Essex Property Trust Inc

Latest Essex Property Trust Inc News and Updates

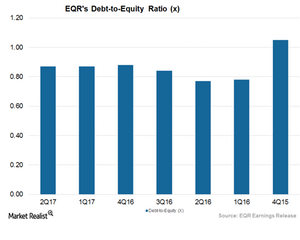

How Equity Residential Improved Its Balance Sheet in 2Q17

During 2Q17, Equity Residential (EQR) reported higher-than-expected top-line and bottom-line results backed by robust rent growth and occupancy levels.

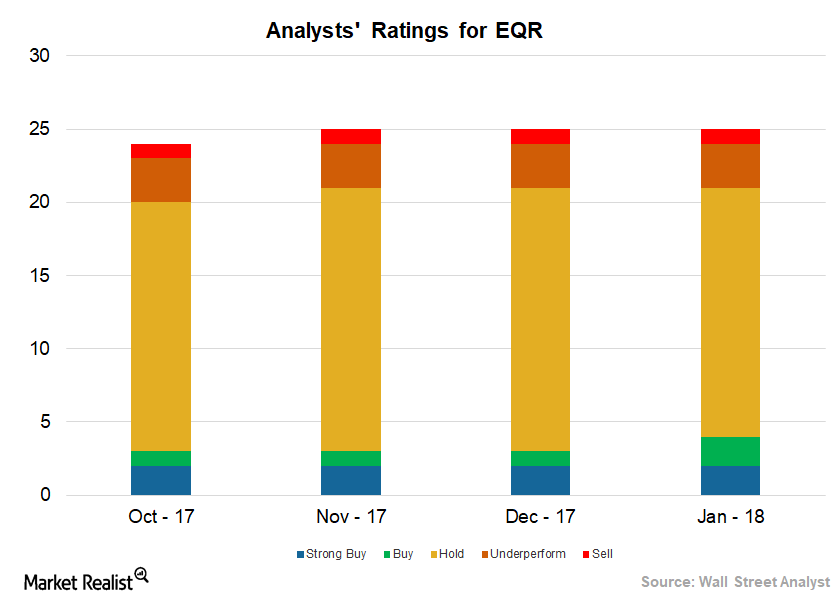

What Do Wall Street Analysts Think of Equity Residential?

Analysts gave EQR a mean price target of $69.08, implying a ~8.3% rise from its current level of $63.77.

