SPDR® Dow Jones REIT ETF

Latest SPDR® Dow Jones REIT ETF News and Updates

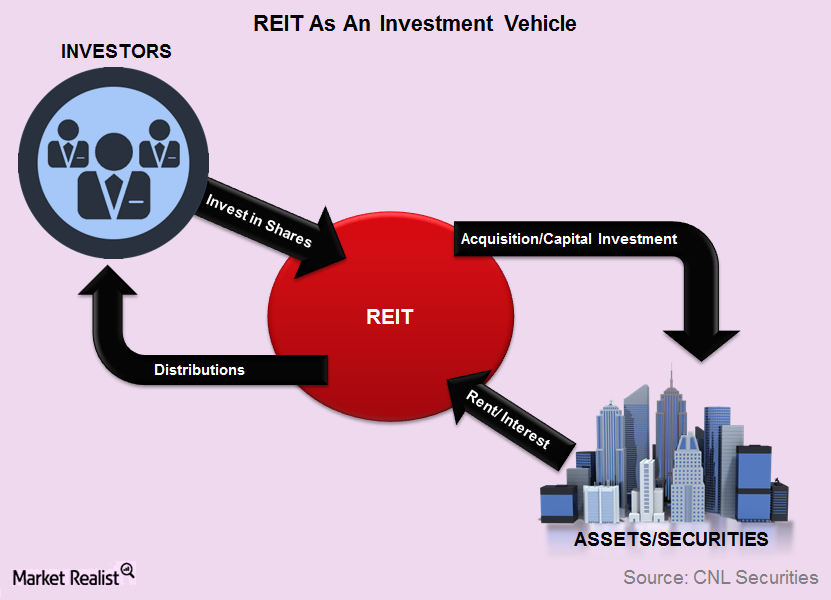

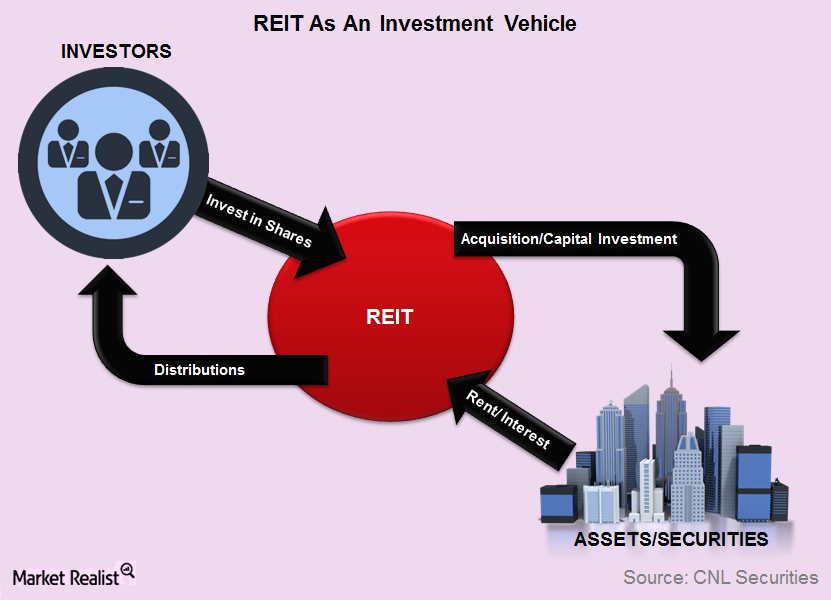

REITs 101: Understanding this Investment Vehicle

In this series, we’ll get down to the brass tacks of investing in the REIT sector, the market’s current landscape, and the benefits you can expect from this type of investment.

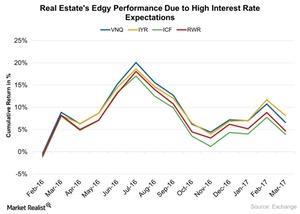

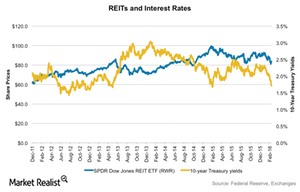

The Real Estate Reaction: Gauging the Impact of the Fed’s Rate Hikes

The rising interest rate is expected to boost the economy in the long run, but it could severely impact sectors like real estate.

REITs 101: Understanding this Vehicle

By Michael Orzano, Director, Global Equity Indices Publicly traded property stocks, including real estate investment trusts (or REITs) and real estate operating companies (or REOCs), allow investors to gain exposure to real estate, which is generally an illiquid asset class, without sacrificing the liquidity benefits of listed equities. They also typically offer higher yields than […]

What Investors Should Consider before Investing in REITs

A REIT (or real estate investment trust) is a company that owns and manages income-producing real estate.

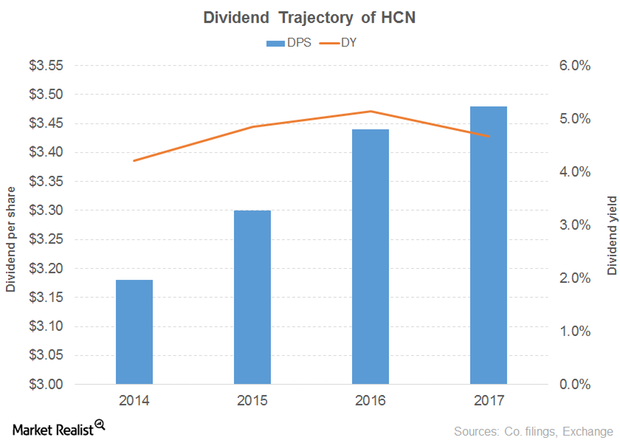

Welltower’s Dividend Yield Falls despite Higher Dividend

Revenue and earnings In this part, we’ll look at Welltower (HCN), a US healthcare REIT. Welltower’s revenue growth slowed from 15% in 2015 to 11% in 2016. The growth was driven by all of its segments, through rental income, resident fees and services, interest income, and other income. Its operating costs and other expenses (including interest expenses) […]

