BTC iShares Cohen & Steers REIT ETF

Latest BTC iShares Cohen & Steers REIT ETF News and Updates

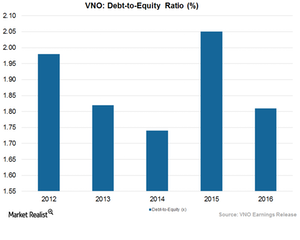

How Well Does Vornado Leverage Its Balance Sheet?

Vornado Realty Trust’s (VNO) total debt-to-total-equity ratio was 153.8%.

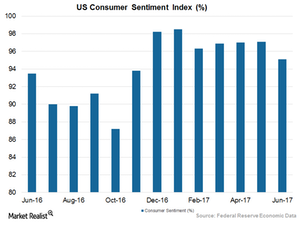

Vornado amid the Economic Transition under President Trump

According to the University of Michigan, the June 2017 consumer sentiment index gained 1.7% year-over-year, standing at 95.1%.

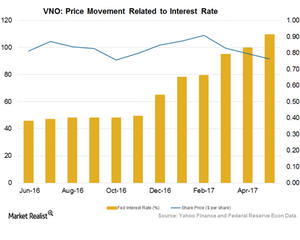

The Fed’s Interest Rate Hike—A Challenge for Vornado Realty Trust

After increasing interest rates in December 2016, the Fed hiked rates in March and June 2017 by 0.25%.

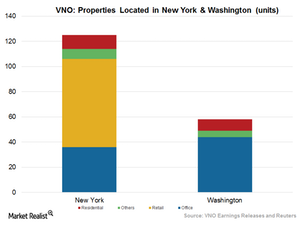

Vornado Realty Trust—Development, Redevelopment, and Occupancy

Vornado Realty Trust (VNO) invested in developing a high-demand office property in Highline at 512 West 22nd Street in Manhattan, which covers 173,000 square feet.

Vornado Realty Trust Works to Streamline Its Operations

Vornado Realty Trust (VNO) disposed of its 32.7% stake in Toys “R” Us and Urban Edge Properties as part of its strategy to concentrate on its core business.

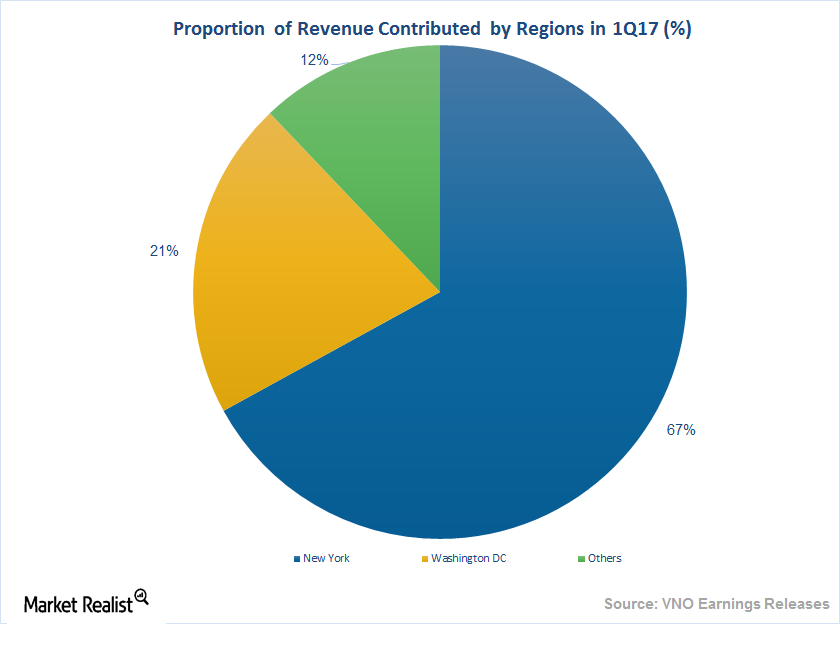

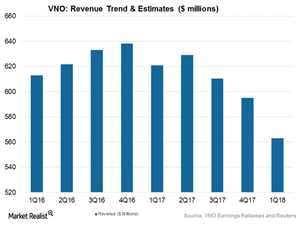

A Look at Vornado’s Top-Line Performance

Vornado Realty Trust (VNO) is in talks to finalize the tax-free spinoff of its business in Washington, D.C. VNO expects to concentrate solely on its New York business after the spinoff.

