iShares Residential Rel Est Capped

Latest iShares Residential Rel Est Capped News and Updates

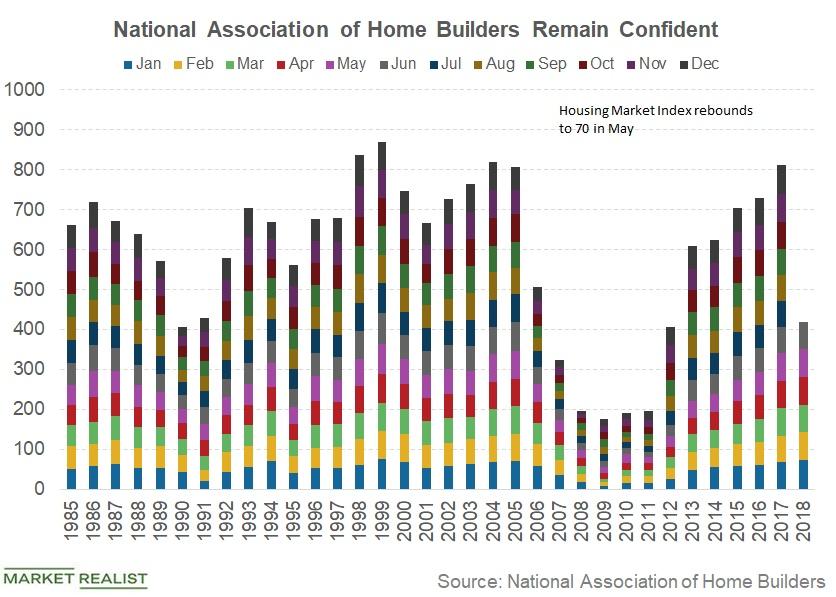

What American Builders Were Worried about in June

The HMI was reported to have decreased by two points to 68 in June as compared to a May reading of 70.

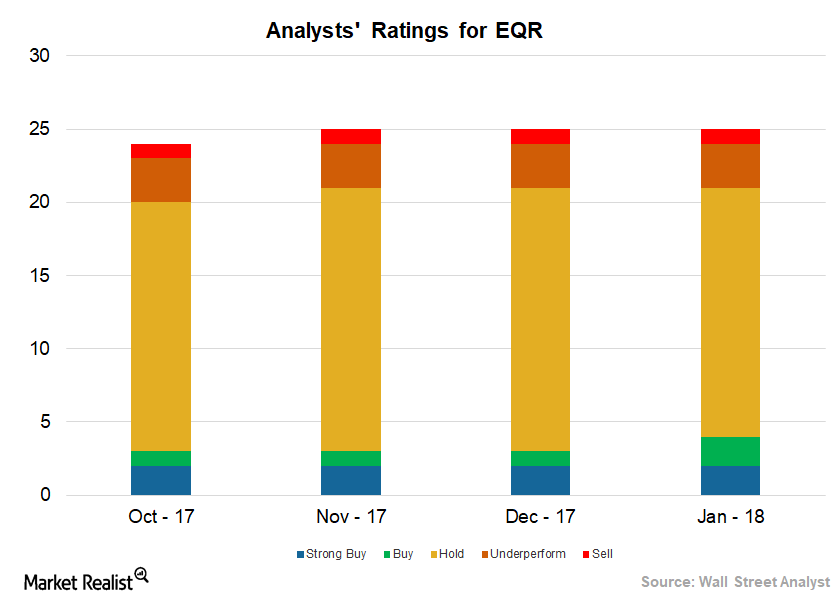

What Do Wall Street Analysts Think of Equity Residential?

Analysts gave EQR a mean price target of $69.08, implying a ~8.3% rise from its current level of $63.77.