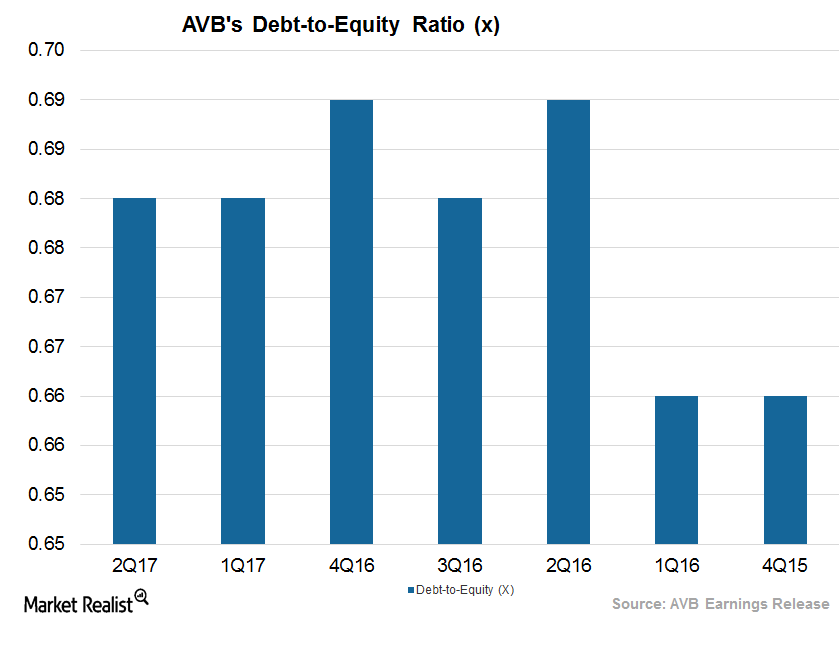

Financing Activities Leverage AvalonBay’s Balance Sheet in 2Q17

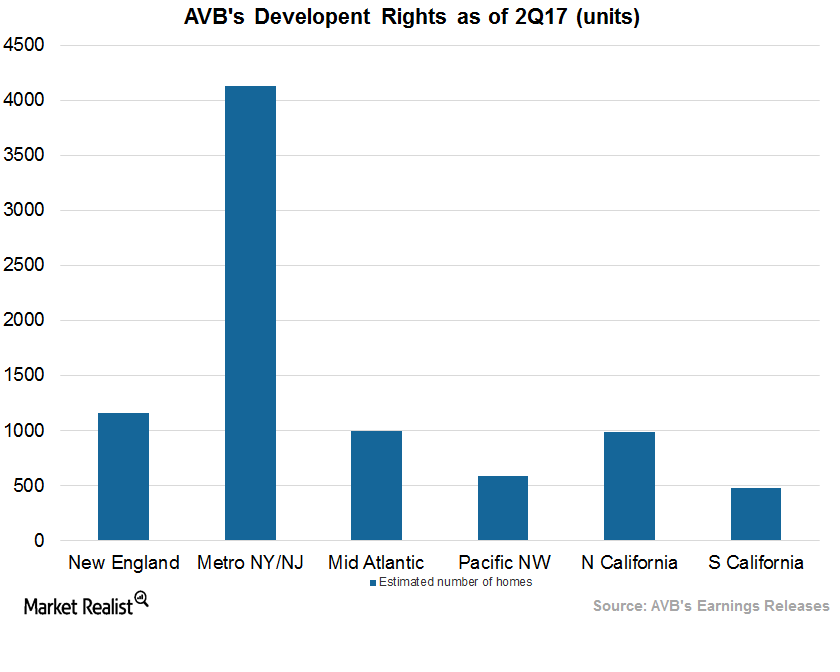

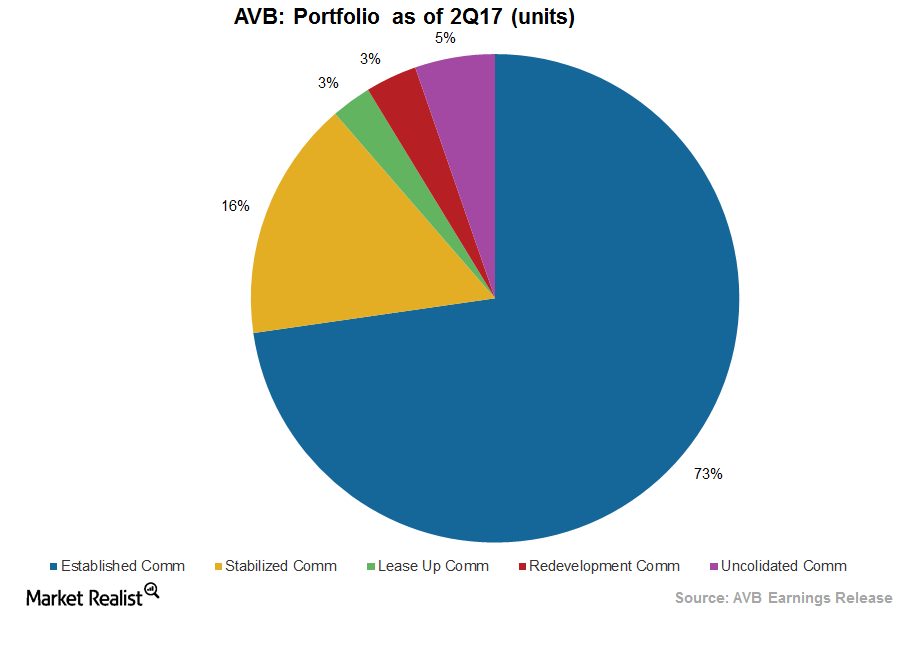

Performance in 2Q17 AvalonBay Communities (AVB) has undertaken several development, redevelopment, and expansion projects to maintain its share in the market. It invested $400 million in new developments during the quarter. REITs such as UDR (UDR), Essex Property Trust (ESS), and Equity Residential (EQR) fund these activities with the help of debt and equity. Therefore, […]

