BTC iShares Cohen & Steers REIT ETF

Latest BTC iShares Cohen & Steers REIT ETF News and Updates

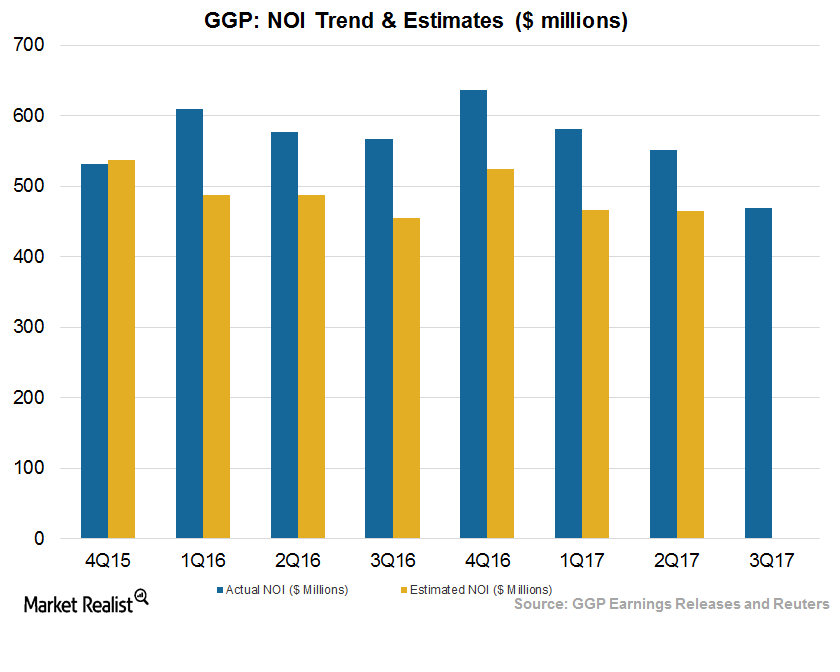

How GGP Managed Its Expenses in 2Q17

In 2Q17, GGP (GGP) reported NOI (net operating income) of $551.0 million, which came in higher than the previous year at $554.0 million.

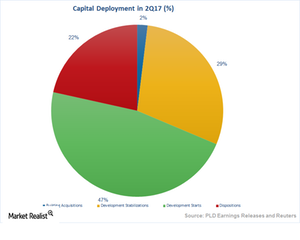

How Prologis Boosted Top-Line Growth in 2Q17

Prologis’s (PLD) upbeat top-line and bottom-line results in 2Q17 were driven by higher-than-expected rent growth and net operating income.

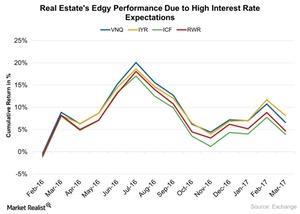

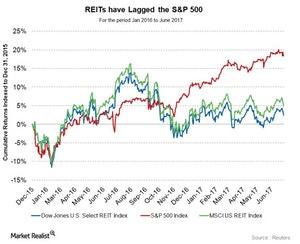

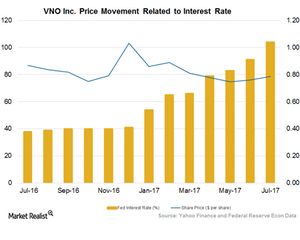

The Real Estate Reaction: Gauging the Impact of the Fed’s Rate Hikes

The rising interest rate is expected to boost the economy in the long run, but it could severely impact sectors like real estate.

Simon Property Group’s Key Business Segments

Simon Property is the only REIT in the S&P 100 Index and has heavy asset concentration on the US east coast and in the central US.

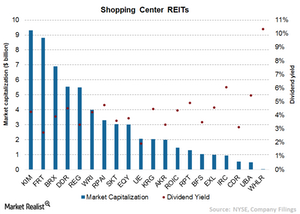

Shopping Center REITs Are Sensitive to Economic Cycles

Shopping center REITs mainly own and operate shopping centers that are smaller than retail malls. They’re mainly driven by higher consumer spending.

What Investors Should Consider before Investing in REITs

A REIT (or real estate investment trust) is a company that owns and manages income-producing real estate.