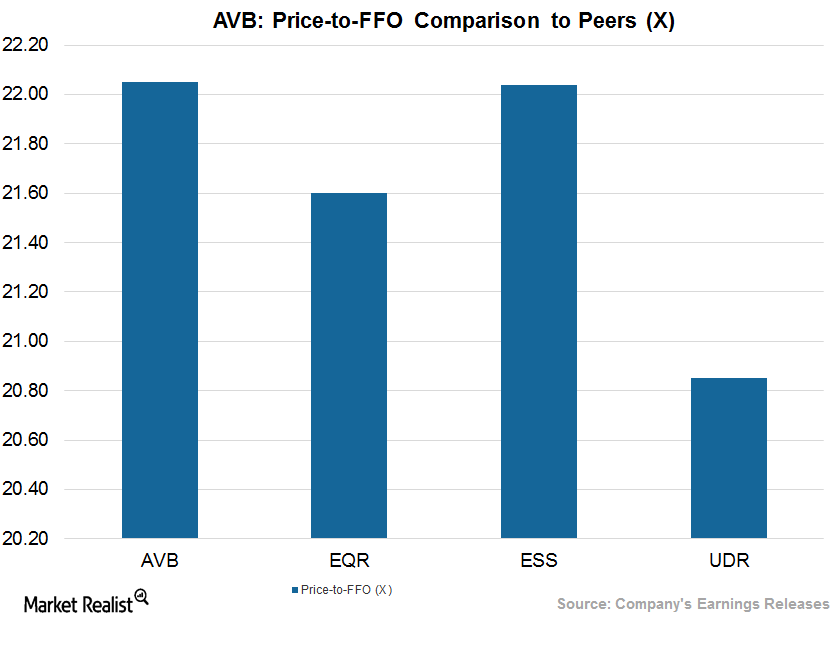

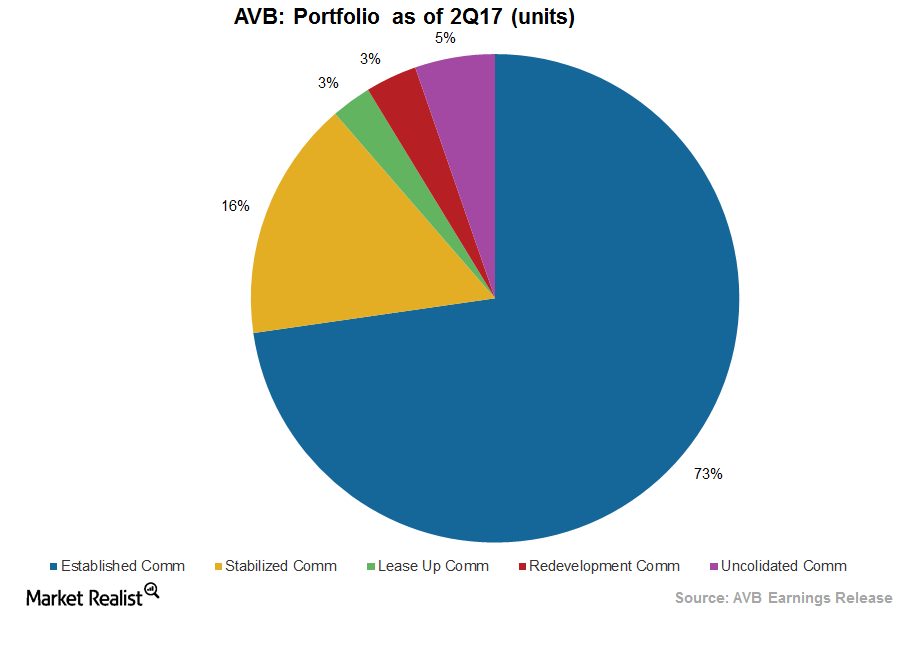

How AvalonBay Compares after 2Q17

Price-to-funds from operations multiple AvalonBay Communities’ (AVB) performance in 2Q17 can be best evaluated by looking at its price-to-FFO (funds from operations) multiple. The multiple, widely used for REITs, gives an idea of how much an investor pays for a particular stock per unit of its profit. The multiple, which has the same implications as the price-to-earnings […]