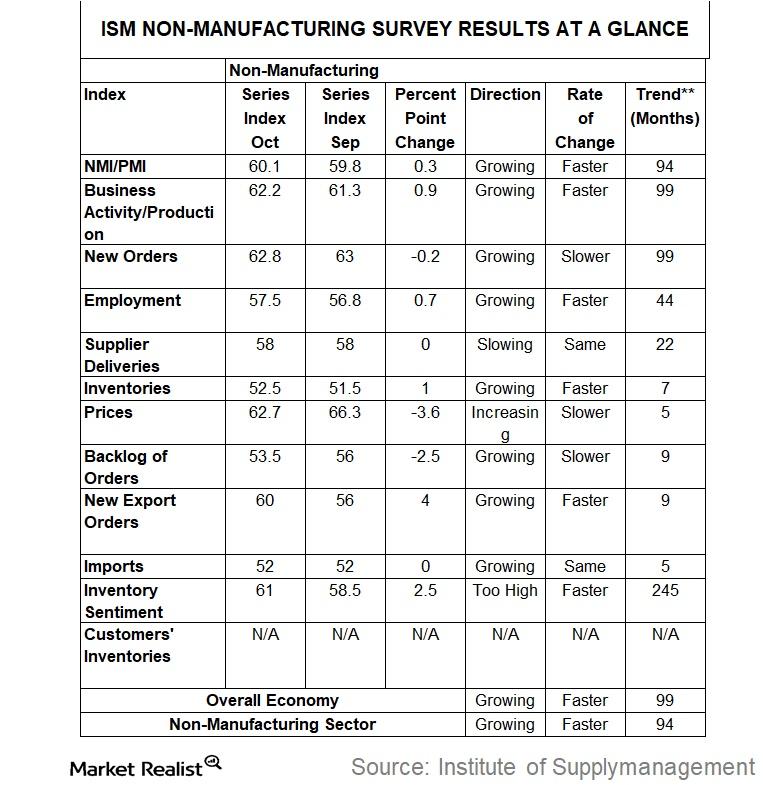

This ISM Index Hit a Lifetime High in October

For October, service sector activity rose at a pace not seen since the inception of the report. The non-manufacturing index reached a lifetime high of 60.1.