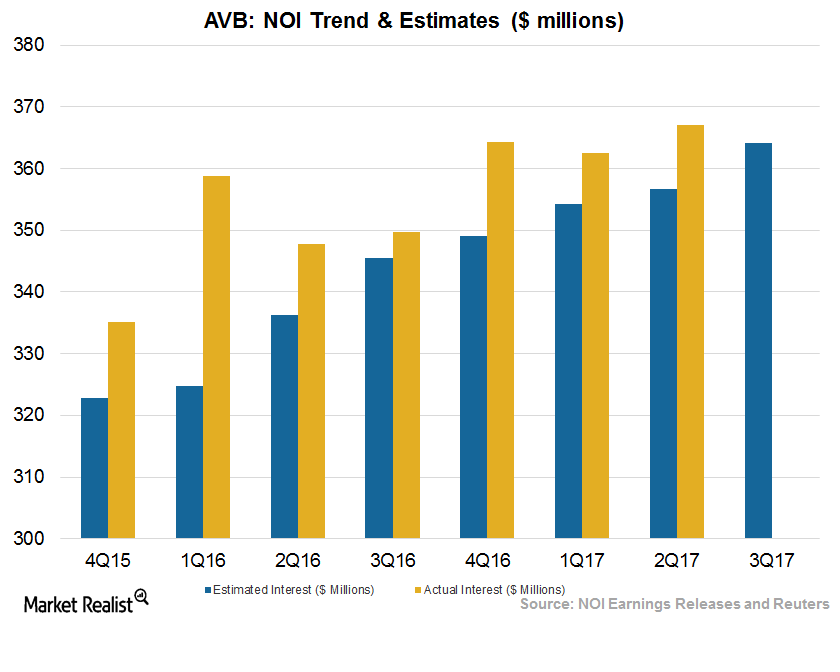

Income Rises in 2Q17, AvalonBay Expects Higher Expenses

Income generated in 2Q17 AvalonBay Communities (AVB) reported NOI (net operating income) of $367.1 million, compared with $339.6 million in 2Q16. The Northern California region reported the highest NOI of $64.6 million, followed by the New York metropolitan area, which reported NOI of $61.5 million. Development and redevelopment communities reported NOI growth of $40.1 million, […]