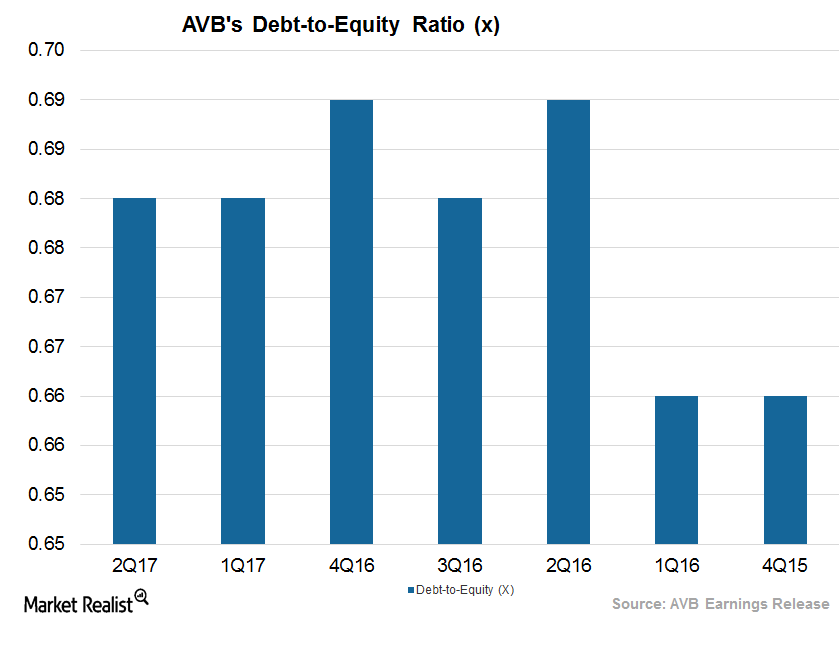

Financing Activities Leverage AvalonBay’s Balance Sheet in 2Q17

Performance in 2Q17 AvalonBay Communities (AVB) has undertaken several development, redevelopment, and expansion projects to maintain its share in the market. It invested $400 million in new developments during the quarter. REITs such as UDR (UDR), Essex Property Trust (ESS), and Equity Residential (EQR) fund these activities with the help of debt and equity. Therefore, […]

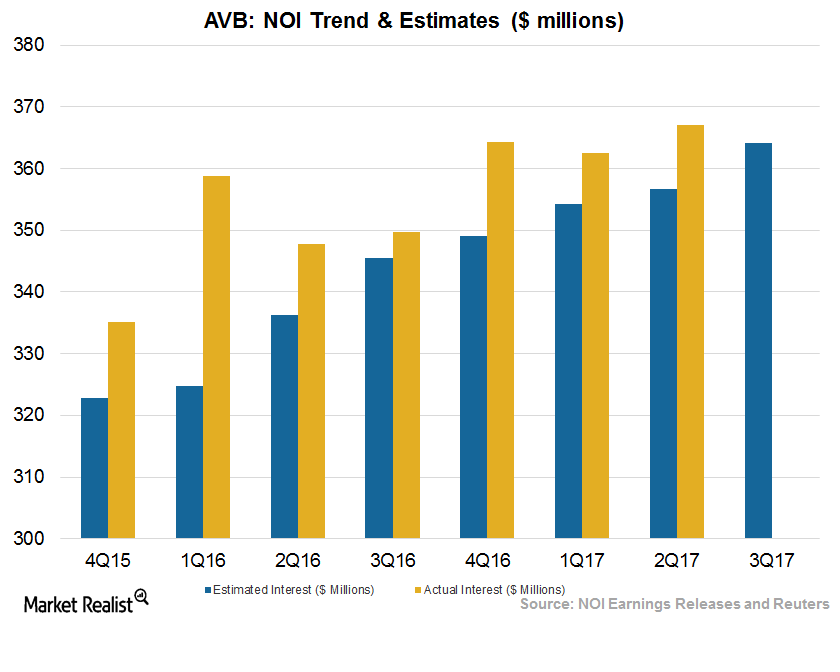

Income Rises in 2Q17, AvalonBay Expects Higher Expenses

Income generated in 2Q17 AvalonBay Communities (AVB) reported NOI (net operating income) of $367.1 million, compared with $339.6 million in 2Q16. The Northern California region reported the highest NOI of $64.6 million, followed by the New York metropolitan area, which reported NOI of $61.5 million. Development and redevelopment communities reported NOI growth of $40.1 million, […]

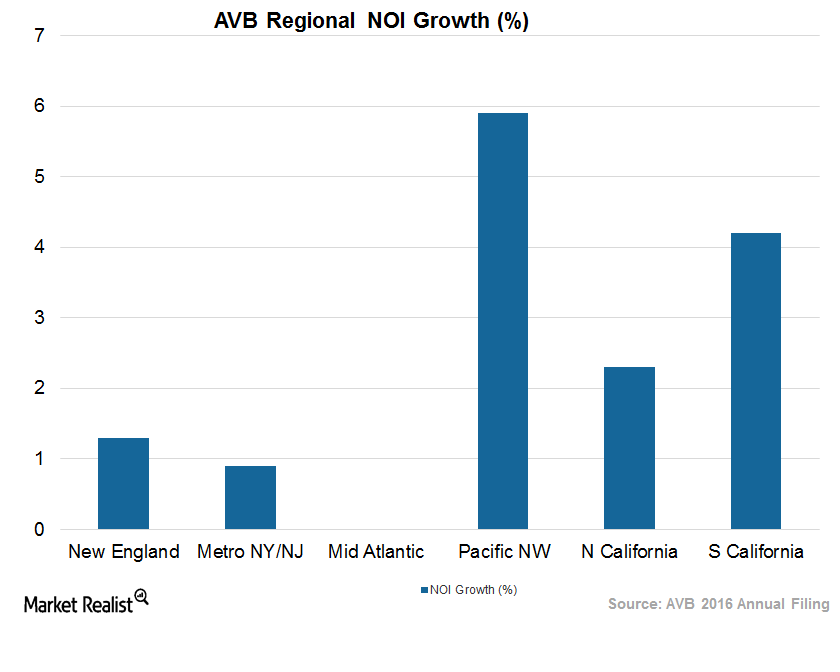

How Geography Affected AvalonBay’s 2Q17 Results

Wide geographical diversity AvalonBay Communities (AVB) has its assets well placed in high-demand Class A cities. These cities have soaring job growth, a high barrier to entry for competitors, and proximity to premium infrastructure. REIT peers UDR (UDR), Equity Residential (EQR), and Essex Property Trust (ESS) are repositioning their properties to Class A cities and […]