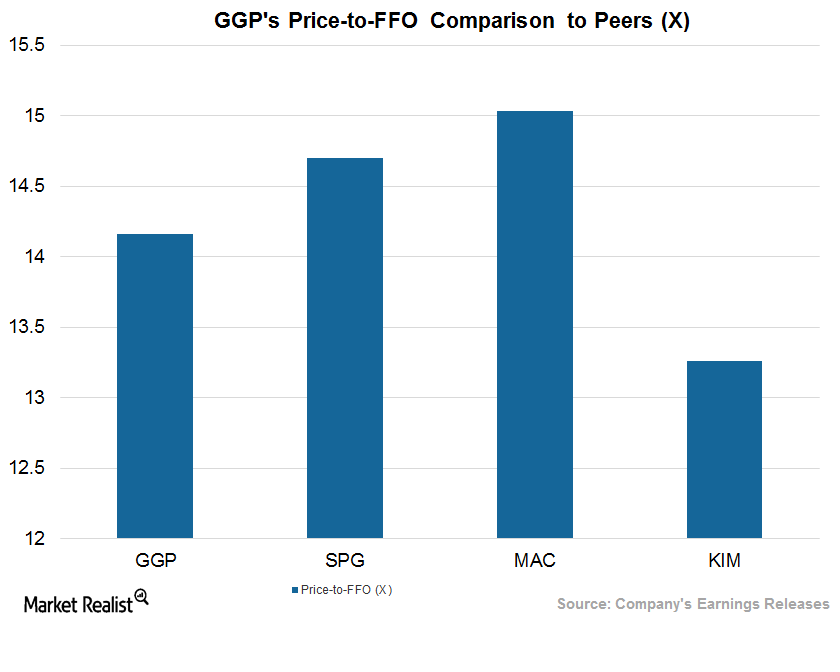

How GGP Stacks Up against Its Peers after 2Q17

GGP’s estimated price-to-FFO multiple for fiscal 2018 is 14.2x, which is at a premium compared to its peers.

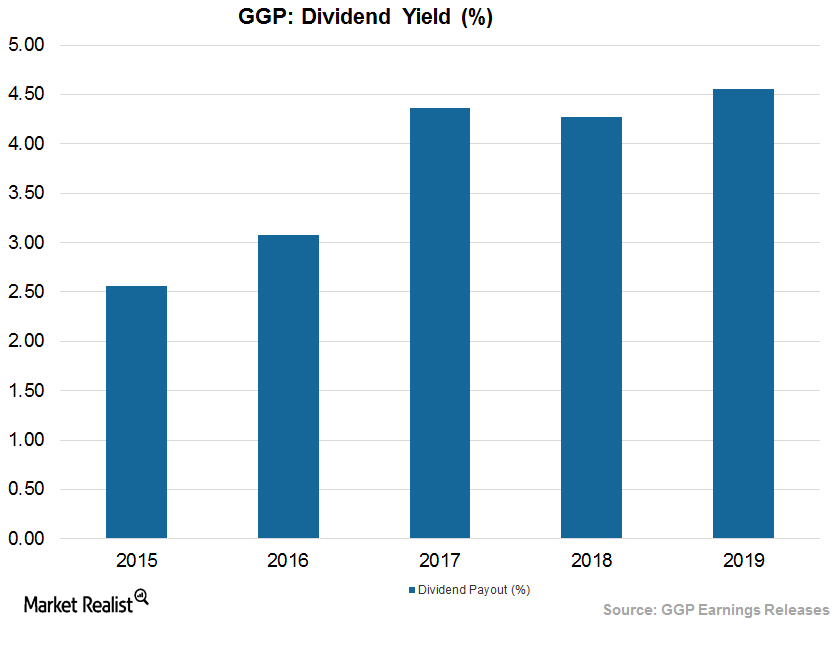

GGP’s Generous Return to Stockholders in 2Q17

In 2Q17, GGP (GGP) paid $17.5 million in dividends to its shareholders. That was higher than $13.3 million paid a year ago.

