How Well Does Essex Property Return Value to Its Shareholders?

Real estate investment trusts (or REIT) such as Essex Property Trust (ESS) need to pay at least 90% of their taxable incomes as dividends or share buybacks as a prerequisite for functioning as REITs.

July 11 2017, Updated 9:06 a.m. ET

Dividends are important for REITs

Real estate investment trusts (or REIT) such as Essex Property Trust (ESS), AvalonBay Communities (AVB), Equity Residential (EQR), and UDR (UDR) need to pay at least 90% of their taxable incomes as dividends or share buybacks as a prerequisite for functioning as REITs. In this manner, they can enjoy several tax benefits.

REITs use their rental incomes as fund sources for paying shareholders, providing them with a sure and predictable flow.

The iShares Residential Real Estate Capped ETF (REZ) has a market cap–weighted index with a wide product portfolio that includes residential REITs. It has an annualized yield of 4.6%.

Consistent dividend payment

Essex Property has been paying dividends to its shareholders consistently in every quarter since it became a public company in June 1994. Essex Property raises its quarterly dividend almost every year. In March 2017, the company raised its dividend by 9.4% to $1.75, and it paid the dividend on April 17, 2017. The company has paid a total dividend per share of $3.50 to its shareholders so far in 2017.

The company raised its dividend by 11.1% to $1.60 on April 15, 2016. Essex paid total dividends per share of $6.40, $5.76, and $5.11 to its shareholders in 2016, 2015, and 2014, respectively.

The company has maintained a consistent dividend yield over the last two years. Its dividend yield was 2.4% in 2015, and it was 2.7% in 2016. Analysts expect Essex to maintain dividend yields of 2.7%, 2.8%, and 3.0%, respectively, in 2017, 2018, and 2019.

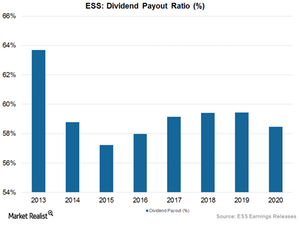

FFO payout ratio

A stock’s FFO (funds from operation) ratio, or its dividend per share-to-diluted FFO per share for a given period, gives us an idea of its shareholder returns.

ESS’s FFO payout ratio was 59.5% in 1Q17. The company’s expected payout ratios for the next four quarters are 59.9%, 58.9%, 58.5%, and 59.1%, respectively, for 2Q17, 3Q17, 4Q17, and 1Q18. The chart above shows the REIT’s estimated dividend payout trend for the next four years.

Although Essex property has undertaken a share repurchase program, it hasn’t bought back any shares in 2016.

Peer group

If we consider other REITs by comparing FFO payout ratios, we’ll find that Essex’s payout ratio was in line with those of its competitors. AvalonBay Communities (AVB) has a payout ratio of 0.65x, Equity Residential has a payout ratio of 1.56x, Essex Property has a payout ratio of 0.58x, and UDR (UDR) has a payout ratio of 0.66x.

In the next article, we’ll find out how ESS is performing in terms of leveraging its debt.