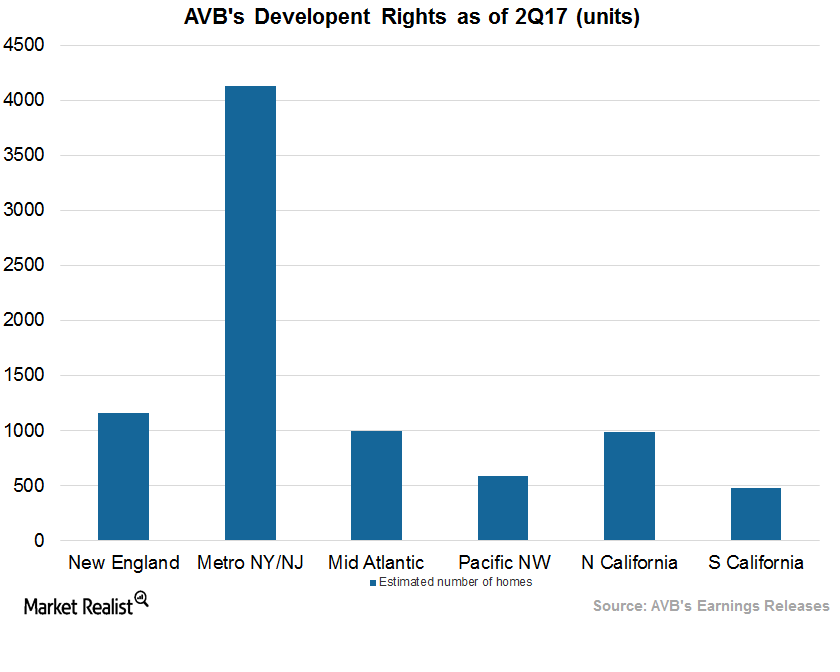

AvalonBay Maintains Profit with Strategic Capital Deployment

Demographic shift American demographics are shifting towards Class A cities with high-income growth and demand for residential apartments. These cities offer job prospects and proximity to offices, schools, and other necessities for premium social living. Although these cities also have high barriers to entry, more residential apartment owners are repositioning their properties in these areas. […]

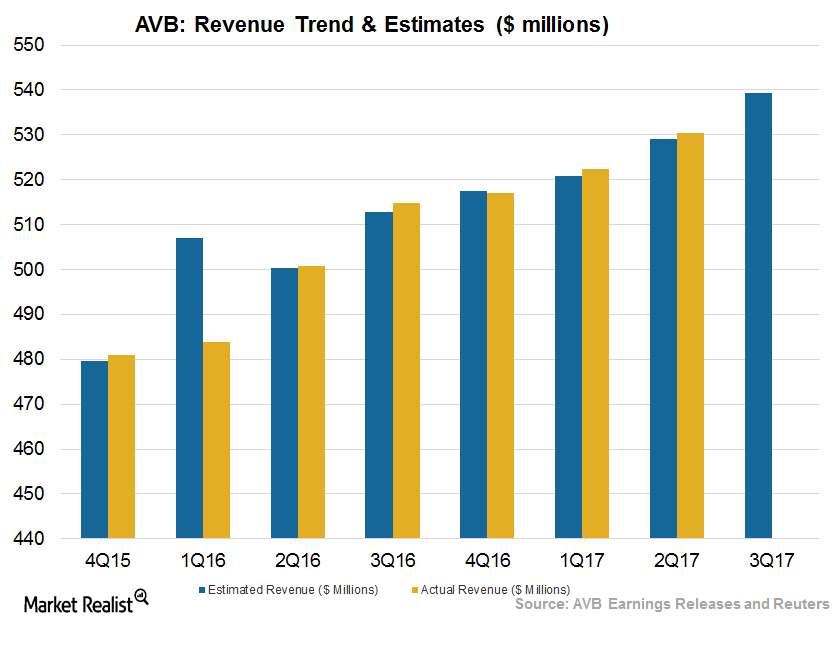

AvalonBay Revenue Climbs in 2Q17, Backed by Rent Growth

Robust 2Q17 driven by rent growth AvalonBay Communities’ (AVB) total revenue of $530.5 million marginally surpassed Wall Street estimates by 0.3%. However, revenue rose by almost 6% from the year prior. Upbeat top-line growth reflected growth in development communities and stabilized operating communities. Same-store revenue rose 2.5% year-over-year. Including revenue from redeveloped communities, same-store revenue […]