Vornado Realty: A Commercial REIT Thriving amid a Retail Crisis

Vornado Realty Trust (VNO) is selling off its non-performing assets and focusing on its core business in a move to improve its profitability. Analysts are encouraged by Vornado’s strategy of optimizing its profits.

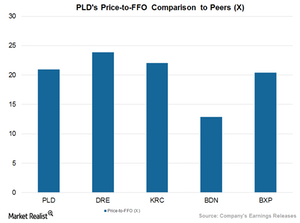

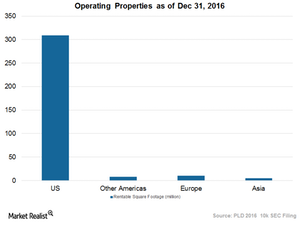

Understanding Prologis’s Multiples Next to Those of Peers

Prologis’s price-to-FFO multiple is now 20.95x, which means that it has been returning consistent capital value and reliable dividend yields to investors.

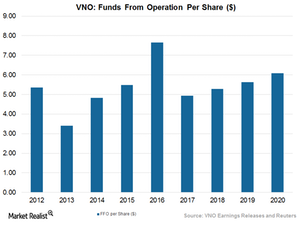

Why Prologis’s Business Model Promises Consistent Profitability

Prologis is expected to achieve a growth rate of 6%, 5.8%, 9.1% and 8.7%, respectively, in AFFO (adjusted funds from operations) over the next four quarters.

Why Look to REITs for Opportunities?

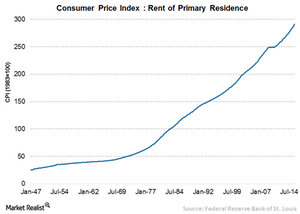

HEDGING AGAINST INFLATION Property stocks and REITs have often been viewed as inflation hedges because expected inflation will affect prices of real estate, and rental income tends to rise along with generalized inflation. However, other factors may mitigate the impact of inflationary forces. Some of these additional factors may include real estate supply and demand […]