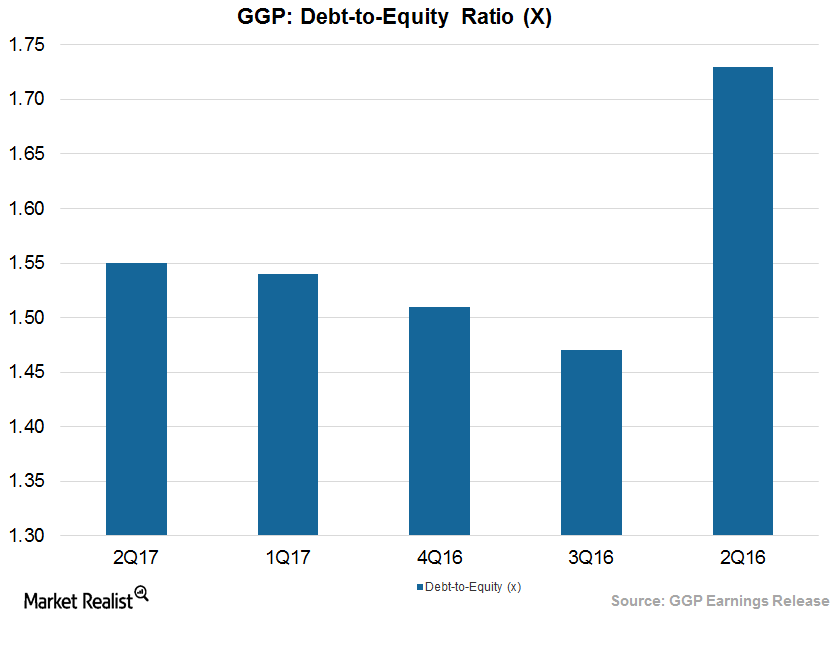

GGP Has High Debt-to-Equity Ratio as of 2Q17: Can It Be Lowered?

GGP maintained a debt-to-equity ratio of 1.55x for 2Q17. That was higher than the industrial mean of 1.07x.

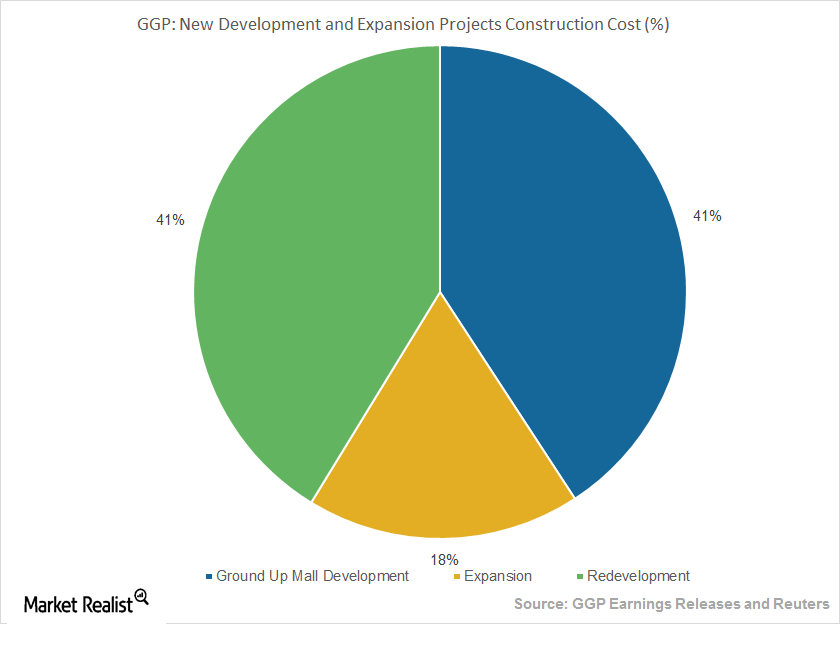

GGP Grew in 2Q17 Due to Development and Redevelopment

GGP has redeveloped its vacant spaces for non-retail uses such as restaurants, entertainment zones, fitness centers, and grocery stores.

What Caused GGP’s Soft Rent Growth in 2Q17?

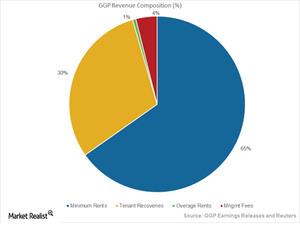

GGP’s (GGP) minimum rent fell by $17.0 million in 2Q17, mainly because of dilution resulting from the sale of an interest in the Fashion Show Mall in Las Vegas n 2016.

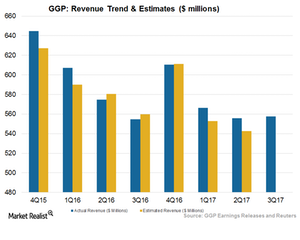

GGP’s Revenue Rode High in 2Q17, Backed by New Leases

GGP’s minimum rent fell 3.9% to $349.2 million, and tenant recoveries fell 4.6% to $161.9 million. Overage rent fell 25.0% to $3.3 million.