What Lies Ahead for AvalonBay

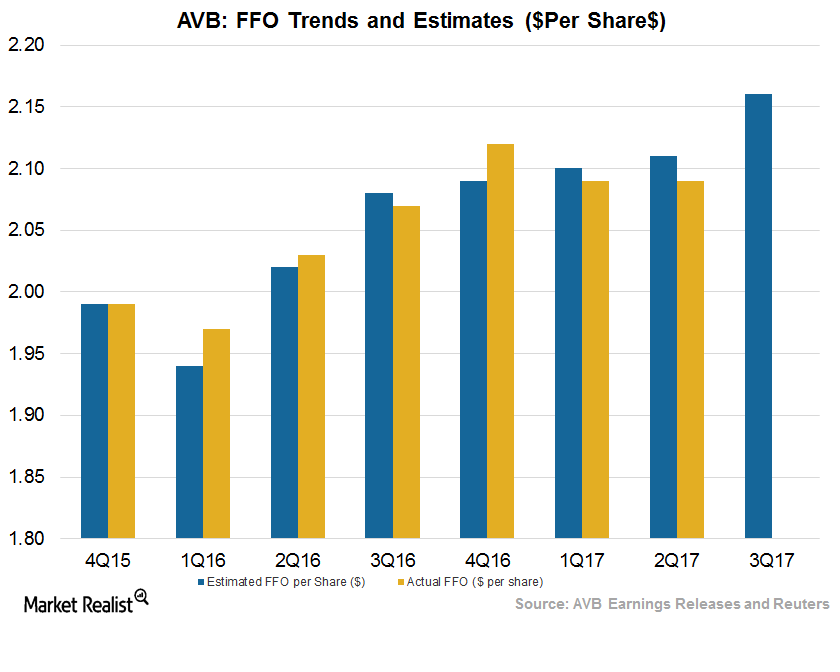

Robust 2Q17 results AvalonBay Communities’ (AVB) top and bottom lines exceeded expectations, backed by higher net operating income growth of 8.1%. Factors affecting profit during 2Q17 Higher occupancy and rent growth in development communities and stabilized operating communities led to upbeat results during the quarter. Higher funds from operations expected for 3Q17 AvalonBay expects […]

Where AvalonBay Stands after Its 2Q17 Earnings Release

AvalonBay Communities (AVB) reported core FFO (funds from operations) of $2.09 per share, in line with Wall Street estimates.

Why Look to REITs for Opportunities?

HEDGING AGAINST INFLATION Property stocks and REITs have often been viewed as inflation hedges because expected inflation will affect prices of real estate, and rental income tends to rise along with generalized inflation. However, other factors may mitigate the impact of inflationary forces. Some of these additional factors may include real estate supply and demand […]

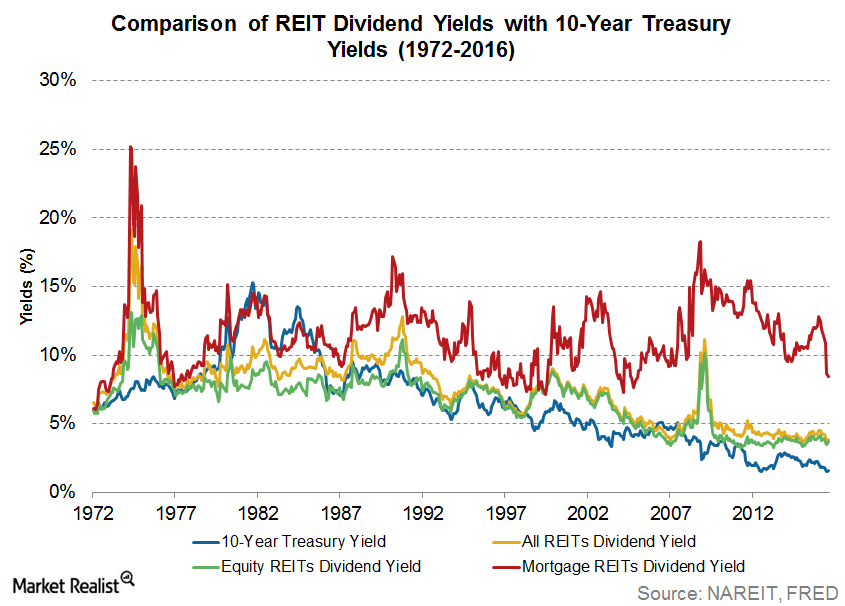

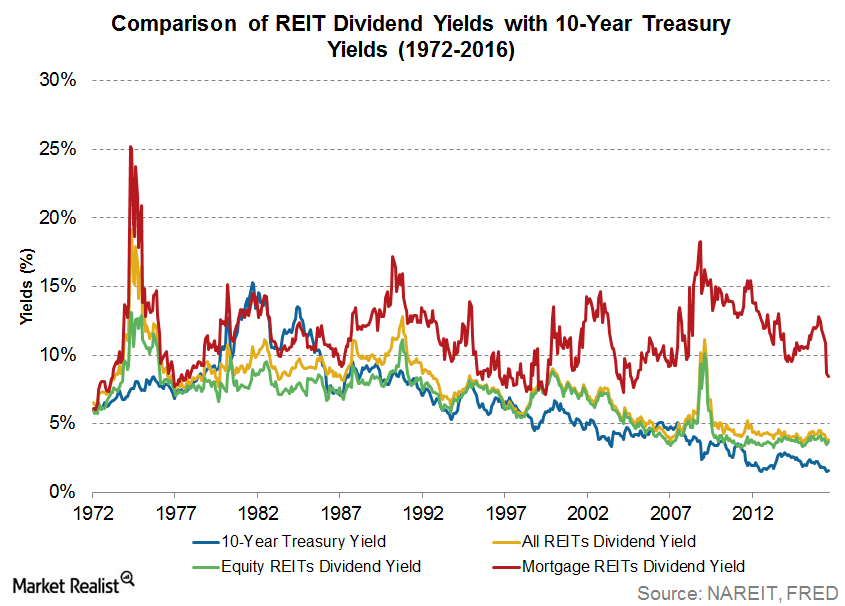

Why REITs Tend to Offer High Dividend Yield

COMPARING DIVIDEND YIELDS ACROSS ASSET CLASSES Since 1999, approximately half of the total return of the Dow Jones U.S. Select REIT Index has come from dividends. During periods of heightened volatility, this income could act as a buffer and may mitigate negative price movements. Historically, the Dow Jones U.S. Select REIT Index has produced higher […]