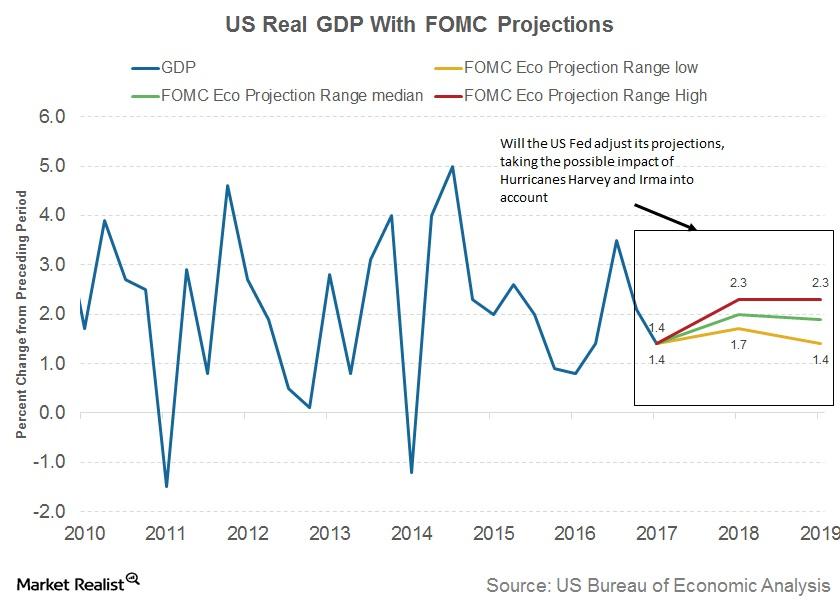

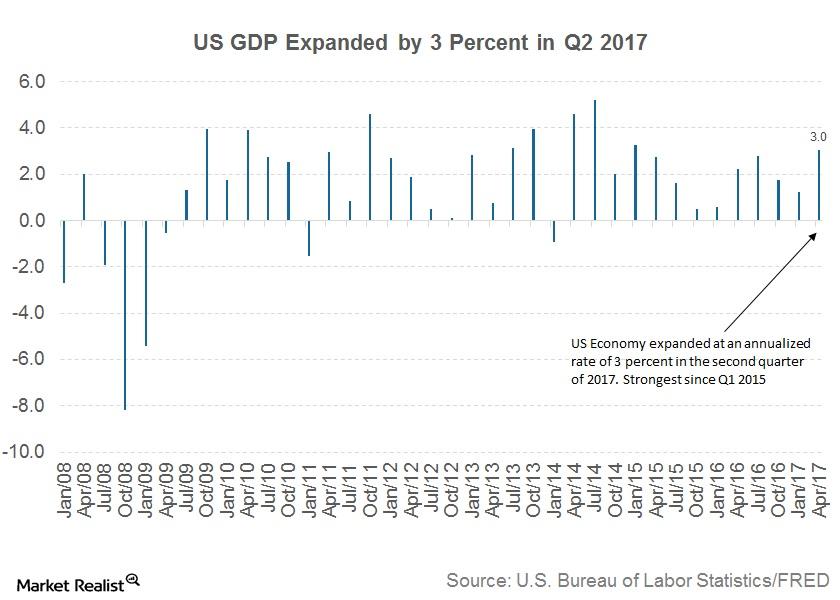

How Has the US Economy Fared since the Last FOMC Meeting?

Since the last FOMC meeting in July, economic conditions in the US have continued to improve.

Why Improving Economic Conditions Aren’t Enough for the FED

In the last few months, the performance of the US economy has been impressive. The unemployment rate fell to 4.3% in August.

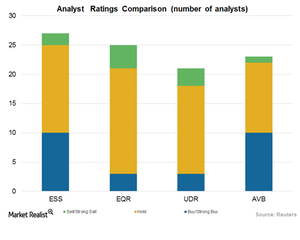

How Does Wall Street Rate Essex Property Trust?

Essex Property Trust’s (ESS) performance expectations in 2017 are reflected in analysts’ ratings for its stock. Analysts have given ESS a mean price target of $257.6.

How Essex Property Trust Compares to Other Industry Players

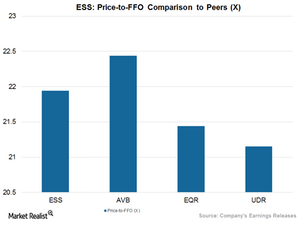

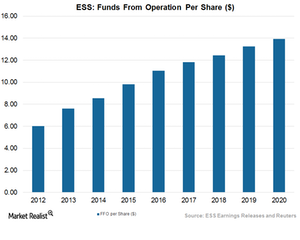

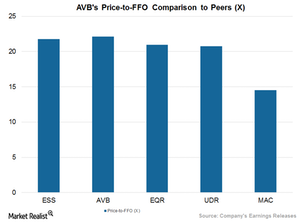

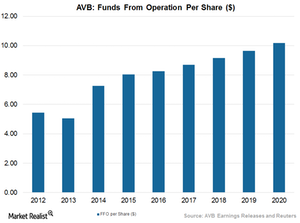

The price-to-FFO (funds from operation) ratio is the most popular method of measuring the relative valuation of real estate investment trusts (or REIT) such as Essex Property Trust.

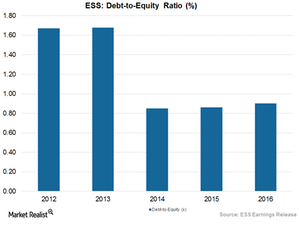

How Well Does Essex Property Manage Its Balance Sheet?