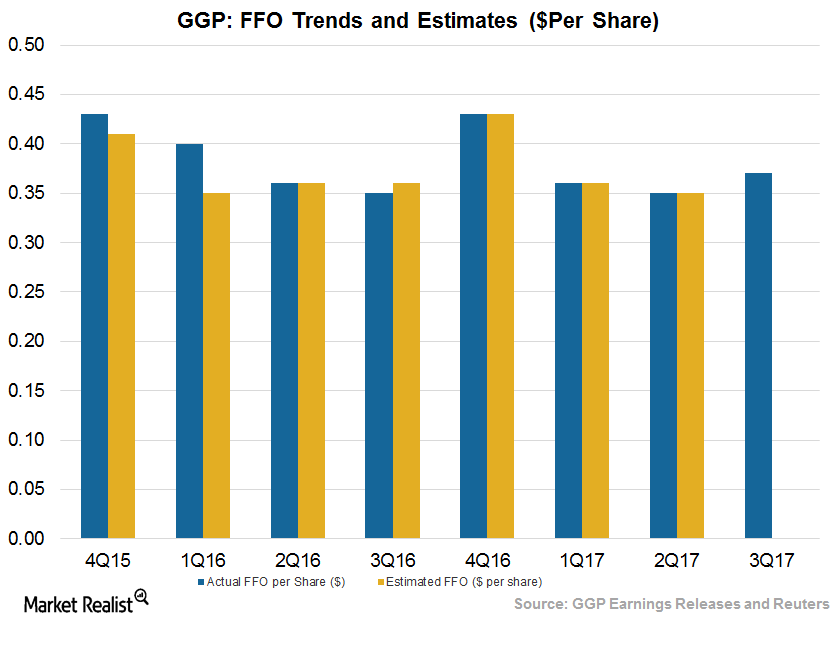

GGP’s 2Q17 Results from an Investor’s Perspective

GGP (GGP) reported funds from operations (or FFO) of $0.35 per share, which was in line with Wall Street estimates. Adjusted FFO remained flat year-over-year.

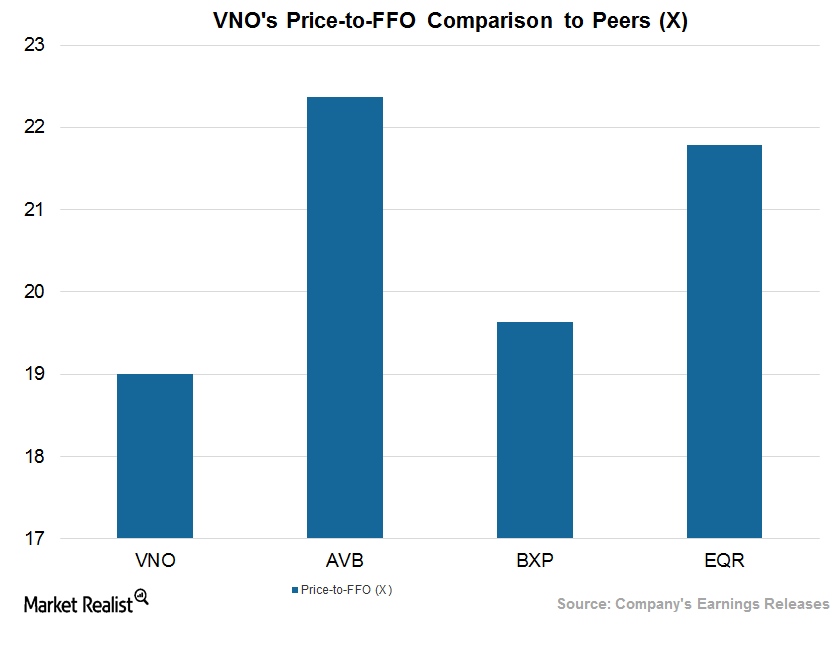

How Vornado Stacks Up against Peers

Vornado’s recent development and redevelopment activities have made investors optimistic about the stock.