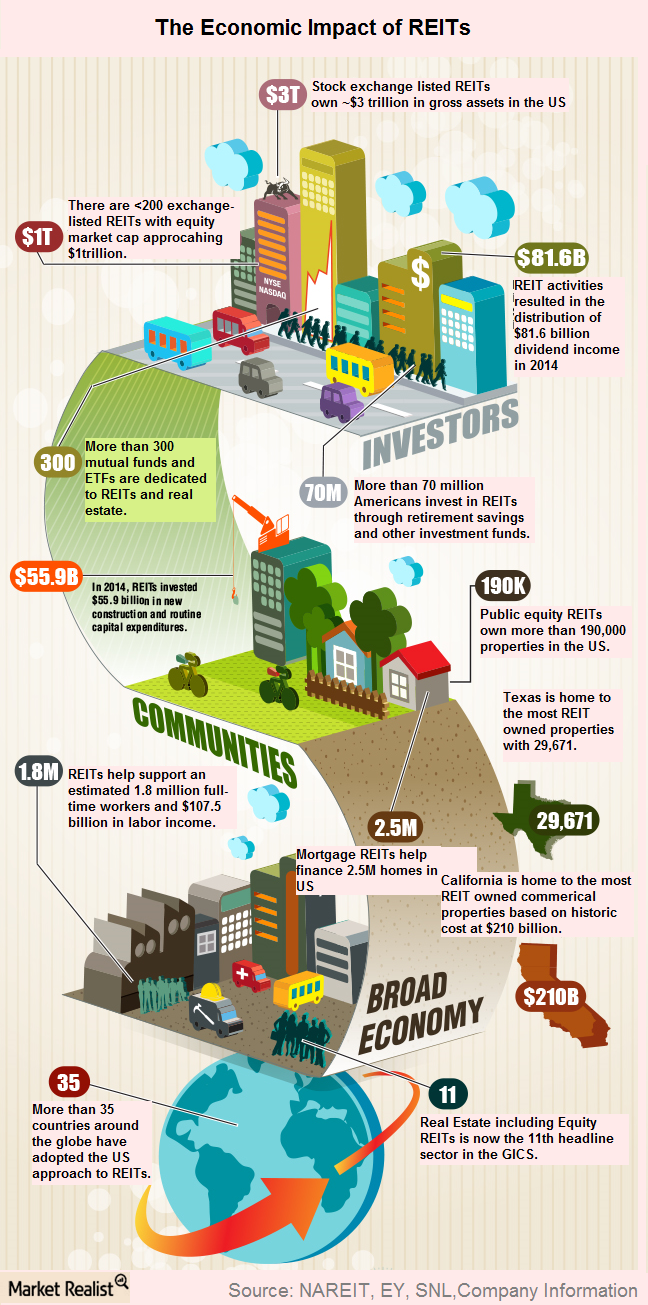

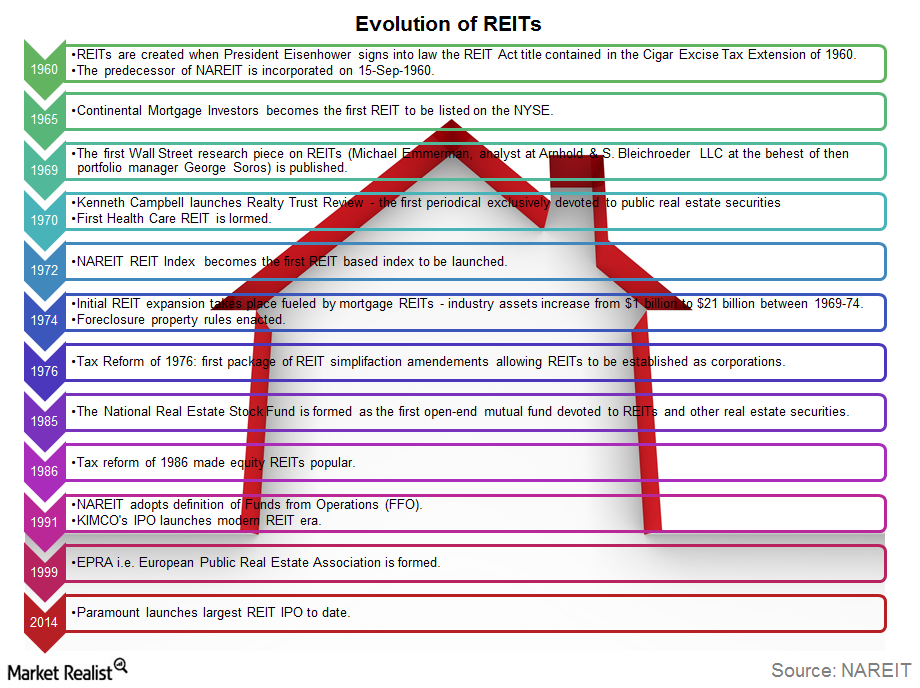

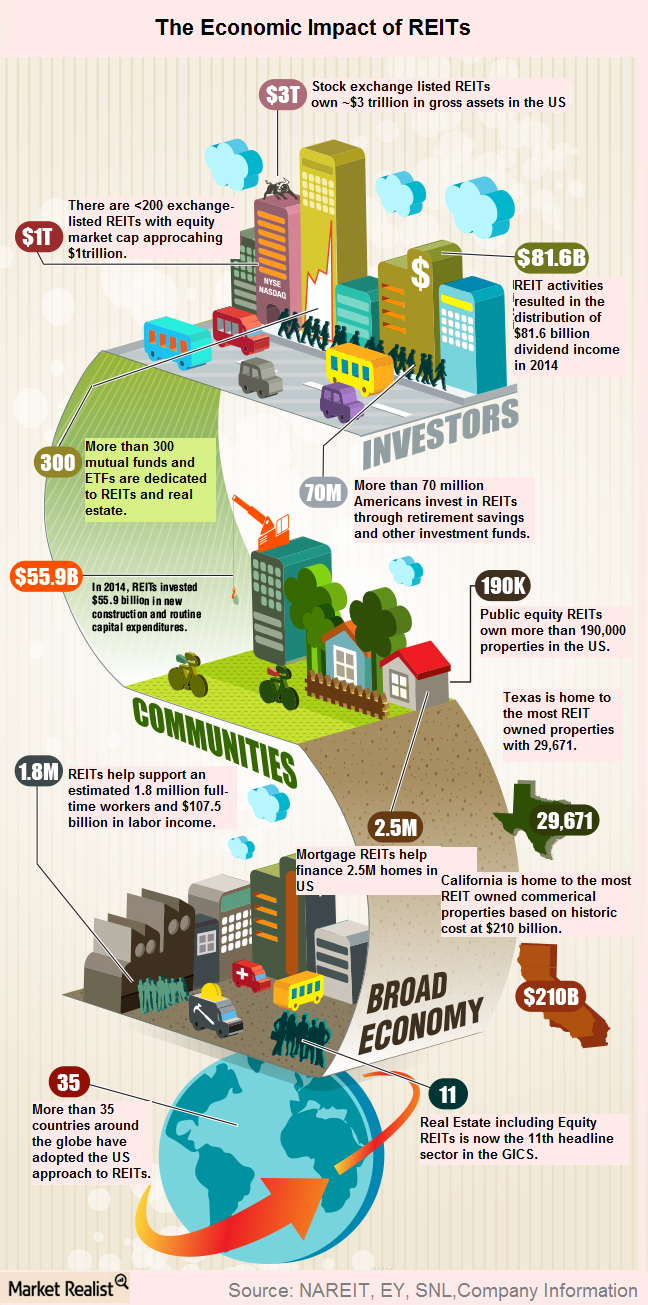

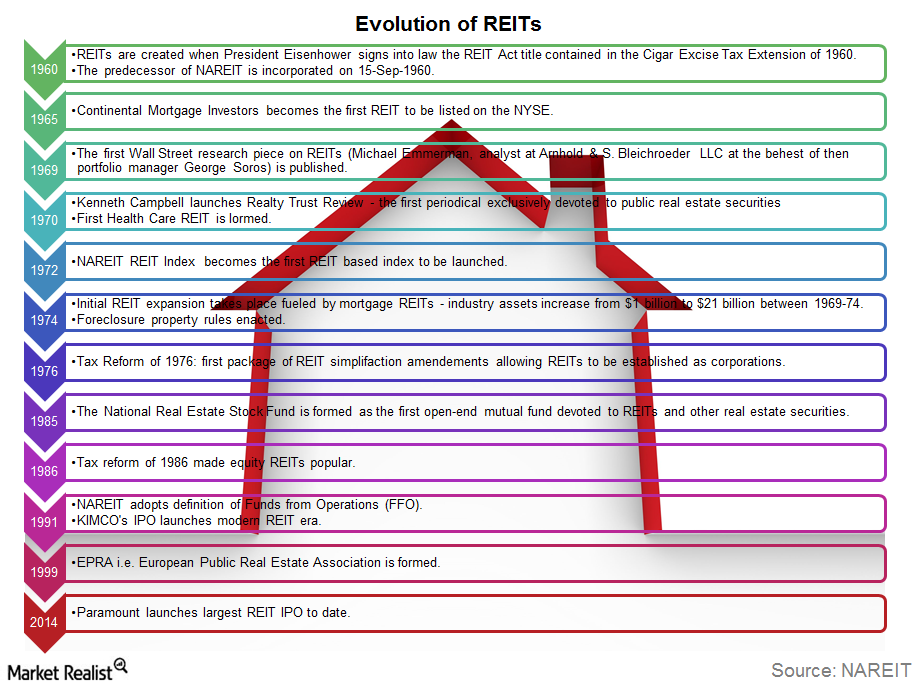

The Evolution of the REIT

The Evolution of REITs The basic concept of REITs originated with the business trusts that were formed in Massachusetts in the mid-19th century, when the wealth created by the industrial revolution led to a demand for real estate investment. The first REIT was set up in 1961, but it took several decades before REITs were […]

Why Look to the REIT Sector for Opportunities?

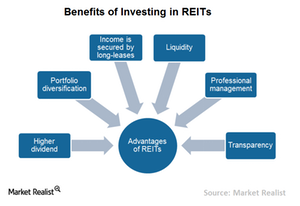

Not only do REITs (RWR)(ICF) help diversify a portfolio, but they also bolster portfolio income with their steady dividends and their long-term capital appreciation.

The Evolution of REITs

The REITs (IYR) sector has shown phenomenal growth over the years. In the past five decades, REITs have grown to a market cap of nearly $1 trillion.

Why Rent Is Going through the Roof

As more and more people seek apartments, rent has also been rising rapidly. In fact, rent has been rising faster than the overall cost of living in the US.

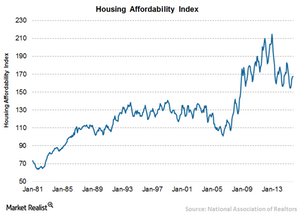

What Are the Factors Driving Housing Affordability?

Housing affordability took a beating in July 2015 after reaching its high in January 2013. The higher ratio of the home affordability index signifies relatively higher home affordability to buyers.

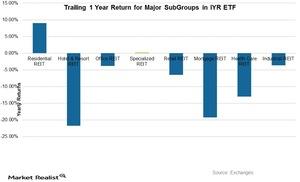

Specialized REITs: The Unsung Heroes

With the growing economy and global investment horizons, investments have shifted beyond the traditional options to specialized REITs.