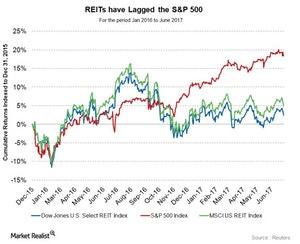

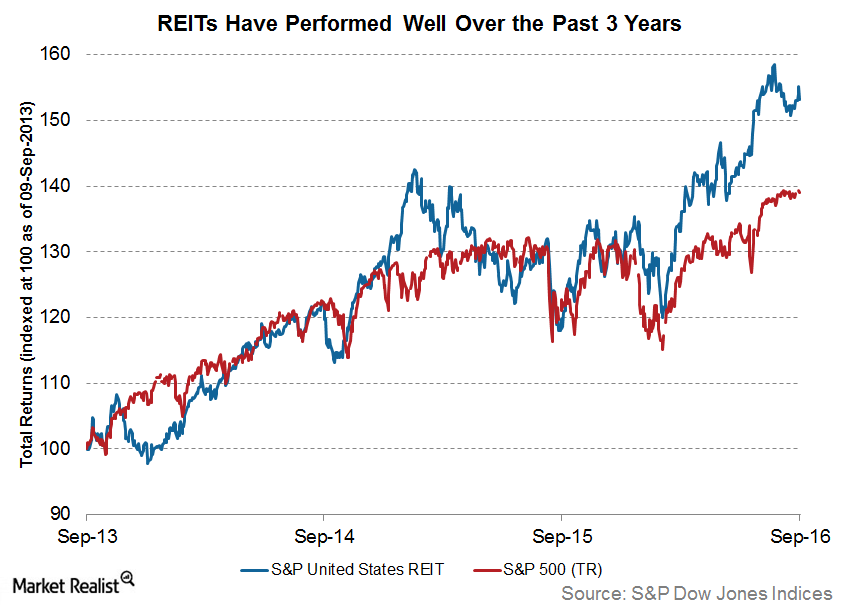

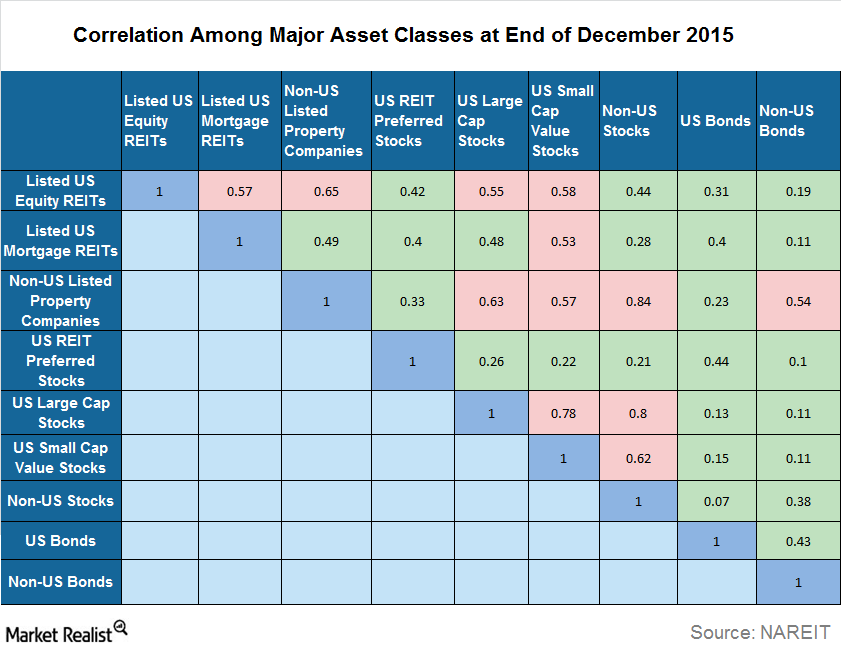

The REIT Advantage: High Return, Low Correlation

RETURNS AND RISKS OF REITS REIT and property stock performance has been relatively strong over the long term, especially when compared with traditional bond and equity indices. Since 1992, the Dow Jones Global Ex-U.S. Select RESI has had an average total return close to 9%, while the Dow Jones U.S. Select REIT Index has had […]