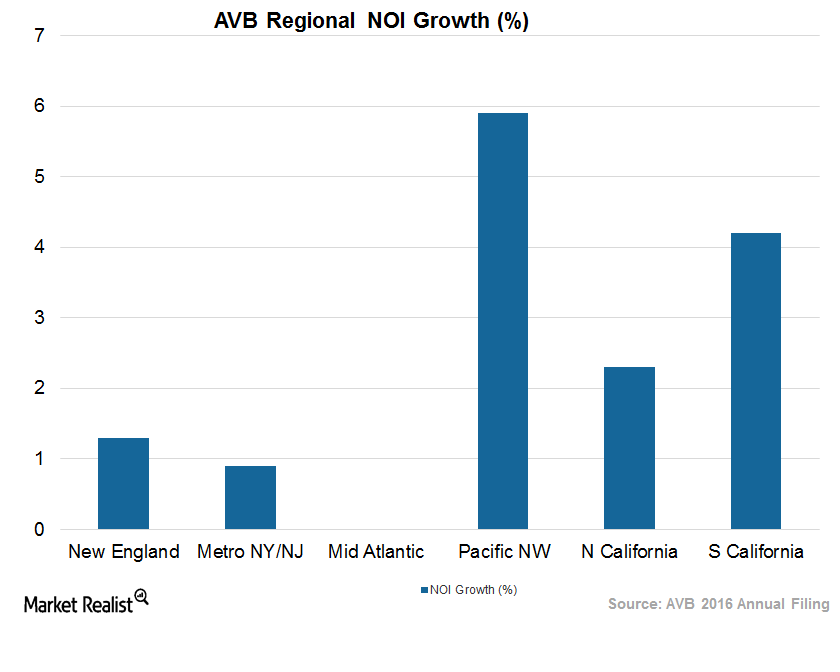

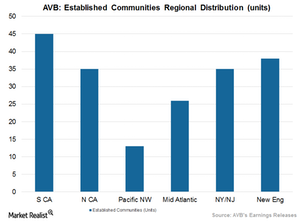

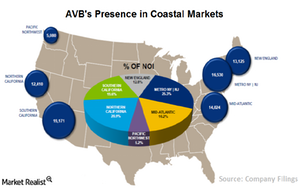

How Geography Affected AvalonBay’s 2Q17 Results

Wide geographical diversity AvalonBay Communities (AVB) has its assets well placed in high-demand Class A cities. These cities have soaring job growth, a high barrier to entry for competitors, and proximity to premium infrastructure. REIT peers UDR (UDR), Equity Residential (EQR), and Essex Property Trust (ESS) are repositioning their properties to Class A cities and […]

AvalonBay Maintains Profit with Strategic Capital Deployment

Demographic shift American demographics are shifting towards Class A cities with high-income growth and demand for residential apartments. These cities offer job prospects and proximity to offices, schools, and other necessities for premium social living. Although these cities also have high barriers to entry, more residential apartment owners are repositioning their properties in these areas. […]

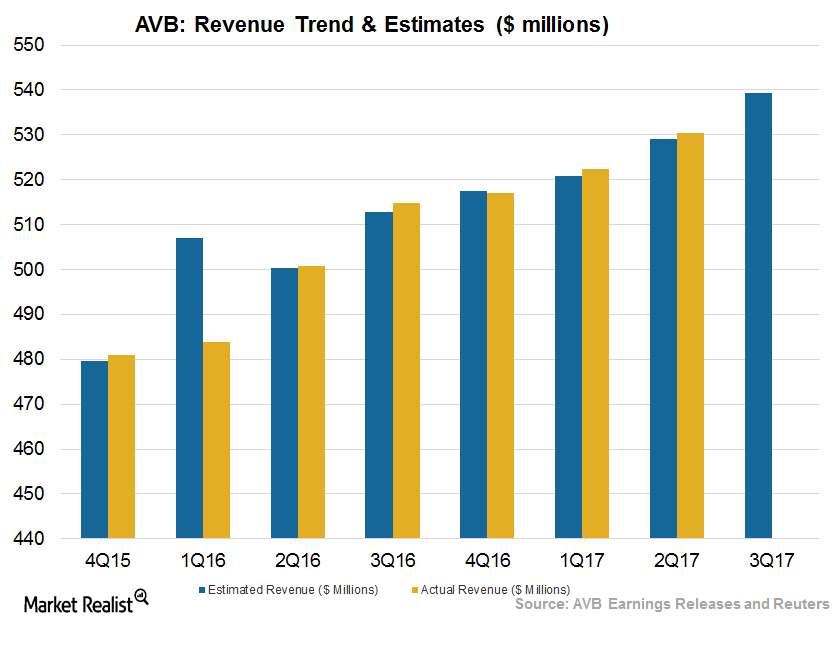

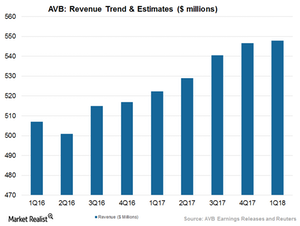

AvalonBay Revenue Climbs in 2Q17, Backed by Rent Growth

Robust 2Q17 driven by rent growth AvalonBay Communities’ (AVB) total revenue of $530.5 million marginally surpassed Wall Street estimates by 0.3%. However, revenue rose by almost 6% from the year prior. Upbeat top-line growth reflected growth in development communities and stabilized operating communities. Same-store revenue rose 2.5% year-over-year. Including revenue from redeveloped communities, same-store revenue […]