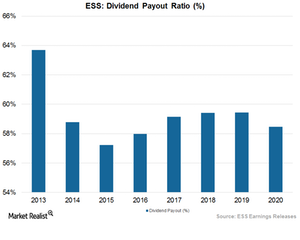

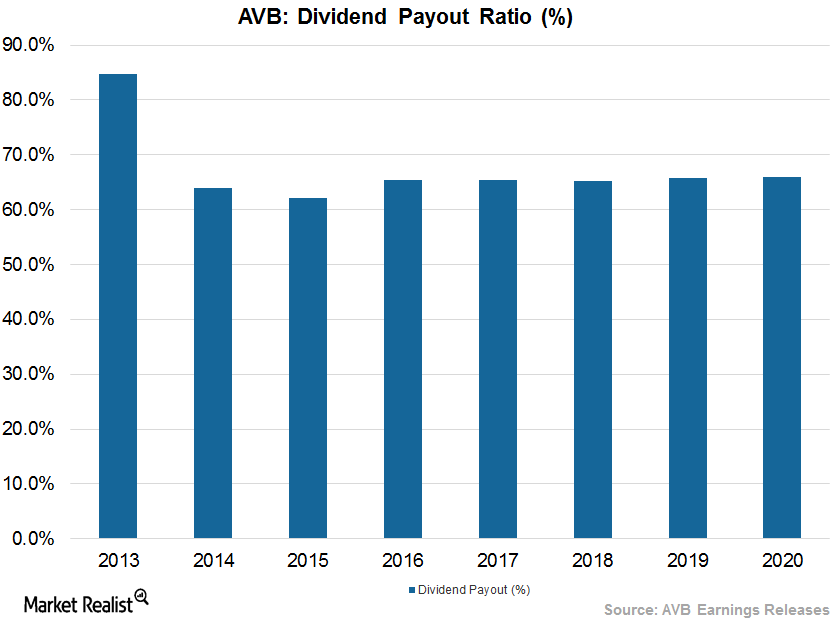

In order to function as real estate investment trusts (or REIT), companies such as Essex Property Trust (ESS) have to pay almost 90% of their taxable income out as dividends.

How Well Does Essex Property Return Value to Its Shareholders?

Real estate investment trusts (or REIT) such as Essex Property Trust (ESS) need to pay at least 90% of their taxable incomes as dividends or share buybacks as a prerequisite for functioning as REITs.

Are Trump and the Rate Hike Blessings in Disguise for ESS?

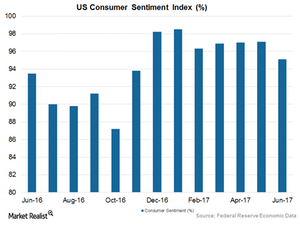

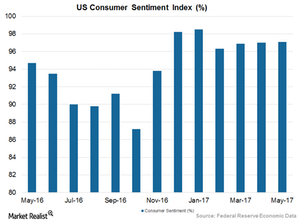

Rising optimism among citizens bodes well for REITs such as Essex Property Trust (ESS) AvalonBay Communities (AVB), Equity Residential (EQR), and UDR (UDR).

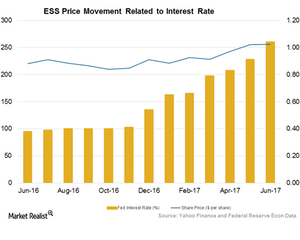

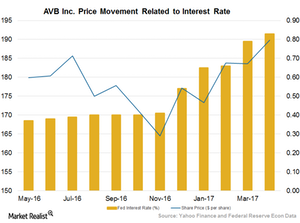

How High Interest Could Affect ESS and Residential REITs

REITs such as Essex Property Trust (ESS) yielded high returns in the long period during which interest rates were below average.

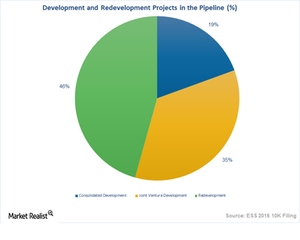

Development Projects Helps Essex Property Combat REIT Headwinds

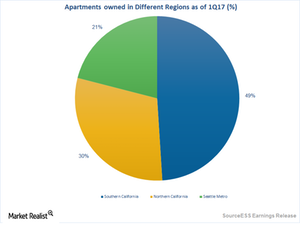

Amid the shifting residential REIT scenario, Essex Property Trust (ESS) has been able to maintain its dominant position.

