscal uncertainty impacts Fed’s hawkish outlook

Stubbornly low inflation (VTIP) and uncertainty (SVXY) arising out of US fiscal spending plans and geopolitical disturbances are likely to impact the Fed’s decision in the near term. The Fed isn’t expected to raise interest rates, but the markets could be reacting to the tone of the Fed’s statement. The Fed has remained hawkish since the beginning of this tightening cycle, but the current economic climate might warrant a dovish tone. We will have to wait until September 20 to find out how the Fed plans this transition.

In the next part of this series, we’ll explain why the Fed is worried about slowing inflation (CPI) growth.