What Lies Ahead for AvalonBay

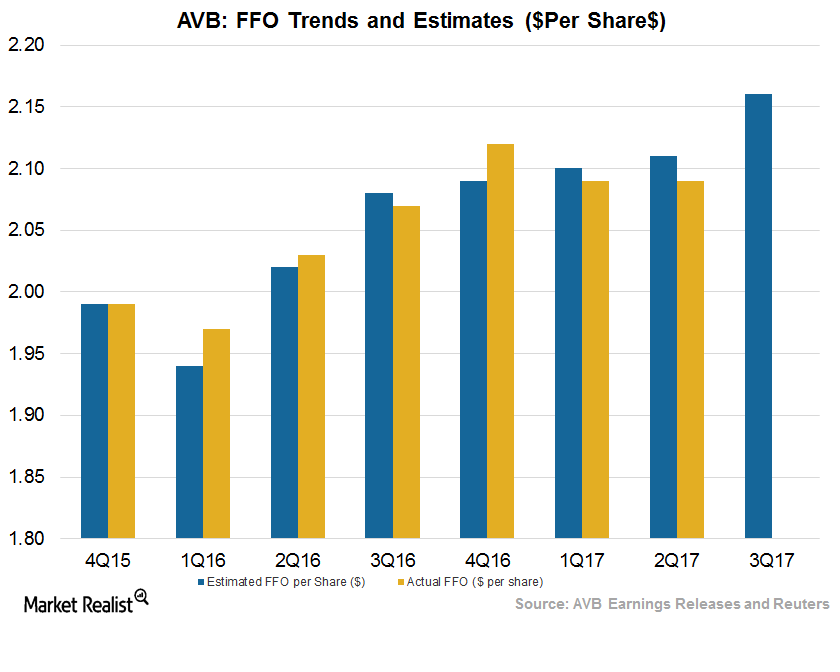

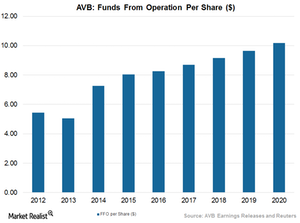

Robust 2Q17 results AvalonBay Communities’ (AVB) top and bottom lines exceeded expectations, backed by higher net operating income growth of 8.1%. Factors affecting profit during 2Q17 Higher occupancy and rent growth in development communities and stabilized operating communities led to upbeat results during the quarter. Higher funds from operations expected for 3Q17 AvalonBay expects […]

Where AvalonBay Stands after Its 2Q17 Earnings Release

AvalonBay Communities (AVB) reported core FFO (funds from operations) of $2.09 per share, in line with Wall Street estimates.

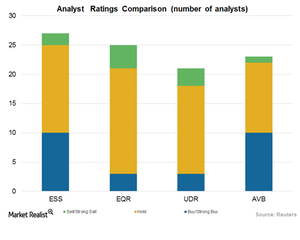

How Does Wall Street Rate Essex Property Trust?

Essex Property Trust’s (ESS) performance expectations in 2017 are reflected in analysts’ ratings for its stock. Analysts have given ESS a mean price target of $257.6.

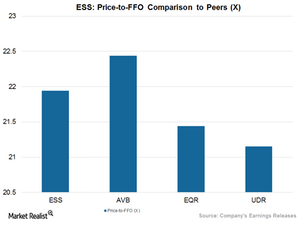

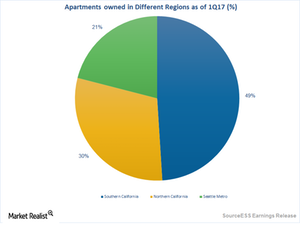

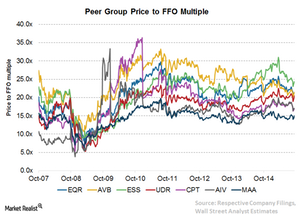

How Essex Property Trust Compares to Other Industry Players

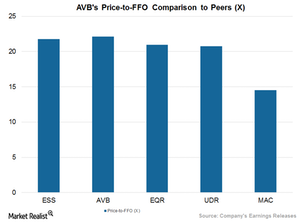

The price-to-FFO (funds from operation) ratio is the most popular method of measuring the relative valuation of real estate investment trusts (or REIT) such as Essex Property Trust.