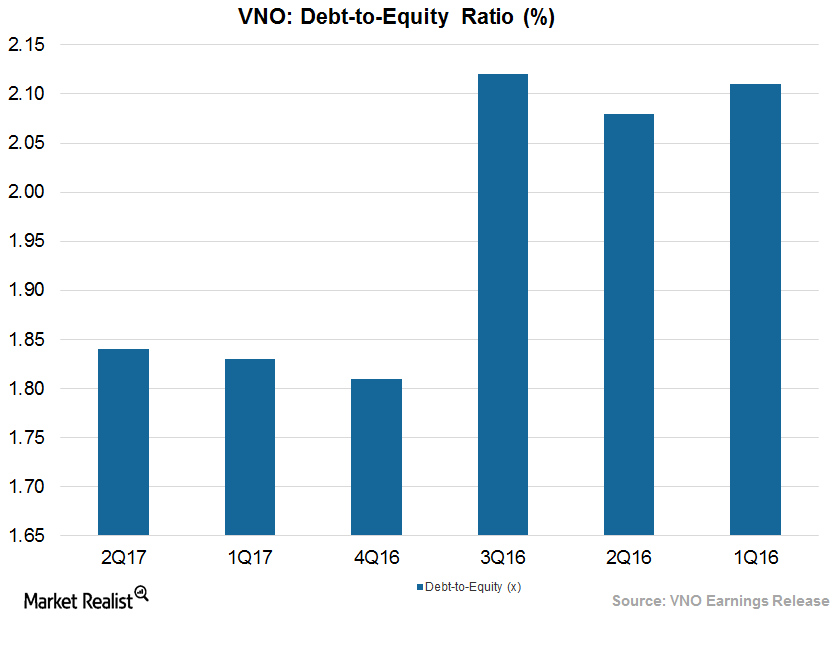

Financing Helped Vornado Maintain Strong Balance Sheet in 2Q17

During 2Q17, Vornado Realty Trust (VNO) reported higher year-over-year top-line and bottom-line results backed by growth in rent and occupancy level.

Did Vornado’s Cost Reduction Efforts Bear Fruit in 2Q17?

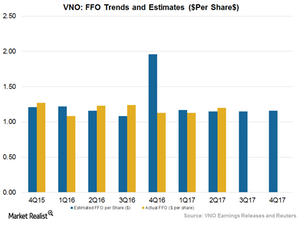

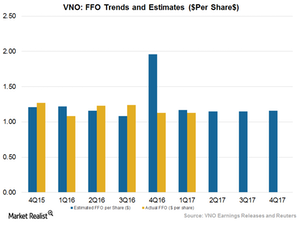

Vornado Realty Trust reported adjusted FFO (funds from operation) of $1.35 per share, which beat Wall Street estimates of $1.20 per share.

How Recent Disposition Activities Helped Vornado in 2Q17

Vornado Trust’s (VNO) top-line and bottom-line results improved year-over-year backed by higher rent growth and lower operational costs.