Essex Property to See Growth due to Winning Strategies

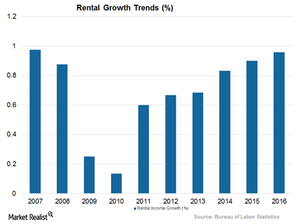

The current macroeconomic scenario is conducive for growth in the residential REIT (real estate investment trust) sector.

Essex Property and Residential REITs Are Poised to Grow

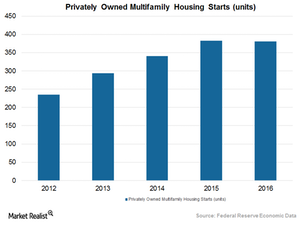

The home building sector has set itself a course for smooth sailing amid the current favorable economic scenario.

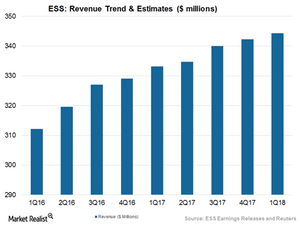

How Essex Property Maintains Its Revenue Growth

A slow and steady improvement in the job market and rising optimism among consumers about their economic welfare has triggered a spike in the construction sector.

Essex Property: An Apartment REIT Standing Strong amid Headwinds

The current economic environment has made investors skeptical about the real estate investment trust (or REIT) industry.

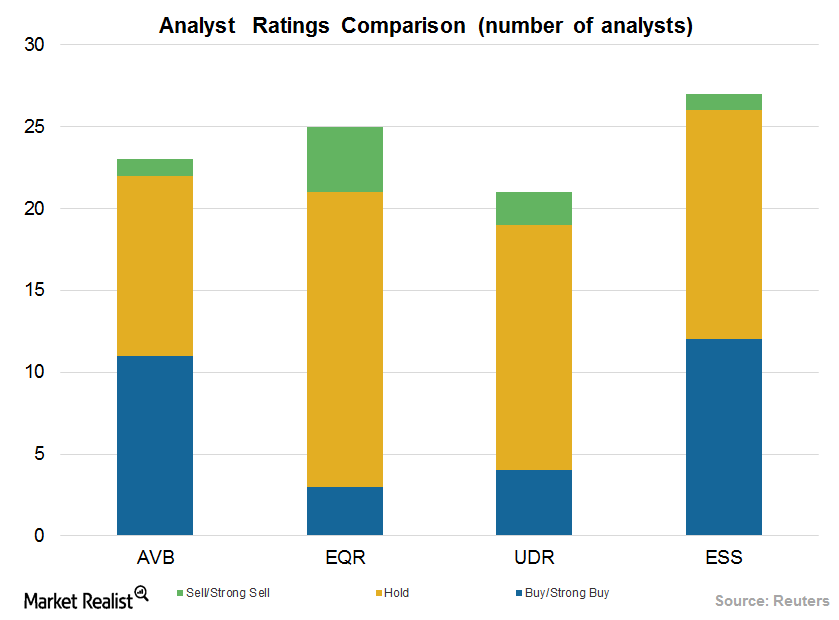

How Wall Street Analysts View AvalonBay Stock

In May 2017, 11 of 23 analysts covering AVB stock issued “buy” or “strong buy” ratings.

AvalonBay—Comparison with Other Retail REITs in Its Industry

Currently, AvalonBay Communities is offering a next-12-month (or NTM) dividend yield of 3%, which is in line with its close competitors.