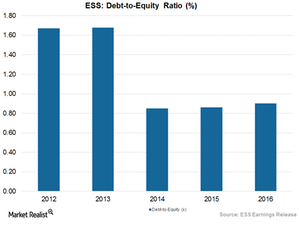

How Well Does Essex Property Manage Its Balance Sheet?

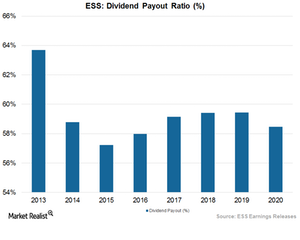

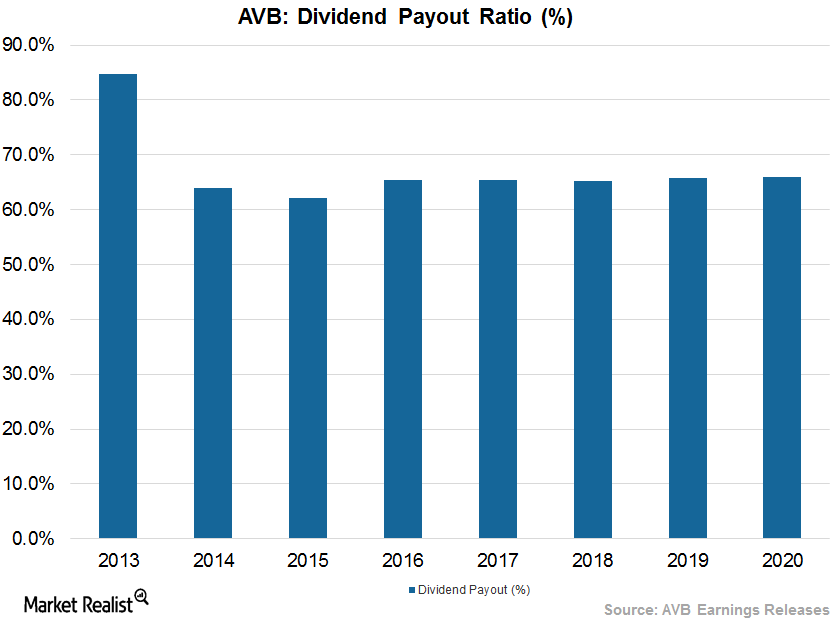

In order to function as real estate investment trusts (or REIT), companies such as Essex Property Trust (ESS) have to pay almost 90% of their taxable income out as dividends.

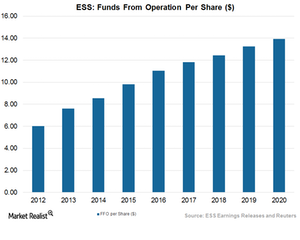

How Well Does Essex Property Return Value to Its Shareholders?

Real estate investment trusts (or REIT) such as Essex Property Trust (ESS) need to pay at least 90% of their taxable incomes as dividends or share buybacks as a prerequisite for functioning as REITs.

Are Trump and the Rate Hike Blessings in Disguise for ESS?

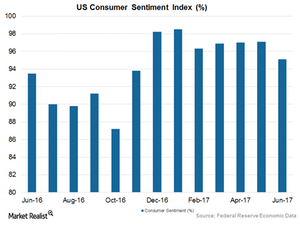

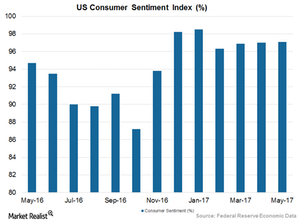

Rising optimism among citizens bodes well for REITs such as Essex Property Trust (ESS) AvalonBay Communities (AVB), Equity Residential (EQR), and UDR (UDR).