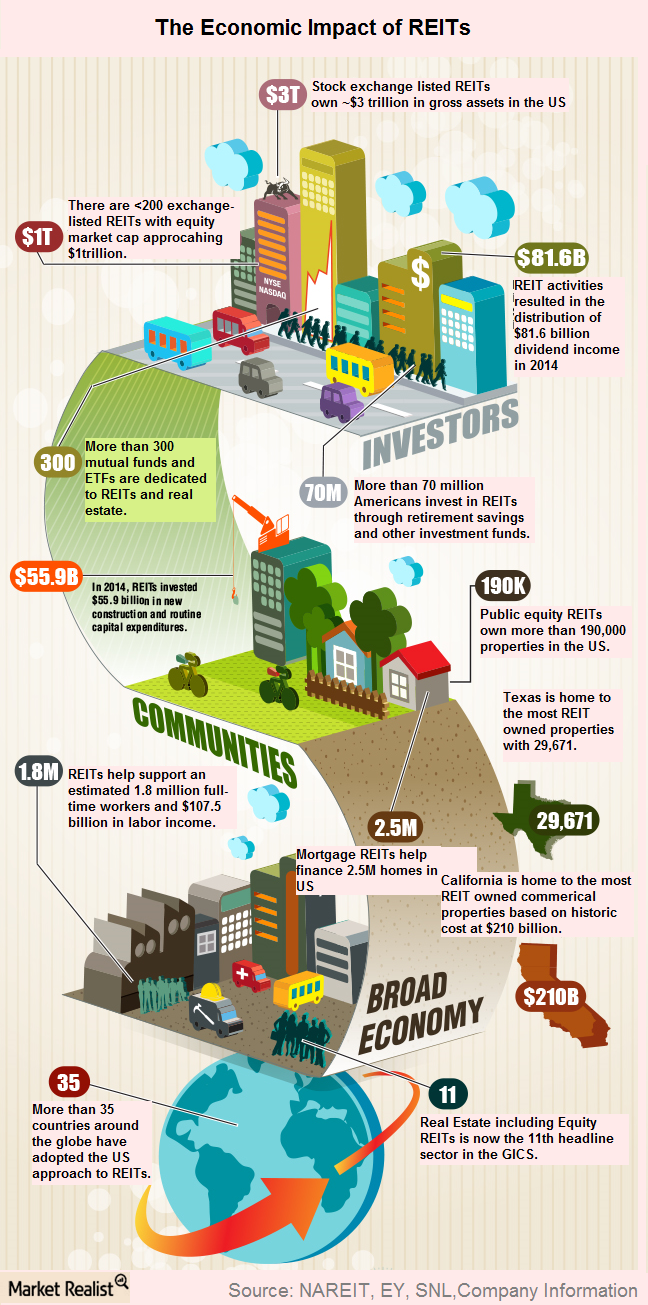

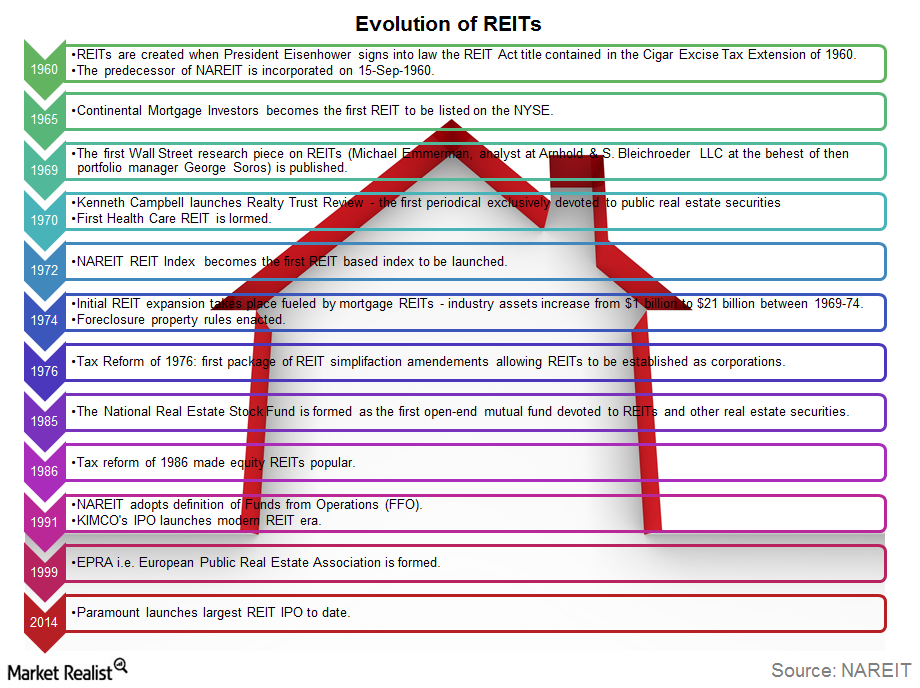

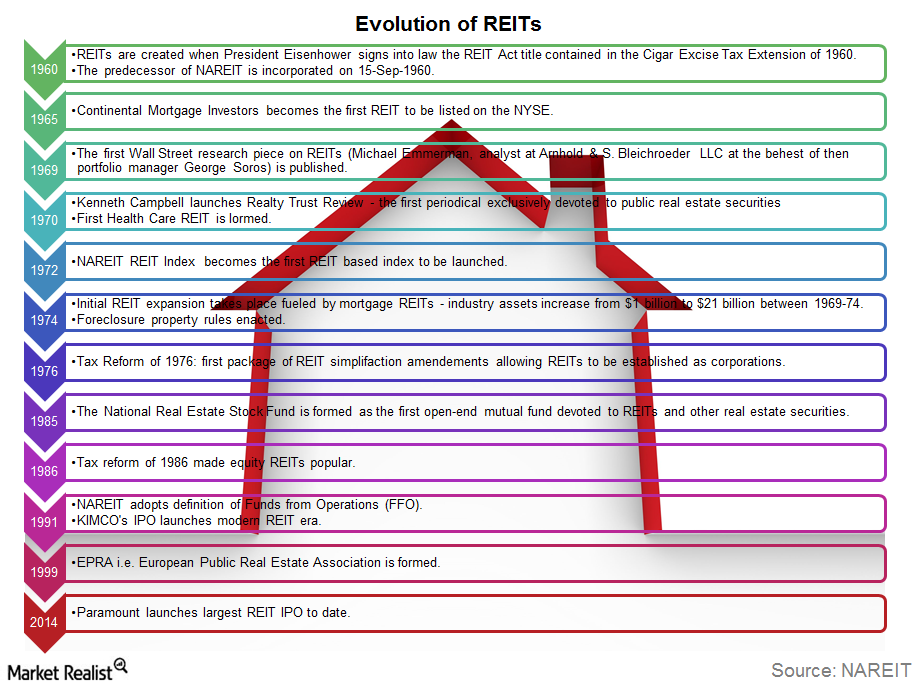

The Evolution of the REIT

The Evolution of REITs The basic concept of REITs originated with the business trusts that were formed in Massachusetts in the mid-19th century, when the wealth created by the industrial revolution led to a demand for real estate investment. The first REIT was set up in 1961, but it took several decades before REITs were […]