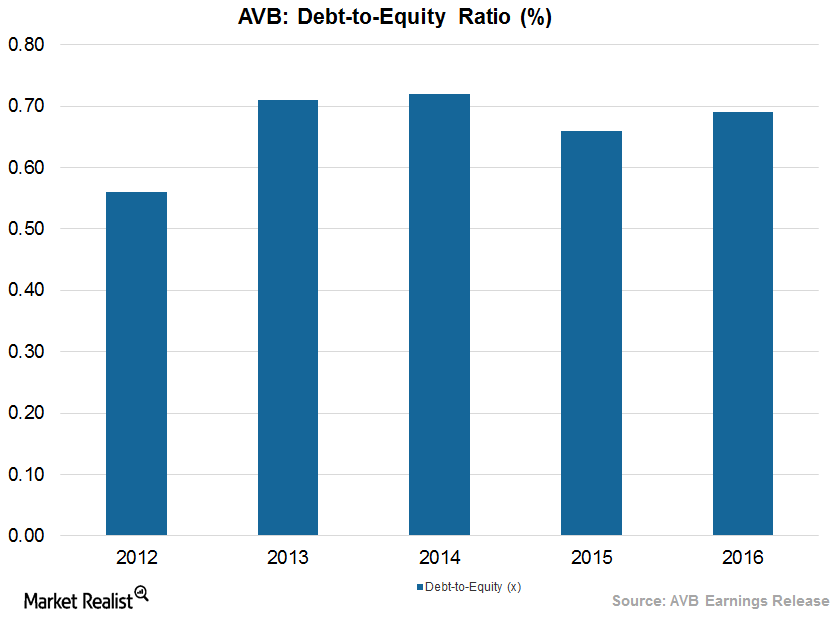

How AvalonBay Communities Leverages Its Balance Sheet

AvalonBay has been able to maintain a low debt-to-equity ratio in the last five years. The company reported a debt-to-equity ratio of ~1.5x in 1Q17.

AvalonBay Communities: A Rewarding Stock for Shareholders

During 2016, AvalonBay Communities (AVB) repurchased 57,172 shares worth $0.6 million.

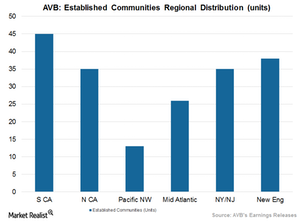

AvalonBay, Residential REITs Target Headwinds through Diversification

During 1Q17, AvalonBay Communities (AVB) had completed the development of projects worth $650 million at an initially projected yield of 5.6%.

Could Rising Consumer Sentiment Boost REITs Like AVB?

According to the University of Michigan, the consumer sentiment index for May 2017 gained 2.5% year-over-year, standing at 97.1%.

The Impact of Trump’s Proposed 2018 Budget on Residential REITs

According to President Trump’s proposed budget for fiscal 2018, the administration is expected to slash $6 million from the U.S. Department of Housing and Urban Development budget, decreasing its funding by 13.2% to $40.7 billion.

How Rising Interest Rates Impact AVB and Residential REITs

There is wide anticipation in the market that the Federal Reserve could raise interest rates again during its upcoming meeting on June 14, 2017.

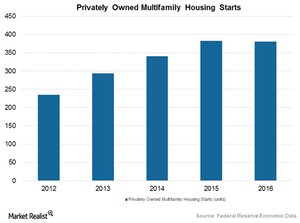

AvalonBay Communities and the Residential REIT Industry Overview

According to NHAB’s Housing Economics survey, housing starts are expected to rise 6.2% in 2017 and ~6.3% in 2018, backed by respective 9.6% and ~11.8% gains in single-family home sales.

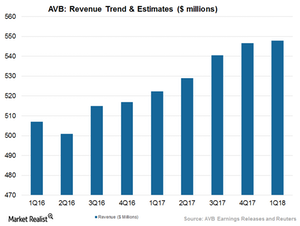

AvalonBay Maintains Revenue Growth amid Industrial Headwinds

AvalonBay’s 1Q17 revenues came in at ~$522.3 million and surpassed estimates by 0.3%.

AvalonBay: Weathering Ups and Downs in Residential REITs

In May 2017, 11 of 23 analysts covering AvalonBay Communities (AVB) stock issued “buy” or “strong buy” ratings. Eleven analysts gave AVB a “hold” rating, and one analyst gave it a “sell” or a “strong sell” rating.