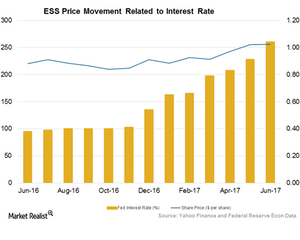

How High Interest Could Affect ESS and Residential REITs

REITs such as Essex Property Trust (ESS) yielded high returns in the long period during which interest rates were below average.

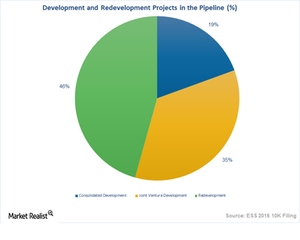

Development Projects Helps Essex Property Combat REIT Headwinds

Amid the shifting residential REIT scenario, Essex Property Trust (ESS) has been able to maintain its dominant position.

Essex Property to See Growth due to Winning Strategies

The current macroeconomic scenario is conducive for growth in the residential REIT (real estate investment trust) sector.

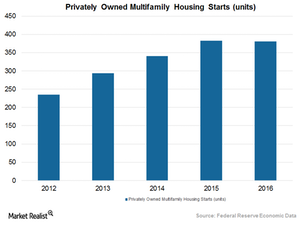

Essex Property and Residential REITs Are Poised to Grow

The home building sector has set itself a course for smooth sailing amid the current favorable economic scenario.

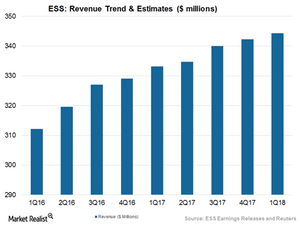

How Essex Property Maintains Its Revenue Growth

A slow and steady improvement in the job market and rising optimism among consumers about their economic welfare has triggered a spike in the construction sector.

Essex Property: An Apartment REIT Standing Strong amid Headwinds

The current economic environment has made investors skeptical about the real estate investment trust (or REIT) industry.

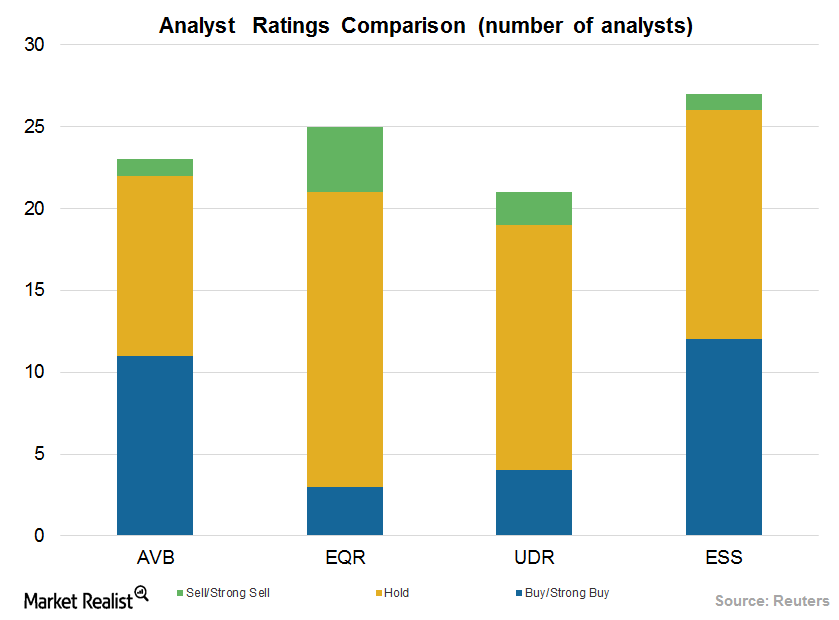

How Wall Street Analysts View AvalonBay Stock

In May 2017, 11 of 23 analysts covering AVB stock issued “buy” or “strong buy” ratings.

