Essex Property and Residential REITs Are Poised to Grow

The home building sector has set itself a course for smooth sailing amid the current favorable economic scenario.

July 7 2017, Updated 5:35 p.m. ET

The home building sector so far in 2017

The home building sector has set itself a course for smooth sailing amid the current favorable economic scenario. Consistent job growth and healthy economic growth have added to homebuilders’ confidence, triggering housing starts.

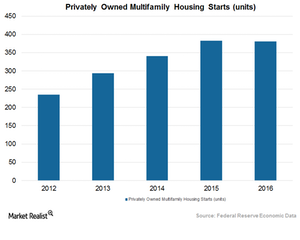

According to the US Department of Housing and Urban Development, housing starts rose 6.1% year-over-year (or YoY) in 2016, backed by a 9% rise in the construction of single-family homes.

Moreover, the moderation of rent growth has helped to increase occupancy in multifamily apartments. Further recent improvements in the job market and higher consumer sentiments are expected to help residential REITs (real estate investment trust) such as Essex Property Trust (ESS), AvalonBay Communities (AVB), Equity Residential (EQR), and UDR (UDR) maintain business momentum in the future.

The iShares Residential Real Estate Capped ETF (REZ) holds a total of ~20% in AvalonBay, Equity Residential, and Essex Property. The ETF has a market cap–weighted index that has a wide product portfolio covering industries such as healthcare, self-storage, and residential REITs. Investors looking to stay risk-averse can look at REZ, which provides them a cushion against volatility.

Supply falls short in Class A cities

There’s been a surge in demand for rented multifamily apartments, especially in Class A cities, which are in high demand due to their proximities to offices, schools, and other social amenities. In these areas, demand for single-family and multifamily homes surpasses supply.

As overall supply isn’t expanding at the same rate as demand, the number of homes available for rent are falling short. Hence, rents are expected to remain high in these apartment markets regardless of ramped-up supply.

Additionally, according to market speculators, the probability of both Baby Boomers and Millennials entering the pool of customers for rented apartments in 2017 is expected to trigger a rise in rented apartment demand.

According to Freddie Mac, ~74.9 million Baby Boomers want larger apartments due to growing family sizes. Also, almost 75.4 million Millennials have reached the stage of life when they’ll leave their parents’ homes and start living independently. Residential REITs such as Essex Property and Equity Residential (EQR) aren’t going to let go of such a favorable opportunity in an economy conducive to their growths.

In the next article, we’ll see how Essex Property maintains its business growth in the residential REIT sector.