Kilroy Realty Corporation: What Does it Do?

Kilroy Realty Corporation (KRC) was founded in 1996 by John B. Kilroy Jr.

Camden Property Trust: Its History and Its Business

Camden Property Trust (CPT) is the fifth largest apartment REIT in the United States. At the end of fiscal 2014, it had 181 multifamily properties comprised of 63,163 apartment homes.

Investing in Macerich: a Must-Know Company Overview

Macerich is a self-managed REIT headquartered in Santa Monica, California. The company was founded in New York in 1964.

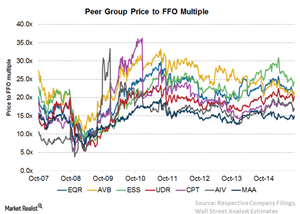

Analyzing Equity Residential’s Higher Price-to-FFO Multiple

The most common way to calculate the relative value of a REIT like Equity Residential (EQR) is the price-to-FFO (funds from operations) multiple.

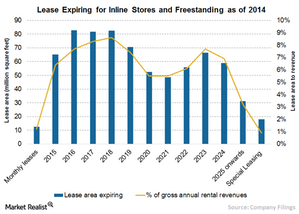

Simon Property Group’s Lease Length Exposure

Only 1.2% of Simon Property’s gross annual revenues from inline or freestanding stores comes from month-to-month leases. 6.5% of leases will expire in 2015.

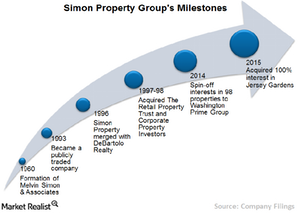

Simon Property Group’s Acquisition Growth Strategy

Simon Property has a strong track record of aggressive acquisitions. Since its IPO in 1993, the company has completed acquisitions worth $40 billion.

Simon Property Group’s Retail Mall Business

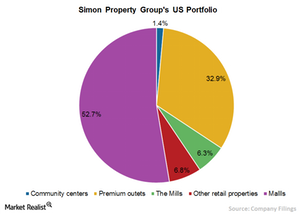

Simon Property’s US properties consist of malls, premium outlets, community centers, and retail properties that make up ~182 million square feet of GLA.

Introducing Simon Property Group: A Must-Know Company Overview

Headquartered in Indianapolis, Simon Property Group formed in 1993 when the shopping center division of Melvin Simon & Associates became publicly-traded.

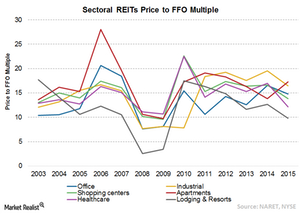

Most of the REITs Are Trading near Historic Multiples

The most common way of calculating the relative value of a REIT is the price-to-FFO multiple. FFO is widely used because it’s the main earnings metric for REITs.

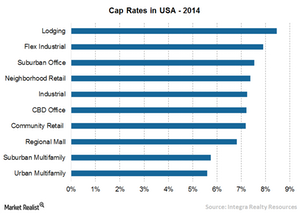

Why Are Capitalization Rates Important for Investors?

The capitalization rate, or cap rate, is an important concept in the commercial real estate industry. It’s defined as an initial yield on a real estate investment.

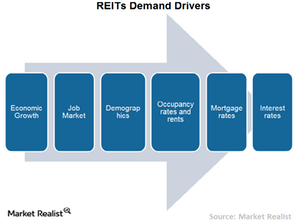

What Factors Drive REIT Earnings?

Economic growth is the major factor that determines REITs’ growth. An uptick in economic fundamentals positively affects the REITs by increasing business growth.

What Are the Different Types of REITs?

There are three types of REITs—equity REITs, mortgage REITs, and hybrid REITs. Mortgage REITs lend money to landlords and their operators to purchase a property.

Advantages and Disadvantages of Investing in REITs

Every investment comes with certain advantages and disadvantages. REITs are no exception. There are benefits and risks associated with investing in REITs.

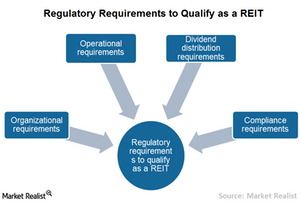

What Are the Regulatory Requirements to Qualify as a REIT?

To qualify as a REIT, a company must make REIT election by filing a Form 1120-REIT with the IRS. This is essential to reduce or eliminate corporate tax.