REITs Explained: Qualifications and Types of REITs

To qualify as a REIT, a company must have most of its assets and income tied to real estate investment and must pay out almost all of its taxable income to shareholders in the form of dividends. In the U.S., a REIT must meet the following four requirements. The REIT must distribute at least 90% […]

Dec. 21 2016, Updated 9:07 a.m. ET

To qualify as a REIT, a company must have most of its assets and income tied to real estate investment and must pay out almost all of its taxable income to shareholders in the form of dividends. In the U.S., a REIT must meet the following four requirements.

- The REIT must distribute at least 90% of its annual taxable income, excluding capital gains, as dividends to its shareholders.

- The REIT must have at least 75% of its assets invested in real estate, mortgage loans, shares in other REITs, cash or government securities.

- The REIT must derive at least 75% of its gross income from rents, mortgage interest or gains from the sale of real property. Also, at least 95% of gross income must come from these sources combined with dividends, interest and gains from securities sales.

- The REIT must have at least 100 shareholders, and less than 50% of the outstanding shares must be concentrated in the hands of five or fewer shareholders.

There are two main types of REITs: equity REITs, which purchase and manage direct investments in real estate, and mortgage REITs, which purchase loans and other debt instruments collateralized by real estate. A smaller and less-significant category is hybrid REITs, which are a combination of equity and mortgage REITs.

Market Realist’s View

Let’s talk about the two main types of REITs (ICF): equity REITs and mortgage REITs.

Equity REITs (IYR)(SCHH) tend to be real estate companies that acquire commercial properties and lease out the spaces in order to earn rental income. They tend to maintain these properties as part of their portfolio. The objective is usually not immediate resale. Equity REITs (RWR) pay out the majority of their income, after deducting operating expenses, to their shareholders in the form of dividends. Long-term capital appreciation benefits accruing from the sale of these commercial properties also accrue to shareholders in the form of dividends.

Mortgage REITs (REM)(REZ), on the other hand, invest in real estate mortgages and mortgage-backed securities. They extend credit directly by lending money to real estate owners and indirectly by acquiring mortgage loans and mortgage-backed securities. They also distribute the majority of their net income to their shareholders annually. Their revenues accrue mainly from the interest they earn from mortgage loans. They make up ~10% of the overall REITs sector. Equity REITs pretty much dominate the REITs market.

Hybrid REITs combine elements of both equity and mortgage REITs by investing in both commercial properties and mortgages.

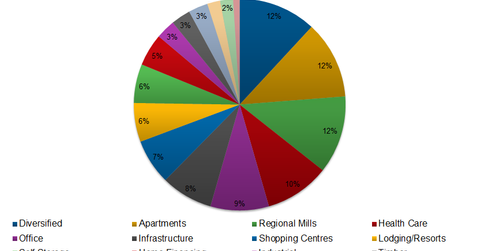

REITs (VNQ) own and manage a wide variety of property types. The graph above shows how almost all property types are represented in the listed REITs universe.