Project Development Spurred Vornado’s Growth in 2Q17

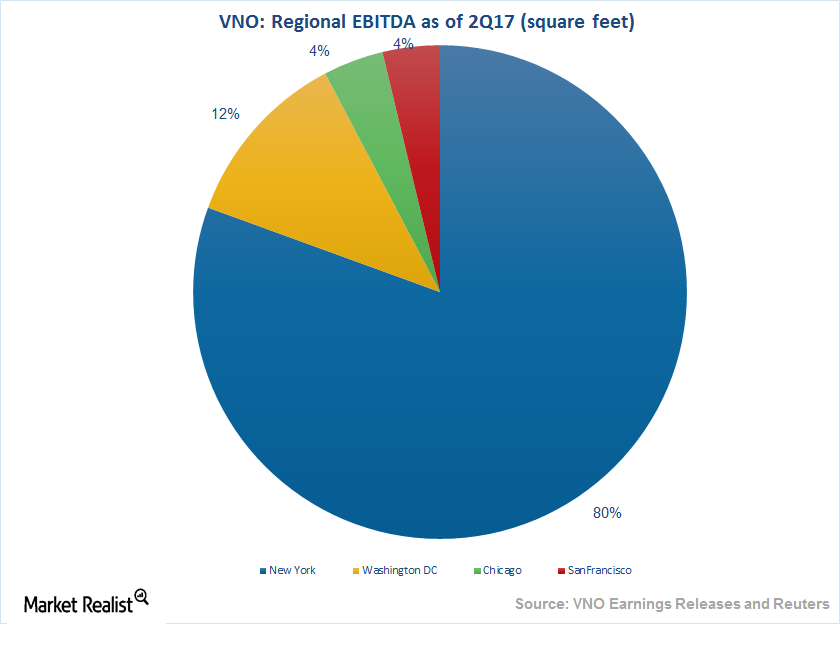

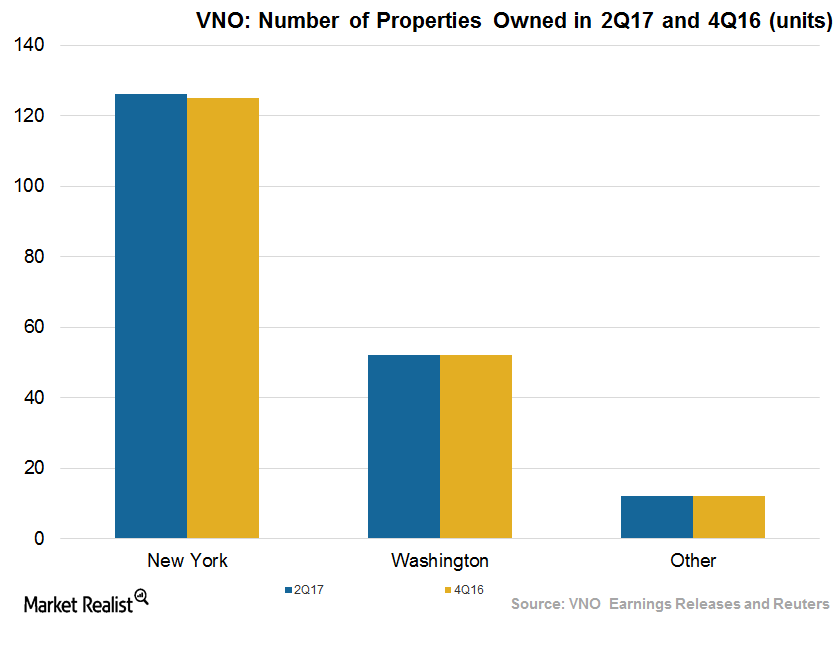

Vornado Realty Trust (VNO) reported decent results in 2Q17. Its top line and bottom line surpassed results from 2Q16 backed by higher rent and new lease activities.

Where Does Vornado Stand after 2Q17 Earnings?

Vornado Realty Trust (VNO) reported core funds from operation (or FFO) of $1.35 per share in 2Q17, which surpassed Wall Street estimates of $1.20 per share.

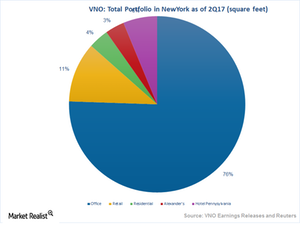

How Vornado’s New York Office Segment Performed in 2Q17

Vornado Realty Trust (VNO) reported higher year-over-year top-line and bottom-line results during 2Q17 backed by higher rent growth, lower costs, and new leases during the quarter.

Vornado’s New Leases Drove Revenue in 2Q17

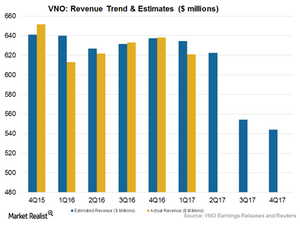

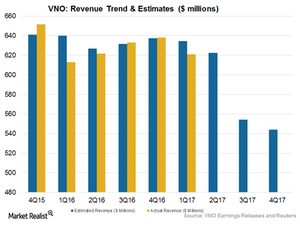

VNO posted rental revenue of $626 million in 2Q17, missing Wall Street’s estimates of $633.2 million.

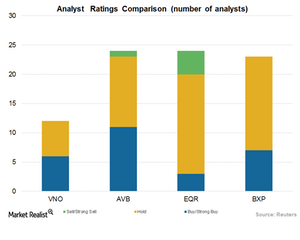

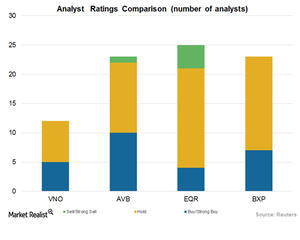

How Wall Street Analysts Rate Vornado

Analysts assigned VNO a mean price target of $89.52, 13.8% higher than its current price level.

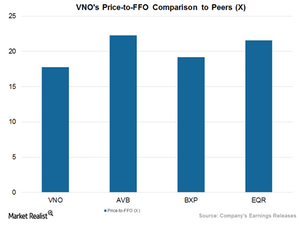

How Vornado Stacks Up against Other Industry Players

VNO’s current price-to-FFO multiple is 17.77x. The company has been able to return value to its shareholders consistently in the form of dividends and share repurchases.

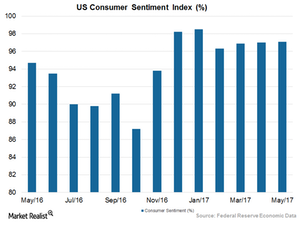

Will Vornado Benefit from a Growing Economy in 2Q17?

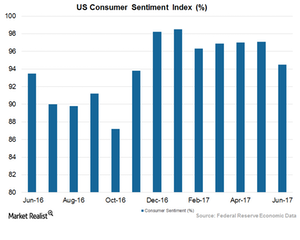

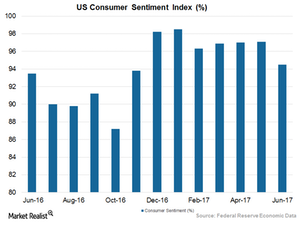

Although Vornado Realty Trust (VNO) may witness lower margins during a higher interest rate environment, it may see significant growth in the near future.

How Macro Issues Could Affect Vornado in 2Q17

Wall Street expects Vornado Realty Trust (VNO) to post flat year-over-year top-line and bottom-line results in 2Q17.