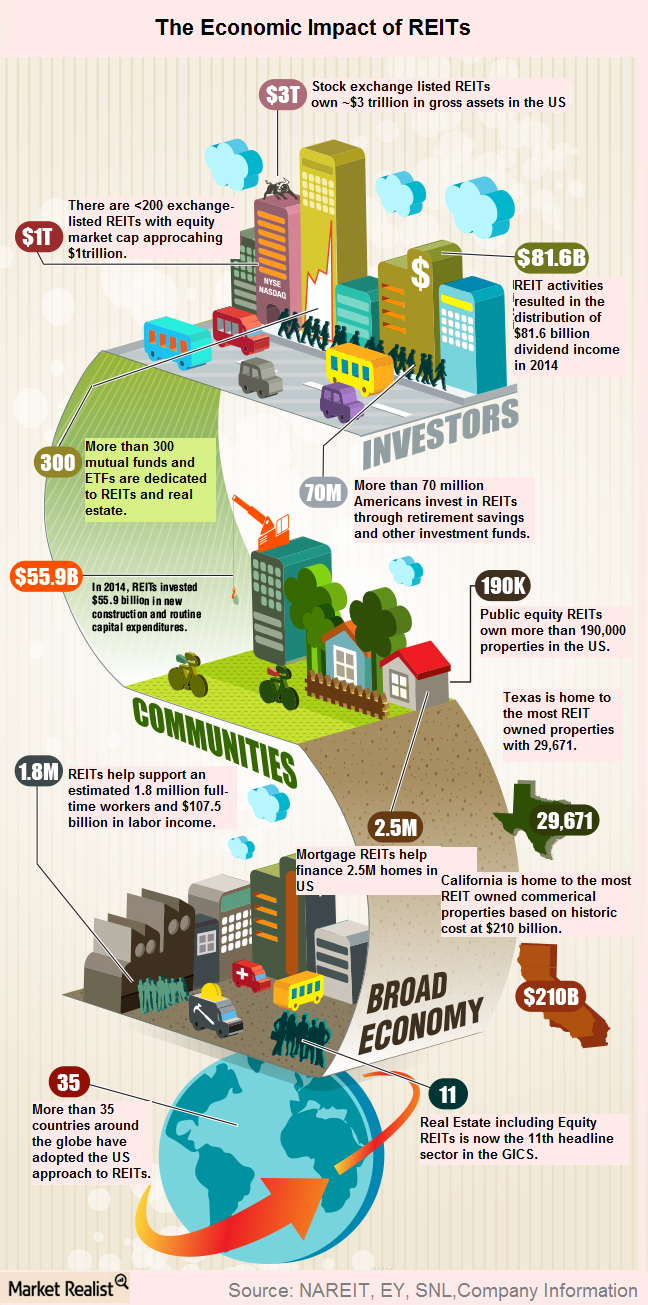

Why Look to the REIT Sector for Opportunities?

Not only do REITs (RWR)(ICF) help diversify a portfolio, but they also bolster portfolio income with their steady dividends and their long-term capital appreciation.

Why REITs Tend to Offer High Dividend Yields

REITs (IYR)(VNQ) are known for their high dividend yields, outclassing almost all other broad market indices.

The REIT Advantage: High Returns, Low Correlation

Not only do REITs tend to provide steady and stable returns over the long term, but they also help in diversifying investor portfolios effectively.

The Evolution of REITs

The REITs (IYR) sector has shown phenomenal growth over the years. In the past five decades, REITs have grown to a market cap of nearly $1 trillion.

How Would Negative Interest Rates Impact REITs?

A fall in interest rates makes REITs more attractive dividend-yielding investments compared to bonds. This is because REITs have been traditionally viewed as dividend-yielding investments.

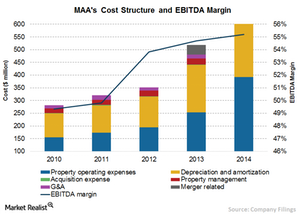

MAA’s EBITDA Margin: Lower than Industry Average

MAA’s EBITDA margin is lower than the industry average of 57.7%, as well as the margins reported by some of the company’s peers.

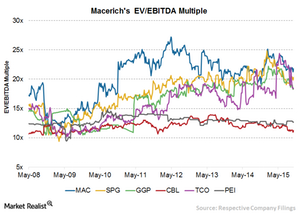

Macerich’s Highest EV-to-EBITDA Multiple Compared to Peers

Over the past eight years, Macerich’s EV-to-EBITDA has ranged between 11.9x–27.2x, with a current EV-to-EBITDA multiple of around 21.8x.

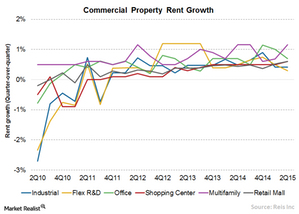

The Rise in Commercial Property Rent Is Beneficial to REITs

Rent increased 0.4% for industrial properties in 2Q15, which was unchanged from the previous quarter, but lower than the 0.5% 2Q14 growth.

General Growth Properties’ Top Tenants in Retail

The malls in GGP’s portfolio receive a smaller percentage of their operating income from anchor tenants than from specialty retailers who lease space.