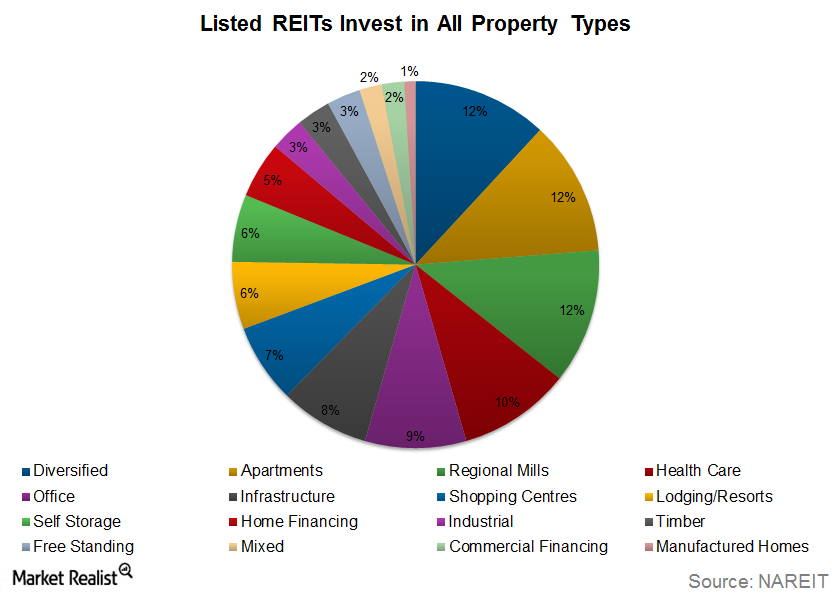

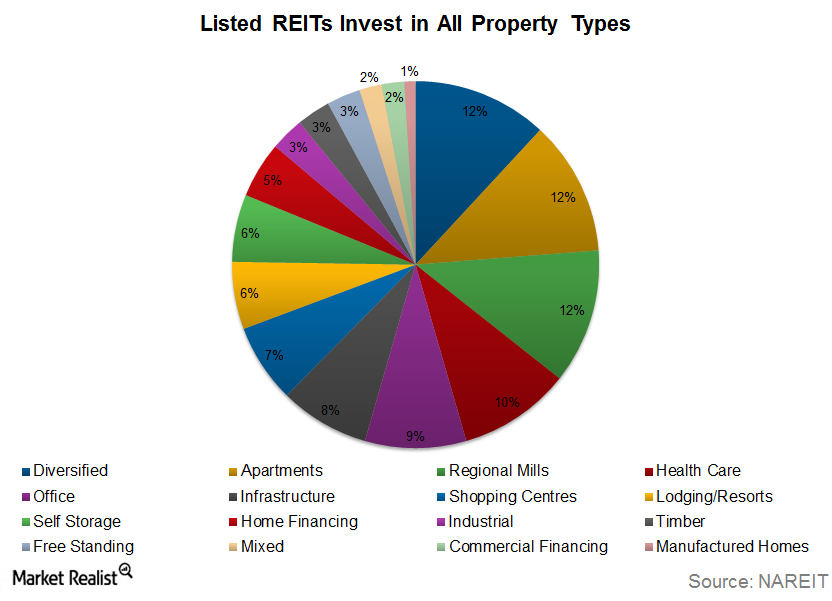

REITs Explained: Qualifications and Types of REITs

To qualify as a REIT, a company must have most of its assets and income tied to real estate investment and must pay out almost all of its taxable income to shareholders in the form of dividends. In the U.S., a REIT must meet the following four requirements. The REIT must distribute at least 90% […]

REIT Explained: Qualifications and Types of REITs

Let’s talk about the two main types of REITs (ICF)—equity REITs and mortgage REITs.

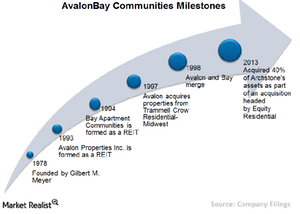

Investing in AvalonBay Communities: A Must-Know Company Overview

AvalonBay Communities is a REIT focused on developing, redeveloping, acquiring, and managing high-quality apartment communities in high barrier-to-entry US markets.