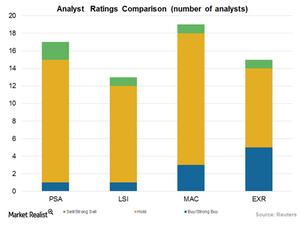

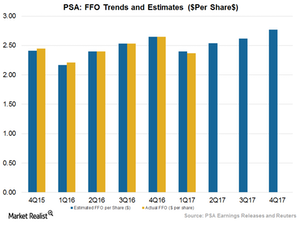

How Analysts View Public Storage

Analysts have assigned PSA a mean price target of $217.67, which is 4.9% higher than its current price level.

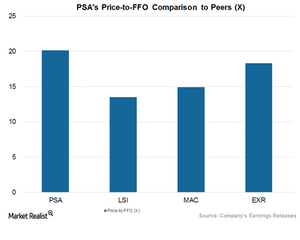

Where Public Storage Stands among Other Major Players

Public Storage has consistently been able to return capital value as well as shareholder returns in the form of dividends and share buybacks.

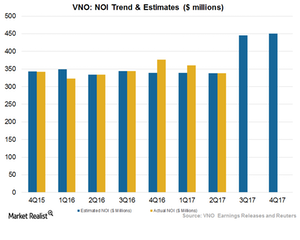

Will Vornado’s Project Streamlining Drive Net Operating Income?

Wall Street analysts expect Vornado Realty Trust (VNO) to report net operating income of $338.1 million in 2Q17.

How Vornado’s Revenue Could Benefit from Strategic Initiatives

Analysts expect Vornado Realty Trust (VNO) to report revenues of $622.3 million for 2Q17 when it releases its earnings on July 31, 2017.

What’s in Store for Vornado’s 2Q17 Earnings?

Vornado Realty Trust (VNO) is scheduled to report its 2Q17 earnings on July 31, 2017.

Public Storage and the Growing US Economy

Public Storage (PSA) is expected to witness a higher cost of debt in 2Q17, mainly due to the Fed’s rate hikes in 2017.

Inside Public Storage’s 2Q17 Battle with Macro Headwinds

Public Storage (PSA) is expected to post flat top-line and bottom-line results in 2Q17.

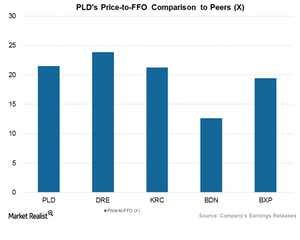

How Prologis Stacks Up against Peers after 2Q17 Earnings

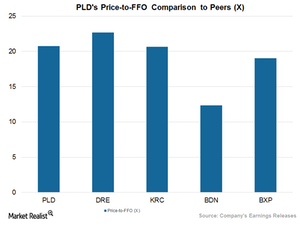

The price-to-FFO multiple is the best way to evaluate Prologis (PLD).

What’s Really Driving Public Storage’s Expected 2Q17 Upbeat Results

Wall Street expects PSA to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.

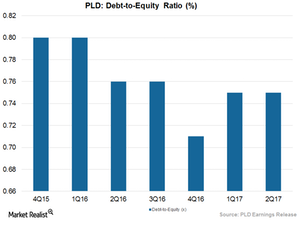

How Prologis Improved Its Balance Sheet

Prologis maintained a debt-to-equity ratio of 0.75x for 2Q17, which was lower than the industrial mean of 1.07x.

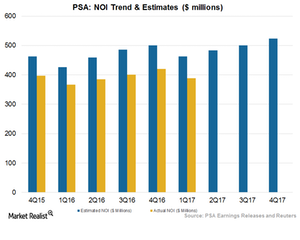

Will Public Storage’s Cost-Reduction Initiatives Drive Higher NOI in 2Q17?

Wall Street analysts expect Public Storage (PSA) to report NOI (net operating income) of $483.7 million for 2Q17.

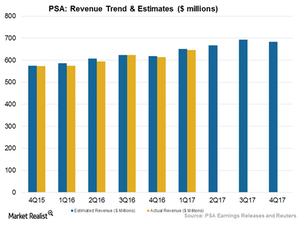

Will Public Storage Ride High on Top Line in 2Q17?

Wall Street expects Public Storage (PSA) to report revenue of $667.9 million for 2Q17. Its earnings call will be on July 27, 2017.

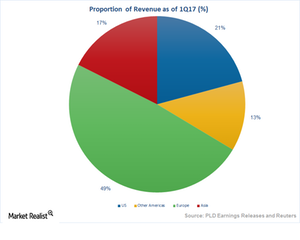

Robust US Business Growth Helped Prologis in 2Q17

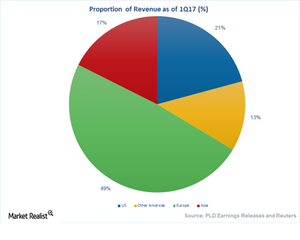

Prologis’s (PLD) properties are spread across the globe. This geographical diversity ensures that the company gets the optimum value from the retail and supply chains in different parts of the world.