AvalonBay—Comparison with Other Retail REITs in Its Industry

Currently, AvalonBay Communities is offering a next-12-month (or NTM) dividend yield of 3%, which is in line with its close competitors.

AvalonBay Communities: A Rewarding Stock for Shareholders

During 2016, AvalonBay Communities (AVB) repurchased 57,172 shares worth $0.6 million.

AvalonBay, Residential REITs Target Headwinds through Diversification

During 1Q17, AvalonBay Communities (AVB) had completed the development of projects worth $650 million at an initially projected yield of 5.6%.

Could Rising Consumer Sentiment Boost REITs Like AVB?

According to the University of Michigan, the consumer sentiment index for May 2017 gained 2.5% year-over-year, standing at 97.1%.

AvalonBay Maintains Revenue Growth amid Industrial Headwinds

AvalonBay’s 1Q17 revenues came in at ~$522.3 million and surpassed estimates by 0.3%.

AvalonBay: Weathering Ups and Downs in Residential REITs

In May 2017, 11 of 23 analysts covering AvalonBay Communities (AVB) stock issued “buy” or “strong buy” ratings. Eleven analysts gave AVB a “hold” rating, and one analyst gave it a “sell” or a “strong sell” rating.

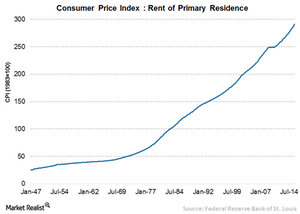

Why Rent Is Going through the Roof

As more and more people seek apartments, rent has also been rising rapidly. In fact, rent has been rising faster than the overall cost of living in the US.

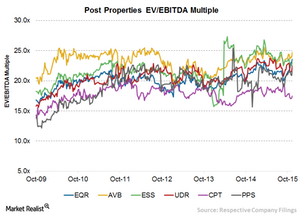

What Post Properties’ Higher-than-Average EV-to-EBITDA Multiple Means

Post Properties’ EV-to-EBITDA ratio is in line with its historical valuation, ranging between 12.2x–25.5x, with a current EV-to-EBITDA ratio of ~21.7x.

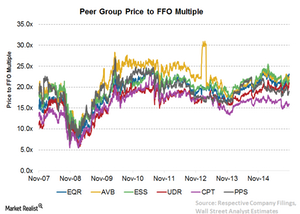

Assessing Post Properties’ Average Price-to-FFO Multiple

Post Properties’ TTM price-to-FFO multiple is in line with its historical valuation at around 18.9x.

A Must-Read Company Overview of Post Properties

Headquartered in Atlanta, Georgia, Post Properties is structured as an REIT and completed its initial public offering in 1993.

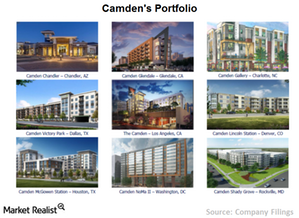

Camden Property Trust: Its History and Its Business

Camden Property Trust (CPT) is the fifth largest apartment REIT in the United States. At the end of fiscal 2014, it had 181 multifamily properties comprised of 63,163 apartment homes.

Why Essex Property Trust Trades at a High Price-to-FFO Multiple

A close look at Essex Property Trust’s trailing-12-month price-to-FFO multiple shows that it’s in line with its historical valuation.

What Are the Major Brands of AvalonBay Communities?

AvalonBay Communities’ brands focus on consumer preference as well as location and price. They help differentiate its apartments from the competition.

An Overview of AvalonBay Communities’ Geographic Coverage

The distribution of properties in attractive US coastal markets reflects AvalonBay Communities’ geographic diversification strategy.

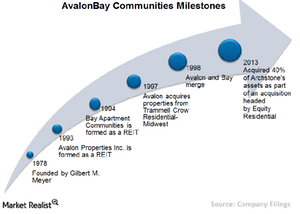

Investing in AvalonBay Communities: A Must-Know Company Overview

AvalonBay Communities is a REIT focused on developing, redeveloping, acquiring, and managing high-quality apartment communities in high barrier-to-entry US markets.