What Lies Ahead for Public Storage in 2Q17

Analysts expect PSA to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.

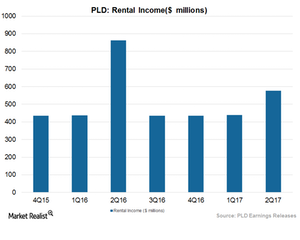

Prologis’s Strong 2Q17 Results Backed by Rent Growth

Prologis (PLD) reported better-than-expected 2Q17 top-line and bottom-line results.

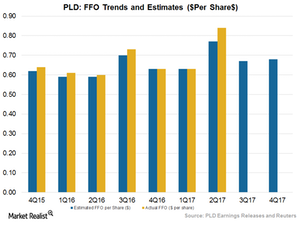

Where Does Prologis Stand after 2Q Earnings?

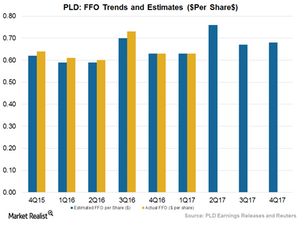

Prologis (PLD) reported core funds from operation (or FFO) of $0.84 per share in 2Q17, which surpassed Wall Street’s estimates of $0.77 by a remarkable 9.1%.

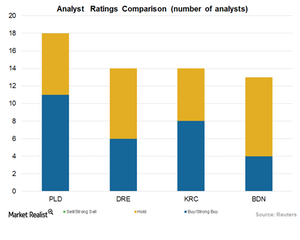

Prologis: What Analysts Recommend for the Stock

Analysts have assigned Prologis stock a mean price target of $58.47, which is 2.1% higher than its current price of $57.28.

Where Does Prologis Stand among Its Peers?

In terms of price-to-FFO multiple, PLD trades at par with most of its peers except Brandywine Realty Trust (BDN).

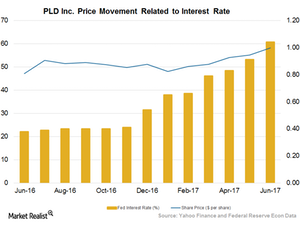

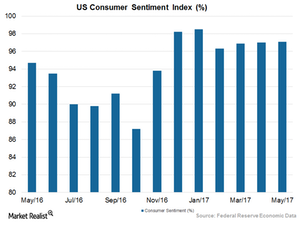

Will Prologis Be Able to Turn Macro Issues to Its Advantage?

In addition to Prologis’s strategic initiatives such as acquisitions, dispositions, and project development activities, several macroeconomic factors also impact performance.

The Factors behind Prologis’s Expected 2Q17 Upbeat Results

Wall Street expects Prologis to report adjusted FFO (funds from operations) of $0.76, a 27.3% rise year-over-year.

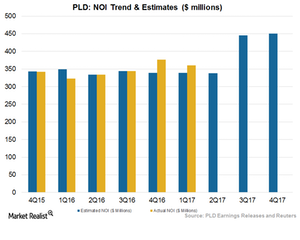

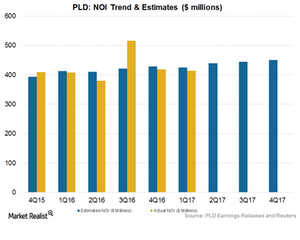

Can Prologis’s Cost Reductions Drive Net Operating Income Higher?

According to Wall Street analysts, Prologis (PLD) is expected to report NOI (net operating income) of $440.2 million in 2Q17.

Prologis’s Main Revenue Drivers in 2Q17

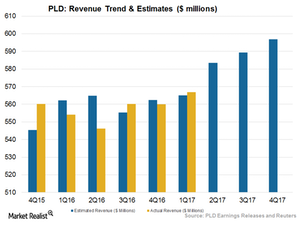

Prologis (PLD) is expected to see higher revenue growth as well as higher margins for 2Q17.

Will Prologis Ride High on Its Top Line in 2Q17?

Analysts expect Prologis (PLD) to report revenue of $583.5 million for 2Q17 when it releases its earnings on July 18, 2017.

What’s in Store for Prologis in 2Q17?

Prologis (PLD) is scheduled to report its fiscal 2Q17 earnings on July 18. 2017. Analysts expect it to report adjusted FFO (funds from operations) of $0.76.

How Wall Street Analysts Rate Vornado Realty Trust

Analysts assigned VNO a mean price target of $108.18, which is 12.9% higher than its current price level.